Accounting I Semester Exam Review An entry level

- Slides: 102

Accounting I Semester Exam Review

An entry level job performing one or two accounting tasks is called a(n) a. b. c. d. accounting clerk entrepreneur internship staff accountant 5

An entry level job performing one or two accounting tasks is called a(n) a. b. c. d. accounting clerk entrepreneur internship staff accountant 5

To find information about a career in accounting a. look for information on accounting careers in the library b. research career information on the internet c. talk to someone who works in the accounting field d. all of the above 3

To find information about a career in accounting a. look for information on accounting careers in the library b. research career information on the internet c. talk to someone who works in the accounting field d. all of the above 3

• The most common form of business organization is a a. b. c. d. corporation lemonade stand partnership sole proprietorship 10

• The most common form of business organization is a a. b. c. d. corporation lemonade stand partnership sole proprietorship 10

A merchandising business a. buys raw materials and transforms them into finished products b. buys finished products and resells them c. provides a service for a fee d. all of the above 6

A merchandising business a. buys raw materials and transforms them into finished products b. buys finished products and resells them c. provides a service for a fee d. all of the above 6

A business that operates to support a cause or interest is known as a a. b. c. d. career goal not-for-profit organization private entity sports franchise 4

A business that operates to support a cause or interest is known as a a. b. c. d. career goal not-for-profit organization private entity sports franchise 4

A corporation is a business organization that is recognized by law to a. b. c. d. have a life of its own have an active social life have at least 3 owners pay no tax 8

A corporation is a business organization that is recognized by law to a. b. c. d. have a life of its own have an active social life have at least 3 owners pay no tax 8

Accounting is often called the "language of business" because a. accountants in many companies share financial information b. all business owners have a good understanding of accounting principles c. it is easy to understand d. it is fundamental to the communication of financial information 15

Accounting is often called the "language of business" because a. accountants in many companies share financial information b. all business owners have a good understanding of accounting principles c. it is easy to understand d. it is fundamental to the communication of financial information 15

Money supplied by investors, banks, or owners of a business is called a. b. c. d. capital incurred expenses secondary alignment pin money 7

Money supplied by investors, banks, or owners of a business is called a. b. c. d. capital incurred expenses secondary alignment pin money 7

The amount of money earned after the costs of operating a business are paid is _______. capital b. expense c. profit d. revenue a. 1

The amount of money earned after the costs of operating a business are paid is _______. capital b. expense c. profit d. revenue a. 1

A free enterprise system allows businesses to a. have their government choose their products b. produce the goods and services they choose c. buy goods at a discount d. operate at a profit 9

A free enterprise system allows businesses to a. have their government choose their products b. produce the goods and services they choose c. buy goods at a discount d. operate at a profit 9

Those who transform ideas for products or services into real-world businesses are known as a. b. c. d. accountants entrepreneurs organizers profit takers 11

Those who transform ideas for products or services into real-world businesses are known as a. b. c. d. accountants entrepreneurs organizers profit takers 11

One of the disadvantages of a sole proprietorship is a. all the profits go to the owner b. it is easy to set up c. the owner has all the risks d. there are few regulations to follow 13

One of the disadvantages of a sole proprietorship is a. all the profits go to the owner b. it is easy to set up c. the owner has all the risks d. there are few regulations to follow 13

One example of an accounting assumption is a. b. c. d. business entity financial accounting financial reports management accounting 17

One example of an accounting assumption is a. b. c. d. business entity financial accounting financial reports management accounting 17

A business owned by two or more people is called a. b. c. d. a corporation a partnership looking for trouble venture capital 12

A business owned by two or more people is called a. b. c. d. a corporation a partnership looking for trouble venture capital 12

The total revenue for the period is $25, 496, the total expenses are $13, 387, and the withdrawals account has an ending balance of $2, 500. The capital account increased by ______. a. b. c. d. $9, 609 $12, 109 $14, 609 $27, 996 23

The total revenue for the period is $25, 496, the total expenses are $13, 387, and the withdrawals account has an ending balance of $2, 500. The capital account increased by ______. a. b. c. d. $9, 609 $12, 109 $14, 609 $27, 996 23

Closing entries close the net income or net loss into the . a. b. c. d. revenue account expense account capital account cash in bank account 20

Closing entries close the net income or net loss into the . a. b. c. d. revenue account expense account capital account cash in bank account 20

GAAP stands for a. a clothing store b. generally accepted accounting period c. generally accepted accounting principles d. generally allowed accounting principles 16.

GAAP stands for a. a clothing store b. generally accepted accounting period c. generally accepted accounting principles d. generally allowed accounting principles 16.

When accounting information is processed by hand it is called a. b. c. d. a financial reporting system a manual accounting system an in-house system open accounting 14.

When accounting information is processed by hand it is called a. b. c. d. a financial reporting system a manual accounting system an in-house system open accounting 14.

The source of information for the closing entries is the ____. a. b. c. d. balance sheet income statement work sheet all the above 22.

The source of information for the closing entries is the ____. a. b. c. d. balance sheet income statement work sheet all the above 22.

The word equities refers to claims against the assets of a business by a. b. c. d. . creditors only owners only customers only both creditors and owners 25

The word equities refers to claims against the assets of a business by a. b. c. d. . creditors only owners only customers only both creditors and owners 25

If the trial balance section of the work sheet is out of balance, the first thing you should do is. a. check the ledger accounts against the work sheet b. add the columns again c. recopy the accounts and balances to a new work sheet d. look in the ledger for the amount of the difference 19.

If the trial balance section of the work sheet is out of balance, the first thing you should do is. a. check the ledger accounts against the work sheet b. add the columns again c. recopy the accounts and balances to a new work sheet d. look in the ledger for the amount of the difference 19.

Each of the following is a business expense except a payment for _____. a. b. c. d. advertising equipment monthly rent utilities bills 24

Each of the following is a business expense except a payment for _____. a. b. c. d. advertising equipment monthly rent utilities bills 24

Accounting is often called the "language of business" because a. b. c. d. asset accounts liability accounts permanent accounts temporary accounts 18

Accounting is often called the "language of business" because a. b. c. d. asset accounts liability accounts permanent accounts temporary accounts 18

A business that operates to earn money for its owners is called a(n) a. career b. for-profit business c. owner financed business d. professional organization 2

A business that operates to earn money for its owners is called a(n) a. career b. for-profit business c. owner financed business d. professional organization 2

When closing the withdrawals account, transfer the balance in this account to the _____ account. a. b. c. d. capital expense income summary revenue 21

When closing the withdrawals account, transfer the balance in this account to the _____ account. a. b. c. d. capital expense income summary revenue 21

True or False

Corporations often start out as sole proprietorship or partnerships. True or False

Corporations often start out as sole proprietorship or partnerships. True or False

Accounts Receivable is a liability account. True or False

Accounts Receivable is a liability account. True or False

The corporation is the easiest form of business to organize. True or False

The corporation is the easiest form of business to organize. True or False

Every transaction affects two or more accounts and is recorded by equal amounts of debits and credits. True or False

Every transaction affects two or more accounts and is recorded by equal amounts of debits and credits. True or False

An owner’s equity account is increased on the debit side and normally has a debit balance. True or False

An owner’s equity account is increased on the debit side and normally has a debit balance. True or False

An increase in revenue is recorded as a credit. True or False

An increase in revenue is recorded as a credit. True or False

A credit to an account always increases it; a debit to an account always decreases it. True or False

A credit to an account always increases it; a debit to an account always decreases it. True or False

The debit and credit parts of an entry must be equal for the accounting equation to remain in balance. True or False

The debit and credit parts of an entry must be equal for the accounting equation to remain in balance. True or False

Only businesses that earn a profit will have the economic resources to continue to operate. True or False

Only businesses that earn a profit will have the economic resources to continue to operate. True or False

When revenue accounts are closed, the Income Summary account is debited. True or False

When revenue accounts are closed, the Income Summary account is debited. True or False

Withdrawals is a permanent account. True or False

Withdrawals is a permanent account. True or False

Increases in expenses are recorded as debits. True or False

Increases in expenses are recorded as debits. True or False

The balance sheet should be prepared before the statement of changes in owner’s equity. True or False

The balance sheet should be prepared before the statement of changes in owner’s equity. True or False

A work sheet is normally prepared in pencil on standard multicolumn accounting paper. True or False

A work sheet is normally prepared in pencil on standard multicolumn accounting paper. True or False

A net loss occurs when the revenue is greater than the expenses. True or False

A net loss occurs when the revenue is greater than the expenses. True or False

After each transaction, the basic accounting equation should remain in balance. True or False

After each transaction, the basic accounting equation should remain in balance. True or False

Assets + Liabilities = Owner’s Equity is another way to express the basic accounting equation. True or False

Assets + Liabilities = Owner’s Equity is another way to express the basic accounting equation. True or False

The difference between the debit and credit amounts in an account is the account balance. True or False

The difference between the debit and credit amounts in an account is the account balance. True or False

Temporary capital accounts are extensions of the owner’s capital account. True or False

Temporary capital accounts are extensions of the owner’s capital account. True or False

A journal is like a diary of a business because it is the only place where complete details of a transaction are recorded. True or False

A journal is like a diary of a business because it is the only place where complete details of a transaction are recorded. True or False

A creditor has a financial claim to the assets of a business. True or False

A creditor has a financial claim to the assets of a business. True or False

The total financial claims do not have to equal the total cost of the property. True or False

The total financial claims do not have to equal the total cost of the property. True or False

Expenses decrease owner’s equity and are recorded as debits. True or False

Expenses decrease owner’s equity and are recorded as debits. True or False

A fiscal period may be one month, three months, six months, or even one year, but usually it is one year. True or False

A fiscal period may be one month, three months, six months, or even one year, but usually it is one year. True or False

A trial balance is prepared after posting is completed. True or False

A trial balance is prepared after posting is completed. True or False

Accounting semester 1 exam

Accounting semester 1 exam World history semester 1 exam

World history semester 1 exam Us history semester 2 final exam review

Us history semester 2 final exam review Zoology final exam review

Zoology final exam review Physics fall semester exam review

Physics fall semester exam review Fall semester exam review us history

Fall semester exam review us history English 3 fall semester exam review

English 3 fall semester exam review Verbal irony def

Verbal irony def Chemistry

Chemistry Chemistry fall semester exam review answers

Chemistry fall semester exam review answers Chemistry 1 semester exam review

Chemistry 1 semester exam review Financial accounting final exam multiple choice

Financial accounting final exam multiple choice Writ of certiorari ap gov example

Writ of certiorari ap gov example English 2 semester exam

English 2 semester exam What is the answer

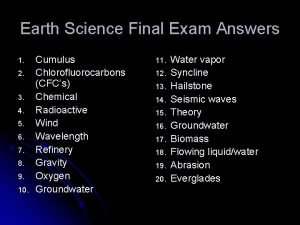

What is the answer Earth science final exam answers

Earth science final exam answers Algebra 2 semester 2 final exam

Algebra 2 semester 2 final exam Spanish packet answers

Spanish packet answers Physics semester 1 final exam study guide answers

Physics semester 1 final exam study guide answers Unit 1 grade 10

Unit 1 grade 10 English 12 a semester exam

English 12 a semester exam Biology 1st semester study guide

Biology 1st semester study guide Us history semester 1 final exam study guide answers

Us history semester 1 final exam study guide answers Unit 1 post test

Unit 1 post test Personal eyeglasses provide as much protection as

Personal eyeglasses provide as much protection as Apes semester 1 final review

Apes semester 1 final review English semester exam

English semester exam World history semester exam

World history semester exam Chemistry semester 2 review unit 12 thermochemistry

Chemistry semester 2 review unit 12 thermochemistry Honors physics semester 2 review

Honors physics semester 2 review World history semester 2 final review packet

World history semester 2 final review packet Geometry unit 1 review

Geometry unit 1 review Biology semester 1 review 2018

Biology semester 1 review 2018 Double entry method

Double entry method Generation of a new entry opportunity

Generation of a new entry opportunity Difference between single entry and double entry system

Difference between single entry and double entry system Books of prime entry

Books of prime entry Capital contribution

Capital contribution Stock split accounting entry

Stock split accounting entry Double-entry accounting meaning

Double-entry accounting meaning Statement of stockholders equity example

Statement of stockholders equity example Spoilage accounting journal entry

Spoilage accounting journal entry Coborn's edi

Coborn's edi Toyota brand hierarchy

Toyota brand hierarchy Uci academic probation

Uci academic probation Edlt cdl

Edlt cdl Eduqas esubmission

Eduqas esubmission Accounting 2101 exam 1

Accounting 2101 exam 1 World history spring final exam review answers

World history spring final exam review answers Exam review template

Exam review template Spanish 1 final review

Spanish 1 final review Human body systems final exam

Human body systems final exam Poe final review

Poe final review Akt sample questions

Akt sample questions Ied final exam

Ied final exam Hbs eoc study guide

Hbs eoc study guide Principles of business final exam answer key

Principles of business final exam answer key Spanish 2 review packet

Spanish 2 review packet Environmental science final review

Environmental science final review Apes exam review

Apes exam review Apwh final exam review

Apwh final exam review Review for exam pronouns

Review for exam pronouns Physics 20 final exam practice

Physics 20 final exam practice Oer eduqas

Oer eduqas Sph3u exam review

Sph3u exam review Physics 1 exam 2 review

Physics 1 exam 2 review Physics exam 2 review

Physics exam 2 review Physical science final exam

Physical science final exam Statics exam 1

Statics exam 1 Mat1033 final exam

Mat1033 final exam Statics final exam review

Statics final exam review Earth science final

Earth science final Mdm exclusives review

Mdm exclusives review Personal finance final exam review

Personal finance final exam review Chapter 24 milady

Chapter 24 milady Thermochemistry exam review

Thermochemistry exam review English ii final exam

English ii final exam Wjecservices

Wjecservices 3rd 9 weeks exam review chemistry

3rd 9 weeks exam review chemistry Romeo and juliet final exam

Romeo and juliet final exam Geometry midterm exam review

Geometry midterm exam review Psyc 1504 final exam

Psyc 1504 final exam Algebra 2 midterm review answers

Algebra 2 midterm review answers Ipma level d exam

Ipma level d exam A level psychology relationships

A level psychology relationships Caia level 2 exam weights

Caia level 2 exam weights Financial accounting chapter 1

Financial accounting chapter 1 Conclusion

Conclusion Conservatism accounting principle

Conservatism accounting principle Role and responsibility of management accountant ppt

Role and responsibility of management accountant ppt Terms review 5-1 accounting

Terms review 5-1 accounting Terms review 9-4 accounting

Terms review 9-4 accounting A computerized cash payments system that transfers funds

A computerized cash payments system that transfers funds 1. 5-1 work together, p. 128

1. 5-1 work together, p. 128 Terms review 10-1 accounting

Terms review 10-1 accounting Chapter review motion part a vocabulary review answer key

Chapter review motion part a vocabulary review answer key Narrative review vs systematic review

Narrative review vs systematic review Narrative review vs systematic review

Narrative review vs systematic review Narrative review vs systematic review

Narrative review vs systematic review Utility of price level accounting

Utility of price level accounting Icaew level 7 apprenticeship

Icaew level 7 apprenticeship Advantages of project appraisal

Advantages of project appraisal Comlex level 3 question bank

Comlex level 3 question bank