Analysis under Certainty The one investment certainty is

- Slides: 15

Analysis under Certainty The one investment certainty is that we are all frequently wrong 26 октября 2002 Стратегии

Up to now n Financial markets and instruments – Specifics of stocks, bonds, and derivatives – Trading process – Financial intermediaries NES FF 2005/06 2

Plan n Analysis under certainty – Term structure of interest rates – Fixed income instruments • • Pricing Risks – Capital budgeting NES FF 2005/06 3

Definitions of rates n Reinvestment: – Simple vs compound interest n Frequency of compounding: – Nominal (coupon) rate vs effective (annual) rate n Continuous compounding: – Log-return NES FF 2005/06 4

Definitions of rates (2) n Yield to maturity / internal yield / bond yield – Rate that equates cash flows on the bond with its market value – Return earned from holding a bond to maturity • n Assuming reinvestment at same rate Par yield – Coupon rate that causes the bond price to equal its face value n Current yield – Annual coupon payment divided by the bond’s price – Often quoted but useless FF 2005/06 NES 5

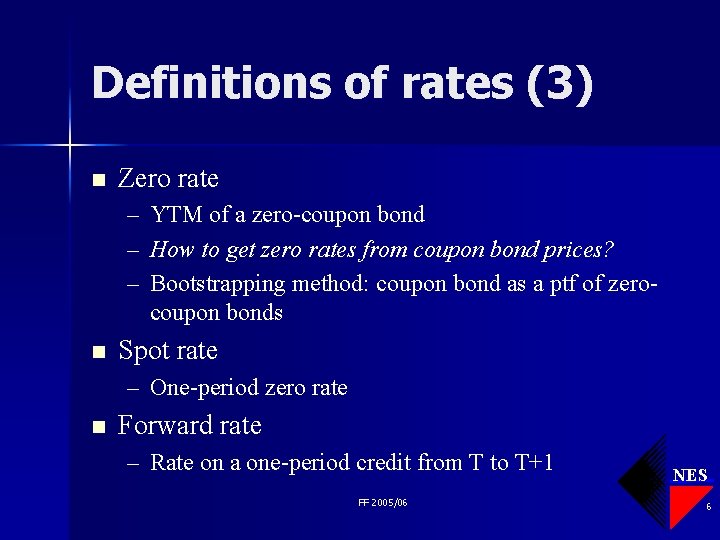

Definitions of rates (3) n Zero rate – – – n YTM of a zero-coupon bond How to get zero rates from coupon bond prices? Bootstrapping method: coupon bond as a ptf of zerocoupon bonds Spot rate – One-period zero rate n Forward rate – Rate on a one-period credit from T to T+1 FF 2005/06 NES 6

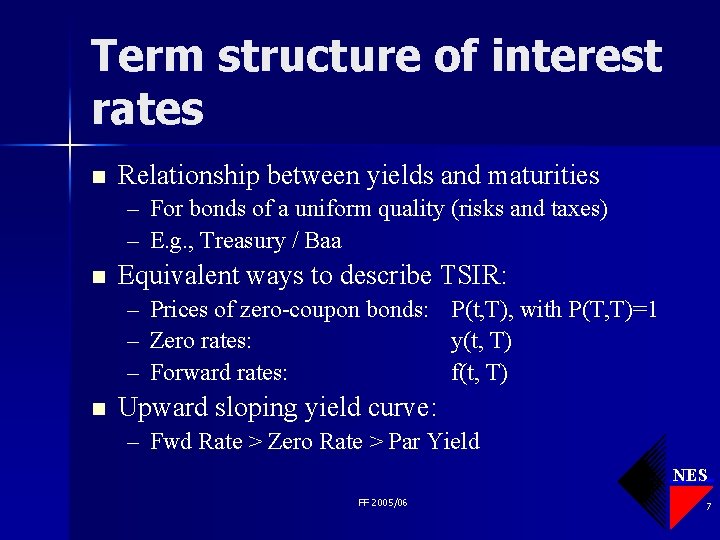

Term structure of interest rates n Relationship between yields and maturities – For bonds of a uniform quality (risks and taxes) – E. g. , Treasury / Baa n Equivalent ways to describe TSIR: – Prices of zero-coupon bonds: P(t, T), with P(T, T)=1 – Zero rates: y(t, T) – Forward rates: f(t, T) n Upward sloping yield curve: – Fwd Rate > Zero Rate > Par Yield NES FF 2005/06 7

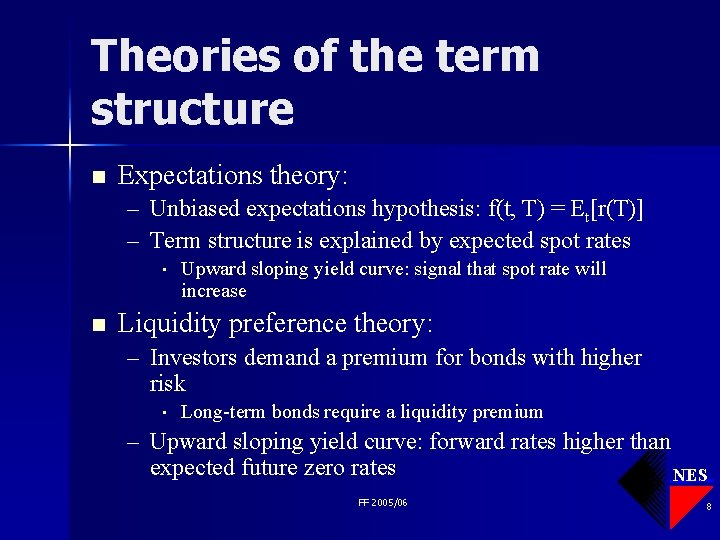

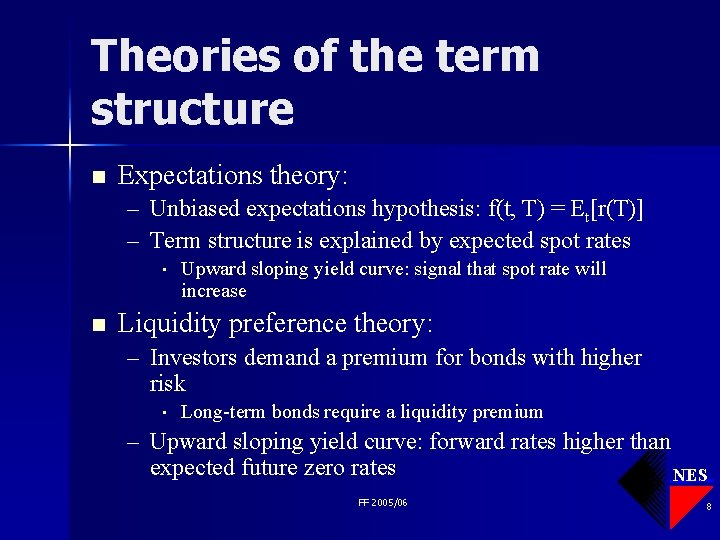

Theories of the term structure n Expectations theory: – Unbiased expectations hypothesis: f(t, T) = Et[r(T)] – Term structure is explained by expected spot rates • n Upward sloping yield curve: signal that spot rate will increase Liquidity preference theory: – Investors demand a premium for bonds with higher risk • Long-term bonds require a liquidity premium – Upward sloping yield curve: forward rates higher than expected future zero rates NES FF 2005/06 8

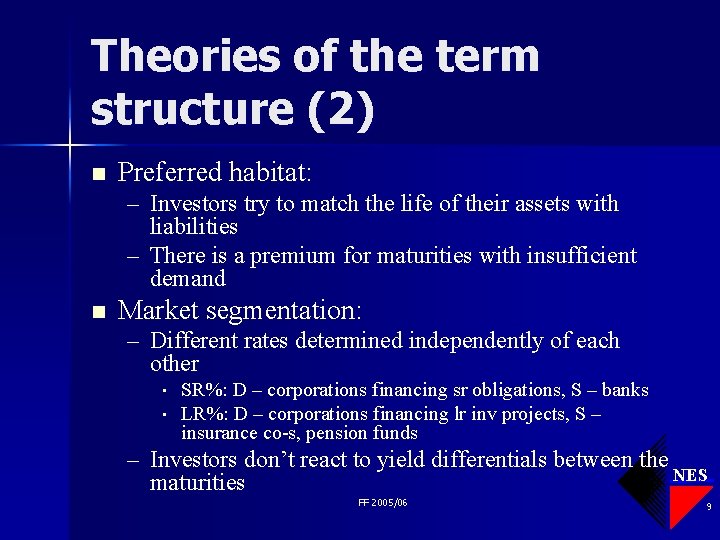

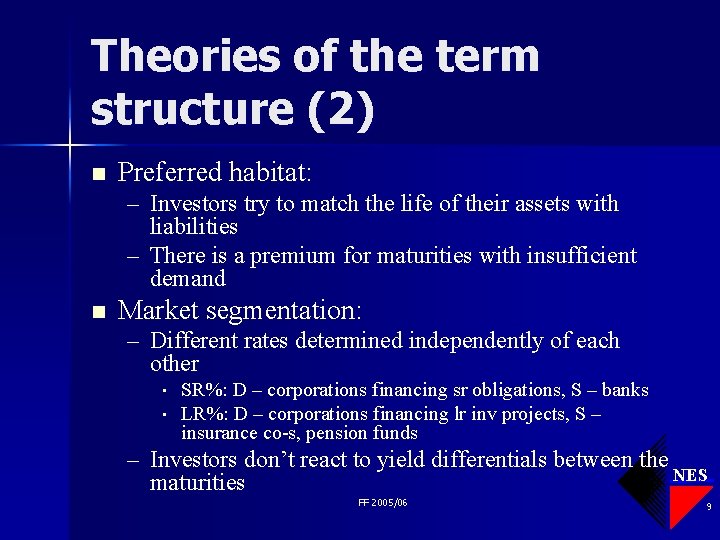

Theories of the term structure (2) n Preferred habitat: – Investors try to match the life of their assets with liabilities – There is a premium for maturities with insufficient demand n Market segmentation: – Different rates determined independently of each other • • SR%: D – corporations financing sr obligations, S – banks LR%: D – corporations financing lr inv projects, S – insurance co-s, pension funds – Investors don’t react to yield differentials between the NES maturities FF 2005/06 9

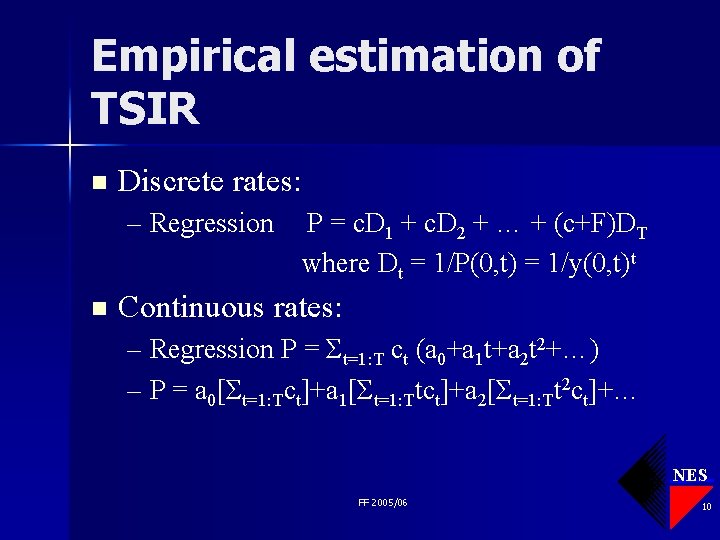

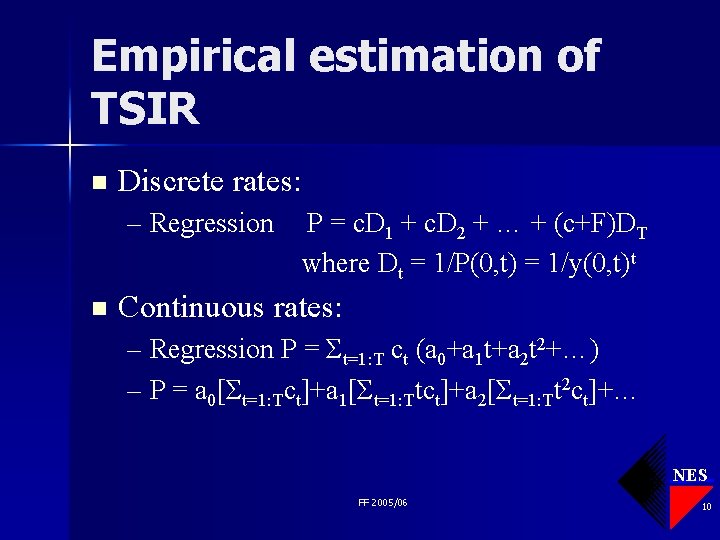

Empirical estimation of TSIR n Discrete rates: – Regression n P = c. D 1 + c. D 2 + … + (c+F)DT where Dt = 1/P(0, t) = 1/y(0, t)t Continuous rates: – Regression P = Σt=1: T ct (a 0+a 1 t+a 2 t 2+…) – P = a 0[Σt=1: Tct]+a 1[Σt=1: Ttct]+a 2[Σt=1: Tt 2 ct]+… NES FF 2005/06 10

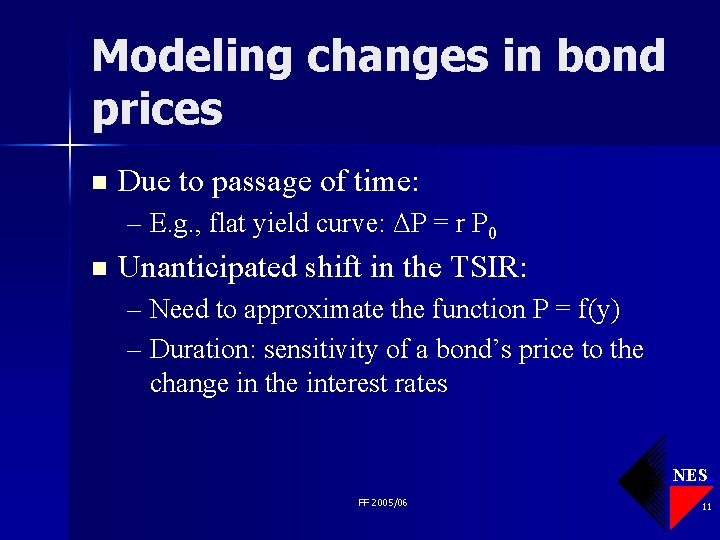

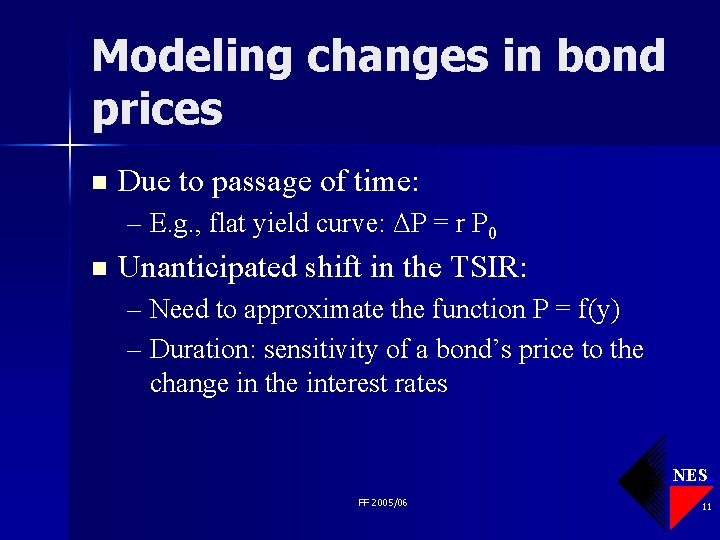

Modeling changes in bond prices n Due to passage of time: – E. g. , flat yield curve: ΔP = r P 0 n Unanticipated shift in the TSIR: – Need to approximate the function P = f(y) – Duration: sensitivity of a bond’s price to the change in the interest rates NES FF 2005/06 11

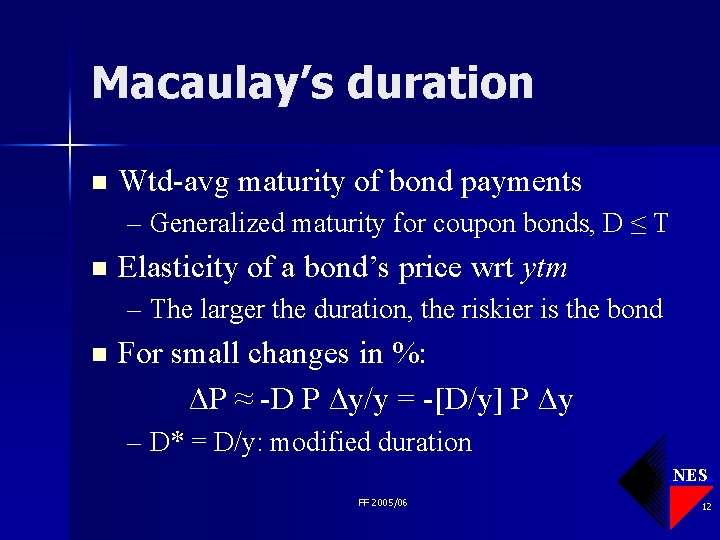

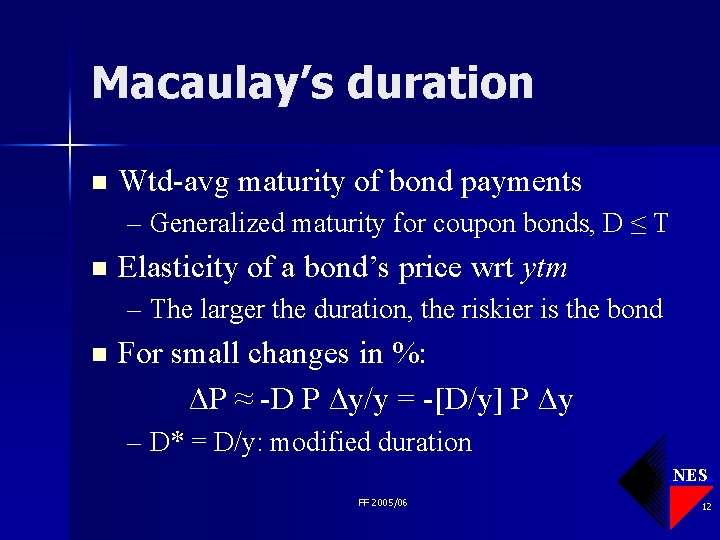

Macaulay’s duration n Wtd-avg maturity of bond payments – Generalized maturity for coupon bonds, D ≤ T n Elasticity of a bond’s price wrt ytm – The larger the duration, the riskier is the bond n For small changes in %: ΔP ≈ -D P Δy/y = -[D/y] P Δy – D* = D/y: modified duration NES FF 2005/06 12

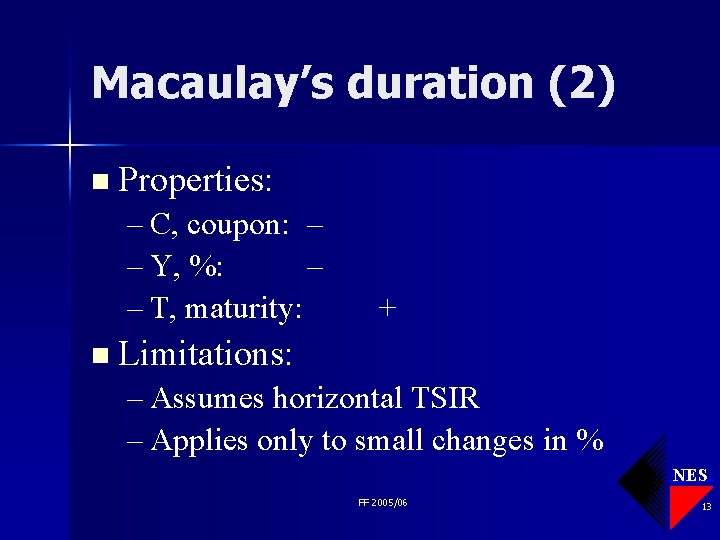

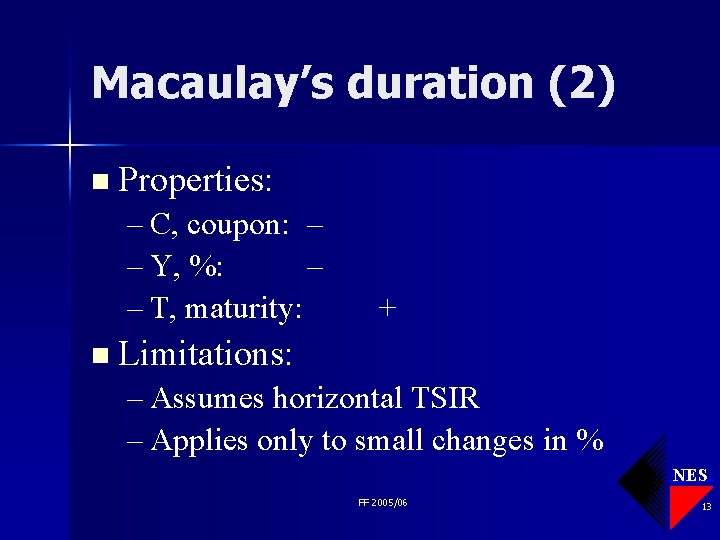

Macaulay’s duration (2) n Properties: – C, coupon: – – Y, %: – – T, maturity: + n Limitations: – Assumes horizontal TSIR – Applies only to small changes in % NES FF 2005/06 13

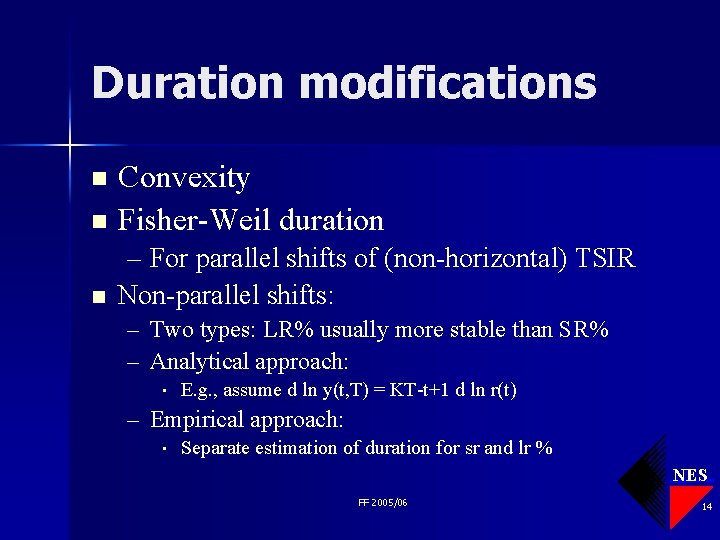

Duration modifications Convexity n Fisher-Weil duration n n – For parallel shifts of (non-horizontal) TSIR Non-parallel shifts: – Two types: LR% usually more stable than SR% – Analytical approach: • E. g. , assume d ln y(t, T) = KT-t+1 d ln r(t) – Empirical approach: • Separate estimation of duration for sr and lr % NES FF 2005/06 14

Conclusions 26 октября 2002 Стратегии