Accounting Principles Second Canadian Edition Weygandt Kieso Kimmel

- Slides: 25

Accounting Principles Second Canadian Edition Weygandt · Kieso · Kimmel · Trenholm Prepared by: Carole Bowman, Sheridan College

CHAPTER 17 INVESTMENTS

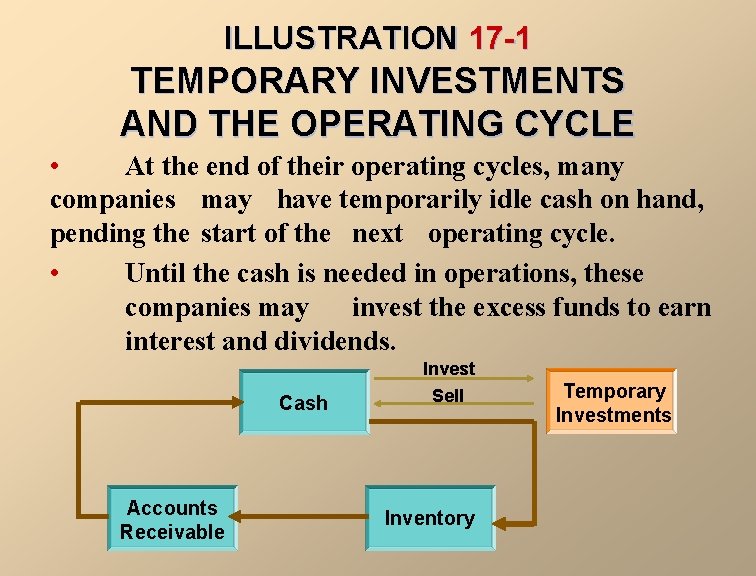

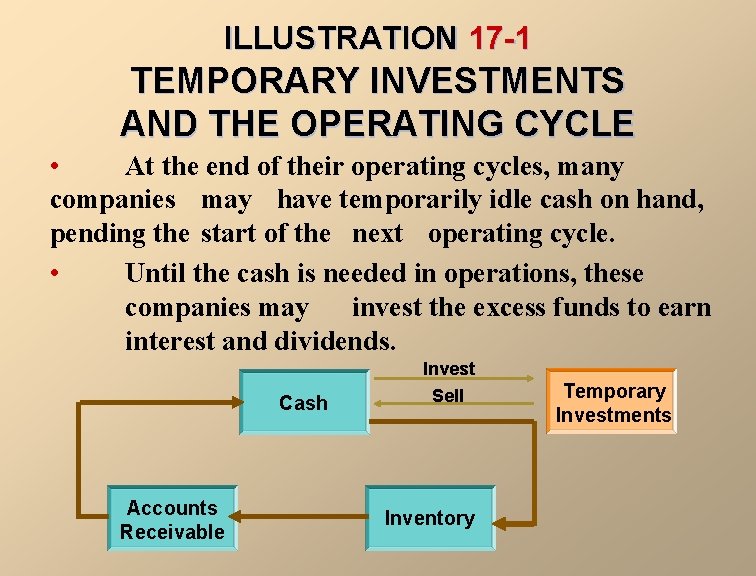

ILLUSTRATION 17 -1 TEMPORARY INVESTMENTS AND THE OPERATING CYCLE • At the end of their operating cycles, many companies may have temporarily idle cash on hand, pending the start of the next operating cycle. • Until the cash is needed in operations, these companies may invest the excess funds to earn interest and dividends. Cash Accounts Receivable Invest Sell Inventory Temporary Investments

TEMPORARY VS. LONG-TERM INVESTMENTS • Temporary investments are securities, held by a company, that are (1) readily marketable, and (2) intended to be converted into cash in the near future. – Readily marketable means the investment can be sold easily, whenever the need for cash arises. – Intention to convert means that management intends to sell the investment if and when the need for cash arises. • Investments that do not meet both criteria are classified as long-term investments.

DEBT INVESTMENTS • Investments in government and corporation bonds. • In accounting for debt investments, entries are required to record the: – acquisition – interest revenue – sale • Are recorded at cost, including brokerage fees.

DEBT INVESTMENTS • Accounting differs depending on whether investment is – Temporary – Long-term

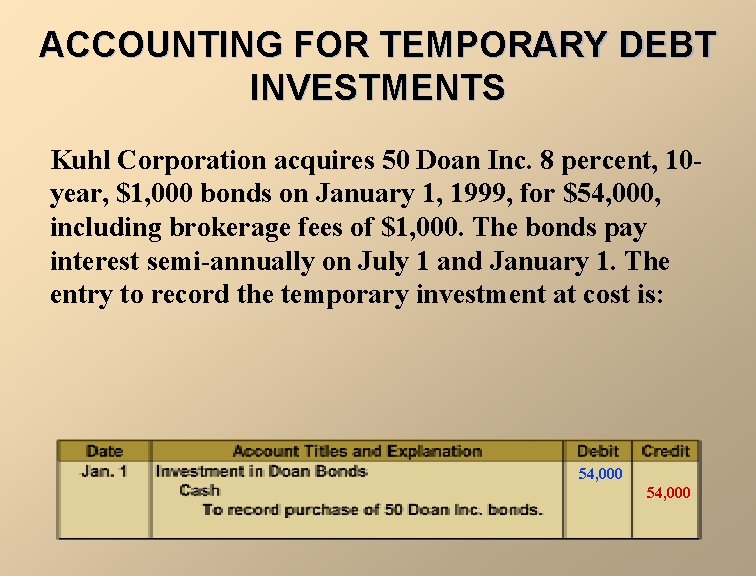

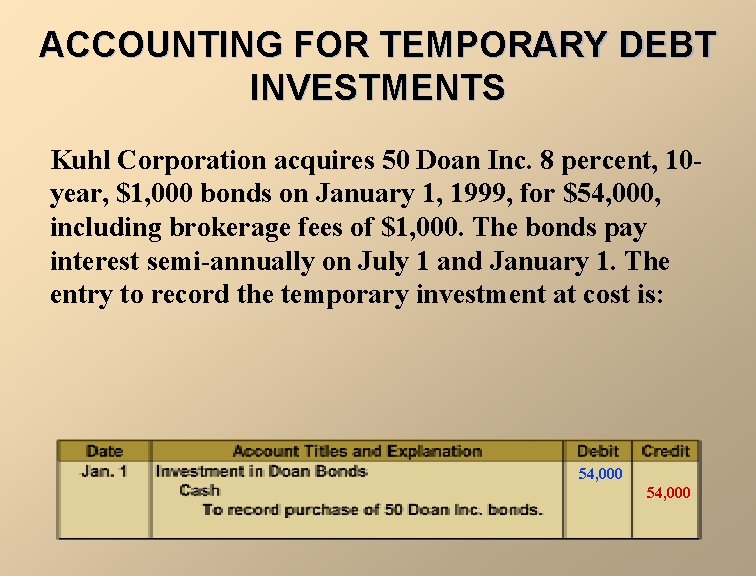

ACCOUNTING FOR TEMPORARY DEBT INVESTMENTS Kuhl Corporation acquires 50 Doan Inc. 8 percent, 10 year, $1, 000 bonds on January 1, 1999, for $54, 000, including brokerage fees of $1, 000. The bonds pay interest semi-annually on July 1 and January 1. The entry to record the temporary investment at cost is: 54, 000

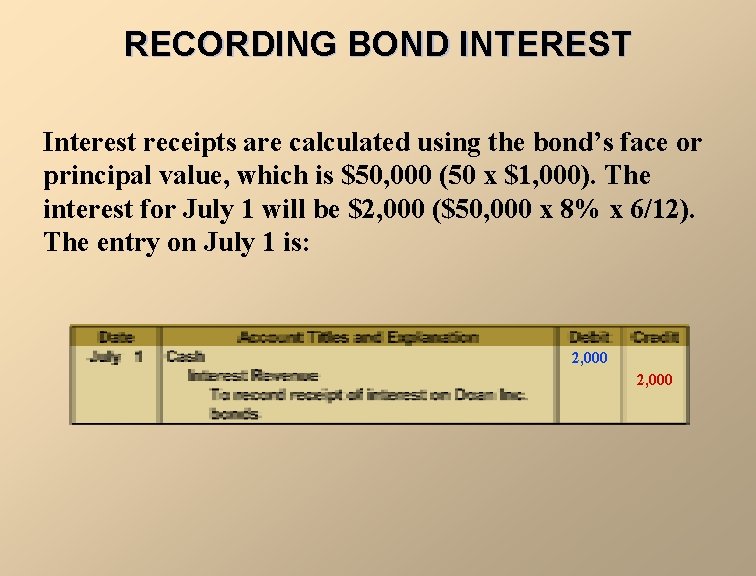

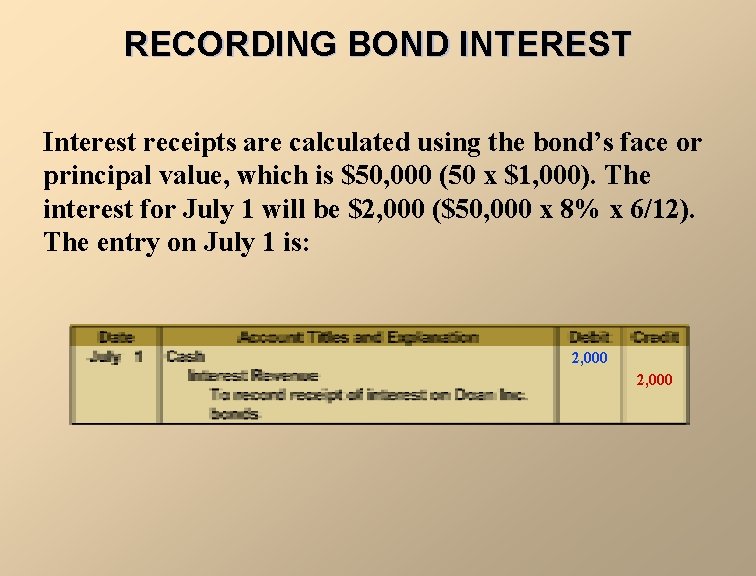

RECORDING BOND INTEREST Interest receipts are calculated using the bond’s face or principal value, which is $50, 000 (50 x $1, 000). The interest for July 1 will be $2, 000 ($50, 000 x 8% x 6/12). The entry on July 1 is: 2, 000

ACCOUNTING FOR LONG-TERM DEBT INVESTMENTS The accounting for temporary and long-term investments is similar. The major exception is when bonds are purchased at a premium or discount (above or below its face value). As shown in Chapter 16 with the bond issuer, the investor would also amortize the premium or discount using either the straight-line or effective interest methods. Using the previous Kuhl example and assuming an effective interest rate of 7%, the entries are: Date Jan 1 Kuhl Corporation (Investor) Investment in Doan Bonds 50, 000 Premium on Bonds 4, 000 Cash 54, 000 To record purchase of 50 Doan bonds Doan Inc. (Investee) Cash 54, 000 Premium on Bonds 4, 000 Bonds Payable 50, 000 To record issue of 8%, 10 year bonds July 1 Cash 2, 000 = ($50, 000 x 8% x 6/12) Premium on Bonds Interest Revenue To record receipt of interest and amortization of bond premium Interest Expense 1, 890 = ($54, 000 x 7% x 6/12) Premium on Bonds 110 Cash 2, 000 To record payment of interest and amortization of bond premium 110 1, 890

ILLUSTRATION 17 -4 ACCOUNTING GUIDELINES FOR EQUITY INVESTMENTS Equity investments are investments in the share capital of corporations.

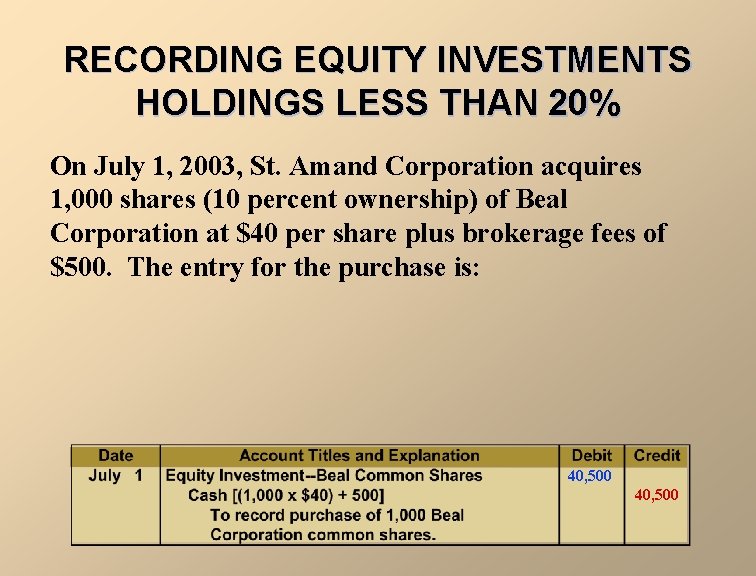

RECORDING EQUITY INVESTMENTS HOLDINGS LESS THAN 20% • In accounting for equity investments of less than 20 percent, the cost method is used. • Under the cost method, the investment is recorded at cost and revenue is recognized only when cash dividends are received.

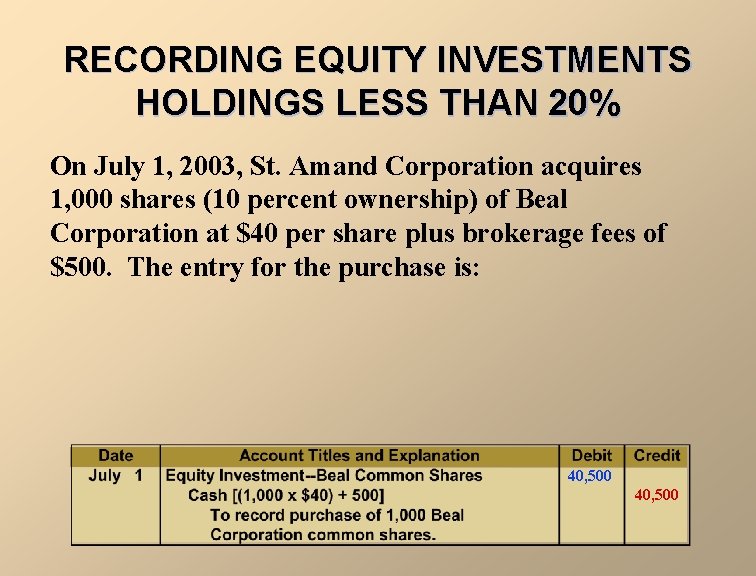

RECORDING EQUITY INVESTMENTS HOLDINGS LESS THAN 20% On July 1, 2003, St. Amand Corporation acquires 1, 000 shares (10 percent ownership) of Beal Corporation at $40 per share plus brokerage fees of $500. The entry for the purchase is: 40, 500

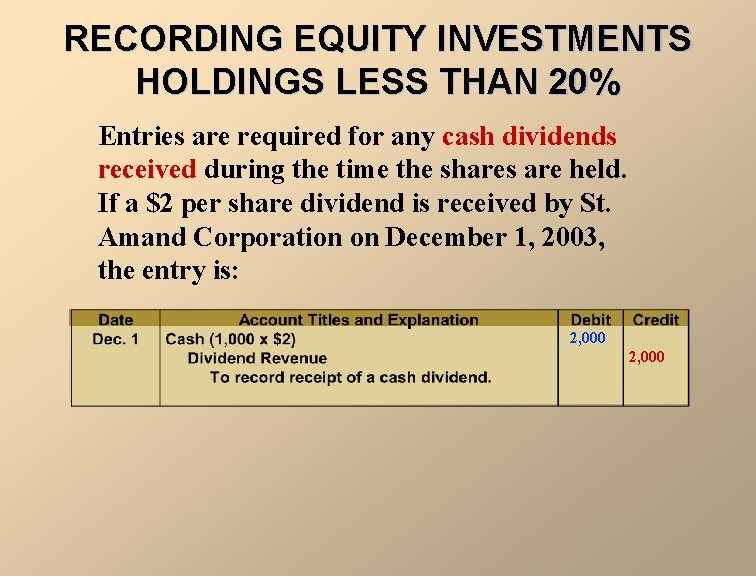

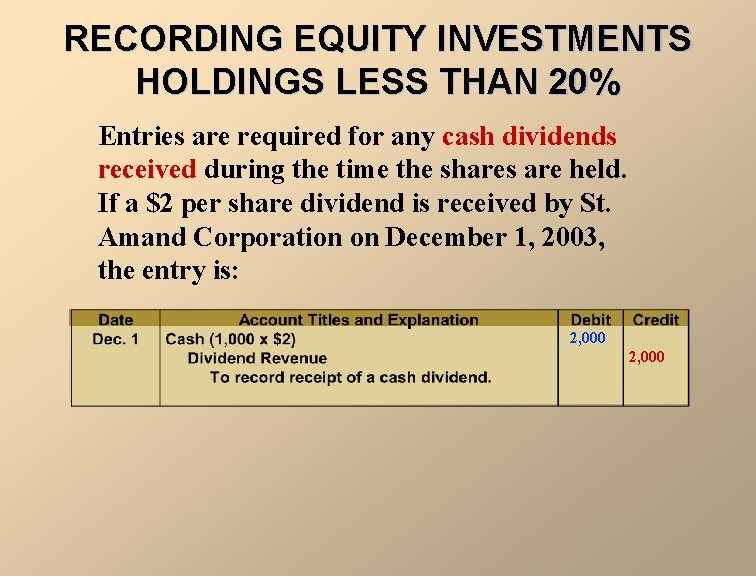

RECORDING EQUITY INVESTMENTS HOLDINGS LESS THAN 20% Entries are required for any cash dividends received during the time the shares are held. If a $2 per share dividend is received by St. Amand Corporation on December 1, 2003, the entry is: 2, 000

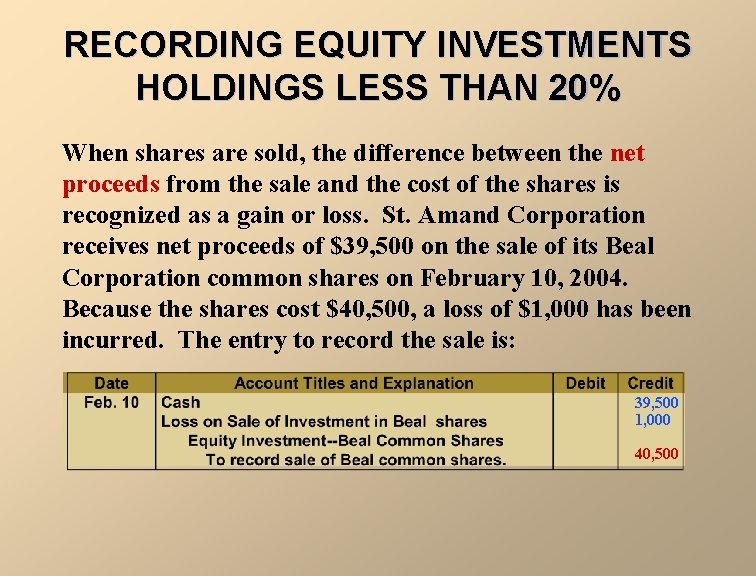

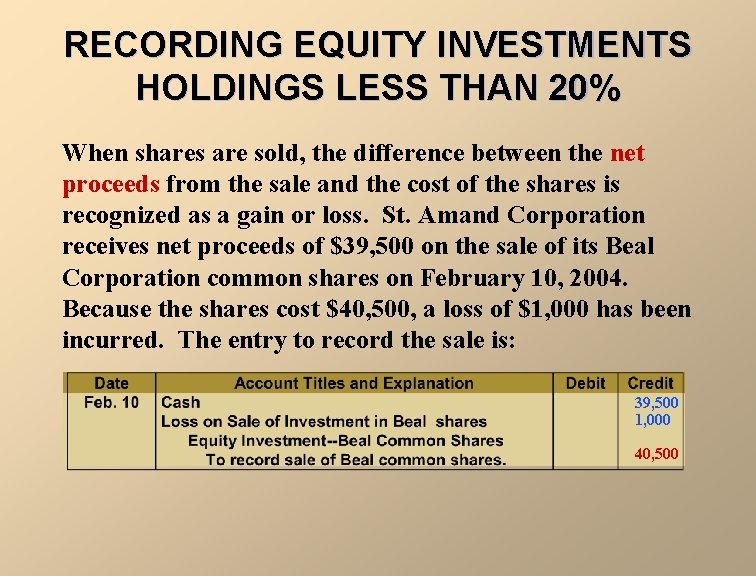

RECORDING EQUITY INVESTMENTS HOLDINGS LESS THAN 20% When shares are sold, the difference between the net proceeds from the sale and the cost of the shares is recognized as a gain or loss. St. Amand Corporation receives net proceeds of $39, 500 on the sale of its Beal Corporation common shares on February 10, 2004. Because the shares cost $40, 500, a loss of $1, 000 has been incurred. The entry to record the sale is: 39, 500 1, 000 40, 500

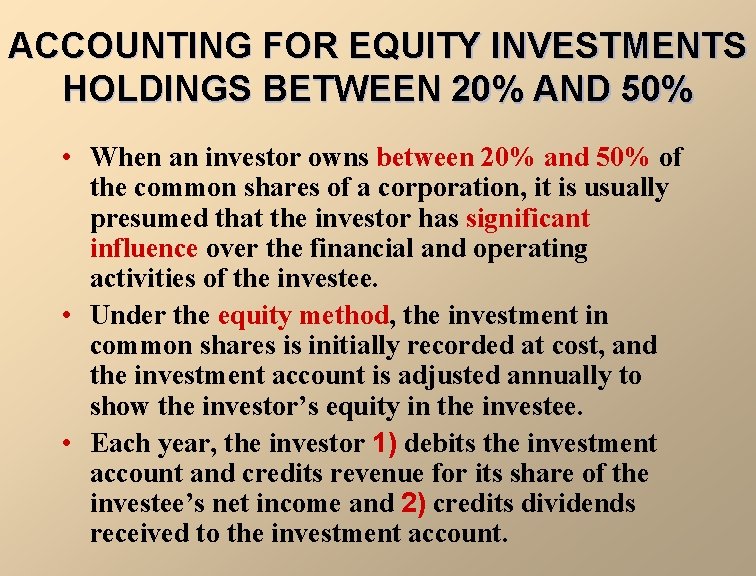

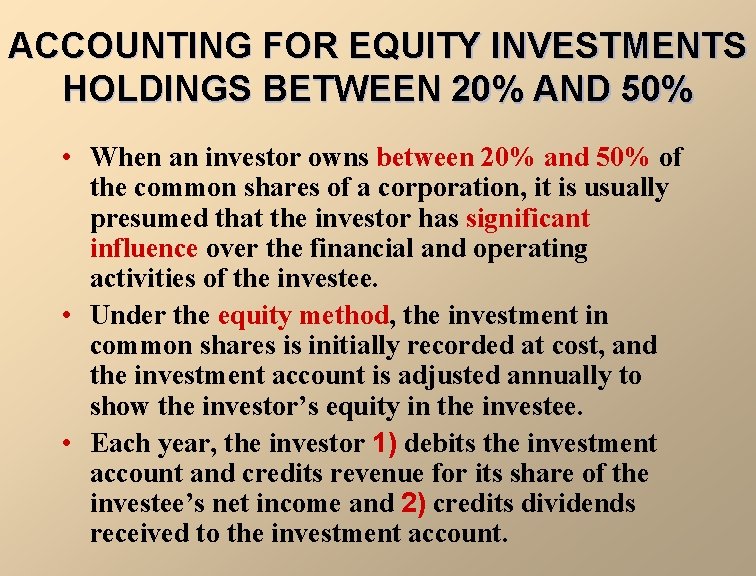

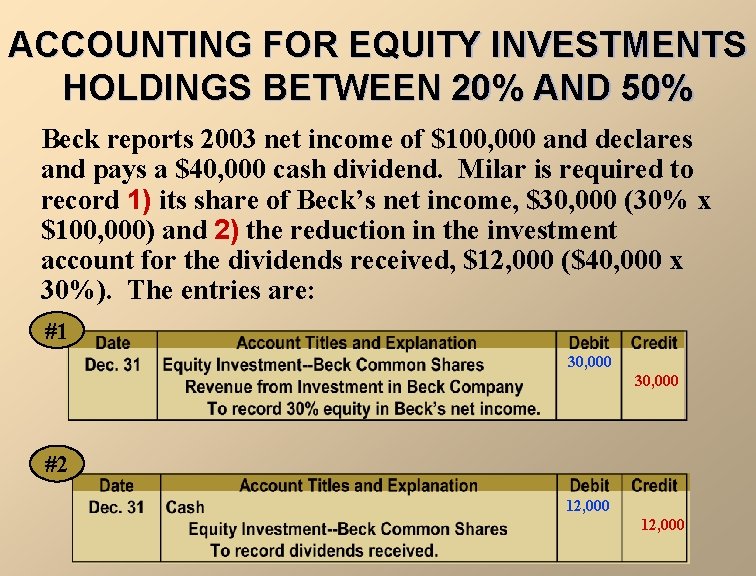

ACCOUNTING FOR EQUITY INVESTMENTS HOLDINGS BETWEEN 20% AND 50% • When an investor owns between 20% and 50% of the common shares of a corporation, it is usually presumed that the investor has significant influence over the financial and operating activities of the investee. • Under the equity method, the investment in common shares is initially recorded at cost, and the investment account is adjusted annually to show the investor’s equity in the investee. • Each year, the investor 1) debits the investment account and credits revenue for its share of the investee’s net income and 2) credits dividends received to the investment account.

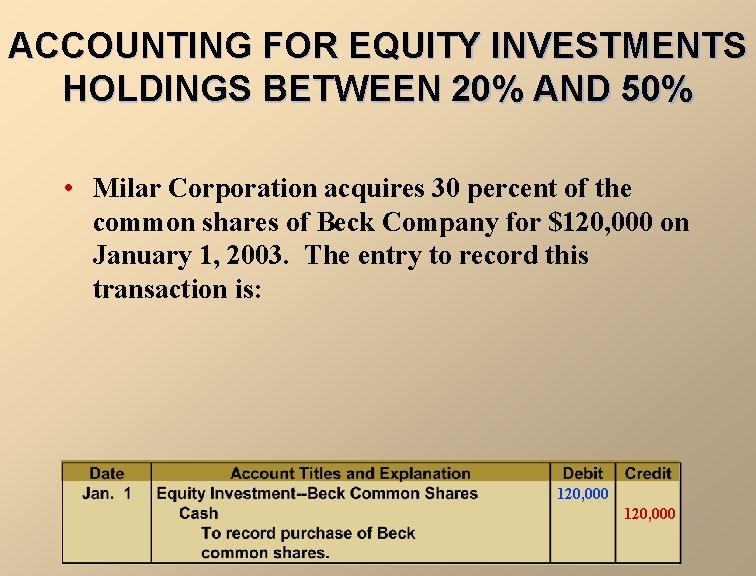

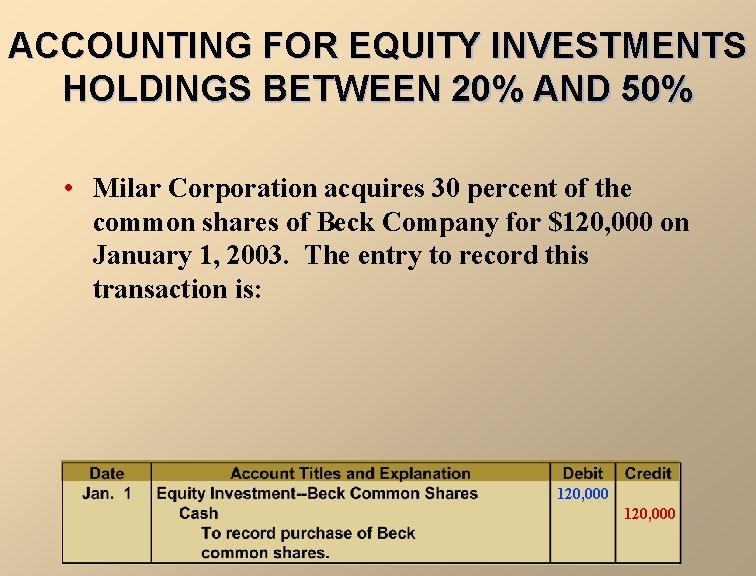

ACCOUNTING FOR EQUITY INVESTMENTS HOLDINGS BETWEEN 20% AND 50% • Milar Corporation acquires 30 percent of the common shares of Beck Company for $120, 000 on January 1, 2003. The entry to record this transaction is: 120, 000

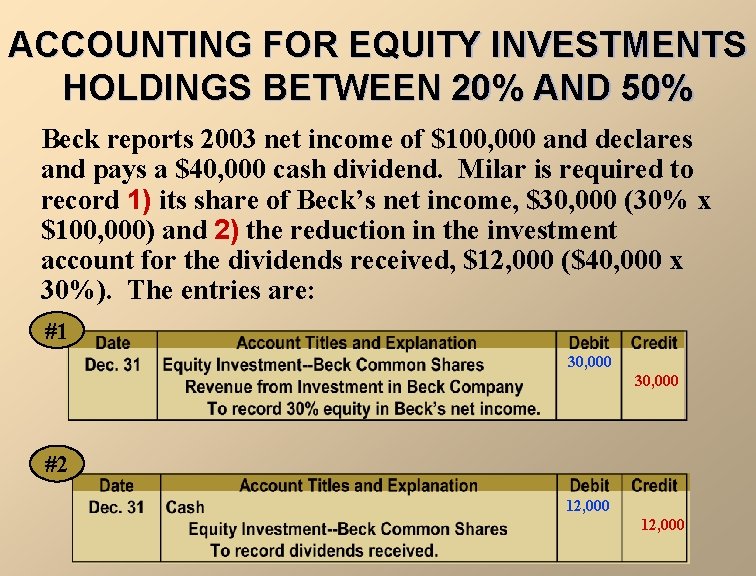

ACCOUNTING FOR EQUITY INVESTMENTS HOLDINGS BETWEEN 20% AND 50% Beck reports 2003 net income of $100, 000 and declares and pays a $40, 000 cash dividend. Milar is required to record 1) its share of Beck’s net income, $30, 000 (30% x $100, 000) and 2) the reduction in the investment account for the dividends received, $12, 000 ($40, 000 x 30%). The entries are: #1 30, 000 #2 12, 000

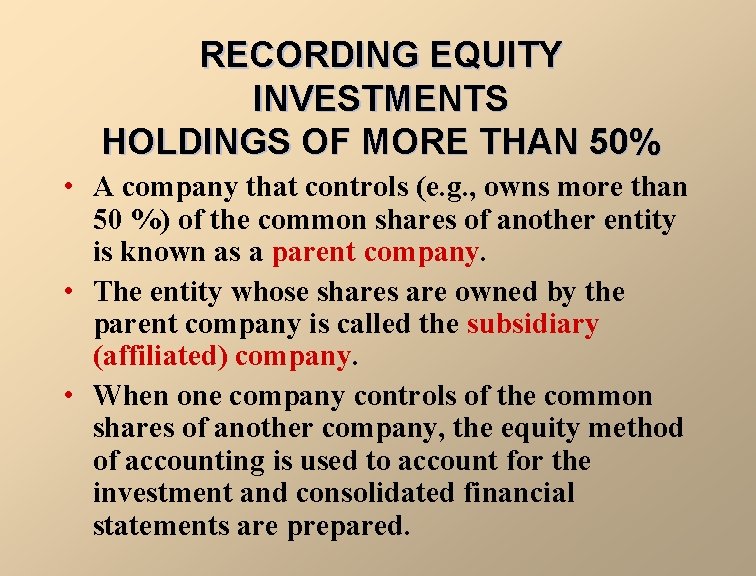

RECORDING EQUITY INVESTMENTS HOLDINGS OF MORE THAN 50% • A company that controls (e. g. , owns more than 50 %) of the common shares of another entity is known as a parent company. • The entity whose shares are owned by the parent company is called the subsidiary (affiliated) company. • When one company controls of the common shares of another company, the equity method of accounting is used to account for the investment and consolidated financial statements are prepared.

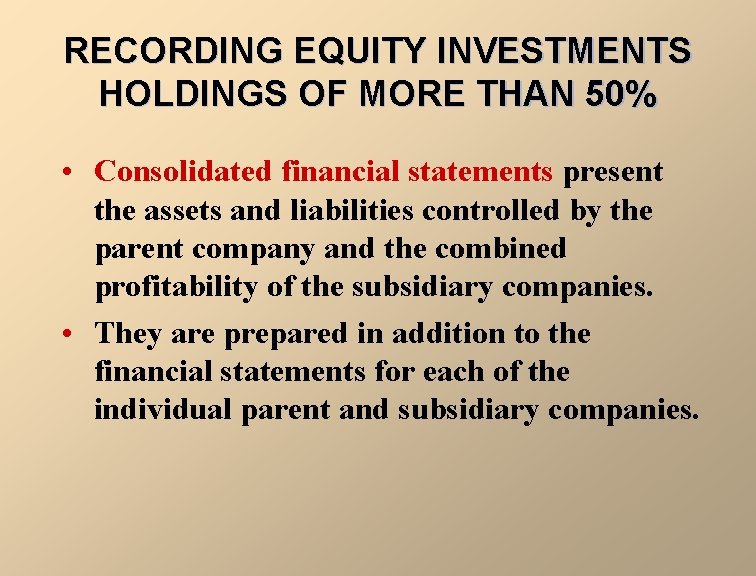

RECORDING EQUITY INVESTMENTS HOLDINGS OF MORE THAN 50% • Consolidated financial statements present the assets and liabilities controlled by the parent company and the combined profitability of the subsidiary companies. • They are prepared in addition to the financial statements for each of the individual parent and subsidiary companies.

VALUATION AND REPORTING OF INVESTMENTS • The value of debt and equity investments may fluctuate greatly during the time they are held. • Conservatism principle requires accountants to use the lower of cost and market (LCM) rule. • Application of the LCM rule varies depending upon whether the investment is temporary or long-term.

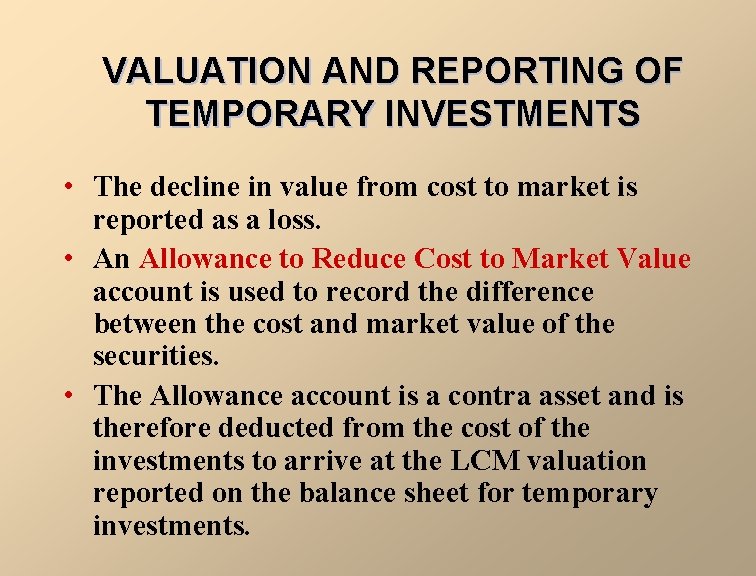

VALUATION AND REPORTING OF TEMPORARY INVESTMENTS • The decline in value from cost to market is reported as a loss. • An Allowance to Reduce Cost to Market Value account is used to record the difference between the cost and market value of the securities. • The Allowance account is a contra asset and is therefore deducted from the cost of the investments to arrive at the LCM valuation reported on the balance sheet for temporary investments.

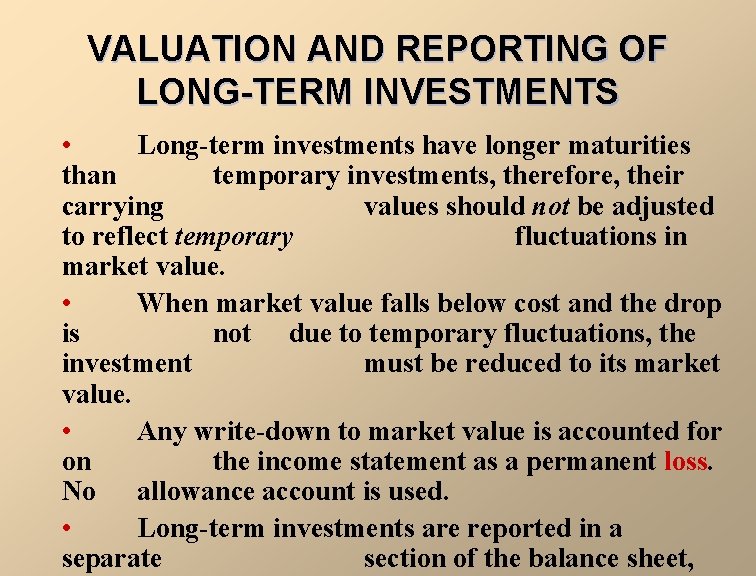

VALUATION AND REPORTING OF LONG-TERM INVESTMENTS • Long-term investments have longer maturities than temporary investments, therefore, their carrying values should not be adjusted to reflect temporary fluctuations in market value. • When market value falls below cost and the drop is not due to temporary fluctuations, the investment must be reduced to its market value. • Any write-down to market value is accounted for on the income statement as a permanent loss. No allowance account is used. • Long-term investments are reported in a separate section of the balance sheet,

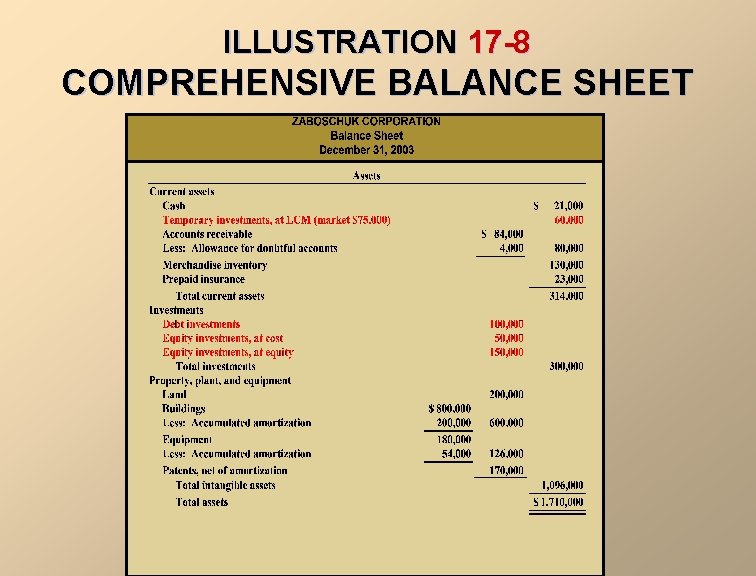

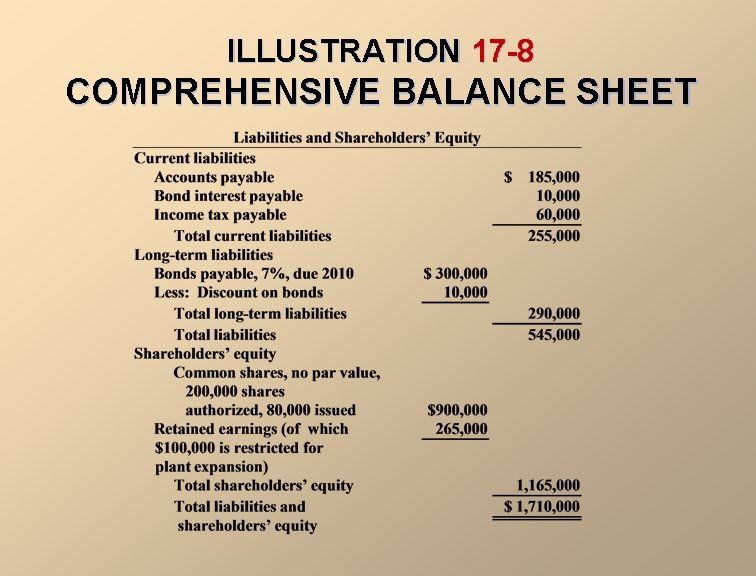

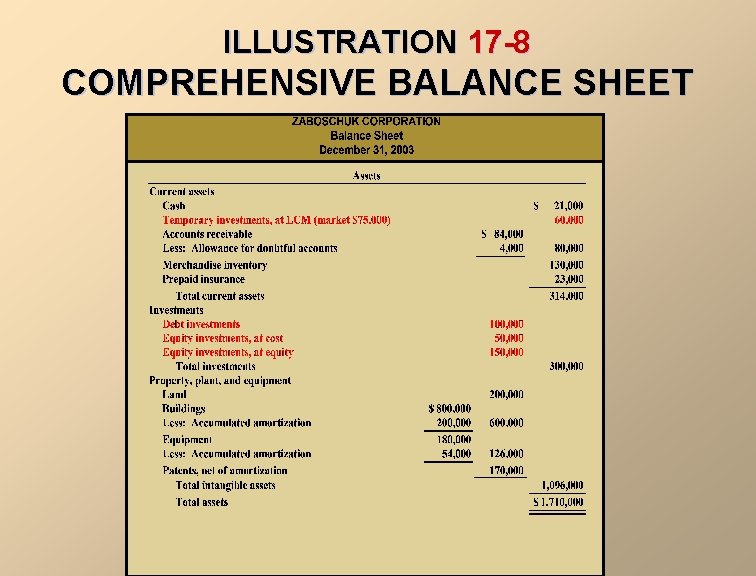

ILLUSTRATION 17 -8 COMPREHENSIVE BALANCE SHEET

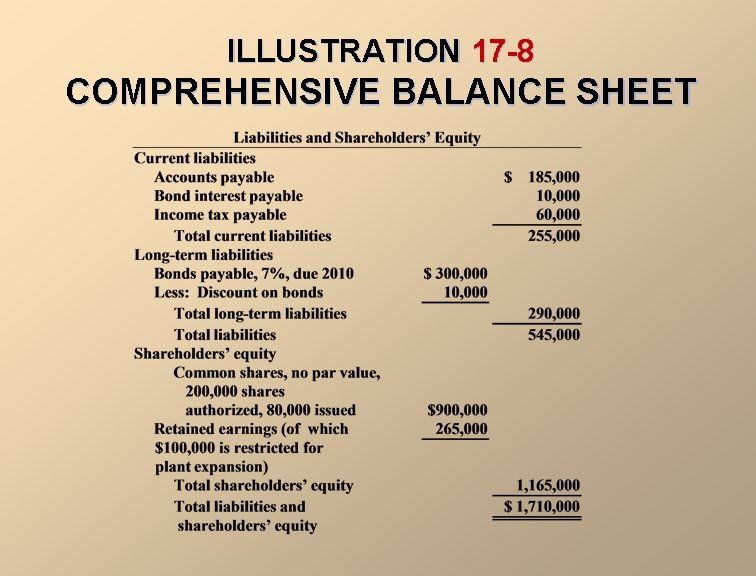

ILLUSTRATION 17 -8 COMPREHENSIVE BALANCE SHEET

COPYRIGHT Copyright © 2002 John Wiley & Sons Canada, Ltd. All rights reserved. Reproduction or translation of this work beyond that permitted by CANCOPY (Canadian Reprography Collective) is unlawful. Request for further information should be addressed to the Permissions Department, John Wiley & Sons Canada, Ltd. The purchaser may make back-up copies for his / her own use only and not for distribution or resale. The author and the publisher assume no responsibility for errors, omissions, or damages, caused by the use of these programs or from the use of the information contained herein.

Kimmel accounting tools 5e

Kimmel accounting tools 5e Kimmel weygandt kieso accounting 5th edition

Kimmel weygandt kieso accounting 5th edition Kimmel weygandt kieso accounting 5th edition

Kimmel weygandt kieso accounting 5th edition Financial and managerial accounting weygandt kimmel kieso

Financial and managerial accounting weygandt kimmel kieso Weygandt kimmel kieso

Weygandt kimmel kieso Kieso weygandt warfield

Kieso weygandt warfield Accounting principles second canadian edition

Accounting principles second canadian edition Accounting principles second canadian edition

Accounting principles second canadian edition Accounting principles second canadian edition

Accounting principles second canadian edition Accounting principles second canadian edition

Accounting principles second canadian edition Kimmel financial accounting 7the edition

Kimmel financial accounting 7the edition Financial accounting kimmel ch1-2

Financial accounting kimmel ch1-2 Kimmel financial accounting 7e

Kimmel financial accounting 7e Kieso intermediate accounting chapter 21 solutions

Kieso intermediate accounting chapter 21 solutions Liabilitas jangka pendek

Liabilitas jangka pendek Primary qualities of accounting information

Primary qualities of accounting information Intermediate accounting kieso

Intermediate accounting kieso Intermediate accounting kieso

Intermediate accounting kieso Intermediate accounting kieso

Intermediate accounting kieso Intermediate accounting kieso

Intermediate accounting kieso Intermediate accounting kieso

Intermediate accounting kieso Intermediate accounting kieso

Intermediate accounting kieso Intermediate accounting kieso

Intermediate accounting kieso Intermediate accounting kieso chapter 17 investment

Intermediate accounting kieso chapter 17 investment Accounting principles 13th edition

Accounting principles 13th edition Accounting principles 13th edition

Accounting principles 13th edition