15 053 l Sensitivity Analysis l presented as

- Slides: 46

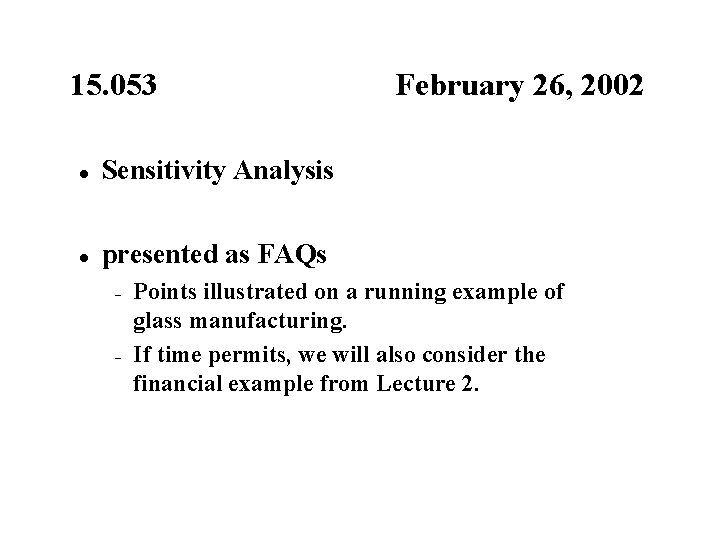

15. 053 l Sensitivity Analysis l presented as FAQs – – February 26, 2002 Points illustrated on a running example of glass manufacturing. If time permits, we will also consider the financial example from Lecture 2.

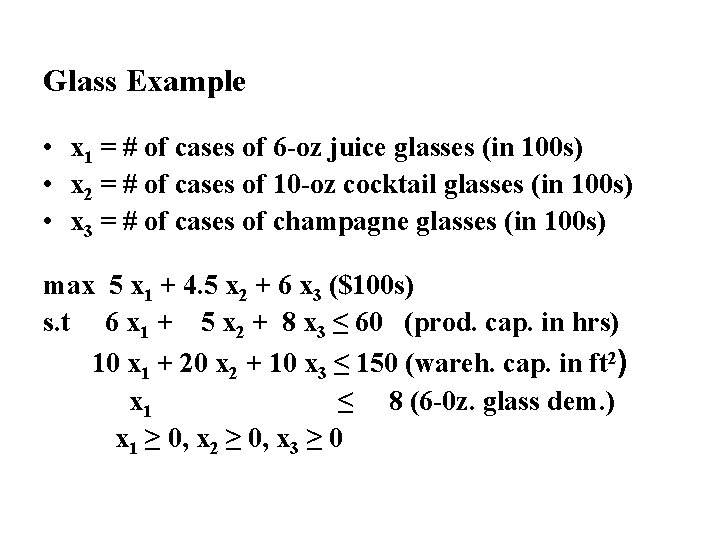

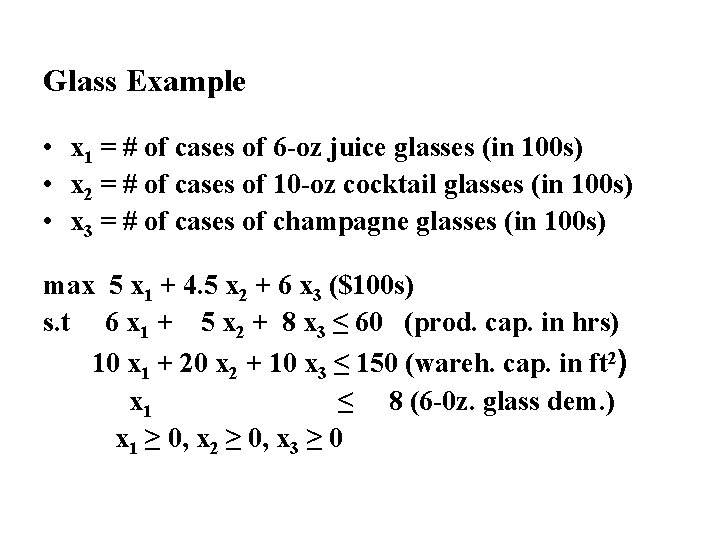

Glass Example • x 1 = # of cases of 6 -oz juice glasses (in 100 s) • x 2 = # of cases of 10 -oz cocktail glasses (in 100 s) • x 3 = # of cases of champagne glasses (in 100 s) max 5 x 1 + 4. 5 x 2 + 6 x 3 ($100 s) s. t 6 x 1 + 5 x 2 + 8 x 3 ≤ 60 (prod. cap. in hrs) 10 x 1 + 20 x 2 + 10 x 3 ≤ 150 (wareh. cap. in ft 2) x 1 ≤ 8 (6 -0 z. glass dem. ) x 1 ≥ 0, x 2 ≥ 0, x 3 ≥ 0

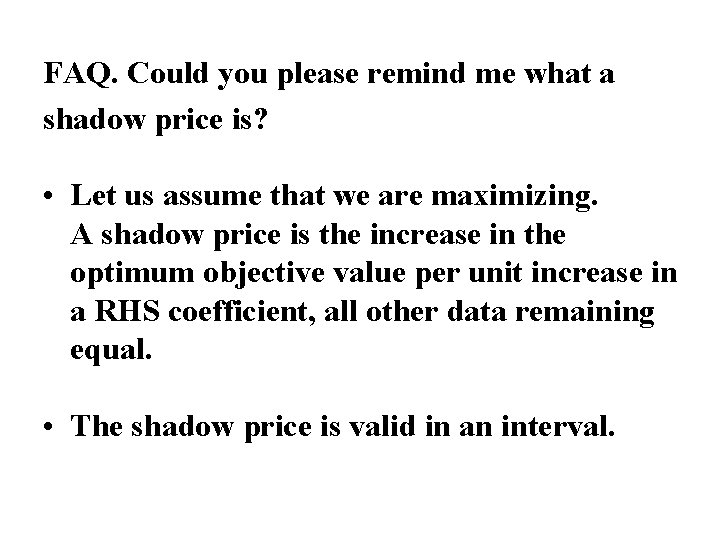

FAQ. Could you please remind me what a shadow price is? • Let us assume that we are maximizing. A shadow price is the increase in the optimum objective value per unit increase in a RHS coefficient, all other data remaining equal. • The shadow price is valid in an interval.

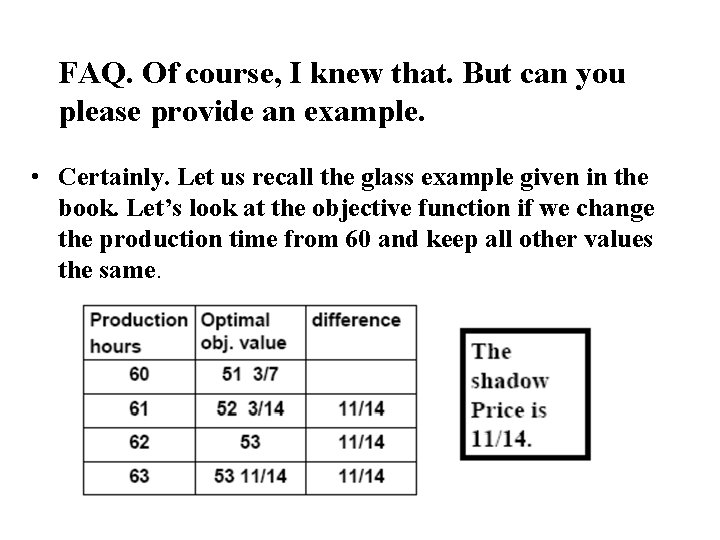

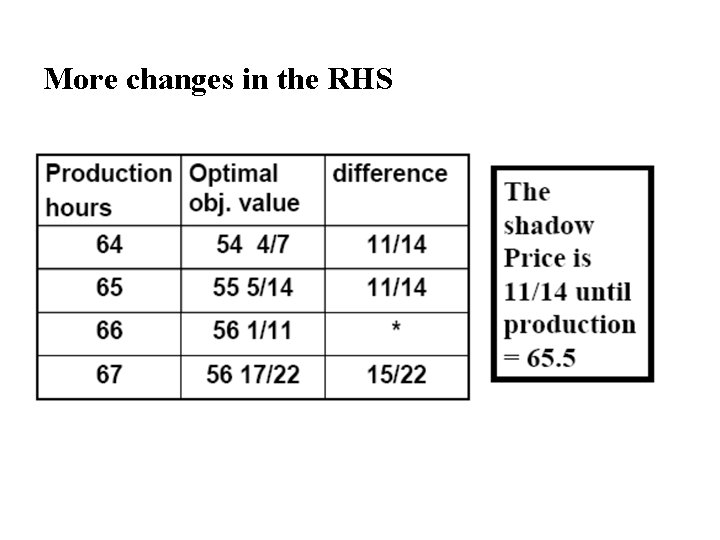

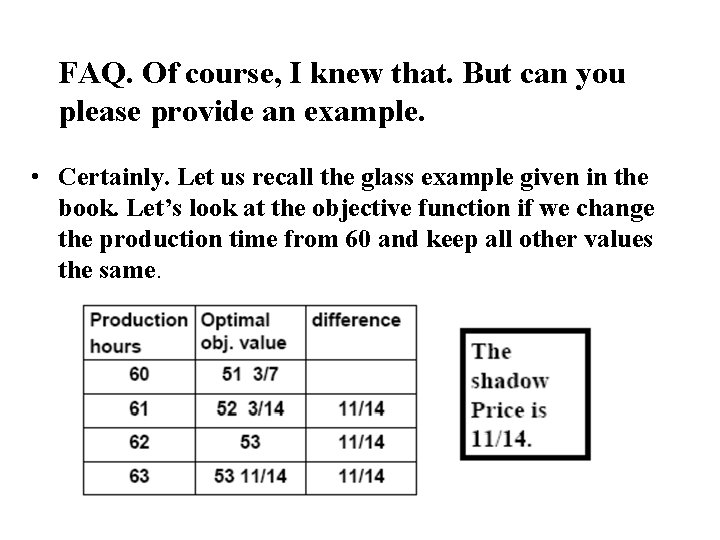

FAQ. Of course, I knew that. But can you please provide an example. • Certainly. Let us recall the glass example given in the book. Let’s look at the objective function if we change the production time from 60 and keep all other values the same.

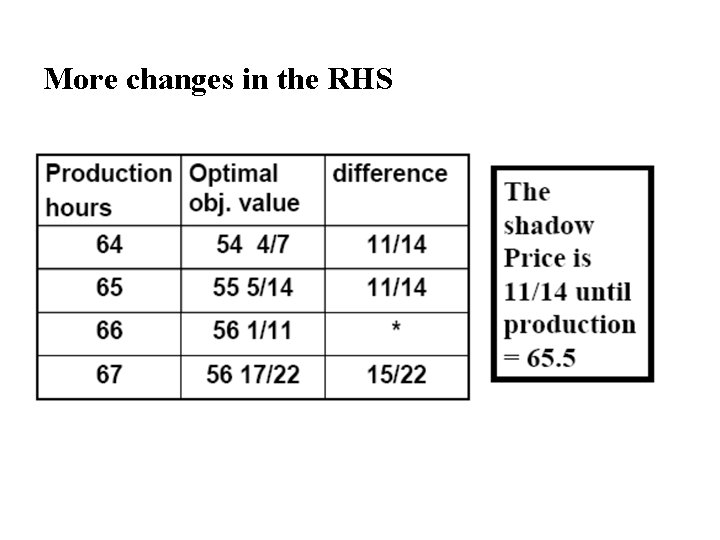

More changes in the RHS

FAQ. What is the intuition for the shadow price staying constant, and then changing? l Recall from the simplex method that the simplex method produces a “basic feasible solution. ” The basis can often be described easily in terms of a brief verbal description.

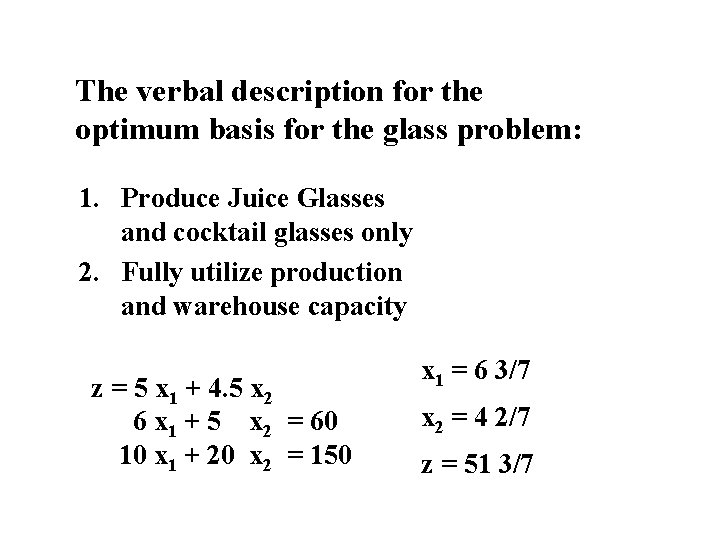

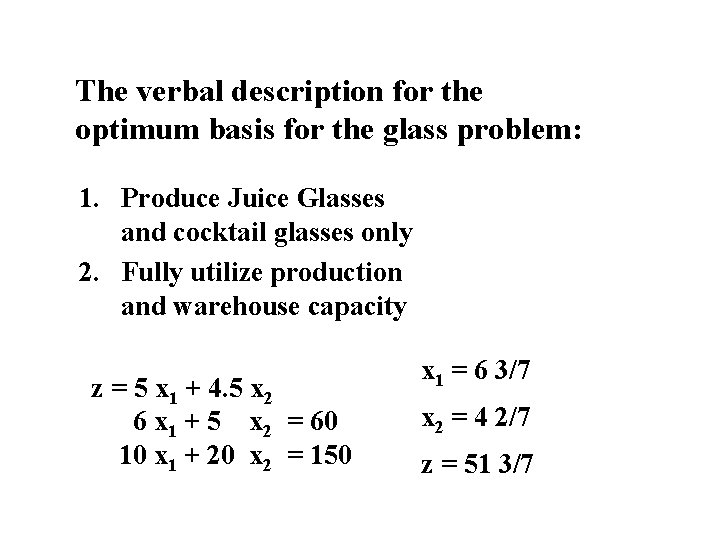

The verbal description for the optimum basis for the glass problem: 1. Produce Juice Glasses and cocktail glasses only 2. Fully utilize production and warehouse capacity z = 5 x 1 + 4. 5 x 2 6 x 1 + 5 x 2 = 60 10 x 1 + 20 x 2 = 150 x 1 = 6 3/7 x 2 = 4 2/7 z = 51 3/7

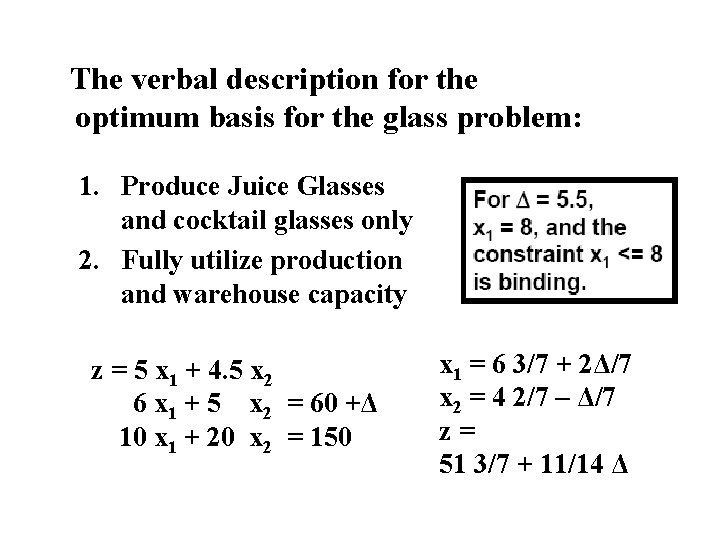

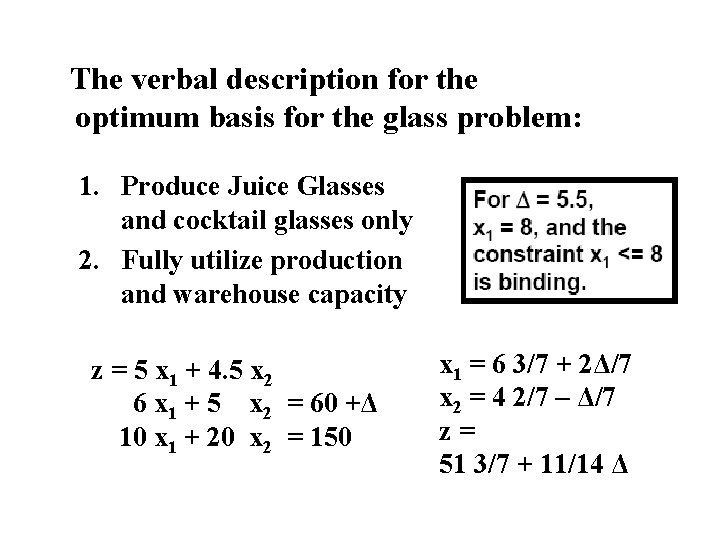

The verbal description for the optimum basis for the glass problem: 1. Produce Juice Glasses and cocktail glasses only 2. Fully utilize production and warehouse capacity z = 5 x 1 + 4. 5 x 2 6 x 1 + 5 x 2 = 60 +Δ 10 x 1 + 20 x 2 = 150 x 1 = 6 3/7 + 2Δ/7 x 2 = 4 2/7 – Δ/7 z= 51 3/7 + 11/14 Δ

FAQ. How can shadow prices be used for managerial interpretations? l Let me illustrate with the previous example. l How much should you be willing to pay for an extra hour of production?

FAQ. Does the shadow price always have an economic interpretation? l The answer is no, unless one wants to really stretch what is meant by an economic interpretation. l Consider ratio constraints

Apartment Development • x 1 = number of 1 -bedroom apartments built • x 2 = number of 2 -bedroom apartments built • x 3 = number of 3 -bedroom apartments build • x 1/(x 1 + x 2 + x 3) ≤. 5 → x 1 ≤. 5 x 1 +. 5 x 2 +. 5 x 3 • →. 5 x 1 – 5. x 2 -. 5 x 3 ≤ 0 • The shadow price is the impact of increasing the 0 to a 1. • This has no obvious managerial interpretation.

FAQ. Right now, I’m new to this. But as I gain experience will interpretations of the shadow prices always be obvious? No. But they should become straightforward for examples given in 15. 053.

FAQ. In the book, they sometimes use “dual price” and we use shadow price. Is there any difference? l No

FAQ. Excel gives a report known as the Sensitivity report. Does this provide shadow prices? l l Yes, plus lots more. In particular, it gives the range for which the shadow price is valid.

FAQ. I have heard that Excel occasionally gives incorrect shadow prices. Is this true? l l There is the possibility that the interval in which the shadow price is valid is empty. Excel can also give incorrect Shadow prices under certain circumstances that will not occur in spreadsheets for 15. 053.

FAQ. You have told me that Excel sometimes makes mistakes. Also, I can do sensitivity analysis by solving an LP a large number of times, with varying data. So, what good is the Sensitivity Report? l l l For large problems it is much more efficient, and for LP models used in practice, it will be accurate. For large problems it can be used to identify opportunities. It can identify which coefficients are most sensitive to changes in value (their accuracy is the most important).

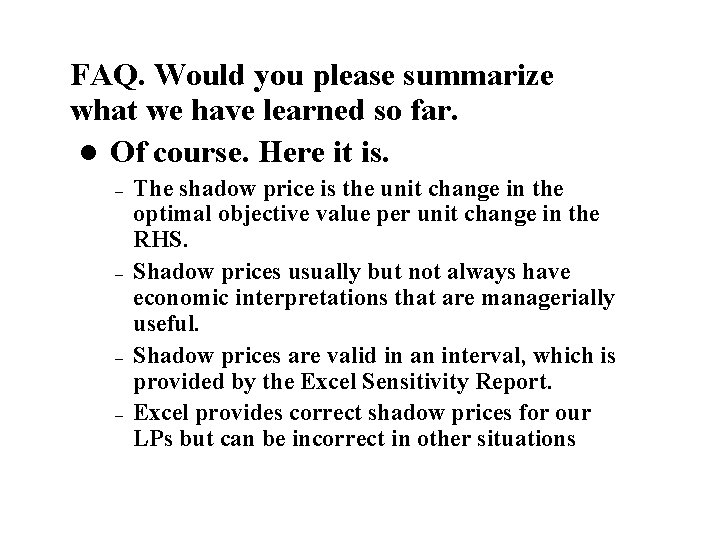

FAQ. Would you please summarize what we have learned so far. l Of course. Here it is. – – The shadow price is the unit change in the optimal objective value per unit change in the RHS. Shadow prices usually but not always have economic interpretations that are managerially useful. Shadow prices are valid in an interval, which is provided by the Excel Sensitivity Report. Excel provides correct shadow prices for our LPs but can be incorrect in other situations

Overview of what is to come l l Using insight from managerial situations to obtain properties of shadow prices reduced costs and pricing out

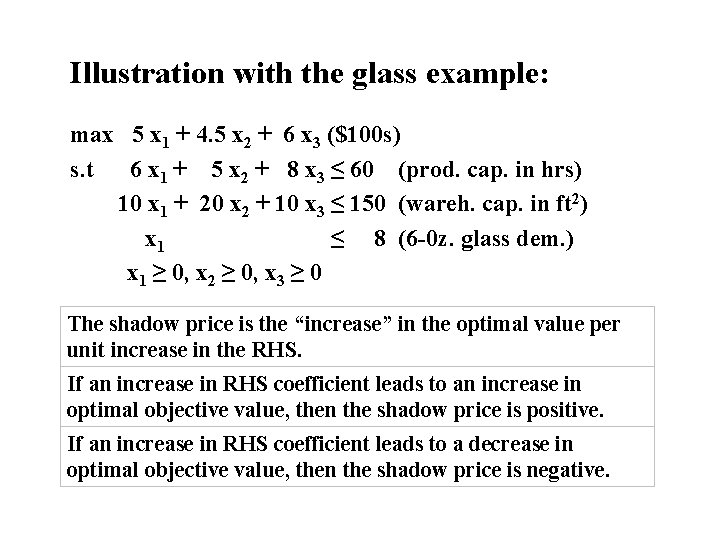

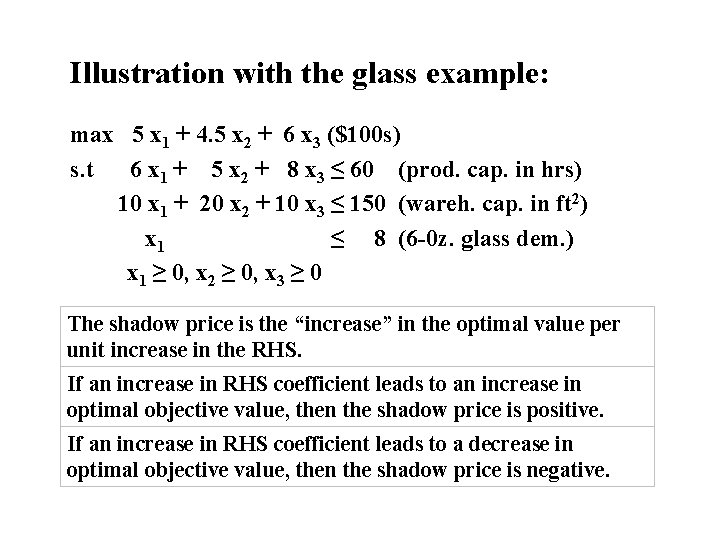

Illustration with the glass example: max 5 x 1 + 4. 5 x 2 + 6 x 3 ($100 s) s. t 6 x 1 + 5 x 2 + 8 x 3 ≤ 60 (prod. cap. in hrs) 10 x 1 + 20 x 2 + 10 x 3 ≤ 150 (wareh. cap. in ft 2) x 1 ≤ 8 (6 -0 z. glass dem. ) x 1 ≥ 0, x 2 ≥ 0, x 3 ≥ 0 The shadow price is the “increase” in the optimal value per unit increase in the RHS. If an increase in RHS coefficient leads to an increase in optimal objective value, then the shadow price is positive. If an increase in RHS coefficient leads to a decrease in optimal objective value, then the shadow price is negative.

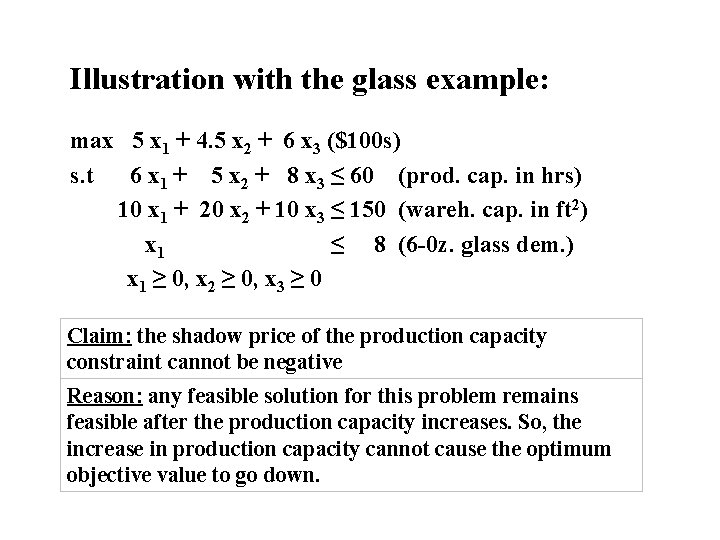

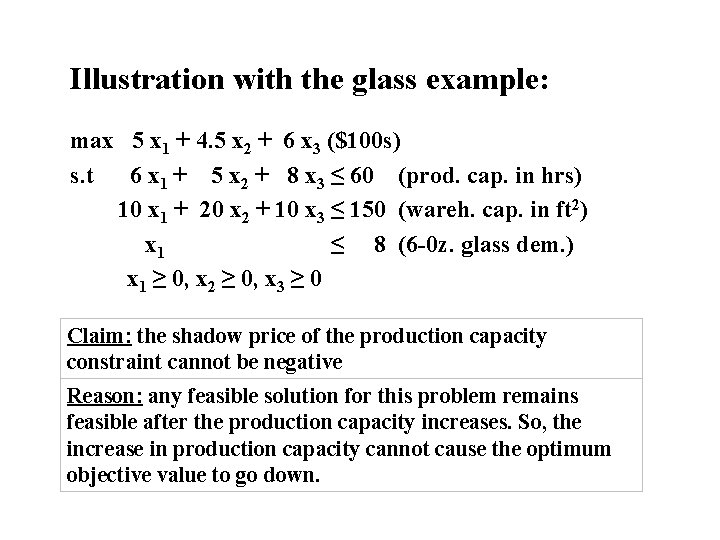

Illustration with the glass example: max 5 x 1 + 4. 5 x 2 + 6 x 3 ($100 s) s. t 6 x 1 + 5 x 2 + 8 x 3 ≤ 60 (prod. cap. in hrs) 10 x 1 + 20 x 2 + 10 x 3 ≤ 150 (wareh. cap. in ft 2) x 1 ≤ 8 (6 -0 z. glass dem. ) x 1 ≥ 0, x 2 ≥ 0, x 3 ≥ 0 Claim: the shadow price of the production capacity constraint cannot be negative Reason: any feasible solution for this problem remains feasible after the production capacity increases. So, the increase in production capacity cannot cause the optimum objective value to go down.

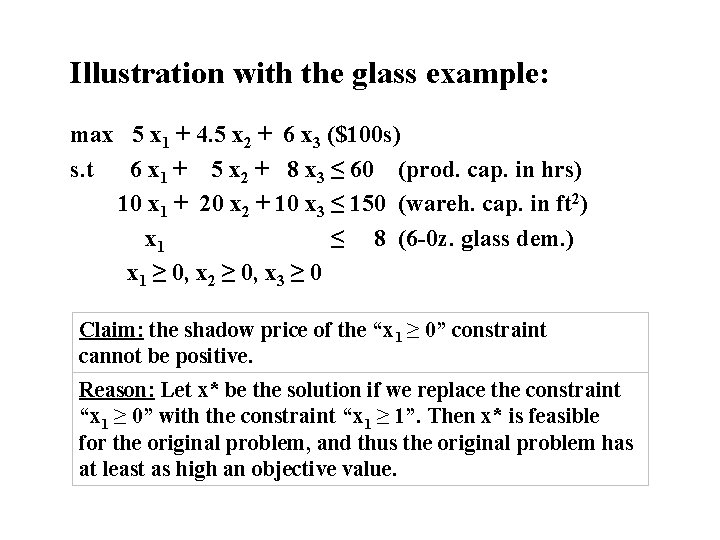

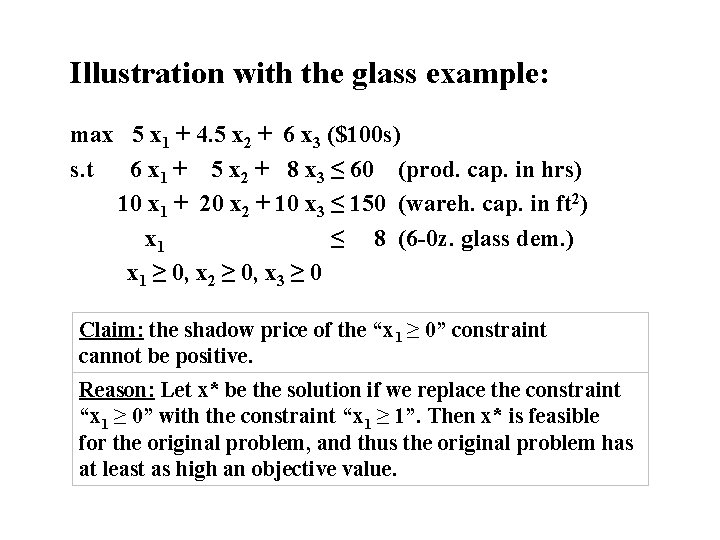

Illustration with the glass example: max 5 x 1 + 4. 5 x 2 + 6 x 3 ($100 s) s. t 6 x 1 + 5 x 2 + 8 x 3 ≤ 60 (prod. cap. in hrs) 10 x 1 + 20 x 2 + 10 x 3 ≤ 150 (wareh. cap. in ft 2) x 1 ≤ 8 (6 -0 z. glass dem. ) x 1 ≥ 0, x 2 ≥ 0, x 3 ≥ 0 Claim: the shadow price of the “x 1 ≥ 0” constraint cannot be positive. Reason: Let x* be the solution if we replace the constraint “x 1 ≥ 0” with the constraint “x 1 ≥ 1”. Then x* is feasible for the original problem, and thus the original problem has at least as high an objective value.

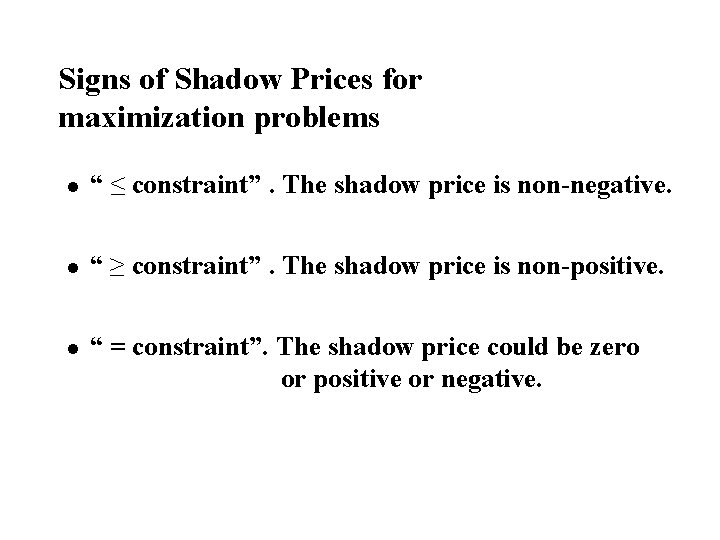

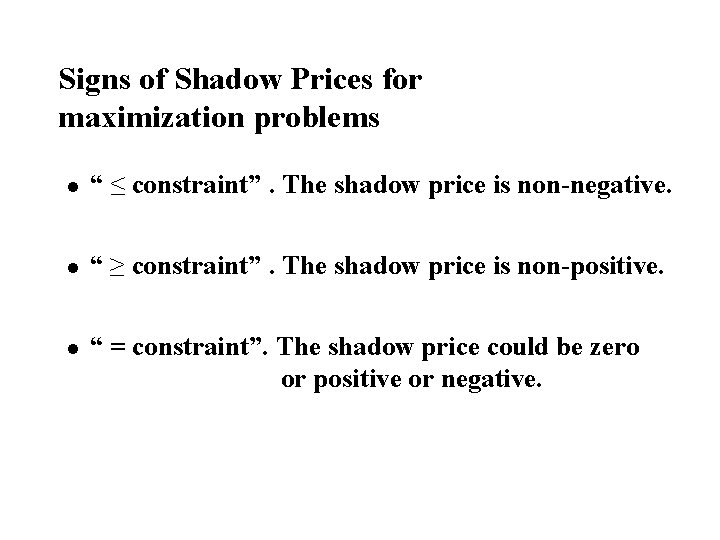

Signs of Shadow Prices for maximization problems l “ ≤ constraint”. The shadow price is non-negative. l “ ≥ constraint”. The shadow price is non-positive. l “ = constraint”. The shadow price could be zero or positive or negative.

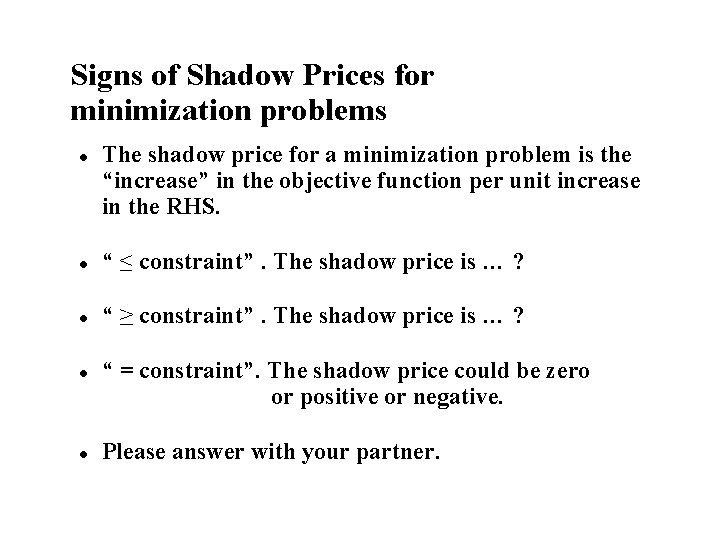

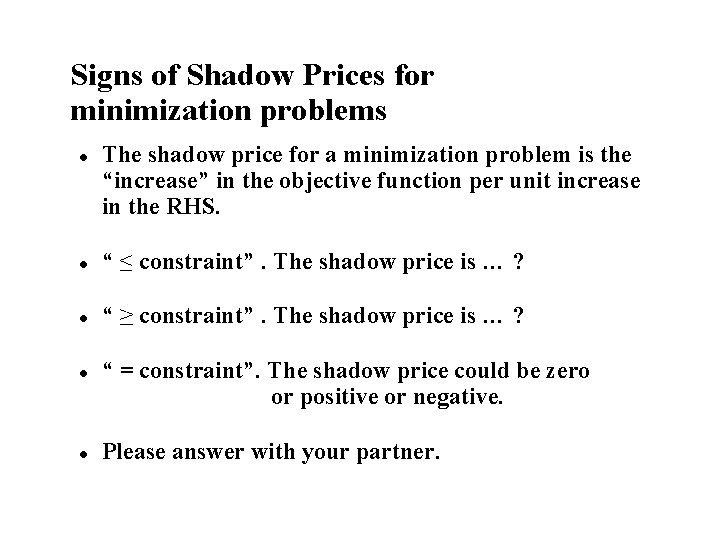

Signs of Shadow Prices for minimization problems l The shadow price for a minimization problem is the “increase” in the objective function per unit increase in the RHS. l “ ≤ constraint”. The shadow price is … ? l “ ≥ constraint”. The shadow price is … ? l l “ = constraint”. The shadow price could be zero or positive or negative. Please answer with your partner.

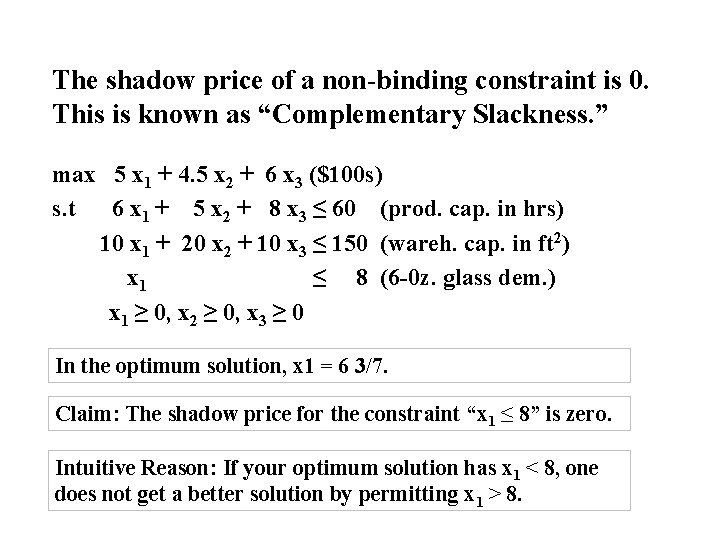

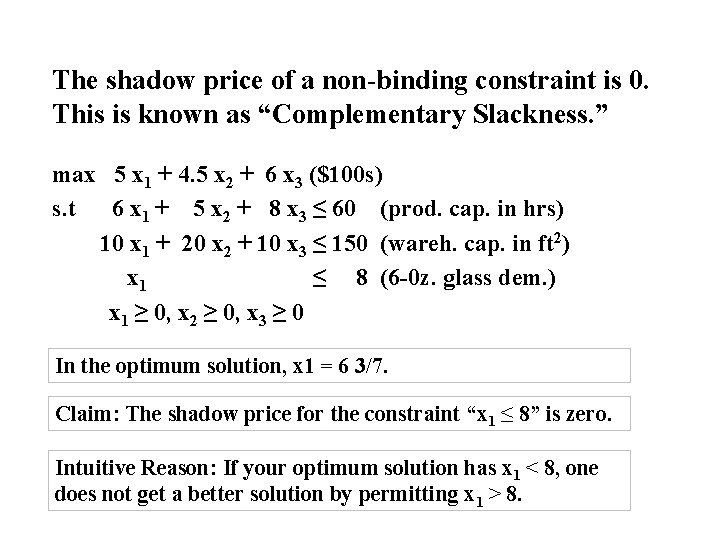

The shadow price of a non-binding constraint is 0. This is known as “Complementary Slackness. ” max 5 x 1 + 4. 5 x 2 + 6 x 3 ($100 s) s. t 6 x 1 + 5 x 2 + 8 x 3 ≤ 60 (prod. cap. in hrs) 10 x 1 + 20 x 2 + 10 x 3 ≤ 150 (wareh. cap. in ft 2) x 1 ≤ 8 (6 -0 z. glass dem. ) x 1 ≥ 0, x 2 ≥ 0, x 3 ≥ 0 In the optimum solution, x 1 = 6 3/7. Claim: The shadow price for the constraint “x 1 ≤ 8” is zero. Intuitive Reason: If your optimum solution has x 1 < 8, one does not get a better solution by permitting x 1 > 8.

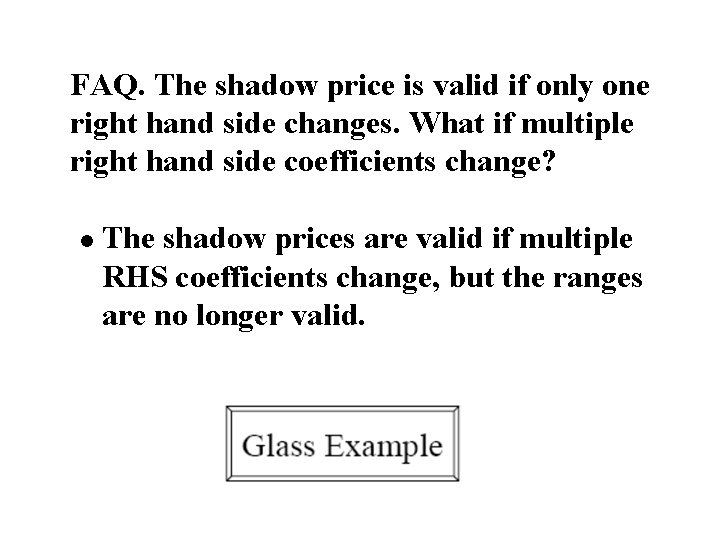

FAQ. The shadow price is valid if only one right hand side changes. What if multiple right hand side coefficients change? l The shadow prices are valid if multiple RHS coefficients change, but the ranges are no longer valid.

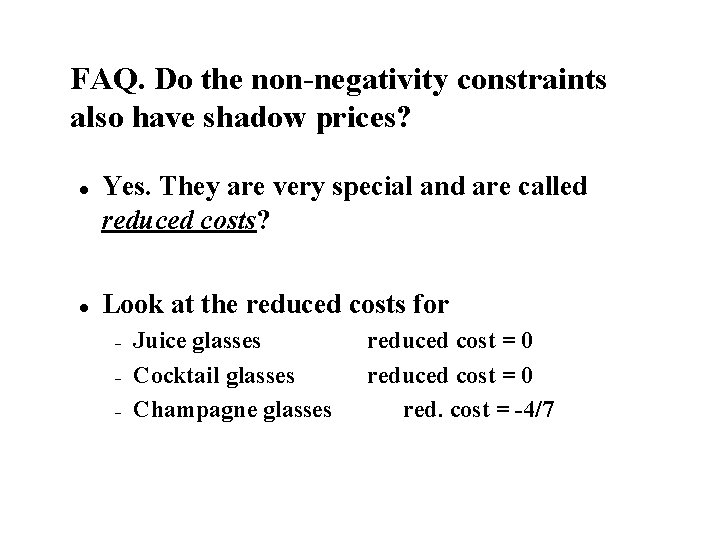

FAQ. Do the non-negativity constraints also have shadow prices? l l Yes. They are very special and are called reduced costs? Look at the reduced costs for – – – Juice glasses Cocktail glasses Champagne glasses reduced cost = 0 red. cost = -4/7

FAQ. Does Excel provide information on the reduced costs? l Yes. They are also part of the sensitivity report.

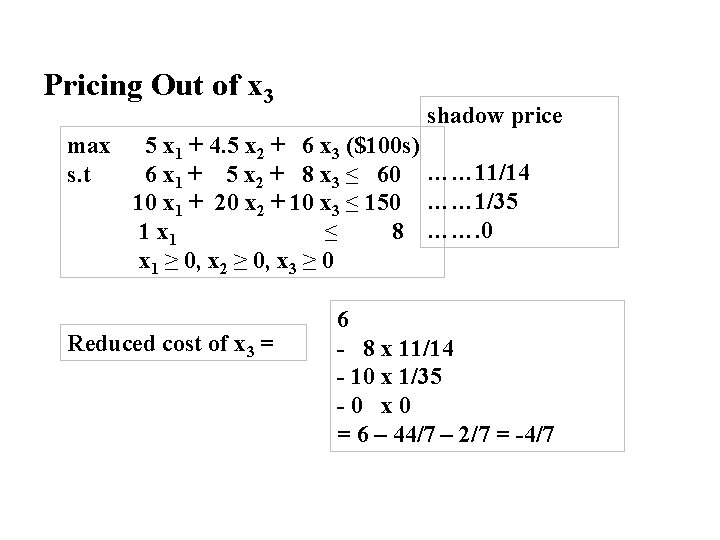

FAQ. What is the managerial interpretation of a reduced cost? l l l There are two interpretations. Here is one of them. We are currently not producing champagne glasses. How much would the profit of champagne glasses need to go up for us to produce champagne glasses in an optimum solution? The reduced cost for champagne classes is – 4/7. If we increase the revenue for these glasses by 4/7 (from 6 to 6 4/7), then there will be an alternative optimum in which champagne glasses are produced.

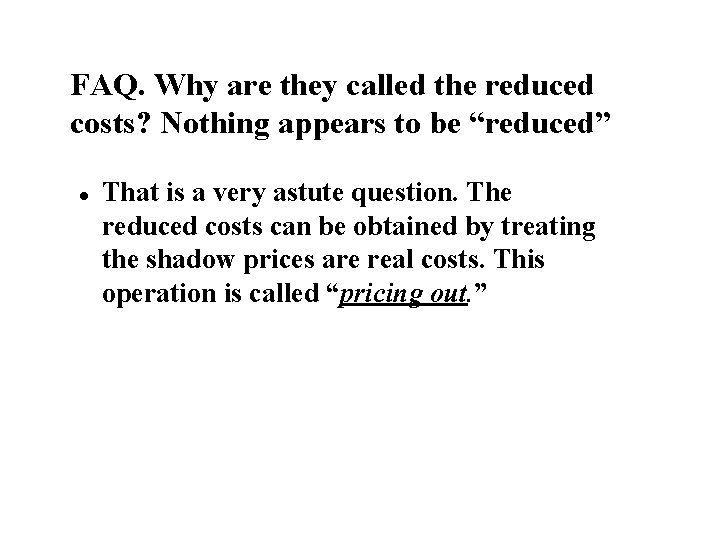

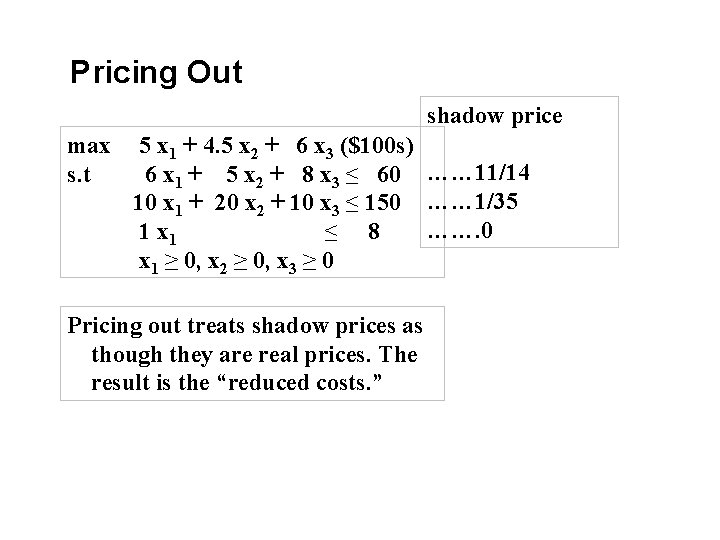

FAQ. Why are they called the reduced costs? Nothing appears to be “reduced” l That is a very astute question. The reduced costs can be obtained by treating the shadow prices are real costs. This operation is called “pricing out. ”

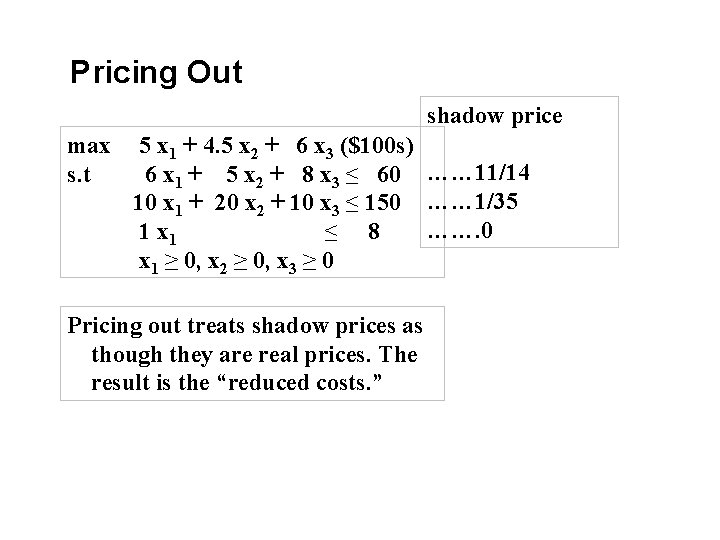

Pricing Out shadow price max s. t 5 x 1 + 4. 5 x 2 + 6 x 3 ($100 s) 6 x 1 + 5 x 2 + 8 x 3 ≤ 60 …… 11/14 10 x 1 + 20 x 2 + 10 x 3 ≤ 150 …… 1/35 ……. 0 1 x 1 ≤ 8 x 1 ≥ 0, x 2 ≥ 0, x 3 ≥ 0 Pricing out treats shadow prices as though they are real prices. The result is the “reduced costs. ”

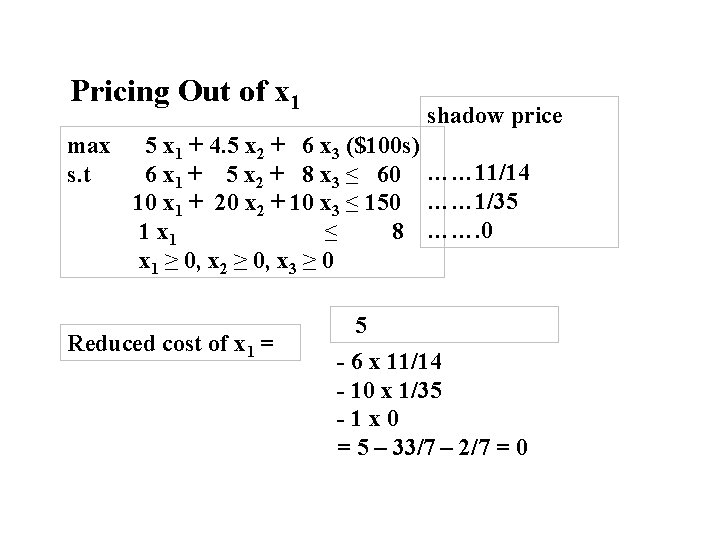

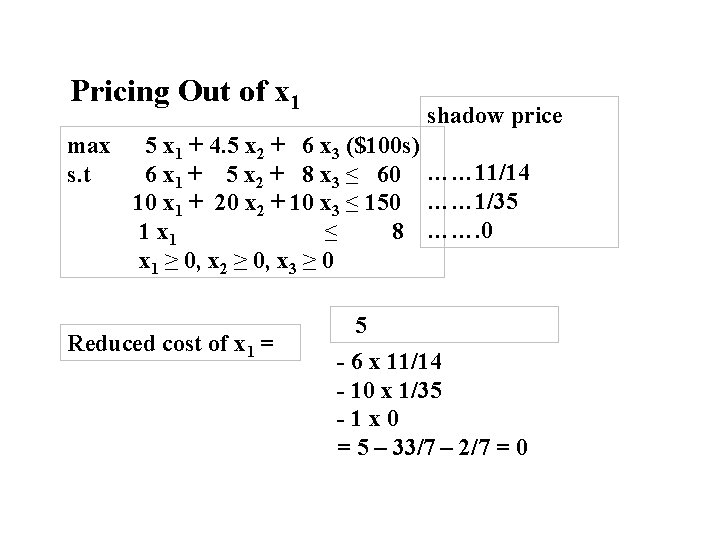

Pricing Out of x 1 max s. t shadow price 5 x 1 + 4. 5 x 2 + 6 x 3 ($100 s) 6 x 1 + 5 x 2 + 8 x 3 ≤ 60 …… 11/14 10 x 1 + 20 x 2 + 10 x 3 ≤ 150 …… 1/35 1 x 1 ≤ 8 ……. 0 x 1 ≥ 0, x 2 ≥ 0, x 3 ≥ 0 Reduced cost of x 1 = 5 - 6 x 11/14 - 10 x 1/35 -1 x 0 = 5 – 33/7 – 2/7 = 0

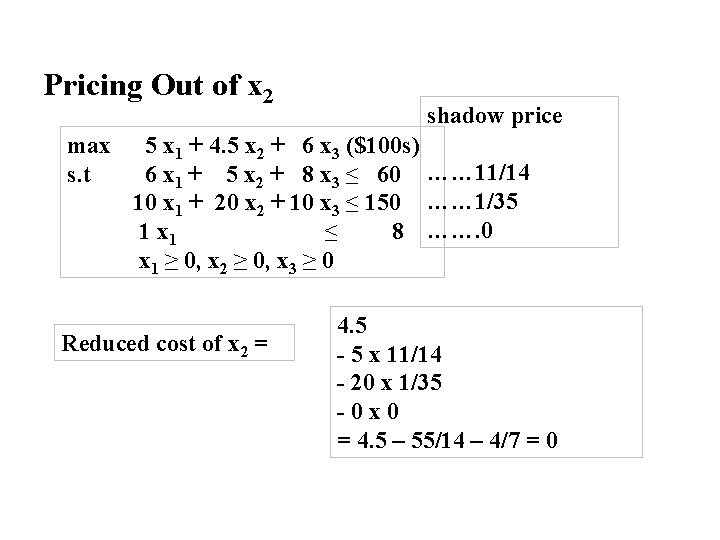

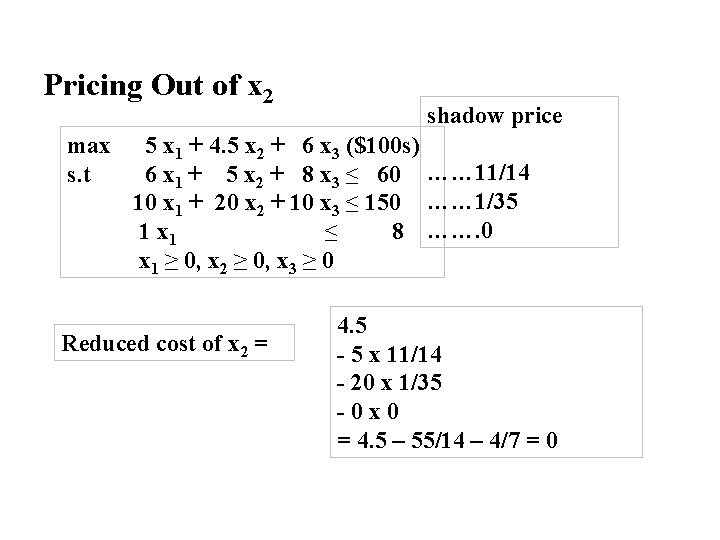

Pricing Out of x 2 max s. t shadow price 5 x 1 + 4. 5 x 2 + 6 x 3 ($100 s) 6 x 1 + 5 x 2 + 8 x 3 ≤ 60 …… 11/14 10 x 1 + 20 x 2 + 10 x 3 ≤ 150 …… 1/35 1 x 1 ≤ 8 ……. 0 x 1 ≥ 0, x 2 ≥ 0, x 3 ≥ 0 Reduced cost of x 2 = 4. 5 - 5 x 11/14 - 20 x 1/35 -0 x 0 = 4. 5 – 55/14 – 4/7 = 0

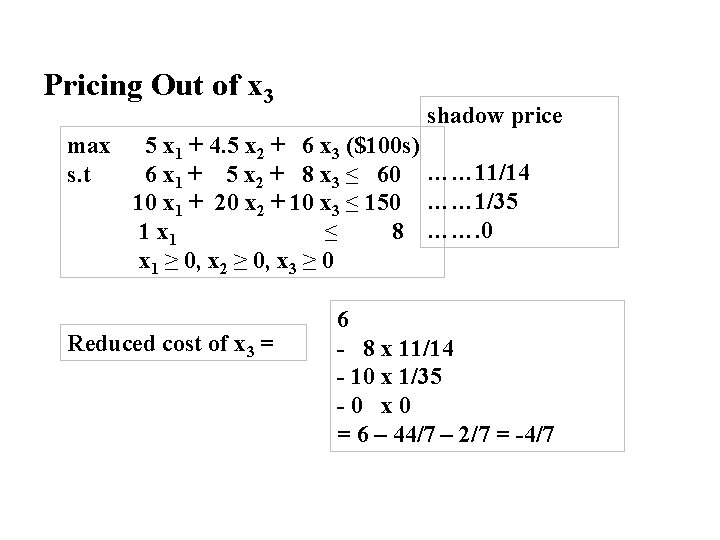

Pricing Out of x 3 max s. t shadow price 5 x 1 + 4. 5 x 2 + 6 x 3 ($100 s) 6 x 1 + 5 x 2 + 8 x 3 ≤ 60 …… 11/14 10 x 1 + 20 x 2 + 10 x 3 ≤ 150 …… 1/35 1 x 1 ≤ 8 ……. 0 x 1 ≥ 0, x 2 ≥ 0, x 3 ≥ 0 Reduced cost of x 3 = 6 - 8 x 11/14 - 10 x 1/35 -0 x 0 = 6 – 44/7 – 2/7 = -4/7

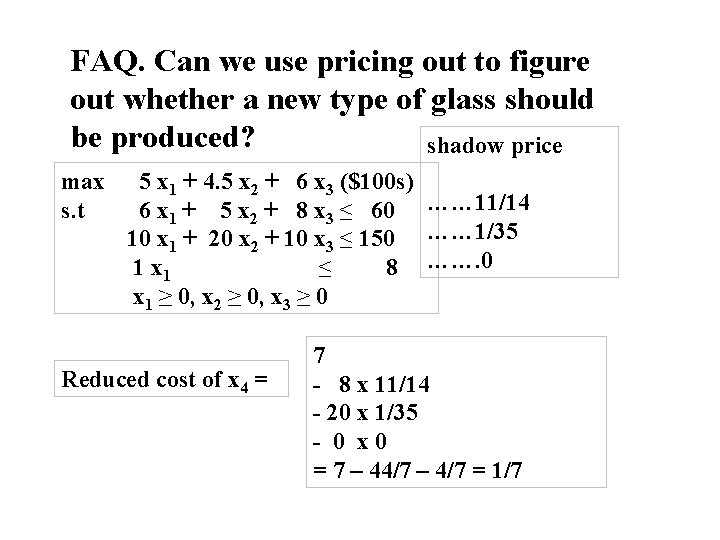

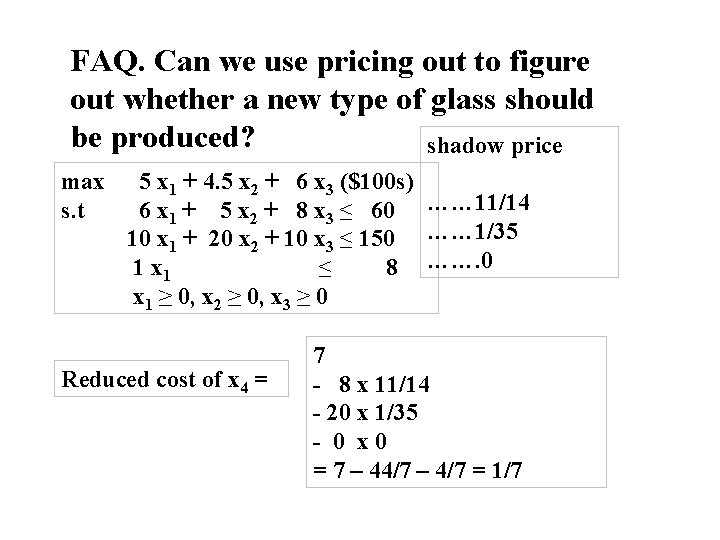

FAQ. Can we use pricing out to figure out whether a new type of glass should be produced? shadow price max s. t 5 x 1 + 4. 5 x 2 + 6 x 3 ($100 s) 6 x 1 + 5 x 2 + 8 x 3 ≤ 60 …… 11/14 10 x 1 + 20 x 2 + 10 x 3 ≤ 150 …… 1/35 1 x 1 ≤ 8 ……. 0 x 1 ≥ 0, x 2 ≥ 0, x 3 ≥ 0 Reduced cost of x 4 = 7 - 8 x 11/14 - 20 x 1/35 - 0 x 0 = 7 – 44/7 – 4/7 = 1/7

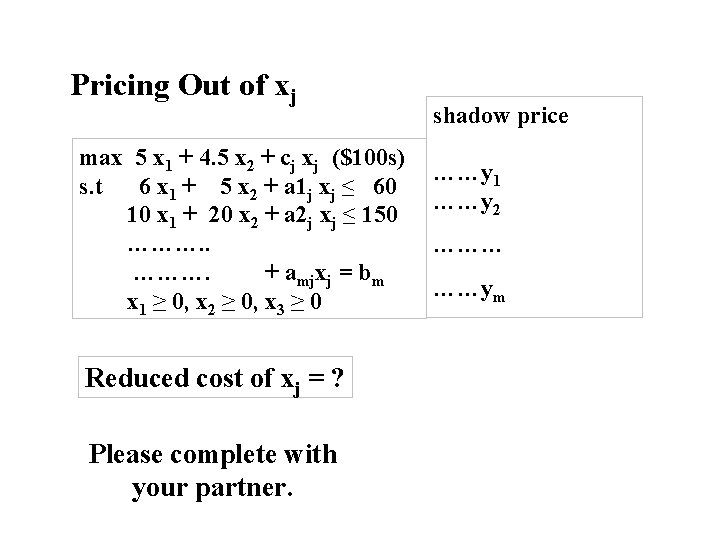

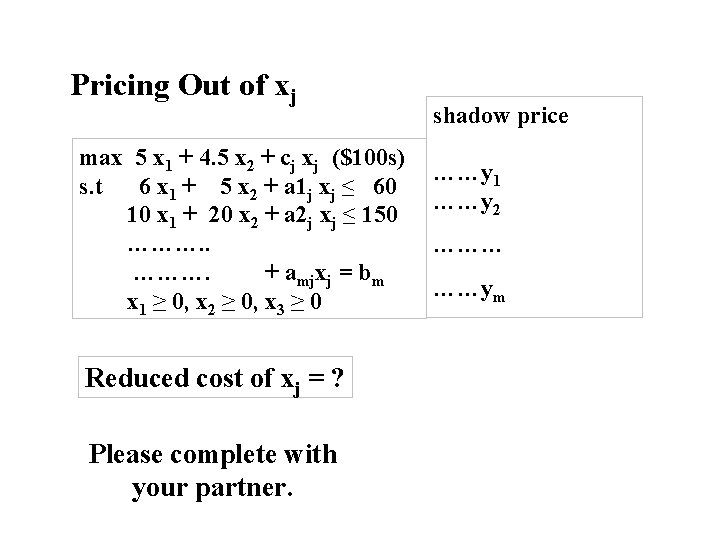

Pricing Out of xj max 5 x 1 + 4. 5 x 2 + cj xj ($100 s) s. t 6 x 1 + 5 x 2 + a 1 j xj ≤ 60 10 x 1 + 20 x 2 + a 2 j xj ≤ 150 ………. + amjxj = bm x 1 ≥ 0, x 2 ≥ 0, x 3 ≥ 0 Reduced cost of xj = ? Please complete with your partner. shadow price ……y 1 ……y 2 ……… ……ym

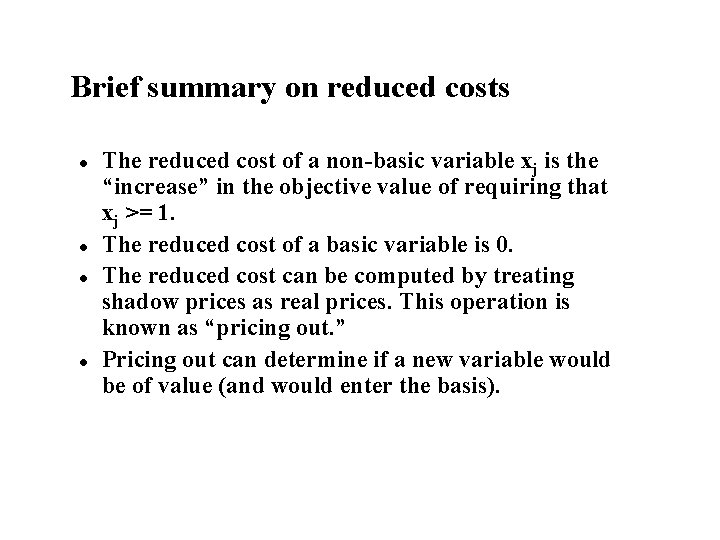

Brief summary on reduced costs l l The reduced cost of a non-basic variable xj is the “increase” in the objective value of requiring that xj >= 1. The reduced cost of a basic variable is 0. The reduced cost can be computed by treating shadow prices as real prices. This operation is known as “pricing out. ” Pricing out can determine if a new variable would be of value (and would enter the basis).

Would you please summarize what we have learned this lecture? l I’d be happy to.

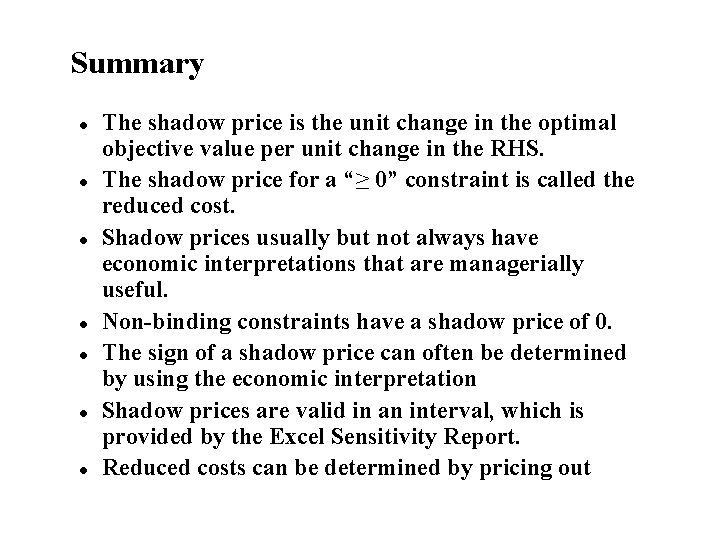

Summary l l l l The shadow price is the unit change in the optimal objective value per unit change in the RHS. The shadow price for a “≥ 0” constraint is called the reduced cost. Shadow prices usually but not always have economic interpretations that are managerially useful. Non-binding constraints have a shadow price of 0. The sign of a shadow price can often be determined by using the economic interpretation Shadow prices are valid in an interval, which is provided by the Excel Sensitivity Report. Reduced costs can be determined by pricing out

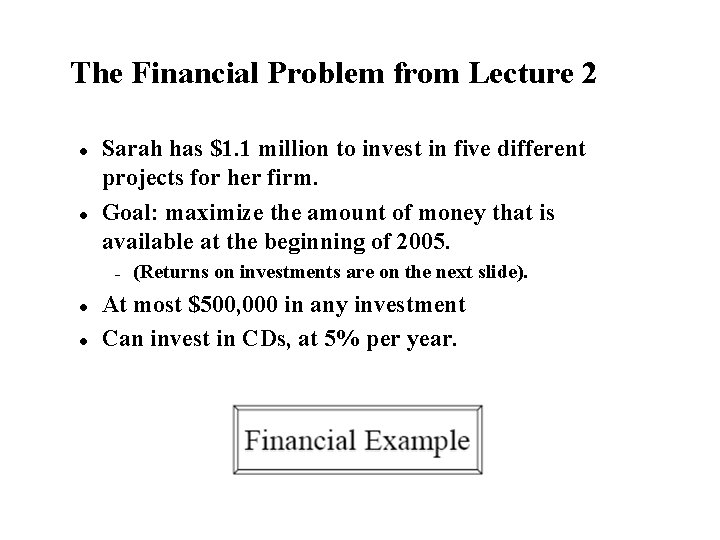

The Financial Problem from Lecture 2 l l Sarah has $1. 1 million to invest in five different projects for her firm. Goal: maximize the amount of money that is available at the beginning of 2005. – l l (Returns on investments are on the next slide). At most $500, 000 in any investment Can invest in CDs, at 5% per year.

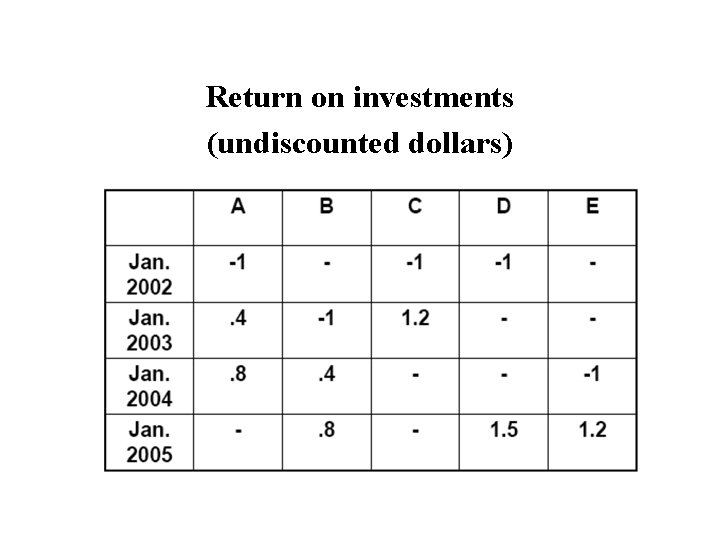

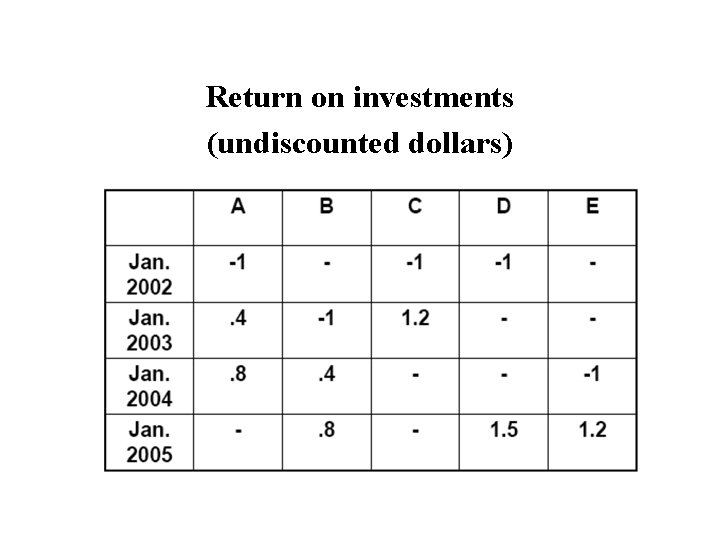

Return on investments (undiscounted dollars)

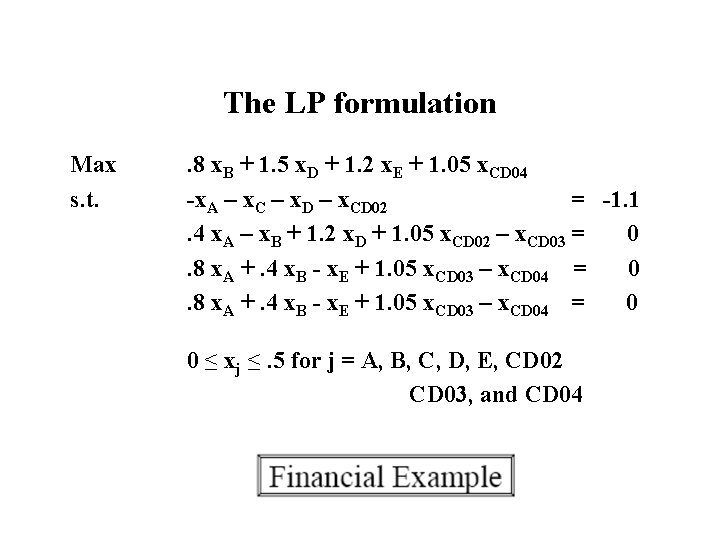

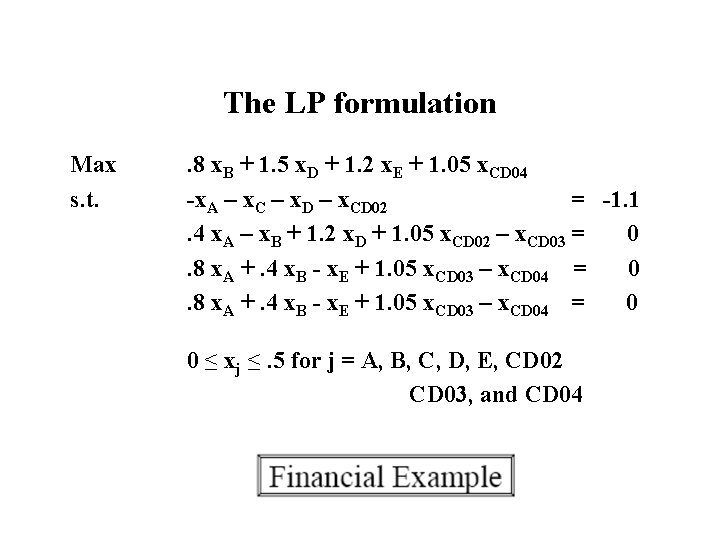

The LP formulation Max s. t. . 8 x. B + 1. 5 x. D + 1. 2 x. E + 1. 05 x. CD 04 -x. A – x. C – x. D – x. CD 02 = -1. 1. 4 x. A – x. B + 1. 2 x. D + 1. 05 x. CD 02 – x. CD 03 = 0. 8 x. A +. 4 x. B - x. E + 1. 05 x. CD 03 – x. CD 04 = 0 0 ≤ xj ≤. 5 for j = A, B, C, D, E, CD 02 CD 03, and CD 04

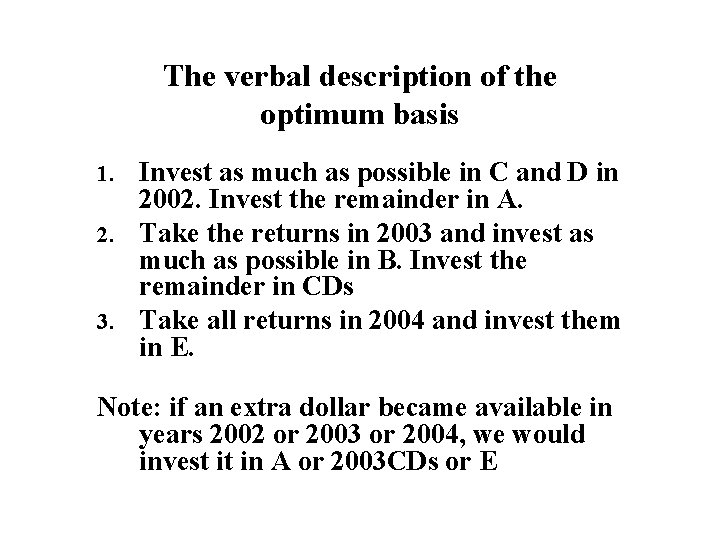

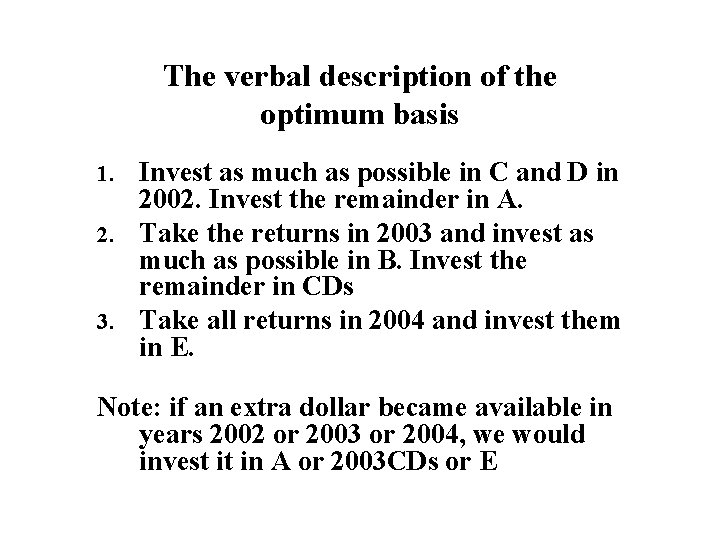

The verbal description of the optimum basis Invest as much as possible in C and D in 2002. Invest the remainder in A. 2. Take the returns in 2003 and invest as much as possible in B. Invest the remainder in CDs 3. Take all returns in 2004 and invest them in E. 1. Note: if an extra dollar became available in years 2002 or 2003 or 2004, we would invest it in A or 2003 CDs or E

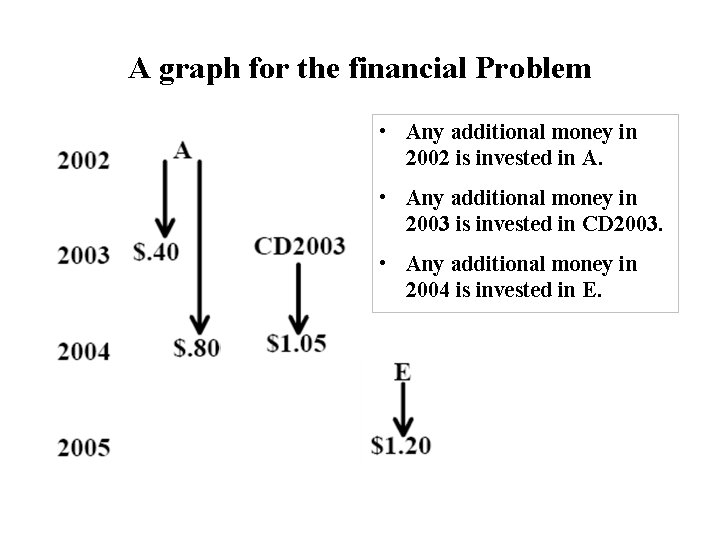

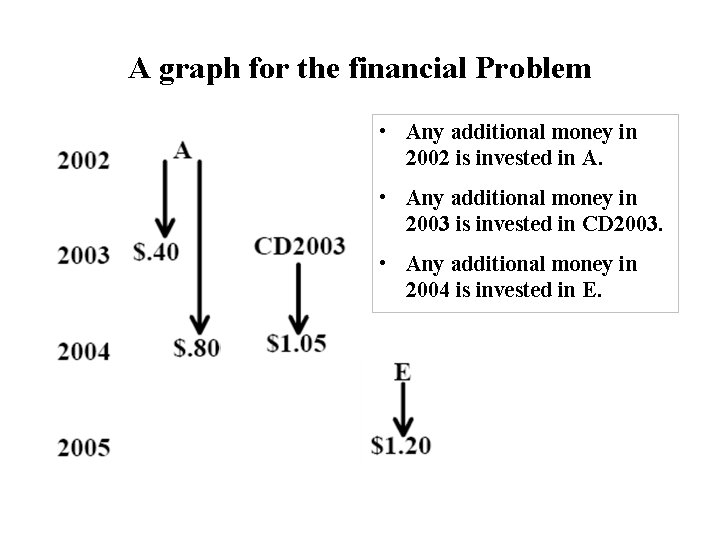

A graph for the financial Problem • Any additional money in 2002 is invested in A. • Any additional money in 2003 is invested in CD 2003. • Any additional money in 2004 is invested in E.

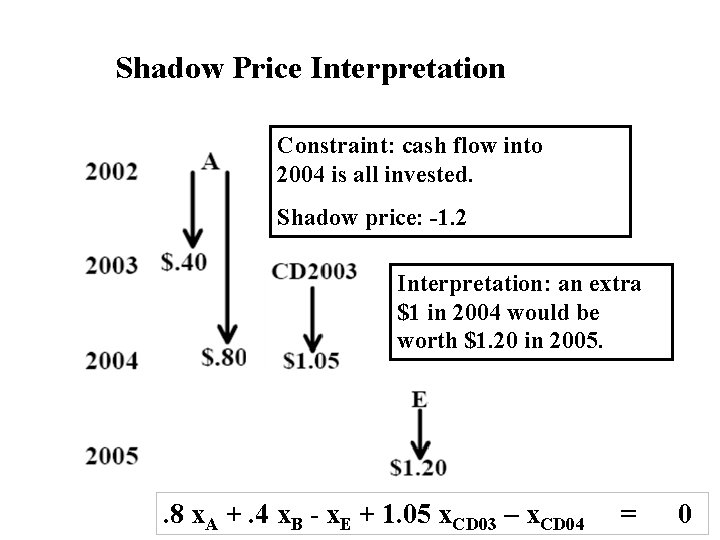

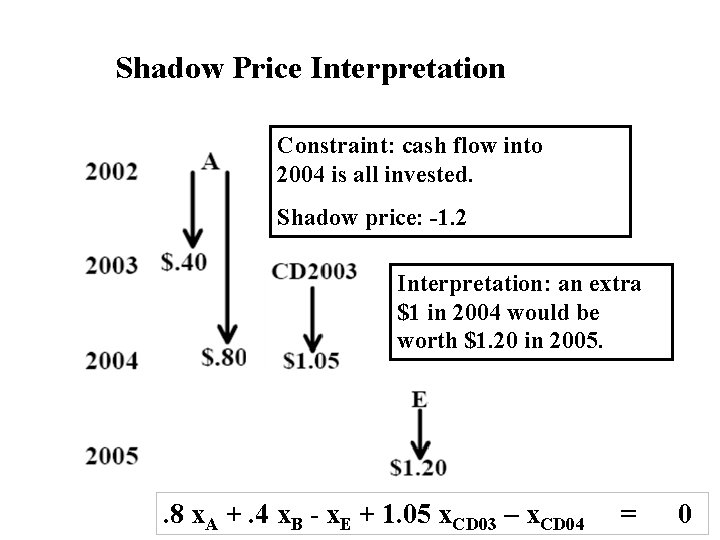

Shadow Price Interpretation Constraint: cash flow into 2004 is all invested. Shadow price: -1. 2 Interpretation: an extra $1 in 2004 would be worth $1. 20 in 2005. . 8 x. A +. 4 x. B - x. E + 1. 05 x. CD 03 – x. CD 04 = 0

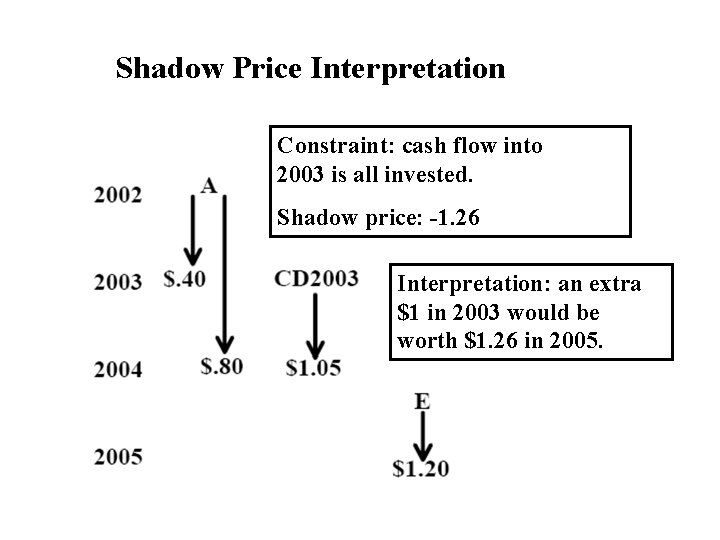

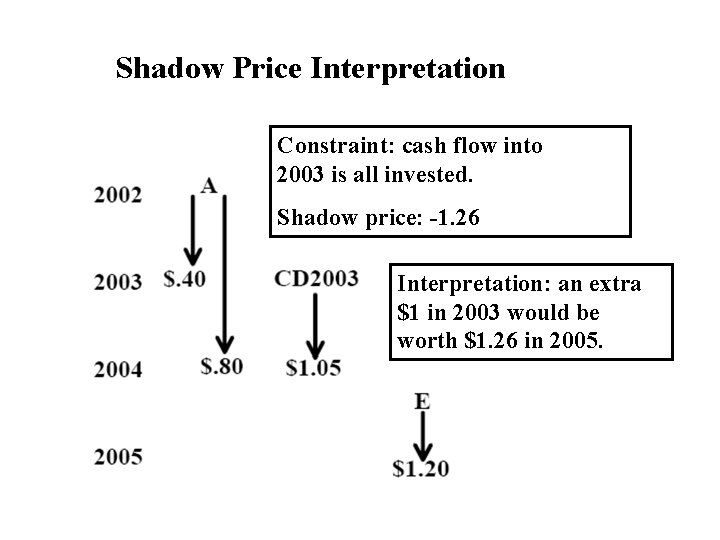

Shadow Price Interpretation Constraint: cash flow into 2003 is all invested. Shadow price: -1. 26 Interpretation: an extra $1 in 2003 would be worth $1. 26 in 2005.

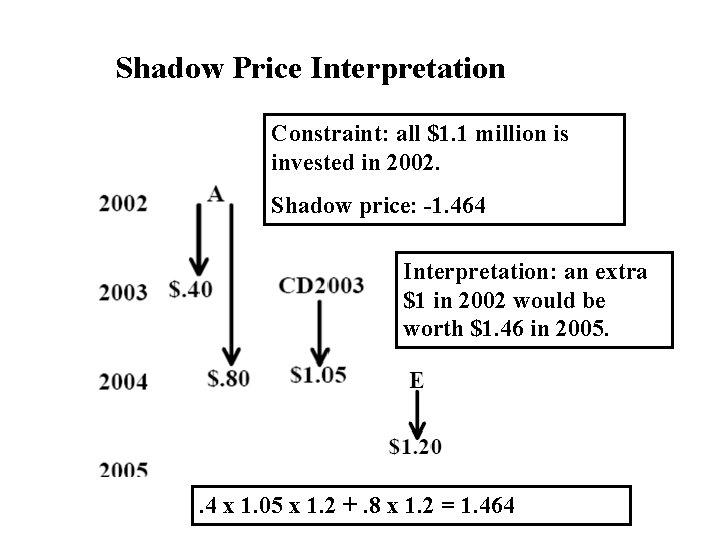

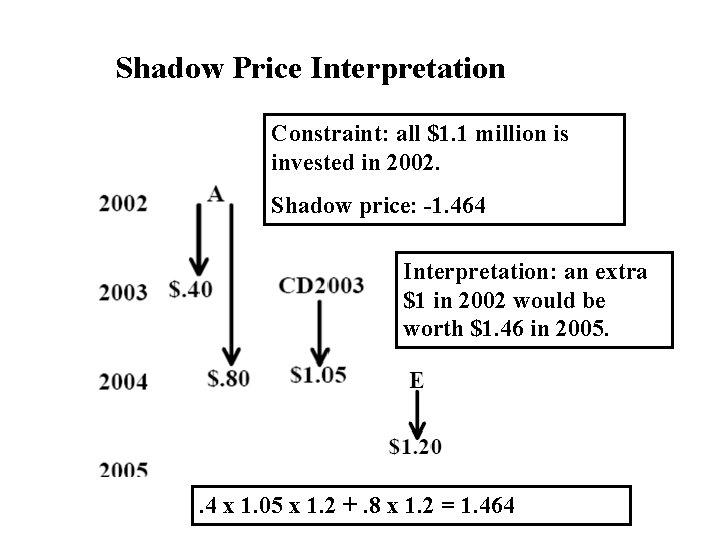

Shadow Price Interpretation Constraint: all $1. 1 million is invested in 2002. Shadow price: -1. 464 Interpretation: an extra $1 in 2002 would be worth $1. 46 in 2005. . 4 x 1. 05 x 1. 2 +. 8 x 1. 2 = 1. 464