Accounting Principles Second Canadian Edition Weygandt Kieso Kimmel

- Slides: 34

Accounting Principles Second Canadian Edition Weygandt · Kieso · Kimmel · Trenholm Prepared by: Carole Bowman, Sheridan College

CHAPTER 11 CURRENT LIABILITIES

ACCOUNTING FOR CURRENT LIABILITIES A current liability is a debt that can reasonably be expected to be paid 1. from existing current assets or in the creation of other current liabilities and 2. within one year or the operating cycle, whichever is longer.

ACCOUNTING FOR CURRENT LIABILITIES l Types of liabilities 1) 2) 3) Definitely determinable Estimated Contingent

ACCOUNTING FOR CURRENT LIABILITIES Definitely determinable current liabilities include: 1. Operating line of credit 2. Accounts and notes payable 3. Sales tax payable 4. Payroll and employee benefits 5. Unearned revenues 6. Current maturities of long-term debt

OPERATING LINE OF CREDIT l l A pre-authorized demand loan, allowing the company to write cheques up to a preset limit when needed. Disclosed by footnote and by reporting any resulting bank overdraft as a current liability.

NOTES PAYABLE l. Notes Payable are obligations in the form of written promissory notes that usually require the borrower to pay interest. l. Notes payable may be used instead of accounts payable because it supplies documentation of the obligation in case legal remedies are needed to collect the debt. l. Notes due for payment within one year of the balance sheet date are usually classified as current liabilities.

SALES TAXES PAYABLE l l l Sales tax is expressed as a stated percentage of the sales price of goods sold to customers by a retailer. Sales tax includes the goods and service tax (GST), provincial sales tax (PST) or harmonized sales taxes (GST and PST combined). The retailer (or selling company) collects the tax from the customer when the sale occurs, and periodically (usually monthly) remits the collections to the government.

PAYROLL AND EMPLOYEE BENEFITS l l Salaries or wages payable represent the amounts owed to employees for a pay period. Payroll withholdings include federal and provincial income taxes, Canada Pension Plan (CPP) contributions, and employment insurance (EI) premiums. Employees may also voluntarily authorize withholdings for charity, retirement, medical, or other purposes. Payroll withholdings are remitted to governmental taxing authorities.

UNEARNED REVENUES l l Unearned Revenues (advances from customers) occur when a company receives cash before a service is rendered. Examples are when an airline sells a ticket for future flights or when a lawyer receives legal fees before work is done.

CURRENT MATURITIES OF LONG-TERM DEBT l l Another item classified as a current liability is current maturities of long-term debt. Current maturities of long-term debt are often identified on the balance sheet as long-term debt due within one year.

ESTIMATED LIABILTIES Obligation that exists but for which the amount and timing is uncertain. l However, the company can reasonably estimate the liability. l Examples include property taxes and warranty liabilities. l

PROPERTY TAXES Property taxes are accrued monthly based on the prior year’s tax bill. l When the property tax bill for the current year is received, the company will adjust its monthly expense for the remainder of the year. l

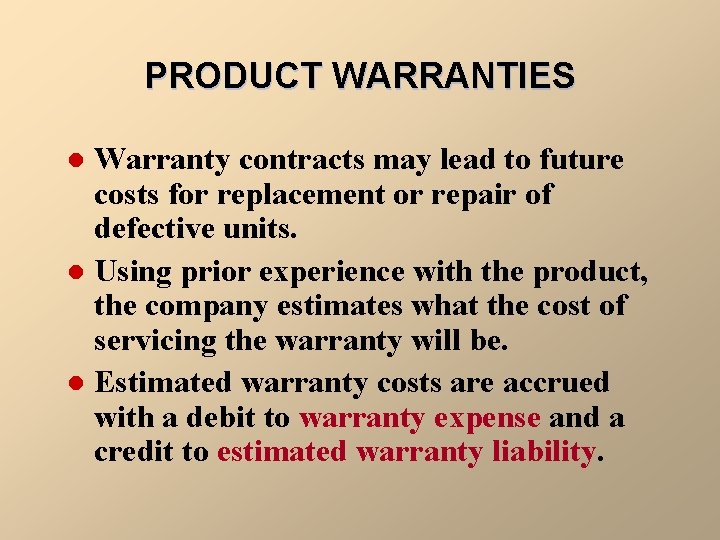

PRODUCT WARRANTIES Warranty contracts may lead to future costs for replacement or repair of defective units. l Using prior experience with the product, the company estimates what the cost of servicing the warranty will be. l Estimated warranty costs are accrued with a debit to warranty expense and a credit to estimated warranty liability. l

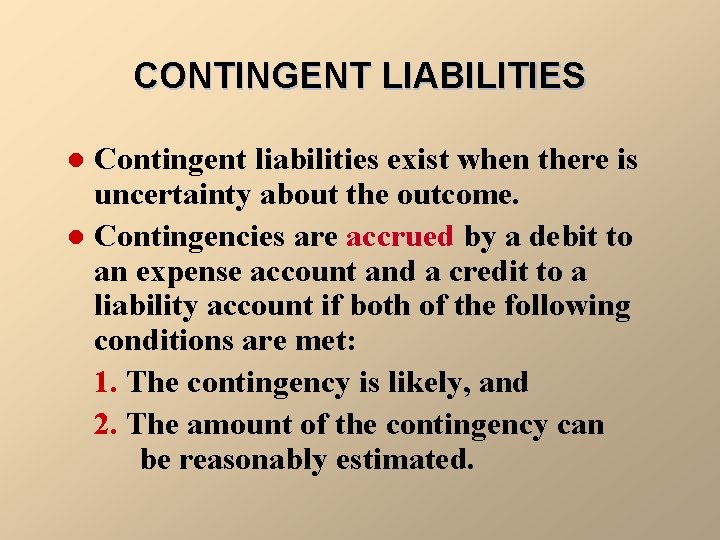

CONTINGENT LIABILITIES Contingent liabilities exist when there is uncertainty about the outcome. l Contingencies are accrued by a debit to an expense account and a credit to a liability account if both of the following conditions are met: 1. The contingency is likely, and 2. The amount of the contingency can be reasonably estimated. l

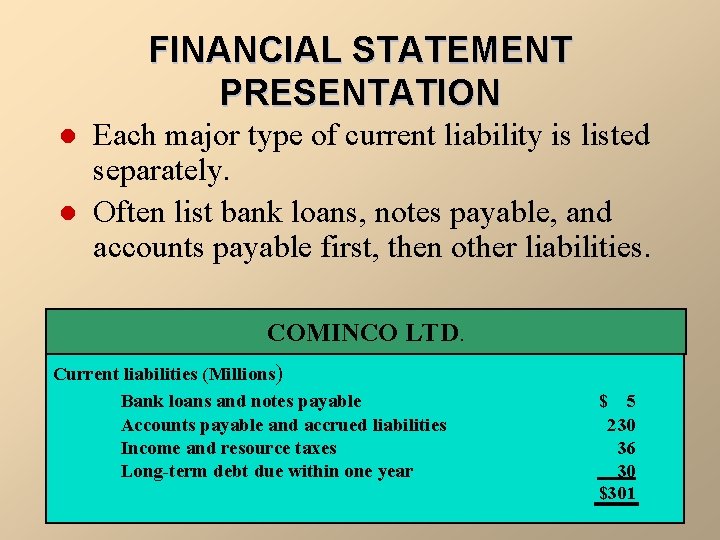

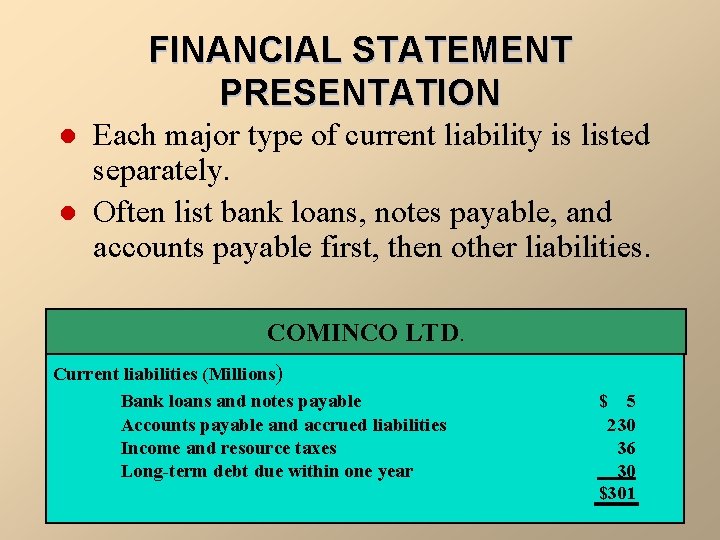

FINANCIAL STATEMENT PRESENTATION l l Each major type of current liability is listed separately. Often list bank loans, notes payable, and accounts payable first, then other liabilities. COMINCO LTD. Current liabilities (Millions) Bank loans and notes payable Accounts payable and accrued liabilities Income and resource taxes Long-term debt due within one year $ 5 230 36 30 $301

APPENDIX 11 A

INTERNAL CONTROLS FOR PAYROLL The objectives of internal accounting control concerning payroll are 1. to safeguard company assets from unauthorized payrolls and 2. to assure the accuracy and reliability of the accounting records pertaining to payrolls. l Payroll activities include: 1. hiring employees 2. timekeeping 3. preparing the payroll 4 Functions 4. paying the payroll of Payroll l These functions should be assigned to different departments or individuals. l

HIRING EMPLOYEES The human resources department is responsible for: 1. Posting job openings 2. Screening and interviewing applicants 3. Hiring of employees 4. Authorizing changes in pay rates during employment 5. Terminations of employment

TIMEKEEPING l l Hourly employees are usually required to record time worked by “punching” a time clock – the time of arrival and departure automatically recorded by the employee when he/she inserts a time card into the clock. The employee’s supervisor must: 1. approve the hours shown by signing the time card at the end of the pay period 2. authorize any overtime hours for an employee.

PREPARING THE PAYROLL The payroll department prepares the payroll on the basis of two sources of input: 1. human resource department authorizations, and 2. approved time cards.

PAYING THE PAYROLL The comptroller’s department is responsible for the payment of the payroll. 1. Payment by direct deposit, or by cheque, minimizes the risk of loss from theft. 2. All direct deposit lists and cheques must be signed by the comptroller and their distribution protected by the comptroller’s department.

DETERMINING AND PAYING THE PAYROLL Determining the payroll involves calculating 1. gross earnings, 2. payroll deductions, and 3. net pay.

GROSS EARNINGS l l Gross earnings is the total compensation earned by an employee. There are three types of gross earnings: 1. wages 2. salaries 3. bonuses Total wages are determined by applying the hourly rate of pay to the hours worked. Most companies are required to pay a minimum of one and one-half times the regular hourly rate for overtime work.

PAYROLL DEDUCTIONS l l The difference between gross pay and the amount actually received is attributable to payroll deductions. Mandatory deductions consist of Canada Pension Plan (CPP, or QPP in Quebec), employment insurance (EI) and personal income tax.

PAYROLL DEDUCTIONS l l Voluntary deductions pertain to withholdings for charitable causes, retirement, and other purposes. All voluntary payroll deductions should be authorized in writing by the employee. Voluntary payroll deductions do not result in a payroll expense to the employer. Net pay is determined by subtracting payroll deductions from gross earnings.

EMPLOYER PAYROLL COSTS l l l CPP • The employer must match each employee’s CPP contribution. EI • The employer is required to contribute 1. 4 times each employee’s EI deductions. Workplace Health, Safety, and Compensation • Employers pay a specified percentage of their gross payroll to provide supplemental benefits for workers who are injured or disabled in the workplace.

ADDITIONAL FRINGE BENEFITS PAID ABSENCES l l Employees may have the right to receive compensation for future benefits when certain conditions of employment are met. The compensation may pertain to: 1. Paid vacation 2. Sick pay benefits 3. Paid holidays

ADDITIONAL FRINGE BENEFITS PAID ABSENCES When the payment of compensation is probable and can reasonably be determined, a liability should be accrued. l When the amount can not be reasonably estimated, the potential liability should be disclosed. l

RECORDING THE PAYROLL l l Many companies use a payroll register to accumulate the gross earnings, deductions, and net pay by employee for each period. In some cases, this record is a journal or book of original entry. The typical entry to record the employee costs in a payroll is to debit Salaries or Wages expense and to credit a variety of liability accounts. When the payroll is paid, the liability accounts are debited and Cash is credited.

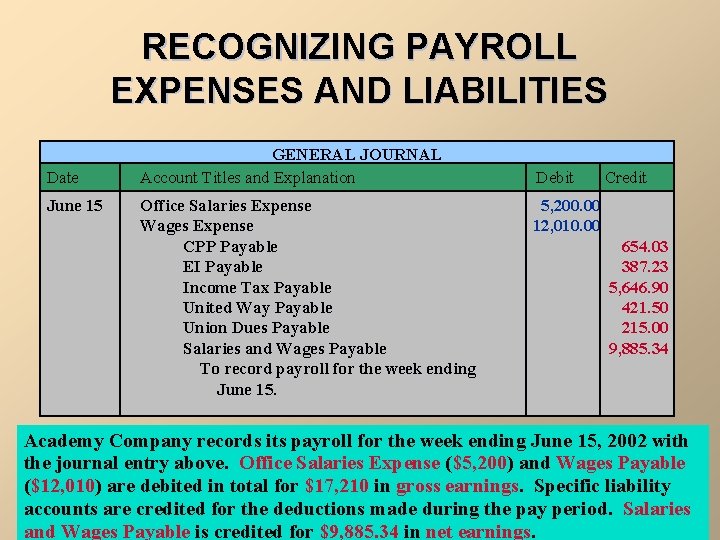

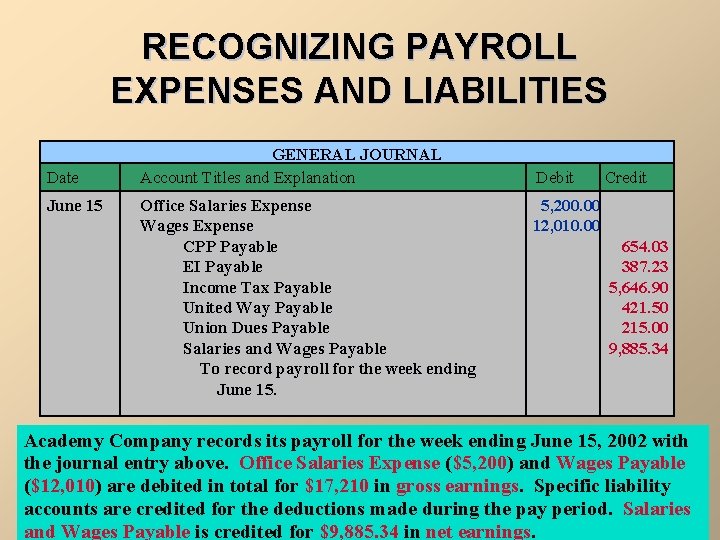

RECOGNIZING PAYROLL EXPENSES AND LIABILITIES Date June 15 GENERAL JOURNAL Account. Titles titlesand and. Explanation explanation Account Office Salaries Expense Wages Expense CPP Payable EI Payable Income Tax Payable United Way Payable Union Dues Payable Salaries and Wages Payable To record payroll for the week ending June 15. Debit Credit Debit 5, 200. 00 12, 010. 00 654. 03 387. 23 5, 646. 90 421. 50 215. 00 9, 885. 34 Academy Company records its payroll for the week ending June 15, 2002 with the journal entry above. Office Salaries Expense ($5, 200) and Wages Payable ($12, 010) are debited in total for $17, 210 in gross earnings. Specific liability accounts are credited for the deductions made during the pay period. Salaries and Wages Payable is credited for $9, 885. 34 in net earnings.

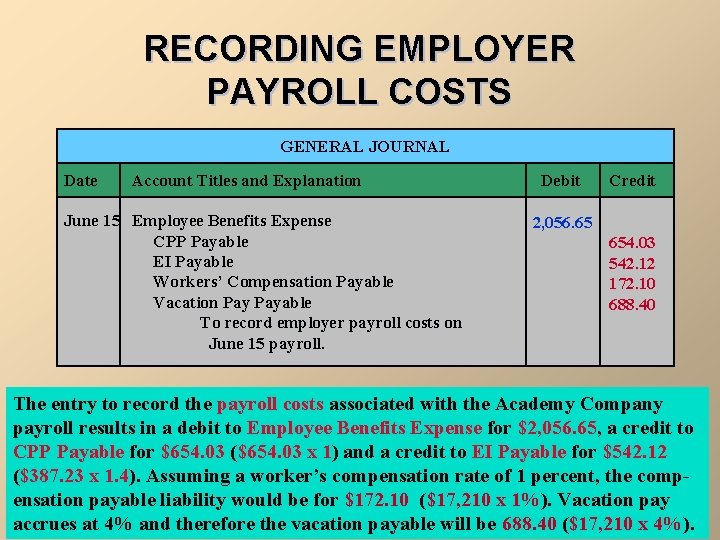

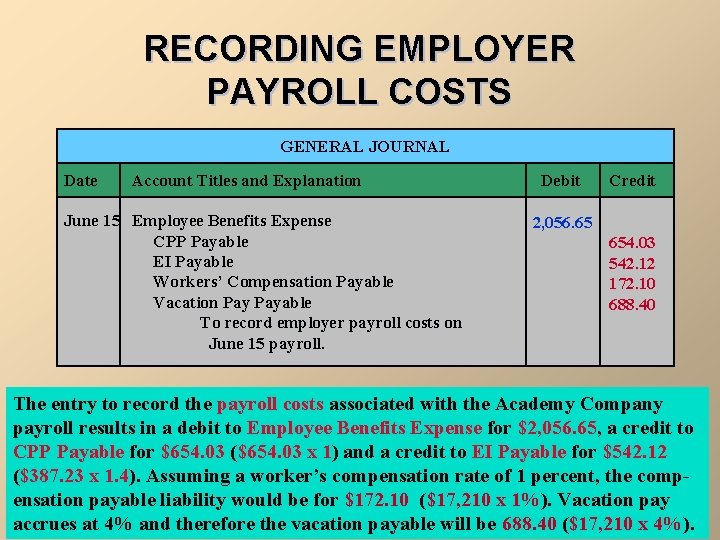

RECORDING EMPLOYER PAYROLL COSTS GENERAL JOURNAL Date Account Titles and Explanation June 15 Employee Benefits Expense CPP Payable EI Payable Workers’ Compensation Payable Vacation Payable To record employer payroll costs on June 15 payroll. Debit Credit 2, 056. 65 654. 03 542. 12 172. 10 688. 40 The entry to record the payroll costs associated with the Academy Company payroll results in a debit to Employee Benefits Expense for $2, 056. 65, a credit to CPP Payable for $654. 03 ($654. 03 x 1) and a credit to EI Payable for $542. 12 ($387. 23 x 1. 4). Assuming a worker’s compensation rate of 1 percent, the compensation payable liability would be for $172. 10 ($17, 210 x 1%). Vacation pay accrues at 4% and therefore the vacation payable will be 688. 40 ($17, 210 x 4%).

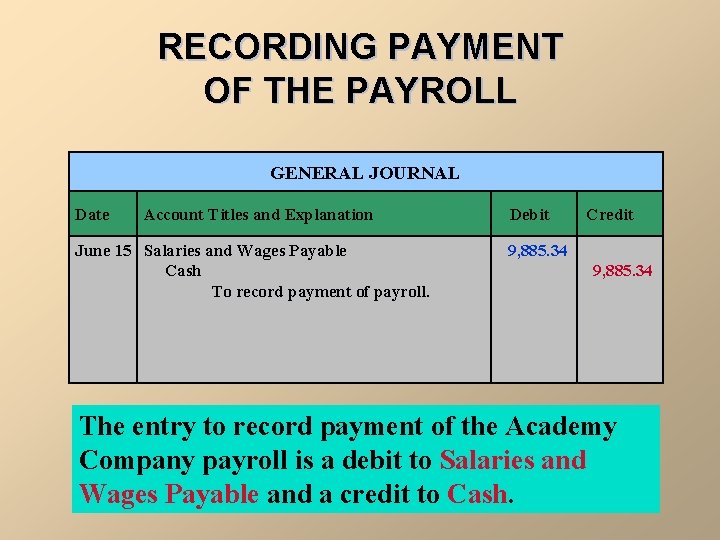

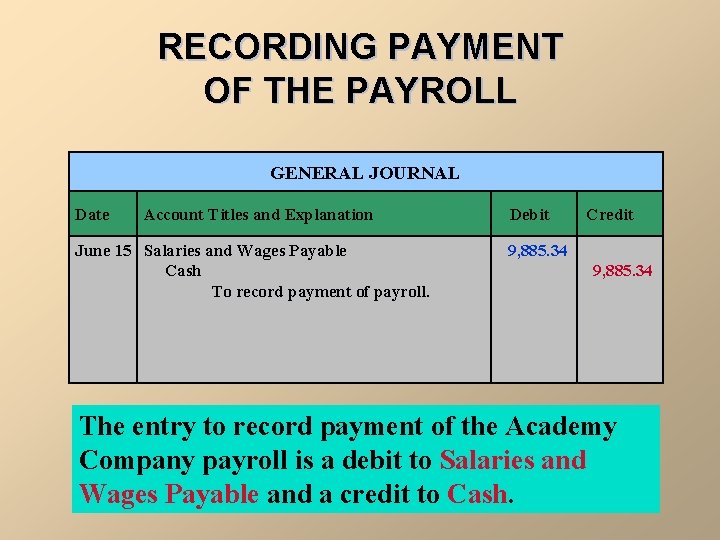

RECORDING PAYMENT OF THE PAYROLL GENERAL JOURNAL Date Account Titles and Explanation June 15 Salaries and Wages Payable Cash To record payment of payroll. Debit Credit 9, 885. 34 The entry to record payment of the Academy Company payroll is a debit to Salaries and Wages Payable and a credit to Cash.

COPYRIGHT Copyright © 2002 John Wiley & Sons Canada, Ltd. All rights reserved. Reproduction or translation of this work beyond that permitted by CANCOPY (Canadian Reprography Collective) is unlawful. Request for further information should be addressed to the Permissions Department, John Wiley & Sons Canada, Ltd. The purchaser may make back-up copies for his / her own use only and not for distribution or resale. The author and the publisher assume no responsibility for errors, omissions, or damages, caused by the use of these programs or from the use of the information contained herein.

Kimmel accounting 5e

Kimmel accounting 5e Kimmel weygandt kieso accounting 5th edition

Kimmel weygandt kieso accounting 5th edition Kimmel weygandt kieso accounting 5th edition

Kimmel weygandt kieso accounting 5th edition Cost of goods manufactured formula

Cost of goods manufactured formula Weygandt kimmel kieso

Weygandt kimmel kieso Kieso weygandt warfield

Kieso weygandt warfield Accounting principles second canadian edition

Accounting principles second canadian edition Accounting principles second canadian edition

Accounting principles second canadian edition Accounting principles second canadian edition

Accounting principles second canadian edition Accounting principles second canadian edition

Accounting principles second canadian edition Kimmel financial accounting 7the edition

Kimmel financial accounting 7the edition Financial accounting kimmel ch1-2

Financial accounting kimmel ch1-2 Kimmel financial accounting 7e

Kimmel financial accounting 7e Chapter 21 accounting for leases kieso terjemahan

Chapter 21 accounting for leases kieso terjemahan Liabilitas jangka pendek

Liabilitas jangka pendek Intermediate accounting kieso

Intermediate accounting kieso Intermediate accounting kieso

Intermediate accounting kieso Intermediate accounting kieso

Intermediate accounting kieso Intermediate accounting kieso

Intermediate accounting kieso Intermediate accounting kieso

Intermediate accounting kieso Intermediate accounting kieso

Intermediate accounting kieso Intermediate accounting kieso

Intermediate accounting kieso Intermediate accounting kieso

Intermediate accounting kieso Intermediate accounting chapter 17

Intermediate accounting chapter 17 Beginning inventory formula

Beginning inventory formula Accounting principles 13th edition

Accounting principles 13th edition Marketing an introduction 6th canadian edition

Marketing an introduction 6th canadian edition Fundamentals of corporate finance, third canadian edition

Fundamentals of corporate finance, third canadian edition Fundamentals of corporate finance canadian edition

Fundamentals of corporate finance canadian edition Taavi kimmel

Taavi kimmel David kimmel design

David kimmel design Alexandra topp

Alexandra topp Kimmel magdolna

Kimmel magdolna Revenue recognition intermediate accounting

Revenue recognition intermediate accounting Chapter 7 intermediate accounting

Chapter 7 intermediate accounting