An Introduction to Financial Econometrics TimeVarying Volatility and

- Slides: 26

An Introduction to Financial Econometrics: Time-Varying Volatility and ARCH Models Modified JJ Vera Tabakova, East Carolina University

Chapter 14: An Introduction to Financial Econometrics: Time-Varying Volatility and ARCH Models 14. 1 The ARCH Model 14. 2 Time-Varying Volatility 14. 3 Testing, Estimating and Forecasting 14. 4 Extensions Below y denotes a return series. Returns are assumed: uncorrelated in levels, with a constant expected value beta_0 , and autocorrelated in squared values: Principles of Econometrics, 3 rd Edition Slide 14 -2

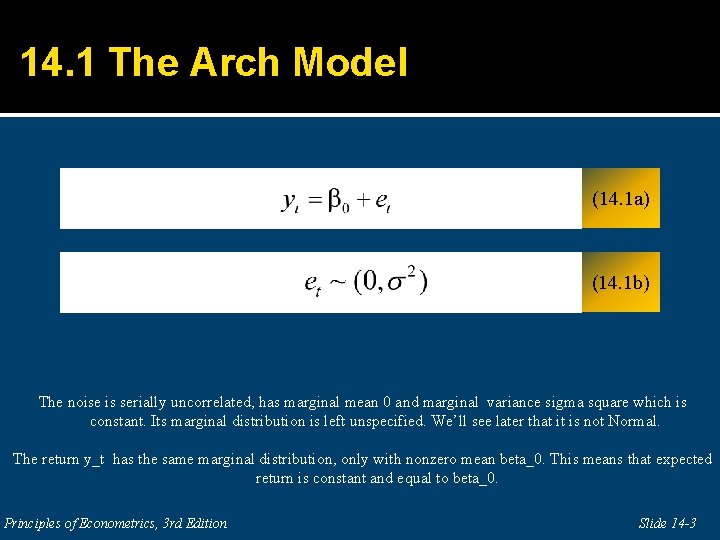

14. 1 The Arch Model (14. 1 a) E (14. 1 b) The noise is serially uncorrelated, has marginal mean 0 and marginal variance sigma square which is constant. Its marginal distribution is left unspecified. We’ll see later that it is not Normal. The return y_t has the same marginal distribution, only with nonzero mean beta_0. This means that expected return is constant and equal to beta_0. Principles of Econometrics, 3 rd Edition Slide 14 -3

14. 1 The Arch Model (14. 2 a) (14. 2 b) (14. 2 c) Moreover, as we see here the noise has a conditional Normal distribution given its own past. Its conditional mean is constant and, like its marginal mean, it is 0. Its conditional variance h_t is time varying: h_t has ARCH(1) dynamics. Principles of Econometrics, 3 rd Edition Slide 14 -4

The positivity conditions are needed to make sure the conditional variance h_t stays positive. The marginal and conditional variance of (demeaned) returns are related Principles of Econometrics, 3 rd Edition

14. 1. 1 Conditional and Unconditional Moments Conditional moments Conditional expected return=marginal expected return: E(y_t| I_t-1) =E(y_t) = beta_0 Conditional variance of returns is time varying h_t: E[(y_t-beta_0) ^2 | I_t-1]= h_t Principles of Econometrics, 3 rd Edition Slide 14 -6

14. 1. 1 Conditional and Unconditional Moments Unconditional moments Marginal expected return : E(y_t) = beta Marginal variance of returns: E[(y_t-beta)^2] = sigma = alpha_0/(1 -alpha_1) Principles of Econometrics, 3 rd Edition Slide 14 -7

14. 2 Time Varying Volatility Figure 14. 1 Examples of Returns to Various Stock Indices Principles of Econometrics, 3 rd Edition Slide 14 -8

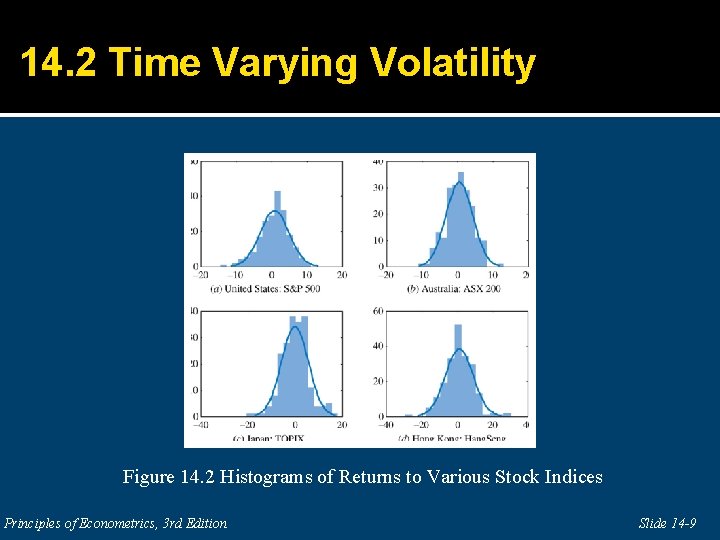

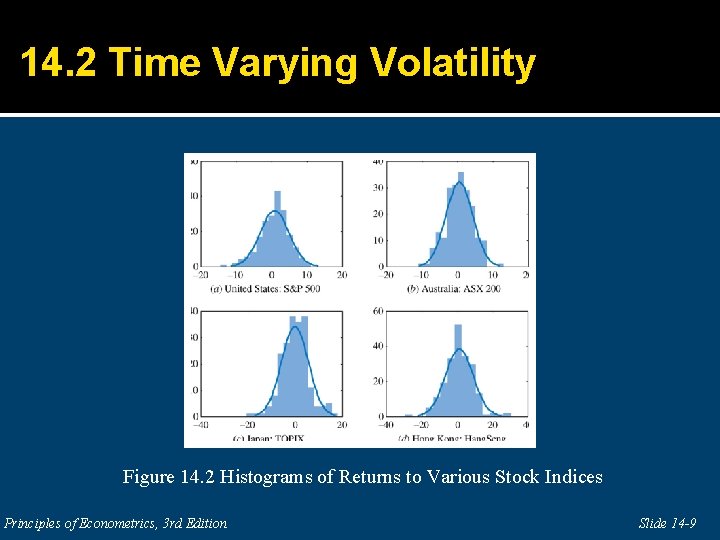

14. 2 Time Varying Volatility Figure 14. 2 Histograms of Returns to Various Stock Indices Principles of Econometrics, 3 rd Edition Slide 14 -9

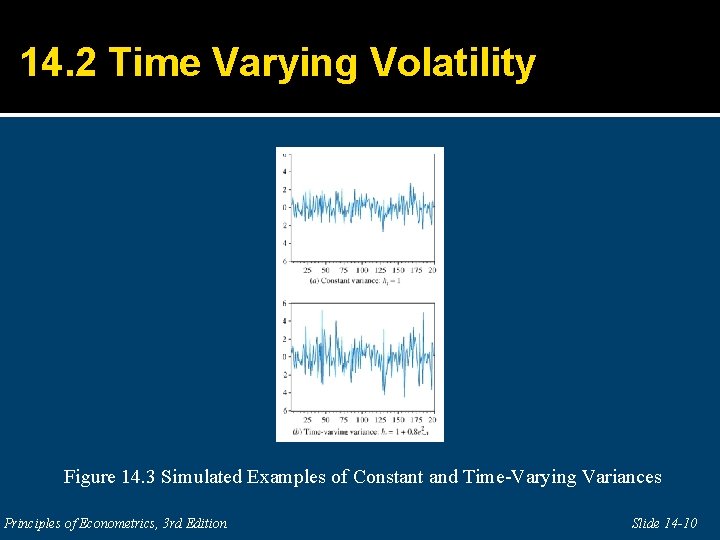

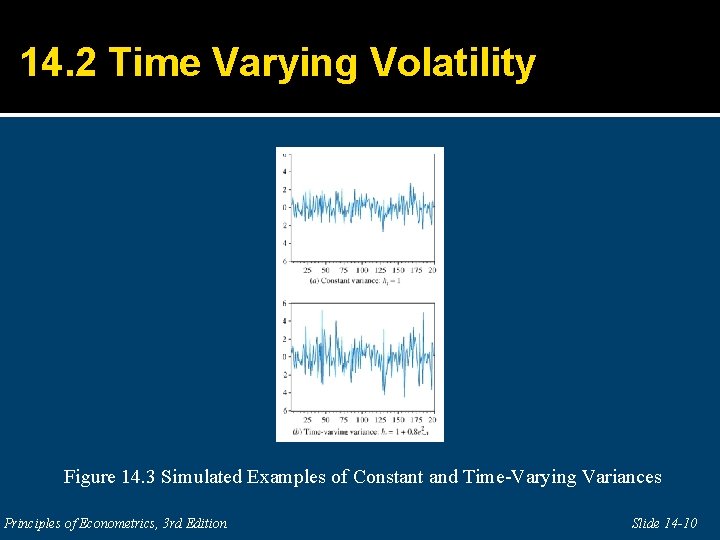

14. 2 Time Varying Volatility Figure 14. 3 Simulated Examples of Constant and Time-Varying Variances Principles of Econometrics, 3 rd Edition Slide 14 -10

14. 2 Time Varying Volatility Figure 14. 4 Frequency Distributions of the Simulated Models Principles of Econometrics, 3 rd Edition Slide 14 -11

Empirical properties of returns When returns are plotted over time, they display volatility clustering. Volatility varies over time( if you calculate variance from subsamples, you will get different results) The marginal distributions of returns have fat tails (kurtosis>3)-because they admit more extreme values than a Normal variable The marginal distributions of returns are often skewed Principles of Econometrics, 3 rd Edition

14. 3 Testing, Estimating and Forecasting 14. 3. 1 Testing for ARCH effects You first estimate beta by regressing returns on a constant. You get hat(beta). Next, compute the OLS residual as y_t- hat(beta). Square the residual, regress on its lag (14. 3) Principles of Econometrics, 3 rd Edition Slide 14 -13

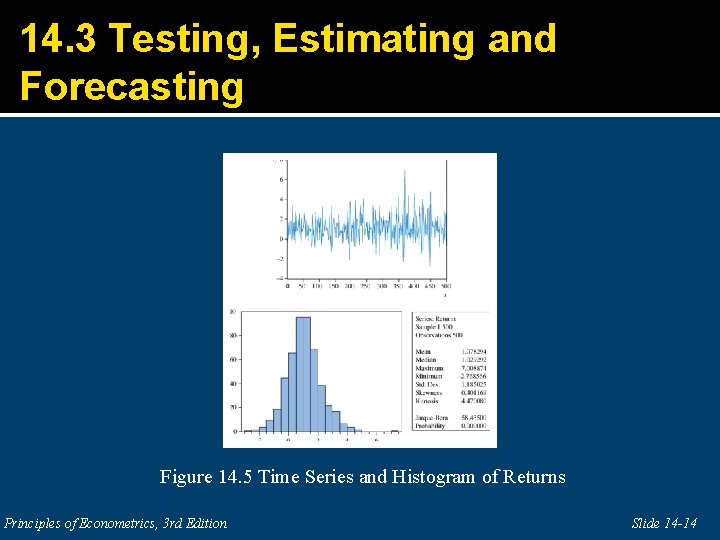

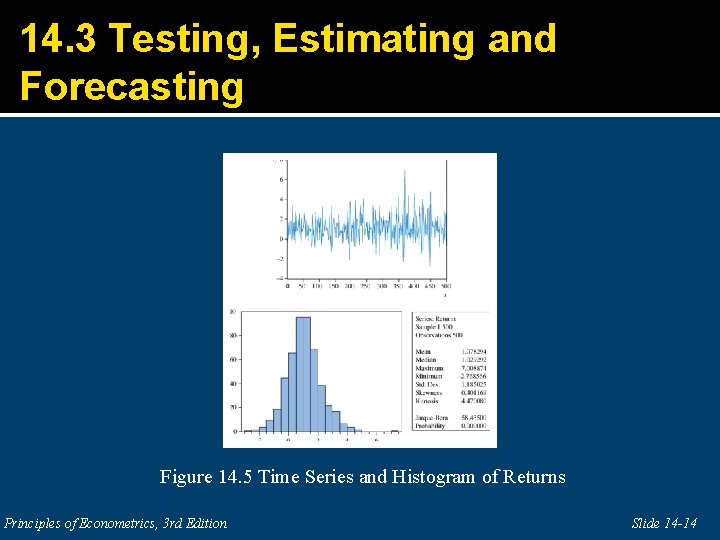

14. 3 Testing, Estimating and Forecasting Figure 14. 5 Time Series and Histogram of Returns Principles of Econometrics, 3 rd Edition Slide 14 -14

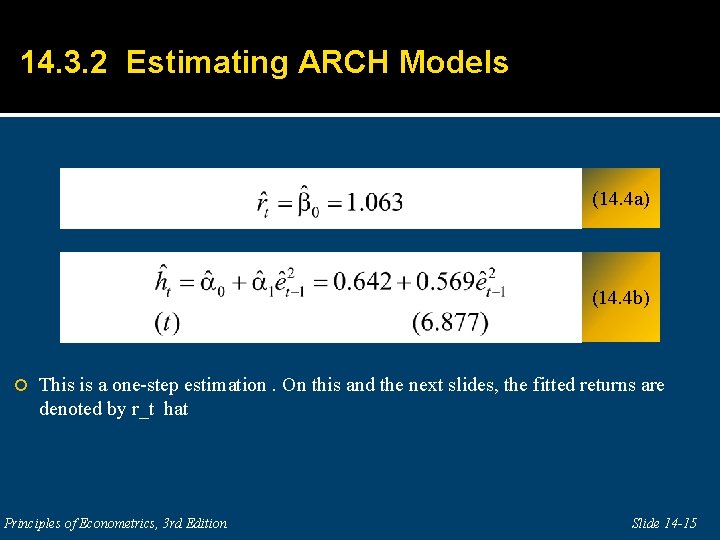

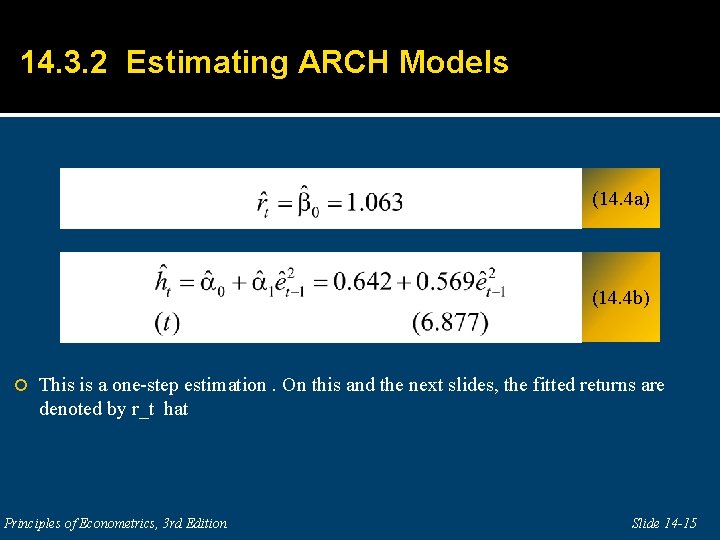

14. 3. 2 Estimating ARCH Models (14. 4 a) (14. 4 b) This is a one-step estimation. On this and the next slides, the fitted returns are denoted by r_t hat Principles of Econometrics, 3 rd Edition Slide 14 -15

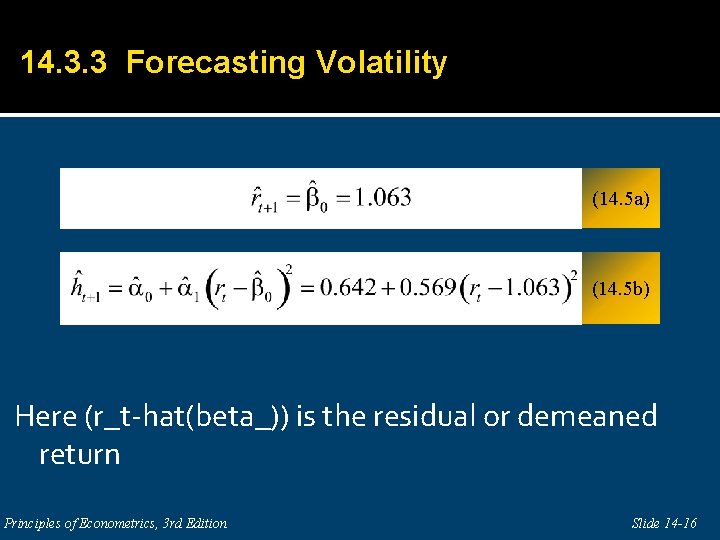

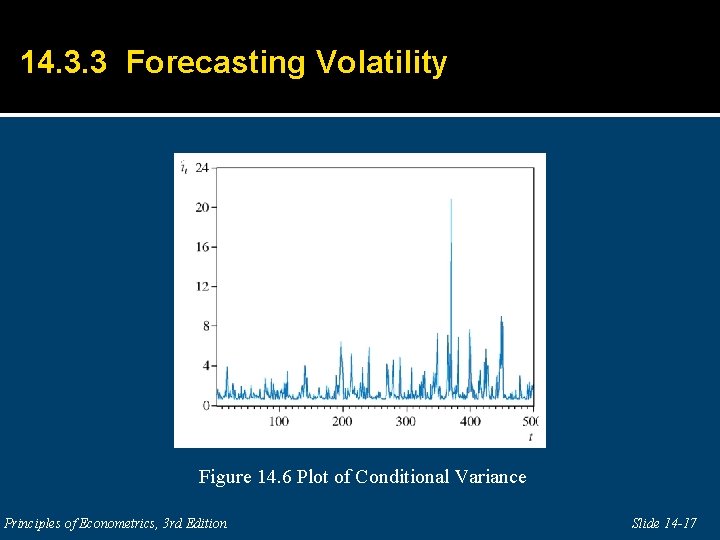

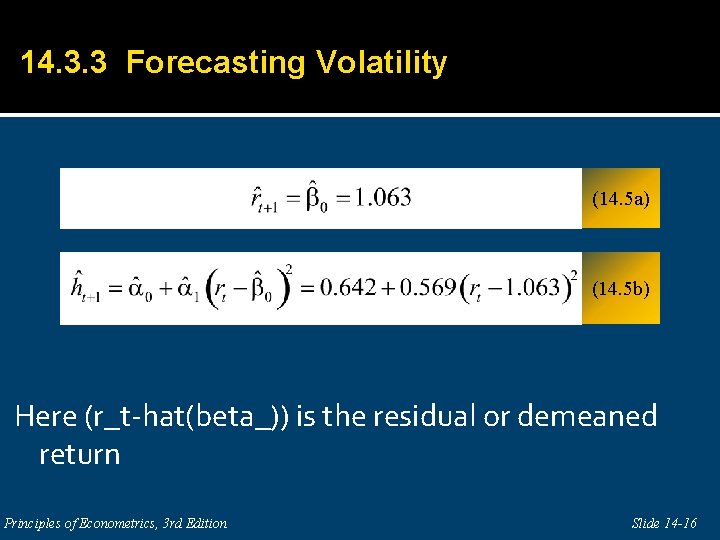

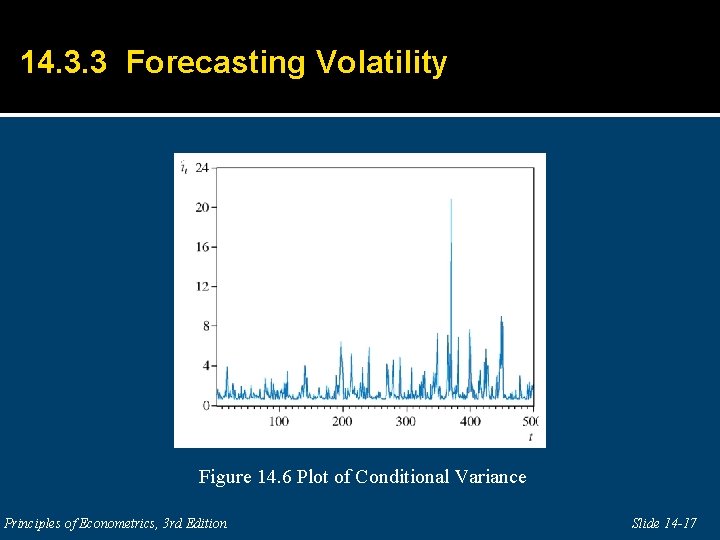

14. 3. 3 Forecasting Volatility (14. 5 a) (14. 5 b) Here (r_t-hat(beta_)) is the residual or demeaned return Principles of Econometrics, 3 rd Edition Slide 14 -16

14. 3. 3 Forecasting Volatility Figure 14. 6 Plot of Conditional Variance Principles of Econometrics, 3 rd Edition Slide 14 -17

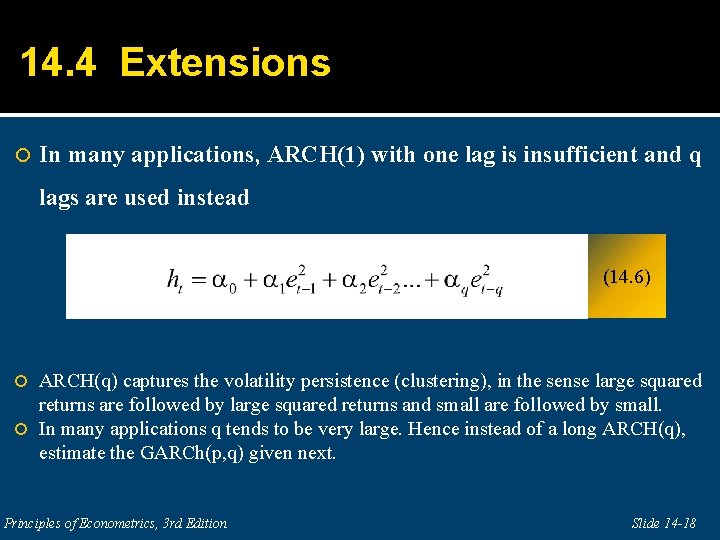

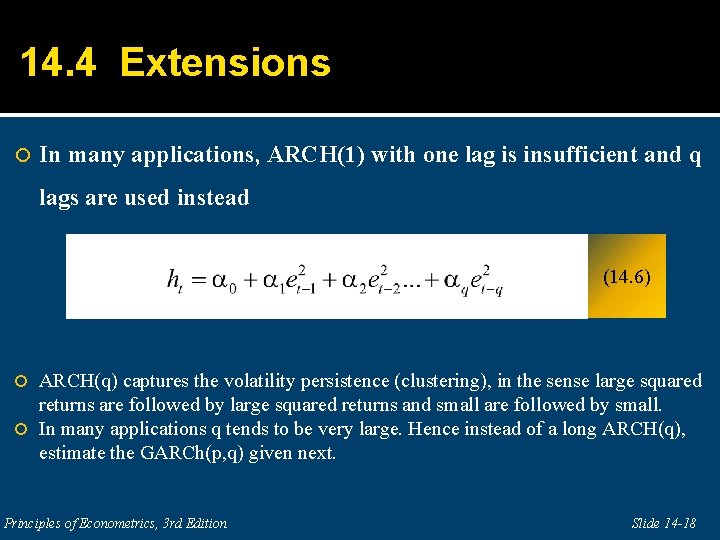

14. 4 Extensions In many applications, ARCH(1) with one lag is insufficient and q lags are used instead (14. 6) ARCH(q) captures the volatility persistence (clustering), in the sense large squared returns are followed by large squared returns and small are followed by small. In many applications q tends to be very large. Hence instead of a long ARCH(q), estimate the GARCh(p, q) given next. Principles of Econometrics, 3 rd Edition Slide 14 -18

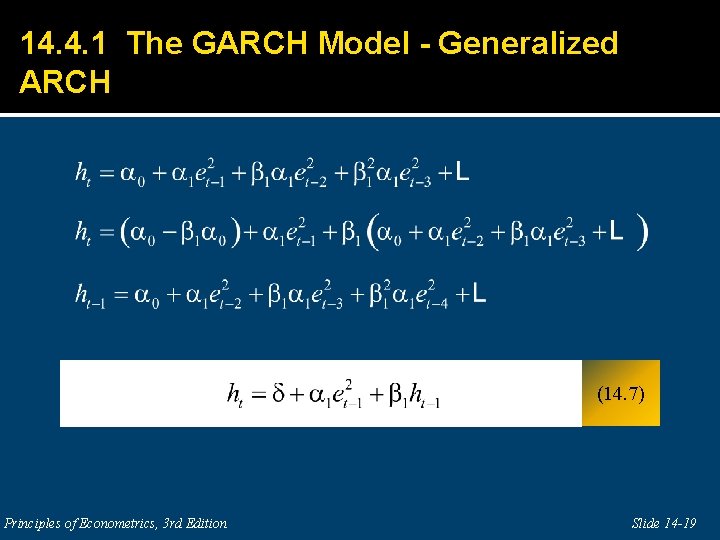

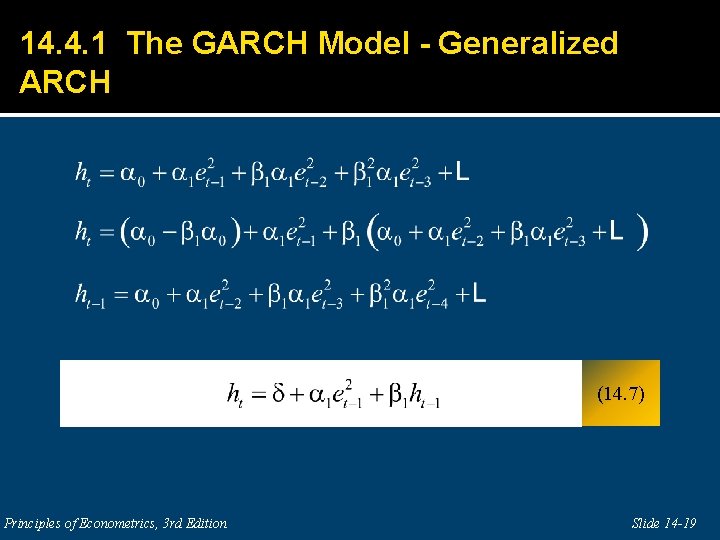

14. 4. 1 The GARCH Model - Generalized ARCH (14. 7) Principles of Econometrics, 3 rd Edition Slide 14 -19

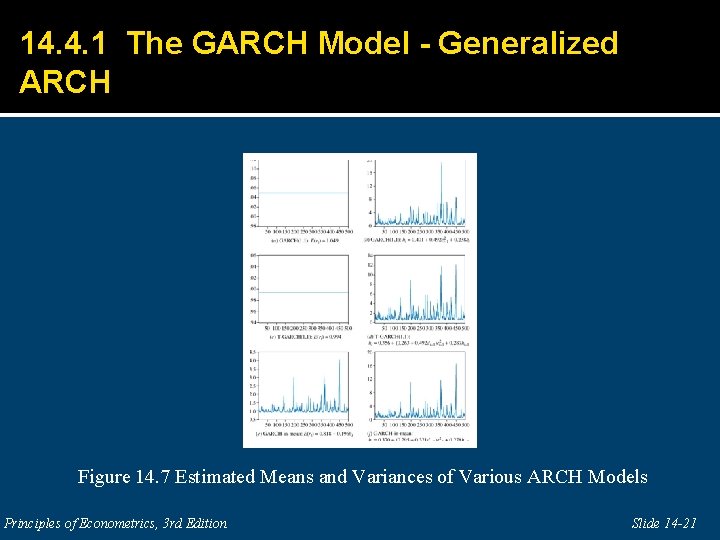

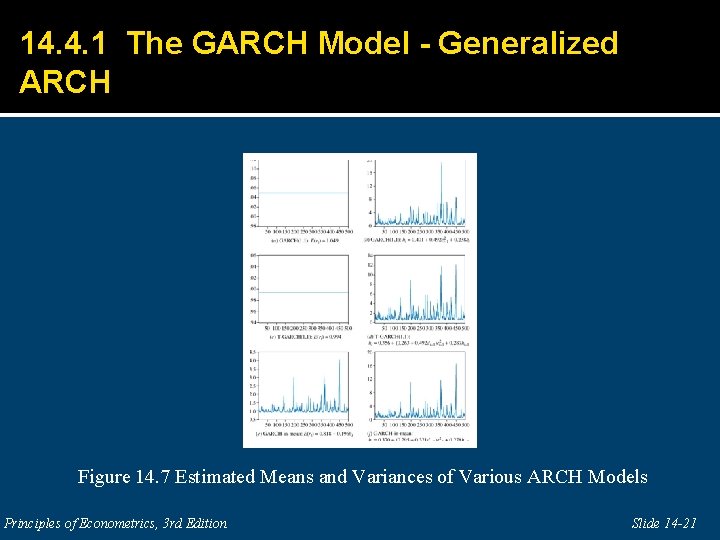

14. 4. 1 The GARCH Model - Generalized ARCH Principles of Econometrics, 3 rd Edition Slide 14 -20

14. 4. 1 The GARCH Model - Generalized ARCH Figure 14. 7 Estimated Means and Variances of Various ARCH Models Principles of Econometrics, 3 rd Edition Slide 14 -21

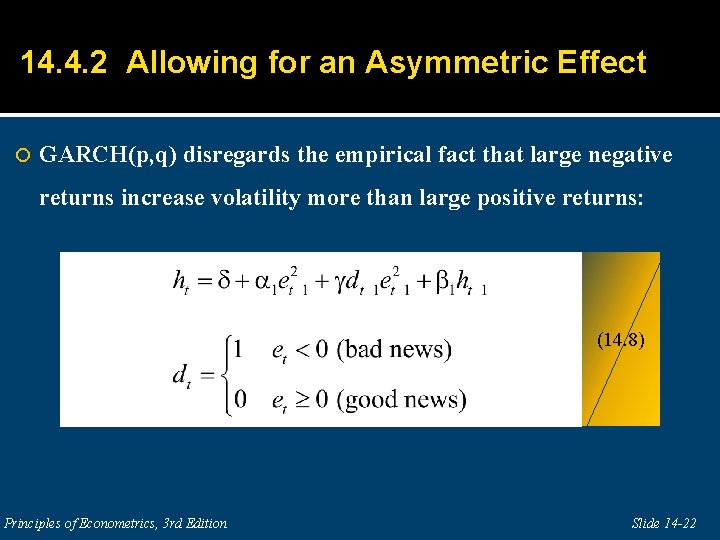

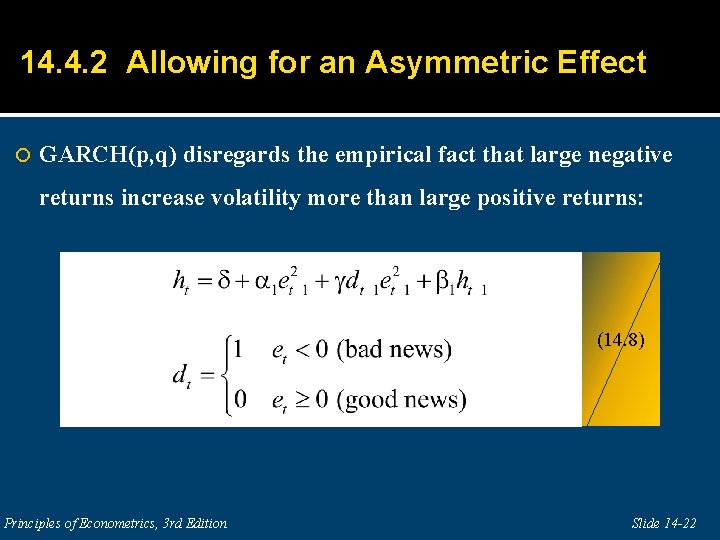

14. 4. 2 Allowing for an Asymmetric Effect GARCH(p, q) disregards the empirical fact that large negative returns increase volatility more than large positive returns: (14. 8) Principles of Econometrics, 3 rd Edition Slide 14 -22

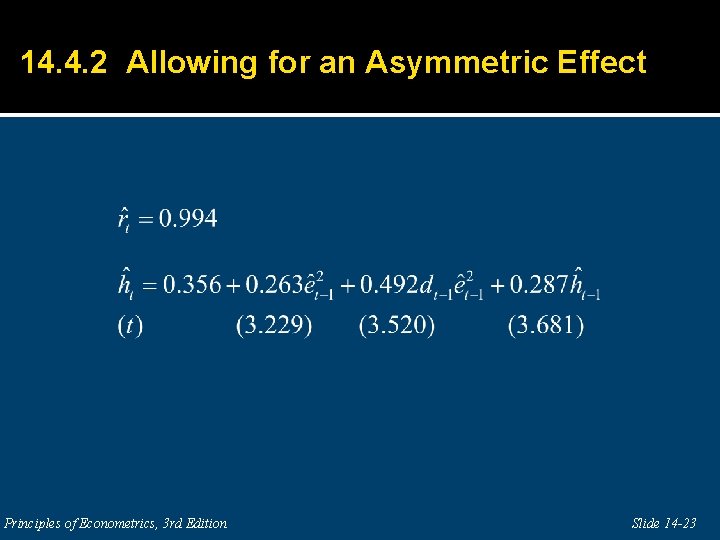

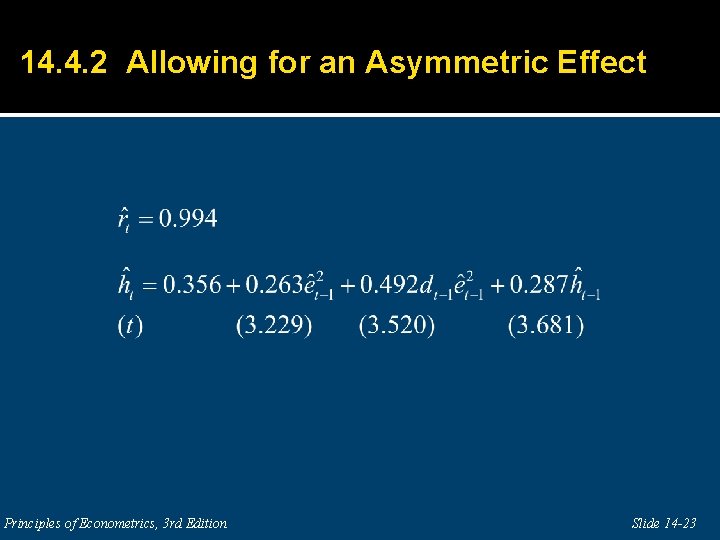

14. 4. 2 Allowing for an Asymmetric Effect Principles of Econometrics, 3 rd Edition Slide 14 -23

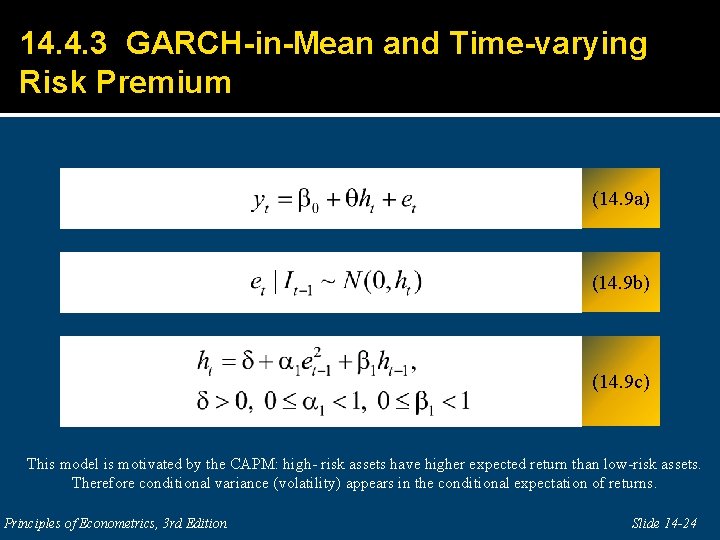

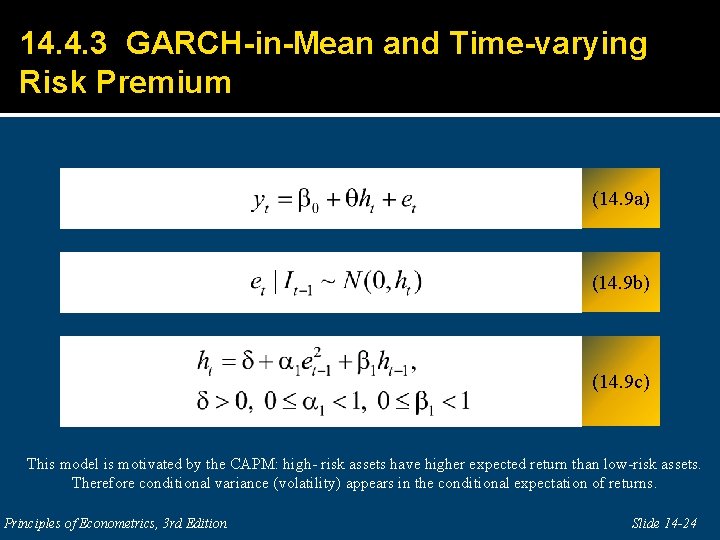

14. 4. 3 GARCH-in-Mean and Time-varying Risk Premium (14. 9 a) (14. 9 b) (14. 9 c) This model is motivated by the CAPM: high- risk assets have higher expected return than low-risk assets. Therefore conditional variance (volatility) appears in the conditional expectation of returns. Principles of Econometrics, 3 rd Edition Slide 14 -24

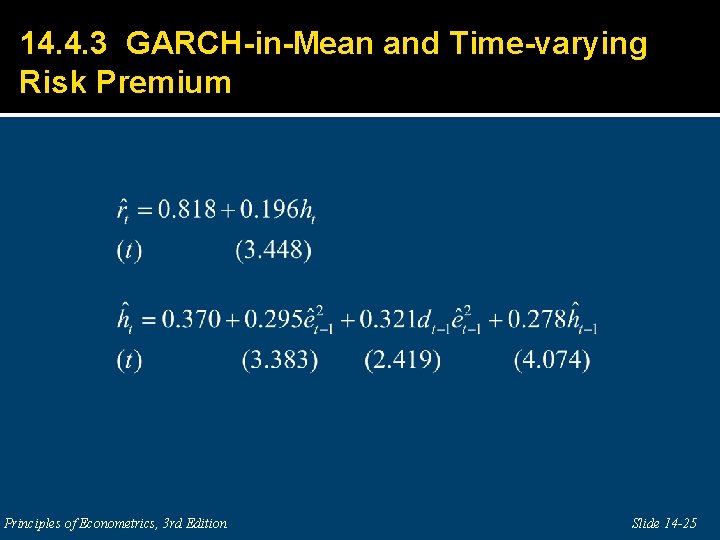

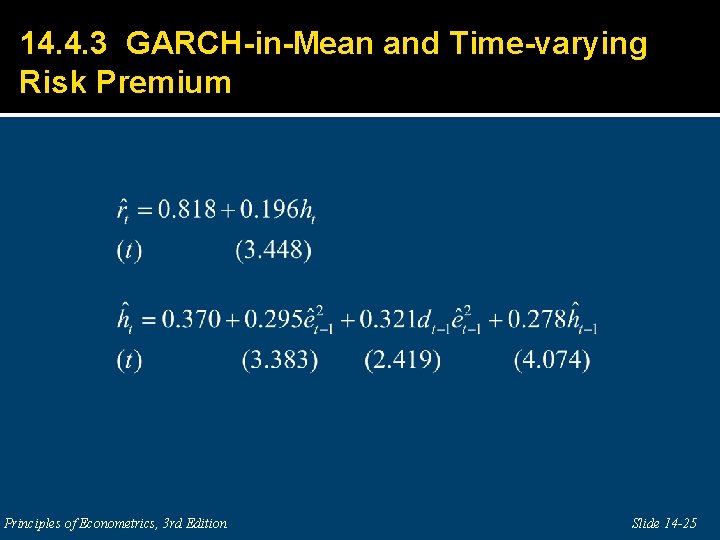

14. 4. 3 GARCH-in-Mean and Time-varying Risk Premium Principles of Econometrics, 3 rd Edition Slide 14 -25

Keywords � � � � ARCH Conditional and Unconditional Forecasts Conditionally normal GARCH-in-mean and GARCH-inmean T-ARCH and T-GARCH Time-varying variance Principles of Econometrics, 3 rd Edition Slide 14 -26

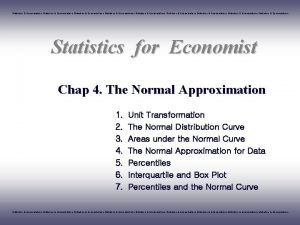

Importance of statistics in finance

Importance of statistics in finance Introduction to econometrics for finance

Introduction to econometrics for finance Types of distillation

Types of distillation Windows credential editor

Windows credential editor Depriester equation

Depriester equation Volatility skew

Volatility skew What is a volatility smile

What is a volatility smile Swaption volatility surface

Swaption volatility surface Volatility adjustment

Volatility adjustment Volatility of ionic compounds

Volatility of ionic compounds 0000ar index

0000ar index Relative volatility formula

Relative volatility formula Dlllist

Dlllist Kdbgscan

Kdbgscan Nature and scope of econometrics

Nature and scope of econometrics Srf and prf in econometrics

Srf and prf in econometrics Econometrics and quantitative economics

Econometrics and quantitative economics Applied econometrics by dimitrios asteriou pdf

Applied econometrics by dimitrios asteriou pdf Examples of non financial methods of motivation

Examples of non financial methods of motivation Probit model

Probit model Nature of econometrics

Nature of econometrics Confidence interval econometrics

Confidence interval econometrics Endogeneity econometrics

Endogeneity econometrics Dataset for multiple regression

Dataset for multiple regression Gujarati econometrics

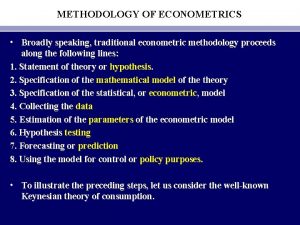

Gujarati econometrics Classical methodology of econometrics

Classical methodology of econometrics Afin in gujarati

Afin in gujarati