AFTERMIDTERM REVIEW FIN 3701 WACC CH 14 THREE

- Slides: 24

AFTER-MIDTERM REVIEW FIN 3701

WACC CH 14

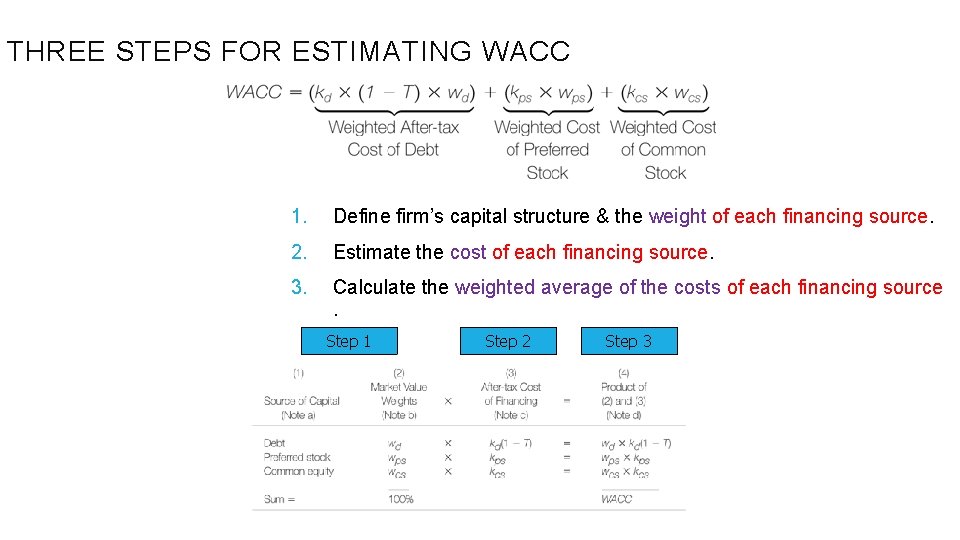

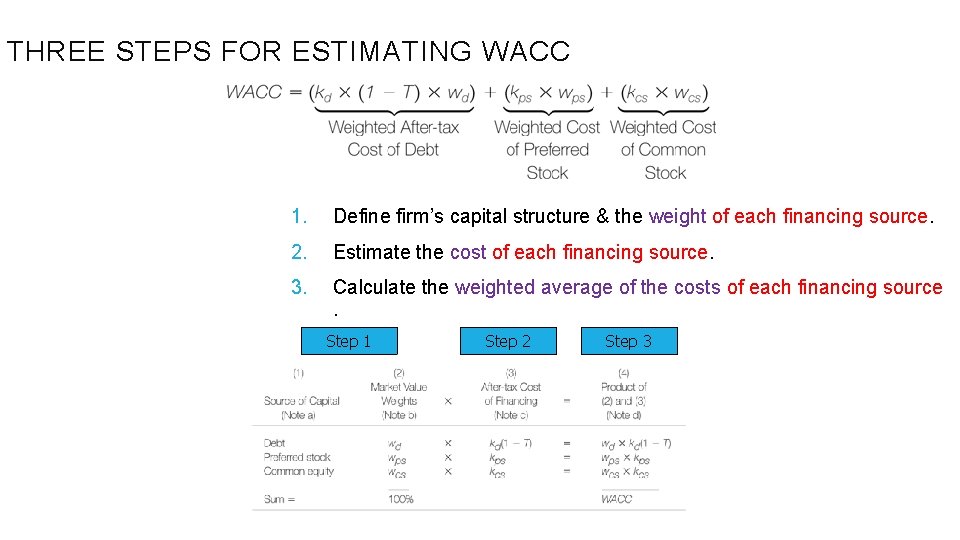

THREE STEPS FOR ESTIMATING WACC 1. Define firm’s capital structure & the weight of each financing source. 2. Estimate the cost of each financing source. 3. Calculate the weighted average of the costs of each financing source . Step 1 Step 2 Step 3

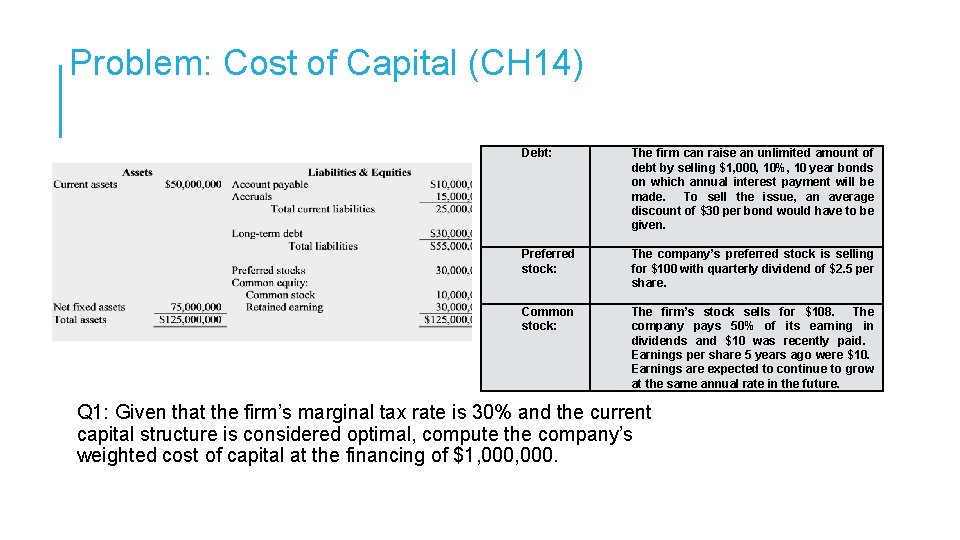

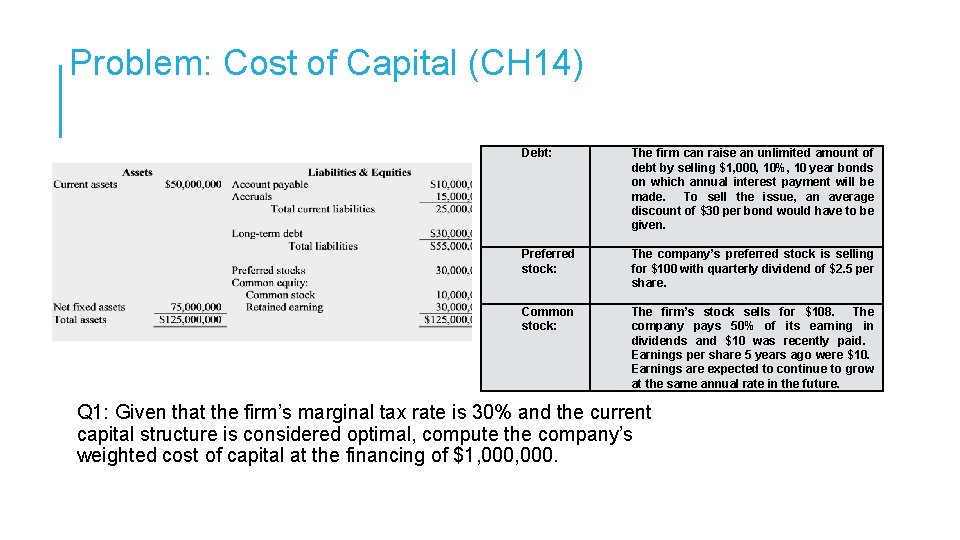

Problem: Cost of Capital (CH 14) Debt: Preferred stock: Common stock: The firm can raise an unlimited amount of debt by selling $1, 000, 10%, 10 year bonds on which annual interest payment will be made. To sell the issue, an average discount of $30 per bond would have to be given. The company’s preferred stock is selling for $100 with quarterly dividend of $2. 5 per share. The firm’s stock sells for $108. The company pays 50% of its earning in dividends and $10 was recently paid. Earnings per share 5 years ago were $10. Earnings are expected to continue to grow at the same annual rate in the future. Q 1: Given that the firm’s marginal tax rate is 30% and the current capital structure is considered optimal, compute the company’s weighted cost of capital at the financing of $1, 000.

CF ESTIMATION & DECISION’S CRITERIA

CH 12: ESTIMATING PROJECT’S CASH FLOWS 1. Project’s Capital Expenditure Requirements 2. Project’s Working Capital Requirements 3. Project’s Operating Cash Flows 4. Project’s Free Cash Flow Cash the firm has left over from its operations and it can use to retire debt and give to its stockholders through dividends or repurchasing outstanding shares.

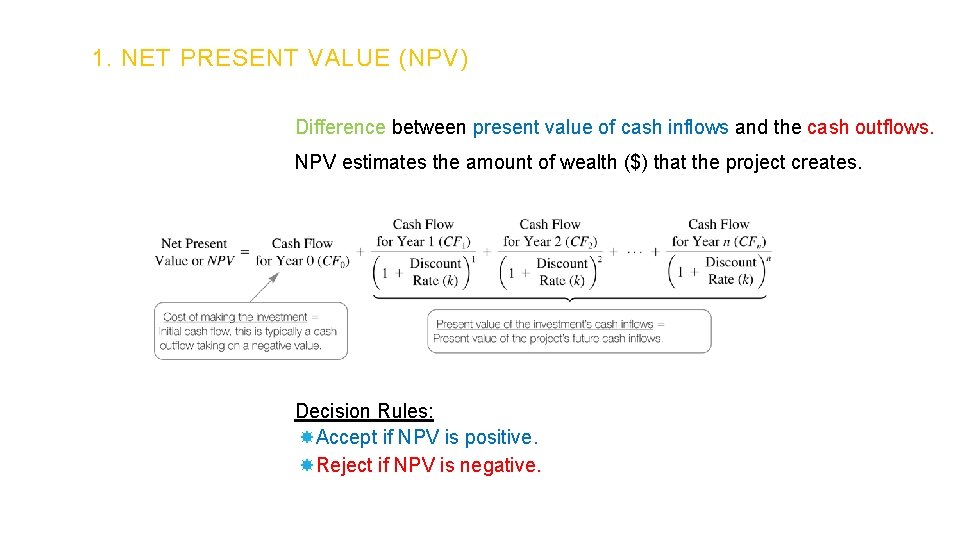

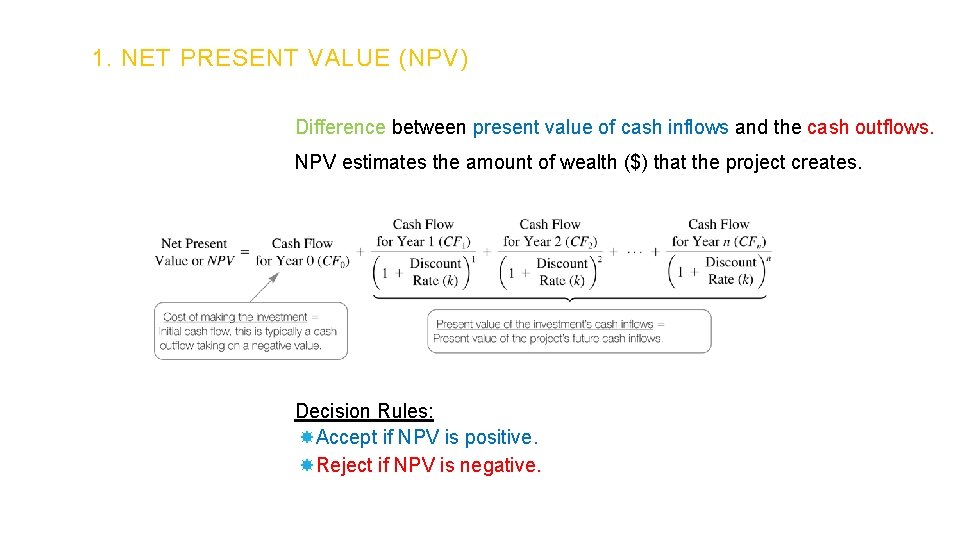

1. NET PRESENT VALUE (NPV) Difference between present value of cash inflows and the cash outflows. NPV estimates the amount of wealth ($) that the project creates. Decision Rules: Accept if NPV is positive. Reject if NPV is negative.

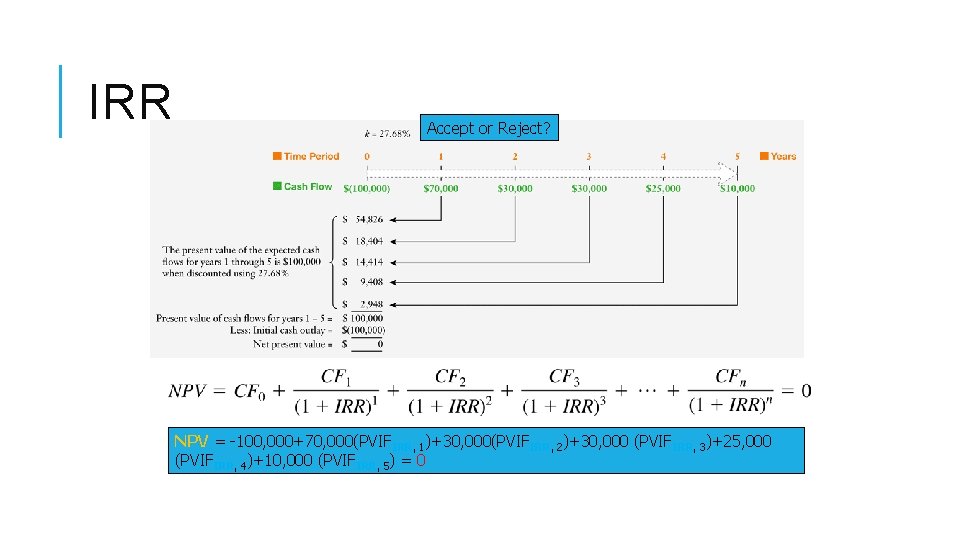

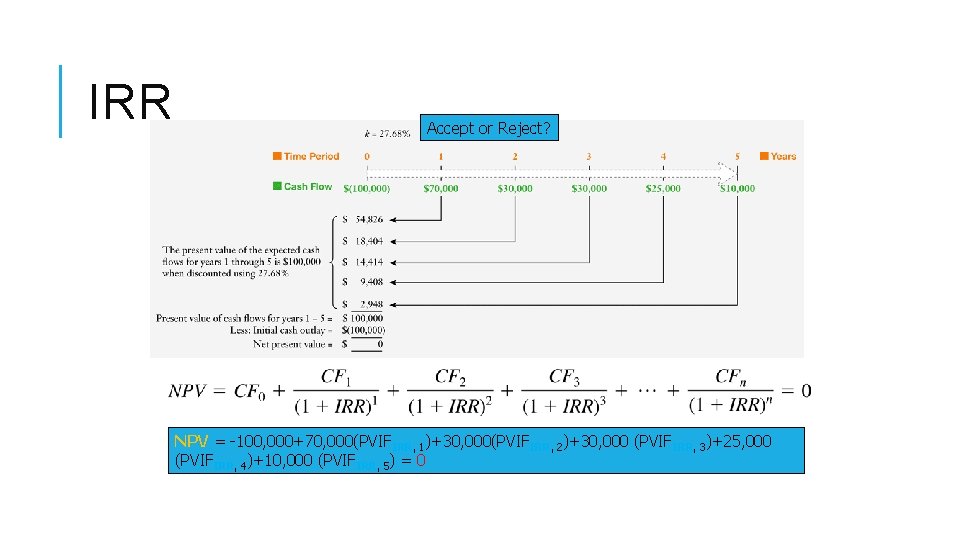

IRR Accept or Reject? NPV = -100, 000+70, 000(PVIFIRR, 1)+30, 000(PVIFIRR, 2)+30, 000 (PVIFIRR, 3)+25, 000 (PVIFIRR, 4)+10, 000 (PVIFIRR, 5) = 0

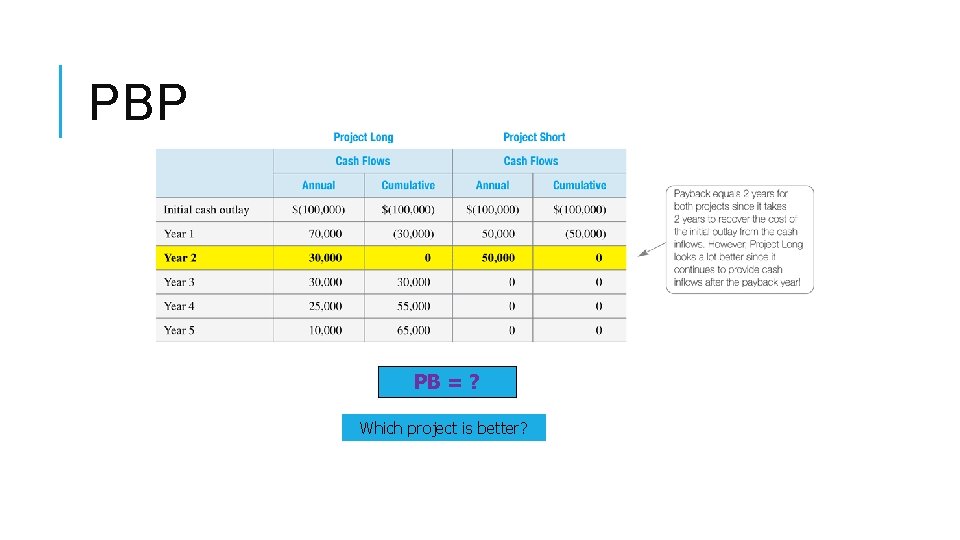

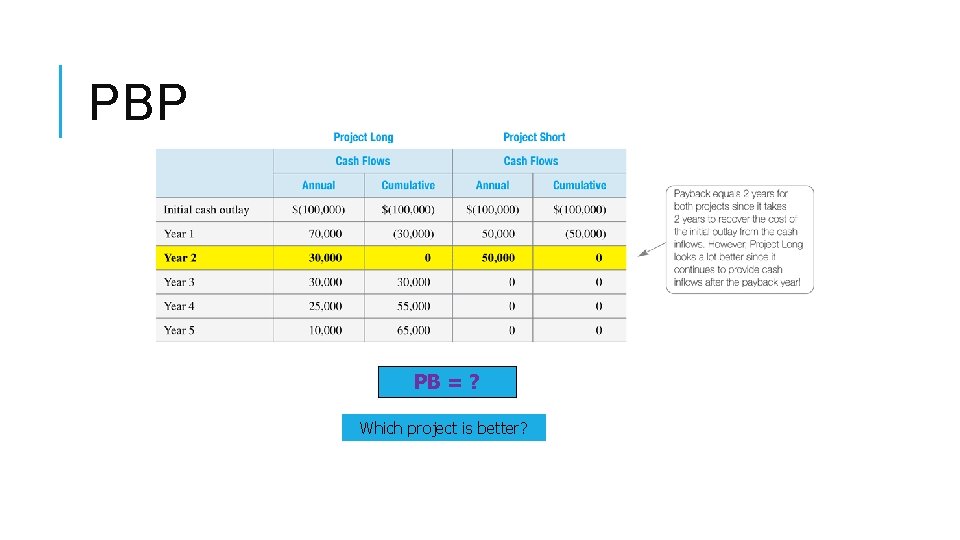

PBP PB = ? Which project is better?

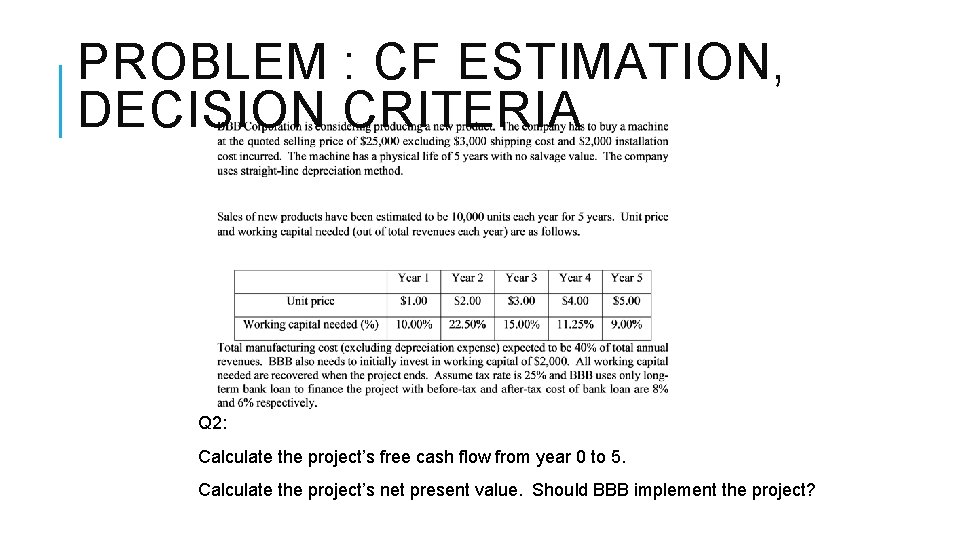

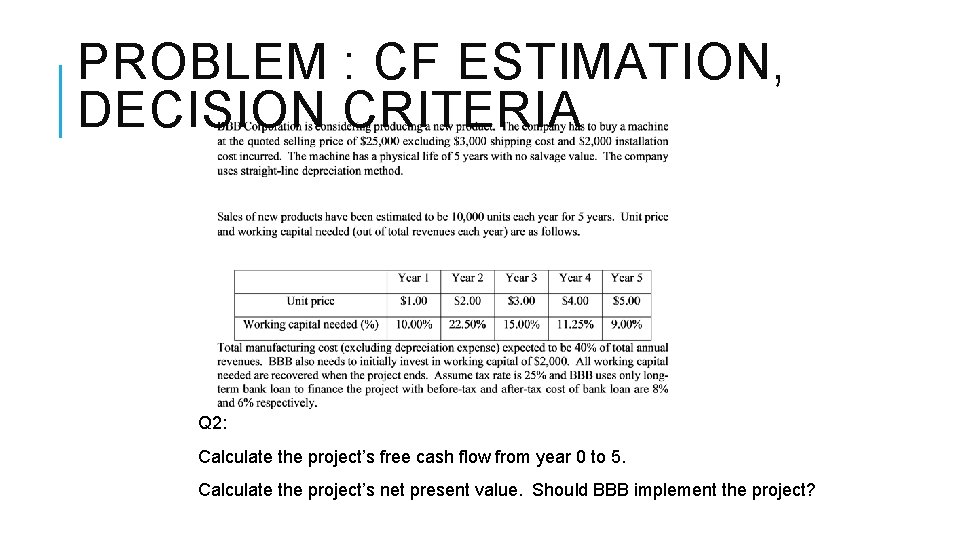

PROBLEM : CF ESTIMATION, DECISION CRITERIA Q 2: Calculate the project’s free cash flow from year 0 to 5. Calculate the project’s net present value. Should BBB implement the project?

BREAKEVEN & LEVERAGE

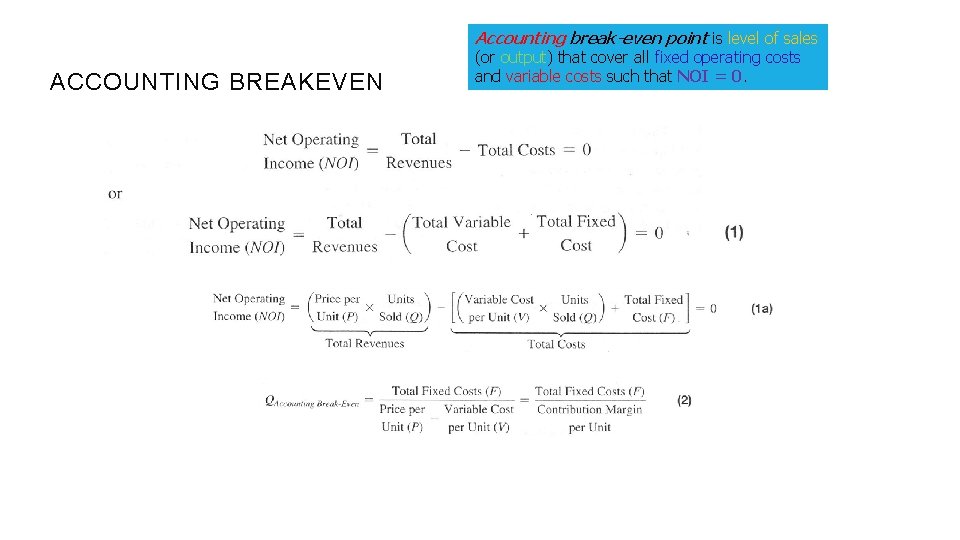

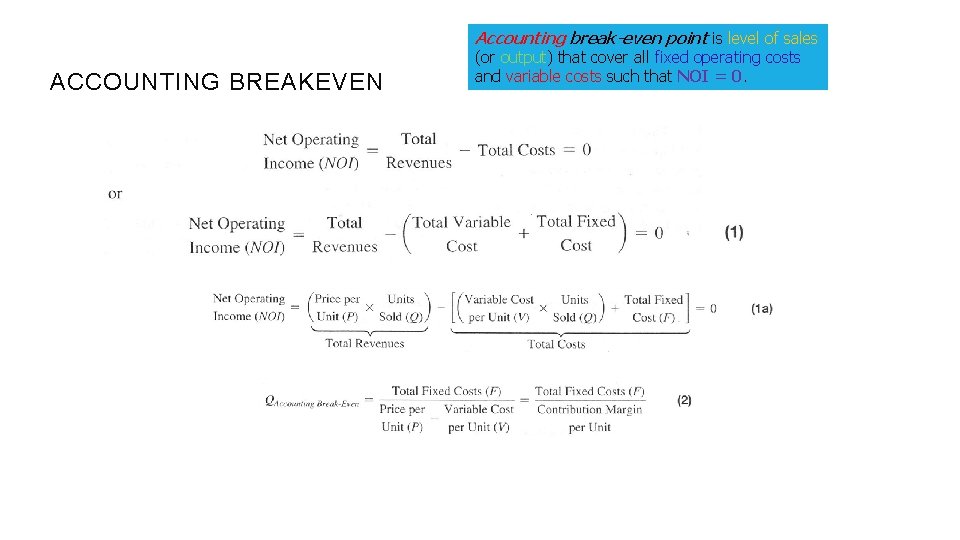

Accounting break-even point is level of sales ACCOUNTING BREAKEVEN (or output) that cover all fixed operating costs and variable costs such that NOI = 0.

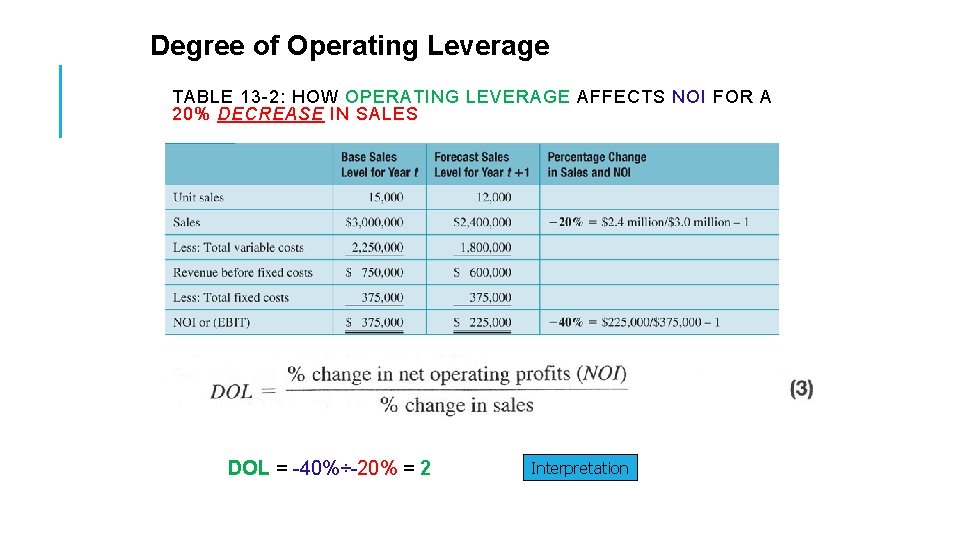

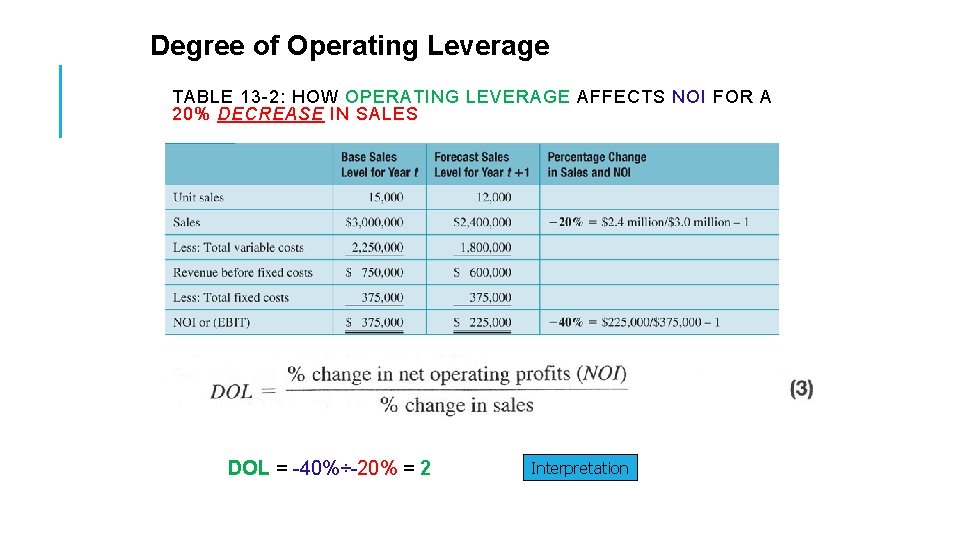

Degree of Operating Leverage TABLE 13 -2: HOW OPERATING LEVERAGE AFFECTS NOI FOR A 20% DECREASE IN SALES DOL = -40%÷-20% = 2 Interpretation

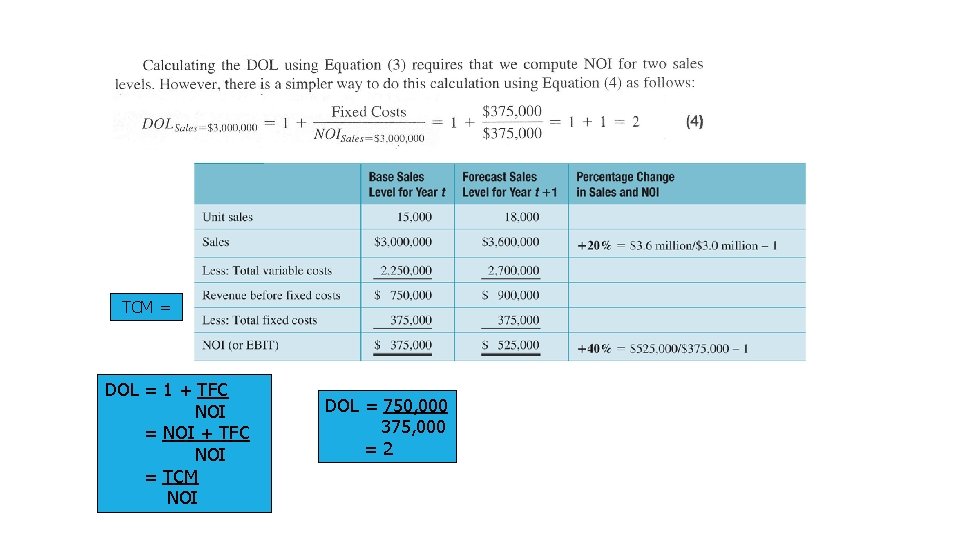

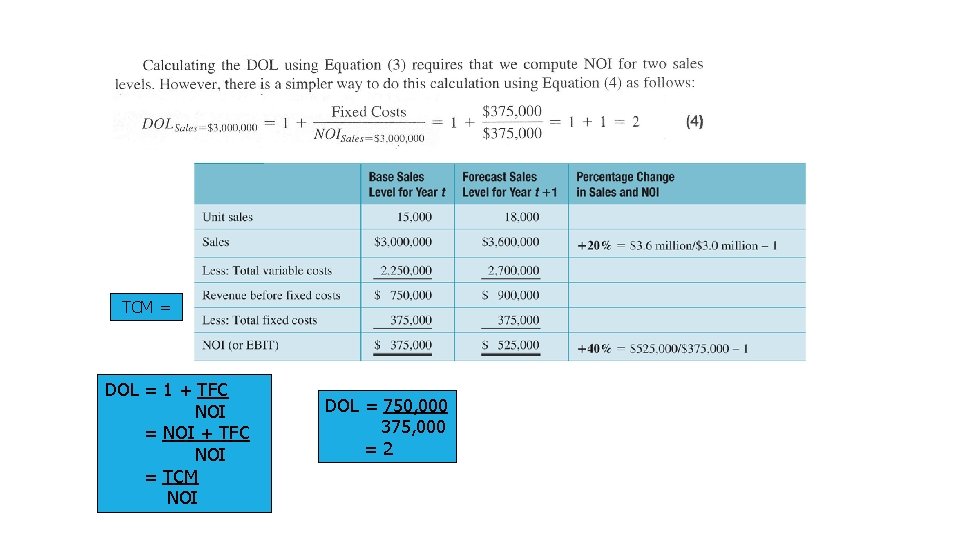

TCM = DOL = 1 + TFC NOI = NOI + TFC NOI = TCM NOI DOL = 750, 000 375, 000 =2

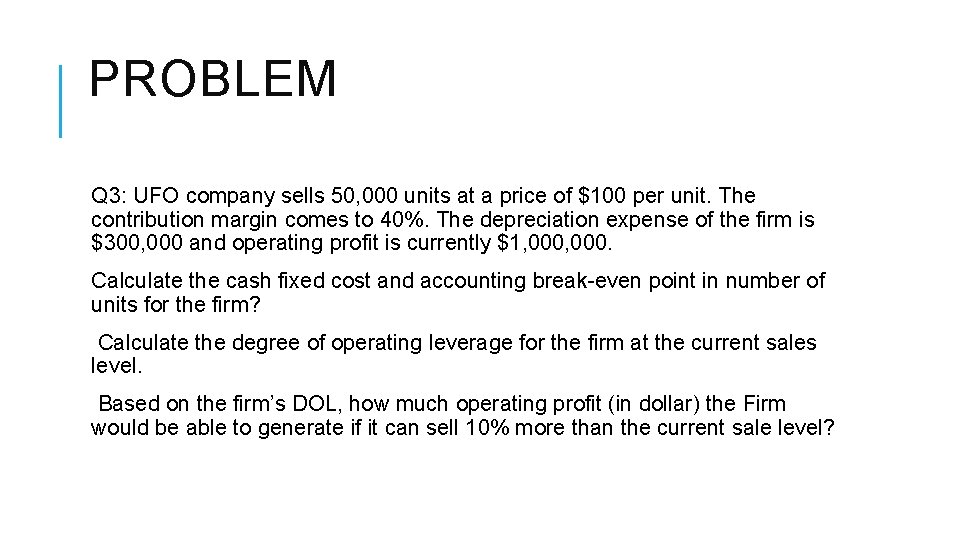

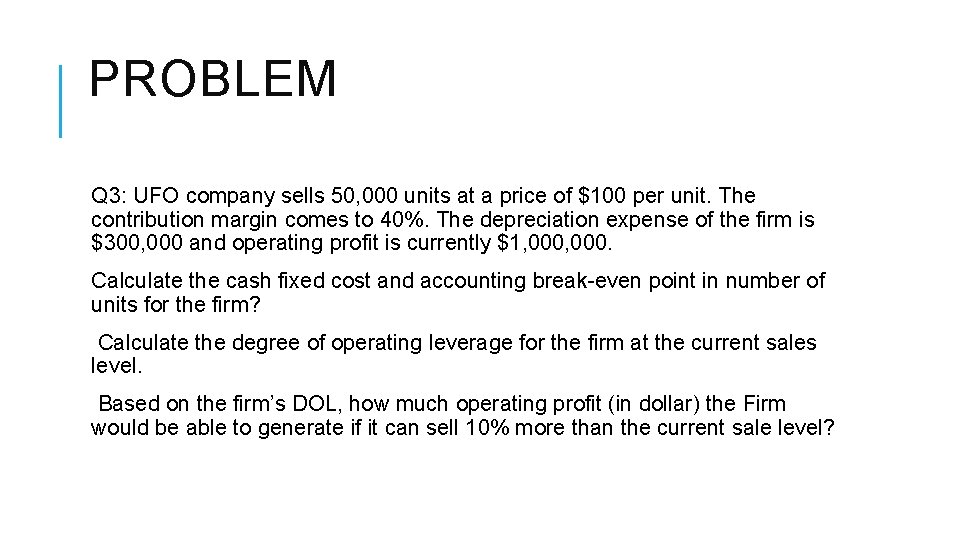

PROBLEM Q 3: UFO company sells 50, 000 units at a price of $100 per unit. The contribution margin comes to 40%. The depreciation expense of the firm is $300, 000 and operating profit is currently $1, 000. Calculate the cash fixed cost and accounting break-even point in number of units for the firm? Calculate the degree of operating leverage for the firm at the current sales level. Based on the firm’s DOL, how much operating profit (in dollar) the Firm would be able to generate if it can sell 10% more than the current sale level?

CH 18: WORKING CAPITAL MGT

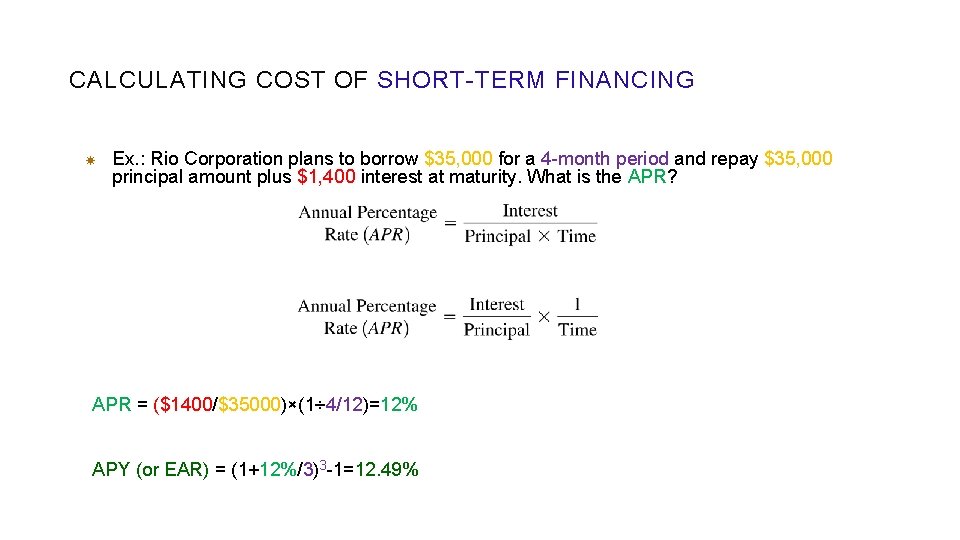

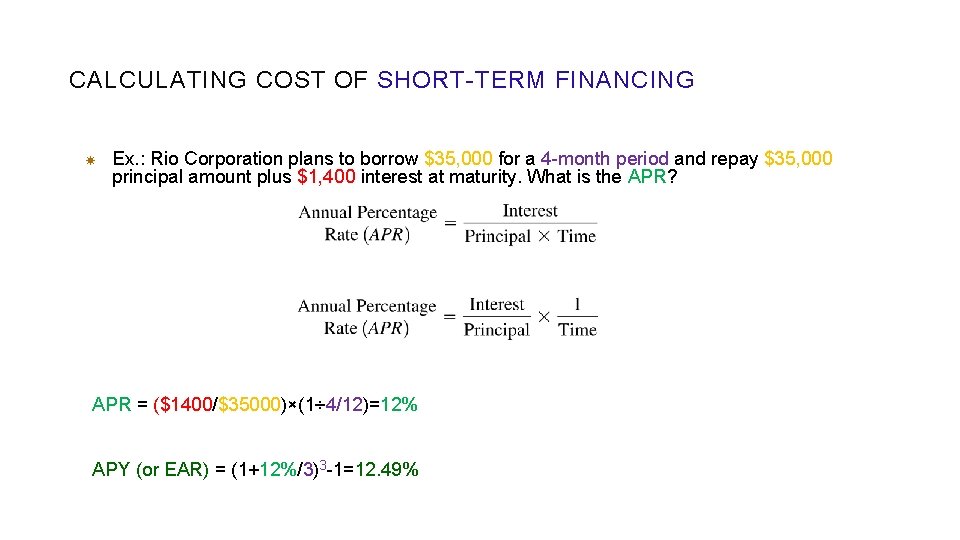

CALCULATING COST OF SHORT-TERM FINANCING Ex. : Rio Corporation plans to borrow $35, 000 for a 4 -month period and repay $35, 000 principal amount plus $1, 400 interest at maturity. What is the APR? APR = ($1400/$35000)×(1÷ 4/12)=12% APY (or EAR) = (1+12%/3)3 -1=12. 49%

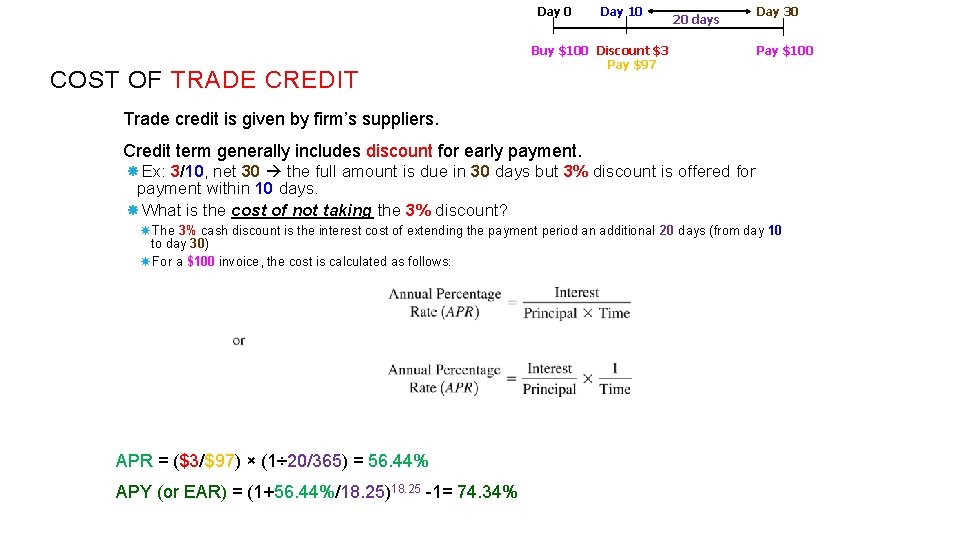

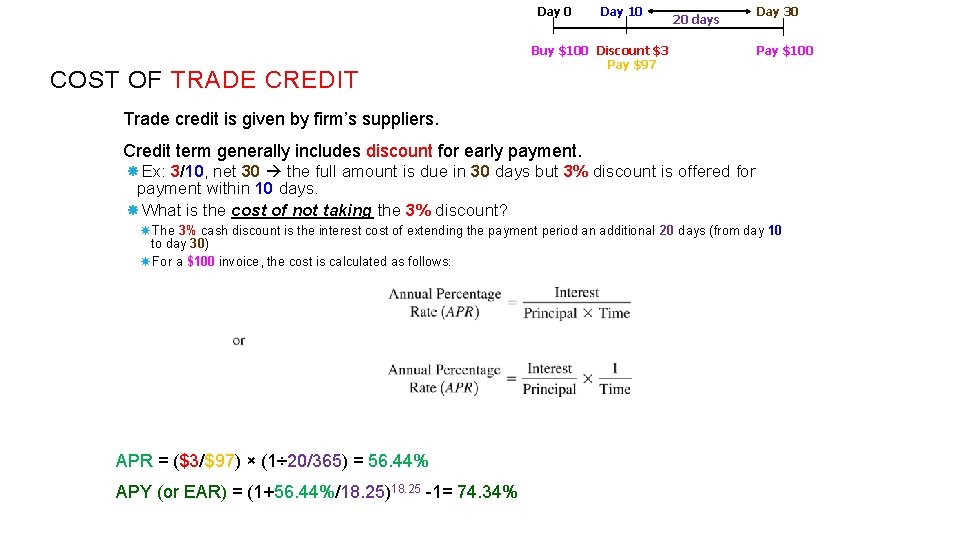

Day 0 COST OF TRADE CREDIT Day 10 Buy $100 Discount $3 Pay $97 20 days Day 30 Pay $100 Trade credit is given by firm’s suppliers. Credit term generally includes discount for early payment. Ex: 3/10, net 30 the full amount is due in 30 days but 3% discount is offered for payment within 10 days. What is the cost of not taking the 3% discount? The 3% cash discount is the interest cost of extending the payment period an additional 20 days (from day 10 to day 30) For a $100 invoice, the cost is calculated as follows: APR = ($3/$97) × (1÷ 20/365) = 56. 44% APY (or EAR) = (1+56. 44%/18. 25)18. 25 -1= 74. 34%

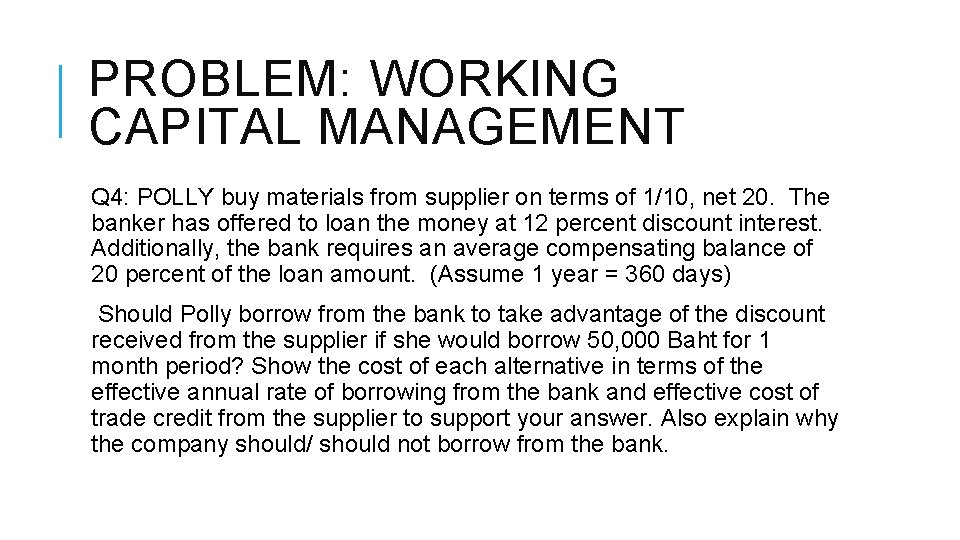

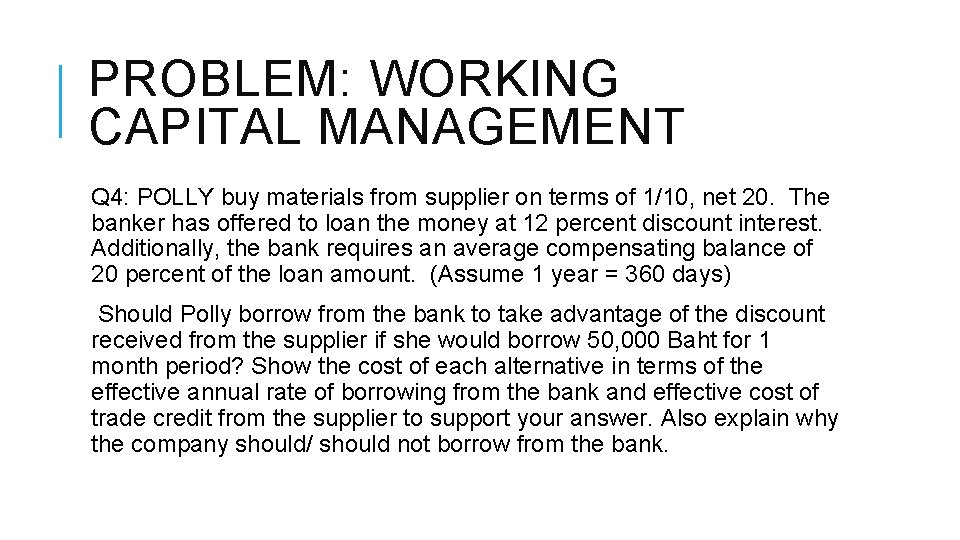

PROBLEM: WORKING CAPITAL MANAGEMENT Q 4: POLLY buy materials from supplier on terms of 1/10, net 20. The banker has offered to loan the money at 12 percent discount interest. Additionally, the bank requires an average compensating balance of 20 percent of the loan amount. (Assume 1 year = 360 days) Should Polly borrow from the bank to take advantage of the discount received from the supplier if she would borrow 50, 000 Baht for 1 month period? Show the cost of each alternative in terms of the effective annual rate of borrowing from the bank and effective cost of trade credit from the supplier to support your answer. Also explain why the company should/ should not borrow from the bank.

DISTRIBUTION POLICY

INDIVIDUAL WEALTH EFFECTS: PERSONAL TAXES Tax rules on cash dividends & share repurchases: 1. 100% of cash dividends are taxable in the year in which they are received. 2. For share buyback, when individuals sell shares back to firm, tax is assessed only on the capital gain (difference between selling price and buying price). Redo Stan’s in class exercises.

NON-CASH DISTRIBUTIONS: STOCK DIVIDENDS AND STOCK SPLITS Stock dividend: A pro-rata distribution of additional stocks to firm’s current stockholders. Ex. Firm pays stock dividend of 1 additional stock per 10 stocks investor has. Stock split: Ex. 2 -for-1 split Investor receive 2 new stocks for every one old stock currently has. Stock splits & stock dividends increase total number of stocks outstanding and reduce stock price per share but do not change firm value.

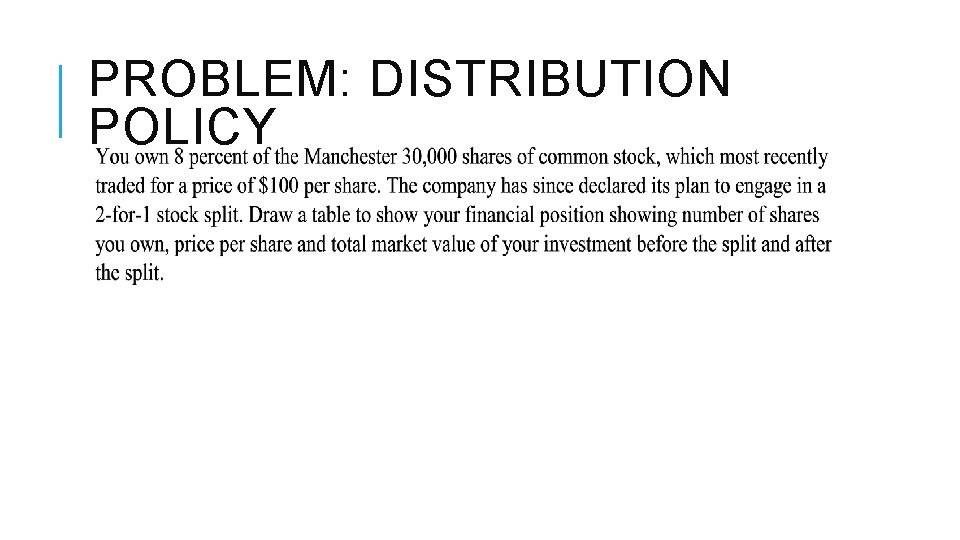

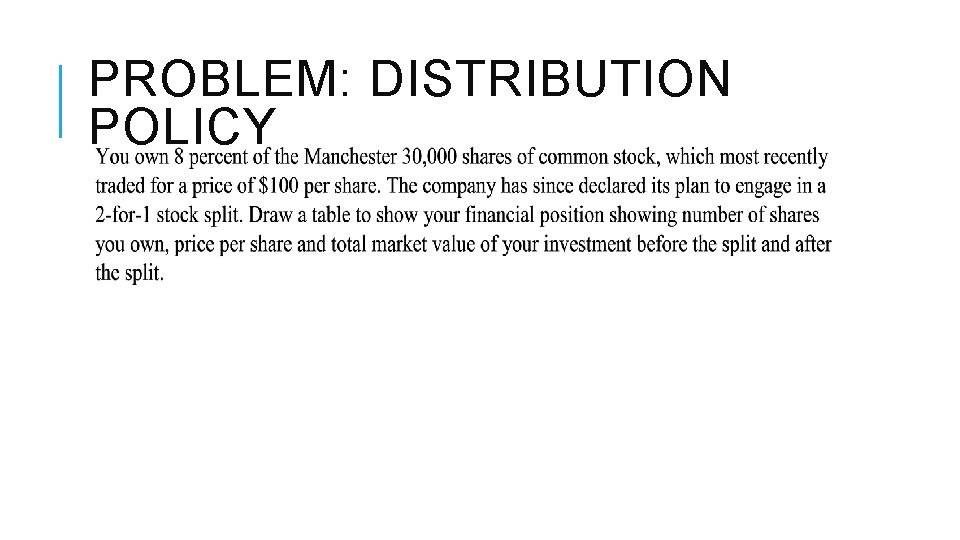

PROBLEM: DISTRIBUTION POLICY

GOOD LUCK!!

Spf fin fod fin

Spf fin fod fin Prisme à base trapézoidale

Prisme à base trapézoidale Wacc formula

Wacc formula Wacc example

Wacc example Como se calcula la wacc

Como se calcula la wacc Equivalent annual annuity

Equivalent annual annuity Sampa video case solution

Sampa video case solution Wacc przykład

Wacc przykład Wacc calculation example

Wacc calculation example Single factor model

Single factor model Whats financial leverage

Whats financial leverage Wacc formula with debt to equity ratio

Wacc formula with debt to equity ratio Rumus wacc

Rumus wacc Biaya modal manajemen keuangan

Biaya modal manajemen keuangan Rumus wacc

Rumus wacc 1192001

1192001 Como calcular el kd del wacc

Como calcular el kd del wacc Como calcular el kd del wacc

Como calcular el kd del wacc Wacc képlet

Wacc képlet Wacc

Wacc Wacc intel

Wacc intel Modigliani miller formula

Modigliani miller formula Wacc capm

Wacc capm Nike cost of equity

Nike cost of equity Ibbotson cost of capital

Ibbotson cost of capital