BRANCH PERFORMANCE Branch Types Rural Branches Urban Branches

BRANCH PERFORMANCE

Branch Types • • • Rural Branches Urban Branches Large Branches Medium Branches Small Branches

Branch Banking • Branch banking leads to more stable banking systems by enabling banks to better diversify their assets and widen their depositor base. • Branch banking induces competition. – Competition forces marginally profitable banks to change either through merger or voluntary liquidation. – When these weaker banks close, the overall stability of banking system improves through consolidation. • Branch banking stabilizes banking systems by reducing their vulnerability to local economic shocks

Economic Factors Affecting Banking Activity • Average employment growth • Average population growth • Average per capita income • Average number of branches • Average population per branch

Benchmarking Efficiency of Bank Branches • Operational efficiency model • Quality efficiency model • Profitability efficiency model

Operational Efficiency Model • Operational efficiency model identifies branches that are group leaders and serve as yardsticks to guide the improvement of performance of inefficient branches – – – – – Managerial performance Clerical performance Management of computer terminals Working space effectiveness Number of current personal accounts Number of savings accounts Number of foreign currency current accounts Number of credit applications Output time

Operational Efficiency of a Branch

Quality Efficiency Model • Service quality as perceived by branch personnel • Service quality as perceived by branch customers

Perceived Dimensions of Service Quality • Reliability - Ability to perform the services accurately and dependably. • Responsiveness – Willingness to help customers and provide prompt service • Assurance – Knowledge and courtesy of employees and their ability to convey trust and confidence • Empathy – Caring, individualized attention provided to customers • Tangibles – Appearance of physical facilities, personnel and communication.

Objective and Perceived Measures of Quality

Profitability Efficiency Model • Consumable Resources – Clerical personnel – Supervisor personnel – Computer terminals – Working space • Revenue Generating Resources – Advances – Deposits – Commissions – Number of credit application accounts – Number of current personal accounts – Number of savings accounts – Number of foreign currency accounts – Number of inter-branch transactions

Profitability Efficiency Model

Service Quality and Profit Performance

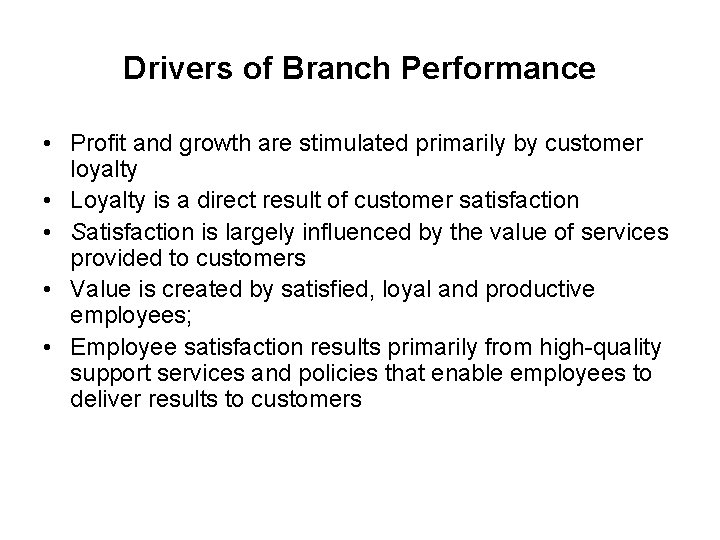

Drivers of Branch Performance • Profit and growth are stimulated primarily by customer loyalty • Loyalty is a direct result of customer satisfaction • Satisfaction is largely influenced by the value of services provided to customers • Value is created by satisfied, loyal and productive employees; • Employee satisfaction results primarily from high-quality support services and policies that enable employees to deliver results to customers

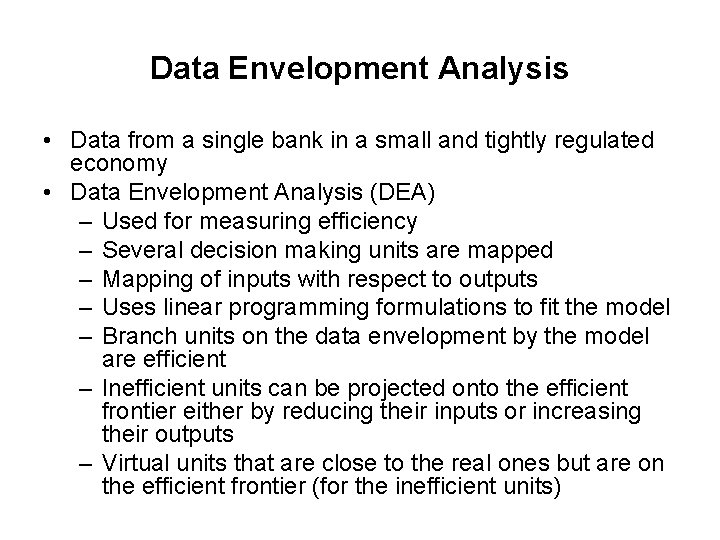

Data Envelopment Analysis • Data from a single bank in a small and tightly regulated economy • Data Envelopment Analysis (DEA) – Used for measuring efficiency – Several decision making units are mapped – Mapping of inputs with respect to outputs – Uses linear programming formulations to fit the model – Branch units on the data envelopment by the model are efficient – Inefficient units can be projected onto the efficient frontier either by reducing their inputs or increasing their outputs – Virtual units that are close to the real ones but are on the efficient frontier (for the inefficient units)

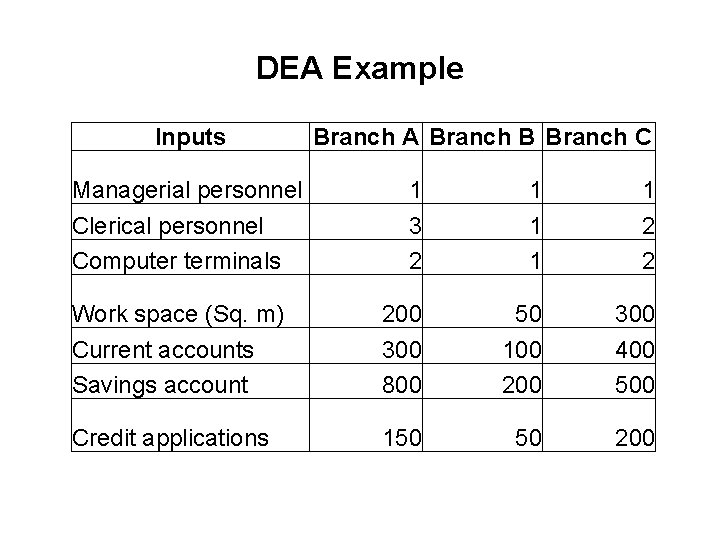

DEA Example Inputs Managerial personnel Clerical personnel Computer terminals Branch A Branch B Branch C 1 3 2 1 1 2 2 Work space (Sq. m) Current accounts Savings account 200 300 800 50 100 200 300 400 500 Credit applications 150 50 200

Branch Quality Outputs Branch A Branch B Branch C Personal (Scores) 70 75 60 Computer (usage %) 40 30 45 Working spare (comfort score) 90 80 60 6 5 2 60 58. 75 61. 25 Credit application process time (days) Service quality

Branch Profitability Outputs Branch A Branch B Branch C Revenue generation (%) 20 10 40 Deposit mobilization per employee 700 800 500 12 14 18 4000 3000 7000 Fee income (%) Interbranch transactions (number)

Operational Efficiency and Profitability 0. 45 Profitability Vs. Operational Efficiency Branch B 0. 4 Branch C Operational Performance 0. 35 0. 3 0. 25 0. 2 Branch A 0. 15 0. 1 0. 05 0 0 0. 05 0. 15 0. 25 0. 3 Profitability 0. 35 0. 45 0. 5

Quality and Operational Efficiency 0. 615 Operational Efficiency Vs. Service Quality Branch C 0. 61 0. 605 Service Quality 0. 6 Branch B 0. 595 0. 59 Branch A 0. 585 0. 58 0. 575 0. 57 0 0. 05 0. 15 0. 25 Operational Efficiency 0. 35 0. 45

Service Quality and Profitability 0. 5 Service Quality Vs. Profitability 0. 45 0. 4 Branch C Profitability 0. 35 0. 3 0. 25 Branch B Branch A 0. 2 0. 15 0. 1 0. 05 0 0. 5825 0. 5875 0. 5925 0. 5975 0. 6025 Service Quality 0. 6075 0. 6125 0. 6175

Relative Efficiency

- Slides: 22