2015 Game Changers Essential Elements of Workforce Planning

- Slides: 16

2015 Game Changers

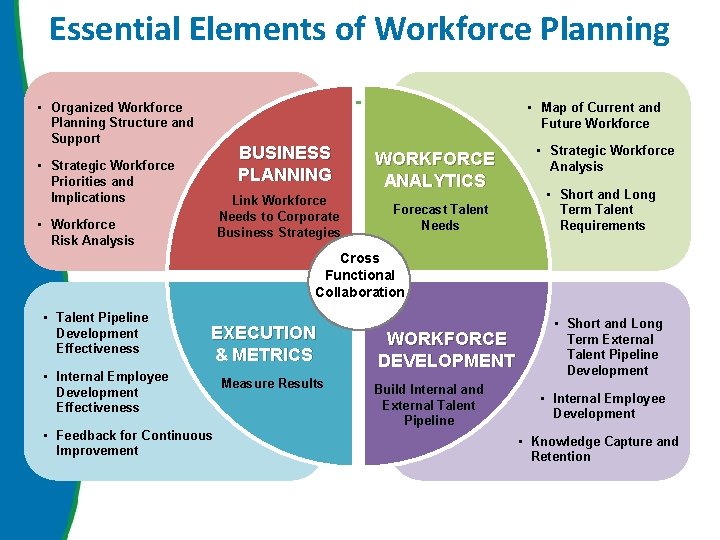

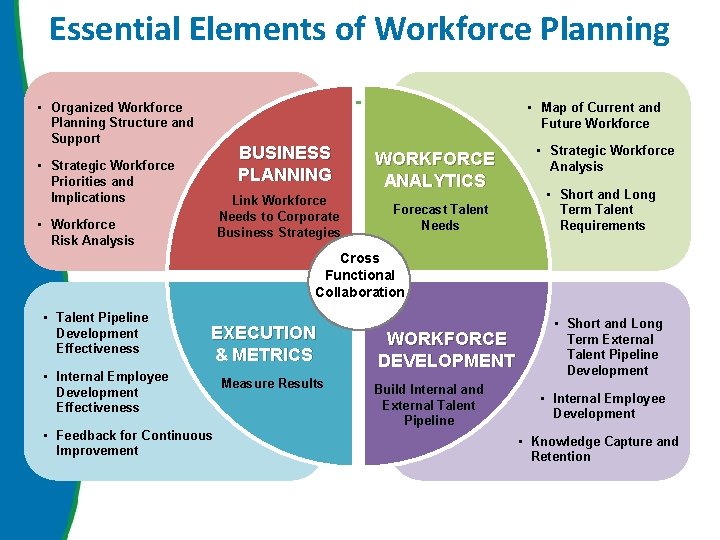

Essential Elements of Workforce Planning • Organized Workforce Planning Structure and Support • Map of Current and Future Workforce BUSINESS PLANNING • Strategic Workforce Priorities and Implications Link Workforce Needs to Corporate Business Strategies • Workforce Risk Analysis WORKFORCE ANALYTICS Forecast Talent Needs • Strategic Workforce Analysis • Short and Long Term Talent Requirements Cross Functional Collaboration • Talent Pipeline Development Effectiveness EXECUTION & METRICS • Internal Employee Development Effectiveness • Feedback for Continuous Improvement Measure Results WORKFORCE DEVELOPMENT Build Internal and External Talent Pipeline • Short and Long Term External Talent Pipeline Development • Internal Employee Development • Knowledge Capture and Retention

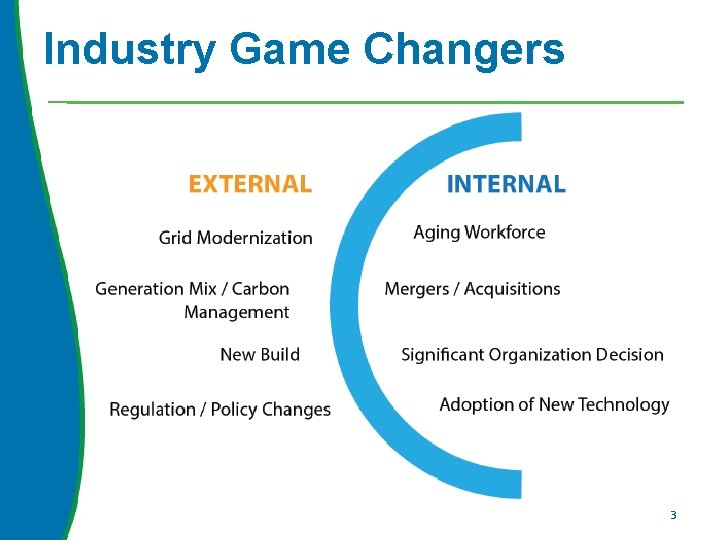

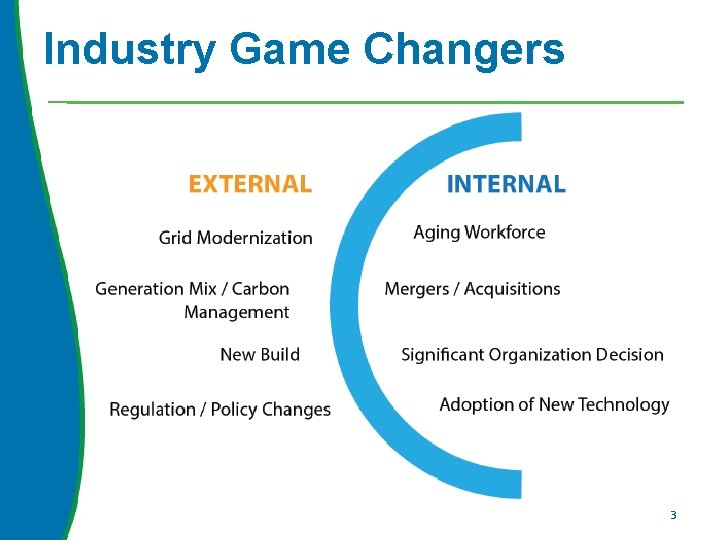

Industry Game Changers 3

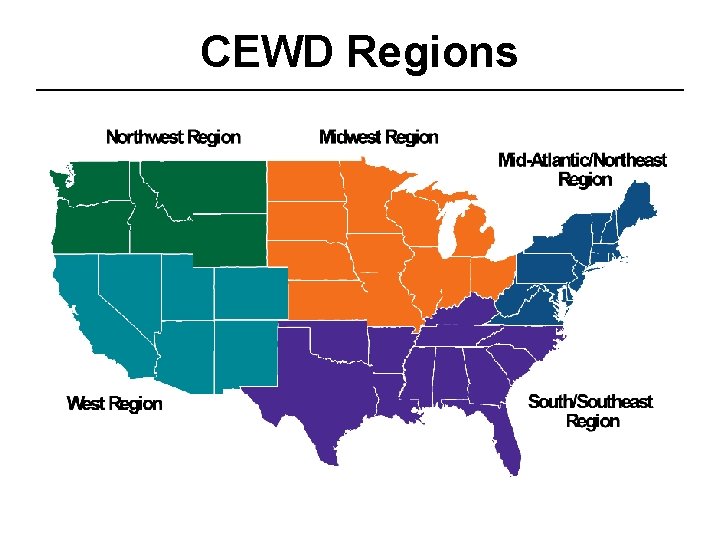

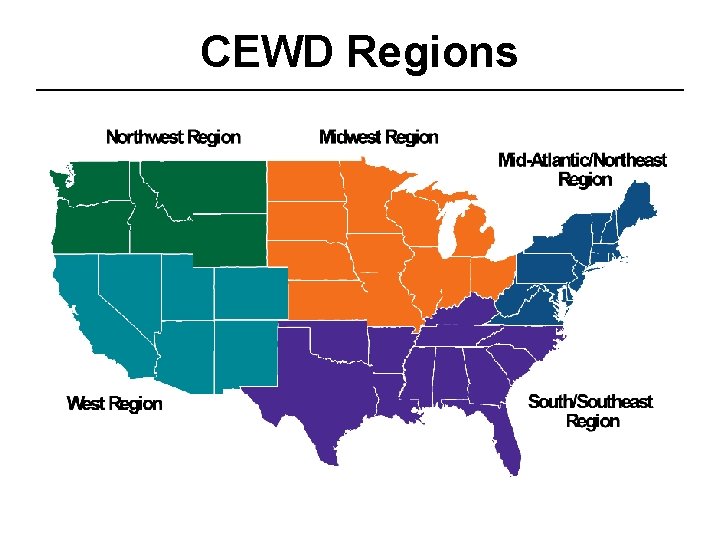

CEWD Regions

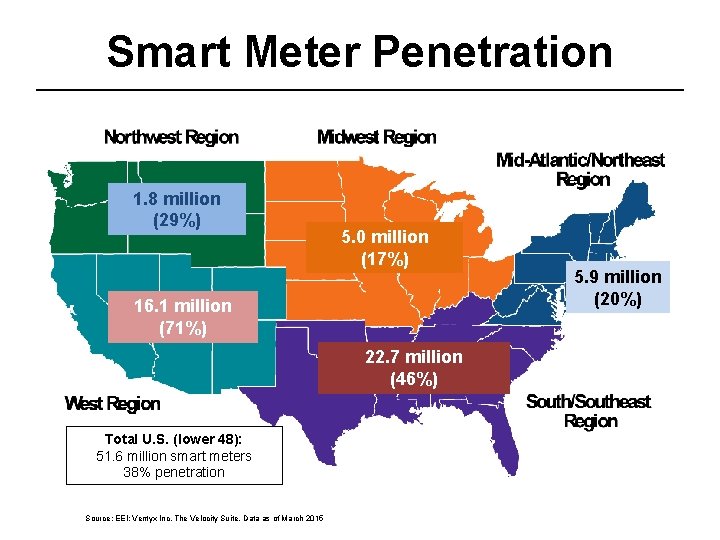

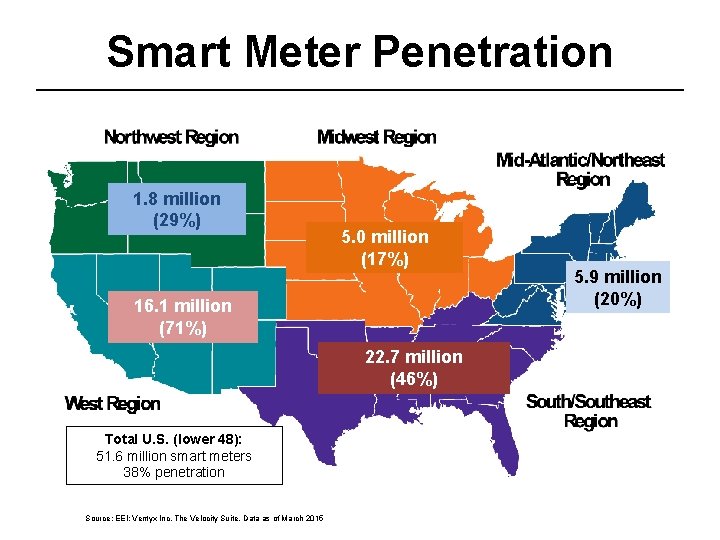

Smart Meter Penetration 1. 8 million (29%) 5. 0 million (17%) 16. 1 million (71%) 22. 7 million (46%) Total U. S. (lower 48): 51. 6 million smart meters 38% penetration Source: EEI; Ventyx Inc, The Velocity Suite. Data as of March 2015 5. 9 million (20%)

Generation Fuel Mix, by CEWD Region Source: EEI; Ventyx Inc, The Velocity Suite. Data as of March 2015

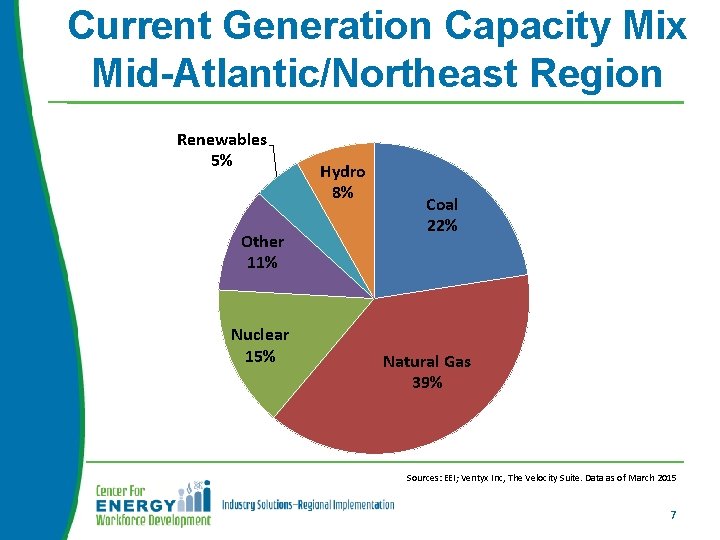

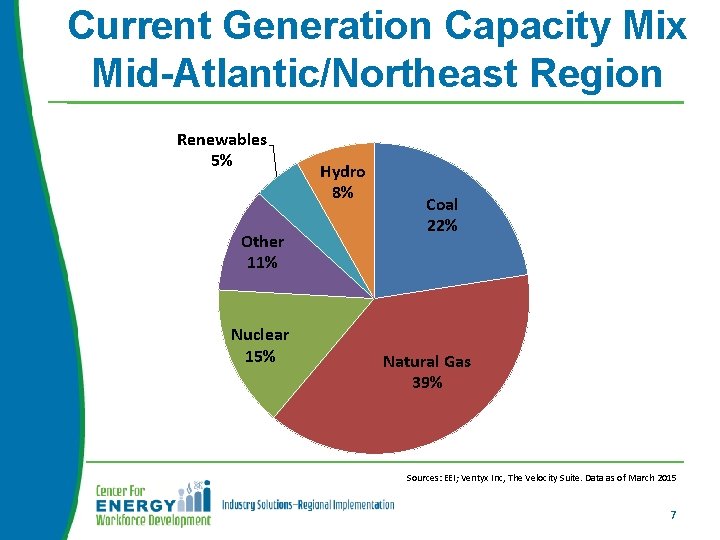

Current Generation Capacity Mix Mid-Atlantic/Northeast Region Renewables 5% Other 11% Nuclear 15% Hydro 8% Coal 22% Natural Gas 39% Sources: EEI; Ventyx Inc, The Velocity Suite. Data as of March 2015 7

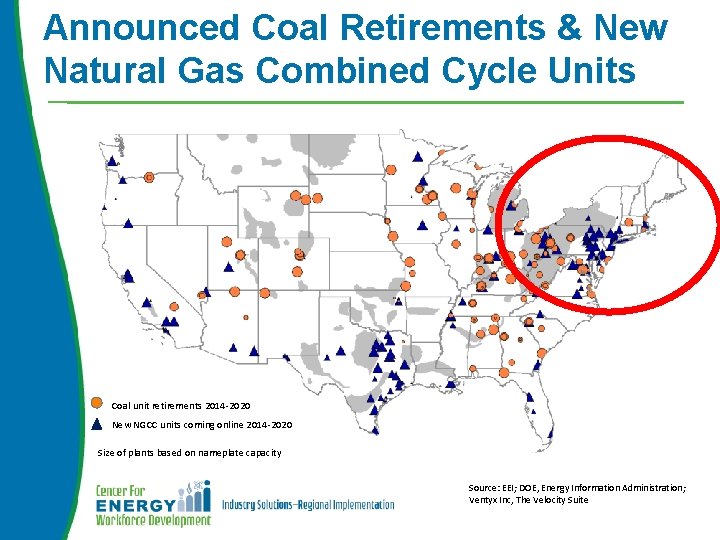

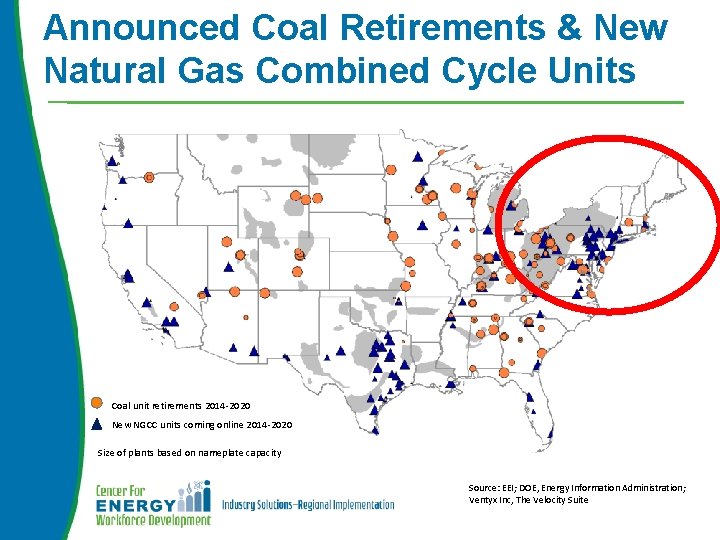

Announced Coal Retirements & New Natural Gas Combined Cycle Units Coal unit retirements 2014 -2020 New NGCC units coming online 2014 -2020 Size of plants based on nameplate capacity Source: EEI; DOE, Energy Information Administration; Ventyx Inc, The Velocity Suite

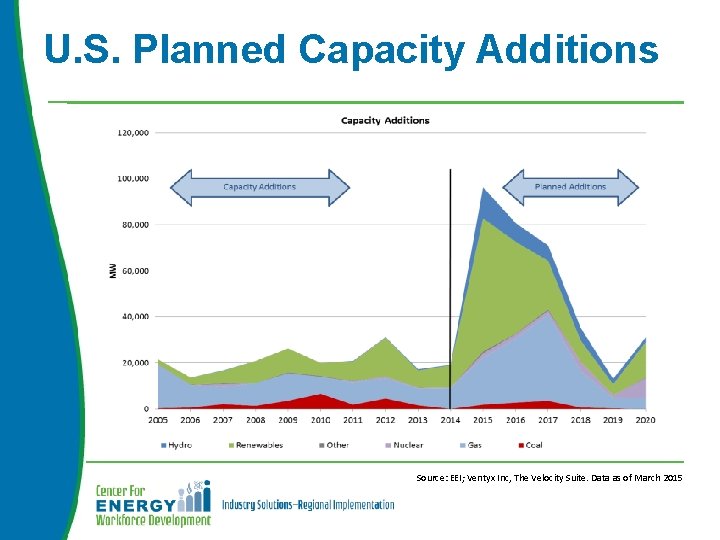

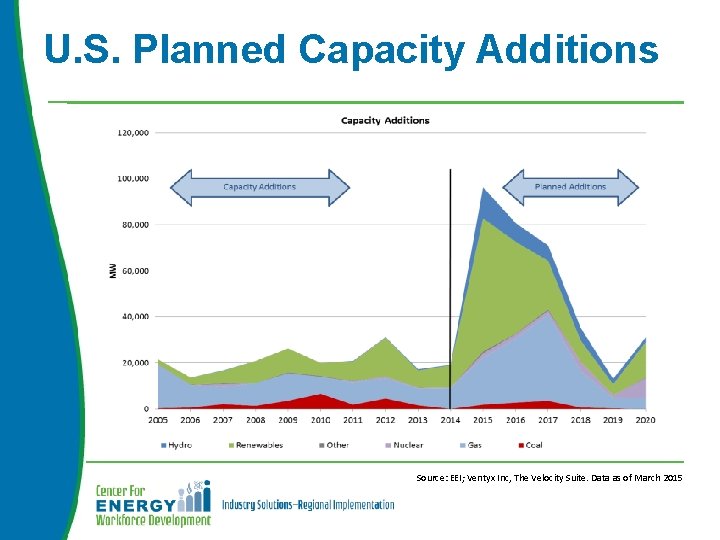

U. S. Planned Capacity Additions Source: EEI; Ventyx Inc, The Velocity Suite. Data as of March 2015

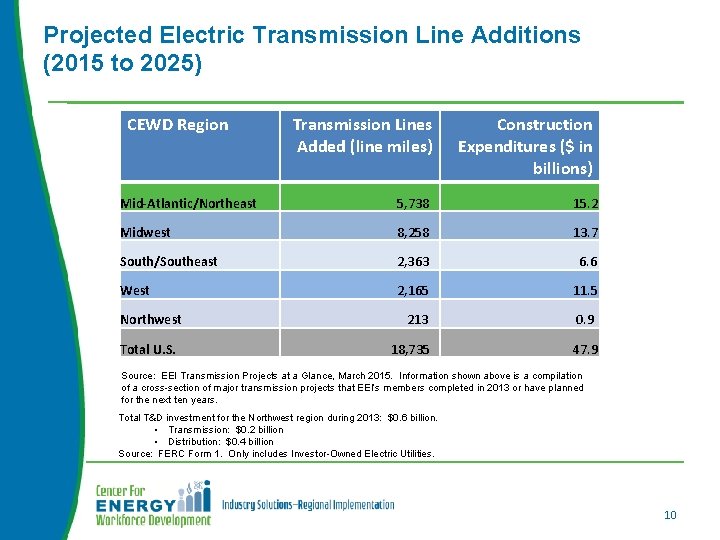

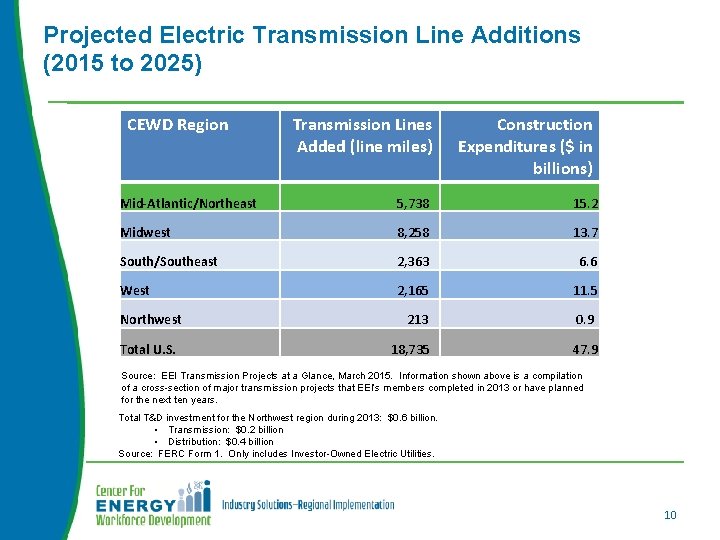

Projected Electric Transmission Line Additions (2015 to 2025) CEWD Region Transmission Lines Added (line miles) Construction Expenditures ($ in billions) Mid-Atlantic/Northeast 5, 738 15. 2 Midwest 8, 258 13. 7 South/Southeast 2, 363 6. 6 West 2, 165 11. 5 213 0. 9 18, 735 47. 9 Northwest Total U. S. Source: EEI Transmission Projects at a Glance, March 2015. Information shown above is a compilation of a cross-section of major transmission projects that EEI’s members completed in 2013 or have planned for the next ten years. Total T&D investment for the Northwest region during 2013: $0. 6 billion. • Transmission: $0. 2 billion • Distribution: $0. 4 billion Source: FERC Form 1. Only includes Investor-Owned Electric Utilities. 10

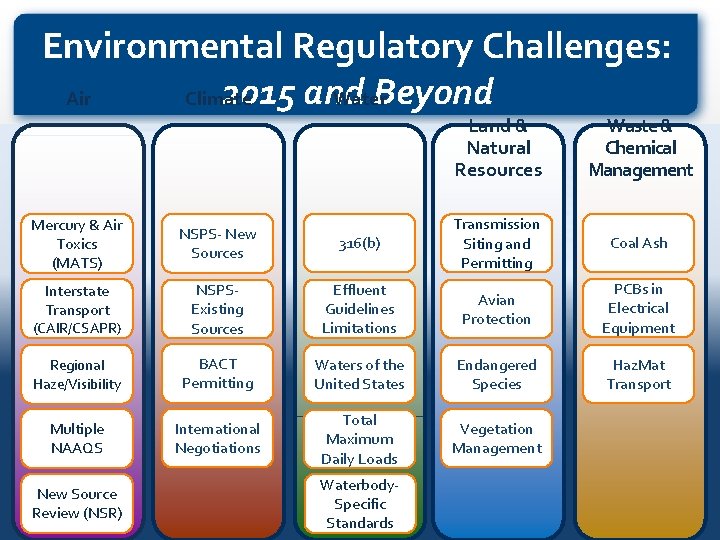

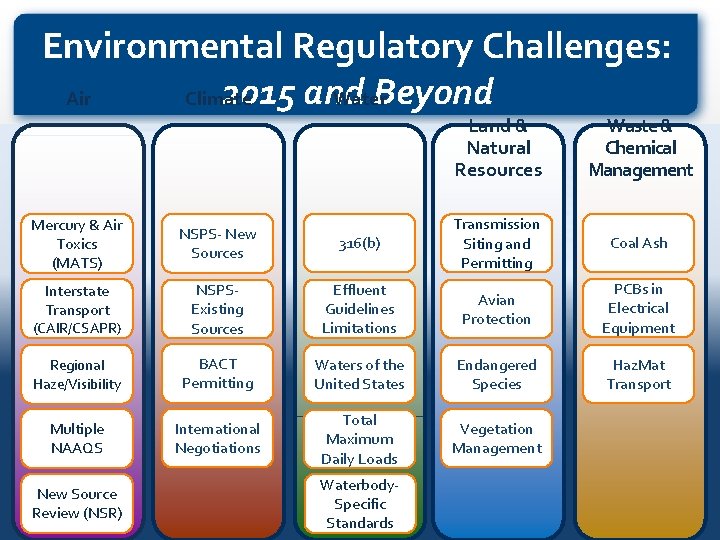

Environmental Regulatory Challenges: 2015 and Beyond Air Climate Water Land & Natural Resources Waste & Chemical Management Coal Ash NSPS- New Sources 316(b) Transmission Siting and Permitting Interstate Transport (CAIR/CSAPR) NSPSExisting Sources Effluent Guidelines Limitations Avian Protection PCBs in Electrical Equipment Regional Haze/Visibility BACT Permitting Waters of the United States Endangered Species Haz. Mat Transport Multiple NAAQS International Negotiations Total Maximum Daily Loads Vegetation Management Mercury & Air Toxics (MATS) New Source Review (NSR) Waterbody. Specific Standards

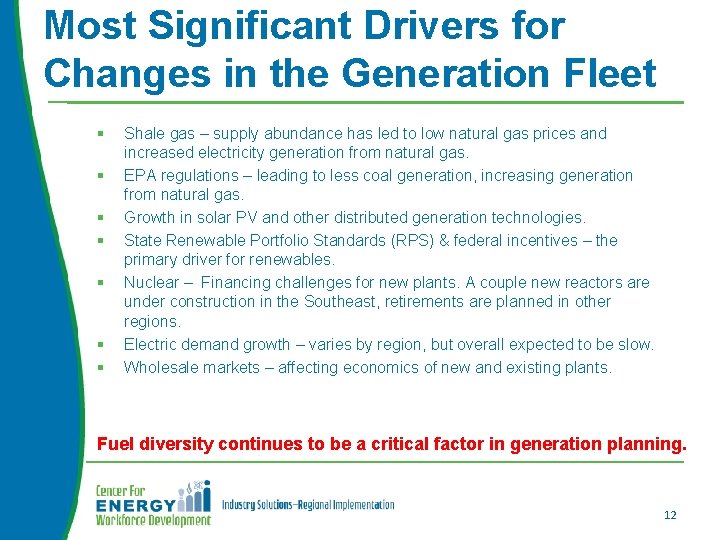

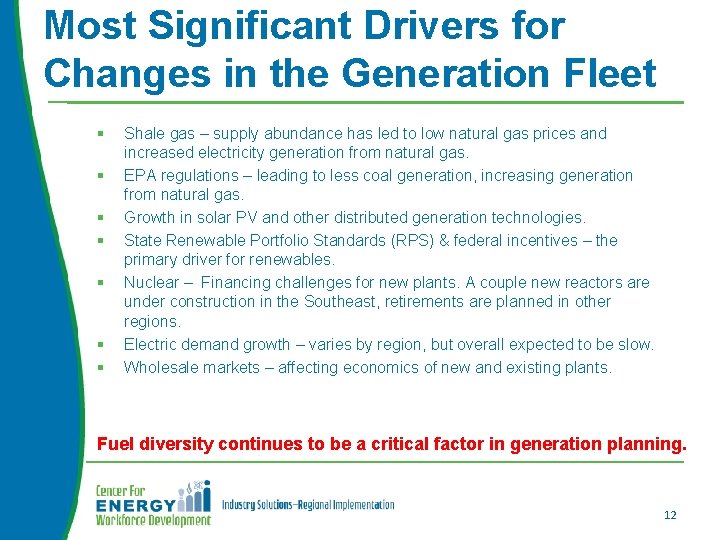

Most Significant Drivers for Changes in the Generation Fleet § § § § Shale gas – supply abundance has led to low natural gas prices and increased electricity generation from natural gas. EPA regulations – leading to less coal generation, increasing generation from natural gas. Growth in solar PV and other distributed generation technologies. State Renewable Portfolio Standards (RPS) & federal incentives – the primary driver for renewables. Nuclear – Financing challenges for new plants. A couple new reactors are under construction in the Southeast, retirements are planned in other regions. Electric demand growth – varies by region, but overall expected to be slow. Wholesale markets – affecting economics of new and existing plants. Fuel diversity continues to be a critical factor in generation planning. 12

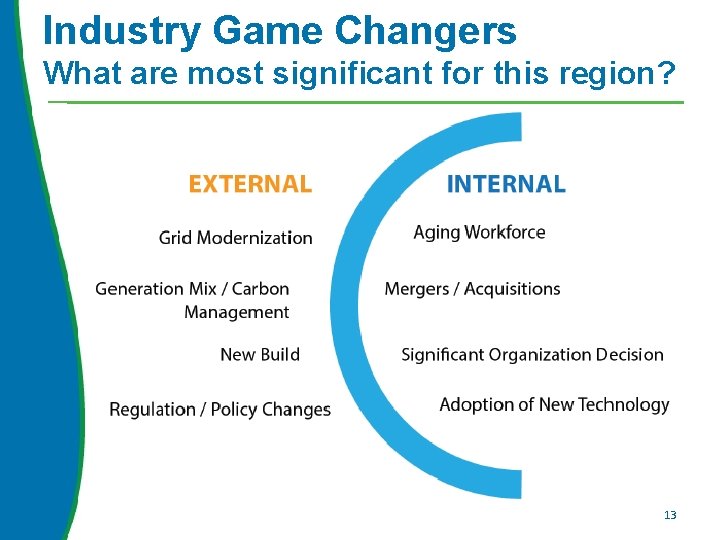

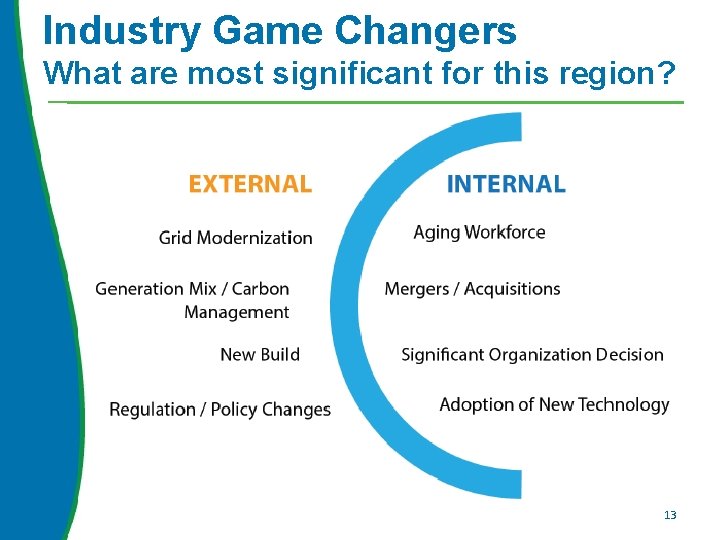

Industry Game Changers What are most significant for this region? 13

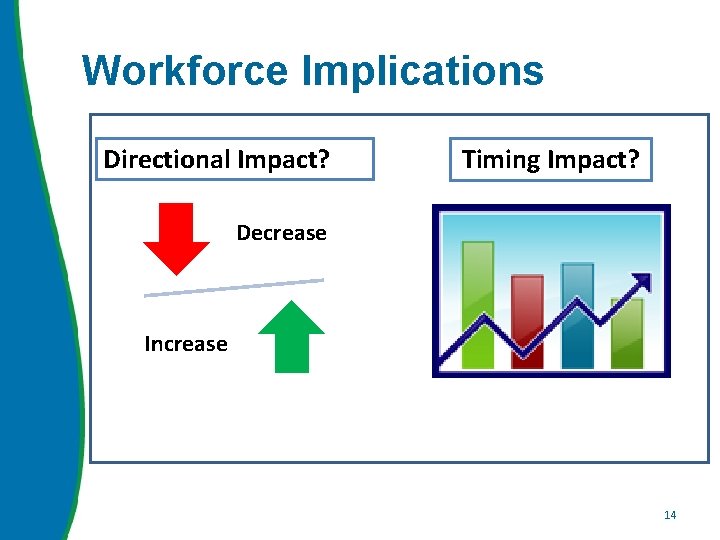

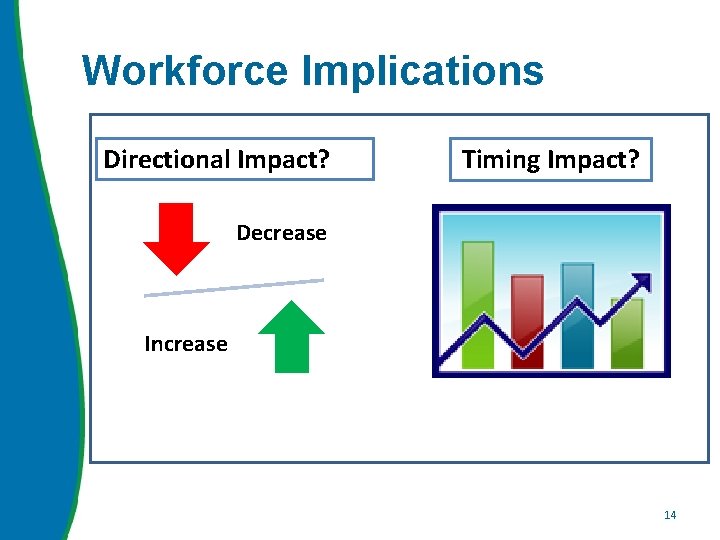

Workforce Implications Directional Impact? Timing Impact? Decrease Increase 14

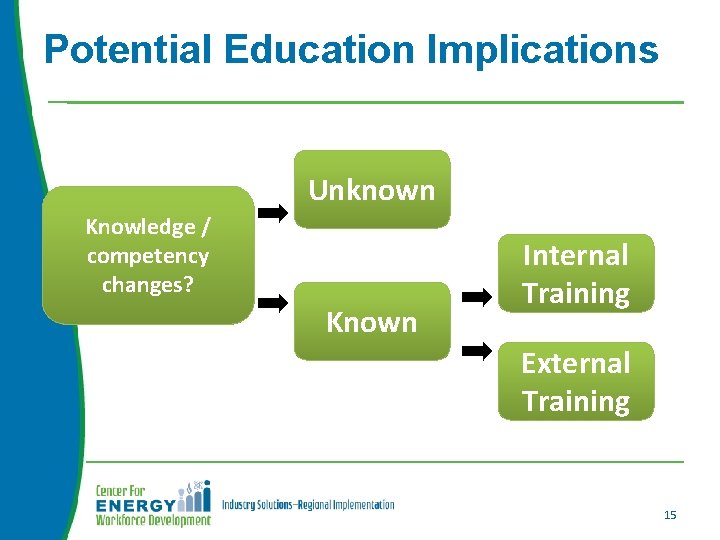

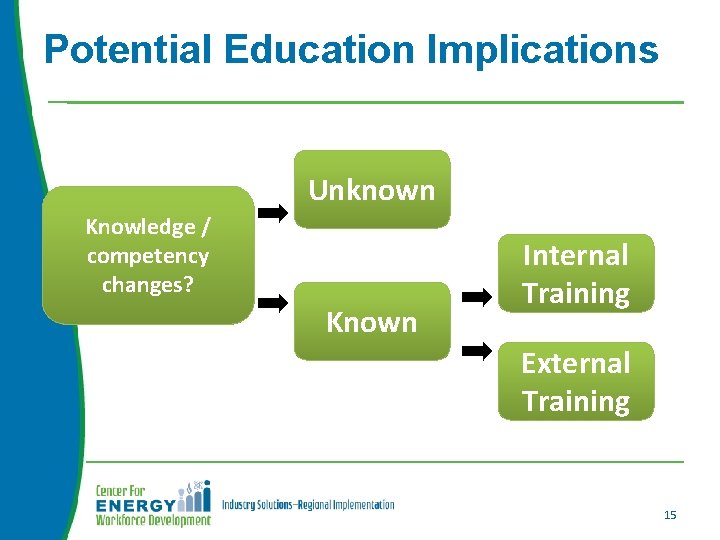

Potential Education Implications Unknown Knowledge / competency changes? Known Internal Training External Training 15

For more information, contact: Ann Randazzo Executive Director Center for Energy Workforce Development ann@cewd. org 703 -237 -7927 www. cewd. org