An Electric Utility Perspective Eric Ackerman Director Alternative

- Slides: 14

An Electric Utility Perspective Eric Ackerman Director, Alternative Regulation 1 MD/DC Utilities Association 89 th Annual Fall Conference September 12, 2013

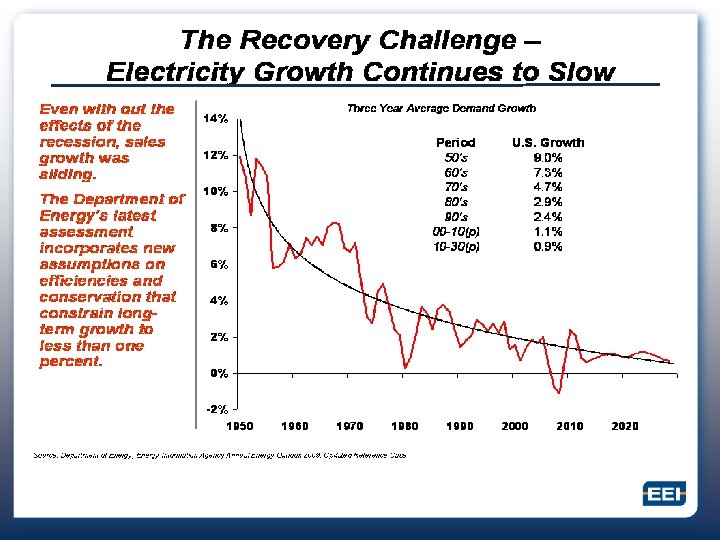

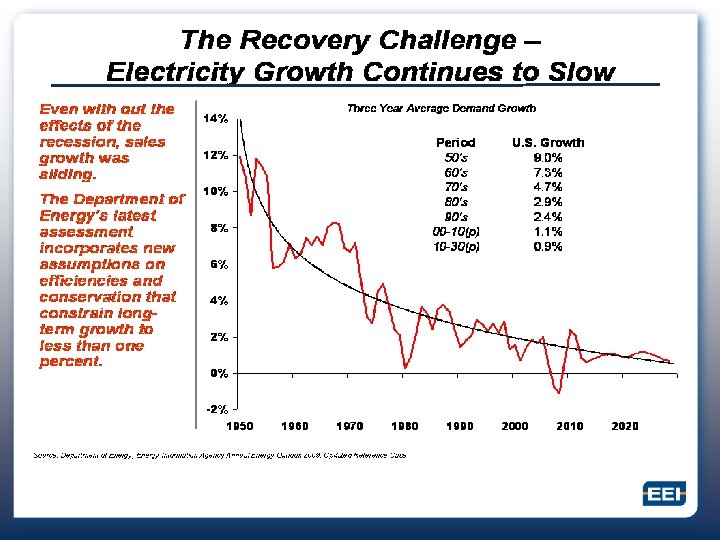

Overview › Infrastructure investment needs are great Ø Financing needs are large Ø Benefits justify investments › Financing new investment under today’s market conditions requires alternative regulatory approaches Ø Because of declining sales growth, utilities cannot finance improvements in the old way Ø To maintain credit worthiness, new regulatory approaches needed

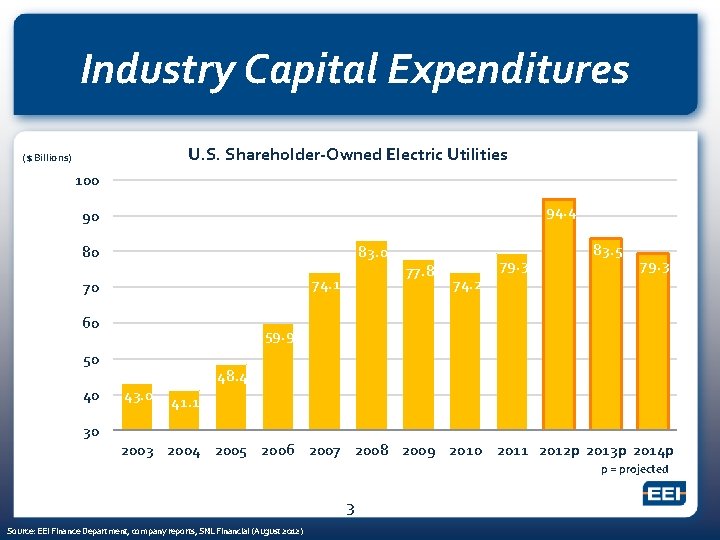

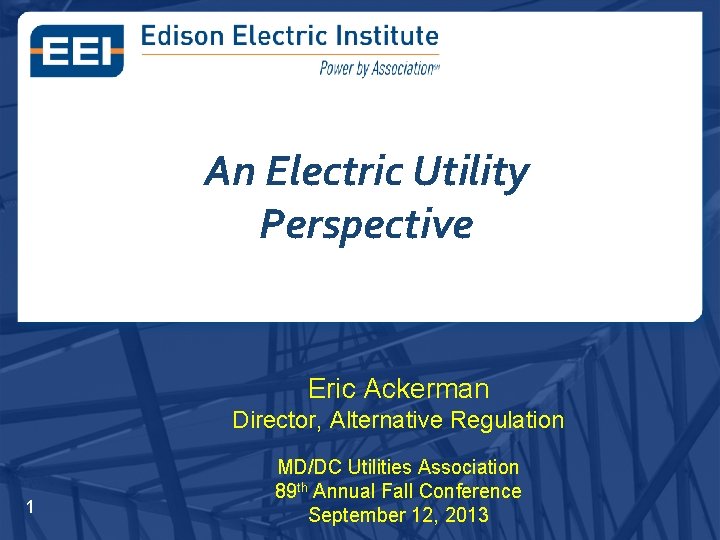

Industry Capital Expenditures U. S. Shareholder-Owned Electric Utilities ($ Billions) 100 94. 4 90 80 83. 0 74. 1 70 60 74. 2 79. 3 59. 9 50 40 77. 8 83. 5 43. 0 48. 4 41. 1 30 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 p 2013 p 2014 p p = projected 3 Source: EEI Finance Department, company reports, SNL Financial (August 2012)

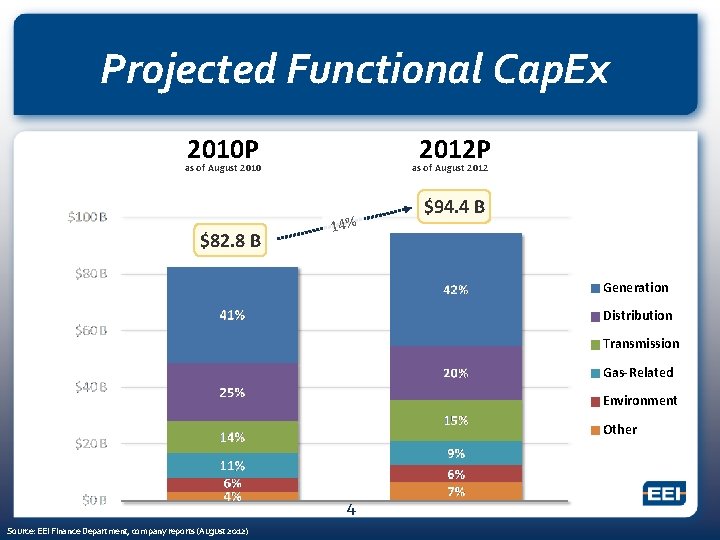

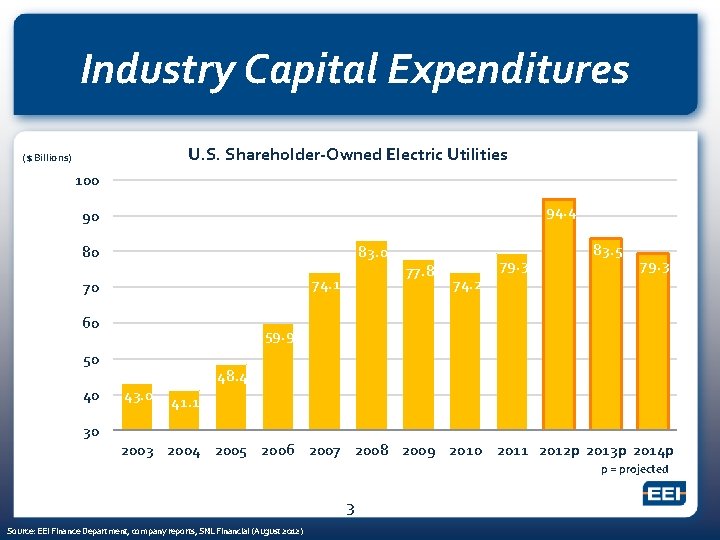

Projected Functional Cap. Ex 2010 P 2012 P as of August 2010 $82. 8 B as of August 2012 14% $94. 4 B Generation Distribution Transmission Gas-Related Environment Other 4 Source: EEI Finance Department, company reports (August 2012)

Benefits Are Substantial › Economic stimulus - jobs › Increased reliability & power quality Ø Reinforce the grid Ø Replace aging infrastructure Ø Harden the system Ø Connect new customers Ø Deploy new “smart” components › Meet renewable resource mandates Ø Ability to integrate renewables › Increased energy efficiency

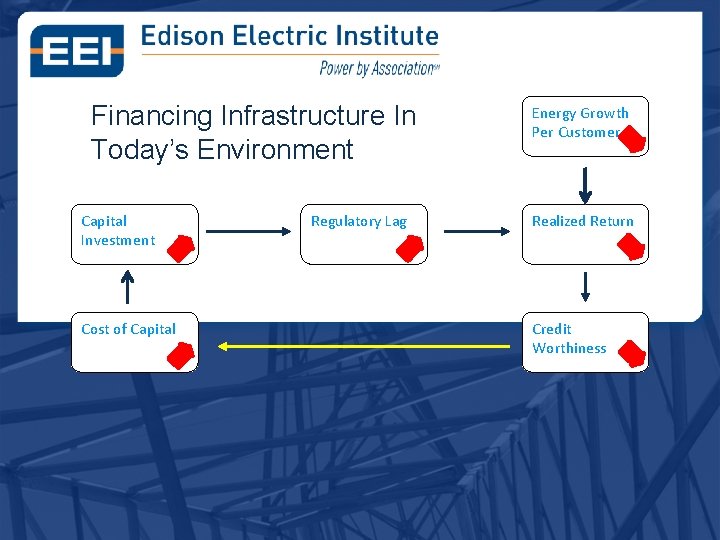

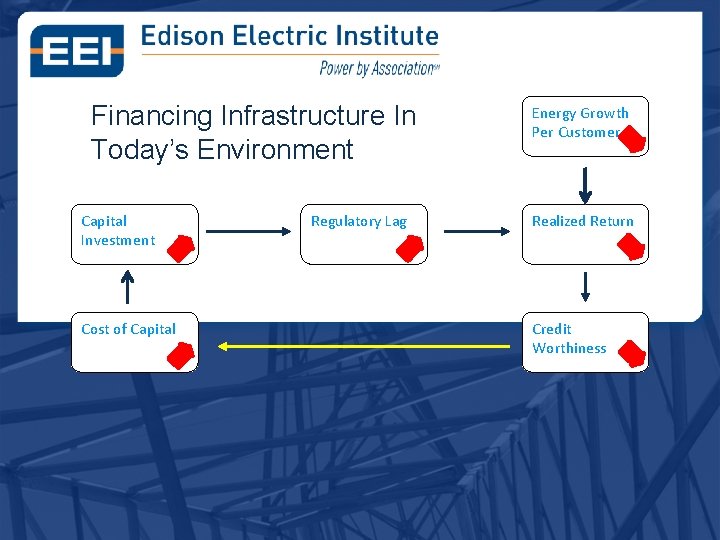

Financing Infrastructure Overview of the In Today’s. Problem Environment Capital Investment Cost of Capital Regulatory Lag Energy Growth Per Customer Realized Return Credit Worthiness

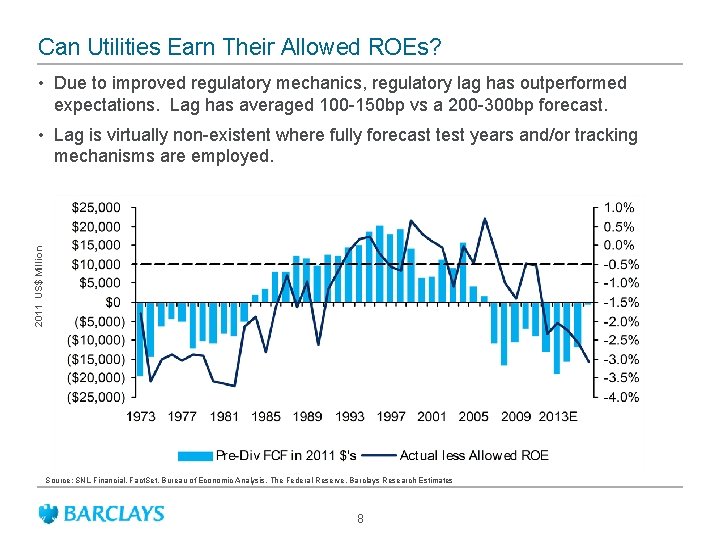

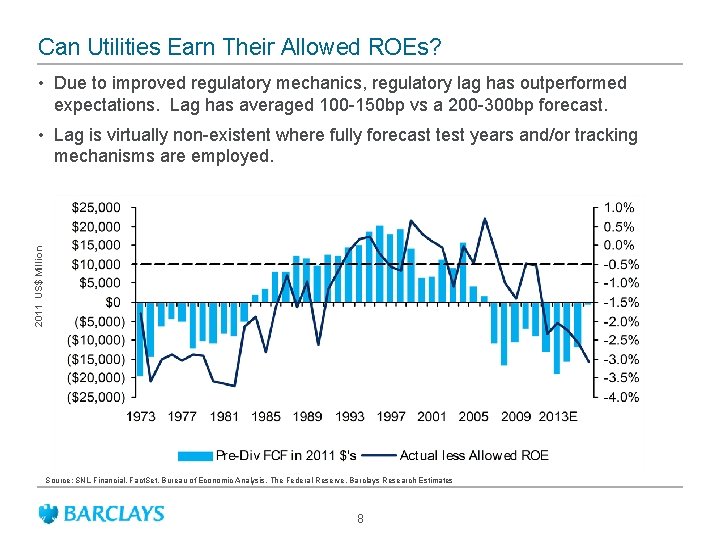

Can Utilities Earn Their Allowed ROEs? • Due to improved regulatory mechanics, regulatory lag has outperformed expectations. Lag has averaged 100 -150 bp vs a 200 -300 bp forecast. 2011 US$ Million • Lag is virtually non-existent where fully forecast test years and/or tracking mechanisms are employed. Source: SNL Financial, Fact. Set, Bureau of Economic Analysis, The Federal Reserve, Barclays Research Estimates 8

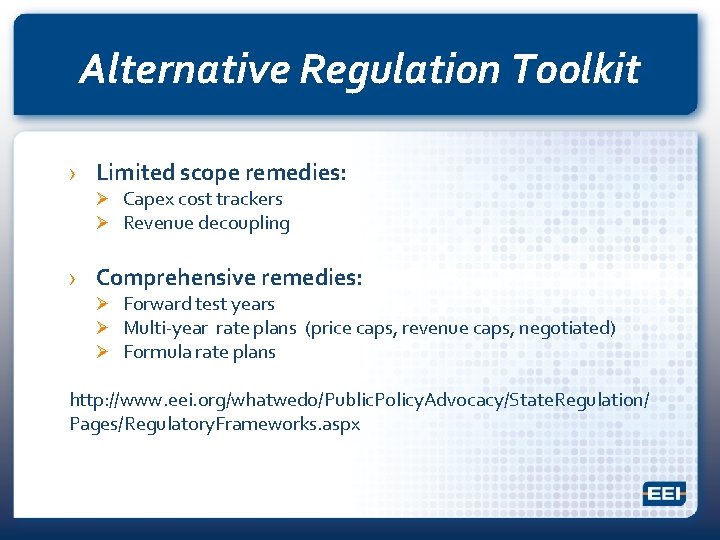

Alternative Regulation Toolkit › Limited scope remedies: Ø Capex cost trackers Ø Revenue decoupling › Comprehensive remedies: Ø Forward test years Ø Multi-year rate plans (price caps, revenue caps, negotiated) Ø Formula rate plans http: //www. eei. org/whatwedo/Public. Policy. Advocacy/State. Regulation/ Pages/Regulatory. Frameworks. aspx

Conclusions 1. Infrastructure investment is a great way to fuel the economic engine in Maryland the District of Columbia. 2. It’s important to manage investment in a way that preserves utility credit worthiness. 3. Alternative regulatory approaches are the key to preserving utility credit, access to capital on the most reasonable terms possible.

Appendix

Allowed vs Realized Returns › Allowed returns - what regulators focus on Ø Return levels (debt, equity) the PUC approves in a rate case Ø Objective is to determine the return on equity required by the market Ø A cost of business, goes in to revenue requirements › Realized returns – what investors focus on Ø ROE the utility actually earns Ø Affected by actual k. Wh sales and costs, regulatory lag Ø Usually diverges from allowed level

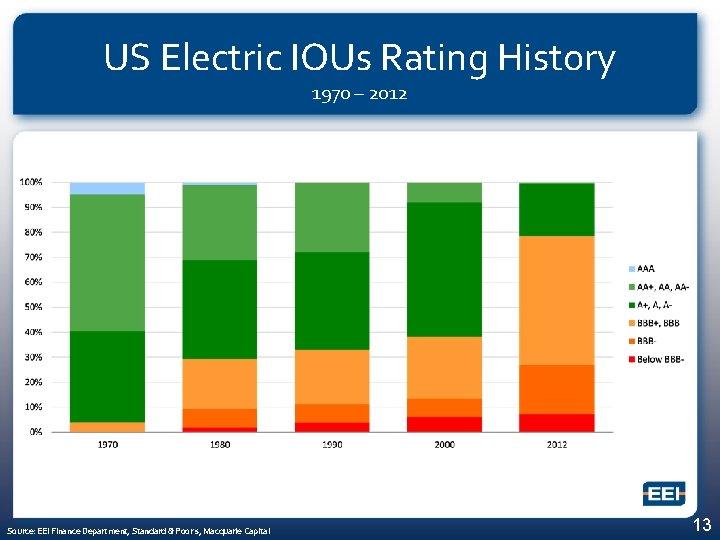

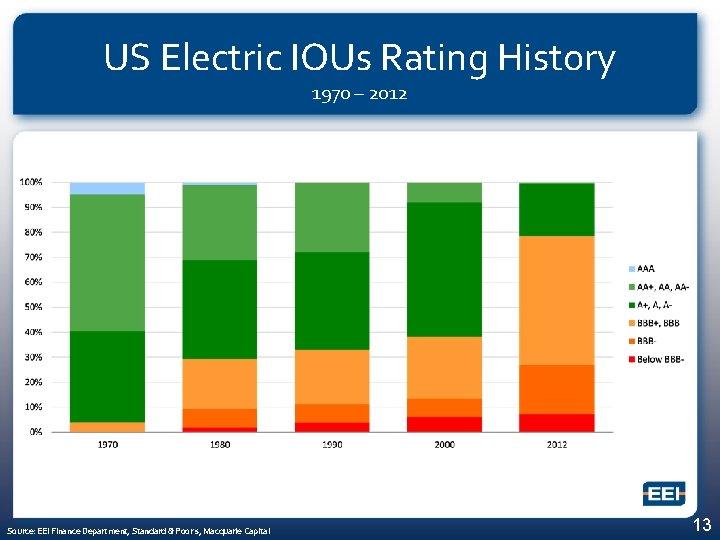

US Electric IOUs Rating History 1970 – 2012 Source: EEI Finance Department, Standard & Poor’s, Macquarie Capital 13

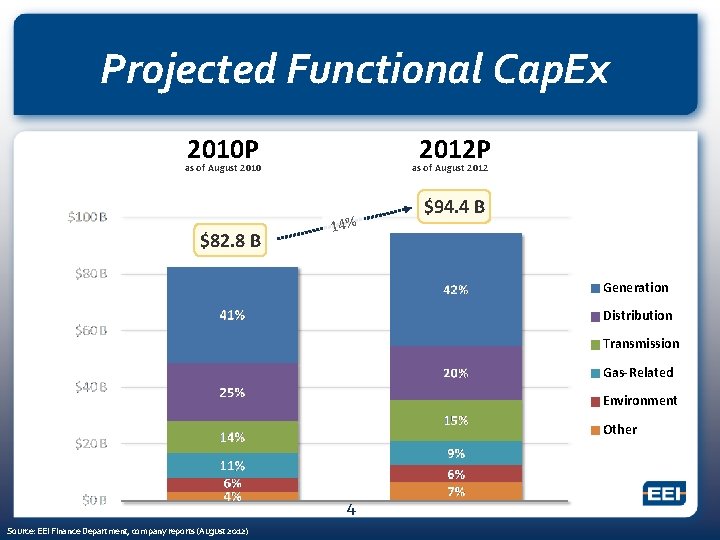

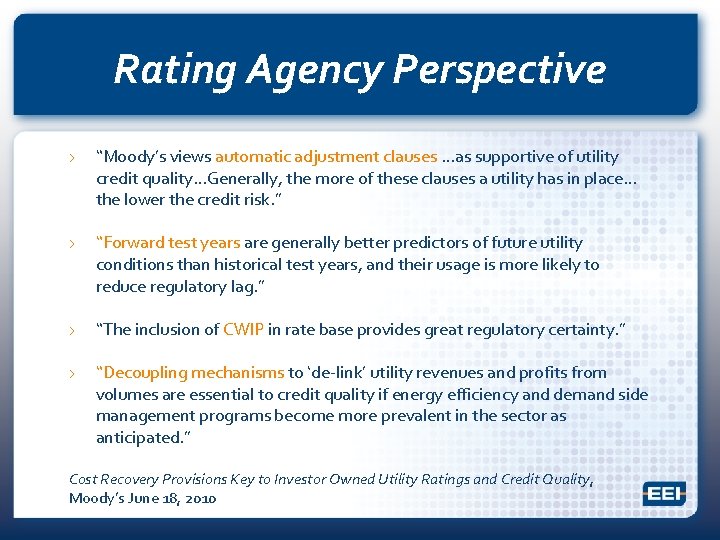

Rating Agency Perspective › “Moody’s views automatic adjustment clauses …as supportive of utility credit quality…Generally, the more of these clauses a utility has in place… the lower the credit risk. ” › “Forward test years are generally better predictors of future utility conditions than historical test years, and their usage is more likely to reduce regulatory lag. ” › “The inclusion of CWIP in rate base provides great regulatory certainty. ” › “Decoupling mechanisms to ‘de-link’ utility revenues and profits from volumes are essential to credit quality if energy efficiency and demand side management programs become more prevalent in the sector as anticipated. ” Cost Recovery Provisions Key to Investor Owned Utility Ratings and Credit Quality, Moody’s June 18, 2010