CAPITAL GAINS TAX Capital Gains Tax is a

- Slides: 24

CAPITAL GAINS TAX

Capital Gains Tax is a tax imposed on the gains presumed to have been realized by the seller from the sale, exchange, or other disposition of capital assets located in the Philippines, including pacto de retro sales and other forms of conditional sale.

WHAT IS PACTO DE RETRO SALE? It means sale with stipulation for repurchase.

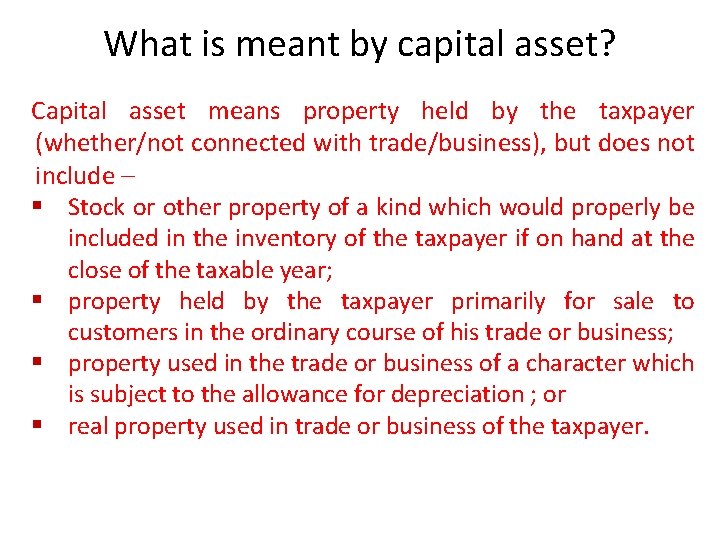

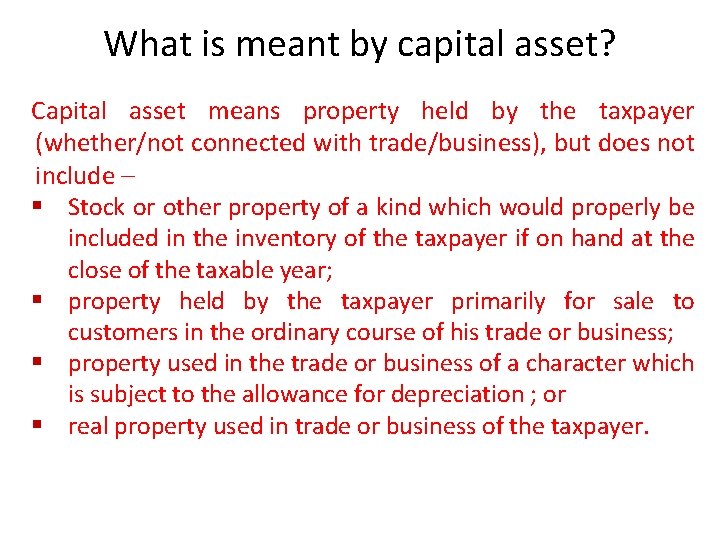

What is meant by capital asset? Capital asset means property held by the taxpayer (whether/not connected with trade/business), but does not include – § Stock or other property of a kind which would properly be included in the inventory of the taxpayer if on hand at the close of the taxable year; § property held by the taxpayer primarily for sale to customers in the ordinary course of his trade or business; § property used in the trade or business of a character which is subject to the allowance for depreciation ; or § real property used in trade or business of the taxpayer.

What is meant by ORDINARY ASSET? Ordinary asset refers to all properties specifically excluded from the definition of capital assets under Sec. 39 (A)(1) of the NIRC.

What is meant by real property? Real property shall have the same meaning attributed to that term under Article 415 of Republic Act No. 386, otherwise known as the “Civil Code of the Philippines”.

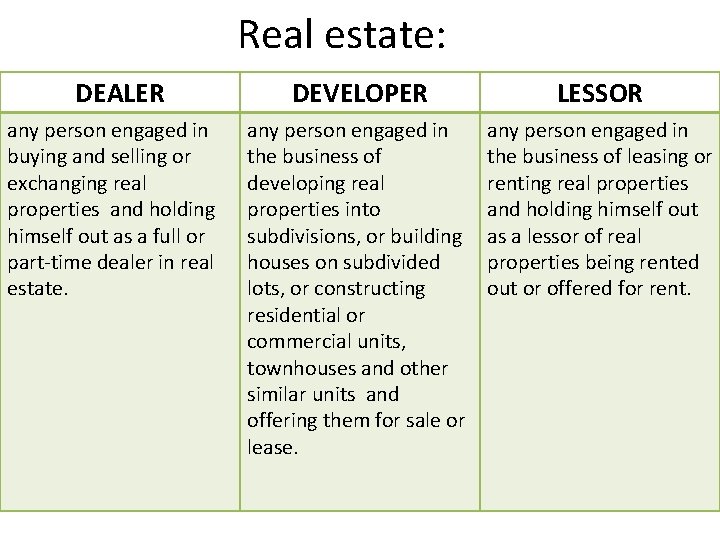

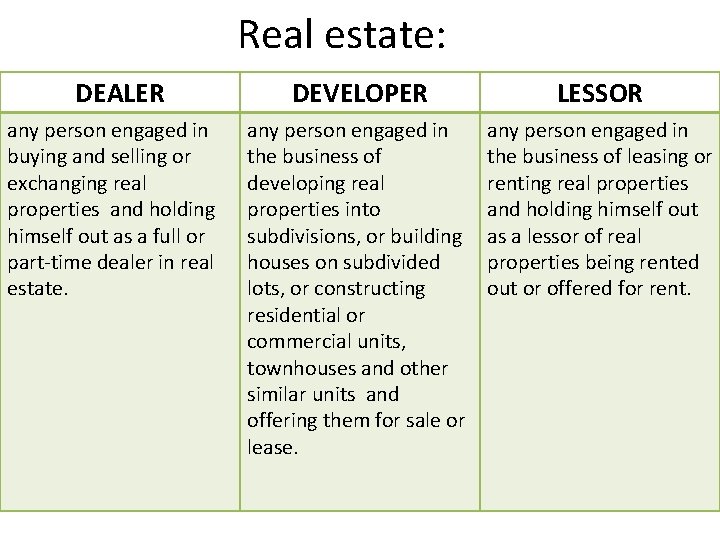

Who are considered engaged in the real estate business? A taxpayer whose primary purpose of engaging in business, or whose Articles of Incorporation states that its primary purpose is to engage in the real estate business shall be deemed to be engaged in the real estate business. They refer collectively to real estate dealers, real estate developers and/or real estate lessors.

Real estate: DEALER any person engaged in buying and selling or exchanging real properties and holding himself out as a full or part-time dealer in real estate. DEVELOPER LESSOR any person engaged in the business of developing real properties into subdivisions, or building houses on subdivided lots, or constructing residential or commercial units, townhouses and other similar units and offering them for sale or lease. any person engaged in the business of leasing or renting real properties and holding himself out as a lessor of real properties being rented out or offered for rent.

Who are considered not engaged in the real estate business? Taxpayers who are considered not engaged in the real estate business refer to persons other than real estate dealers, real estate developers and/or real estate lessors.

Who are considered habitually engaged in the real estate business? Real estate dealers or real estate developers who are registered with the Housing and Land Use Regulatory Board (HULRB) or HUDCC

WHAT IS THE BASIS OF VALUATION OF PROPERTY? Gross Selling Price, Zonal Value (FMV by Commissioner) or Assessed Value (FMV by Prov’l. /City Assessor) whichever is higher. If there is no zonal value-GSP or FMV (tax declaration) wc/ever is higher. If there is improvement - FMV per latest declaration at the time of sale /disposition, duly certified by the City/Municipal Assessor shall be used. No adjustments, provided tax declaration bears upgraded FMV If tax declaration was issued 3 or more years prior to sale or disposition, the seller/transferor shall be required to submit a certification from City/Municipal Assessor, otherwise, the taxpayer shall secure latest tax declaration. For shares of stocks - based on net capital gains realized from sale/barter/exchange/disposition of shares of stocks in a domestic corporation, considered as capital assets not traded thru LSE.

CGT tax rates: Ø Real Properties – 6% Ø For shares of stocks not traded in LSE on Capital Gains: • not over P 100, 000 – 5% • excess of P 100, 000 – 10%

Who are required to file the Final Capital Gains Tax return? Every person, whether natural or juridical, resident or non-resident, including estates and trusts, who sells, transfers, exchanges or disposes real properties located in the Philippines classified as capital assets, including pacto de retro sales and other forms of conditional sales or shares of stocks in domestic corporations not traded through the local stock exchange classified as capital assets.

Who/what are considered exempt from payment of Final CGT? • Dealer in securities, regularly engaged in the buying and selling of securities • An entity exempt from the payment of income tax under existing investment incentives and other special laws • Individual/non-individual exchanging real property solely for shares of stocks resulting in corporate control • A government entity or GOCC selling real property • If the disposition of the real property is gratuitous • Where the disposition is pursuant to the CARP law

Who are conditionally exempt from the payment of Final CGT? Natural persons who dispose their principal residence, provided : § proceeds of the sale been fully utilized in acquiring or constructing new principal residence within 18 months from the date of sale or disposition; § historical cost or adjusted basis of the real property sold or disposed will be carried over to the new principal residence ; § The Commissioner has been duly notified, thru return, within 30 days from the date of sale or disposition; § Exemption was availed only once every ten (10) years;

no full utilization of the proceeds -portion of the gain presumed to have been realized from the sale or disposition will be subject to Capital Gains Tax. In case of sale/transfer of principal residence, the Buyer/Transferee shall withhold from the seller and shall deduct from the agreed selling price/consideration the 6% CGT which shall be deposited in cash or manager’s check in interestbearing account with an Authorized Agent Bank (AAB) under an Escrow Agreement between the concerned RDO, the Seller and the Transferee, and the AAB to the effect that the amount so deposited, including its interest yield, shall only be released to such Transferor upon certification by the said RDO that the proceeds of the sale/disposition thereof has, in fact, been utilized in the acquisition or construction of the Seller/Transferor’s new principal residence within eighteen (18) calendar months from date of the said sale or disposition.

When is the date of sale or disposition of a property ? This refers to the date of notarization of the document evidencing the transfer of said property.

What is an escrow? In general, the term “Escrow” means a scroll, writing or deed, delivered by the grantor, promisor or obligor into the hands of a third person, to be held by the latter until the happening of a contingency or performance of a condition, and then by him delivered to the grantee, promise or obligee.

WHAT IS CAR? Certificate Authorizing Registration (CAR) is a certification issued by the Commissioner or his duly authorized representative attesting that the transfer and conveyance of land, buildings/improvements or shares of stock arising from sale, barter or exchange have been reported and the taxes due inclusive of the documentary stamp tax, have been fully paid.

UP TO WHEN A CAR IS VALID? CARs shall now have a validity of one (1) year from date of issue. In case of failure to present the same to the Registry of Deeds (RD) within the one (1) year period, the same shall be presented for revalidation to the District Office where the CAR was issued.

CGT Returns: Final Capital Gains Tax for Onerous Transfer of Real Property Classified as Capital Assets (Taxable and Exempt) BIR Form 1706 – Final Capital Gains Tax Return (For Onerous Transfer of Real Property Classified as Capital Assets -Taxable and Exempt) Tax Rates: For real property - 6%. Deadline: Within 30 days after each sale, exchange, transfer or other disposition of real property.

Capital Gains Tax for Onerous Transfer of Shares of Stocks Not Traded Through the Local Stock Exchange BIR Form 1707 - Capital Gains Tax Return (For Onerous Transfer of Shares of Stocks Not Traded Through the Local Stock Exchange) Tax Rates: For Shares of Stocks Not Traded in the Stock Exchange - Not over P 100, 000 - 5% - Any amount in excess of P 100, 000 - 10% Deadline: Within 30 days after each sale, exchange, transfer or other disposition of shares of stocks or real property. In case of installment sale, the return shall be filed within 30 days following the receipt of the first down payment and within 30 days following the subsequent installment payments. Only one return shall be filed for multiple transactions within the day.

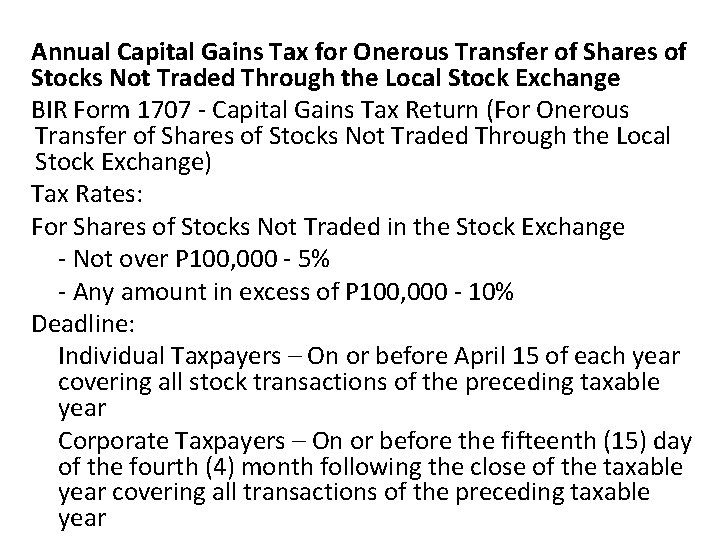

Annual Capital Gains Tax for Onerous Transfer of Shares of Stocks Not Traded Through the Local Stock Exchange BIR Form 1707 - Capital Gains Tax Return (For Onerous Transfer of Shares of Stocks Not Traded Through the Local Stock Exchange) Tax Rates: For Shares of Stocks Not Traded in the Stock Exchange - Not over P 100, 000 - 5% - Any amount in excess of P 100, 000 - 10% Deadline: Individual Taxpayers – On or before April 15 of each year covering all stock transactions of the preceding taxable year Corporate Taxpayers – On or before the fifteenth (15) day of the fourth (4) month following the close of the taxable year covering all transactions of the preceding taxable year

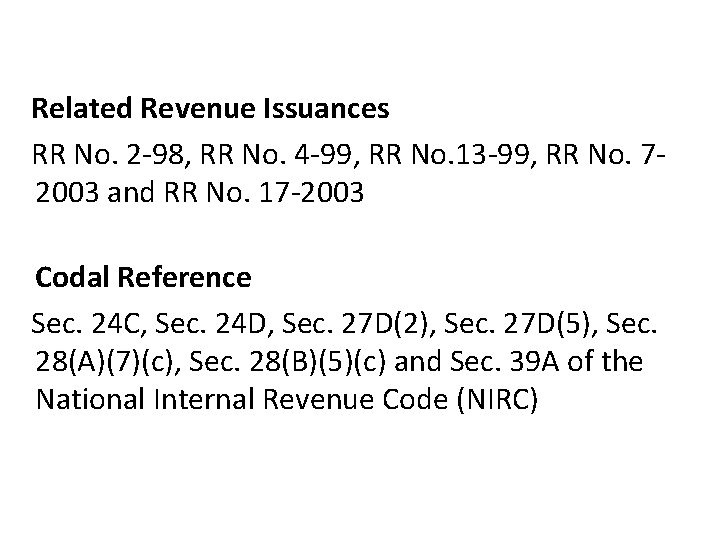

Related Revenue Issuances RR No. 2 -98, RR No. 4 -99, RR No. 13 -99, RR No. 72003 and RR No. 17 -2003 Codal Reference Sec. 24 C, Sec. 24 D, Sec. 27 D(2), Sec. 27 D(5), Sec. 28(A)(7)(c), Sec. 28(B)(5)(c) and Sec. 39 A of the National Internal Revenue Code (NIRC)

Dividend yield and capital gains yield

Dividend yield and capital gains yield Current yield formula

Current yield formula Current dividend

Current dividend Current yield ytm

Current yield ytm Capital gain yield

Capital gain yield Dividend yield and capital gains yield

Dividend yield and capital gains yield Junk bond ratings

Junk bond ratings Gst conclusion

Gst conclusion Ralphs annual income is about $32 000

Ralphs annual income is about $32 000 How to calculate depreciation tax shield

How to calculate depreciation tax shield Capital recovery concept tax

Capital recovery concept tax Interdependence and the gains from trade chapter 3

Interdependence and the gains from trade chapter 3 Chapter 3 interdependence and the gains from trade answers

Chapter 3 interdependence and the gains from trade answers Army code of ethics

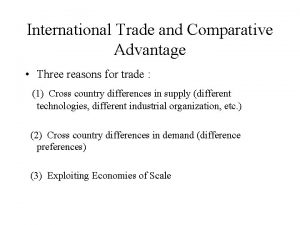

Army code of ethics How to calculate unexploited gains from trade

How to calculate unexploited gains from trade Chapter 3 interdependence and the gains from trade

Chapter 3 interdependence and the gains from trade How did wwi begin?

How did wwi begin? Chapter 3 interdependence and the gains from trade summary

Chapter 3 interdependence and the gains from trade summary Law of comparative advantage

Law of comparative advantage Interdependence and the gains from trade

Interdependence and the gains from trade As a fluid gains speed, its internal pressure

As a fluid gains speed, its internal pressure Fldoe learning gains

Fldoe learning gains Rapides gains

Rapides gains Interdependence and the gains from trade

Interdependence and the gains from trade Gains in perspective taking permit the transition to

Gains in perspective taking permit the transition to