California Real Estate Principles 10 1 Edition Chapter

- Slides: 28

California Real Estate Principles, 10. 1 Edition Chapter 8 Introduction to Real Estate Finance © 2016 On. Course Learning

Chapter 8 1. Describe the types of promissory notes, then explain adjustable rate loans. 2. Explain a deed of trust (trust deed), a mortgage, installment sales contract, and foreclosure procedures. 3. Define clauses common to financing documents: acceleration, alienation, subordination, prepayment penalty. 4. Outline the principles of loan regulations: Truth -In-Lending, RESPA, Fair Credit, Real Fair Credit Reporting and Property Loan Law.

Financing Process 1. 2. 3. 4. 5. APPLICATION: Lender form used to acquire information on income, credit and assets. ANALYSIS: Verification of income, credit and assets. Underwriter decides if borrower is qualified. If so, loan terms. The major issue the FICO score PROCESSING: Papers drawn. Escrow instructions, appraisal, loan documents. CLOSING: Papers signed, loan funds, loan and escrow closes, documents recorded, insurance issued (property and title), closing statements issued SERVICING: Process of collecting loan payments. Check on loan until paid off. Pay impound bills.

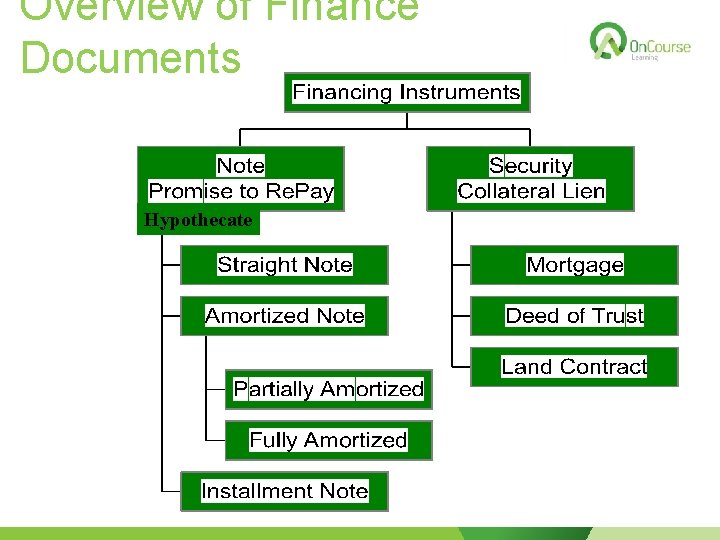

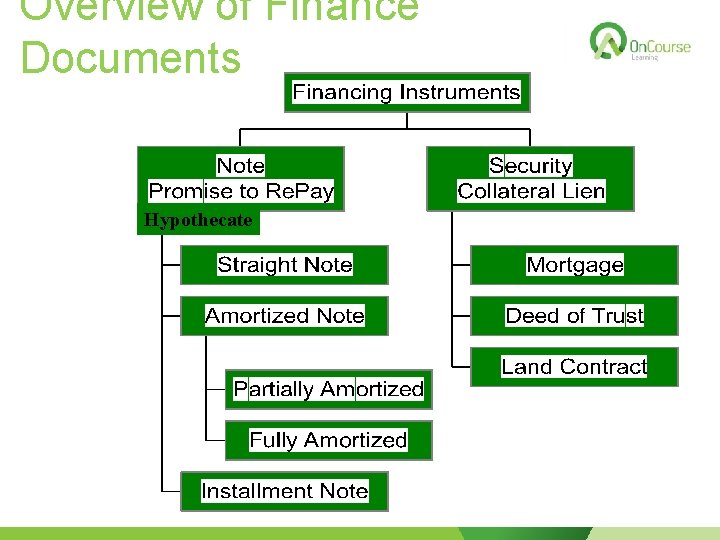

Overview of Finance Documents Hypothecate

Promissory Notes Legal obligation for the debt Straight Note Payments of Interest Only Entire principal repaid on the final due date Installment Note Periodic payments of principal & interest Amortized Note Monthly payments which include both Principal and Interest Fully Amortized type : Liquidates the debt with final payment Partially Amortized : Balloon payment type requires larger final payment

Real Estate Loans • • Fixed Rate - The interest rate remains the same Adjustable Rate Mortgage (ARM)-rate – Lower initial rate than fixed-rate mortgage – Rate cap and payment cap Variable Interest Rate (VIR) Graduated Payment Mortgage (GPM)-increasing Graduated Payment Adjustable Mortgage (GPAM) Growing Equity Mortgage (GEM)principal All-Inclusive Trust Deed (AITD) Reverse Annuity Mortgage (RAM)

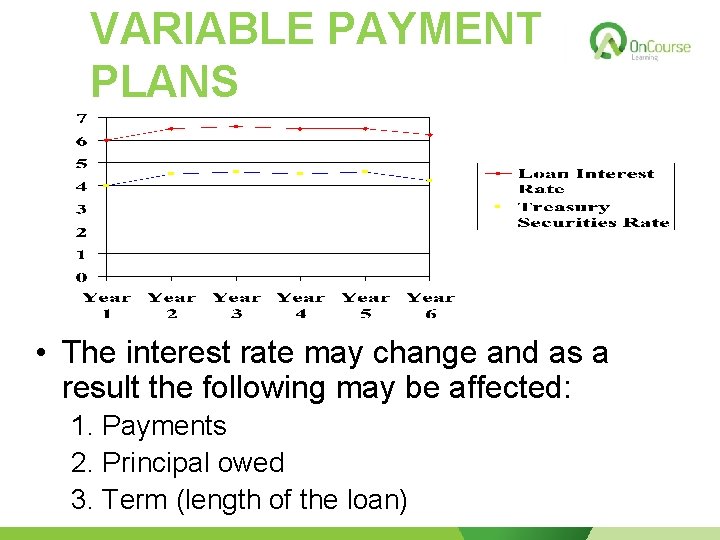

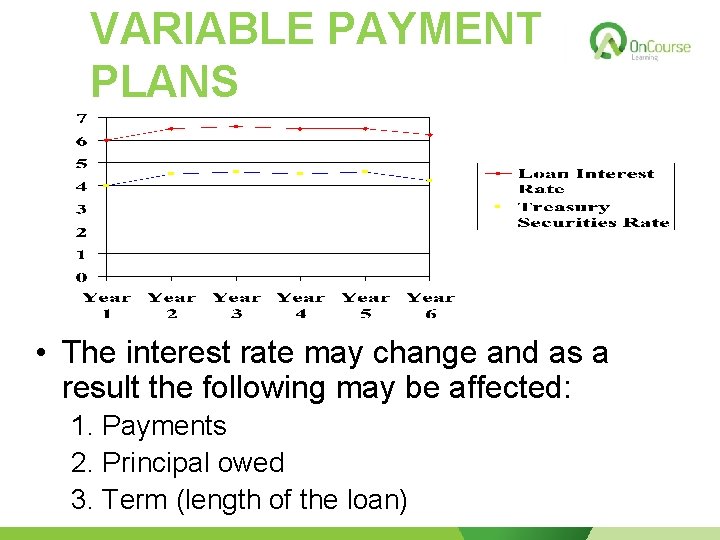

VARIABLE PAYMENT PLANS • The interest rate may change and as a result the following may be affected: 1. Payments 2. Principal owed 3. Term (length of the loan)

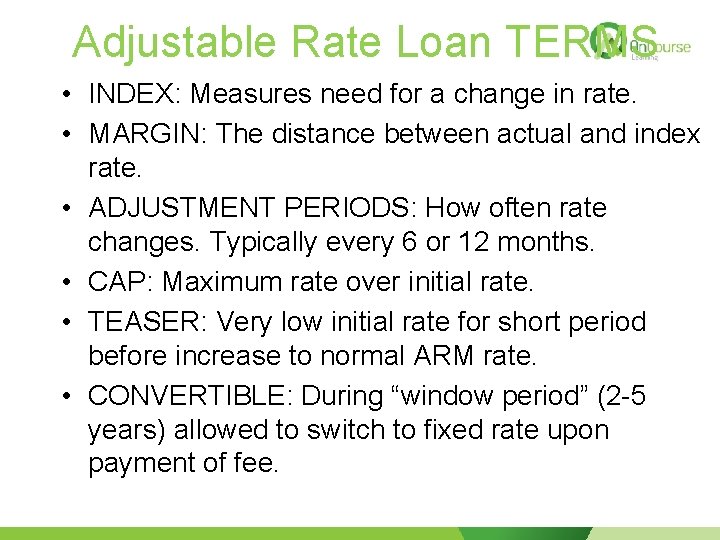

Adjustable Rate Loan TERMS • INDEX: Measures need for a change in rate. • MARGIN: The distance between actual and index rate. • ADJUSTMENT PERIODS: How often rate changes. Typically every 6 or 12 months. • CAP: Maximum rate over initial rate. • TEASER: Very low initial rate for short period before increase to normal ARM rate. • CONVERTIBLE: During “window period” (2 -5 years) allowed to switch to fixed rate upon payment of fee.

Negative Amortized Note • This is when the loan payment does not cover the monthly interest • Shortage is added to principal loan amount • Results in increased loan balance • AKA: Option Arm, Neg Am, Four-pay option ARM • Minimum payment , Interest only (I/O), 15 year, 30/40 year fully amortized.

Negative Amortized Note • This is when the loan payment does not cover the monthly interest • Shortage is added to principal loan amount • Results in increased loan balance

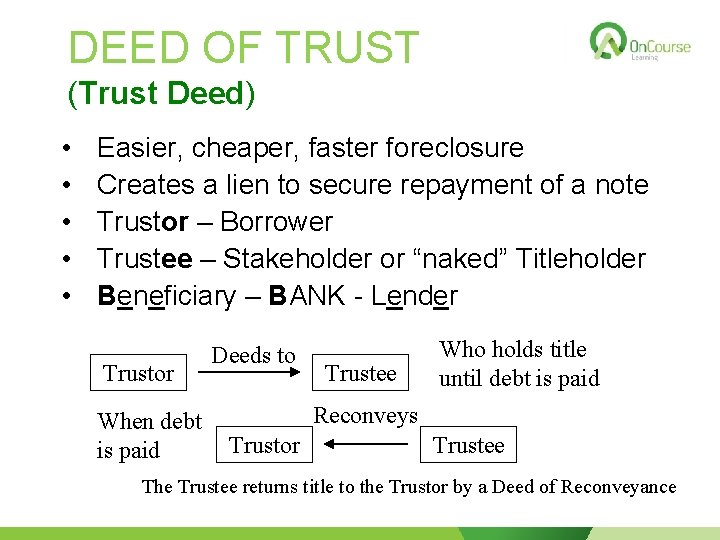

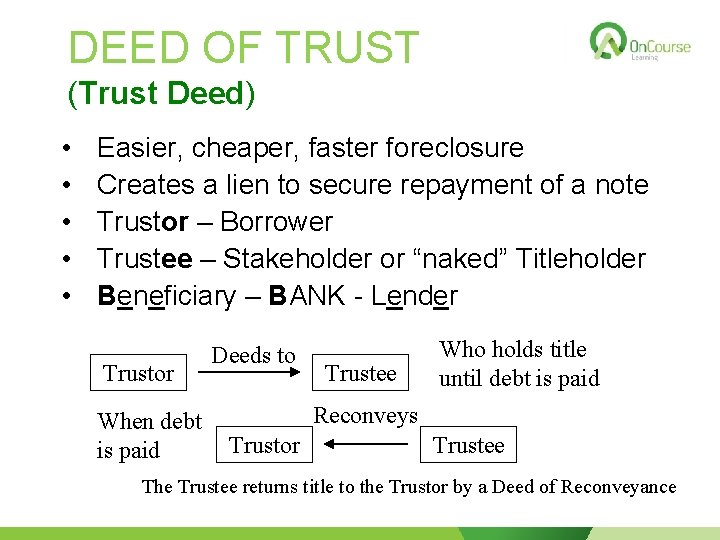

DEED OF TRUST (Trust Deed) • • • Easier, cheaper, faster foreclosure Creates a lien to secure repayment of a note Trustor – Borrower Trustee – Stakeholder or “naked” Titleholder Beneficiary – BANK - Lender Trustor When debt is paid Deeds to Trustee Who holds title until debt is paid Reconveys Trustor Trustee The Trustee returns title to the Trustor by a Deed of Reconveyance

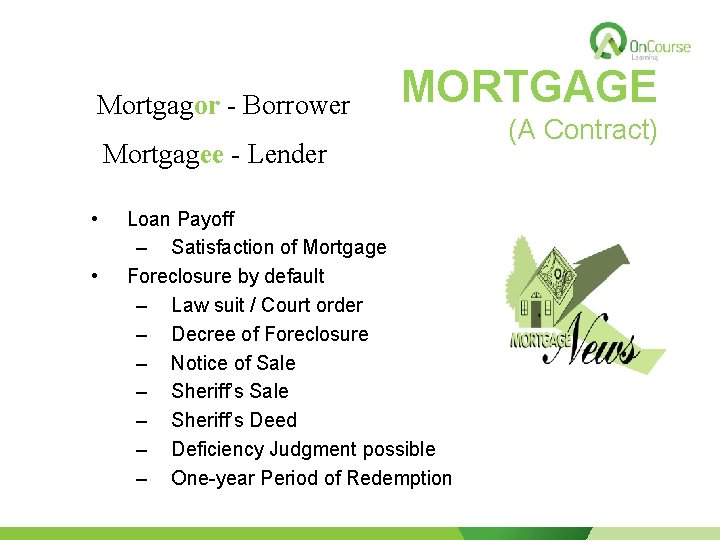

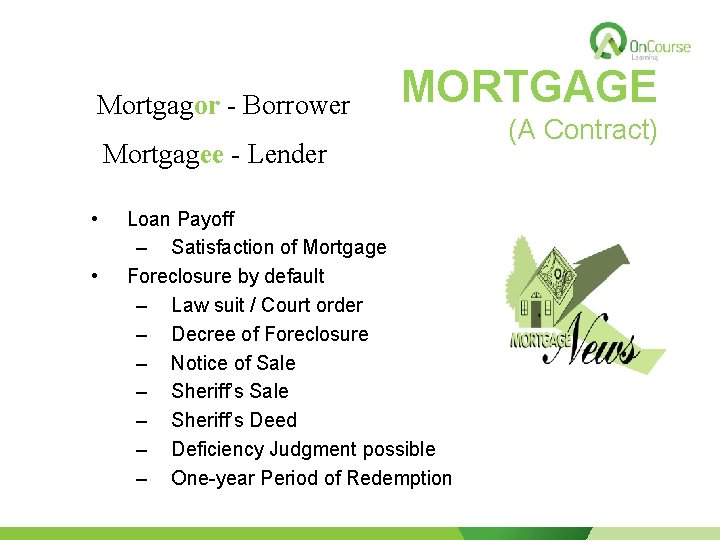

Mortgagor - Borrower MORTGAGE Mortgagee - Lender • • Loan Payoff – Satisfaction of Mortgage Foreclosure by default – Law suit / Court order – Decree of Foreclosure – Notice of Sale – Sheriff’s Deed – Deficiency Judgment possible – One-year Period of Redemption (A Contract)

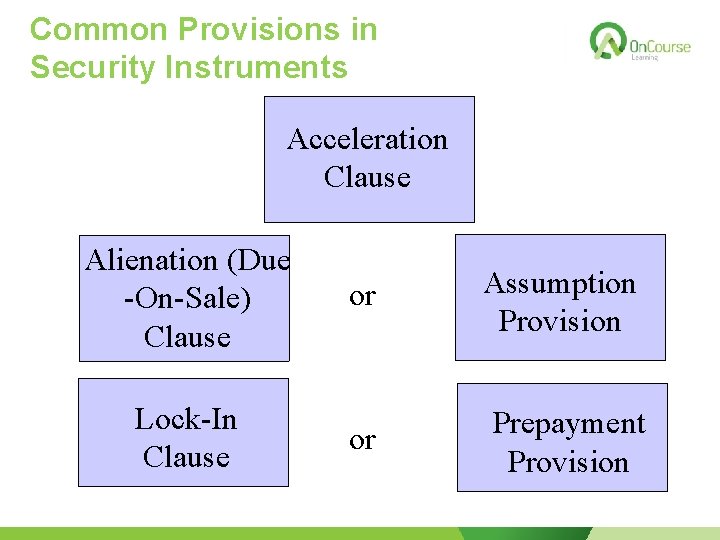

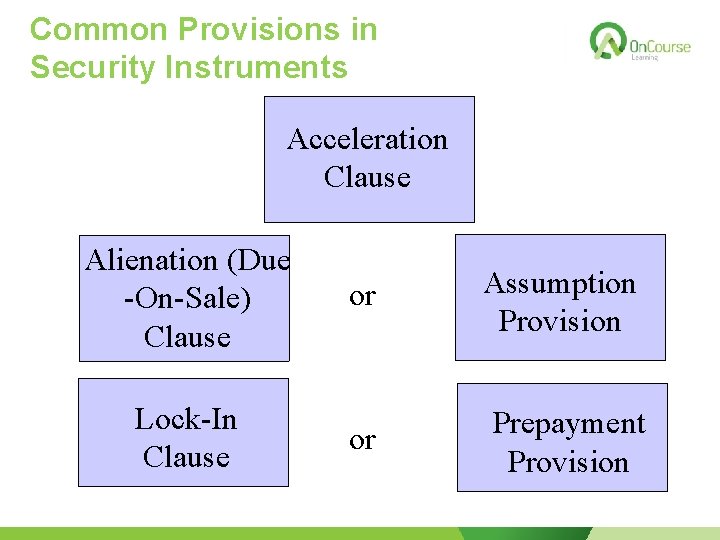

Common Provisions in Security Instruments Acceleration Clause Alienation (Due -On-Sale) Clause Lock-In Clause or Assumption Provision or Prepayment Provision

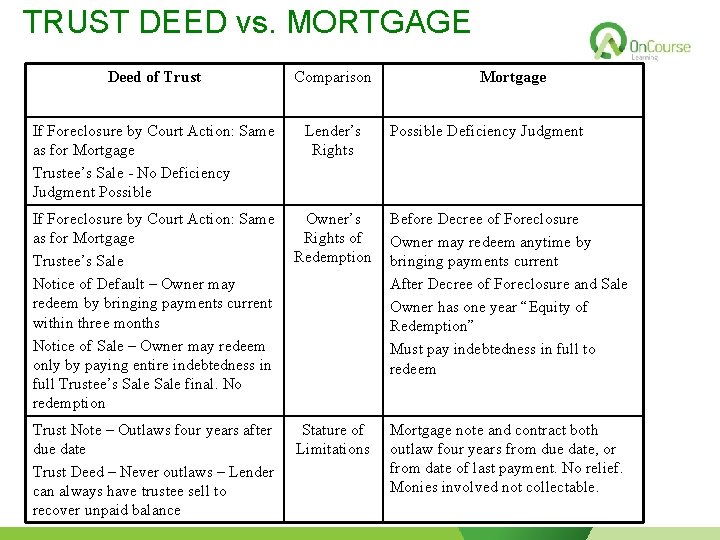

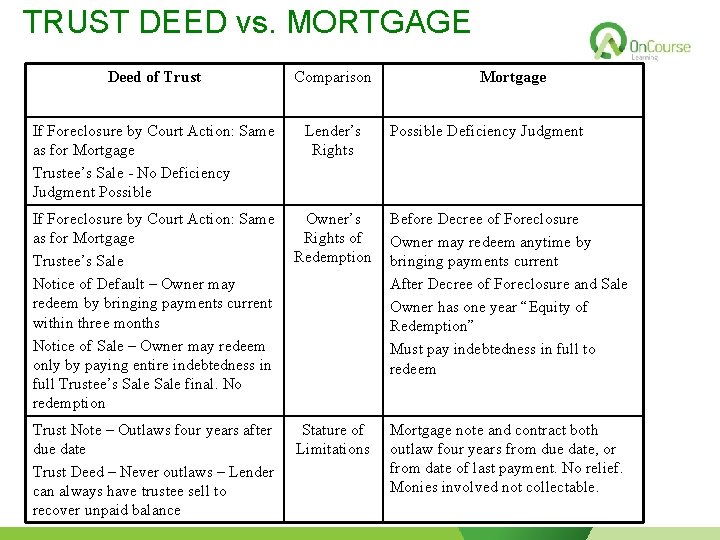

TRUST DEED vs. MORTGAGE Deed of Trust Comparison Mortgage If Foreclosure by Court Action: Same as for Mortgage Trustee’s Sale - No Deficiency Judgment Possible Lender’s Rights If Foreclosure by Court Action: Same as for Mortgage Trustee’s Sale Notice of Default – Owner may redeem by bringing payments current within three months Notice of Sale – Owner may redeem only by paying entire indebtedness in full Trustee’s Sale final. No redemption Owner’s Rights of Redemption Before Decree of Foreclosure Owner may redeem anytime by bringing payments current After Decree of Foreclosure and Sale Owner has one year “Equity of Redemption” Must pay indebtedness in full to redeem Trust Note – Outlaws four years after due date Trust Deed – Never outlaws – Lender can always have trustee sell to recover unpaid balance Stature of Limitations Mortgage note and contract both outlaw four years from due date, or from date of last payment. No relief. Monies involved not collectable. Possible Deficiency Judgment

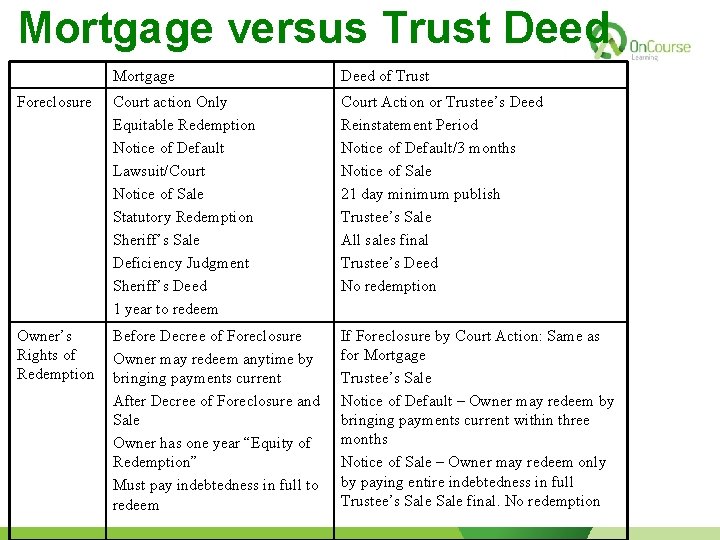

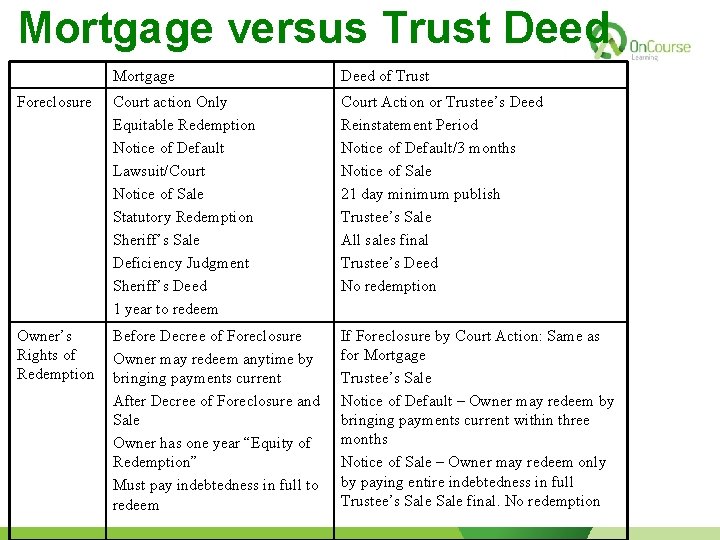

Mortgage versus Trust Deed Mortgage Deed of Trust Foreclosure Court action Only Equitable Redemption Notice of Default Lawsuit/Court Notice of Sale Statutory Redemption Sheriff’s Sale Deficiency Judgment Sheriff’s Deed 1 year to redeem Court Action or Trustee’s Deed Reinstatement Period Notice of Default/3 months Notice of Sale 21 day minimum publish Trustee’s Sale All sales final Trustee’s Deed No redemption Owner’s Rights of Redemption Before Decree of Foreclosure Owner may redeem anytime by bringing payments current After Decree of Foreclosure and Sale Owner has one year “Equity of Redemption” Must pay indebtedness in full to redeem If Foreclosure by Court Action: Same as for Mortgage Trustee’s Sale Notice of Default – Owner may redeem by bringing payments current within three months Notice of Sale – Owner may redeem only by paying entire indebtedness in full Trustee’s Sale final. No redemption

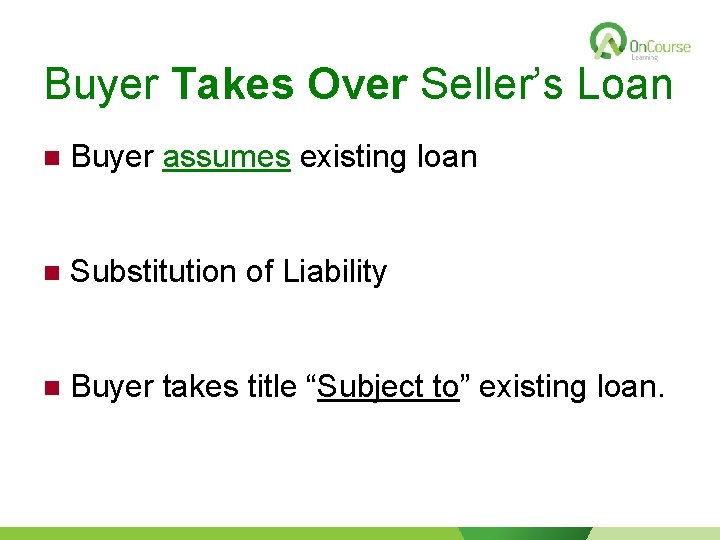

Buyer Takes Over Seller’s Loan n Buyer assumes existing loan n Substitution of Liability n Buyer takes title “Subject to” existing loan.

Prepayment Penalty • Certain California lenders prohibited from charging prepayment penalty on owner-occupied home loans if the loan has been on the lender’s books for more than 3 years. • Does not apply to federally supervised lenders • No prepayment penalty on FHA, VA, or Cal-Vet loans

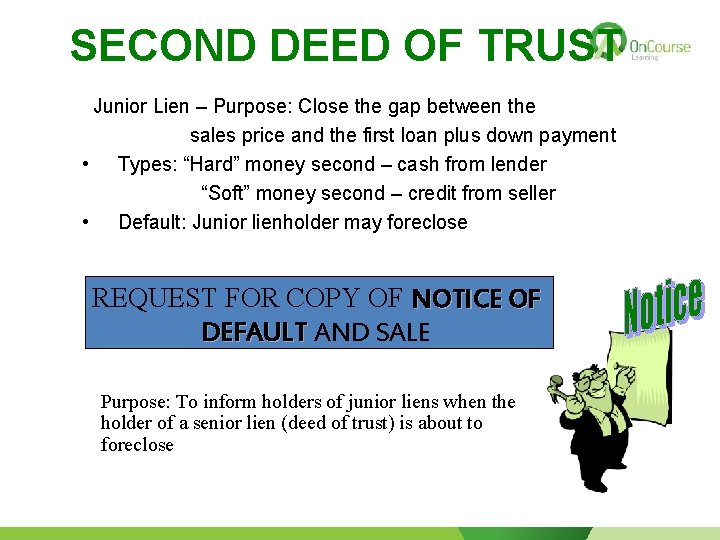

SECOND DEED OF TRUST Junior Lien – Purpose: Close the gap between the sales price and the first loan plus down payment • Types: “Hard” money second – cash from lender “Soft” money second – credit from seller • Default: Junior lienholder may foreclose REQUEST FOR COPY OF NOTICE OF DEFAULT AND SALE Purpose: To inform holders of junior liens when the holder of a senior lien (deed of trust) is about to foreclose

SALES CONTRACT • • Land Contract or Installment Sales Contract Vendor - Vendee Low down payment usually required Allows marginal buyer to acquire real estate Buyer gets immediate possession Buyer receives full legal title after loan paid off Seller must follow statutory notice requirements if buyer defaults All parties should consult their attorney Vendee may receive poor title. Vendor may have problems during the term.

Sales Contract (cont. ) • • • Buyer usually receives equitable, insurable, recorded title The contract cannot prohibit recording Creates a cloud on vendor’s title Removed by court or vendee signing a quitclaim deed Vendee may assign all rights if no release from vendor

Basic Rule of Finance • If you don’t pay … they will take it away !

TRUSTEE’S SALE STEPS 1. Beneficiary requests trustee to foreclose 2. Trustee records Notice of Default 3. Three-month waiting period (Borrower has reinstatement period) 4. Advertise “Notice of Sale” with date, time and place of sale (Borrower has limited right to reinstate) 5. Sale to highest bidder for cash (loan amount + costs) 6. Trustee’s deed is issued (all sales final; borrower has no right of redemption) 7. Disbursement of funds

TRUTH IN LENDING LAW Regulation Z (TIL) • Purpose – disclosure of credit • A. P. R. – cost of credit in percentage terms • Right of rescission • Annual Percentage Rate (APR) must be stated when advertising financing

Equal Credit Opportunity Act • Enforced by the Board of Governors of the Federal Reserve System, through the Federal Reserve Board. • Prohibits lender or mortgage broker from discriminating against credit applicants on the basis of race, color, religion, national origin, sex, marital status, or age, among other things. • Lender cannot ask borrower if: divorced, separated, has childbearing plans, receives alimony or child support (unless using the income to qualify for the loan). • Lender has 30 days to approve or disapprove. • If not approved, lender must state why.

Fair Credit Reporting Act Requires that, if a loan is denied, lender or mortgage broker must: • Give applicant a statement of denial reasons. • Include the name of the federal agency that can be contacted if the applicant feels discriminated against. • If denial is based on information contained in the applicant’s credit report, inform applicant of the right to receive a free copy of the report, and how to do so. • Information can be obtained from the Board of Governors of the Federal Reserve System, through the Federal Reserve Board.

Real Estate Settlement Procedures Act (RESPA) • Requires lender or mortgage broker to disclose any affiliated business arrangement with an individual or entity offering settlement services. • Special information booklet (Buying your Home: Settlement Costs and Helpful Information) within three days of loan application. • Good Faith Estimate of settlement service charges must be provided within 3 business days of loan application.

Truth in Lending Disclosure Settlement Statement • May inspect one day before closing • Includes disclosure of lender-paid broker fees • Escrow Account Statement – No more than two months of excess payments • Accounting provided within 45 days • Annual review of escrow account www. hud. gov

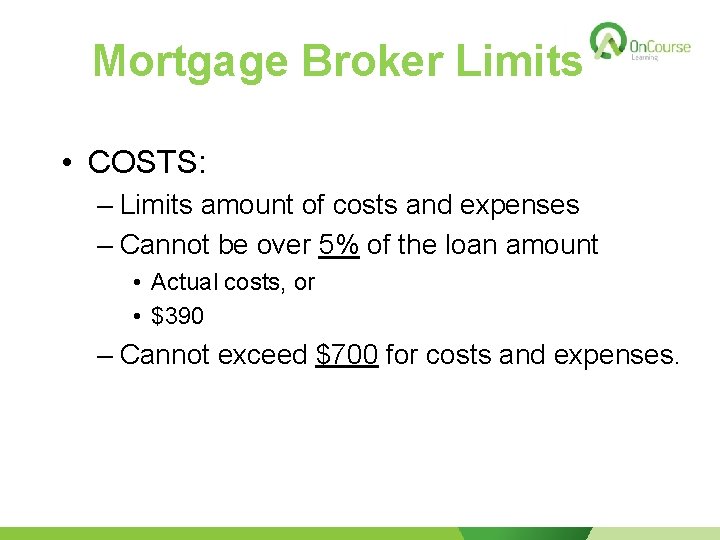

Mortgage Broker Limits • COSTS: – Limits amount of costs and expenses – Cannot be over 5% of the loan amount • Actual costs, or • $390 – Cannot exceed $700 for costs and expenses.

Involuntary inactive real estate license florida

Involuntary inactive real estate license florida Florida real estate principles practices

Florida real estate principles practices Florida real estate broker's guide 6th edition

Florida real estate broker's guide 6th edition Florida real estate broker's guide

Florida real estate broker's guide Modern real estate practice in pennsylvania

Modern real estate practice in pennsylvania Florida real estate broker's guide 6th edition

Florida real estate broker's guide 6th edition Florida real estate broker's guide 6th edition

Florida real estate broker's guide 6th edition Florida real estate broker's guide 6th edition

Florida real estate broker's guide 6th edition Florida real estate broker's guide 6th edition

Florida real estate broker's guide 6th edition Florida real estate broker's guide

Florida real estate broker's guide Florida real estate broker's guide 6th edition

Florida real estate broker's guide 6th edition Southpointe village apartments fishers in

Southpointe village apartments fishers in Florida real estate principles practices and law download

Florida real estate principles practices and law download Income approach appraisal

Income approach appraisal Florida real estate principles practices

Florida real estate principles practices Florida real estate principles practices & law

Florida real estate principles practices & law Rent real estate principles a value approach

Rent real estate principles a value approach Example of no brokerage relationship

Example of no brokerage relationship Rent real estate principles a value approach

Rent real estate principles a value approach Slidetodoc.com

Slidetodoc.com Chapter 11 real estate and other investments

Chapter 11 real estate and other investments Using mis (10th edition) 10th edition

Using mis (10th edition) 10th edition Report

Report Realtor elevator pitch example

Realtor elevator pitch example Mofir real estate

Mofir real estate Real estate stakeholders

Real estate stakeholders Greece property market

Greece property market Sandy miller real estate

Sandy miller real estate Littoral water rights

Littoral water rights