ANNUITY EXAMPLES ANSWERS Maximizing Annuity Payments Male applicant

- Slides: 13

ANNUITY EXAMPLES ANSWERS

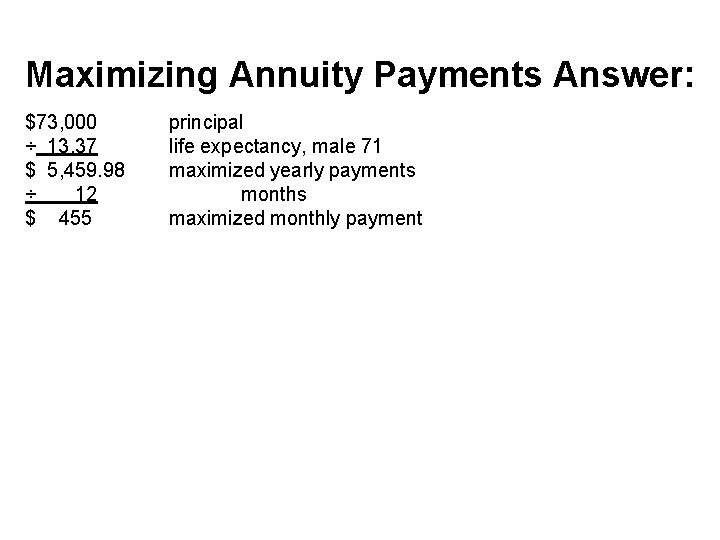

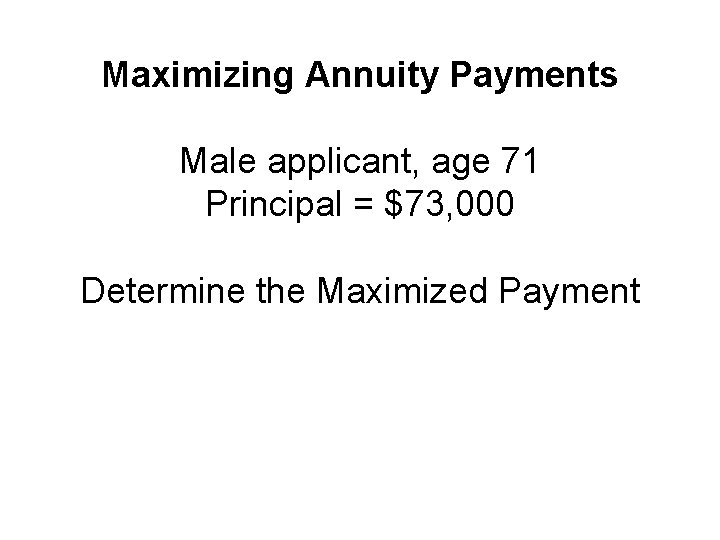

Maximizing Annuity Payments Male applicant, age 71 Principal = $73, 000 Determine the Maximized Payment

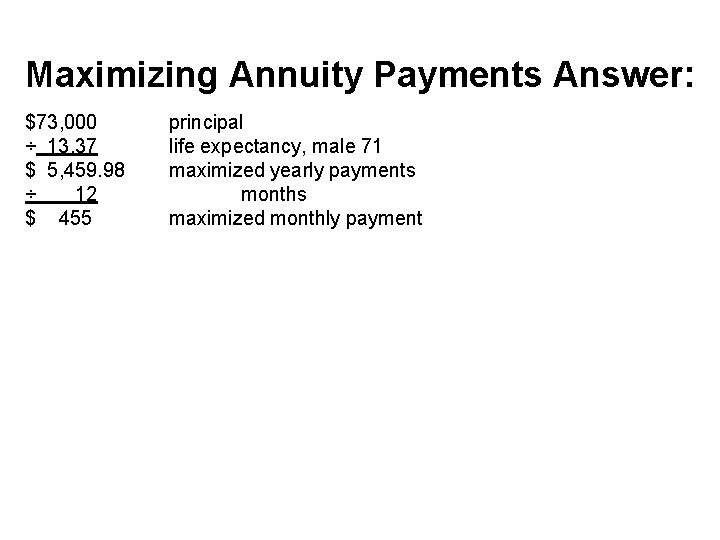

Maximizing Annuity Payments Answer: $73, 000 ÷ 13. 37 $ 5, 459. 98 ÷ 12 $ 455 principal life expectancy, male 71 maximized yearly payments months maximized monthly payment

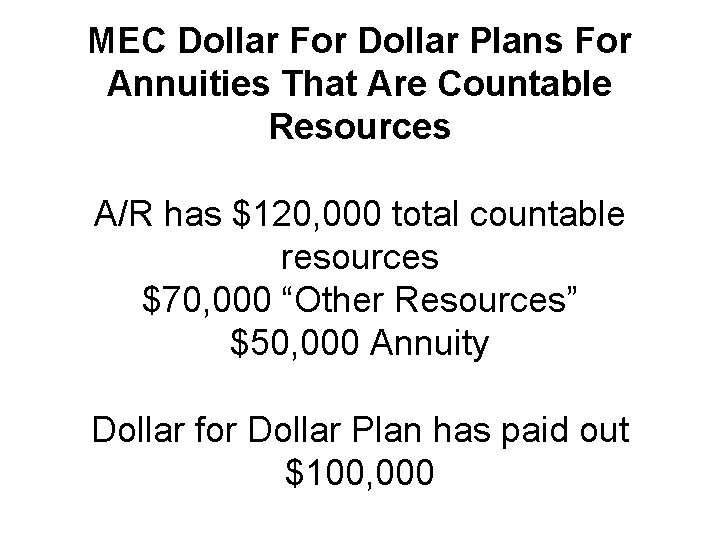

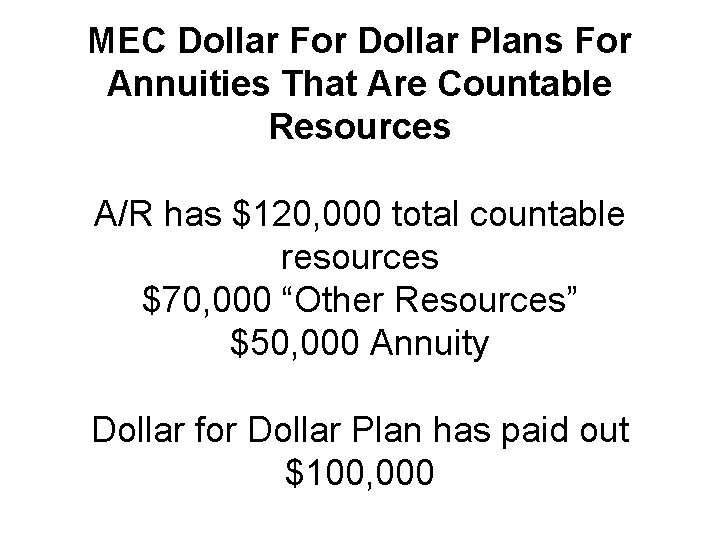

MEC Dollar For Dollar Plans For Annuities That Are Countable Resources A/R has $120, 000 total countable resources $70, 000 “Other Resources” $50, 000 Annuity Dollar for Dollar Plan has paid out $100, 000

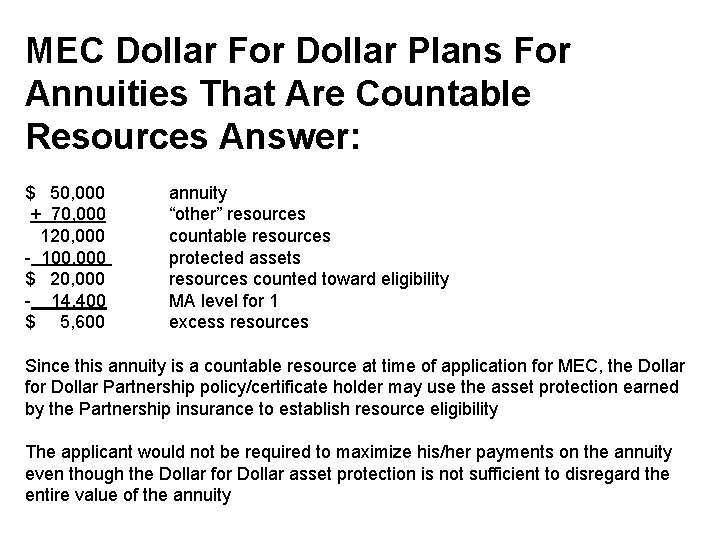

MEC Dollar For Dollar Plans For Annuities That Are Countable Resources Answer: $ 50, 000 + 70, 000 120, 000 - 100, 000 $ 20, 000 - 14, 400 $ 5, 600 annuity “other” resources countable resources protected assets resources counted toward eligibility MA level for 1 excess resources Since this annuity is a countable resource at time of application for MEC, the Dollar for Dollar Partnership policy/certificate holder may use the asset protection earned by the Partnership insurance to establish resource eligibility The applicant would not be required to maximize his/her payments on the annuity even though the Dollar for Dollar asset protection is not sufficient to disregard the entire value of the annuity

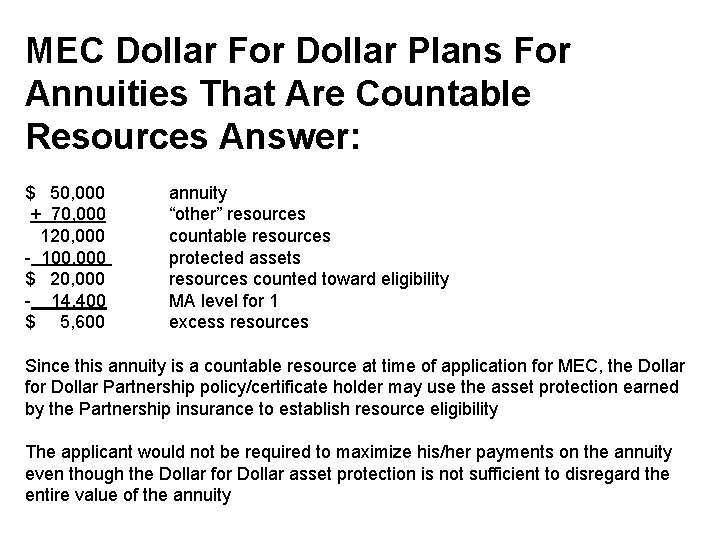

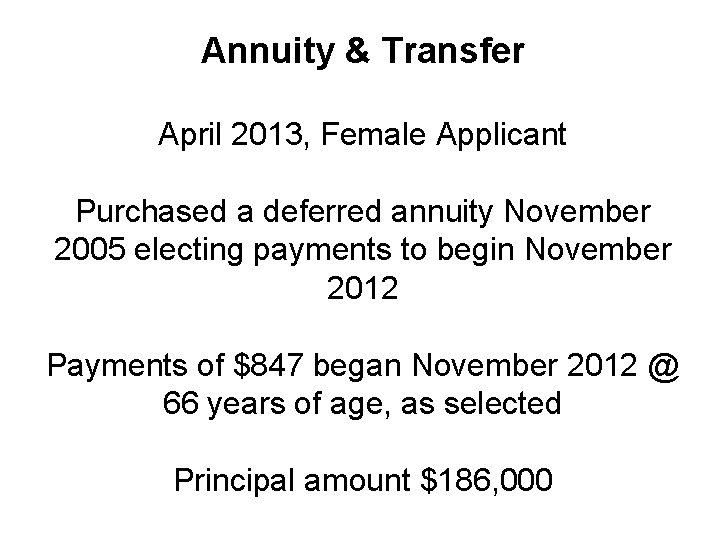

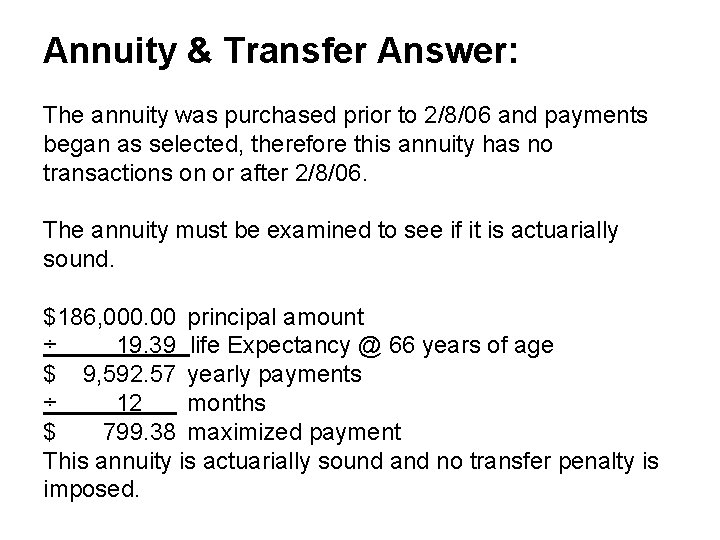

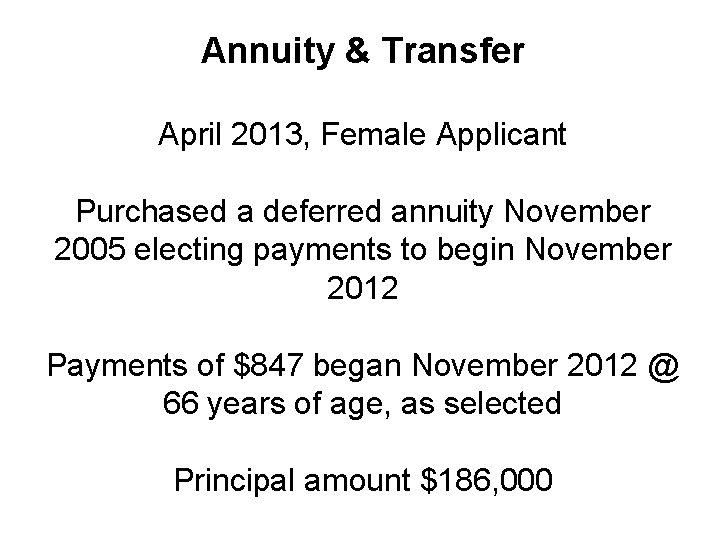

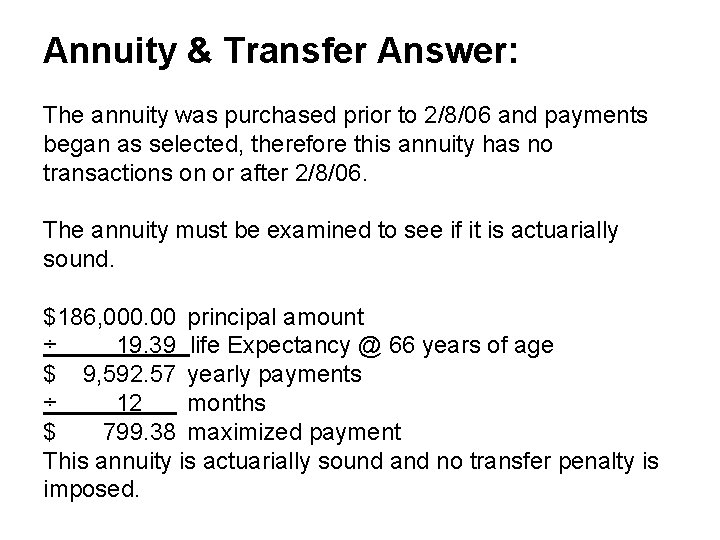

Annuity & Transfer April 2013, Female Applicant Purchased a deferred annuity November 2005 electing payments to begin November 2012 Payments of $847 began November 2012 @ 66 years of age, as selected Principal amount $186, 000

Annuity & Transfer Answer: The annuity was purchased prior to 2/8/06 and payments began as selected, therefore this annuity has no transactions on or after 2/8/06. The annuity must be examined to see if it is actuarially sound. $186, 000. 00 principal amount ÷ 19. 39 life Expectancy @ 66 years of age $ 9, 592. 57 yearly payments ÷ 12 months $ 799. 38 maximized payment This annuity is actuarially sound and no transfer penalty is imposed.

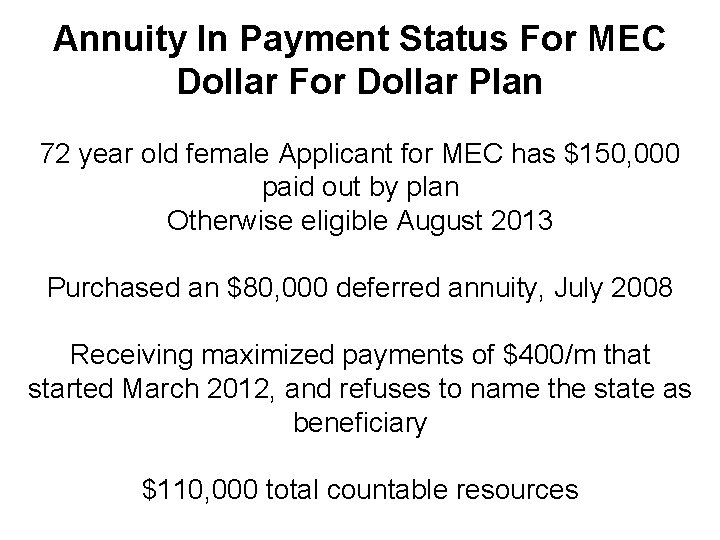

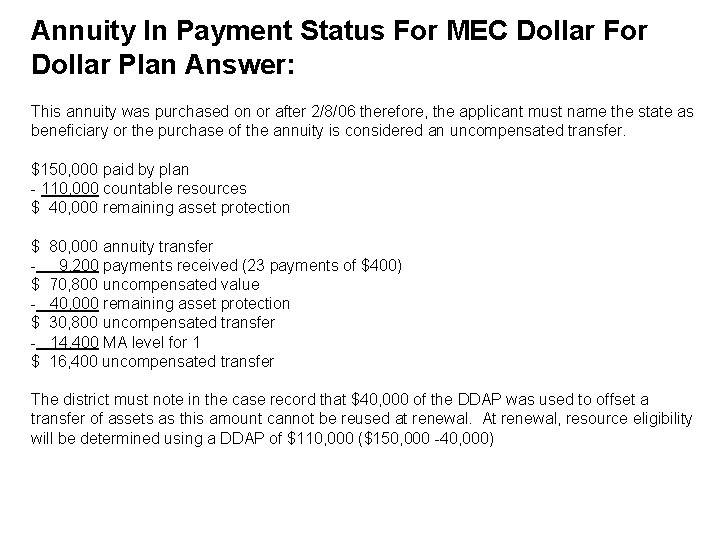

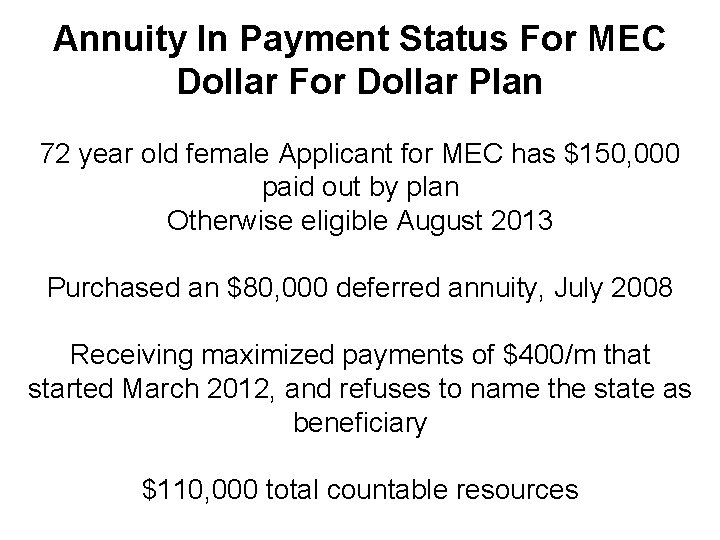

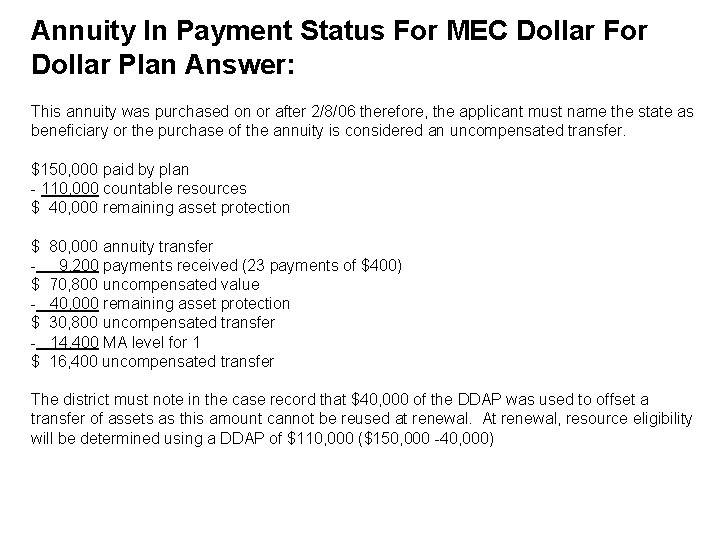

Annuity In Payment Status For MEC Dollar For Dollar Plan 72 year old female Applicant for MEC has $150, 000 paid out by plan Otherwise eligible August 2013 Purchased an $80, 000 deferred annuity, July 2008 Receiving maximized payments of $400/m that started March 2012, and refuses to name the state as beneficiary $110, 000 total countable resources

Annuity In Payment Status For MEC Dollar For Dollar Plan Answer: This annuity was purchased on or after 2/8/06 therefore, the applicant must name the state as beneficiary or the purchase of the annuity is considered an uncompensated transfer. $150, 000 paid by plan - 110, 000 countable resources $ 40, 000 remaining asset protection $ $ 80, 000 annuity transfer 9, 200 payments received (23 payments of $400) 70, 800 uncompensated value 40, 000 remaining asset protection 30, 800 uncompensated transfer 14, 400 MA level for 1 16, 400 uncompensated transfer The district must note in the case record that $40, 000 of the DDAP was used to offset a transfer of assets as this amount cannot be reused at renewal. At renewal, resource eligibility will be determined using a DDAP of $110, 000 ($150, 000 -40, 000)

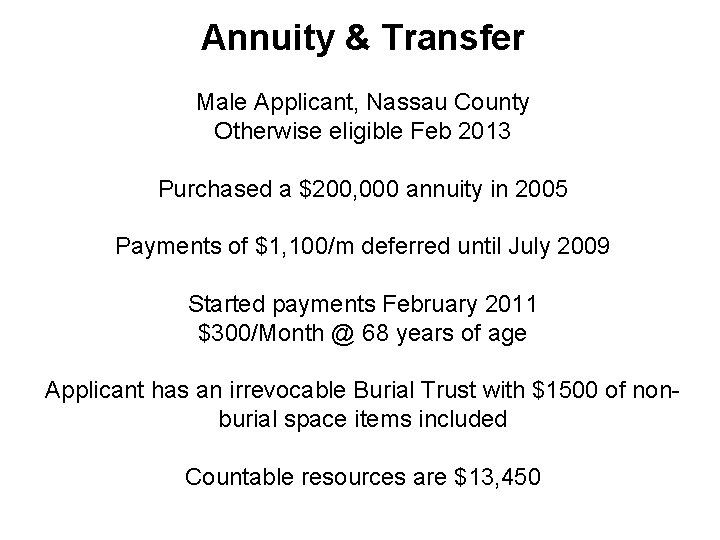

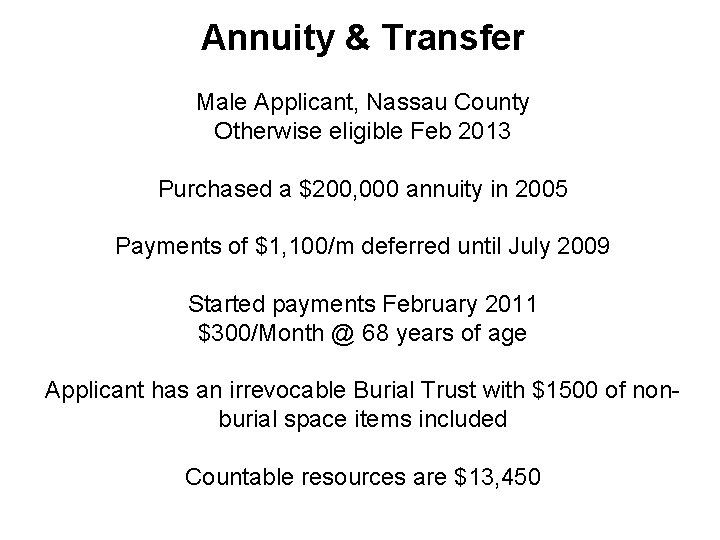

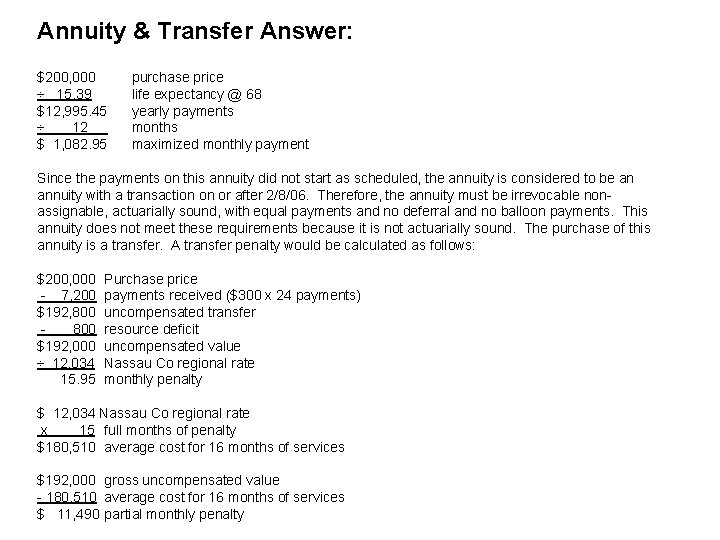

Annuity & Transfer Male Applicant, Nassau County Otherwise eligible Feb 2013 Purchased a $200, 000 annuity in 2005 Payments of $1, 100/m deferred until July 2009 Started payments February 2011 $300/Month @ 68 years of age Applicant has an irrevocable Burial Trust with $1500 of nonburial space items included Countable resources are $13, 450

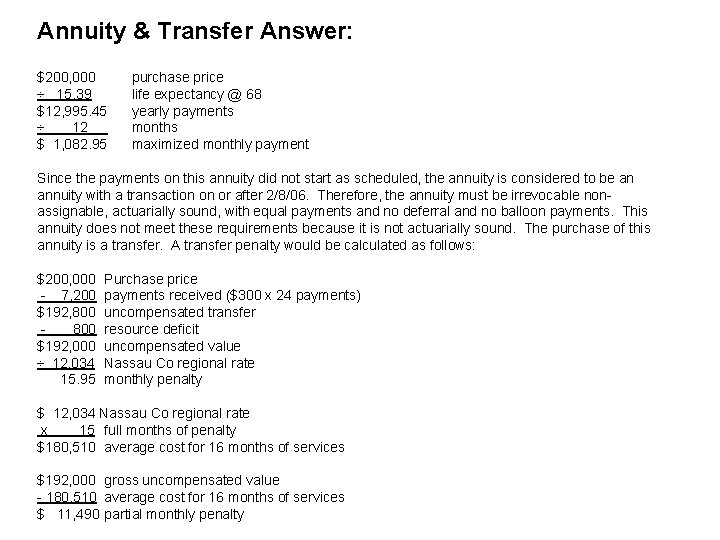

Annuity & Transfer Answer: $200, 000 ÷ 15. 39 $12, 995. 45 ÷ 12 $ 1, 082. 95 purchase price life expectancy @ 68 yearly payments months maximized monthly payment Since the payments on this annuity did not start as scheduled, the annuity is considered to be an annuity with a transaction on or after 2/8/06. Therefore, the annuity must be irrevocable nonassignable, actuarially sound, with equal payments and no deferral and no balloon payments. This annuity does not meet these requirements because it is not actuarially sound. The purchase of this annuity is a transfer. A transfer penalty would be calculated as follows: $200, 000 - 7, 200 $192, 800 $192, 000 ÷ 12, 034 15. 95 Purchase price payments received ($300 x 24 payments) uncompensated transfer resource deficit uncompensated value Nassau Co regional rate monthly penalty $ 12, 034 Nassau Co regional rate x 15 full months of penalty $180, 510 average cost for 16 months of services $192, 000 gross uncompensated value - 180, 510 average cost for 16 months of services $ 11, 490 partial monthly penalty

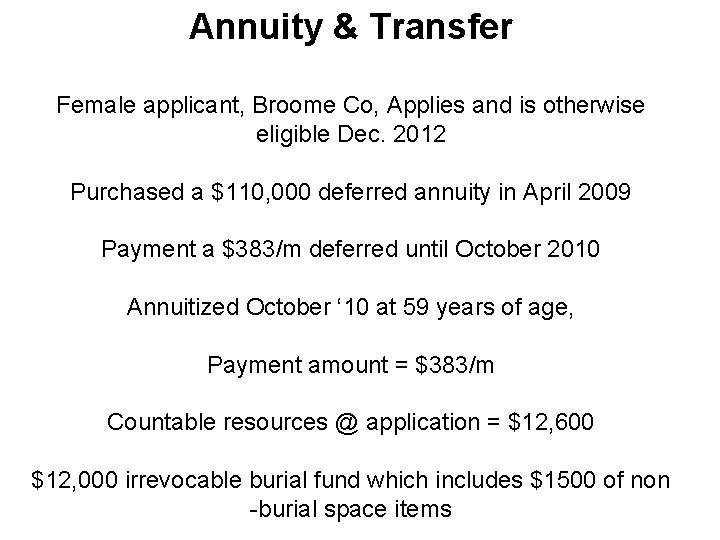

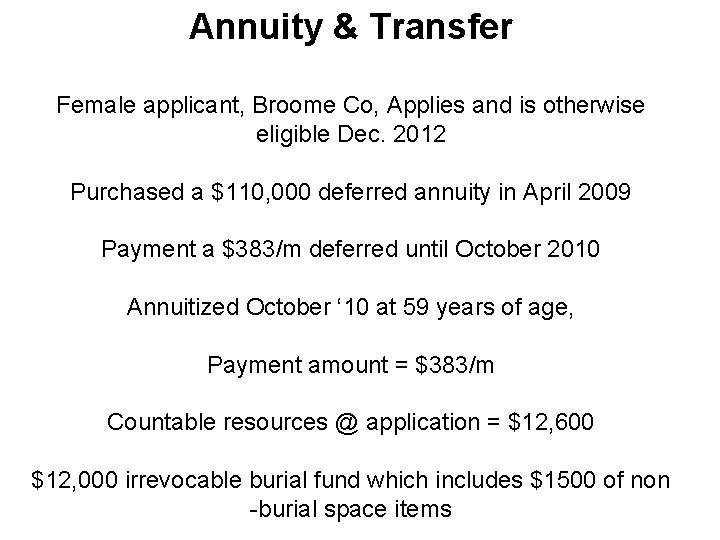

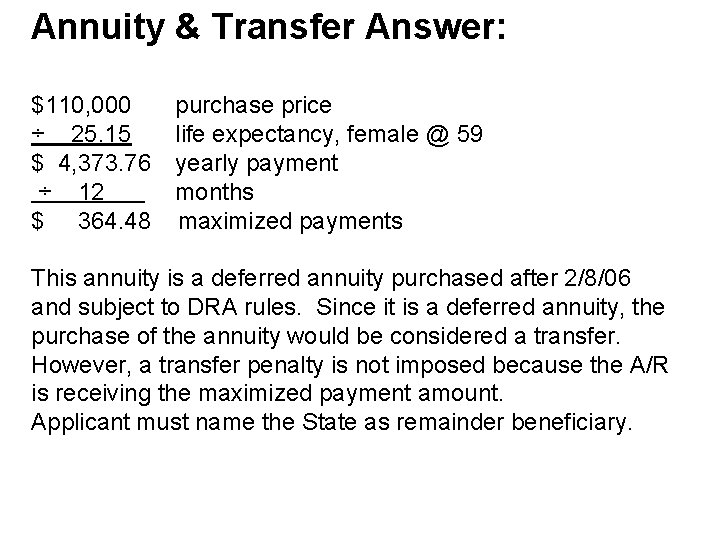

Annuity & Transfer Female applicant, Broome Co, Applies and is otherwise eligible Dec. 2012 Purchased a $110, 000 deferred annuity in April 2009 Payment a $383/m deferred until October 2010 Annuitized October ‘ 10 at 59 years of age, Payment amount = $383/m Countable resources @ application = $12, 600 $12, 000 irrevocable burial fund which includes $1500 of non -burial space items

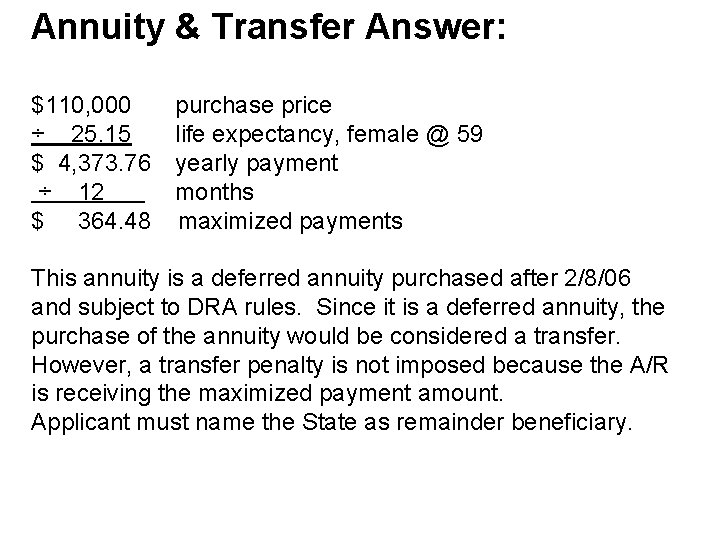

Annuity & Transfer Answer: $110, 000 ÷ 25. 15 $ 4, 373. 76 ÷ 12 $ 364. 48 purchase price life expectancy, female @ 59 yearly payment months maximized payments This annuity is a deferred annuity purchased after 2/8/06 and subject to DRA rules. Since it is a deferred annuity, the purchase of the annuity would be considered a transfer. However, a transfer penalty is not imposed because the A/R is receiving the maximized payment amount. Applicant must name the State as remainder beneficiary.

Christopher mikaelian

Christopher mikaelian Ordinary annuity vs annuity due

Ordinary annuity vs annuity due Annuity due timeline

Annuity due timeline Motor power constant

Motor power constant Special amount column definition

Special amount column definition Annuity math questions and answers pdf

Annuity math questions and answers pdf Government transfer payments examples

Government transfer payments examples Hardship transfer examples

Hardship transfer examples Simultaneous multithreading: maximizing on-chip parallelism

Simultaneous multithreading: maximizing on-chip parallelism Profit-maximizing price formula

Profit-maximizing price formula How to calculate profit for monopoly

How to calculate profit for monopoly Monopoly profit maximizing price

Monopoly profit maximizing price Maximizing instructional time in the classroom

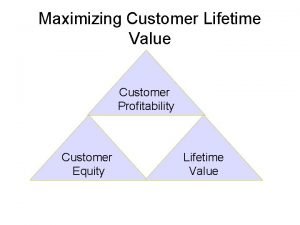

Maximizing instructional time in the classroom Maximizing customer lifetime value

Maximizing customer lifetime value