Capital Asset Pricing Model CAPM Security Market Line

![CAPM q Capital Market Line E[r. P] E[r. M] M CML rf M Investments CAPM q Capital Market Line E[r. P] E[r. M] M CML rf M Investments](https://slidetodoc.com/presentation_image_h2/4705b55625f083eb74cc8d1cd8ba8292/image-5.jpg)

![Application q Graph of disequilibrium SML E[ri] 15% = 2% rm=11% rf=3% 1. 0 Application q Graph of disequilibrium SML E[ri] 15% = 2% rm=11% rf=3% 1. 0](https://slidetodoc.com/presentation_image_h2/4705b55625f083eb74cc8d1cd8ba8292/image-18.jpg)

- Slides: 19

Capital Asset Pricing Model CAPM Security Market Line CAPM and Market Efficiency Alpha (a) vs. Beta (b)

CAPM q Capital Asset Pricing Model Ø Ø q An equilibrium model underlying modern finance theory Based on diversification principle and simplified assumptions Who developed it? Ø Ø Ø Markowitz: Nobel Prize Sharpe: Nobel Prize Treynor, Lintner and Mossin Investments 11 2

CAPM q Assumptions Ø Individual investors are price takers q Ø Single-period investment horizon q Ø Investors maximize expected utility Homogeneous expectations q q q Ø Individual’s action inconsequential to stock prices Investors do not know the actual outcome Investors agree on the likelihood of each outcome Investors risk aversion may be different Market is frictionless q Investments 11 No taxes, and transaction costs 3

CAPM q Resulting Equilibrium Outcome Ø Ø All investors will hold the same portfolio for risky assets – the market portfolio Market portfolio contains all securities and the proportion of each security is its market value as a percentage of total market value Risk premium on the market depends on the average risk aversion of all market participants Risk premium on an individual security is a function of its covariance with the market Investments 11 4

![CAPM q Capital Market Line Er P Er M M CML rf M Investments CAPM q Capital Market Line E[r. P] E[r. M] M CML rf M Investments](https://slidetodoc.com/presentation_image_h2/4705b55625f083eb74cc8d1cd8ba8292/image-5.jpg)

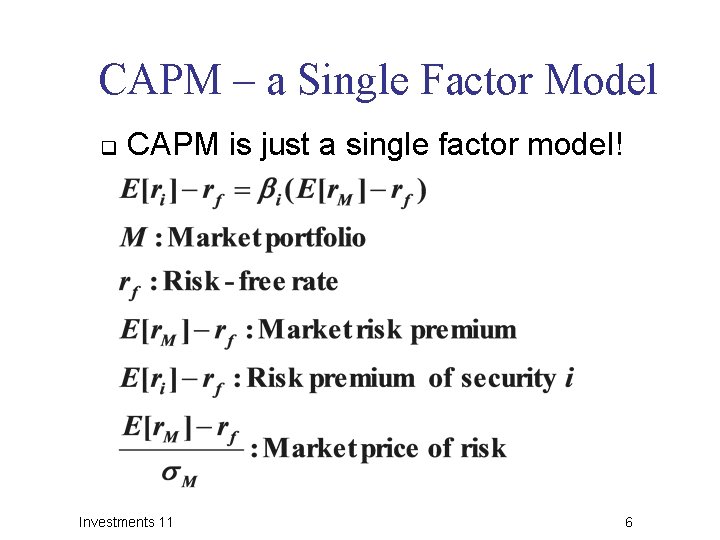

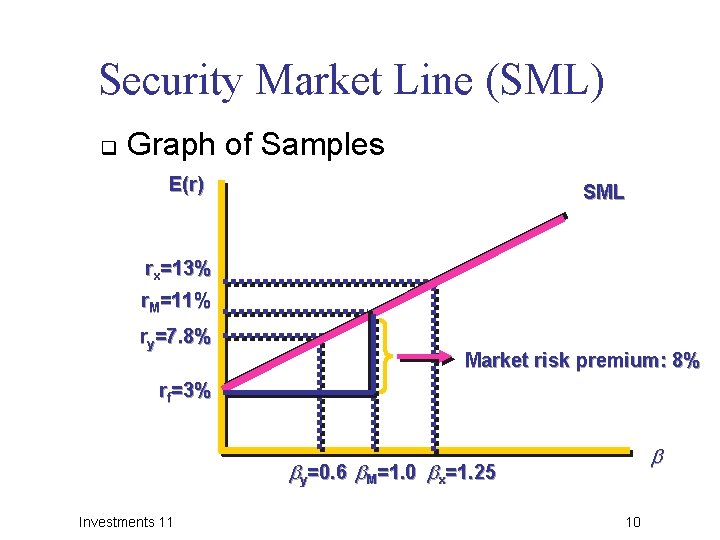

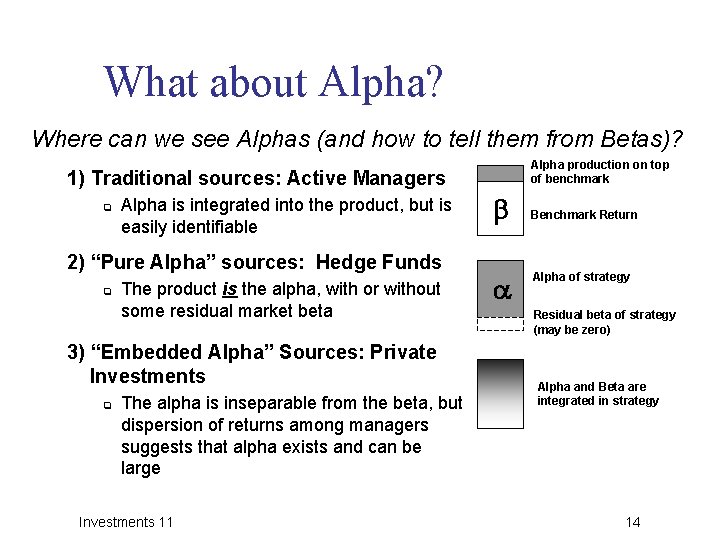

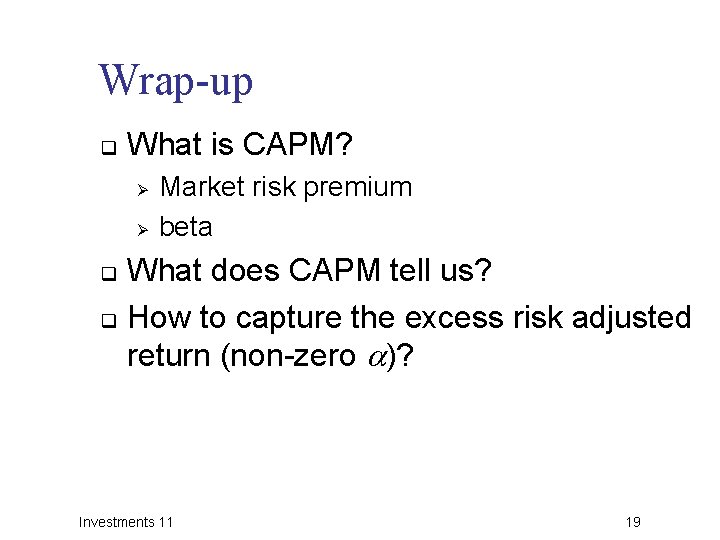

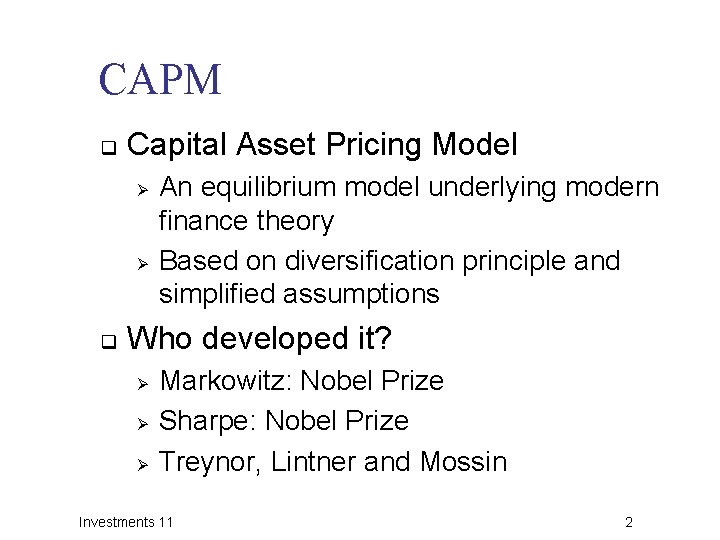

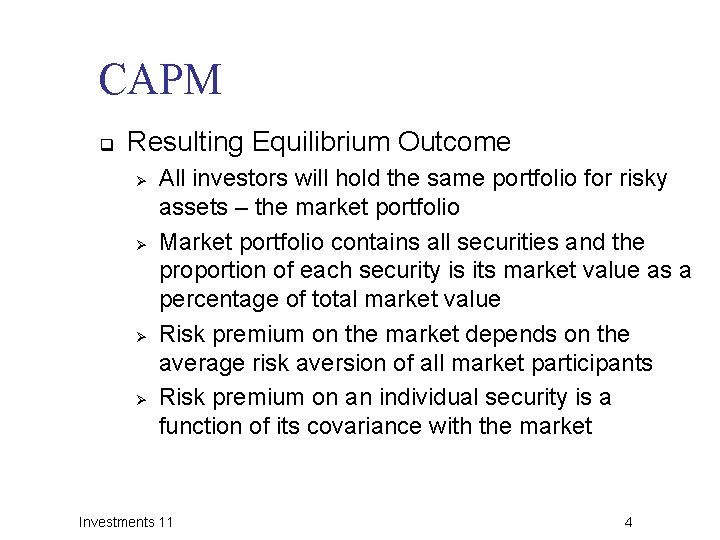

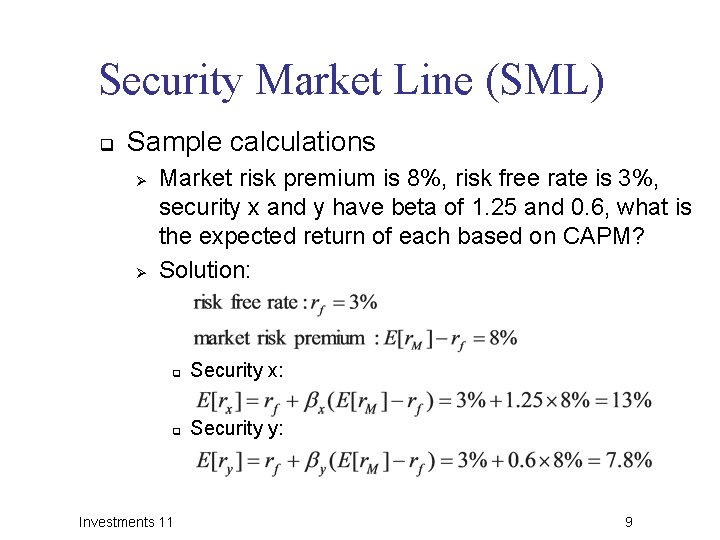

CAPM q Capital Market Line E[r. P] E[r. M] M CML rf M Investments 11 P 5

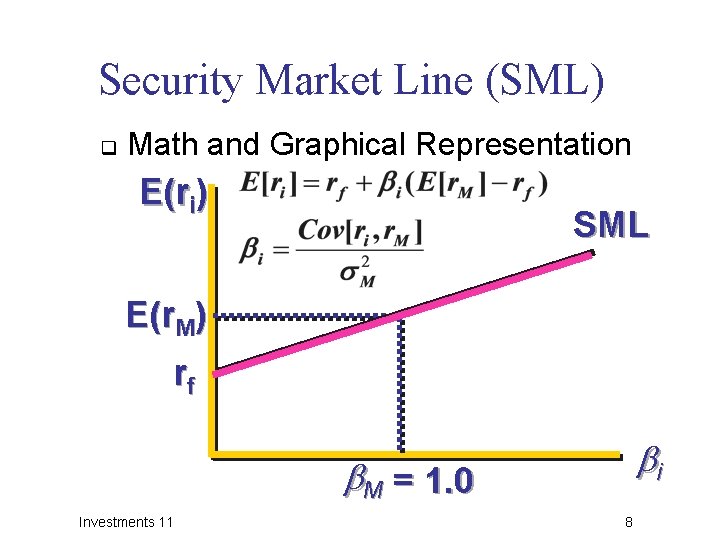

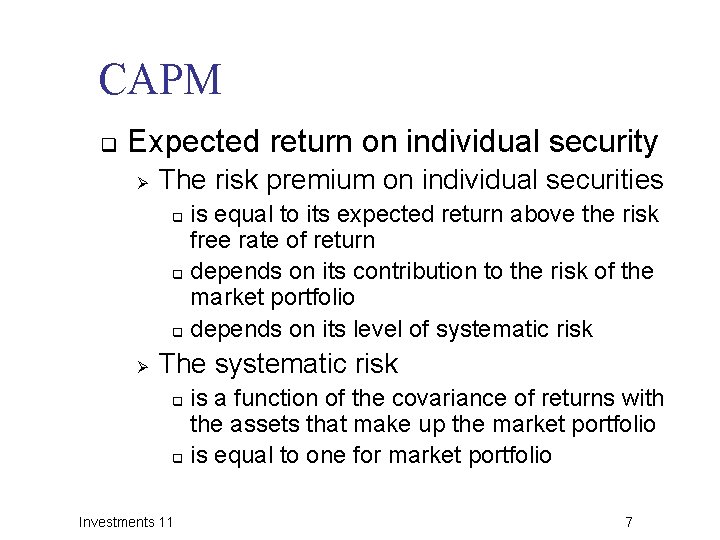

CAPM – a Single Factor Model q CAPM is just a single factor model! Investments 11 6

CAPM q Expected return on individual security Ø The risk premium on individual securities is equal to its expected return above the risk free rate of return q depends on its contribution to the risk of the market portfolio q depends on its level of systematic risk q Ø The systematic risk is a function of the covariance of returns with the assets that make up the market portfolio q is equal to one for market portfolio q Investments 11 7

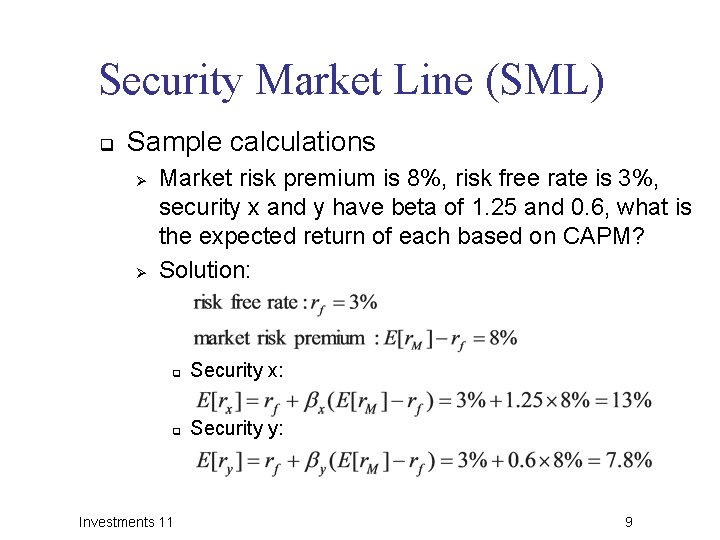

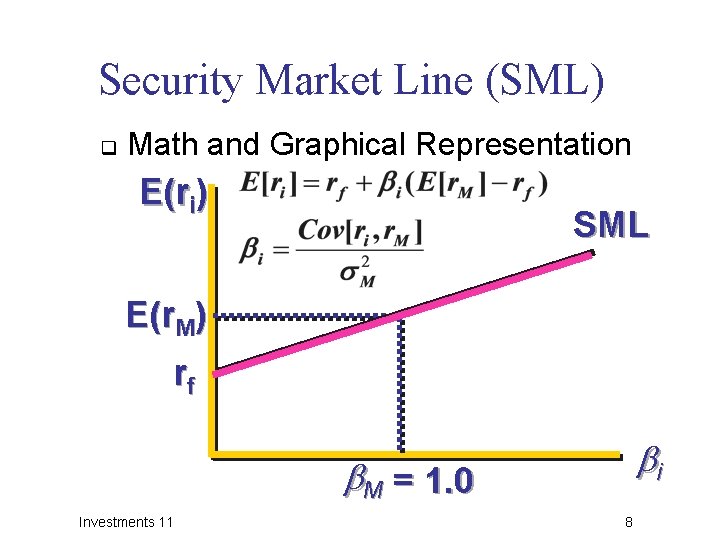

Security Market Line (SML) q Math and Graphical Representation E(ri) SML E(r. M) rf i M = 1. 0 Investments 11 8

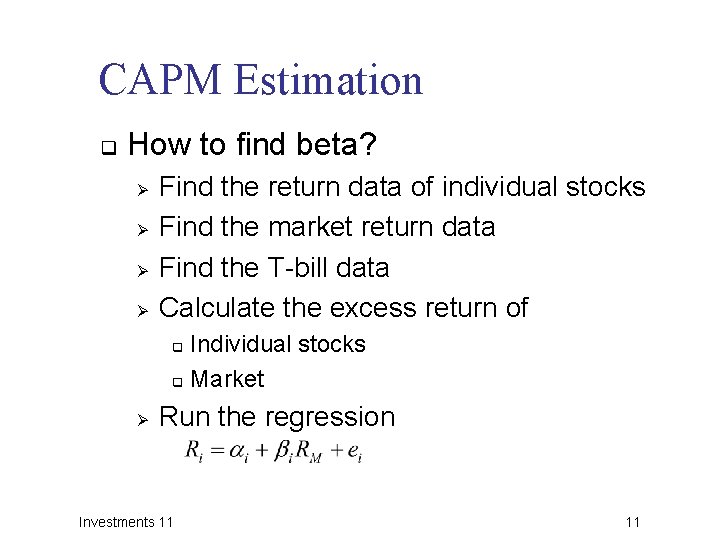

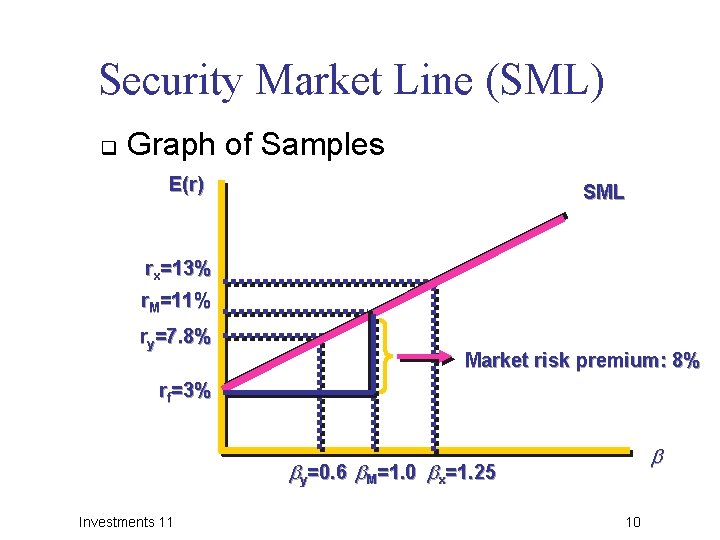

Security Market Line (SML) q Sample calculations Ø Ø Market risk premium is 8%, risk free rate is 3%, security x and y have beta of 1. 25 and 0. 6, what is the expected return of each based on CAPM? Solution: q Security x: q Security y: Investments 11 9

Security Market Line (SML) q Graph of Samples E(r) SML rx=13% r. M=11% ry=7. 8% Market risk premium: 8% rf=3% y=0. 6 M=1. 0 x=1. 25 Investments 11 10

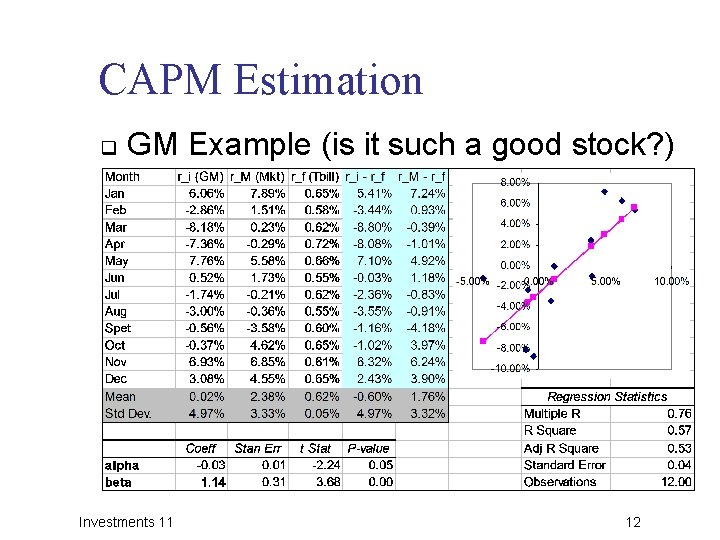

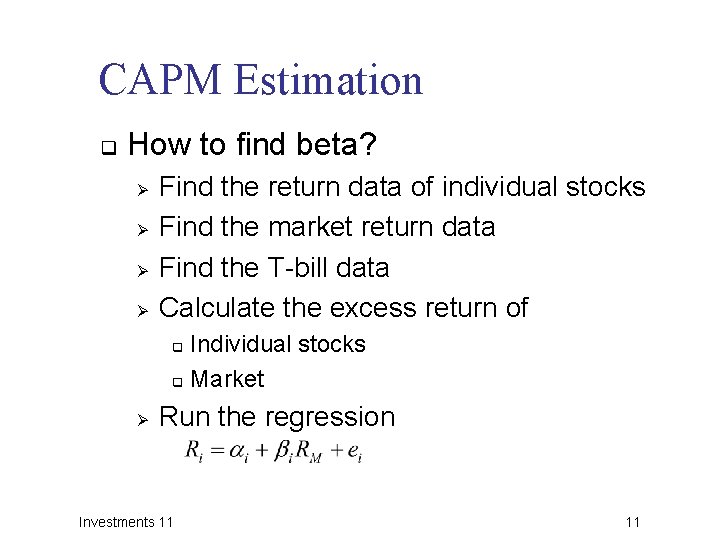

CAPM Estimation q How to find beta? Ø Ø Find the return data of individual stocks Find the market return data Find the T-bill data Calculate the excess return of Individual stocks q Market q Ø Run the regression Investments 11 11

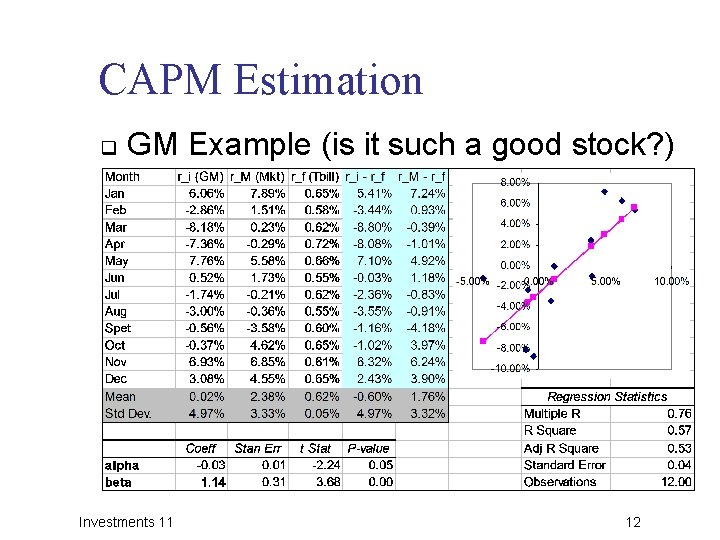

CAPM Estimation q GM Example (is it such a good stock? ) Investments 11 12

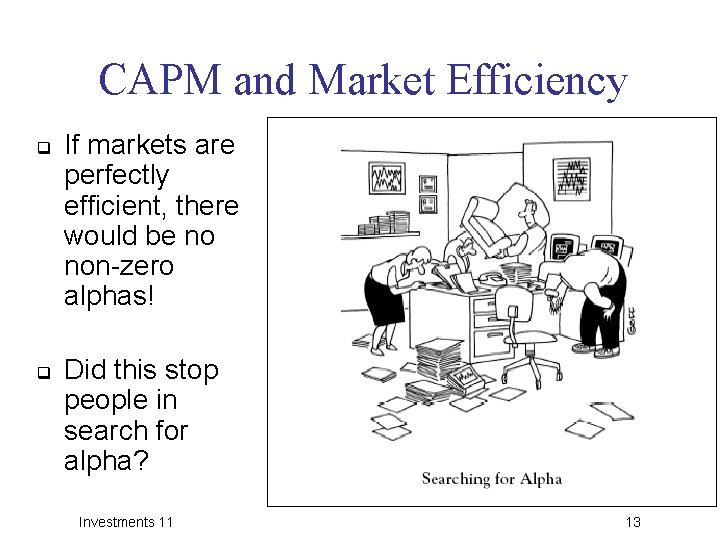

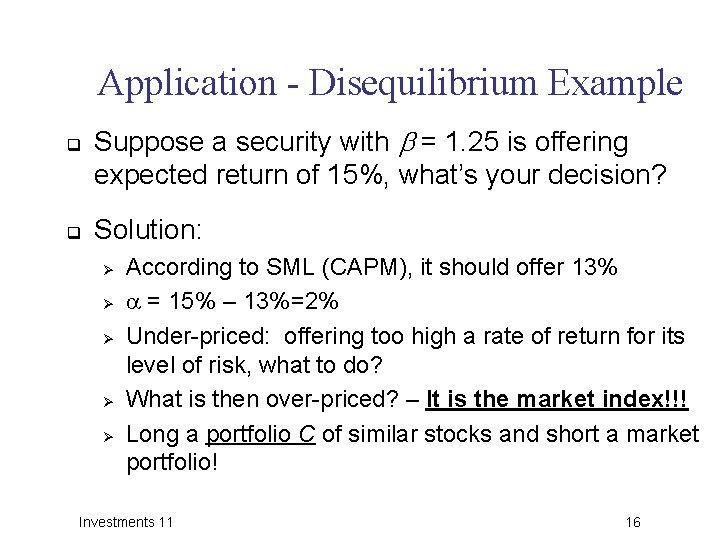

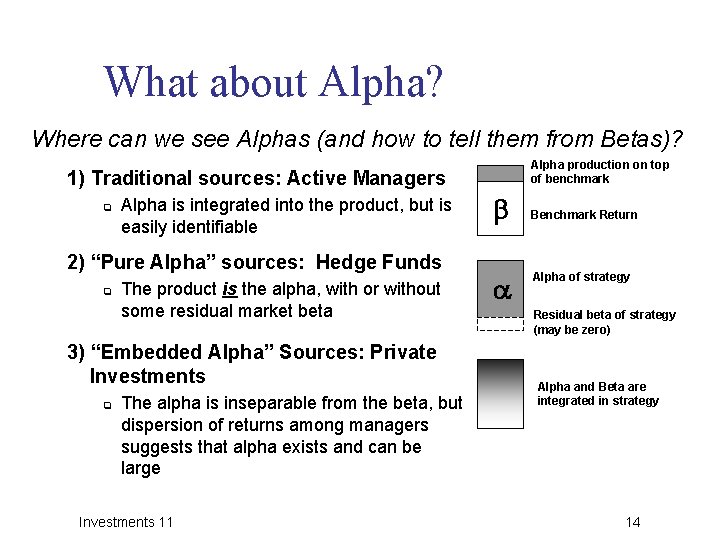

CAPM and Market Efficiency q q If markets are perfectly efficient, there would be no non-zero alphas! Did this stop people in search for alpha? Investments 11 13

What about Alpha? Where can we see Alphas (and how to tell them from Betas)? Alpha production on top of benchmark 1) Traditional sources: Active Managers q Alpha is integrated into the product, but is easily identifiable 2) “Pure Alpha” sources: Hedge Funds q The product is the alpha, with or without some residual market beta 3) “Embedded Alpha” Sources: Private Investments q The alpha is inseparable from the beta, but dispersion of returns among managers suggests that alpha exists and can be large Investments 11 b a Benchmark Return Alpha of strategy Residual beta of strategy (may be zero) Alpha and Beta are integrated in strategy 14

Investments - It Is All about Alpha! q q Investments – Active vs. Passive Ø Alpha (a) vs. Beta (b) Beta is easy – it is the market Ø Beta should be free q q Hedge Funds manage to charge for b (and not just a token)… Alpha is hard, but does it require frequent trading? Ø Ø Ø Not necessarily – it is about taking right long-term positions, and identifying underpriced factors Good old “Buy Low – Sell High” always works!!! Not having too many constraints helps Investments 11 15

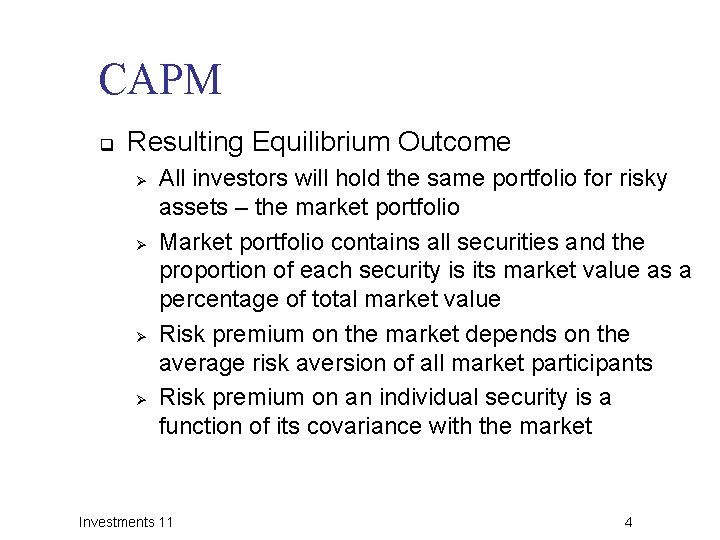

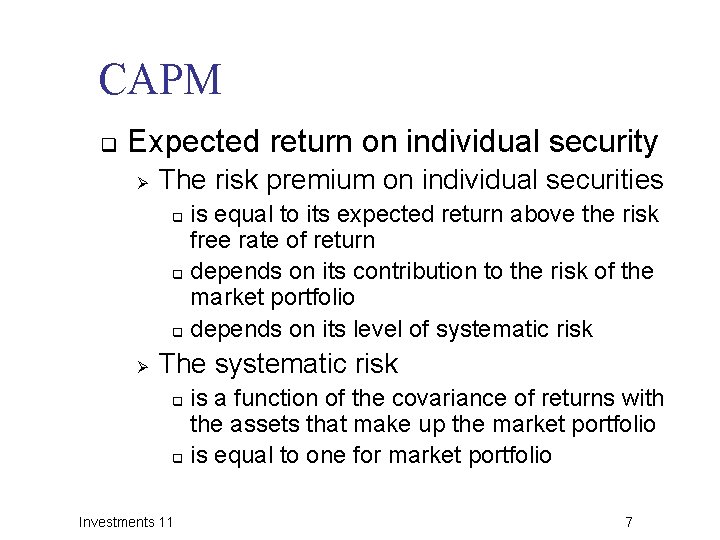

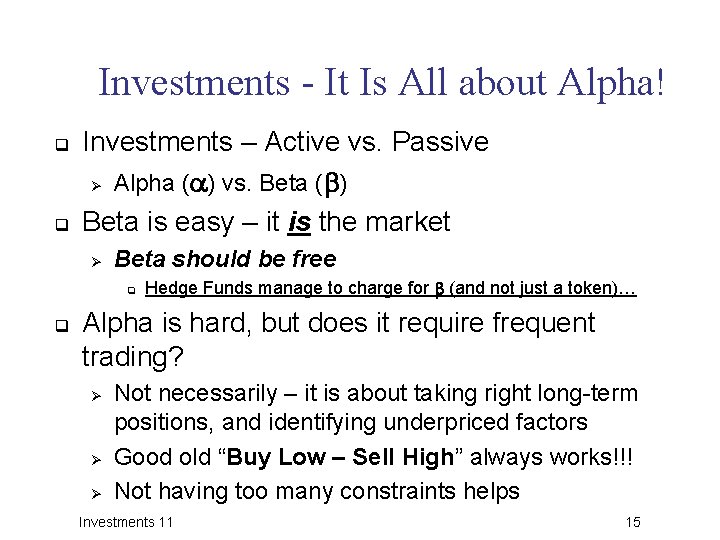

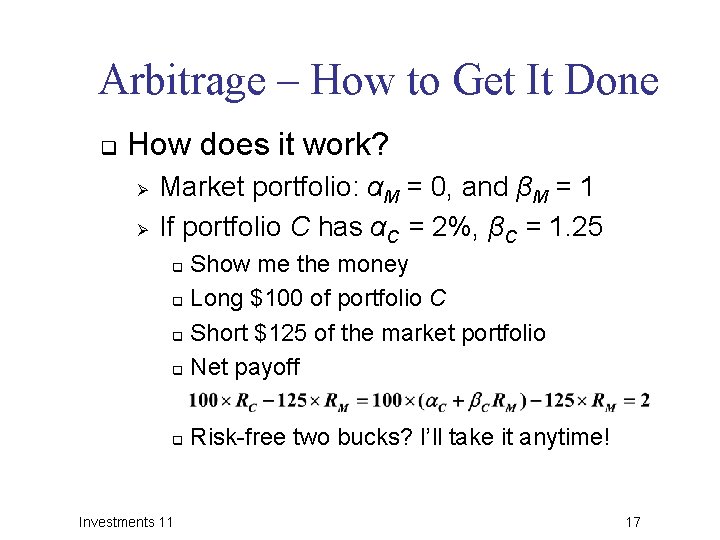

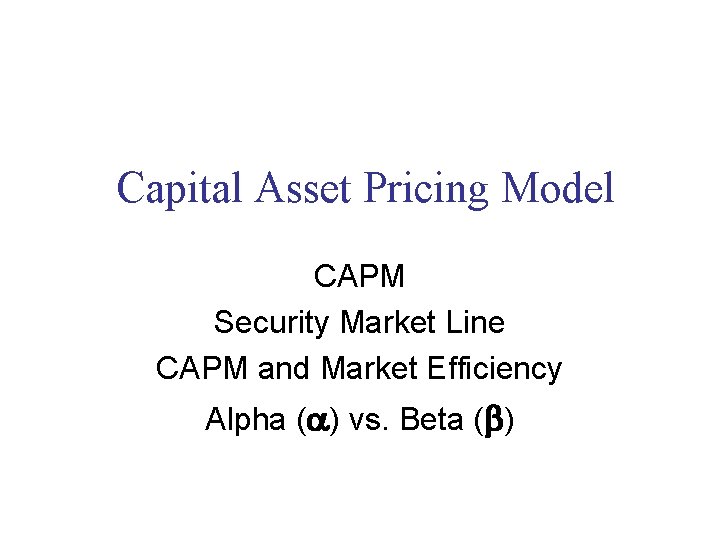

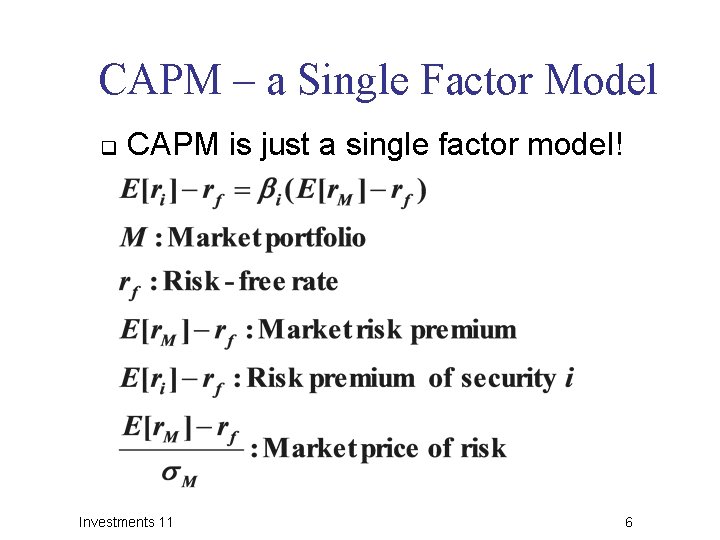

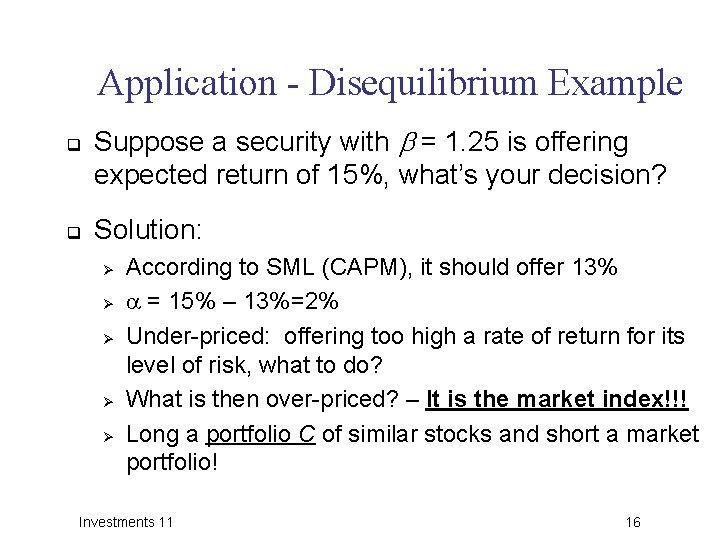

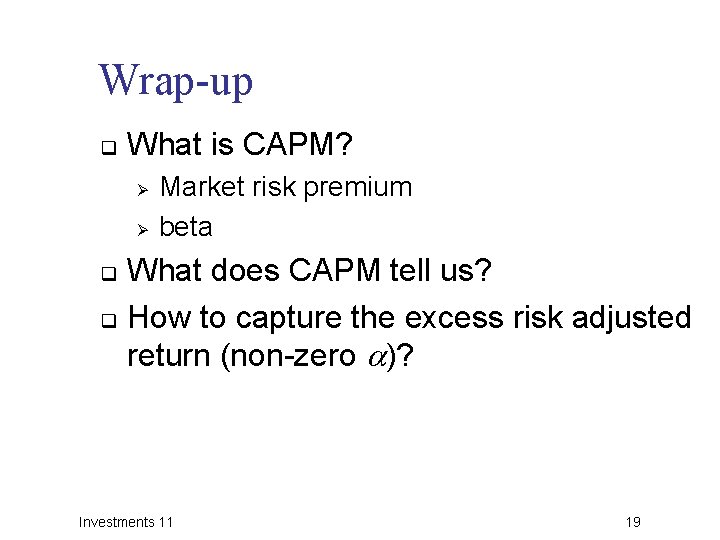

Application - Disequilibrium Example q q Suppose a security with = 1. 25 is offering expected return of 15%, what’s your decision? Solution: Ø Ø Ø According to SML (CAPM), it should offer 13% = 15% – 13%=2% Under-priced: offering too high a rate of return for its level of risk, what to do? What is then over-priced? – It is the market index!!! Long a portfolio C of similar stocks and short a market portfolio! Investments 11 16

Arbitrage – How to Get It Done q How does it work? Ø Ø Market portfolio: αM = 0, and βM = 1 If portfolio C has αC = 2%, βC = 1. 25 Show me the money q Long $100 of portfolio C q Short $125 of the market portfolio q Net payoff q q Investments 11 Risk-free two bucks? I’ll take it anytime! 17

![Application q Graph of disequilibrium SML Eri 15 2 rm11 rf3 1 0 Application q Graph of disequilibrium SML E[ri] 15% = 2% rm=11% rf=3% 1. 0](https://slidetodoc.com/presentation_image_h2/4705b55625f083eb74cc8d1cd8ba8292/image-18.jpg)

Application q Graph of disequilibrium SML E[ri] 15% = 2% rm=11% rf=3% 1. 0 Investments 11 1. 25 18

Wrap-up q What is CAPM? Ø Ø Market risk premium beta What does CAPM tell us? q How to capture the excess risk adjusted return (non-zero )? q Investments 11 19