California Real Estate Principles 10 1 Edition Chapter

- Slides: 23

California Real Estate Principles, 10. 1 Edition Chapter 14 Introduction to Taxation © 2016 On. Course Learning

Chapter 14 • Describe the real property assessment procedure as required by Proposition 13. • List the rules regarding the date and manner of payment of real property taxes; describe the tax sale procedure in the event of nonpayment of property taxes. • Explain homeowners, veteran's, and senior citizen's property tax exemptions. • List the income tax advantages of real estate ownership, including the changes due to recent revisions in the tax laws.

Ad Valorem “According to Value” • Real Property Taxes • • House Motor Home Boat Apartment building Personal Property Taxes Sales Tax License Fee Use Tax Transfer Tax

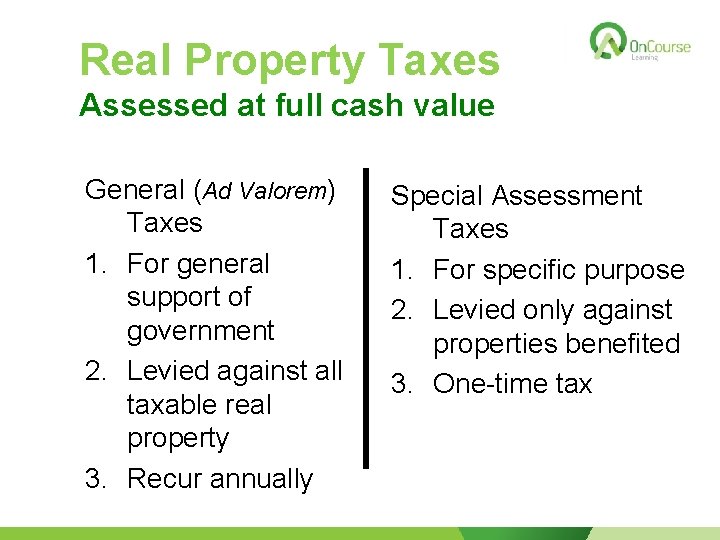

Real Property Taxes Assessed at full cash value General (Ad Valorem) Taxes 1. For general support of government 2. Levied against all taxable real property 3. Recur annually Special Assessment Taxes 1. For specific purpose 2. Levied only against properties benefited 3. One-time tax

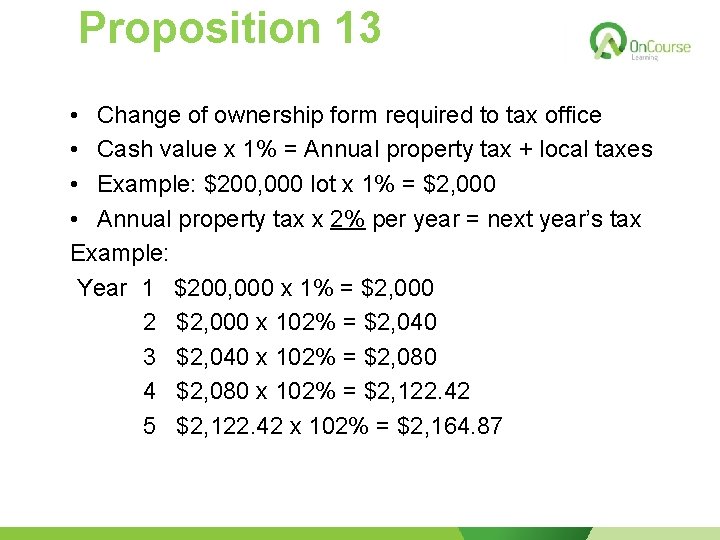

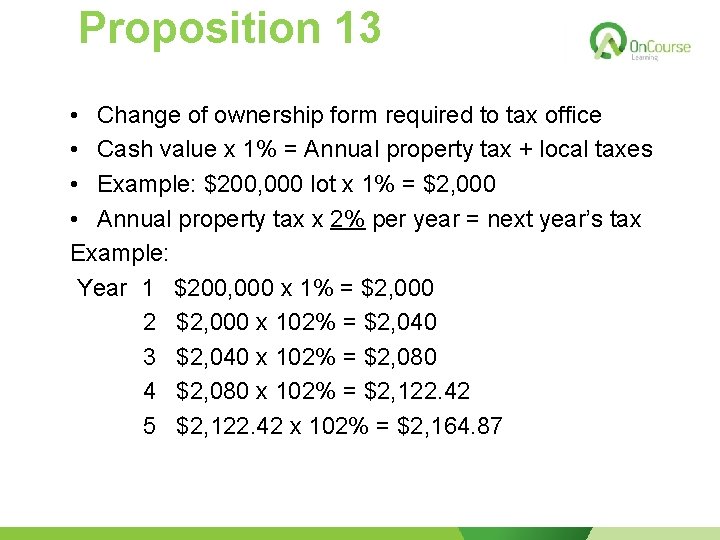

Proposition 13 • Change of ownership form required to tax office • Cash value x 1% = Annual property tax + local taxes • Example: $200, 000 lot x 1% = $2, 000 • Annual property tax x 2% per year = next year’s tax Example: Year 1 $200, 000 x 1% = $2, 000 2 $2, 000 x 102% = $2, 040 3 $2, 040 x 102% = $2, 080 4 $2, 080 x 102% = $2, 122. 42 5 $2, 122. 42 x 102% = $2, 164. 87

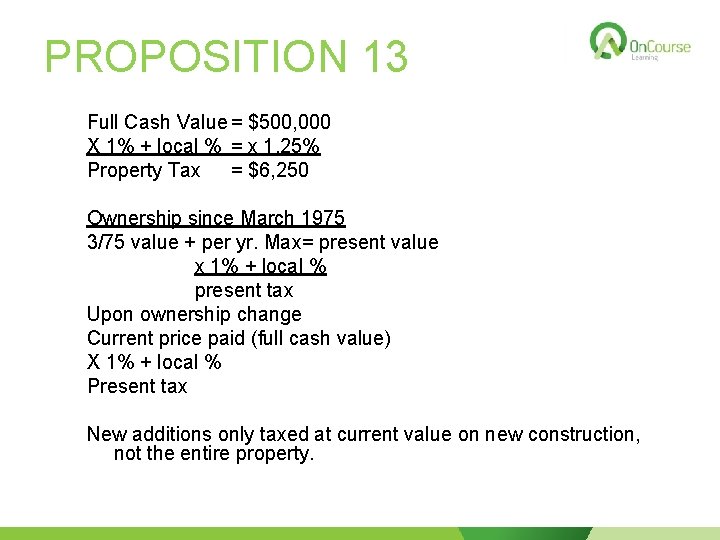

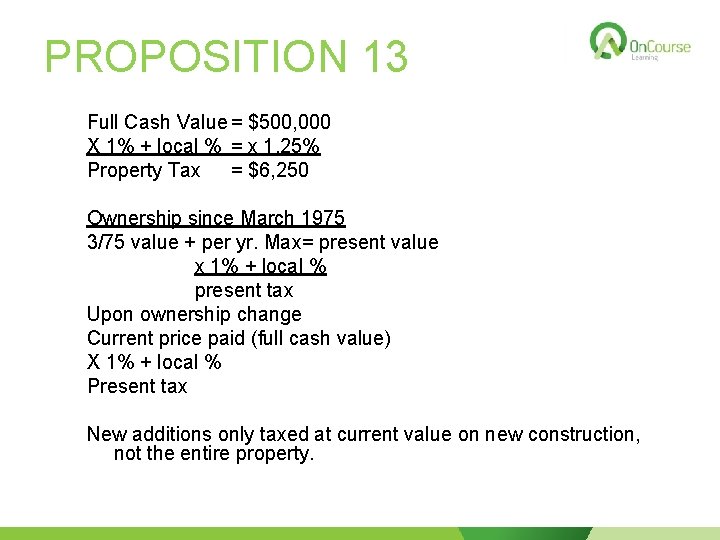

PROPOSITION 13 Full Cash Value = $500, 000 X 1% + local % = x 1. 25% Property Tax = $6, 250 Ownership since March 1975 3/75 value + per yr. Max= present value x 1% + local % present tax Upon ownership change Current price paid (full cash value) X 1% + local % Present tax New additions only taxed at current value on new construction, not the entire property.

No Tax Change • Transfers between spouses • Primary residence plus first $1 million of real property from parents to their children

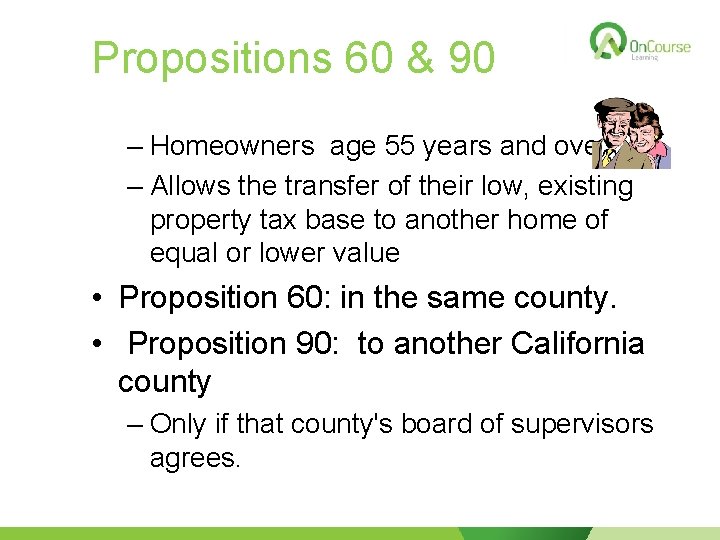

Propositions 60 & 90 – Homeowners age 55 years and over – Allows the transfer of their low, existing property tax base to another home of equal or lower value • Proposition 60: in the same county. • Proposition 90: to another California county – Only if that county's board of supervisors agrees.

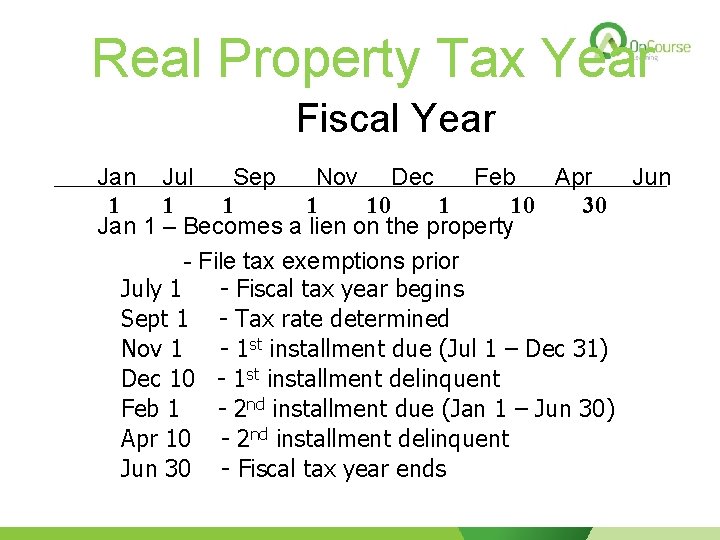

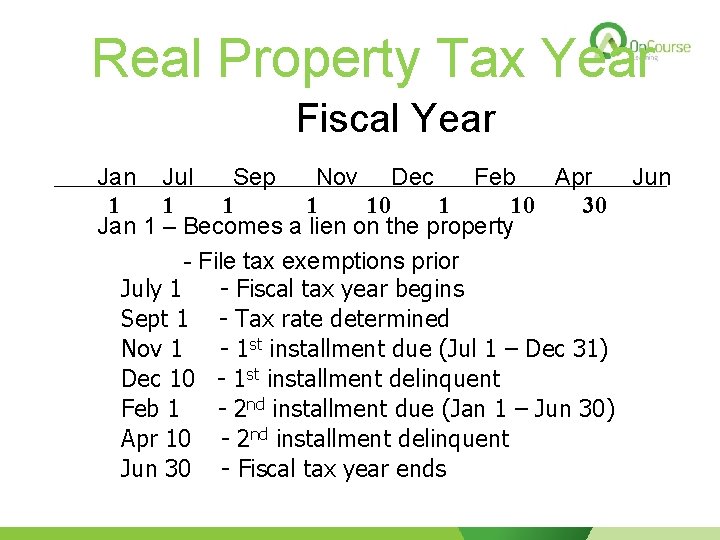

Real Property Tax Year Fiscal Year Jan Jul Sep Nov Dec Feb Apr Jun 1 1 10 30 Jan 1 – Becomes a lien on the property - File tax exemptions prior July 1 - Fiscal tax year begins Sept 1 - Tax rate determined Nov 1 - 1 st installment due (Jul 1 – Dec 31) Dec 10 - 1 st installment delinquent Feb 1 - 2 nd installment due (Jan 1 – Jun 30) Apr 10 - 2 nd installment delinquent Jun 30 - Fiscal tax year ends

Tax Sale • • A 10% penalty added to each late installment June 8 delinquent tax list published June 30 property “Sold” to state Five-year redemption period Un-redeemed property deeded to state Tax collector publishes notice of intent to sell Public auction tax sale Controller’s tax deed

Real Property Tax Exemptions 1. California Homeowner’s Exemption $7, 000 Reduces property tax ($7000 x 1% = $70) Owner as of January 1 -File by February 15 2. Veteran’s Exemption $4, 000 3. Property tax postponement laws must be checked with the county in which the property is located 4. California Renter’s Relief Credit against state income tax liability

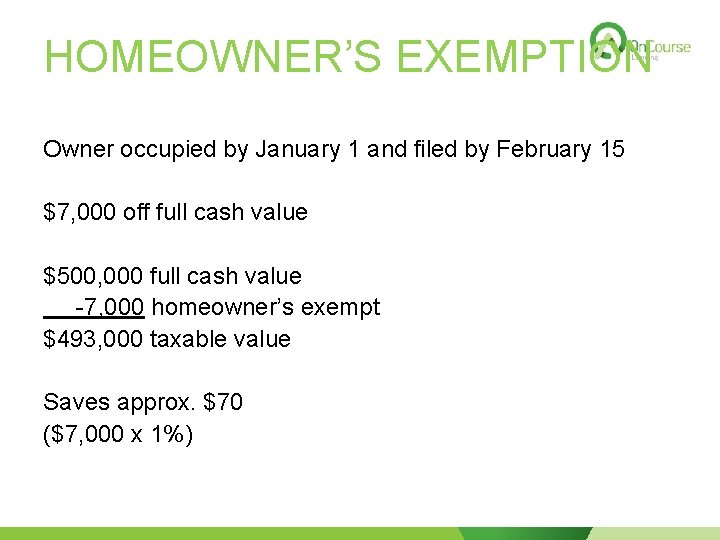

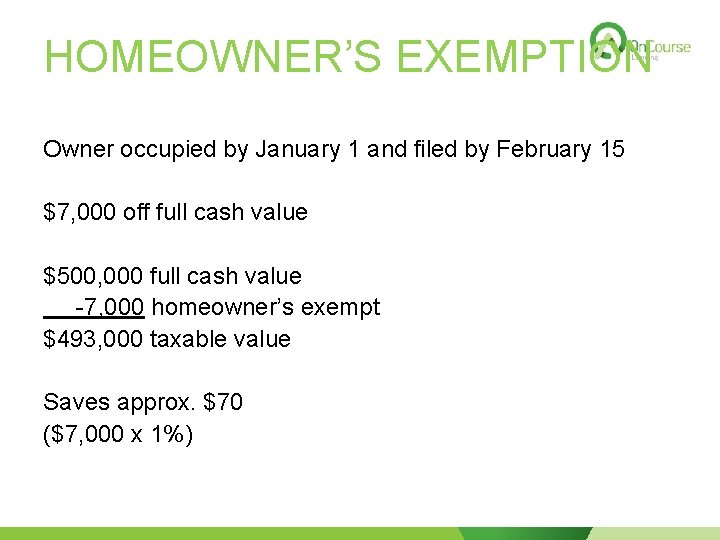

HOMEOWNER’S EXEMPTION Owner occupied by January 1 and filed by February 15 $7, 000 off full cash value $500, 000 full cash value -7, 000 homeowner’s exempt $493, 000 taxable value Saves approx. $70 ($7, 000 x 1%)

Special Assessments Liens • Tax liens and assessments have priority over all other liens. • Street Improvement Act of 1911 – Assessments noted on tax bill – For streets, sidewalks, lighting, water, sewer or benefit the owners directly such as for neighborhood parks, schools, and fire stations.

Mello-Roos Community Facilities Act of 1982 • Failure to disclose allows buyer a 3 -day right of rescission, and may result in disciplinary action for the licensed agent • Municipal bonds • Skirts around property tax limitations of Prop 13 • Boom for developers • Broker must disclose to prospective purchaser • May not be fully tax deductible

INCOME TAXATION • State and federal income tax A progressive tax • Agents: Recommend tax counsel • Tax consequences may be a material fact • Need good record keeping on property

PERSONAL RESIDENCE Interest Deduction Major Tax Advantages for Homeowners: 1. Subject to a $1 million dollar limitation 2. The interest on money borrowed to purchase a first and second home is fully deductible against the homeowner’s income 3. Property taxes paid are deductible against personal income

No taxable gain recognized on Residence • Homeowners may claim an exception from taxation on profit from the sale of their personal residence up to a maximum amount of $250, 000 for singles, up to $500, 000 for married couples. • Homeowner must have owned & resided in home 2 of last 5 yrs. • Can take the deduction every 2 years. • May not deduct depreciation, maintenance or operation expenses. • Any gains above these amounts are taxed at the current capital gain tax rate.

Installment sale Sale with down payment & loan. Income tax is due as loan is repaid over term.

Income Property Annual Deduction Operating Expenses T Taxes (Property) I Insurance M Maintenance M Management U Utilities R Reserves for Replacement – Depreciation • 27 ½ years for residential income property • 39 years for non-residential income property

Investment property • Vacant land (unimproved property)

Trade or Business Property • Owner derives major source of livelihood from the property

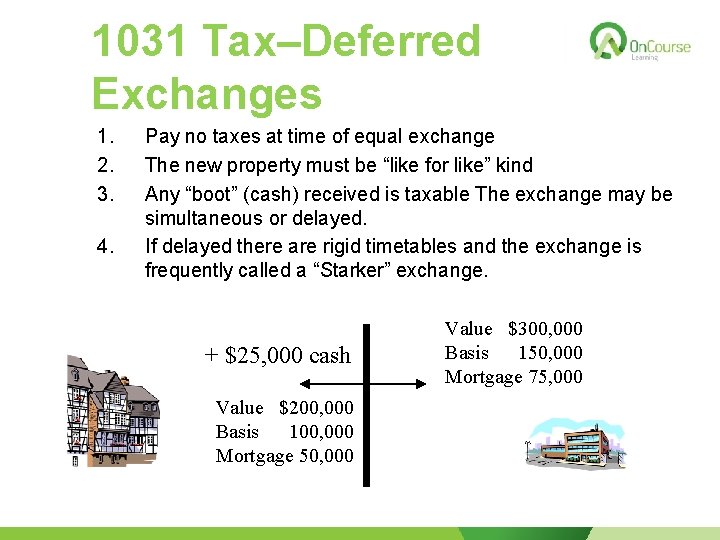

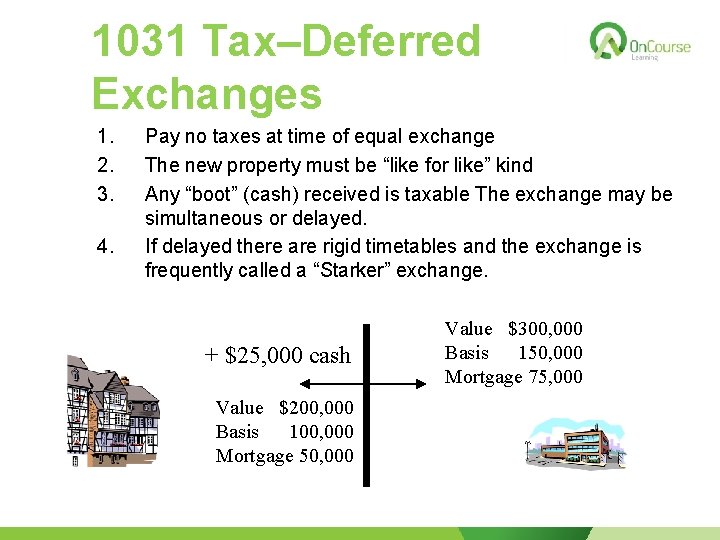

1031 Tax–Deferred Exchanges 1. 2. 3. 4. Pay no taxes at time of equal exchange The new property must be “like for like” kind Any “boot” (cash) received is taxable The exchange may be simultaneous or delayed. If delayed there are rigid timetables and the exchange is frequently called a “Starker” exchange. + $25, 000 cash Value $200, 000 Basis 100, 000 Mortgage 50, 000 Value $300, 000 Basis 150, 000 Mortgage 75, 000

Non-personal residence • Exchange – IRC 1031 – Decreases basis on new property by the gain deferred on old property • Tax liability is not forgiven - Defers (postpones) tax due, NOT tax “free” • Close of escrow date rules: – Close concurrent – Delayed – accommodator • 45 days to name the new property • 180 days (6 months) to close the escrow – Mortgage relief (Boot)

Involuntary inactive real estate license florida

Involuntary inactive real estate license florida Florida real estate principles practices & law 43rd edition

Florida real estate principles practices & law 43rd edition Florida real estate broker's guide

Florida real estate broker's guide Florida real estate broker's guide

Florida real estate broker's guide Modern real estate practice in pennsylvania

Modern real estate practice in pennsylvania The no brokerage relationship notice must be disclosed

The no brokerage relationship notice must be disclosed Florida real estate broker's guide 6th edition

Florida real estate broker's guide 6th edition Florida real estate broker's guide 6th edition

Florida real estate broker's guide 6th edition Florida real estate broker's guide 6th edition

Florida real estate broker's guide 6th edition Florida real estate broker's guide

Florida real estate broker's guide Florida real estate broker's guide 6th edition

Florida real estate broker's guide 6th edition 11245 lantern road fishers in 46038

11245 lantern road fishers in 46038 Florida real estate principles practices and law download

Florida real estate principles practices and law download Income approach appraisal

Income approach appraisal Florida real estate principles

Florida real estate principles Ostensible partnership real estate

Ostensible partnership real estate Rent real estate principles a value approach

Rent real estate principles a value approach Example of no brokerage relationship

Example of no brokerage relationship Rent real estate principles a value approach

Rent real estate principles a value approach Marketing real people real choices 11th edition

Marketing real people real choices 11th edition Chapter 11 real estate and other investments

Chapter 11 real estate and other investments Using mis (10th edition) 10th edition

Using mis (10th edition) 10th edition Using mis 10th edition

Using mis 10th edition 60 second pitch

60 second pitch