ASEAN3 Workshop The Rise of Asset Securitisation in

- Slides: 23

ASEAN+3 Workshop The Rise of Asset Securitisation in East Asia Securitisation and Banks James H. Lau Jr. Chief Executive Officer The Hong Kong Mortgage Corporation Limited 8 November 2005 The Hong Kong Mortgage Corporation Limited 1

Contents v Introduction v Major securitisation issues for banks ØInternational accounting standards ØBasel II regulatory framework v Issues and implications The Hong Kong Mortgage Corporation Limited 2

INTRODUCTION: Why securitise? v To improve asset-liability management v To enhance credit risk management v To improve balance sheet, CAR and financial ratios v To expand funding sources and broaden investor base The Hong Kong Mortgage Corporation Limited 3

What assets to securitise? v Mortgages v Credit card receivables v Auto loans v Corporate loans v Any other assets with cashflow The Hong Kong Mortgage Corporation Limited 4

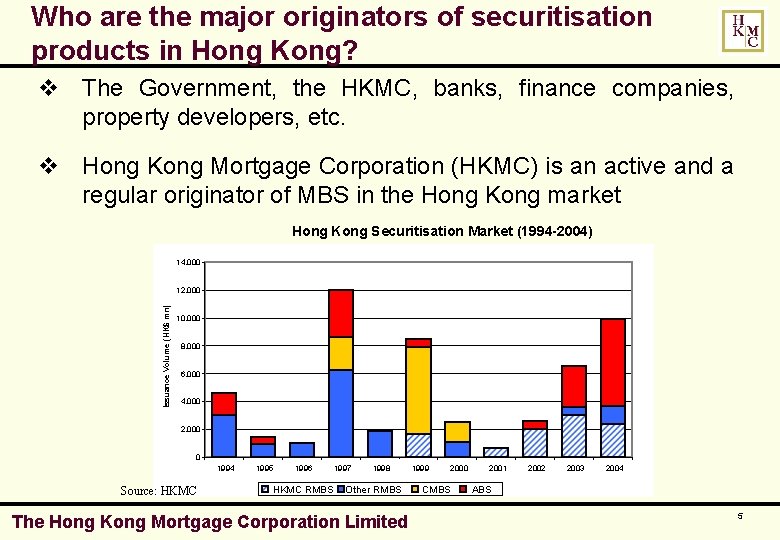

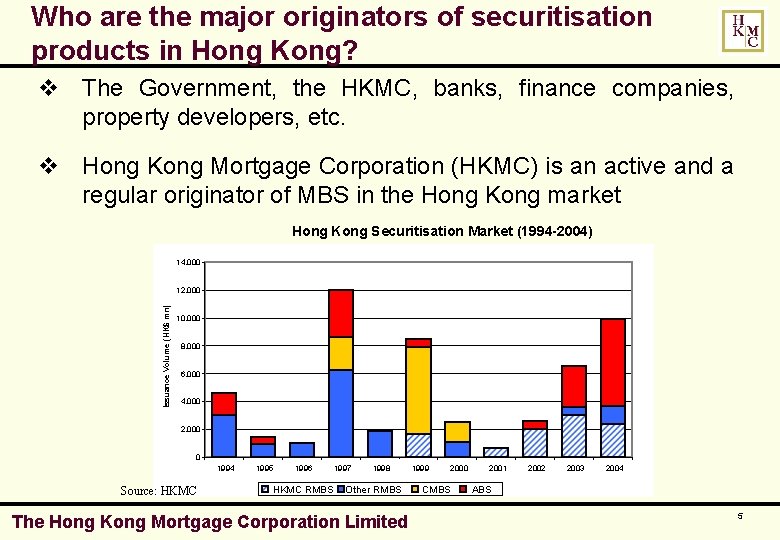

Who are the major originators of securitisation products in Hong Kong? v The Government, the HKMC, banks, finance companies, property developers, etc. v Hong Kong Mortgage Corporation (HKMC) is an active and a regular originator of MBS in the Hong Kong market Hong Kong Securitisation Market (1994 -2004) 14, 000 Issuance Volume (HK$ mn) 12, 000 10, 000 8, 000 6, 000 4, 000 2, 000 0 1994 Source: HKMC 1995 1996 HKMC RMBS 1997 1998 Other RMBS The Hong Kong Mortgage Corporation Limited 1999 2000 CMBS 2001 2002 2003 2004 ABS 5

Major investors in securitisation products in Hong Kong v Retirement funds, investment funds, insurance companies, banks, etc. v Growing in retirement funds demands more long-term HKD debts and securitised products Source: MPFA The Hong Kong Mortgage Corporation Limited 6

Regulatory framework for banks in Hong Kong v Hong Kong is a forerunner in securitisation in Asia. The Hong Kong Monetary Authority (HKMA) issued a set of guidelines titled “Supervisory treatment on asset securitisation and mortgage backed securities” on 30 August 1997, which set out: w Supervisory tests (“true sale” tests) applied to asset securitisation for deciding whether the assets concerned can be excluded from the seller’s balance sheet for capital adequacy purposes w Criteria for MBS to qualify for 50% risk weight v The guidelines will be replaced upon the implementation of the Basel II framework on securitisation on 1 January 2007. The Hong Kong Mortgage Corporation Limited 7

MAJOR SECURITISATION ISSUES FOR BANKS v Implementation of the new International Accounting Standards (i. e. IAS 27, SIC 12 and IAS 39) w More complicated treatment of account consolidation for subsidiaries/SPEs and asset derecognition from balance sheet v Implementation of Basel II in 2007 w More complicated structure in achieving economic capital allocation and credit risk transfer The Hong Kong Mortgage Corporation Limited 8

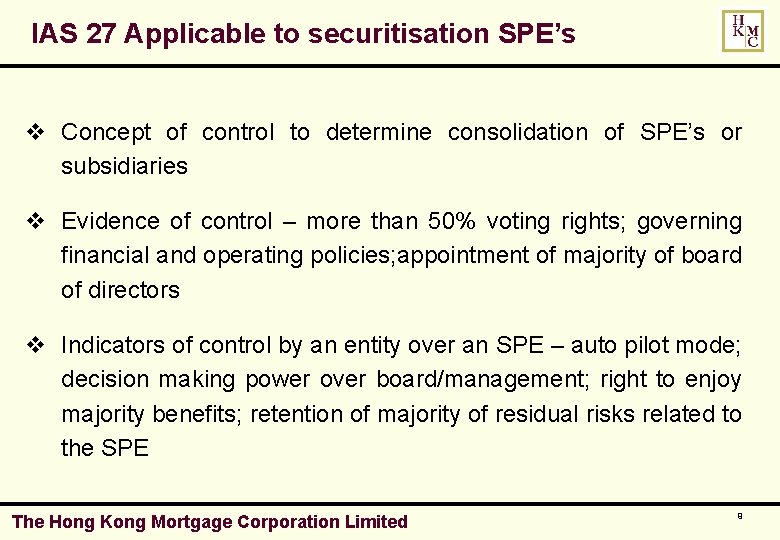

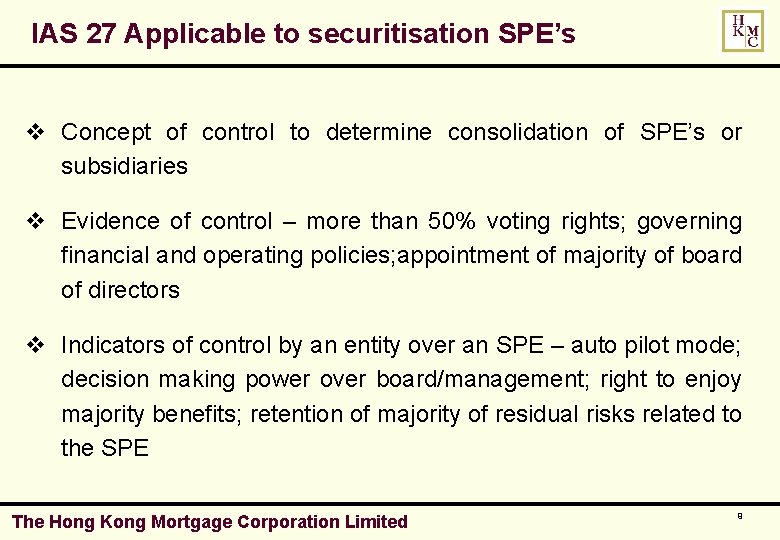

IAS 27 Applicable to securitisation SPE’s v Concept of control to determine consolidation of SPE’s or subsidiaries v Evidence of control – more than 50% voting rights; governing financial and operating policies; appointment of majority of board of directors v Indicators of control by an entity over an SPE – auto pilot mode; decision making power over board/management; right to enjoy majority benefits; retention of majority of residual risks related to the SPE The Hong Kong Mortgage Corporation Limited 9

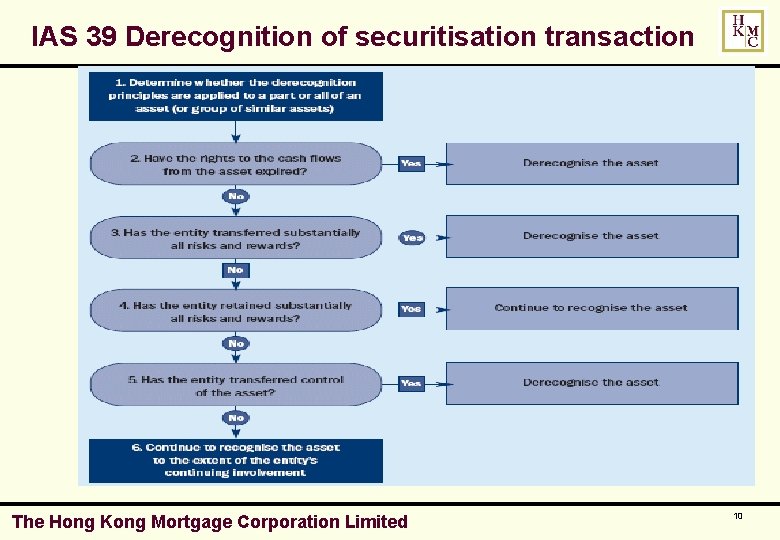

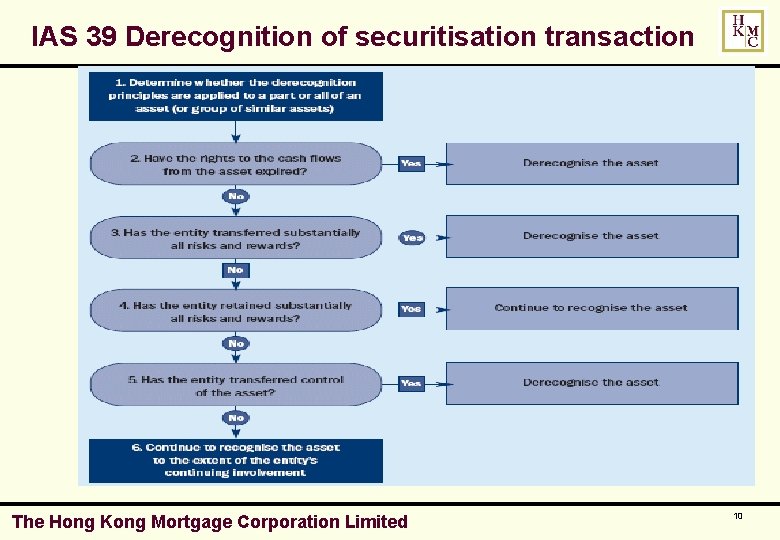

IAS 39 Derecognition of securitisation transaction The Hong Kong Mortgage Corporation Limited 10

Basel II: Objectives Compared with Basel Accord established in July 1988, Basel II can: v Better align regulatory capital to underlying risk v Improve risk management capabilities of banks v Provide a comprehensive coverage of risks The Hong Kong Mortgage Corporation Limited 11

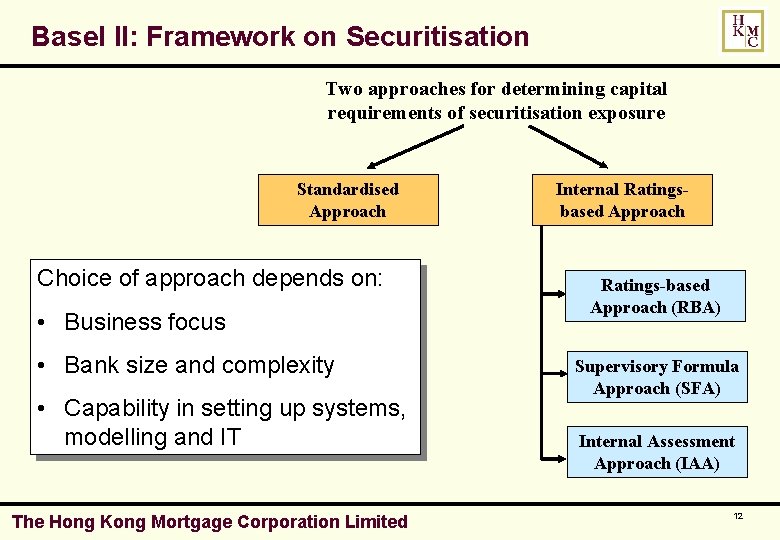

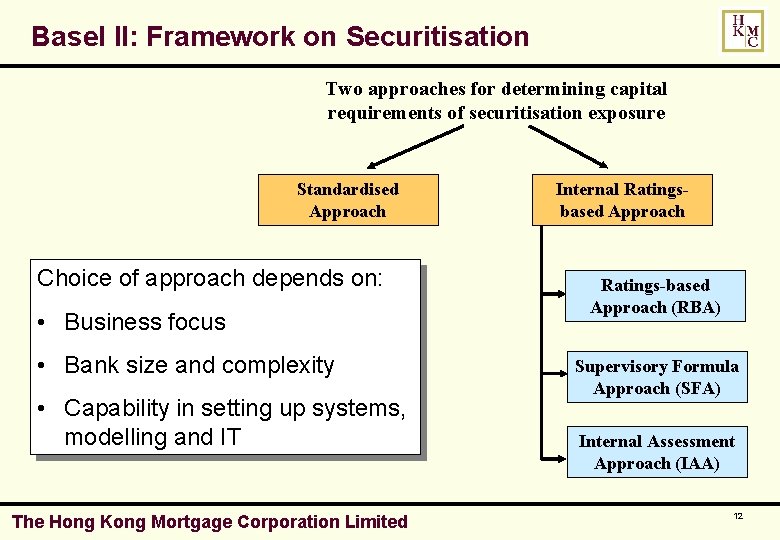

Basel II: Framework on Securitisation Two approaches for determining capital requirements of securitisation exposure Standardised Approach Choice of approach depends on: • Business focus • Bank size and complexity • Capability in setting up systems, modelling and IT The Hong Kong Mortgage Corporation Limited Internal Ratingsbased Approach Ratings-based Approach (RBA) Supervisory Formula Approach (SFA) Internal Assessment Approach (IAA) 12

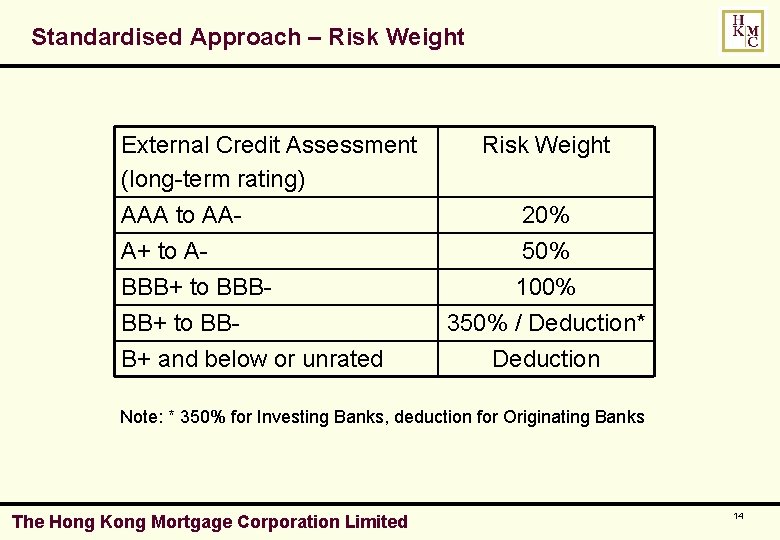

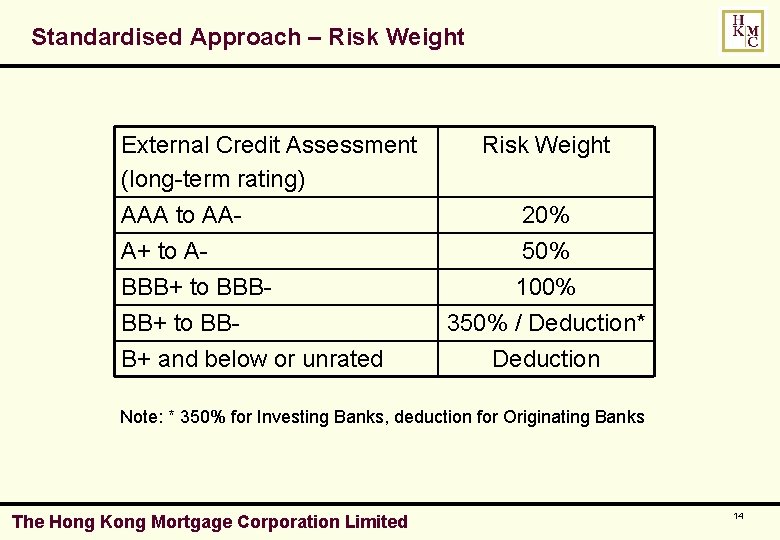

Standardised Approach v Amount of capital allocation for securitisation exposure depends on credit ratings v Unrated securitisation exposures to be deducted from regulatory capital Exceptions: (i) The most senior exposure in a securitisation (ii) Exposure in a second-loss position or better in ABCP programme (iii) Eligible liquidity facilities v Standardised Approach preferred by small- to medium-sized banks The Hong Kong Mortgage Corporation Limited 13

Standardised Approach – Risk Weight External Credit Assessment (long-term rating) AAA to AAA+ to ABBB+ to BBB+ and below or unrated Risk Weight 20% 50% 100% 350% / Deduction* Deduction Note: * 350% for Investing Banks, deduction for Originating Banks The Hong Kong Mortgage Corporation Limited 14

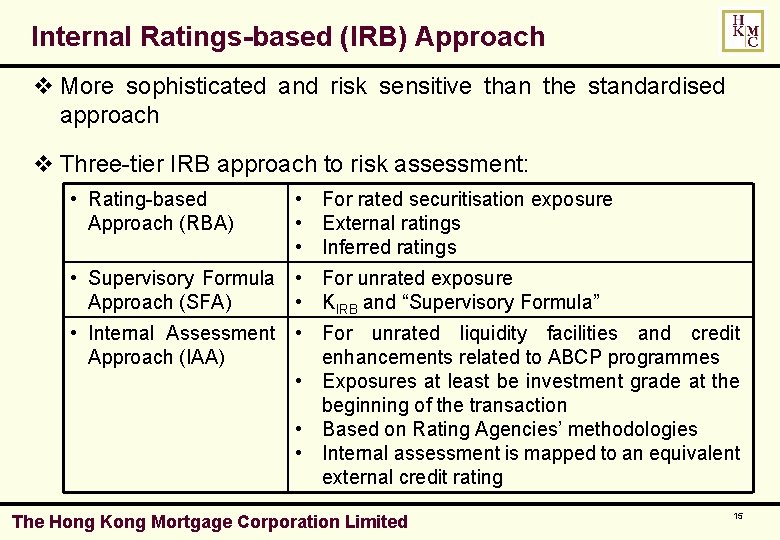

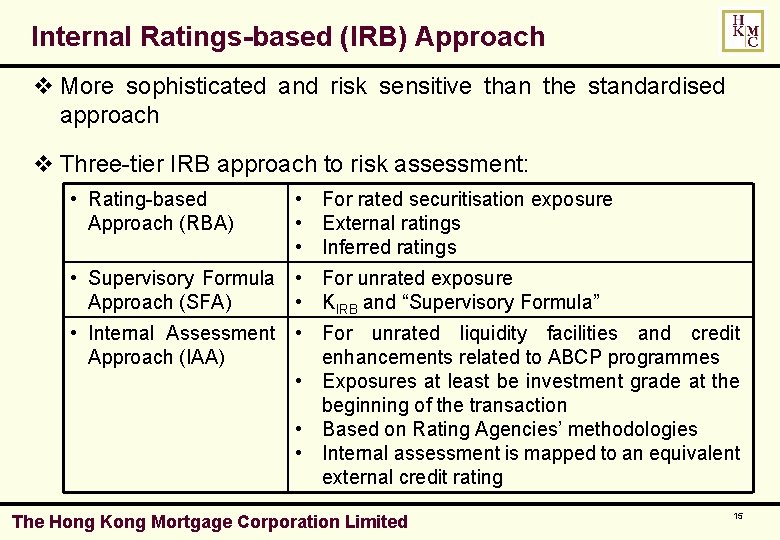

Internal Ratings-based (IRB) Approach v More sophisticated and risk sensitive than the standardised approach v Three-tier IRB approach to risk assessment: • Rating-based Approach (RBA) • For rated securitisation exposure • External ratings • Inferred ratings • Supervisory Formula • For unrated exposure Approach (SFA) • KIRB and “Supervisory Formula” • Internal Assessment • For unrated liquidity facilities and credit Approach (IAA) enhancements related to ABCP programmes • Exposures at least be investment grade at the beginning of the transaction • Based on Rating Agencies’ methodologies • Internal assessment is mapped to an equivalent external credit rating The Hong Kong Mortgage Corporation Limited 15

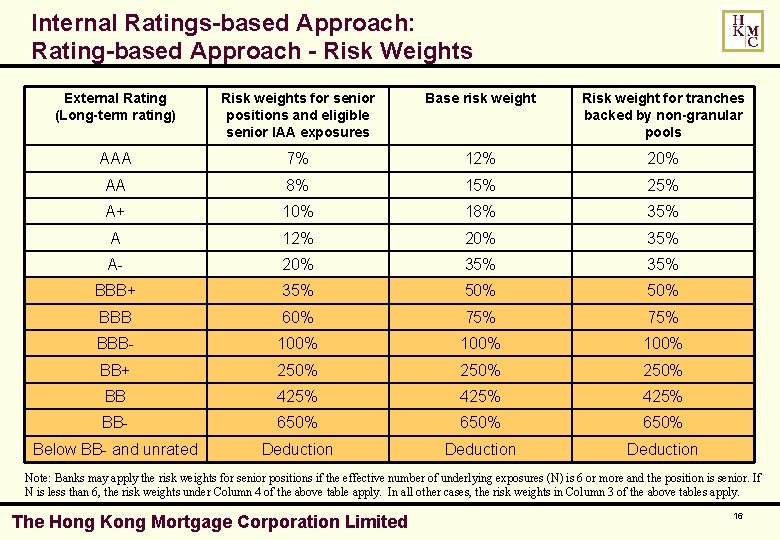

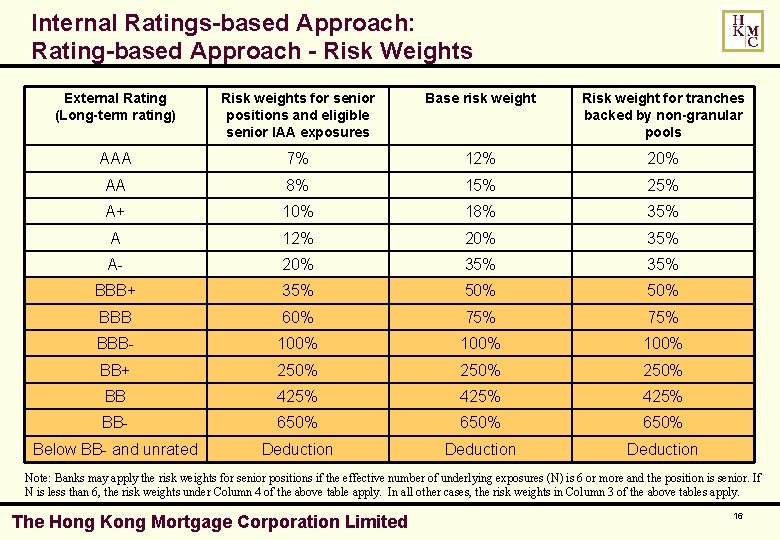

Internal Ratings-based Approach: Rating-based Approach - Risk Weights External Rating (Long-term rating) Risk weights for senior positions and eligible senior IAA exposures Base risk weight Risk weight for tranches backed by non-granular pools AAA 7% 12% 20% AA 8% 15% 25% A+ 10% 18% 35% A 12% 20% 35% A- 20% 35% BBB+ 35% 50% BBB 60% 75% BBB- 100% BB+ 250% BB 425% BB- 650% Below BB- and unrated Deduction Note: Banks may apply the risk weights for senior positions if the effective number of underlying exposures (N) is 6 or more and the position is senior. If N is less than 6, the risk weights under Column 4 of the above table apply. In all other cases, the risk weights in Column 3 of the above tables apply. The Hong Kong Mortgage Corporation Limited 16

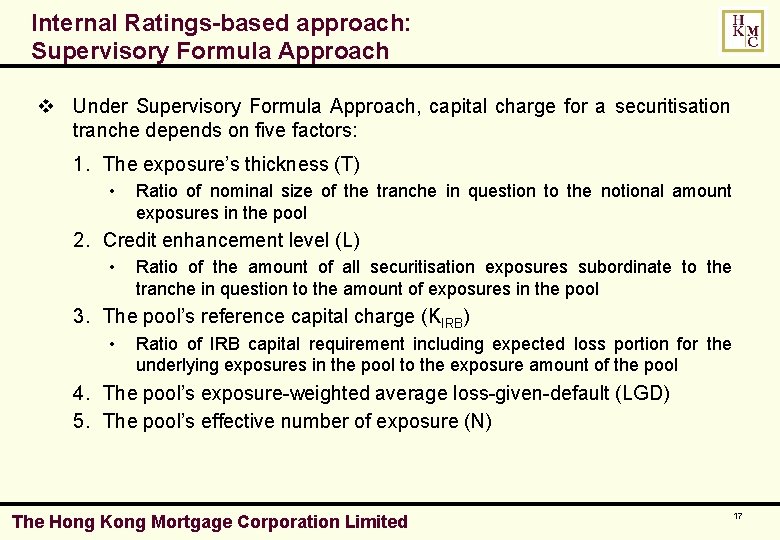

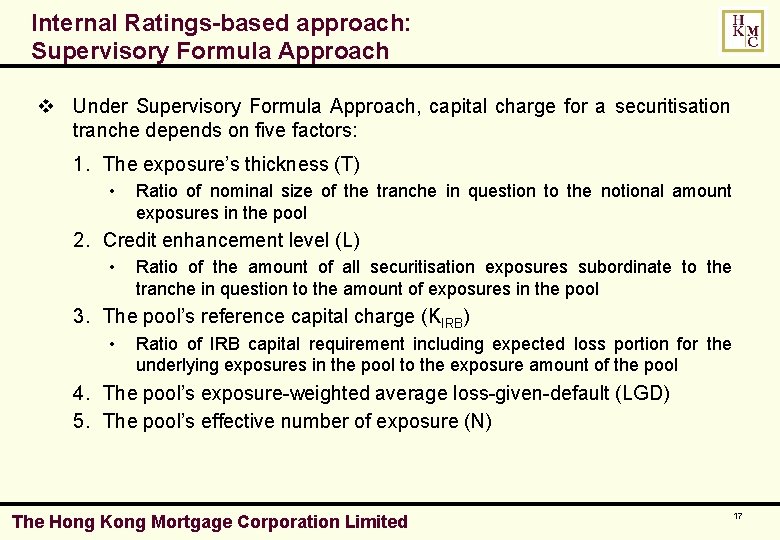

Internal Ratings-based approach: Supervisory Formula Approach v Under Supervisory Formula Approach, capital charge for a securitisation tranche depends on five factors: 1. The exposure’s thickness (T) • Ratio of nominal size of the tranche in question to the notional amount exposures in the pool 2. Credit enhancement level (L) • Ratio of the amount of all securitisation exposures subordinate to the tranche in question to the amount of exposures in the pool 3. The pool’s reference capital charge (KIRB) • Ratio of IRB capital requirement including expected loss portion for the underlying exposures in the pool to the exposure amount of the pool 4. The pool’s exposure-weighted average loss-given-default (LGD) 5. The pool’s effective number of exposure (N) The Hong Kong Mortgage Corporation Limited 17

Internal Ratings-based approach: Internal Assessment Approach v Only for unrated liquidity facilities and credit enhancements related to ABCP programmes v A bank may use its IAA model to evaluate the credit quality of the securitisation exposure it extends to ABCP programme if the assessment process meets the operational requirements v Internal assessments of exposure provided to ABCP programmes must be mapped to equivalent external ratings v Those rating equivalents are used to determine the appropriate risk weights under the RBA The Hong Kong Mortgage Corporation Limited 18

Internal Ratings-based approach: Internal Assessment Approach v Major operational requirements for internal assessment process: w ABCP must be externally rated w The credit quality of the exposures must at least be investment grade at the beginning of the transaction w The internal assessment process must be based on the rating agencies’ methodologies w The internal assessment process must identify gradation of risk w Banks must perform regular reviews of the internal assessment process and assess the validity of those internal assessments w The bank must track the performance of its internal assessments over time to evaluate the performance of the process and make adjustment, if necessary The Hong Kong Mortgage Corporation Limited 19

Internal Ratings-based approach: Internal Assessment Approach v Major operational requirements (Continued): w ABCP must have credit and investment guidelines, i. e. underwriting standards w Credit analysis of the asset seller’s risk profile must be preformed w Underwriting policy of ABCP programme must establish minimum asset eligibility criteria w The ABCP programme should have processes established to consider the operational capability and credit quality of the servicer w The ABCP programme must consider all sources of potential risk in estimating of loss on an asset pool w ABCP programme must incorporate structural features into the purchase of assets in order to mitigate potential credit deterioration of the underlying portfolio The Hong Kong Mortgage Corporation Limited 20

ISSUES AND IMPLICATIONS v Accounting standards constraining securitisation possibilities v Regulatory authority for banks: treatment of IAS-induced changes v Basel II – for better or for worse v More incentive for elaborate securitisation structure to optimise use of risk capital v Maximise the size of investment grade tranches and minimise the size of sub-investment grade tranches, particularly equity positions, to reduce the utilisation of risk capital The Hong Kong Mortgage Corporation Limited 21

More issues v Need clear guidelines on whether “significant” risk transfer takes places v Need articulation of “implicit support” v Selection of appropriate elements of IRB approach v Banks may be pressured to sell sub-investment grade tranches to market participants not bound by Basel II The Hong Kong Mortgage Corporation Limited 22

END OF PRESENTATION THANK YOU James_H_Lau@HKMC. COM. HK The Hong Kong Mortgage Corporation Limited 23

Central registry of securitisation asset reconstruction

Central registry of securitisation asset reconstruction Asean3

Asean3 Warehouse finance

Warehouse finance Securitization and reconstruction of financial assets

Securitization and reconstruction of financial assets Tricky dick: the rise and fall and rise of richard m. nixon

Tricky dick: the rise and fall and rise of richard m. nixon Raise and rise again until lambs become lions

Raise and rise again until lambs become lions A union b example

A union b example Rise and rise until lambs become lions

Rise and rise until lambs become lions Chó sói

Chó sói Thẻ vin

Thẻ vin Thơ thất ngôn tứ tuyệt đường luật

Thơ thất ngôn tứ tuyệt đường luật Các châu lục và đại dương trên thế giới

Các châu lục và đại dương trên thế giới Từ ngữ thể hiện lòng nhân hậu

Từ ngữ thể hiện lòng nhân hậu Diễn thế sinh thái là

Diễn thế sinh thái là Vẽ hình chiếu vuông góc của vật thể sau

Vẽ hình chiếu vuông góc của vật thể sau Lp html

Lp html Thế nào là giọng cùng tên

Thế nào là giọng cùng tên 101012 bằng

101012 bằng Lời thề hippocrates

Lời thề hippocrates Khi nào hổ con có thể sống độc lập

Khi nào hổ con có thể sống độc lập Tư thế worm breton là gì

Tư thế worm breton là gì đại từ thay thế

đại từ thay thế Quá trình desamine hóa có thể tạo ra

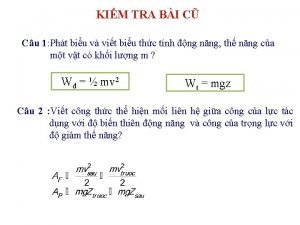

Quá trình desamine hóa có thể tạo ra Công thức tiính động năng

Công thức tiính động năng