1 What is TDS Tax Deducted at Source

![Responsibilities of the Deductor/ Collector [Cont. . ] Deposit deducted tax within the prescribed Responsibilities of the Deductor/ Collector [Cont. . ] Deposit deducted tax within the prescribed](https://slidetodoc.com/presentation_image/31fcaf136f009ff2f5ed3ac79b73be01/image-8.jpg)

![Payment covered under the scheme of TDS [Cont. . ] Payments in respect of Payment covered under the scheme of TDS [Cont. . ] Payments in respect of](https://slidetodoc.com/presentation_image/31fcaf136f009ff2f5ed3ac79b73be01/image-11.jpg)

![Consequences of non-compliance with TDS provisions [Cont. . ] Assessee in default An assessee Consequences of non-compliance with TDS provisions [Cont. . ] Assessee in default An assessee](https://slidetodoc.com/presentation_image/31fcaf136f009ff2f5ed3ac79b73be01/image-13.jpg)

![Consequences of non-compliance with TDS provisions [Cont. . ] Note: The amendment is not Consequences of non-compliance with TDS provisions [Cont. . ] Note: The amendment is not](https://slidetodoc.com/presentation_image/31fcaf136f009ff2f5ed3ac79b73be01/image-14.jpg)

![Consequences of non-compliance with TDS provisions [Cont. . ] Interest Section Nature of default Consequences of non-compliance with TDS provisions [Cont. . ] Interest Section Nature of default](https://slidetodoc.com/presentation_image/31fcaf136f009ff2f5ed3ac79b73be01/image-15.jpg)

![Consequences of non-compliance with TDS provisions [Cont. . ] Levy of fee u/s 234 Consequences of non-compliance with TDS provisions [Cont. . ] Levy of fee u/s 234](https://slidetodoc.com/presentation_image/31fcaf136f009ff2f5ed3ac79b73be01/image-16.jpg)

![Consequences of non-compliance with TDS provisions [Cont. . ] Penalty Section Nature of default Consequences of non-compliance with TDS provisions [Cont. . ] Penalty Section Nature of default](https://slidetodoc.com/presentation_image/31fcaf136f009ff2f5ed3ac79b73be01/image-17.jpg)

![Consequences of non-compliance with TDS provisions [Cont. . ] Penalty [Cont. . ] Section Consequences of non-compliance with TDS provisions [Cont. . ] Penalty [Cont. . ] Section](https://slidetodoc.com/presentation_image/31fcaf136f009ff2f5ed3ac79b73be01/image-18.jpg)

![Consequences of non-compliance with TDS provisions [Cont. . ] Prosecution Section Nature of default Consequences of non-compliance with TDS provisions [Cont. . ] Prosecution Section Nature of default](https://slidetodoc.com/presentation_image/31fcaf136f009ff2f5ed3ac79b73be01/image-19.jpg)

![Certain peculiar TDS related issues [Cont. . ] Month for the calculation of Interest Certain peculiar TDS related issues [Cont. . ] Month for the calculation of Interest](https://slidetodoc.com/presentation_image/31fcaf136f009ff2f5ed3ac79b73be01/image-21.jpg)

![Certain peculiar TDS related issues [Cont. . ] S. 194 J applies to payments Certain peculiar TDS related issues [Cont. . ] S. 194 J applies to payments](https://slidetodoc.com/presentation_image/31fcaf136f009ff2f5ed3ac79b73be01/image-22.jpg)

![Certain peculiar TDS related issues [Cont. . ] Fees For Technical Services CBDT's latter Certain peculiar TDS related issues [Cont. . ] Fees For Technical Services CBDT's latter](https://slidetodoc.com/presentation_image/31fcaf136f009ff2f5ed3ac79b73be01/image-23.jpg)

![Certain peculiar TDS related issues [Cont. . ] Sum paid to co. providing support Certain peculiar TDS related issues [Cont. . ] Sum paid to co. providing support](https://slidetodoc.com/presentation_image/31fcaf136f009ff2f5ed3ac79b73be01/image-24.jpg)

![Certain peculiar TDS related issues [Cont. . ] Bar against direct demand on assesses Certain peculiar TDS related issues [Cont. . ] Bar against direct demand on assesses](https://slidetodoc.com/presentation_image/31fcaf136f009ff2f5ed3ac79b73be01/image-25.jpg)

- Slides: 28

1

What is TDS? Tax Deducted at Source (TDS) aims at collection of revenue at the very source of income; an indirect method of collecting tax; combines the concepts of pay as you earn and collect as it is being earned. TDS is one of the modes of collection of taxes, by which a certain percentage of amounts are deducted by a person at the time of making/crediting certain specific nature of payment to the other person and deducted amount is remitted to the Government account. 2

Basis of TDS ? Charge of income-tax. 4. (1) Where any Central Act enacts that income-tax shall be charged for any assessment year at any rate or rates, income-tax at that rate or those rates shall be charged for that year in accordance with, and subject to the provisions (including provisions for the levy of additional income-tax) of, this Act in respect of the total income of the previous year of every person : (2) In respect of income chargeable under sub-section (1), income-tax shall be deducted at the source or paid in advance, where it is so deductible or payable under any provision of this Act. 3

Role of PAN ? [Requirement to furnish Permanent Account Number. 206 AA. (1) Notwithstanding anything contained in any other provisions of this Act, any person entitled to receive any sum or income or amount, on which tax is deductible under Chapter XVIIB (hereafter referred to as deductee) shall furnish his Permanent Account Number to the person responsible for deducting such tax (hereafter referred to as deductor), failing which tax shall be deducted at the higher of the following rates, namely: — (i) at the rate specified in the relevant provision of this Act; or(ii) at the rate or rates in force; or(iii) at the rate of twenty per cent. (2) No declaration under sub-section (1) or sub-section (1 A) or sub-section (1 C) of section 197 A shall be valid unless the person furnishes his Permanent Account Number in such declaration. (3) In case any declaration becomes invalid under sub-section (2), the deductor shall deduct the tax at source in accordance with the provisions of sub-section (1). [Cont. . ] 4

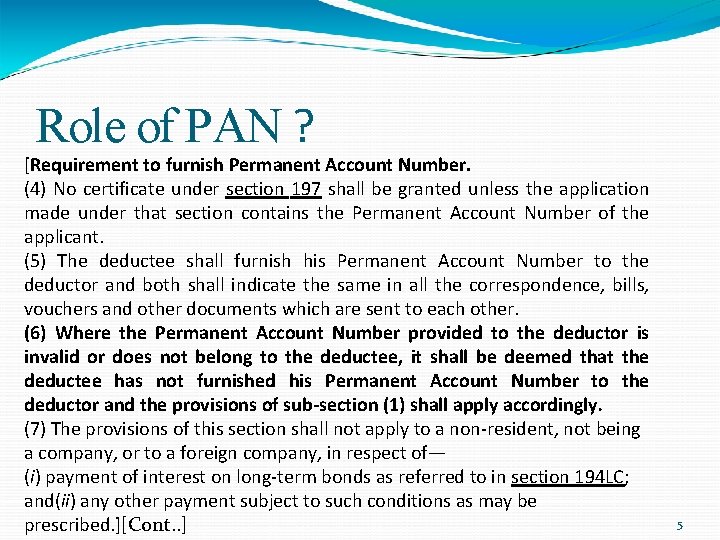

Role of PAN ? [Requirement to furnish Permanent Account Number. (4) No certificate under section 197 shall be granted unless the application made under that section contains the Permanent Account Number of the applicant. (5) The deductee shall furnish his Permanent Account Number to the deductor and both shall indicate the same in all the correspondence, bills, vouchers and other documents which are sent to each other. (6) Where the Permanent Account Number provided to the deductor is invalid or does not belong to the deductee, it shall be deemed that the deductee has not furnished his Permanent Account Number to the deductor and the provisions of sub-section (1) shall apply accordingly. (7) The provisions of this section shall not apply to a non-resident, not being a company, or to a foreign company, in respect of— (i) payment of interest on long-term bonds as referred to in section 194 LC; and(ii) any other payment subject to such conditions as may be prescribed. ][Cont. . ] 5

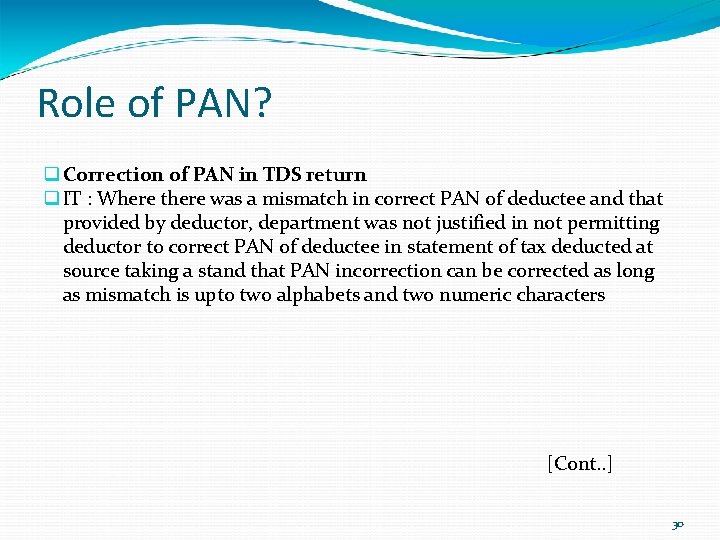

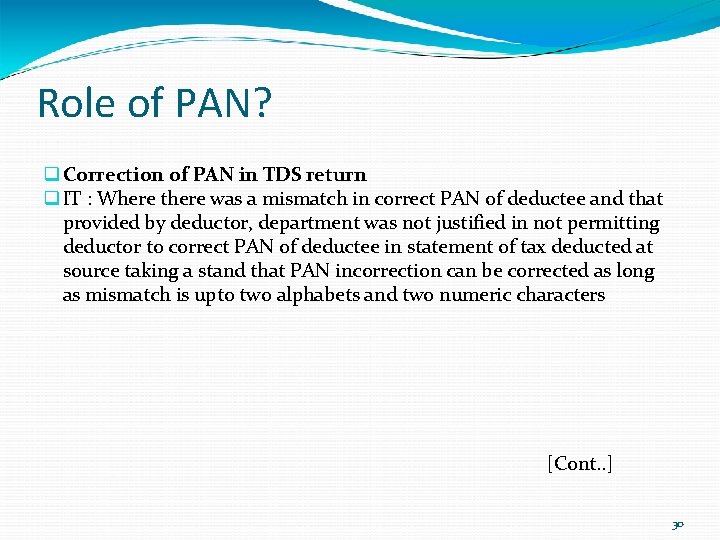

Role of PAN? Correction of PAN in TDS return IT : Where there was a mismatch in correct PAN of deductee and that provided by deductor, department was not justified in not permitting deductor to correct PAN of deductee in statement of tax deducted at source taking a stand that PAN incorrection can be corrected as long as mismatch is upto two alphabets and two numeric characters [Cont. . ] 30

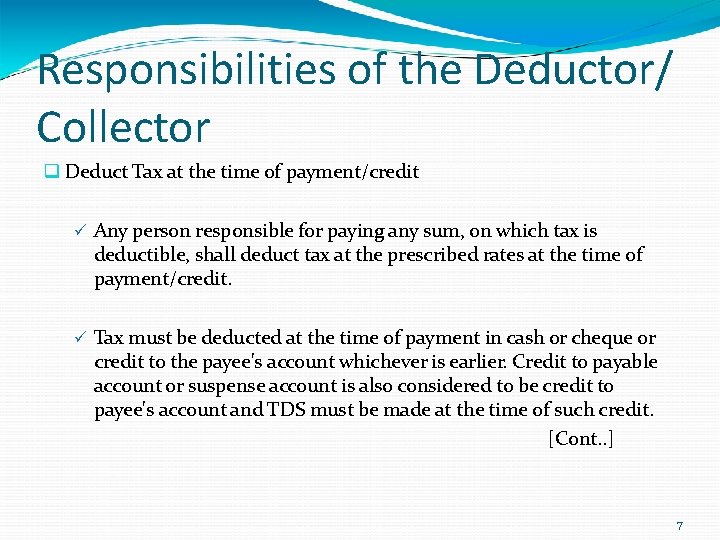

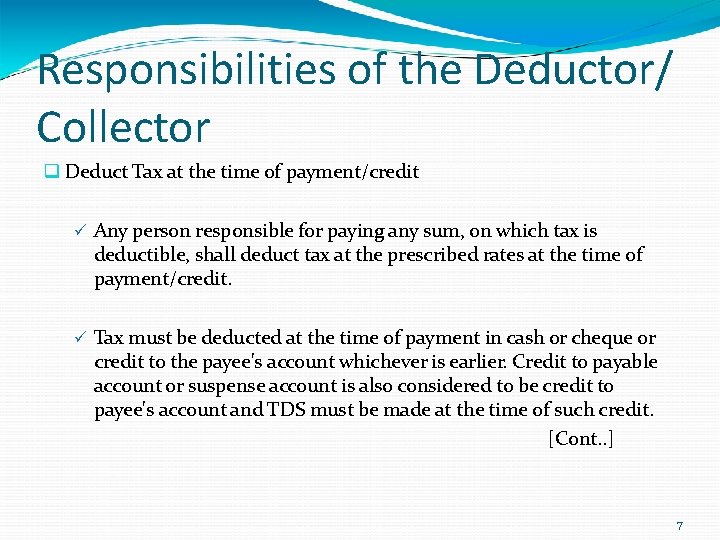

Responsibilities of the Deductor/ Collector Deduct Tax at the time of payment/credit Any person responsible for paying any sum, on which tax is deductible, shall deduct tax at the prescribed rates at the time of payment/credit. Tax must be deducted at the time of payment in cash or cheque or credit to the payee's account whichever is earlier. Credit to payable account or suspense account is also considered to be credit to payee's account and TDS must be made at the time of such credit. [Cont. . ] 7

![Responsibilities of the Deductor Collector Cont Deposit deducted tax within the prescribed Responsibilities of the Deductor/ Collector [Cont. . ] Deposit deducted tax within the prescribed](https://slidetodoc.com/presentation_image/31fcaf136f009ff2f5ed3ac79b73be01/image-8.jpg)

Responsibilities of the Deductor/ Collector [Cont. . ] Deposit deducted tax within the prescribed time limits: In case of Government deductors: on the same day where the tax is paid without production of an income-tax challan; and In case of Others : on or before 30 th day of April where the income or amount is credited or paid in the month of March; in any other case, on or before seven days from the end of the month in which- the deduction is made; or income-tax is due under sub-� section (1 A) of section 192. 8

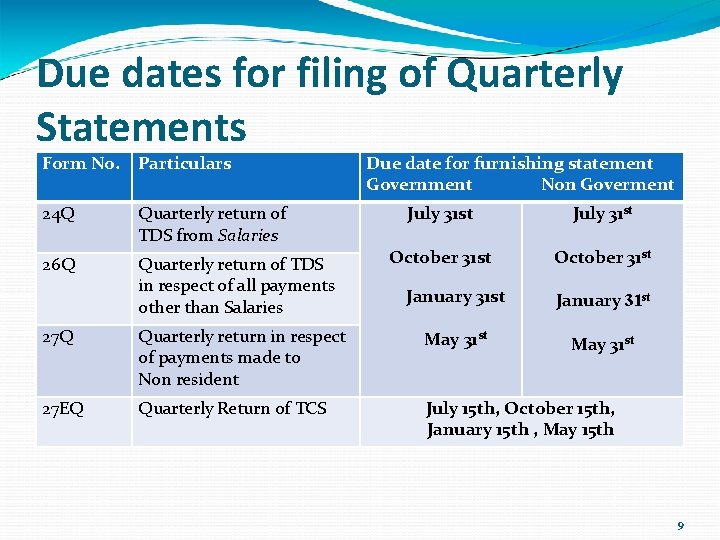

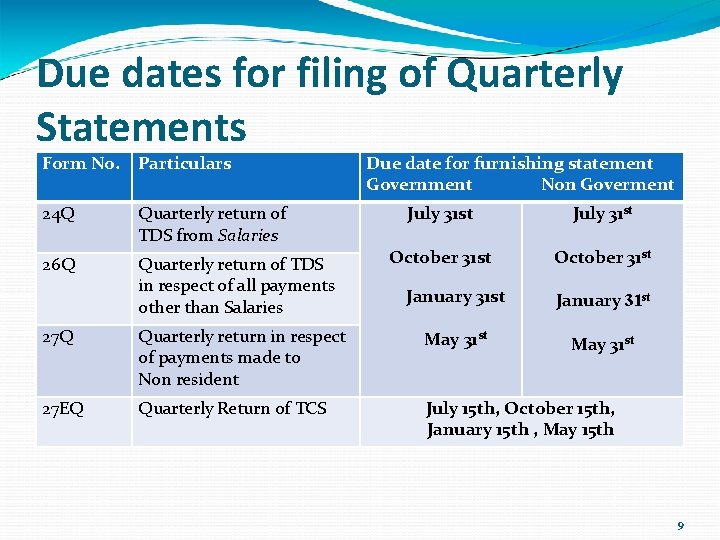

Due dates for filing of Quarterly Statements Form No. Particulars 24 Q Quarterly return of TDS from Salaries 26 Q Quarterly return of TDS in respect of all payments other than Salaries Due date for furnishing statement Government Non Goverment July 31 st October 31 st January 31 st May 31 st 27 Q Quarterly return in respect of payments made to Non resident May 31 st 27 EQ Quarterly Return of TCS July 15 th, October 15 th, January 15 th , May 15 th 9

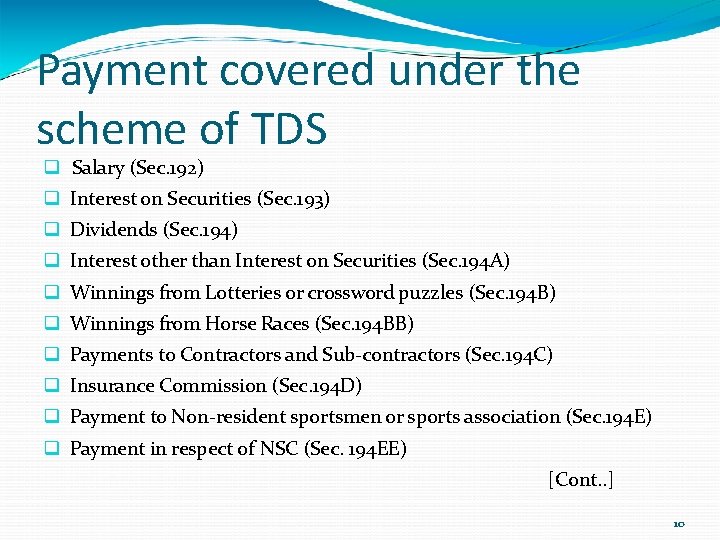

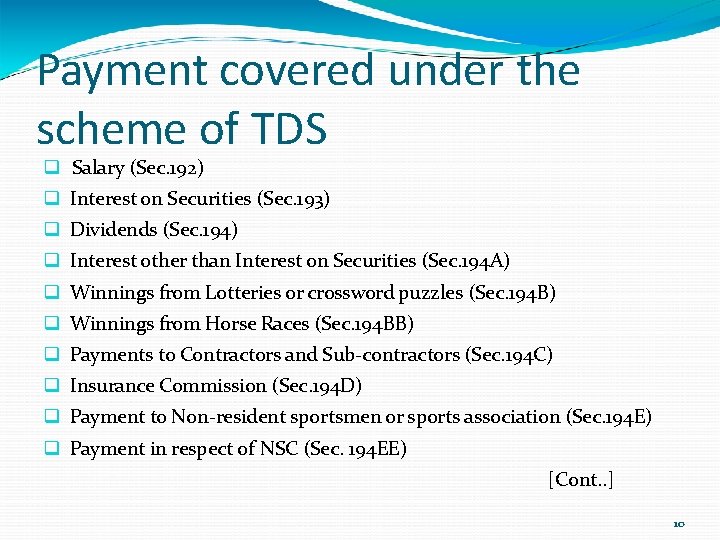

Payment covered under the scheme of TDS Salary (Sec. 192) Interest on Securities (Sec. 193) Dividends (Sec. 194) Interest other than Interest on Securities (Sec. 194 A) Winnings from Lotteries or crossword puzzles (Sec. 194 B) Winnings from Horse Races (Sec. 194 BB) Payments to Contractors and Sub-contractors (Sec. 194 C) Insurance Commission (Sec. 194 D) Payment to Non-resident sportsmen or sports association (Sec. 194 E) Payment in respect of NSC (Sec. 194 EE) [Cont. . ] 10

![Payment covered under the scheme of TDS Cont Payments in respect of Payment covered under the scheme of TDS [Cont. . ] Payments in respect of](https://slidetodoc.com/presentation_image/31fcaf136f009ff2f5ed3ac79b73be01/image-11.jpg)

Payment covered under the scheme of TDS [Cont. . ] Payments in respect of Repurchase of units of Mutual Funds or UTI (Sec. 194 F) Commission on Sale of Lottery Tickets (Sec. 194 G) Commission or Brokerage (Sec. 194 H) Rent (Sec. 194 I) TDS on transfer of Immovable property (Sec. 194 IA) Fees for Professional or Technical Services (Sec. 194 J) Payment of Compensation on acquisition of certain immovable property (Sec. 194 LA) Other Sums (Sec. 195) Long term capital gain (Sec. 196 B) Income or Long term capital gain from Foreign Currency bonds/Global Depository Receipts (Sec. 196 C) Income of Foreign Institutional Investors from Securities (Sec. 196 D) 11

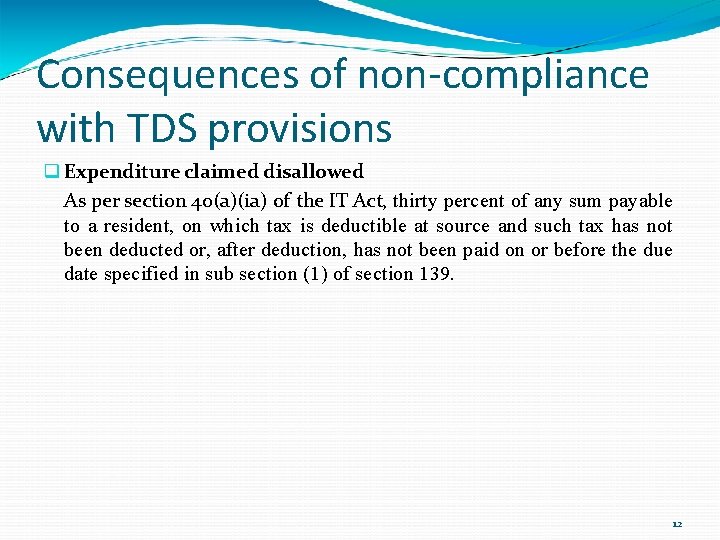

Consequences of non-compliance with TDS provisions Expenditure claimed disallowed As per section 40(a)(ia) of the IT Act, thirty percent of any sum payable to a resident, on which tax is deductible at source and such tax has not been deducted or, after deduction, has not been paid on or before the due date specified in sub section (1) of section 139. 12

![Consequences of noncompliance with TDS provisions Cont Assessee in default An assessee Consequences of non-compliance with TDS provisions [Cont. . ] Assessee in default An assessee](https://slidetodoc.com/presentation_image/31fcaf136f009ff2f5ed3ac79b73be01/image-13.jpg)

Consequences of non-compliance with TDS provisions [Cont. . ] Assessee in default An assessee shall be deemed to be in default in respect of : Non deduction of tax at source Non payment, in whole or in part, of the tax deducted Amendment to section 201 f. 1 -7 -2012, if the payer has not deducted tax, he shall not be deemed to be an assessee in default in case : The recipient has included such income in the return submitted u/s. 139 and has paid tax on such income and The payee submits a certificate to this effect from a chartered accountant (Form No. 26 A) [Cont. . ] 13

![Consequences of noncompliance with TDS provisions Cont Note The amendment is not Consequences of non-compliance with TDS provisions [Cont. . ] Note: The amendment is not](https://slidetodoc.com/presentation_image/31fcaf136f009ff2f5ed3ac79b73be01/image-14.jpg)

Consequences of non-compliance with TDS provisions [Cont. . ] Note: The amendment is not applicable if the recipient is a Non resident. If any deductor who is not considered as an assessee in default as per the above provision, interest u/s. 201(1 A) under clause(1) shall be payable from the date on which such tax was deductible to the date of furnishing of return of income (w. e. f 01. 07. 2012). [Cont. . ] 14

![Consequences of noncompliance with TDS provisions Cont Interest Section Nature of default Consequences of non-compliance with TDS provisions [Cont. . ] Interest Section Nature of default](https://slidetodoc.com/presentation_image/31fcaf136f009ff2f5ed3ac79b73be01/image-15.jpg)

Consequences of non-compliance with TDS provisions [Cont. . ] Interest Section Nature of default Interest 201(1 A) Non-deduction of tax at source, either in whole or part. After deduction, non payment of tax, either in whole or part. Non- payment of tax u/s 192(1 A). simple interest @ 1% per month from the date on which tax was deductible to the date on which tax is actually deducted simple interest @1. 5% per month from the date on which tax was deducted to the date on which tax is actually paid [Cont. . ] 15

![Consequences of noncompliance with TDS provisions Cont Levy of fee us 234 Consequences of non-compliance with TDS provisions [Cont. . ] Levy of fee u/s 234](https://slidetodoc.com/presentation_image/31fcaf136f009ff2f5ed3ac79b73be01/image-16.jpg)

Consequences of non-compliance with TDS provisions [Cont. . ] Levy of fee u/s 234 E (w. e. f. 01. 07. 2012) Failure to file TDS/TCS quarterly statements shall be liable for a fee of Rs. 200 per day of default and shall not exceed the amount of tax deductible or collectible. The fee shall be paid before delivering the quarterly statements. [Cont. . ] 16

![Consequences of noncompliance with TDS provisions Cont Penalty Section Nature of default Consequences of non-compliance with TDS provisions [Cont. . ] Penalty Section Nature of default](https://slidetodoc.com/presentation_image/31fcaf136f009ff2f5ed3ac79b73be01/image-17.jpg)

Consequences of non-compliance with TDS provisions [Cont. . ] Penalty Section Nature of default Penalty 271 C Failure to deduct the whole or any part of tax at source Sum equal to the amount of tax which was failed to be deducted 271 CA Failure to collect the whole or any part of tax at source (TCS) Sum equal to the amount of tax which he failed to collect 271 H(1)(a) Failure to submit quarterly Penalty of Rs. 10, 000 to Rs. 1, 000 return 271 H(1)(b) for furnishing quarterly returns No penalty shall be levied if the with incorrect information revised returns are filed within a period of one year from the due date. [Cont. . ] 17

![Consequences of noncompliance with TDS provisions Cont Penalty Cont Section Consequences of non-compliance with TDS provisions [Cont. . ] Penalty [Cont. . ] Section](https://slidetodoc.com/presentation_image/31fcaf136f009ff2f5ed3ac79b73be01/image-18.jpg)

Consequences of non-compliance with TDS provisions [Cont. . ] Penalty [Cont. . ] Section Nature of default Penalty 272 B Failure to comply with provisions of Section 139 A for quoting Pan Rs. 10, 000 272 BB Failure to obtain TAN Rs. 10, 000 272 A(2) 1. Failure to issue TDS certificates 2. Failure to deliver declaration in Form 15 G/15 H 3. Failure to file quarterly statements (only till 30 -06 -2012) Rs. 100 for every day during which the failure continues but the penalty shall not exceed the amount of tax Deductible 18

![Consequences of noncompliance with TDS provisions Cont Prosecution Section Nature of default Consequences of non-compliance with TDS provisions [Cont. . ] Prosecution Section Nature of default](https://slidetodoc.com/presentation_image/31fcaf136f009ff2f5ed3ac79b73be01/image-19.jpg)

Consequences of non-compliance with TDS provisions [Cont. . ] Prosecution Section Nature of default Prosecution 276 B Failure to pay Tax Deducted Punishable with rigorous at Source imprisonment for minimum 3 months , maximum 7 years and with fine 276 BB Failure to pay Tax Collected at Source (TCS) Punishable with rigorous imprisonment for minimum 3 months , maximum 7 years and with fine 19

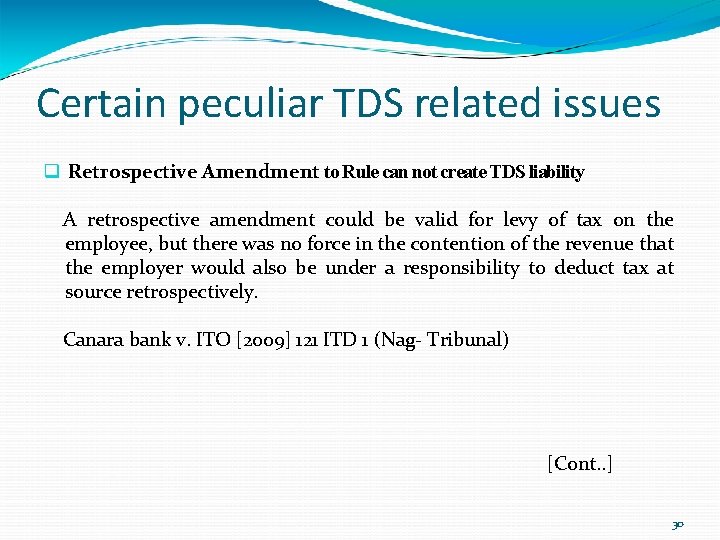

Certain peculiar TDS related issues Retrospective Amendment to Rule can not create TDS liability A retrospective amendment could be valid for levy of tax on the employee, but there was no force in the contention of the revenue that the employer would also be under a responsibility to deduct tax at source retrospectively. Canara bank v. ITO [2009] 121 ITD 1 (Nag- Tribunal) [Cont. . ] 30

![Certain peculiar TDS related issues Cont Month for the calculation of Interest Certain peculiar TDS related issues [Cont. . ] Month for the calculation of Interest](https://slidetodoc.com/presentation_image/31fcaf136f009ff2f5ed3ac79b73be01/image-21.jpg)

Certain peculiar TDS related issues [Cont. . ] Month for the calculation of Interest payable under section 201(1 A) should be computed by taking a period of 30 days as a month instead of british calendar month. Navayuga Quazigund Expressway (P. ) Ltd v. Dy CIT [2015] 64 taxmann. com 212 (Hyd-tri) Oil & Natural Gas Commission v. s Asst. CIT [2015] 62 taxmann. com 133/155 ITD 603 (Ahd-Trib. ) [Cont. . ] 21

![Certain peculiar TDS related issues Cont S 194 J applies to payments Certain peculiar TDS related issues [Cont. . ] S. 194 J applies to payments](https://slidetodoc.com/presentation_image/31fcaf136f009ff2f5ed3ac79b73be01/image-22.jpg)

Certain peculiar TDS related issues [Cont. . ] S. 194 J applies to payments made to non-professionals such as hospitals by TPA(Third party Administrators) It has been decided by Delhi High Court that though a hospital by itself, being an artificial entity, is not a Dz medical professionaldz ety it provides medical services by engaging the services of doctors and qualified medical professionals. These are services rendered in the course of the carrying on of the medical profession. S. 194 J applies to payments made to non-professionals such as hospitals. It was decided in the case Dedicated Health Care Services TPA vs. ACIT. 22

![Certain peculiar TDS related issues Cont Fees For Technical Services CBDTs latter Certain peculiar TDS related issues [Cont. . ] Fees For Technical Services CBDT's latter](https://slidetodoc.com/presentation_image/31fcaf136f009ff2f5ed3ac79b73be01/image-23.jpg)

Certain peculiar TDS related issues [Cont. . ] Fees For Technical Services CBDT's latter circular no. 715 dated 08. 1995 dealing with question no. 29 as to whether a maintenance contract including supply of spares would be covered u/s. 194 C of the Act would be covered u/s. 194 C or 194 J of the Act. The Board's answer thereto clarified such a contract including supply of shares would come u/s. 194 C of the Act. It further declared that such a contract would attract Section 194 J of the Act if it involved technical services being rendered be the recipient. 23

![Certain peculiar TDS related issues Cont Sum paid to co providing support Certain peculiar TDS related issues [Cont. . ] Sum paid to co. providing support](https://slidetodoc.com/presentation_image/31fcaf136f009ff2f5ed3ac79b73be01/image-24.jpg)

Certain peculiar TDS related issues [Cont. . ] Sum paid to co. providing support services to assessee’s rail equipment manufacturing activity liable to TDS u/s 194 J IT: Where assessee, engaged in manufacturing rail vehicles and coaches, made payments to 'CSCIPL' for rendering desktop, help desk, call centre, datacentre, network and application management services to support assessee's rail equipment manufacturing and services operation, said services being in nature of technical or professional services, required deduction of tax at source under section 194 J and not under section 194 C It was decided in the case Bombardier Transportation India (P. ) Ltd. vs. DCIT. [2018] 89 taxmann. com 324 (Ahmedabad - Trib. ) 24

![Certain peculiar TDS related issues Cont Bar against direct demand on assesses Certain peculiar TDS related issues [Cont. . ] Bar against direct demand on assesses](https://slidetodoc.com/presentation_image/31fcaf136f009ff2f5ed3ac79b73be01/image-25.jpg)

Certain peculiar TDS related issues [Cont. . ] Bar against direct demand on assesses /Payee Letter F. No. 275/29/2014 IT- (B) dated 01/06/2015: Provides that as per section 199 of the Act credit of TDS is given to the person only if it is paid to the central government Account. However as per section 205 of the Act the Assessee shall not be called upon to pay the tax to the extant tax has been deducted from his income where the tax is deductible at source under provisions of Chapter XVII. Thus the Act puts a bar on direct demand against the assessee in such cases and the demand on account of tax credit mismatch can not be enforced coercively. 25

26

Shailendra Jain E-mail: aotariff@gmail. com 34

35