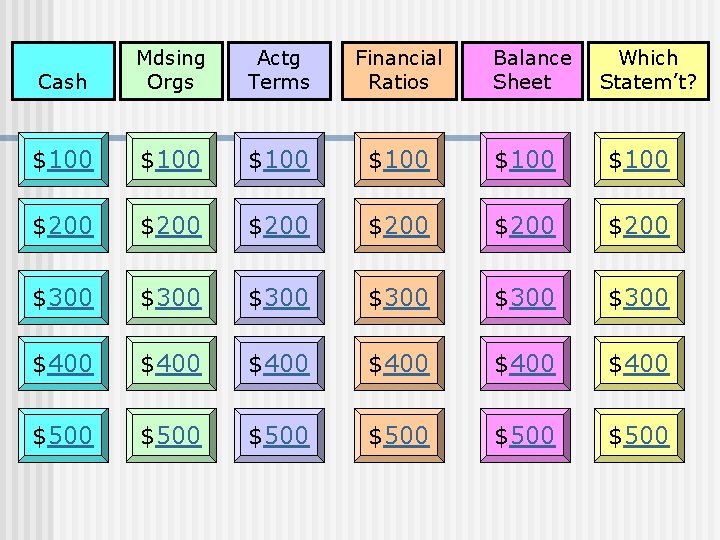

Accounting Jeopardy Financial Todays Categories Cash n Merchandising

- Slides: 35

Accounting Jeopardy… Financial

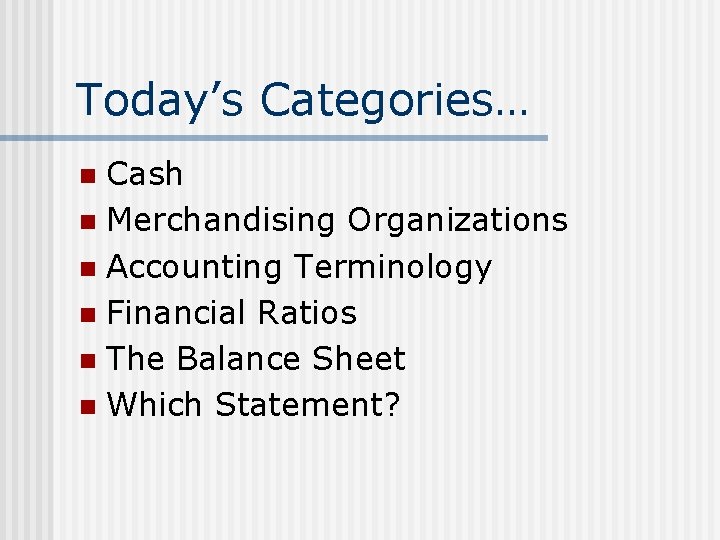

Today’s Categories… Cash n Merchandising Organizations n Accounting Terminology n Financial Ratios n The Balance Sheet n Which Statement? n

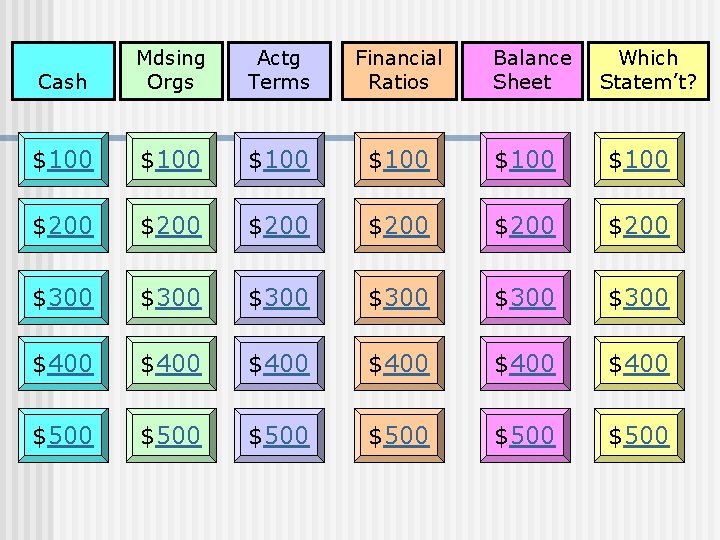

Cash Mdsing Orgs Actg Terms Financial Ratios Balance Sheet Which Statem’t? $100 $100 $200 $200 $300 $300 $400 $400 $500 $500

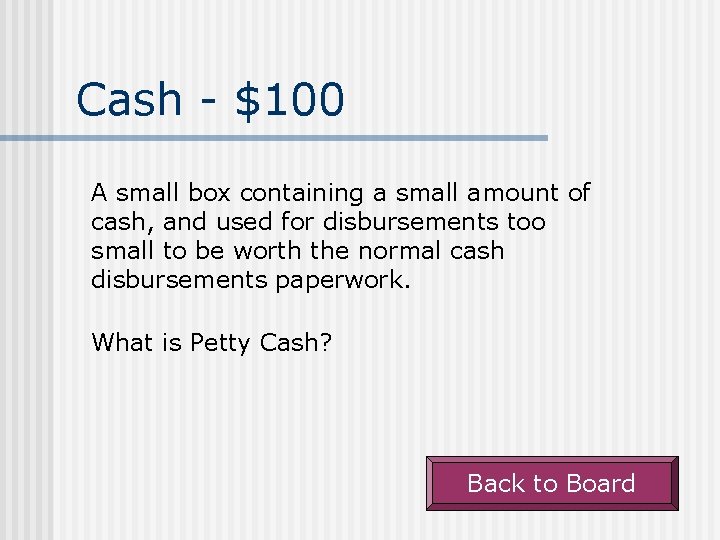

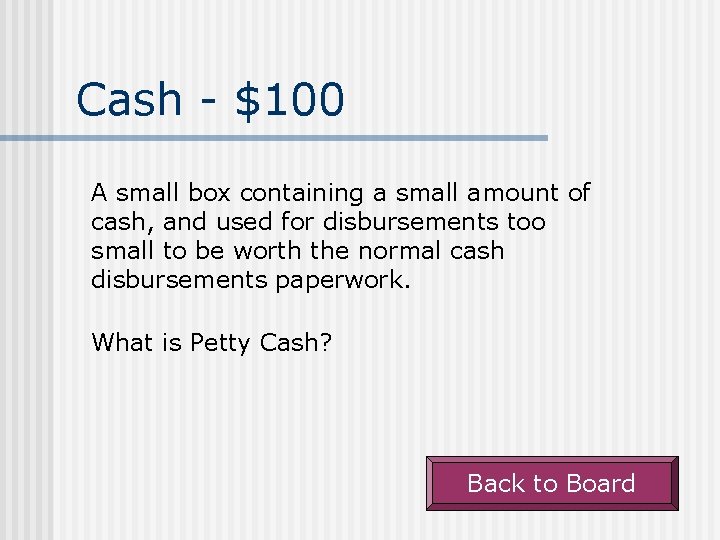

Cash - $100 A small box containing a small amount of cash, and used for disbursements too small to be worth the normal cash disbursements paperwork. What is Petty Cash? Back to Board

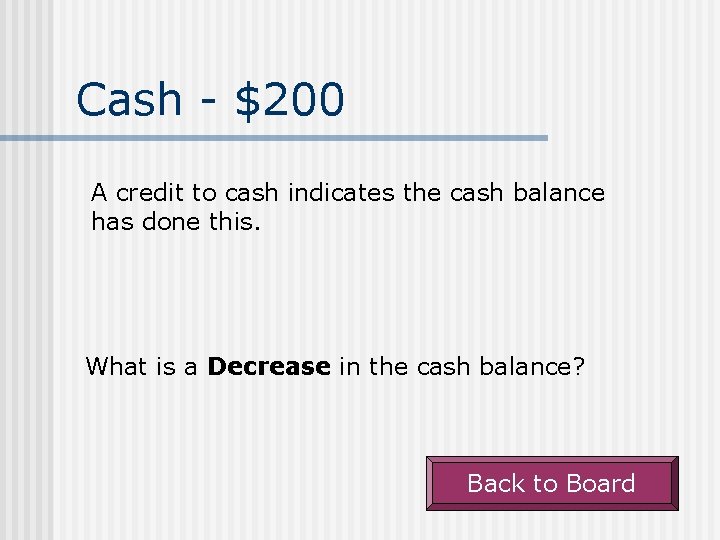

Cash - $200 A credit to cash indicates the cash balance has done this. What is a Decrease in the cash balance? Back to Board

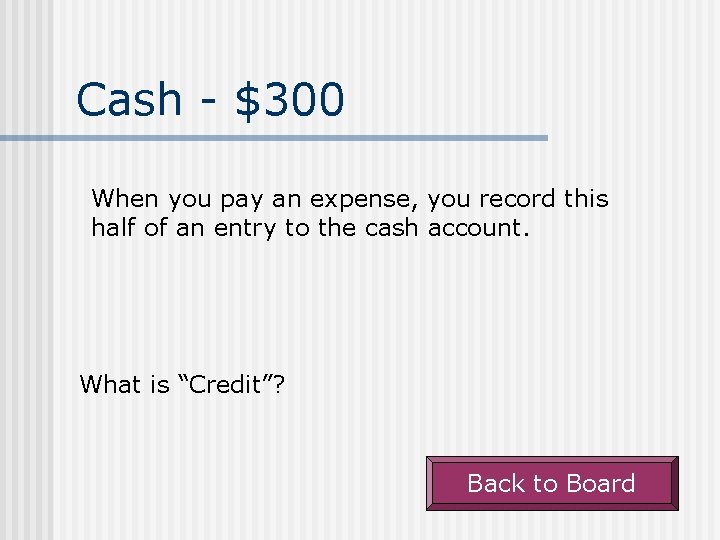

Cash - $300 When you pay an expense, you record this half of an entry to the cash account. What is “Credit”? Back to Board

Cash - $400 The bank issues this type of memo to notify you that they have reduced your checking account balance. What is a Debit Memo? Back to Board

Cash - $500 The name of the account used to write-off small cash account errors, when those errors are too small and immaterial to be worth the time needed to investigate them. What is “Cash Short and Over”? Back to Board

Merchandising - $100 This balance sheet account holds the value of purchased merchandise (and its incoming freight) until the goods are sold. What is the Inventory account? Back to Board

Merchandising $200 When merchandise is sold on terms of Net 30, you debit this account for the amount charged to the customer. What is “Accounts Receivable”? Back to Board

Merchandising $300 When merchandise is sold, you debit this account for the cost of the products which went out the door with the customer. What is “Cost of Goods Sold”? Back to Board

Merchandising $400 When you sell merchandise, you credit this account for the amount charged the customer. What is Revenue? Back to Board

Merchandising $500 When a company sells merchandise, it credits this account for the cost of the goods that went out the door with the customer. What is the Inventory account? Back to Board

Terminology $100 A reduction in assets, caused by the normal operation of the business, is usually this. What is an Expense? Back to Board

Terminology $200 Alpha Corp. loans money to Zulu Co. ; Zulu gives Alpha this document, which can then be freely traded on the secondary market. What is a Marketable Security (or Debt Security)? Back to Board

Terminology $300 DAILY DOUBLE!!!

Terminology $400 The most liquid asset of all. What is Cash? Back to Board

Terminology $500 One of the three methods of Accelerated Depreciation mentioned in class. What is Sum-of-Years-Digits, OR Double. Declining Balance, OR MACRS? Back to Board

Ratios - $100 Net Income divided by Number of Shares Outstanding. What is Earnings per Share (or EPS)? Back to Board

Ratios - $200 Current Assets divided by Current Liabilities What is the Current Ratio? Back to Board

Ratios - $300 Cost of Goods Sold divided by Inventory. What is Inventory Turnover? Back to Board

Ratios - $400 Sales divided by Accounts Receivable. What is A/R Turnover? Back to Board

Ratios - $500 This ratio is 365 divided by A/R Turnover. What is Average Days to Collect? Back to Board

Balance Sheet - $100 Prepaid Rent appears under this major section of the Balance Sheet. What is the “Asset” section? Back to Board

Balance Sheet - $200 Allowance for Bad Debt appears under this major section of the Balance Sheet. What are “Assets”? Back to Board

Balance Sheet $300 Warranty Obligations appears under this major section of the Balance Sheet. What is the “Liabilities” section of the Balance Sheet? Back to Board

Balance Sheet - $400 Unearned Revenue appears under this major section of the Balance Sheet. What is the “Liability” section of the Balance Sheet? Back to Board

Balance Sheet - $500 Unrealized Gain on Available for Sale Securities is reported under this major section of the Balance Sheet. What is the “Equity” section of the Balance Sheet? Back to Board

Which Statement $100 Gross Margin appears on this statement. What is the Income Statement? Back to Board

Which Statement $200 Gain on Disposal of Equipment appears on this statement. What is the Income Statement? Back to Board

Which Statement $300 Accumulated Depreciation appears on this statement. What is the Balance Sheet? Back to Board

Which Statement $400 Unrealized Gain on Trading Securities appears on this statement. What is the Income Statement? Back to Board

Which Statement $500 Wages Payable to Employees appears on this statement. What is the Balance Sheet? Back to Board

Daily Double n Specify Your Wager!

Terminology --When a company sells on credit, it uses this account to set aside an amount in expectation that some or all of the receivable will eventually become uncollectible. What is “Allowance for Bad Debt”. Back to Board