CAPITAL ADEQUACY FOR INSTITUTIONS OFFERING ISLAMIC FINANCIAL SERVICES

- Slides: 42

CAPITAL ADEQUACY FOR INSTITUTIONS OFFERING ISLAMIC FINANCIAL SERVICES Basel II and the IFSB Standard Simon Archer University of Surrey Consultant to IFSB

Contents of Presentation • Capital adequacy regulation of conventional banks: Basel I & Basel II Pillar 1. • Applicability to IIFS • IFSB CAS methodology for calculating capital adequacy • Conclusions 2

Rationales for capital adequacy regulation of conventional banks • Role of equity capital in general: to absorb unexpected losses – Expected losses are covered by provisions – Creditor protection • Market forces & their limitations • Economic versus regulatory capital in banks & similar financial institutions • Specific reasons for regulation of capital of such institutions – Systemic risk & social costs – Deposit guarantee schemes and market failure 3

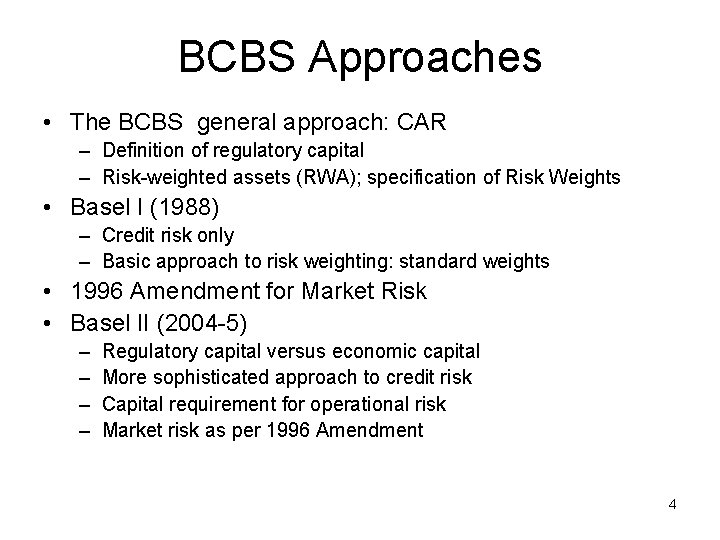

BCBS Approaches • The BCBS general approach: CAR – Definition of regulatory capital – Risk-weighted assets (RWA); specification of Risk Weights • Basel I (1988) – Credit risk only – Basic approach to risk weighting: standard weights • 1996 Amendment for Market Risk • Basel II (2004 -5) – – Regulatory capital versus economic capital More sophisticated approach to credit risk Capital requirement for operational risk Market risk as per 1996 Amendment 4

The BCBS Capital Adequacy Methodology: a Brief Reminder • Capital Adequacy Ratio (CAR) = OC/RWA – OC = Bank’s Own Capital – RWA = Risk Weighted Assets • Minimum CAR = 8% • RWA approach designed for credit risk • Maximum credit risk (normally) = RW of 100% => Capital Requirement (charge) = 8% of carrying value of asset • Certain credit risks (equity position risk in the banking book and specialized lending ) have credit risk weighting > 100% • Market Risk & Operational Risk: capital requirement established directly, then converted to credit risk equivalent by multiplying by the reciprocal of 8%, i. e. 12. 5 5

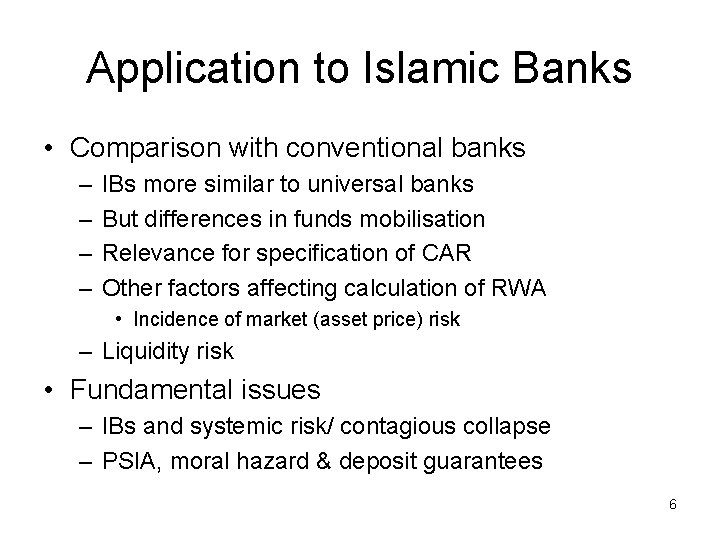

Application to Islamic Banks • Comparison with conventional banks – – IBs more similar to universal banks But differences in funds mobilisation Relevance for specification of CAR Other factors affecting calculation of RWA • Incidence of market (asset price) risk – Liquidity risk • Fundamental issues – IBs and systemic risk/ contagious collapse – PSIA, moral hazard & deposit guarantees 6

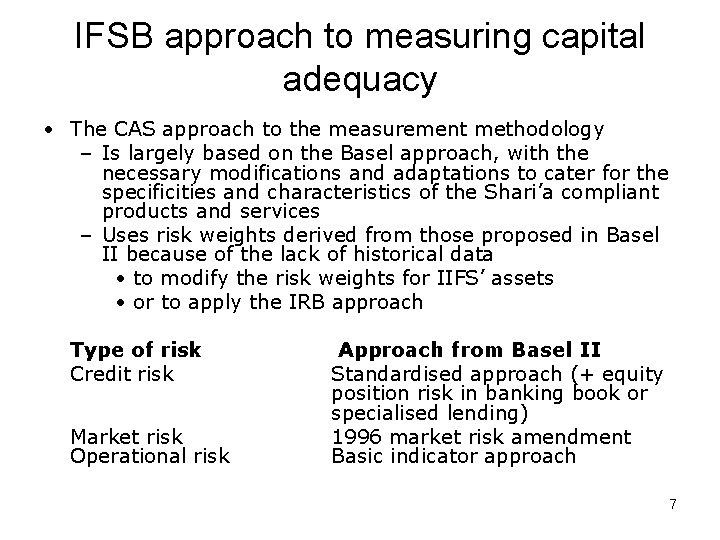

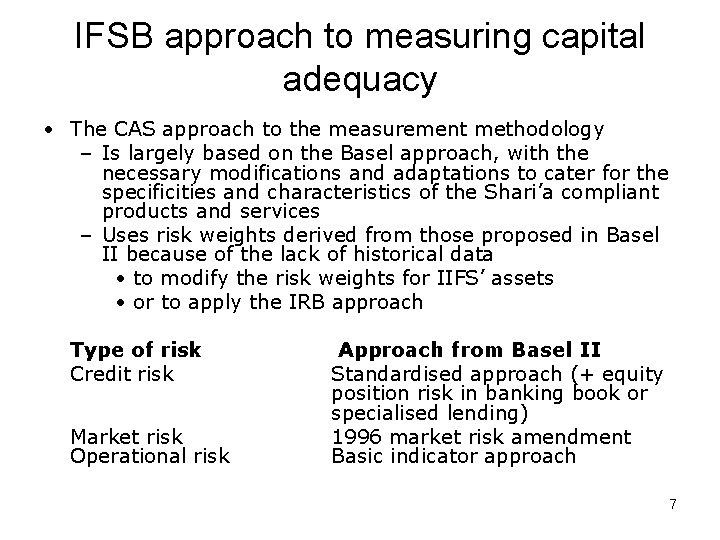

IFSB approach to measuring capital adequacy • The CAS approach to the measurement methodology – Is largely based on the Basel approach, with the necessary modifications and adaptations to cater for the specificities and characteristics of the Shari’a compliant products and services – Uses risk weights derived from those proposed in Basel II because of the lack of historical data • to modify the risk weights for IIFS’ assets • or to apply the IRB approach Type of risk Credit risk Market risk Operational risk Approach from Basel II Standardised approach (+ equity position risk in banking book or specialised lending) 1996 market risk amendment Basic indicator approach 7

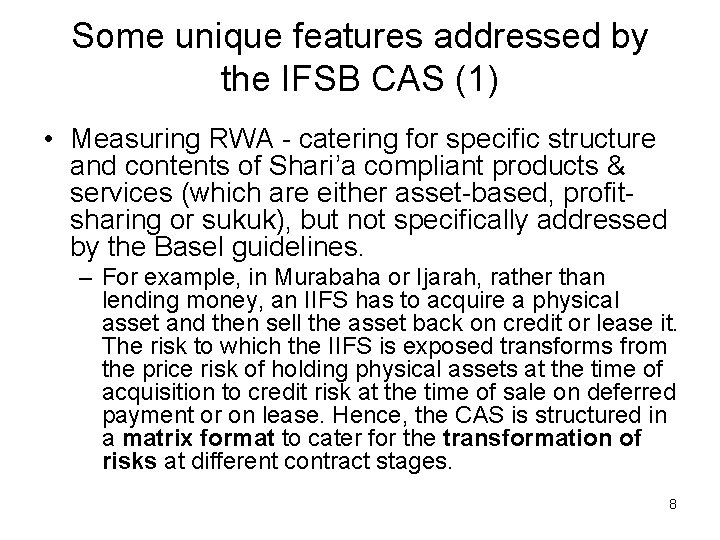

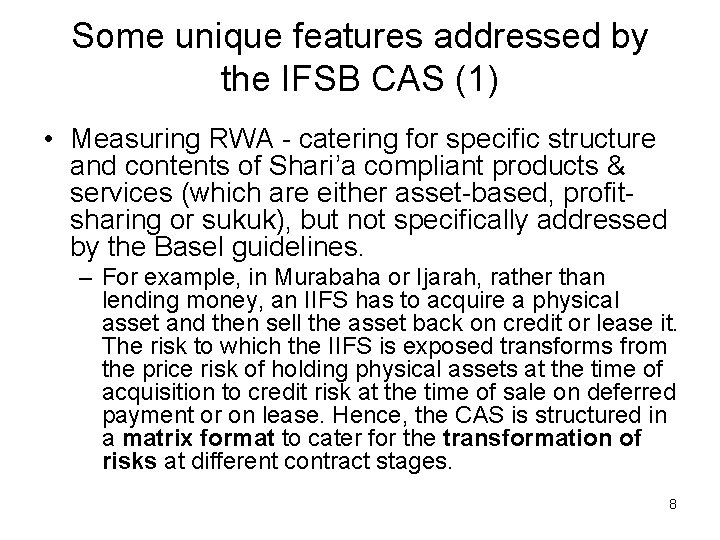

Some unique features addressed by the IFSB CAS (1) • Measuring RWA - catering for specific structure and contents of Shari’a compliant products & services (which are either asset-based, profitsharing or sukuk), but not specifically addressed by the Basel guidelines. – For example, in Murabaha or Ijarah, rather than lending money, an IIFS has to acquire a physical asset and then sell the asset back on credit or lease it. The risk to which the IIFS is exposed transforms from the price risk of holding physical assets at the time of acquisition to credit risk at the time of sale on deferred payment or on lease. Hence, the CAS is structured in a matrix format to cater for the transformation of risks at different contract stages. 8

Some unique features addressed by the IFSB CAS (2) – In measuring the capital requirements arising from of the IIFS’s use of these contracts in its financing activities, the resultant assets are risk-weighted according to different risk categories - credit risk or market (price) risk - taking account of the fact that the category of risk may change according to various stages of contracts. 9

Some unique features addressed by the CAS (3) • Measuring OC and RWA - Treatment of PSIA and assets financed by PSIA in the Capital Adequacy Ratio (CAR) calculation. – Neither Restricted nor Unrestricted PSIA are part of OC – The IFSB Standard on Capital Adequacy incorporates an investor protection approach in the treatment of assets financed by IAH. Accordingly, these assets do not normally attract any capital charges since the IAH bear their own commercial risk & PSIA are not part of OC. 10

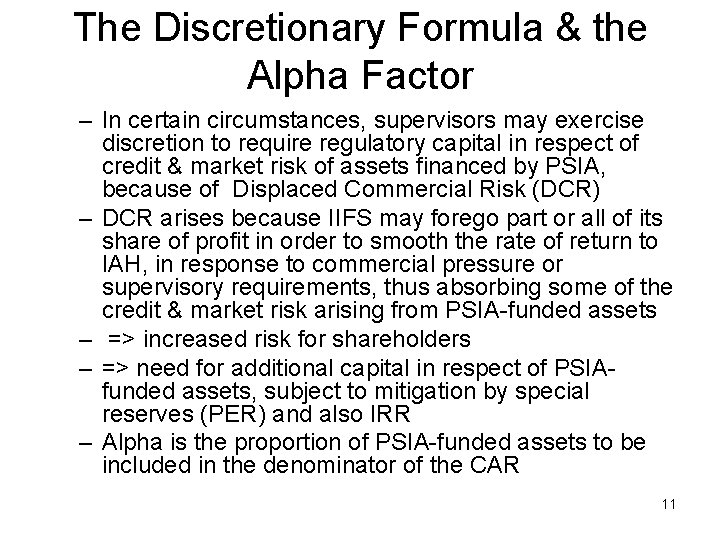

The Discretionary Formula & the Alpha Factor – In certain circumstances, supervisors may exercise discretion to require regulatory capital in respect of credit & market risk of assets financed by PSIA, because of Displaced Commercial Risk (DCR) – DCR arises because IIFS may forego part or all of its share of profit in order to smooth the rate of return to IAH, in response to commercial pressure or supervisory requirements, thus absorbing some of the credit & market risk arising from PSIA-funded assets – => increased risk for shareholders – => need for additional capital in respect of PSIAfunded assets, subject to mitigation by special reserves (PER) and also IRR – Alpha is the proportion of PSIA-funded assets to be included in the denominator of the CAR 11

Measurement of capital adequacy for credit risk (1) – Credit risk is generally measured according to the Standardised Approach of Basel II, except exposures arising from investments by means of Musharaka or Mudaraba contracts in assets that are not held for trading, which are measured by using either • One of the two methods et out in Basel II for “equity position risk in the banking book”, namely the simple risk weight method • The method used in Basel II for “specialized lending” (e. g. project finance), namely the supervisory slotting method. 12

Measurement of capital adequacy for credit risk (2) – Until adequate historical data are available, the IFSB standard uses the credit risk weights set out in Basel II • Those set out in the standardized approach for assets other than Mudaraba and Musharaka • The rates set out in Basel II for the two methods mentioned above to be used for Mudaraba and Musharaka contracts (subject to risk mitigation) 13

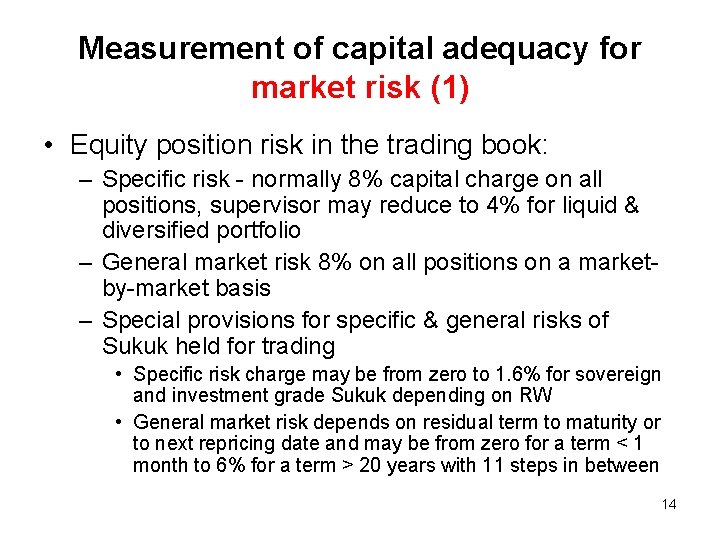

Measurement of capital adequacy for market risk (1) • Equity position risk in the trading book: – Specific risk - normally 8% capital charge on all positions, supervisor may reduce to 4% for liquid & diversified portfolio – General market risk 8% on all positions on a marketby-market basis – Special provisions for specific & general risks of Sukuk held for trading • Specific risk charge may be from zero to 1. 6% for sovereign and investment grade Sukuk depending on RW • General market risk depends on residual term to maturity or to next repricing date and may be from zero for a term < 1 month to 6% for a term > 20 years with 11 steps in between 14

Measurement of capital adequacy for market risk (2) • Foreign exchange risk (including gold and silver) – 2 steps: measure – Exposure in a single currency position (net open position) – Risks inherent in portfolio mix of long & short positions (assets and liabilities plus off-balance sheet positions e. g. guarantees) in different currencies • ‘Shorthand method’ is recommended • Net position in each currency is converted into reporting currency at spot rates, and greater of net short or net long positions is added to the net gold/silver position to derive net overall position • Capital charge is 8% of net overall position 15

Measurement of capital adequacy for market risk (3) • Commodities (price) risk: Maturity ladder or simplified approach using standard unit of quantitative measurement of weight or volume converted at spot rates into the reporting currency – Maturity ladder places net positions into 7 time-bands from 0 -1 month to > 3 years for each commodity type • Net quantitative amounts of matching long & short positions are converted into the reporting currency at spot prices and a capital charge of 1. 5% is applied. Unmatched positions from earlier time-bands may be carried forward and offset subject to a 0. 6% surcharge per time-band of carry-forward • Any remaining net position receives a capital charge of 15%. – Simplified approach applies a 15% capital charge to all net positions, long or short, in each commodity plus an additional 3% charge of 3% of the gross (long + short) positions 16

Measurement of capital adequacy for market risk (4) • The commodity exposures include those arising from inventory (price) risk resulting from IIFS holding assets with a view to reselling or leasing them. • Assets held in inventory with a view to resale or lease receive a 15% capital charge • In the case of equity investment made by means of Musharaka or Mudaraba contracts where the underlying assets are commodities held for trading, market risk measurements for commodities are applicable • ‘Commodity ladder’ approach, or • Simplified approach • The overall capital charge for market risk is converted into a ‘credit risk equivalent’ by being multiplied by the reciprocal of the required CAR, i. e. 12. 5 (100/8) 17

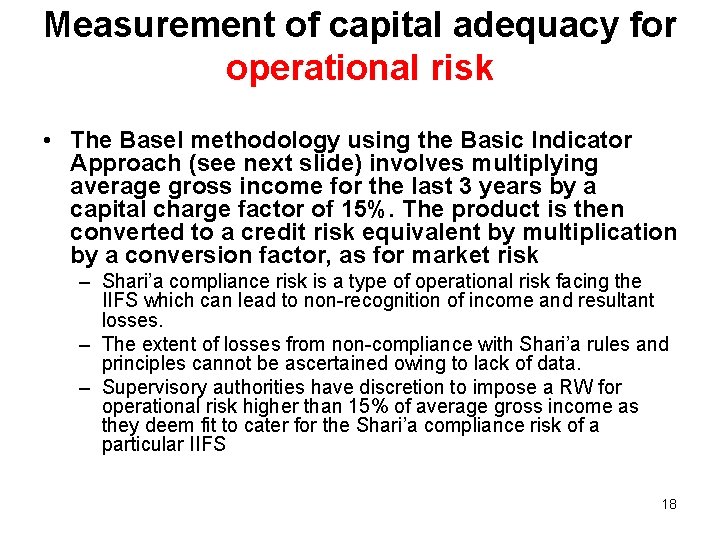

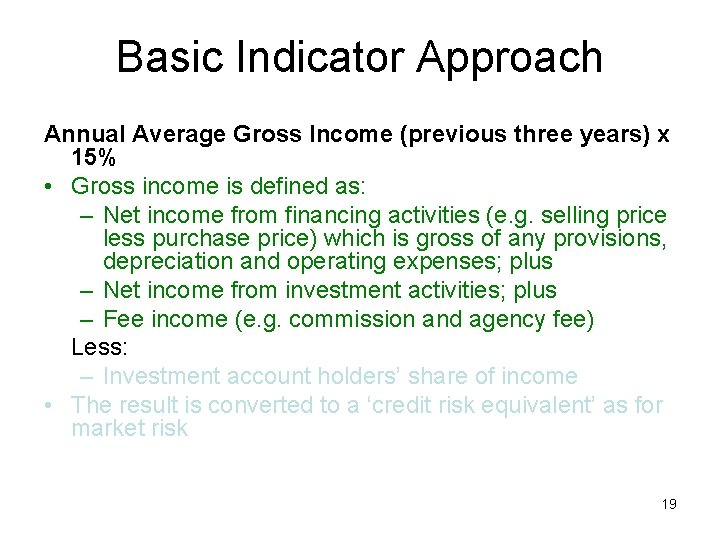

Measurement of capital adequacy for operational risk • The Basel methodology using the Basic Indicator Approach (see next slide) involves multiplying average gross income for the last 3 years by a capital charge factor of 15%. The product is then converted to a credit risk equivalent by multiplication by a conversion factor, as for market risk – Shari’a compliance risk is a type of operational risk facing the IIFS which can lead to non-recognition of income and resultant losses. – The extent of losses from non-compliance with Shari’a rules and principles cannot be ascertained owing to lack of data. – Supervisory authorities have discretion to impose a RW for operational risk higher than 15% of average gross income as they deem fit to cater for the Shari’a compliance risk of a particular IIFS 18

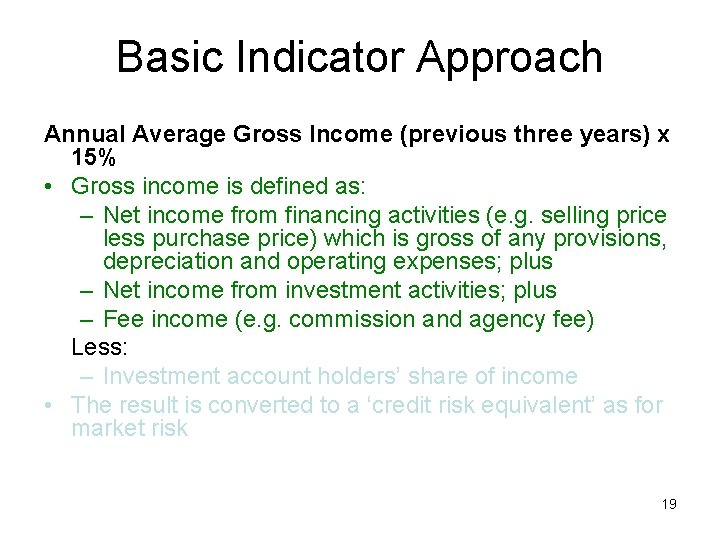

Basic Indicator Approach Annual Average Gross Income (previous three years) x 15% • Gross income is defined as: – Net income from financing activities (e. g. selling price less purchase price) which is gross of any provisions, depreciation and operating expenses; plus – Net income from investment activities; plus – Fee income (e. g. commission and agency fee) Less: – Investment account holders’ share of income • The result is converted to a ‘credit risk equivalent’ as for market risk 19

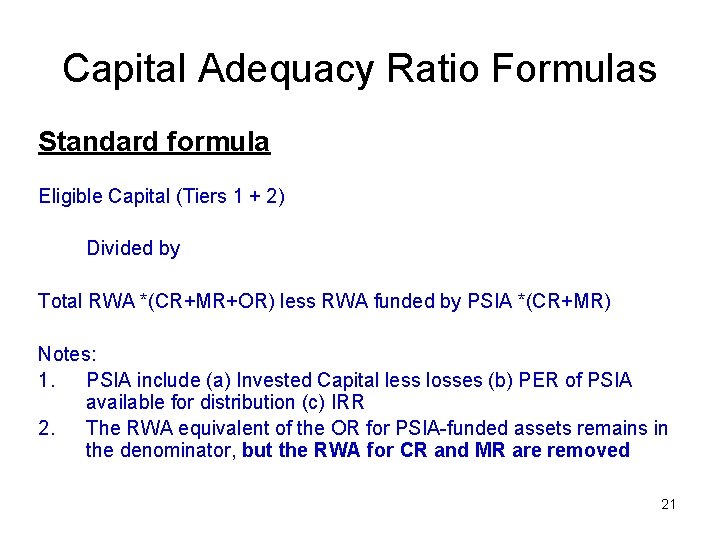

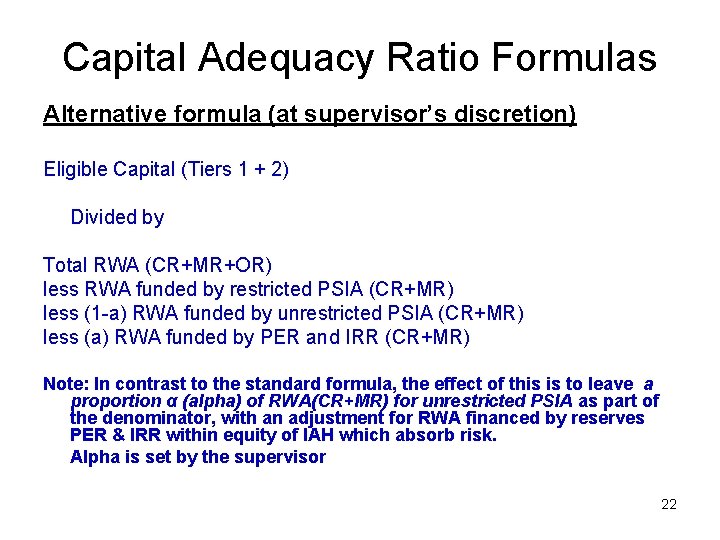

Treatment of Equity of Investment Accounts Standard & Alternative Formulas • Standard formula – assumes that: – 100% of credit & market risk of risk weighted assets financed by IAH funds is borne by IAH – 100% of operational risk of managing these assets is borne by IIFS • Alternative formula, at supervisor’s discretion – – Some proportion α (decided by supervisor) of credit & market risk of risk weighted assets financed by IAH funds is deemed to be borne by IIFS (displaced commercial risk) – 100% of operational risk of managing these assets is borne by IIFS 20

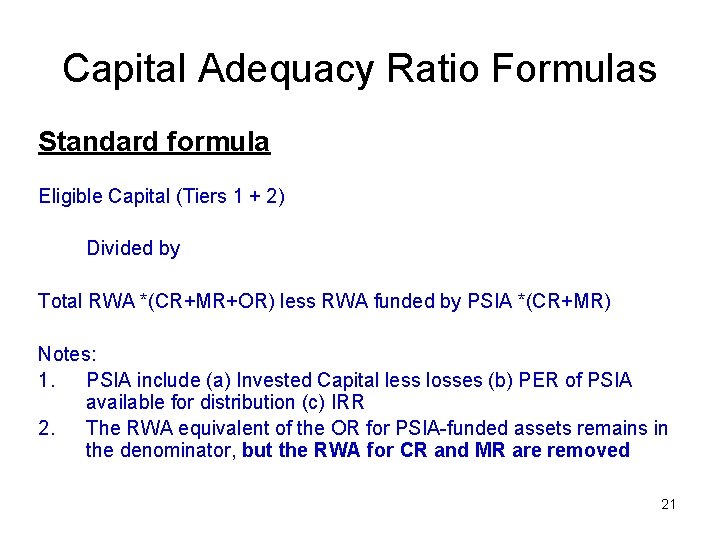

Capital Adequacy Ratio Formulas Standard formula Eligible Capital (Tiers 1 + 2) Divided by Total RWA *(CR+MR+OR) less RWA funded by PSIA *(CR+MR) Notes: 1. PSIA include (a) Invested Capital less losses (b) PER of PSIA available for distribution (c) IRR 2. The RWA equivalent of the OR for PSIA-funded assets remains in the denominator, but the RWA for CR and MR are removed 21

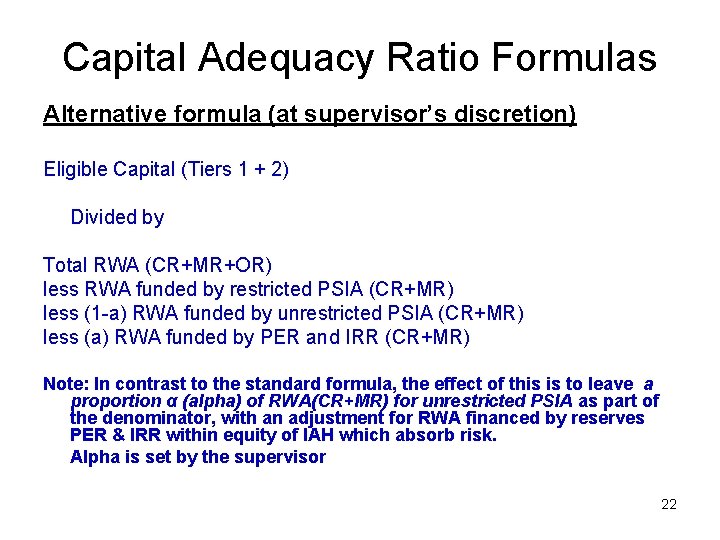

Capital Adequacy Ratio Formulas Alternative formula (at supervisor’s discretion) Eligible Capital (Tiers 1 + 2) Divided by Total RWA (CR+MR+OR) less RWA funded by restricted PSIA (CR+MR) less (1 -a) RWA funded by unrestricted PSIA (CR+MR) less (a) RWA funded by PER and IRR (CR+MR) Note: In contrast to the standard formula, the effect of this is to leave a proportion α (alpha) of RWA(CR+MR) for unrestricted PSIA as part of the denominator, with an adjustment for RWA financed by reserves PER & IRR within equity of IAH which absorb risk. Alpha is set by the supervisor 22

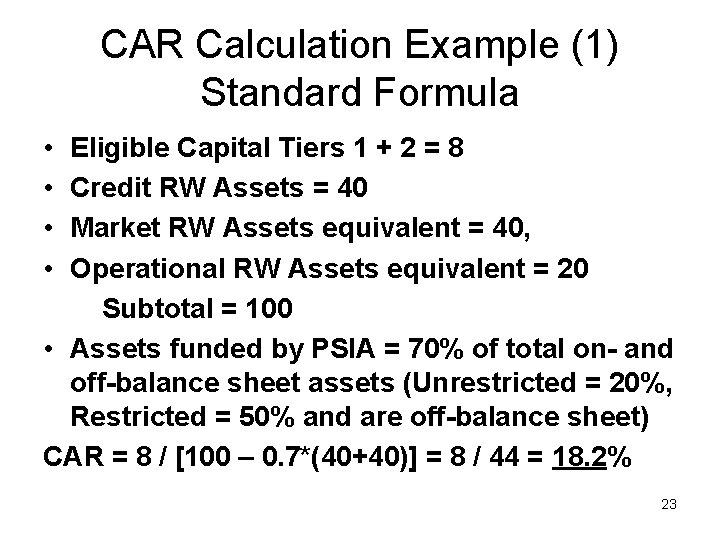

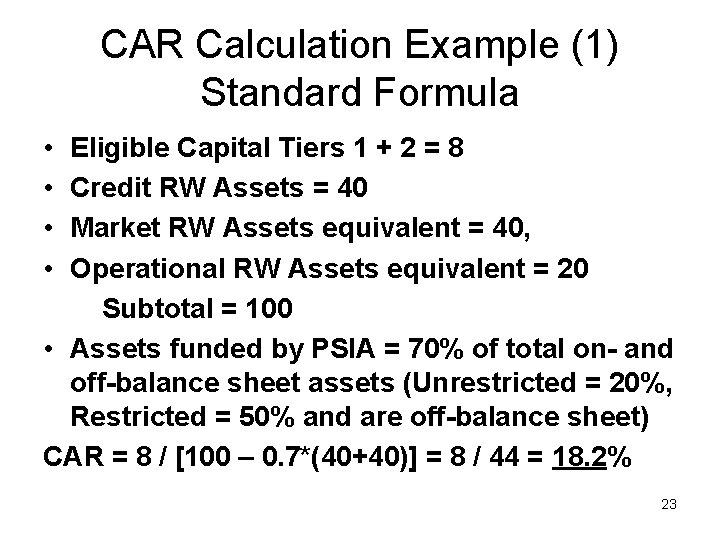

CAR Calculation Example (1) Standard Formula • • Eligible Capital Tiers 1 + 2 = 8 Credit RW Assets = 40 Market RW Assets equivalent = 40, Operational RW Assets equivalent = 20 Subtotal = 100 • Assets funded by PSIA = 70% of total on- and off-balance sheet assets (Unrestricted = 20%, Restricted = 50% and are off-balance sheet) CAR = 8 / [100 – 0. 7*(40+40)] = 8 / 44 = 18. 2% 23

CAR Calculation Example (2) Supervisory Discretion Formula • Assume eligible capital = 8, alpha = 30%, and PER + IRR = 10% of unrestricted PSIA • Restricted PSIA (20%) • Unrestricted PSIA (50%) • All other funds (30%) • Total = 100 20% CRWA 8 MRWA equ. 8 ORWA equ. 0 Totals 16 50% 30% Total 20 20 0 40 12 12 20 44 40 40 20 100 24

Supervisory Discretion Formula Calculation continued CAR = EC = 8 divided by [Total RWA = 100 Less CRWA and MRWA equiv of Restricted PSIA = 8+8 = 16 Less (1 -alpha)* CRWA and MRWA equiv of Unrestricted PSIA = (1 -0. 3)*(20+20) = 28 Less alpha*(PER+IRR) = 0. 3*0. 1*(20+20) = 1. 2] 8/(100 – 16 – 28 – 1. 2) = 8/54. 8 = 14. 6% 25

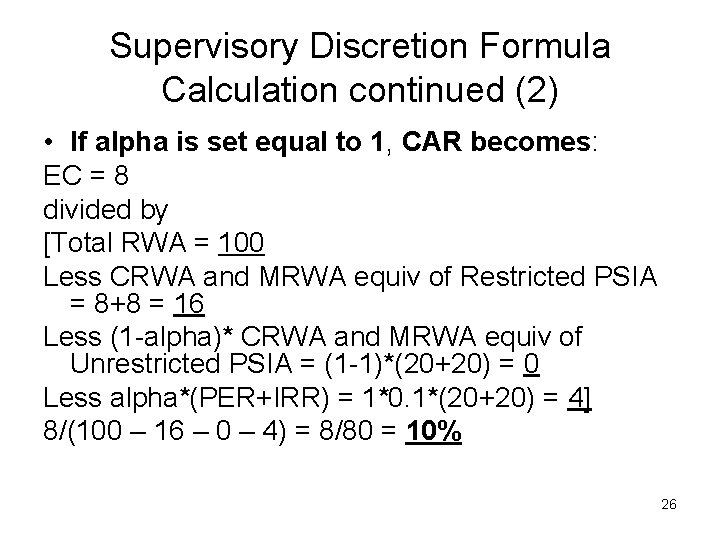

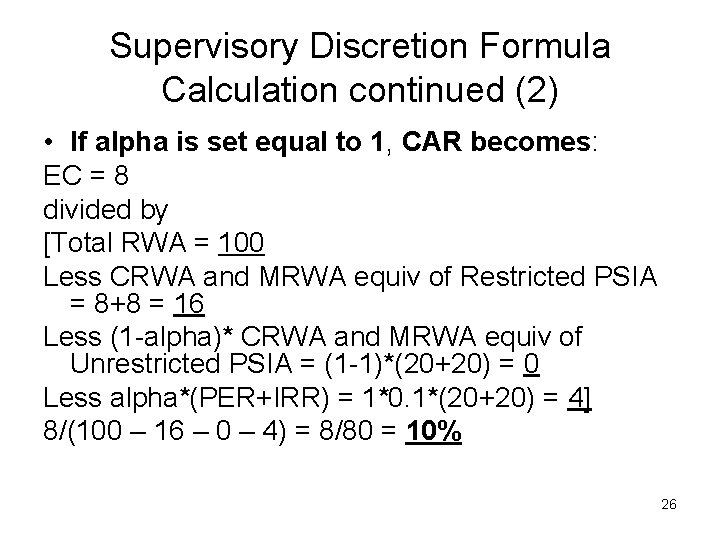

Supervisory Discretion Formula Calculation continued (2) • If alpha is set equal to 1, CAR becomes: EC = 8 divided by [Total RWA = 100 Less CRWA and MRWA equiv of Restricted PSIA = 8+8 = 16 Less (1 -alpha)* CRWA and MRWA equiv of Unrestricted PSIA = (1 -1)*(20+20) = 0 Less alpha*(PER+IRR) = 1*0. 1*(20+20) = 4] 8/(100 – 16 – 0 – 4) = 8/80 = 10% 26

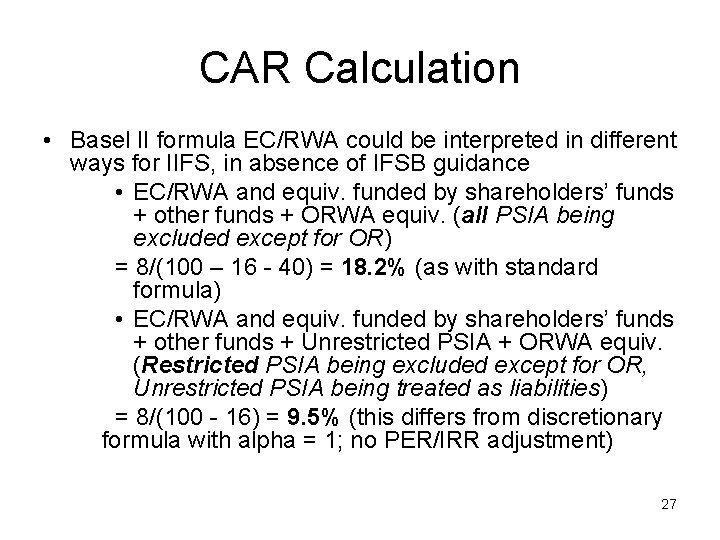

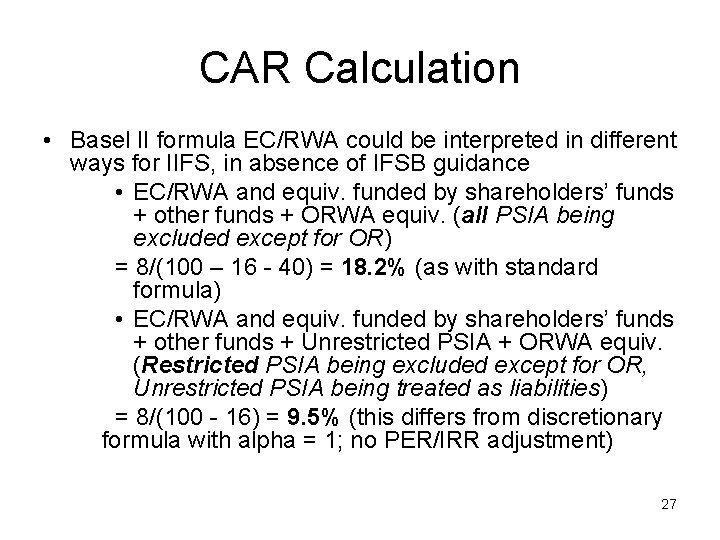

CAR Calculation • Basel II formula EC/RWA could be interpreted in different ways for IIFS, in absence of IFSB guidance • EC/RWA and equiv. funded by shareholders’ funds + other funds + ORWA equiv. (all PSIA being excluded except for OR) = 8/(100 – 16 - 40) = 18. 2% (as with standard formula) • EC/RWA and equiv. funded by shareholders’ funds + other funds + Unrestricted PSIA + ORWA equiv. (Restricted PSIA being excluded except for OR, Unrestricted PSIA being treated as liabilities) = 8/(100 - 16) = 9. 5% (this differs from discretionary formula with alpha = 1; no PER/IRR adjustment) 27

Comments on Displaced Commercial Risk • Juristic nature of PSIA: profit sharing & loss bearing. BUT • Unrestricted PSIA holders & risk appetite • Smoothing of PSIA returns • Constructive obligation & capital certainty? • Deposit guarantee schemes (Takaful or provided gratis by central bank)? 28

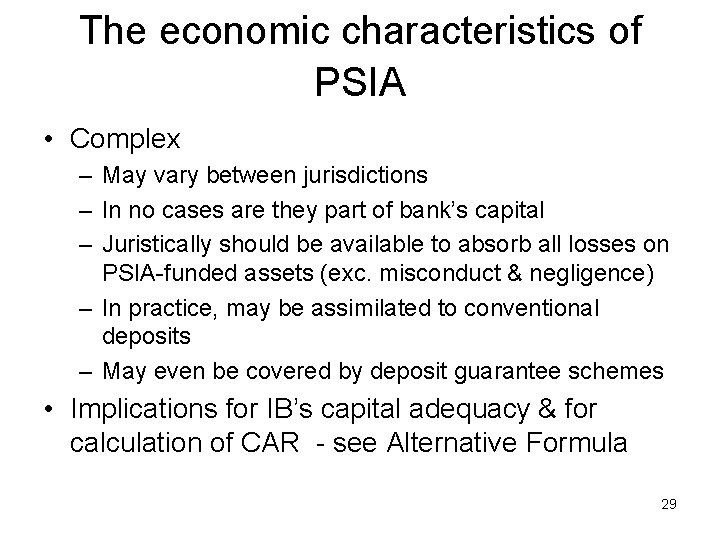

The economic characteristics of PSIA • Complex – May vary between jurisdictions – In no cases are they part of bank’s capital – Juristically should be available to absorb all losses on PSIA-funded assets (exc. misconduct & negligence) – In practice, may be assimilated to conventional deposits – May even be covered by deposit guarantee schemes • Implications for IB’s capital adequacy & for calculation of CAR - see Alternative Formula 29

RWs for profit-sharing assets (1) • Musharaka and Mudaraba financing assets not easily accommodated within Basel credit risk methodology • When assets owned by the Musharaka or Mudaraba are commodities or other trading assets, market risk • When M or M used as a means of financing and to be held to maturity, credit risk (capital impairment) 30

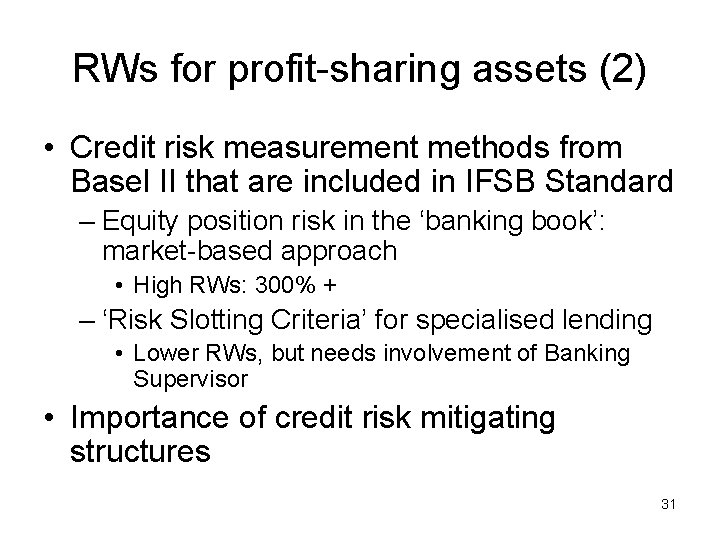

RWs for profit-sharing assets (2) • Credit risk measurement methods from Basel II that are included in IFSB Standard – Equity position risk in the ‘banking book’: market-based approach • High RWs: 300% + – ‘Risk Slotting Criteria’ for specialised lending • Lower RWs, but needs involvement of Banking Supervisor • Importance of credit risk mitigating structures 31

Examples of specific requirements Credit Risk with Market Risk (1) • Mudarabah & Non-binding MPO – Need to provide 15% capital charge (= 187. 5 RW) for price risk on any assets held pending completion of sale to customer – Replaced by credit risk weight on the receivable when sale takes place • MPO – Assets held pending completion of sale to customer receive RW of 100% applied to the net amount of acquisition cost less resale value and less any HJ deposit paid by customer (normally this net amount would be zero or very small) 32

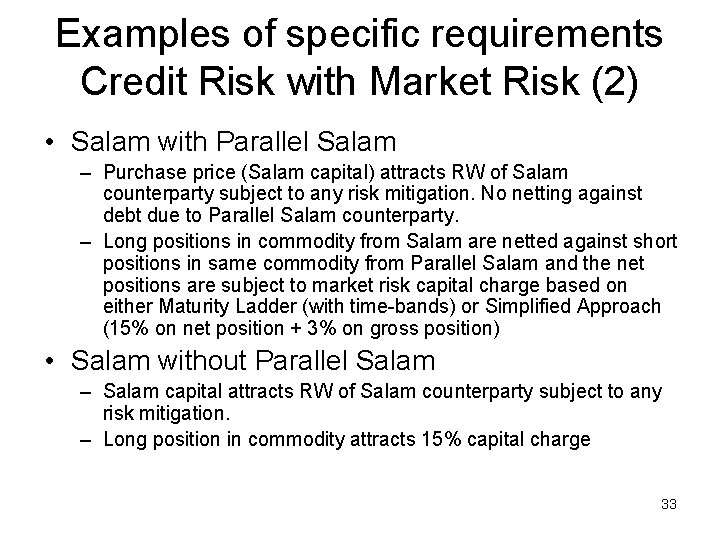

Examples of specific requirements Credit Risk with Market Risk (2) • Salam with Parallel Salam – Purchase price (Salam capital) attracts RW of Salam counterparty subject to any risk mitigation. No netting against debt due to Parallel Salam counterparty. – Long positions in commodity from Salam are netted against short positions in same commodity from Parallel Salam and the net positions are subject to market risk capital charge based on either Maturity Ladder (with time-bands) or Simplified Approach (15% on net position + 3% on gross position) • Salam without Parallel Salam – Salam capital attracts RW of Salam counterparty subject to any risk mitigation. – Long position in commodity attracts 15% capital charge 33

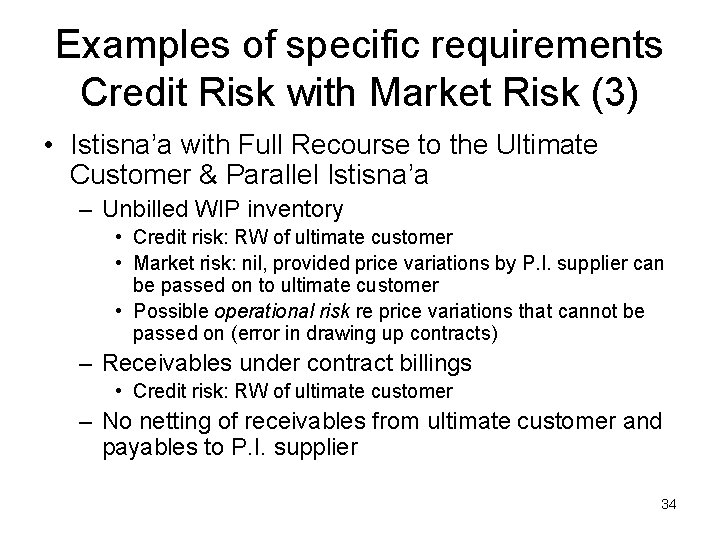

Examples of specific requirements Credit Risk with Market Risk (3) • Istisna’a with Full Recourse to the Ultimate Customer & Parallel Istisna’a – Unbilled WIP inventory • Credit risk: RW of ultimate customer • Market risk: nil, provided price variations by P. I. supplier can be passed on to ultimate customer • Possible operational risk re price variations that cannot be passed on (error in drawing up contracts) – Receivables under contract billings • Credit risk: RW of ultimate customer – No netting of receivables from ultimate customer and payables to P. I. supplier 34

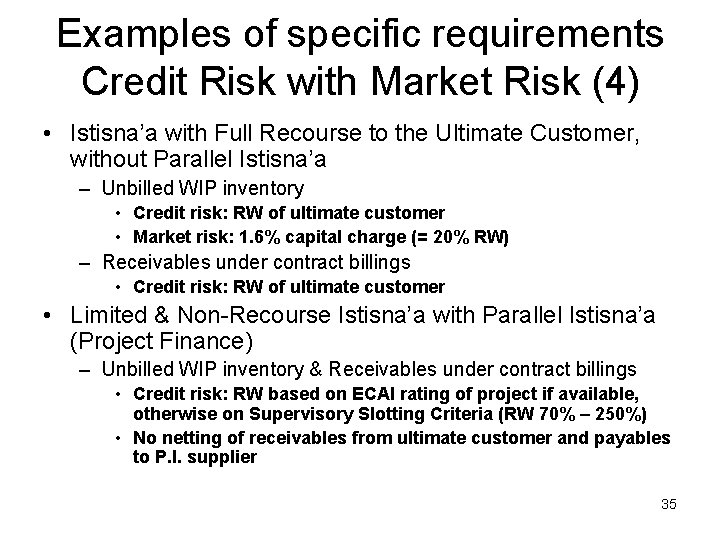

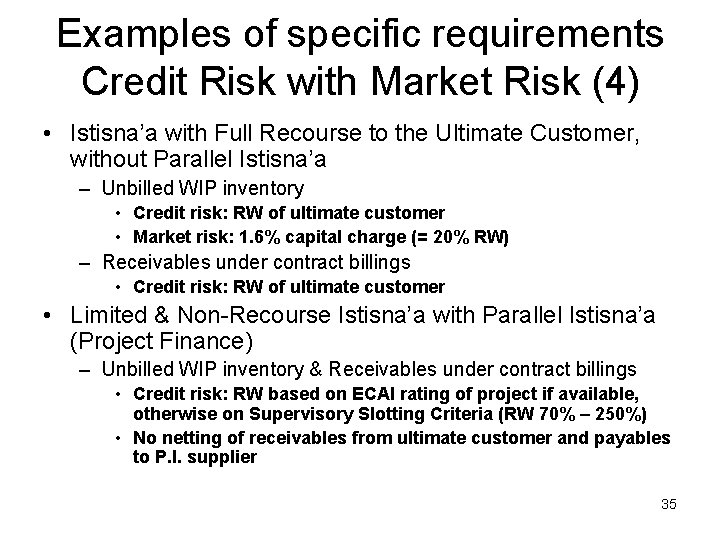

Examples of specific requirements Credit Risk with Market Risk (4) • Istisna’a with Full Recourse to the Ultimate Customer, without Parallel Istisna’a – Unbilled WIP inventory • Credit risk: RW of ultimate customer • Market risk: 1. 6% capital charge (= 20% RW) – Receivables under contract billings • Credit risk: RW of ultimate customer • Limited & Non-Recourse Istisna’a with Parallel Istisna’a (Project Finance) – Unbilled WIP inventory & Receivables under contract billings • Credit risk: RW based on ECAI rating of project if available, otherwise on Supervisory Slotting Criteria (RW 70% – 250%) • No netting of receivables from ultimate customer and payables to P. I. supplier 35

Examples of specific requirements Credit Risk with Market Risk (5) • Operating Ijarah – With binding PL • Credit risk: Assets held pending signature of lease contract with customer receive RW of 100% (or customer’s RW if lower) applied to the net amount of acquisition cost less resale value and less any HJ deposit paid by customer – Non-binding PL • Market risk: Carrying value of assets held pending signature of lease contract with customer attracts 15% capital charge – Both binding and non-binding PL • Credit risk: After signature of lease contract, total estimated value of lease receivables remaining payable for whole duration of contract, less recovery value of the asset, is treated as receivable from the lessee and receives RW of lessee as obligor • Market risk: During contract – carrying (recovery) value of asset is risk weighted at 100%. End of contract pending re-lease or disposal carrying value of asset attracts 15% capital charge. 36

Examples of specific requirements Credit Risk with Market Risk (6) • Ijarah Muntahia Bittamleek – With binding PL • Credit risk: Assets held pending signature of lease contract with customer receive RW of 100% (or customer’s RW if lower) applied to the net amount of acquisition cost less resale value and less any HJ deposit paid by customer – Non-binding PL • Market risk: Carrying value of assets held pending signature of lease contract with customer attracts 15% capital charge – Both binding and non-binding PL • Credit risk: After signature of lease contract, total estimated value of lease receivables remaining payable for whole duration of contract, less recovery value of the IIFS’s share of asset*, is treated as receivable from the lessee and receives RW of lessee as obligor. (No market risk) • *In some forms of IMB, ownership of asset is transferred progressively to lessee 37

Examples of RW for Profit-Sharing Financing Assets (1) • Musharakah – Private commercial enterprise to undertake trading activities in FX, securities or commodities • Market risk of underlying assets – Other private commercial enterprises • Contributed capital less reductions in Diminishing Musharaka, Credit RW as follows: Either – Equity position in banking book: 400% RW subject to risk mitigation, or – Supervisory slotting: 90%-270% RW – Joint ownership of real estate or movable assets • Credit risk: RW based on customers in underlying subcontracts (Ijarah, IMB or Murabahah) • Market risk: as in underlying subcontracts, otherwise capital charge as for underlying assets 38

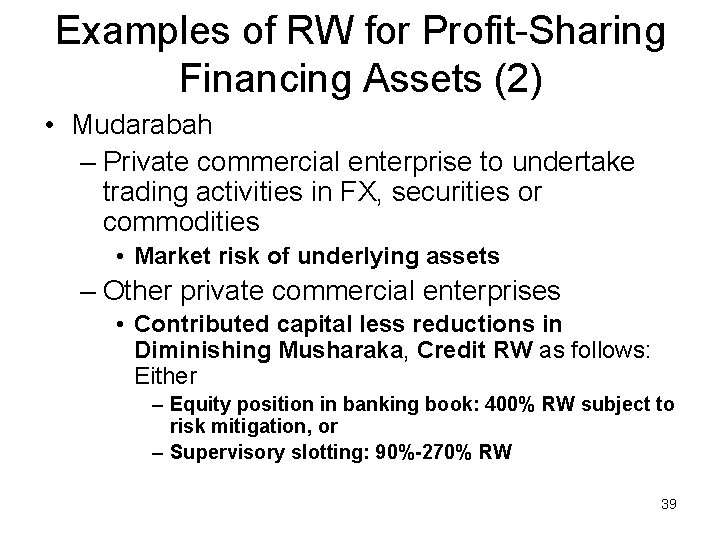

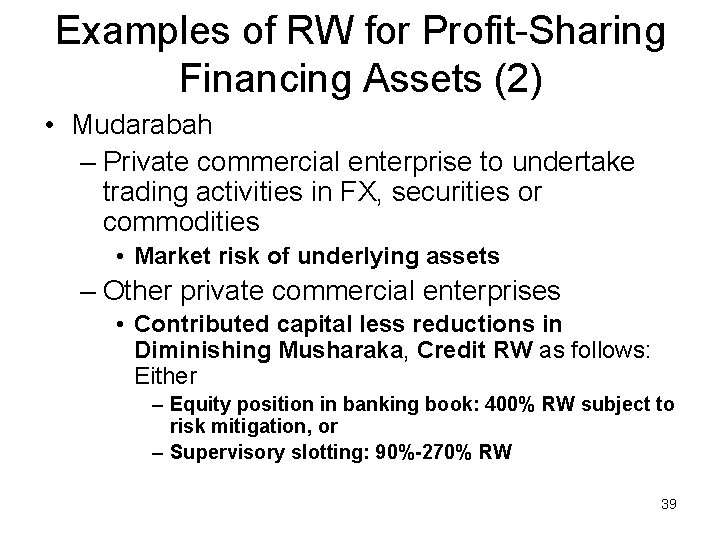

Examples of RW for Profit-Sharing Financing Assets (2) • Mudarabah – Private commercial enterprise to undertake trading activities in FX, securities or commodities • Market risk of underlying assets – Other private commercial enterprises • Contributed capital less reductions in Diminishing Musharaka, Credit RW as follows: Either – Equity position in banking book: 400% RW subject to risk mitigation, or – Supervisory slotting: 90%-270% RW 39

Examples of RW for Profit-Sharing Financing Assets (2) • Mudarabah (continued) – Mudarabah for Project Finance • Credit risk: : • on progress payments due from the ultimate customer following certification of work, – subject to binding agreement with ultimate customer to make progress payments into a ‘repayment account’ with the IIFS, RW is based on rating of ultimate customer. – If no such agreement, RW is based on Mudarib’s credit rating (or 100% RW) • on balance of amount advanced to and due from Mudarib, RW is 400% (equity position risk) or based on the supervisory slotting method (RW 90%-270%). 40

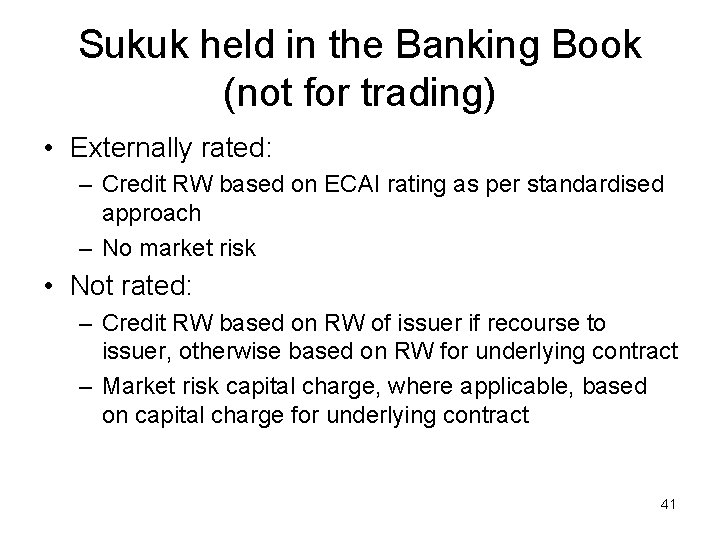

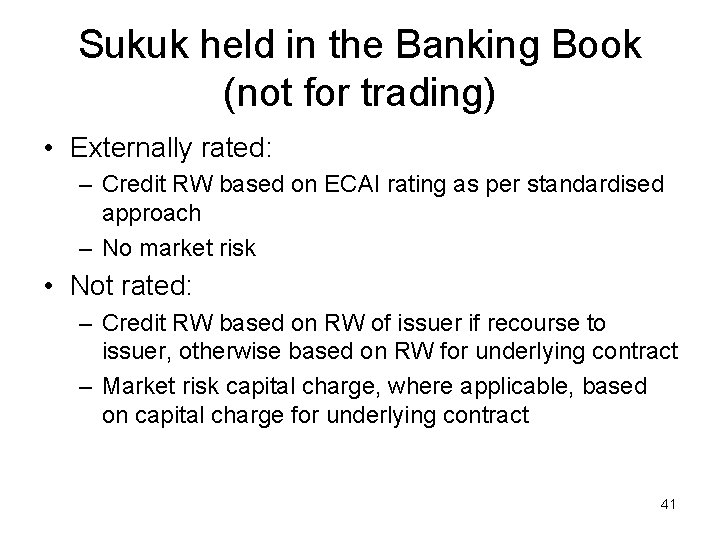

Sukuk held in the Banking Book (not for trading) • Externally rated: – Credit RW based on ECAI rating as per standardised approach – No market risk • Not rated: – Credit RW based on RW of issuer if recourse to issuer, otherwise based on RW for underlying contract – Market risk capital charge, where applicable, based on capital charge for underlying contract 41

Conclusions • IFSB CAS needed to extend & adapt Basel II approach to cater for: – Characteristics of Islamic financing assets which may involve • • several stages of contract execution market as well as credit risk equity position risk in the ‘banking book’ different forms of and limitations on collateral – Financing by Profit Sharing and Loss Bearing Investment Accounts • Especially unrestricted IAH • Issue of Displaced Commercial Risk 42

Capital adequacy ratio formula

Capital adequacy ratio formula Whats a banking institution

Whats a banking institution Islamic financial services industry stability report

Islamic financial services industry stability report Managed services presentation

Managed services presentation Ibm services great 8 offering theme

Ibm services great 8 offering theme Why study financial markets?

Why study financial markets? Participants of money market

Participants of money market Functions of financial institutions

Functions of financial institutions Introduction to financial institutions

Introduction to financial institutions Regulatory institutions in indian financial system

Regulatory institutions in indian financial system Types of non banking financial institutions

Types of non banking financial institutions Financial institutions and markets lecture notes ppt

Financial institutions and markets lecture notes ppt Enterprise risk management for financial institutions

Enterprise risk management for financial institutions Chapter 12 money and financial institutions

Chapter 12 money and financial institutions Chapter 12 money and financial institutions

Chapter 12 money and financial institutions Louisiana office of financial institutions

Louisiana office of financial institutions Financial markets instruments and institutions

Financial markets instruments and institutions Madura j. financial markets and institutions

Madura j. financial markets and institutions Accounting for financial institutions

Accounting for financial institutions Equity securities

Equity securities Financial literacy at minority serving institutions

Financial literacy at minority serving institutions Madura j. financial markets and institutions

Madura j. financial markets and institutions Financial institutions division

Financial institutions division Why study financial markets and institutions

Why study financial markets and institutions Solve the analogy

Solve the analogy What is adequacy in testing

What is adequacy in testing Briefly explain test adequacy criteria with proper example

Briefly explain test adequacy criteria with proper example Criteria of adequacy scope

Criteria of adequacy scope Horizontal and vertical adequacy

Horizontal and vertical adequacy Certificate of adequacy

Certificate of adequacy Objects of knowledge

Objects of knowledge Adequacy

Adequacy Adequacy

Adequacy Cash flow statement

Cash flow statement Model adequacy checking anova

Model adequacy checking anova Liability adequacy test

Liability adequacy test Working capital management refers to

Working capital management refers to Difference between capital reserve and reserve capital

Difference between capital reserve and reserve capital Multinational capital structure

Multinational capital structure Difference between capital reserve and reserve capital

Difference between capital reserve and reserve capital Basle ii

Basle ii Regulatory capital vs economic capital

Regulatory capital vs economic capital Variable capital examples

Variable capital examples