Administrative Data at Statistics Canada Current Uses and

- Slides: 25

Administrative Data at Statistics Canada – Current Uses and the Way Forward Wesley Yung and Peter Lys, Statistics Canada

Outline § Introduction § Tax Data • Goods and Service Tax (GST) • Annual Tax § Increased use of GST data • Monthly Food Services Survey • Quarterly Services Indicators § Increased use of Annual Tax data § Summary and Future Work Statistics Canada • Statistique Canada Oct. 14, 2008

Introduction § Statistics Canada has a long history of using administrative data • Direct tabulation – Trade statistics • Frame maintenance – Business Register § More recently, in business surveys program • ‘Replacing’ survey data • Take none estimation Statistics Canada • Statistique Canada Oct. 14, 2008

Introduction, cont. § Benefits realized • Reduced collection costs • Increased data quality § Will discuss two recent methodologies that significantly increase use of tax data and some future uses Statistics Canada • Statistique Canada Oct. 14, 2008

Tax Data § Tax data collected by Canadian Revenue Agency (CRA) • Monthly Goods and Services Tax (GST) data • Annual tax (T 1 and T 2) data § Goal of CRA is non-statistical, so very little verification of data performed § Statistics Canada receives data from CRA and ‘processes’ the data Statistics Canada • Statistique Canada Oct. 14, 2008

Tax Data – GST § A tax of 5% levied on all goods and services § Depending on size of business, data remitted monthly, quarterly or annually § Data provided to Statistics Canada 7 to 8 weeks after reference month § Processing at Statistics Canada comprises outlier detection, imputation and calendarization Statistics Canada • Statistique Canada Oct. 14, 2008

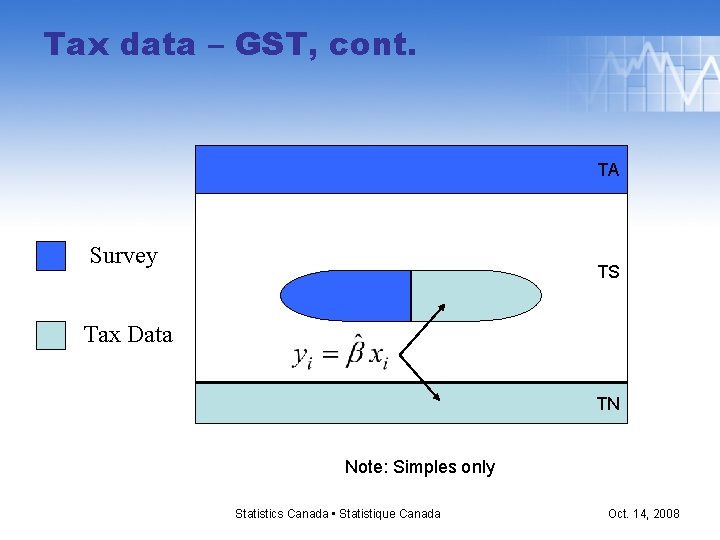

Tax Data – GST § Database containing monthly sales for all businesses produced § GST data used by three mission critical monthly surveys § Survey data ‘replaced’ by GST data for a portion of ‘simple’ units and for take none • Model needed to account for conceptual differences and timeliness issues § Once replaced, modified GST data treated as survey data Statistics Canada • Statistique Canada Oct. 14, 2008

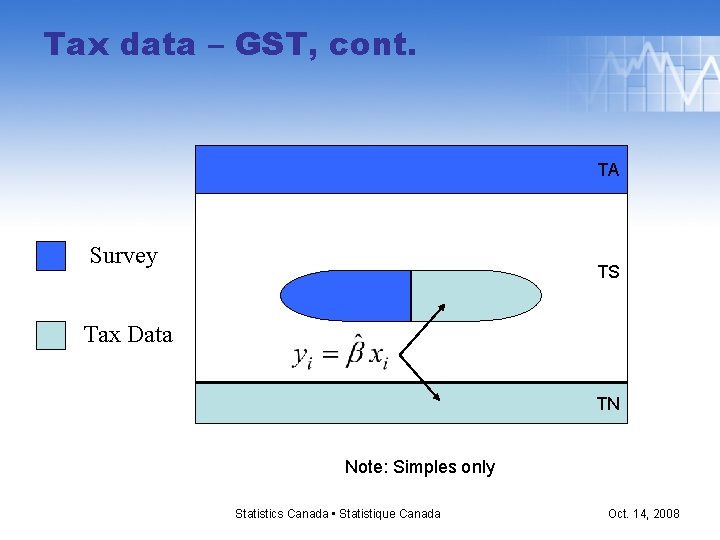

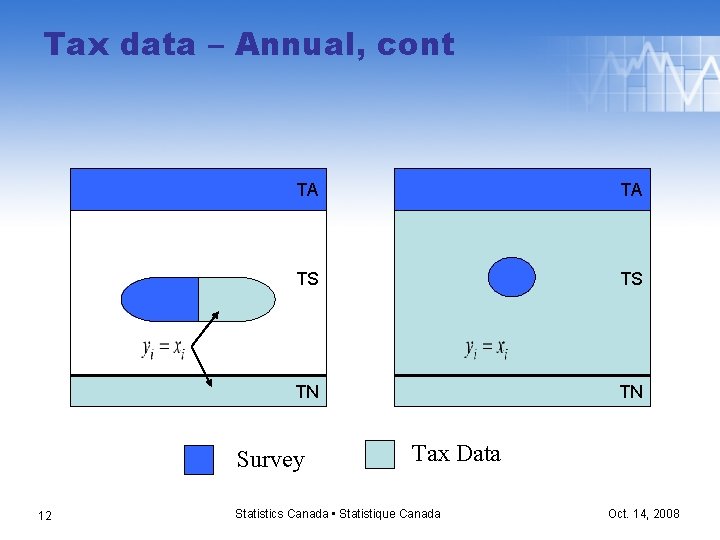

Tax data – GST, cont. TA Survey TS Tax Data TN Note: Simples only Statistics Canada • Statistique Canada Oct. 14, 2008

Tax data – Annual tax § Two types: • T 1 – Unincorporated businesses (individuals) • T 2 – Incorporated businesses § For T 1, have electronic filers (~80% of universe) plus 2 variables for entire universe • Produce calibrated estimates at aggregated levels § For T 2, Statistics Canada receives universe from CRA § ‘Processing’ done at Statistics Canada (outlier detection, imputation, allocation to details…) Statistics Canada • Statistique Canada Oct. 14, 2008

Tax data – Annual, cont § T 2 data used in Unified Enterprise Survey (UES) § The UES • Consists of over 60 annual business surveys • Uses common concepts and methodology § T 2 information linked to survey variables through COA (financial variables only) • No model needed Statistics Canada • Statistique Canada Oct. 14, 2008

Tax data – Annual, cont § T 2 information used to replace survey data for a portion of simple units and take none units § Several different implementations • 55% of sampled simples replaced • 100% of simples replaced (financial data). Sample for non-financial data • 100% of non-sampled simples replaced. Nonfinancial estimates calibrated Statistics Canada • Statistique Canada Oct. 14, 2008

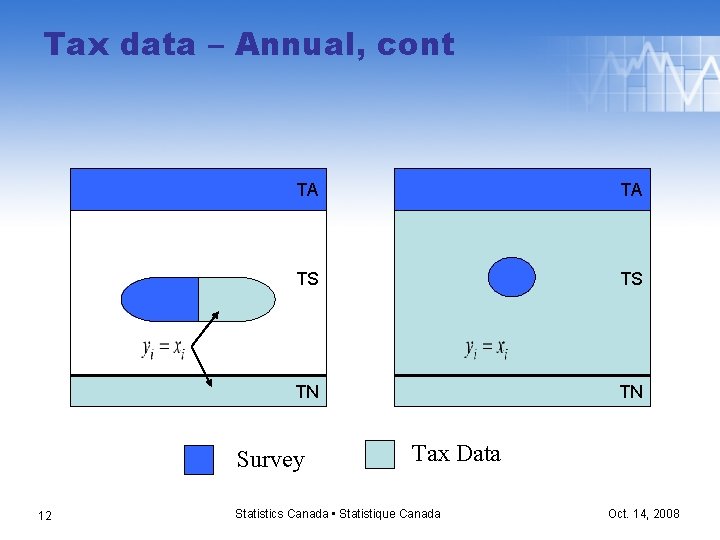

Tax data – Annual, cont TA TA TS TS TN TN Survey 12 Tax Data Statistics Canada • Statistique Canada Oct. 14, 2008

Increased use of GST data § Current use of GST data restricted due to operational constraints • Use of existing systems • Trust in tax data § Two sub-annual surveys recently redesigned/developed • Opportunity to significantly increase use of GST data § Monthly Food Services Survey (MFSS) § Quarterly Services Indicators (QSI) Statistics Canada • Statistique Canada Oct. 14, 2008

Increased use of GST data – MFSS Combines typical business survey design with a strategy that takes full advantage of tax data § In certain strata, use GST data for all simple businesses and typical survey for complex ones • Small sample of simples selected to build model § In other strata, use typical survey design Statistics Canada • Statistique Canada Oct. 14, 2008

Increased use of GST data – MFSS, cont § GST data used for: • ~25, 000 businesses based on sample of ~500 for model building • ~40, 000 businesses in take none § Resulted in • Significant improvement in quality • Reduction in respondent burden Statistics Canada • Statistique Canada Oct. 14, 2008

Increased use of GST data – QSI § Need to improve availability of sub-annual services industries data § Goals of QSI • Produce quarter-to-quarter movements • Economical § GST data used for all simple businesses, with traditional survey of complex ones • No sample of simple businesses to build model Statistics Canada • Statistique Canada Oct. 14, 2008

Increased use of GST data – Challenges § Stability of model parameters (MFSS) • Large changes across time • Large variability within time § Business status • Deaths in GST data identified based on remittance or not Statistics Canada • Statistique Canada Oct. 14, 2008

Increased use of GST data – Challenges § Updating of GST data • Monthly updates received from CRA § Late remittances and corrections § Full processing performed to produce another ‘vintage’ of data for particular reference month. • Both MFSS and QSI publish revised estimates § Some of the revision coming from ‘reprocessed’ GST data (imputation and calendarization) § Not a true reflection of economy Statistics Canada • Statistique Canada Oct. 14, 2008

Increased use of Annual Tax Data § UES is now over ten years old and is starting to show its age § A major redesign is being planned and increasing the use of tax data is one goal § One possible option • Complex businesses continue to be surveyed § Covers both financial and non-financial data § ‘Optimized’ for financial data Statistics Canada • Statistique Canada Oct. 14, 2008

Increased use of Annual Tax Data, cont. • For simple businesses, tax data becomes source of financial information § Can tax be used for small complex businesses? • Survey simple businesses only to respond to specific program/data needs § Commodities for example § ‘Optimized’ for data needs since financial information coming from tax data Statistics Canada • Statistique Canada Oct. 14, 2008

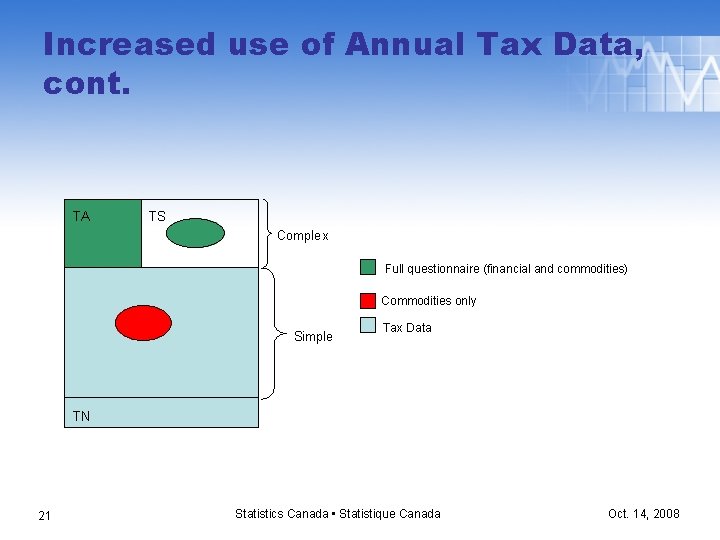

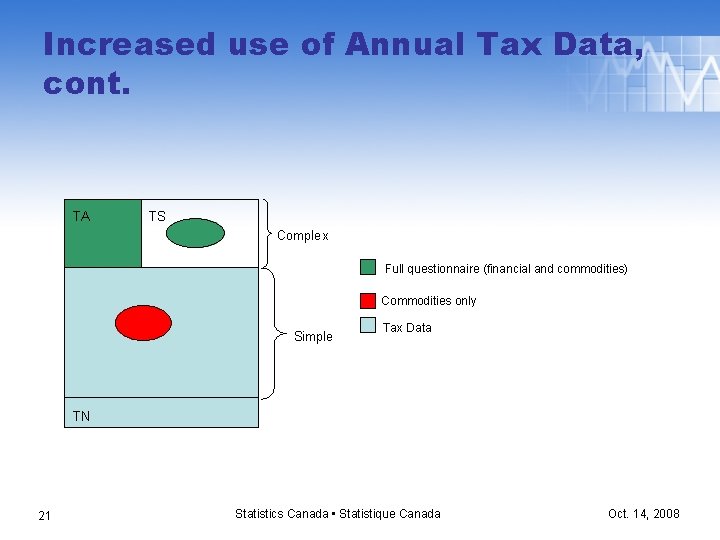

Increased use of Annual Tax Data, cont. TA TS Complex Full questionnaire (financial and commodities) Commodities only Simple Tax Data TN 21 Statistics Canada • Statistique Canada Oct. 14, 2008

Increased use of Annual Tax Data Challenges § Detailed financial data • Not always reported by businesses • Allocated using ratios § Commodity data • ‘Design’ sample for commodity data § Now designed for revenue § How to coordinate commodity and complex business sample? • Need to make commodity and financial data coherent – Calibration Statistics Canada • Statistique Canada Oct. 14, 2008

Increased use of Annual Tax Data – Challenges, cont. § Business status and industry coding • Many updates come from survey feedback • Nature of business report? § Combine with commodity questions? • Close co-operation with CRA to obtain this information? § Acceptance by users • Possible break in series Statistics Canada • Statistique Canada Oct. 14, 2008

Summary and Future Work § Use of GST data in MFSS and QSI step in right direction but still some challenges § Plans discussed to increase use of annual tax data but some work still to do § Statistics Canada also looking at broadening and deepening use of tax data • Tax schedules • Uses outside business survey program Statistics Canada • Statistique Canada Oct. 14, 2008

§ For more information, please contact: § Pour plus d’information, veuillez contacter : Wesley. Yung@statcan. gc. ca 25 Statistics Canada • Statistique Canada Oct. 14, 2008