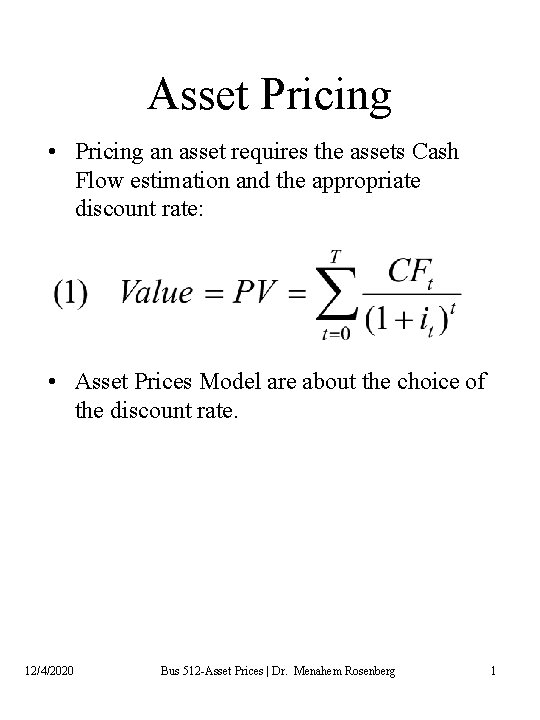

Asset Pricing Pricing an asset requires the assets

- Slides: 19

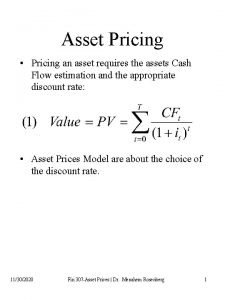

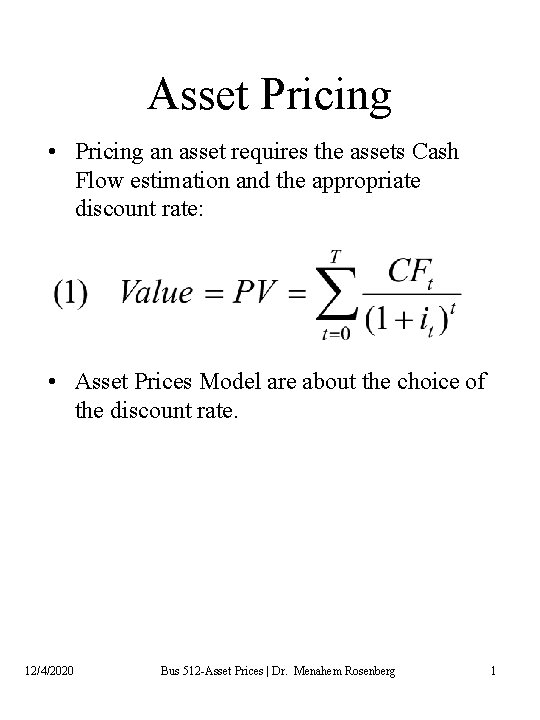

Asset Pricing • Pricing an asset requires the assets Cash Flow estimation and the appropriate discount rate: • Asset Prices Model are about the choice of the discount rate. 12/4/2020 Bus 512 -Asset Prices | Dr. Menahem Rosenberg 1

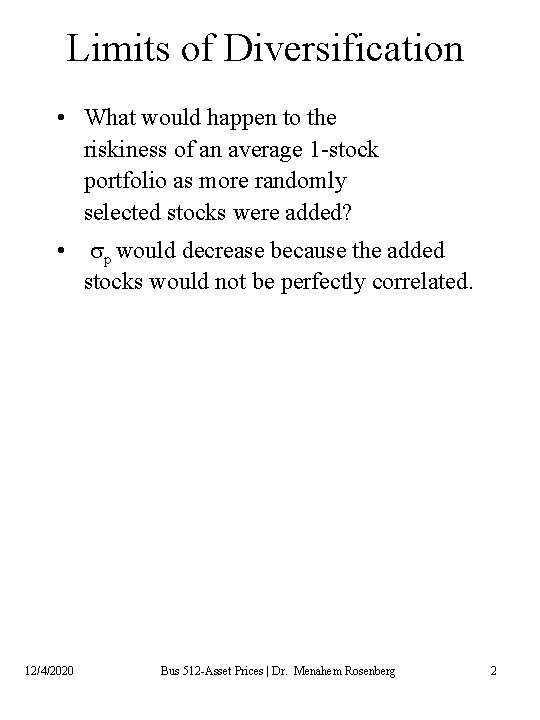

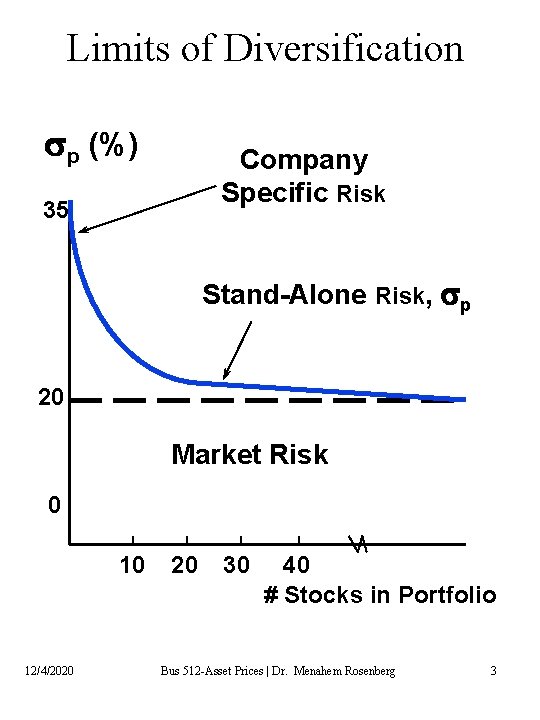

Limits of Diversification • What would happen to the riskiness of an average 1 -stock portfolio as more randomly selected stocks were added? • sp would decrease because the added stocks would not be perfectly correlated. 12/4/2020 Bus 512 -Asset Prices | Dr. Menahem Rosenberg 2

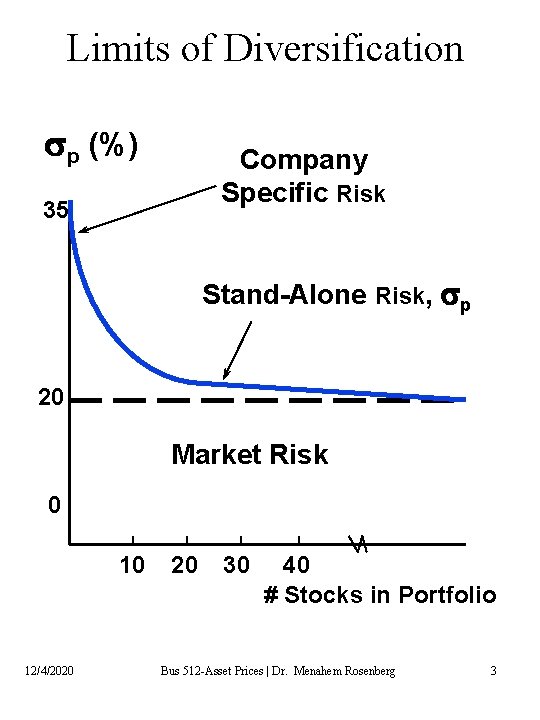

Limits of Diversification sp (%) Company Specific Risk 35 Stand-Alone Risk, sp 20 Market Risk 0 10 12/4/2020 20 30 40 # Stocks in Portfolio Bus 512 -Asset Prices | Dr. Menahem Rosenberg 3

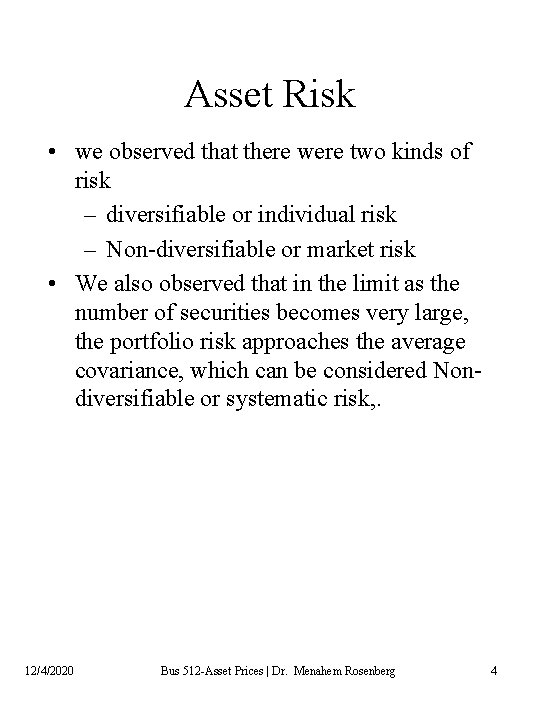

Asset Risk • we observed that there were two kinds of risk – diversifiable or individual risk – Non-diversifiable or market risk • We also observed that in the limit as the number of securities becomes very large, the portfolio risk approaches the average covariance, which can be considered Nondiversifiable or systematic risk, . 12/4/2020 Bus 512 -Asset Prices | Dr. Menahem Rosenberg 4

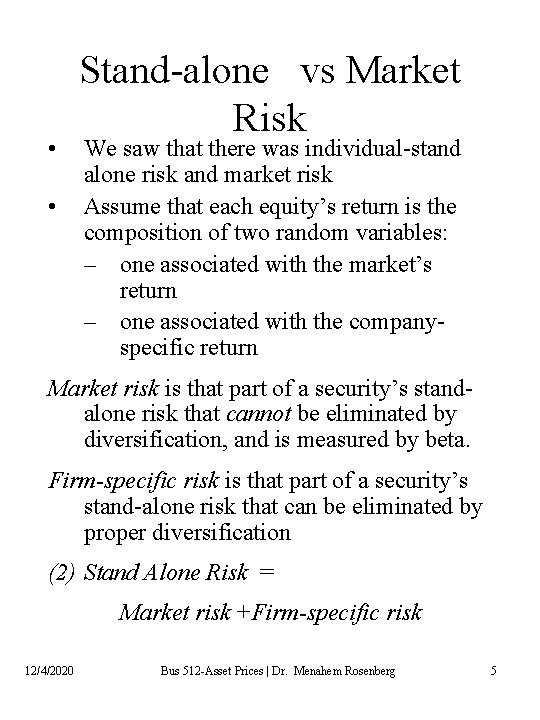

• • Stand-alone vs Market Risk We saw that there was individual-stand alone risk and market risk Assume that each equity’s return is the composition of two random variables: – one associated with the market’s return – one associated with the companyspecific return Market risk is that part of a security’s standalone risk that cannot be eliminated by diversification, and is measured by beta. Firm-specific risk is that part of a security’s stand-alone risk that can be eliminated by proper diversification (2) Stand Alone Risk = Market risk +Firm-specific risk 12/4/2020 Bus 512 -Asset Prices | Dr. Menahem Rosenberg 5

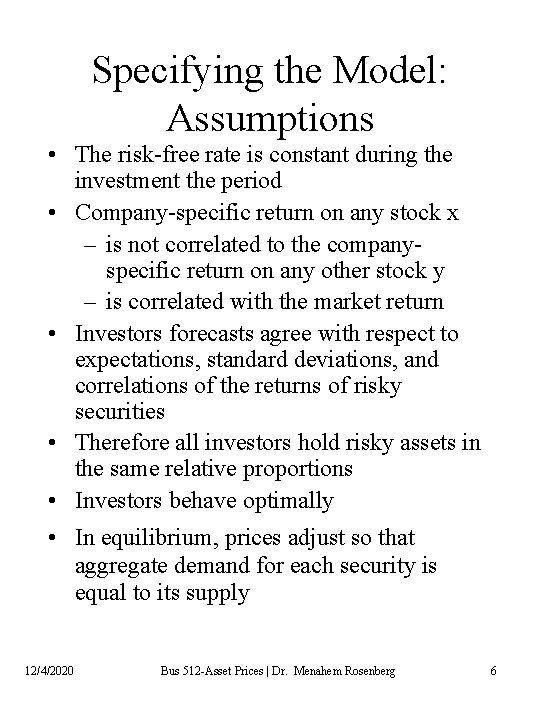

Specifying the Model: Assumptions • The risk-free rate is constant during the investment the period • Company-specific return on any stock x – is not correlated to the companyspecific return on any other stock y – is correlated with the market return • Investors forecasts agree with respect to expectations, standard deviations, and correlations of the returns of risky securities • Therefore all investors hold risky assets in the same relative proportions • Investors behave optimally • In equilibrium, prices adjust so that aggregate demand for each security is equal to its supply 12/4/2020 Bus 512 -Asset Prices | Dr. Menahem Rosenberg 6

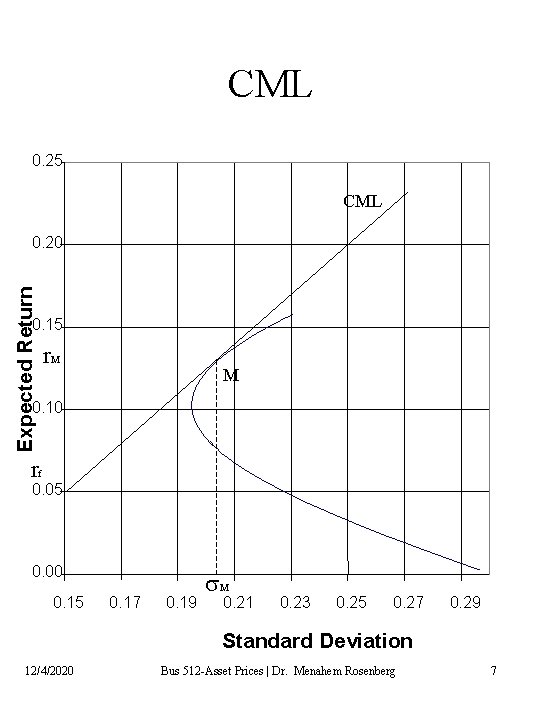

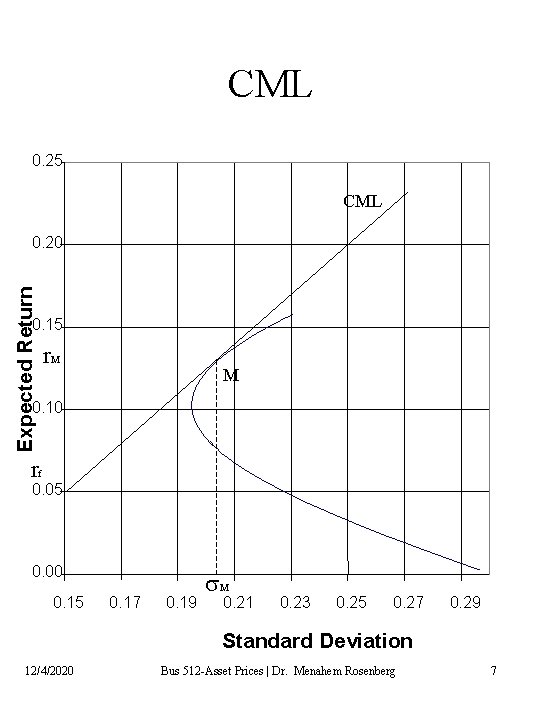

CML 0. 25 CML Expected Return 0. 20 0. 15 r. M M 0. 10 rf 0. 05 0. 00 0. 15 0. 17 0. 19 s. M 0. 21 0. 23 0. 25 0. 27 0. 29 Standard Deviation 12/4/2020 Bus 512 -Asset Prices | Dr. Menahem Rosenberg 7

CML and the CAPM • Depending on their risk aversions, different investors hold portfolios with different mixes of riskless asset and the market portfolio • CAPM says that in equilibrium, any investor’s relative holding of risky assets will be the same as in the market portfolio • Since every investor’s relative holdings of the risky security is the same, the only way the asset market can clear is if those optimal relative proportions are the proportions in which they are valued in the market place 12/4/2020 Bus 512 -Asset Prices | Dr. Menahem Rosenberg 8

CAPM • Since any investor’s relative holding of risky assets will be the same as in the market portfolio, equilibrium will determine the assets relative pricing, which leads to the Capital Asset Pricing model. • The stock compensated risk is measured as the risk it adds to a well diversified portfolio: – Case 1 : it does not add any additional risk, its return changes are the same as the markets return – Case 2: it adds risk to the portfolio, its return relative to the market volatility is higher. – Case 3: it reduces the portfolio risk, its return relative to the market volatility is lower. • CAPM will compare and determine risky assets return premium (risk premium) - their return above the risk free asset return. 12/4/2020 Bus 512 -Asset Prices | Dr. Menahem Rosenberg 9

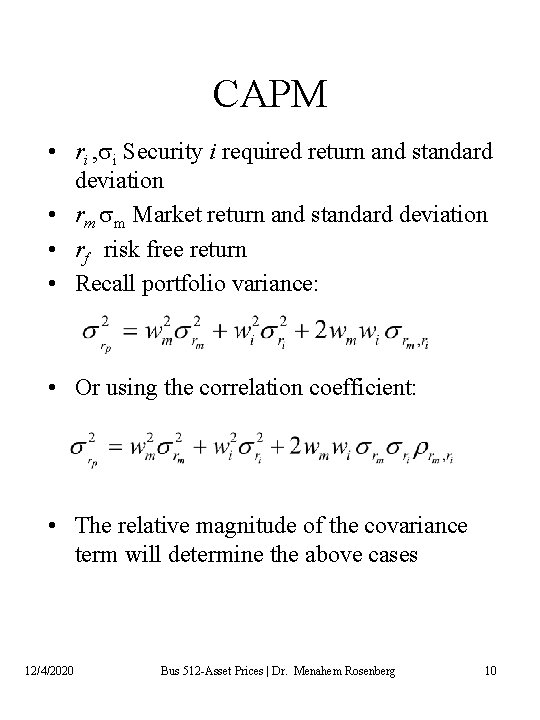

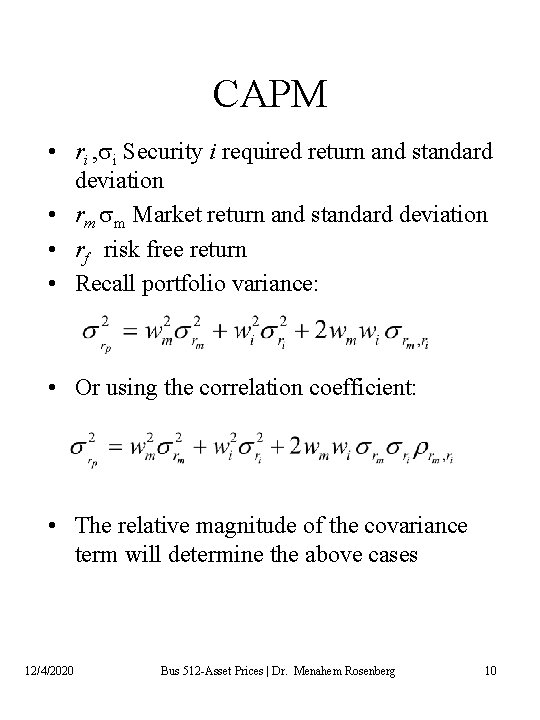

CAPM • ri , si Security i required return and standard deviation • rm sm Market return and standard deviation • rf risk free return • Recall portfolio variance: • Or using the correlation coefficient: • The relative magnitude of the covariance term will determine the above cases 12/4/2020 Bus 512 -Asset Prices | Dr. Menahem Rosenberg 10

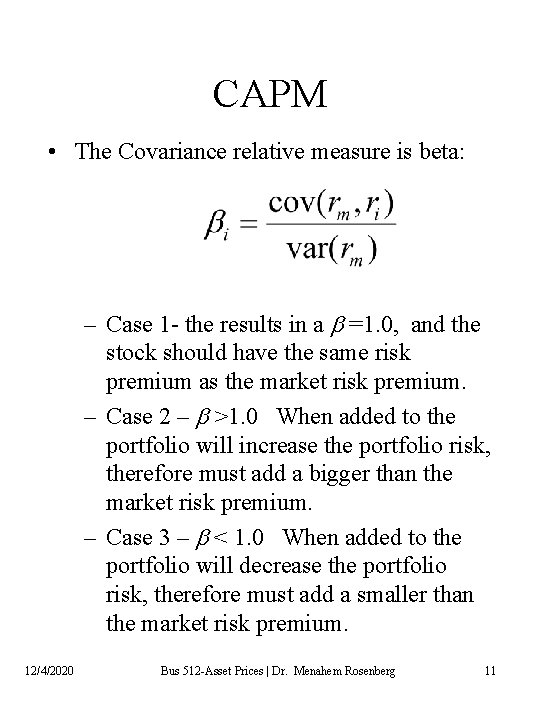

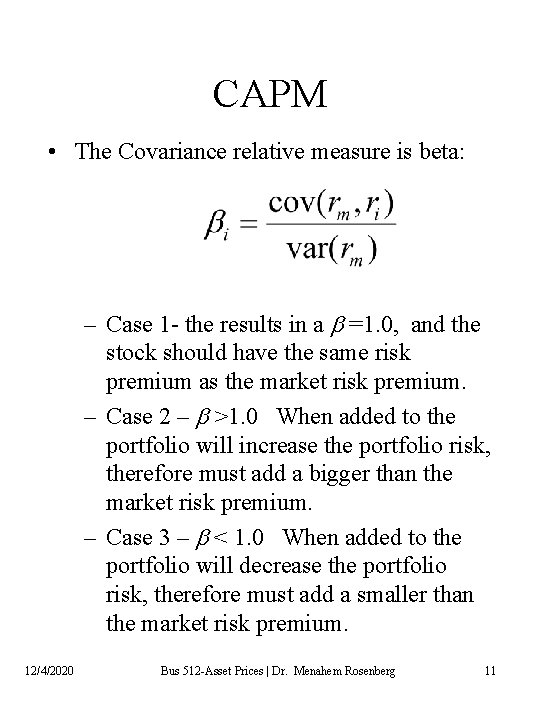

CAPM • The Covariance relative measure is beta: – Case 1 - the results in a b =1. 0, and the stock should have the same risk premium as the market risk premium. – Case 2 – b >1. 0 When added to the portfolio will increase the portfolio risk, therefore must add a bigger than the market risk premium. – Case 3 – b < 1. 0 When added to the portfolio will decrease the portfolio risk, therefore must add a smaller than the market risk premium. 12/4/2020 Bus 512 -Asset Prices | Dr. Menahem Rosenberg 11

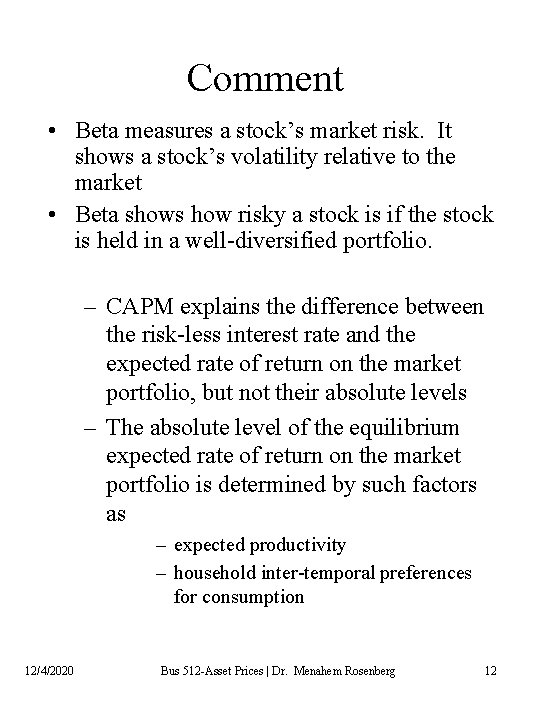

Comment • Beta measures a stock’s market risk. It shows a stock’s volatility relative to the market • Beta shows how risky a stock is if the stock is held in a well-diversified portfolio. – CAPM explains the difference between the risk-less interest rate and the expected rate of return on the market portfolio, but not their absolute levels – The absolute level of the equilibrium expected rate of return on the market portfolio is determined by such factors as – expected productivity – household inter-temporal preferences for consumption 12/4/2020 Bus 512 -Asset Prices | Dr. Menahem Rosenberg 12

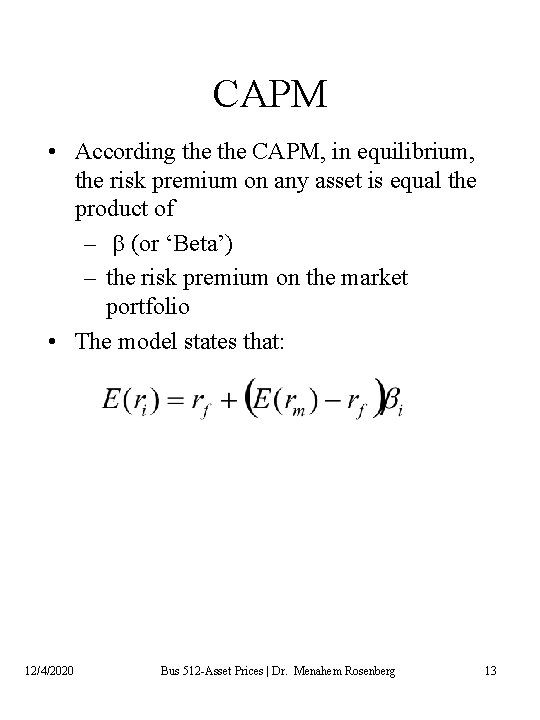

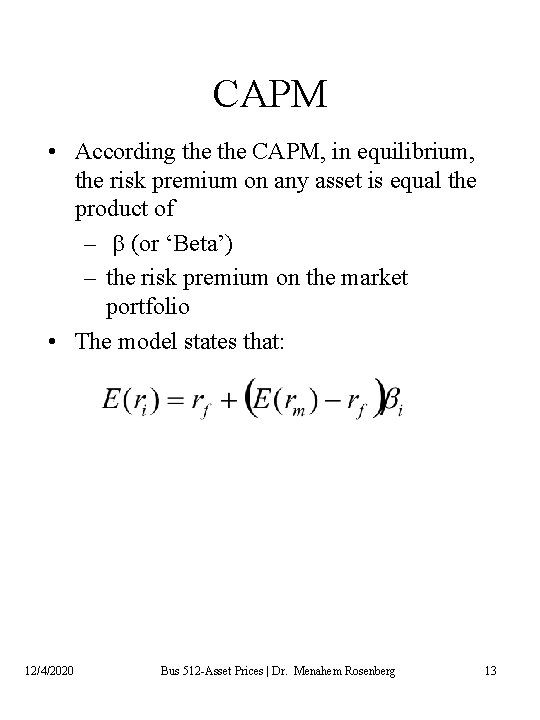

CAPM • According the CAPM, in equilibrium, the risk premium on any asset is equal the product of – b (or ‘Beta’) – the risk premium on the market portfolio • The model states that: 12/4/2020 Bus 512 -Asset Prices | Dr. Menahem Rosenberg 13

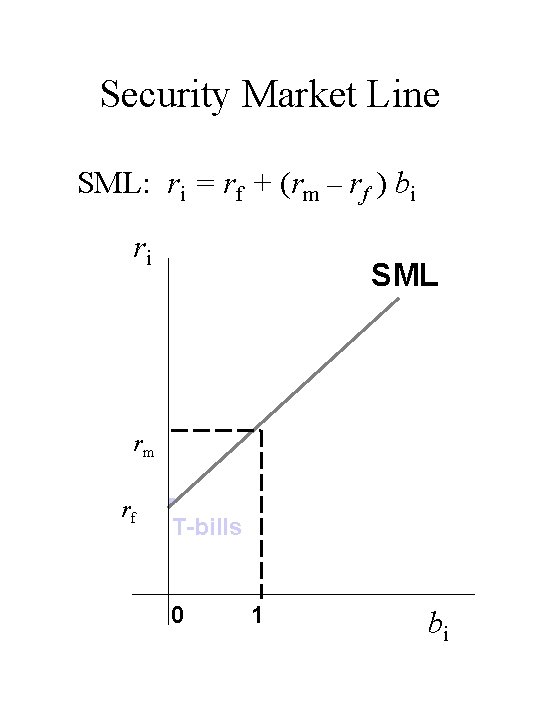

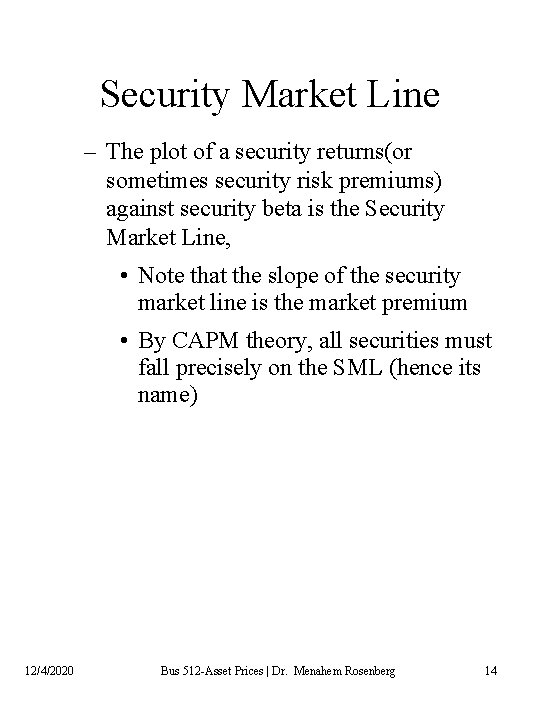

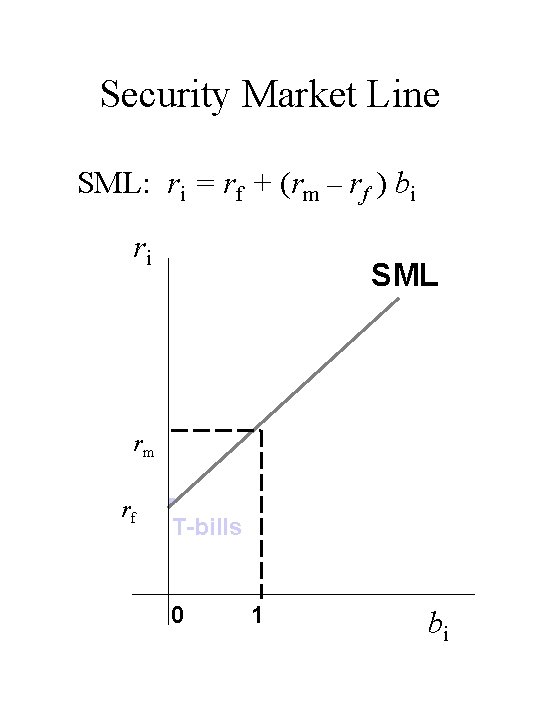

Security Market Line – The plot of a security returns(or sometimes security risk premiums) against security beta is the Security Market Line, • Note that the slope of the security market line is the market premium • By CAPM theory, all securities must fall precisely on the SML (hence its name) 12/4/2020 Bus 512 -Asset Prices | Dr. Menahem Rosenberg 14

Security Market Line SML: ri = rf + (rm – rf ) bi ri rm rf SML . T-bills 0 1 bi

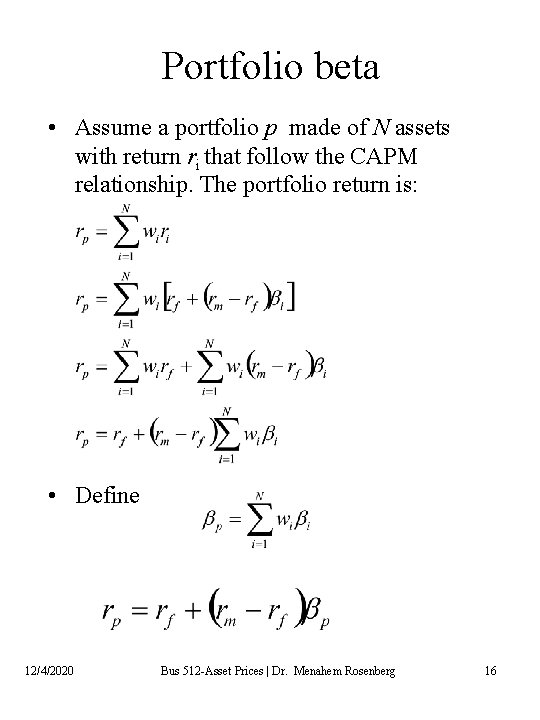

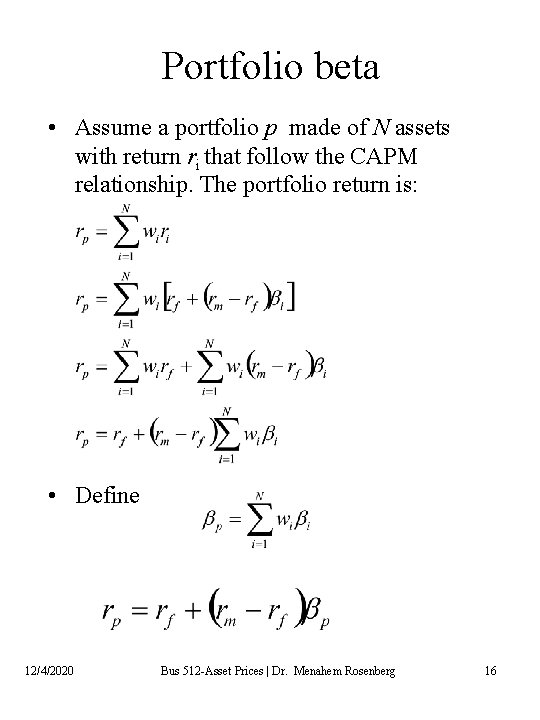

Portfolio beta • Assume a portfolio p made of N assets with return ri that follow the CAPM relationship. The portfolio return is: • Define 12/4/2020 Bus 512 -Asset Prices | Dr. Menahem Rosenberg 16

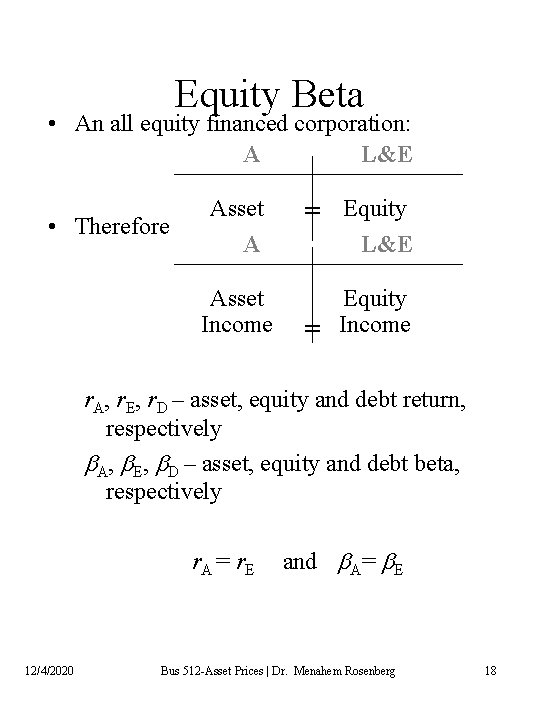

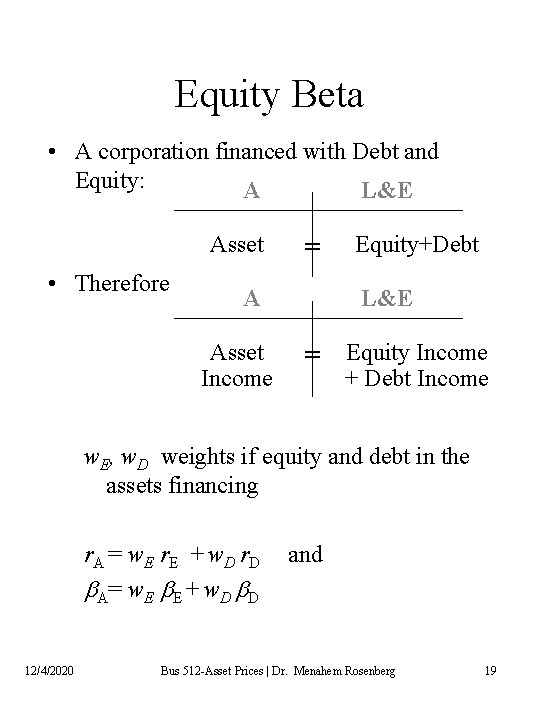

Equity Beta • When a corporation is all equity financed, its equity return is equal to its asset return. • Its equity beta is also equal to its asset beta. • When a corporation is also debt financed, its asset return is divided between its equity and debt, so that the asset return is divided between the equity return and the debt return. 12/4/2020 Bus 512 -Asset Prices | Dr. Menahem Rosenberg 17

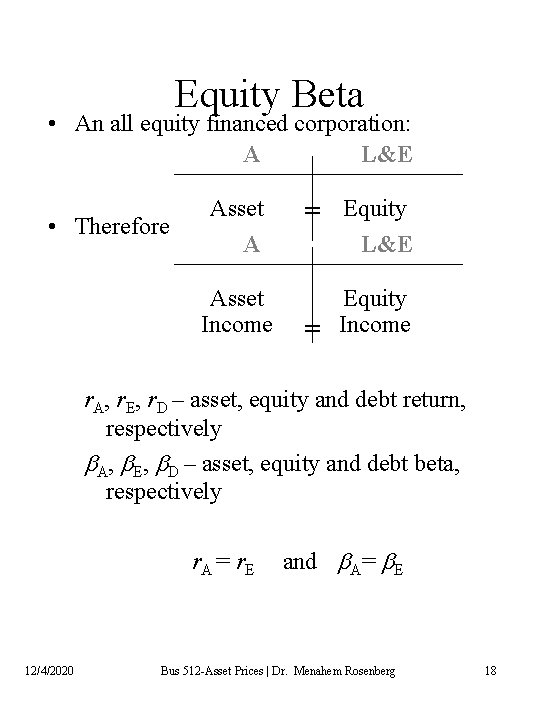

Equity Beta • An all equity financed corporation: A L&E • Therefore Asset A = Equity Asset Income Equity = Income L&E r. A, r. E, r. D – asset, equity and debt return, respectively b. A, b. E, b. D – asset, equity and debt beta, respectively r. A = r. E 12/4/2020 and b. A= b. E Bus 512 -Asset Prices | Dr. Menahem Rosenberg 18

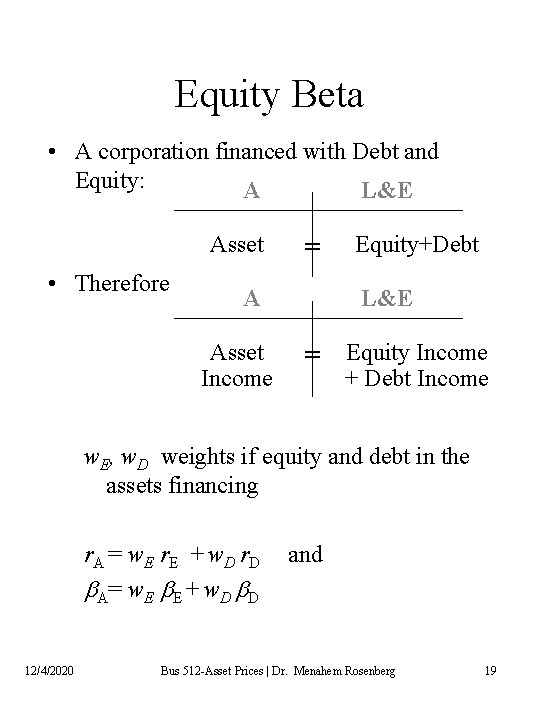

Equity Beta • A corporation financed with Debt and Equity: A L&E Asset • Therefore = A Asset Income Equity+Debt L&E = Equity Income + Debt Income w. E, w. D weights if equity and debt in the assets financing r. A = w E r. E + w D r. D b A= w E b E + w D b D 12/4/2020 and Bus 512 -Asset Prices | Dr. Menahem Rosenberg 19

Natural asset companies

Natural asset companies Financial assets and real assets

Financial assets and real assets Accumulated depreciation straight line method

Accumulated depreciation straight line method Real assets vs financial assets

Real assets vs financial assets Real assets versus financial assets

Real assets versus financial assets Types of real assets

Types of real assets Plant assets, natural resources, and intangible assets

Plant assets, natural resources, and intangible assets Infrastructure and asset management

Infrastructure and asset management Asset management vs project management

Asset management vs project management Multi factor pricing model

Multi factor pricing model Frazzini

Frazzini Ellipse software

Ellipse software How to calculate capm in excel

How to calculate capm in excel Fundamental theorem of asset pricing proof

Fundamental theorem of asset pricing proof Capital asset pricing model excel

Capital asset pricing model excel Expected return capm formula

Expected return capm formula Risk return and capital asset pricing model

Risk return and capital asset pricing model Quá trình desamine hóa có thể tạo ra

Quá trình desamine hóa có thể tạo ra Khi nào hổ mẹ dạy hổ con săn mồi

Khi nào hổ mẹ dạy hổ con săn mồi Mật thư tọa độ 5x5

Mật thư tọa độ 5x5