Accounting for Contingencies Probable Possible and Remote FASB

Accounting for Contingencies: Probable, Possible, and Remote FASB Statement No. 5: “. . . an existing condition, situation, or set of circumstances involving uncertainty as to possible gain. . . or loss. . . to an enterprise that will ultimately be resolved when one or more future events occur or fail to occur. ”

Accounting for Contingencies: Probable, Possible, and Remote • Contingent losses: Circumstances involving potential losses that will not be resolved until some future event occurs. • Contingent gains: Circumstances involving potential gains that will not be resolved until some future event occurs. 2

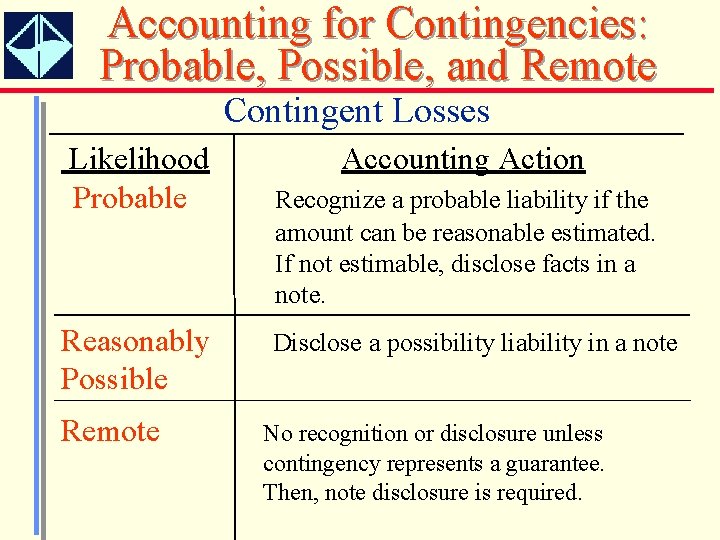

Accounting for Contingencies: Probable, Possible, and Remote Contingent Losses Likelihood Probable Reasonably Possible Remote Accounting Action Recognize a probable liability if the amount can be reasonable estimated. If not estimable, disclose facts in a note. Disclose a possibility liability in a note No recognition or disclosure unless contingency represents a guarantee. Then, note disclosure is required.

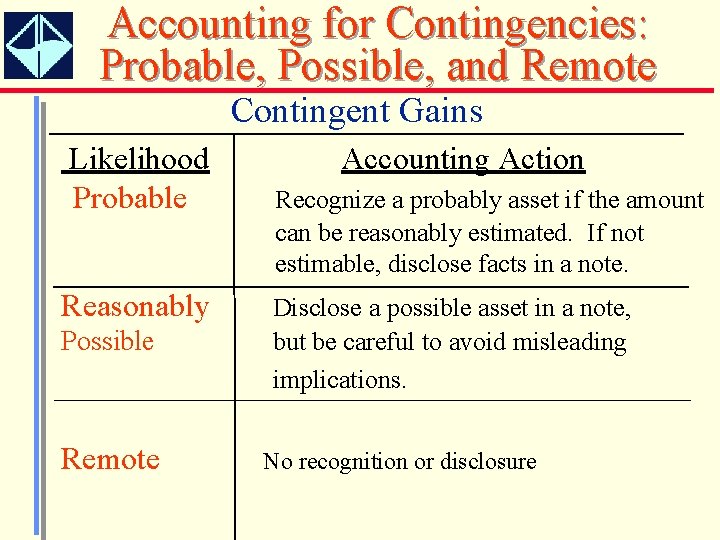

Accounting for Contingencies: Probable, Possible, and Remote Contingent Gains Likelihood Probable Reasonably Possible Remote Accounting Action Recognize a probably asset if the amount can be reasonably estimated. If not estimable, disclose facts in a note. Disclose a possible asset in a note, but be careful to avoid misleading implications. No recognition or disclosure

Accounting for Contingencies: Probable, Possible, and Remote Class Question Do frequent-flier miles meet the definition of a liability? The EITF considered this issue but reached no consensus. 5

Accounting for Lawsuits For uninsured risks, a firm must decide when the liability for litigation becomes probable, and thus, a recorded loss. FASB Statement No. 5 identifies several key factors to consider: § The nature of the lawsuit. § Progress of the case in court, including progress between date of the financial statements and their issuance date. § Views of legal counsel as to the possibility of loss. § Prior experience with similar cases. § Management’s intended response to the lawsuit. 6

Environmental Liabilities FASB Statement No. 5 does not give specific guidance on disclosure required when a loss contingency cannot be estimated. Recently, accounting standard setters have issued several statements and Exposure Drafts designed to improve the environmental liability information reported in the financial statements and notes. 7

Environmental Liabilities The SEC issued Staff Accounting Bulletin No. 92, its interpretation of GAAP regarding contingent liabilities, with particular applicability to companies with environmental liabilities. 1996, AICPA issued Statement of Position 96 -1, “Environmental Remediation Liabilities (including Auditing Guidance). ” This document outlines the key events that can used to determine whether an environmental liability is probable. The FASB issued SFAS No. 143 “Accounting for Asset Retirement Obligations” which concluded that an obligation associated with retiring an asset should be recognized when incurred using present value techniques. The offsetting debit should be an addition to the cost of the associated asset. 8

- Slides: 8