1 Definition meaning of cost accounting 2 Cost

- Slides: 52

1. Definition & meaning of cost accounting 2. Cost terminology 3. Classification of costs and calculation of various cost. 4. Model Paper 5. Quiz 6. Home Assignment

COST ACCOUNTING INTRODUCTION

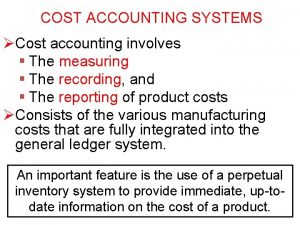

COST ACCOUNTING - MEANING Cost accounting is concerned with recording, classifying and summarizing costs for determination of costs of products or services, planning, controlling and reducing such costs and furnishing of information to management for decision making

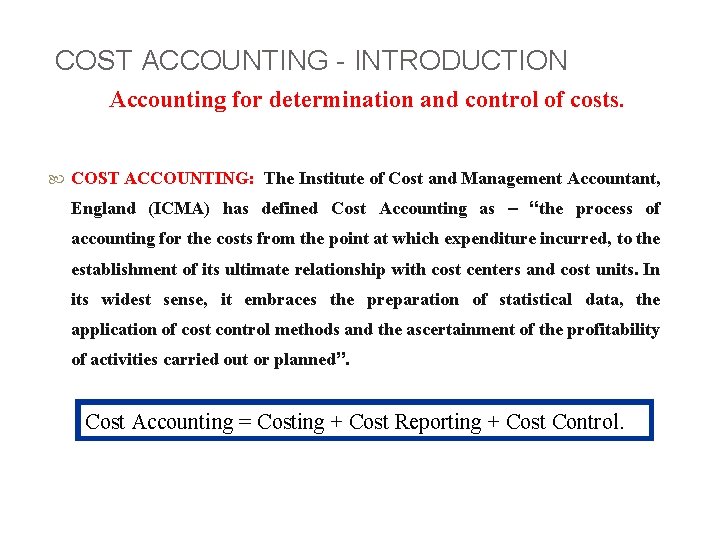

COST ACCOUNTING - INTRODUCTION Accounting for determination and control of costs. COST ACCOUNTING: The Institute of Cost and Management Accountant, England (ICMA) has defined Cost Accounting as – “the process of accounting for the costs from the point at which expenditure incurred, to the establishment of its ultimate relationship with cost centers and cost units. In its widest sense, it embraces the preparation of statistical data, the application of cost control methods and the ascertainment of the profitability of activities carried out or planned”. Cost Accounting = Costing + Cost Reporting + Cost Control.

COST - MEANING Cost means the amount of expenditure ( actual or notional) incurred on, or attributable to, a given thing.

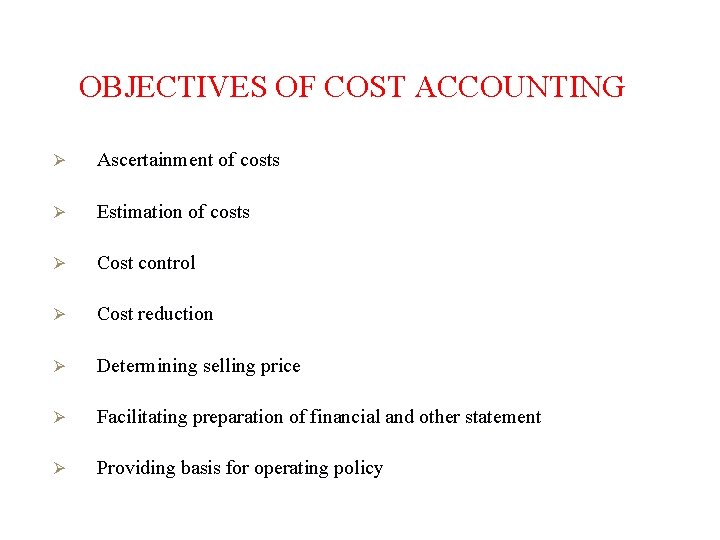

OBJECTIVES OF COST ACCOUNTING Ø Ascertainment of costs Ø Estimation of costs Ø Cost control Ø Cost reduction Ø Determining selling price Ø Facilitating preparation of financial and other statement Ø Providing basis for operating policy

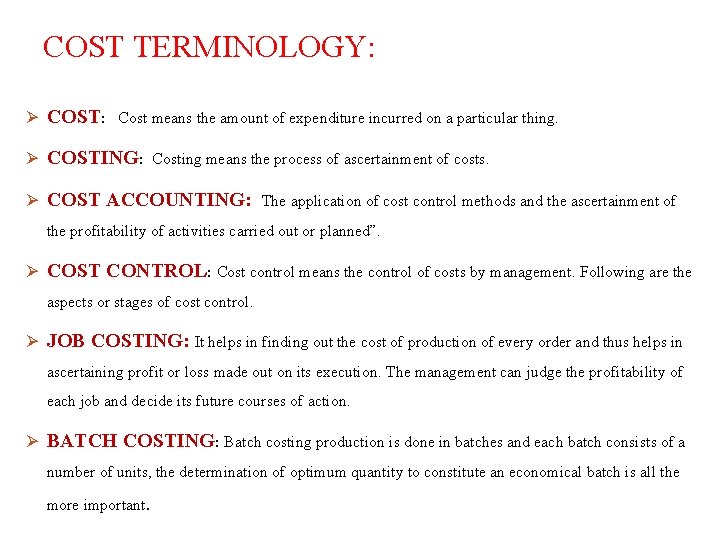

COST TERMINOLOGY: Ø COST: Cost means the amount of expenditure incurred on a particular thing. Ø COSTING: Costing means the process of ascertainment of costs. Ø COST ACCOUNTING: The application of cost control methods and the ascertainment of the profitability of activities carried out or planned”. Ø COST CONTROL: Cost control means the control of costs by management. Following are the aspects or stages of cost control. Ø JOB COSTING: It helps in finding out the cost of production of every order and thus helps in ascertaining profit or loss made out on its execution. The management can judge the profitability of each job and decide its future courses of action. Ø BATCH COSTING: Batch costing production is done in batches and each batch consists of a number of units, the determination of optimum quantity to constitute an economical batch is all the more important.

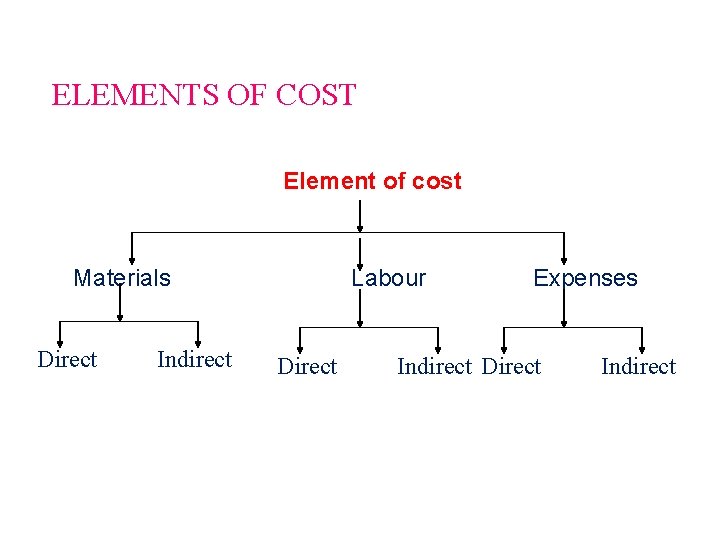

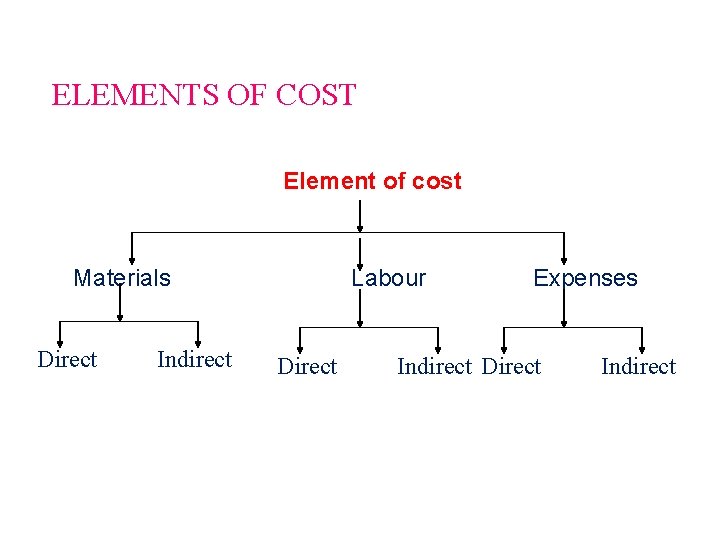

ELEMENTS OF COST Element of cost Materials Direct Indirect Labour Expenses Direct Indirect

MATERIAL: The substance from which the finished product is made is known as material. (a) DIRECT MATERIAL: is one which can be directly or easily identified in the product Eg: Timber in furniture, Cloth in dress, etc. (b) INDIRECT MATERIAL: one which cannot be easily identified in the product.

EXAMPLES OF INDIRECT MATERIAL At factory level – lubricants, oil, consumables, etc. At office level – Printing & stationery, Brooms, Dusters, etc. At selling & dist. level – Packing materials, printing & stationery, etc.

LABOUR: The human effort required to convert the materials into finished product is called labour. (a) DIRECT LABOUR: is one which can be conveniently identified or attributed wholly to a particular job, product or process. Eg: wages paid to carpenter, fees paid to tailor, etc. (b) INDIRECT LABOUR: is one which cannot be conveniently identified or attributed wholly to a particular job, product or process.

EXAMPLES OF INDIRECT LABOUR At factory level – foremen’s salary, works manager’s salary, gate keeper’s salary, etc At office level – Accountant’s salary, GM’s salary, Manager’s salary, etc. At selling and dist. level – salesmen salaries, Logistics manager salary, etc.

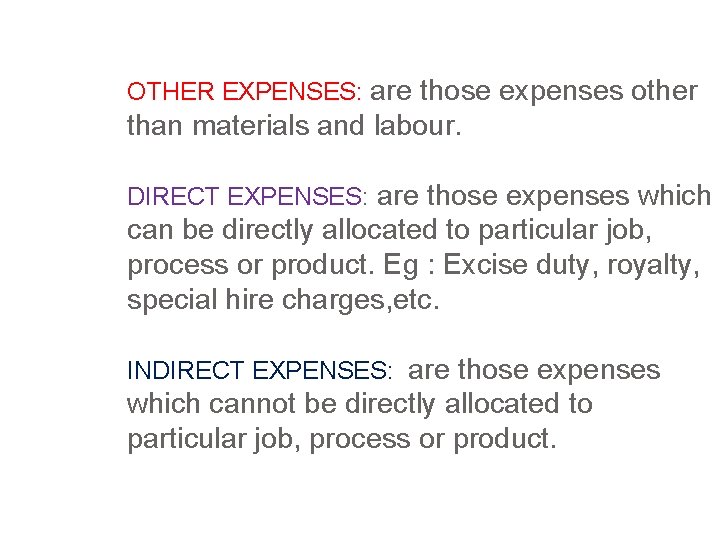

OTHER EXPENSES: are those expenses other than materials and labour. DIRECT EXPENSES: are those expenses which can be directly allocated to particular job, process or product. Eg : Excise duty, royalty, special hire charges, etc. INDIRECT EXPENSES: are those expenses which cannot be directly allocated to particular job, process or product.

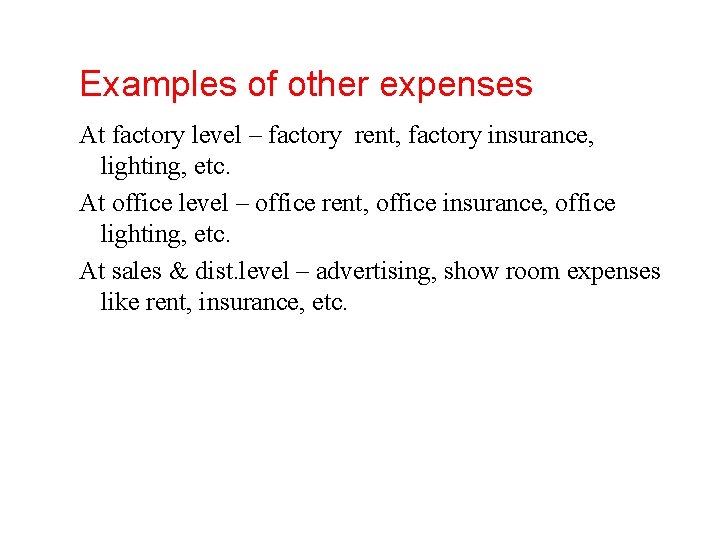

Examples of other expenses At factory level – factory rent, factory insurance, lighting, etc. At office level – office rent, office insurance, office lighting, etc. At sales & dist. level – advertising, show room expenses like rent, insurance, etc.

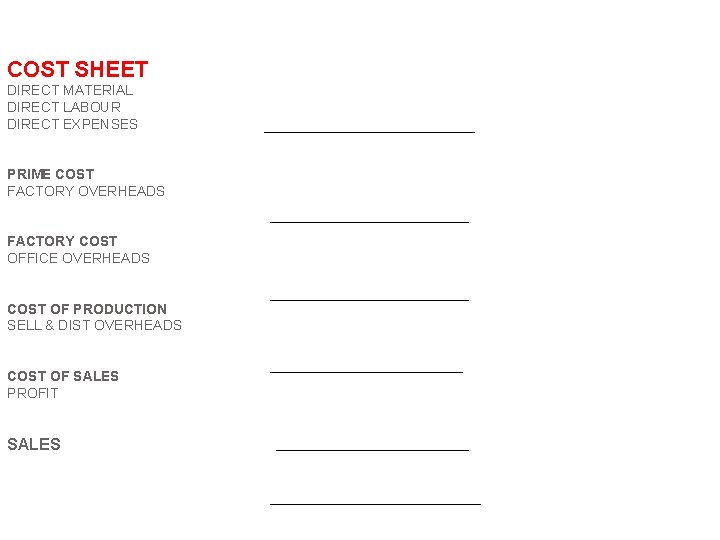

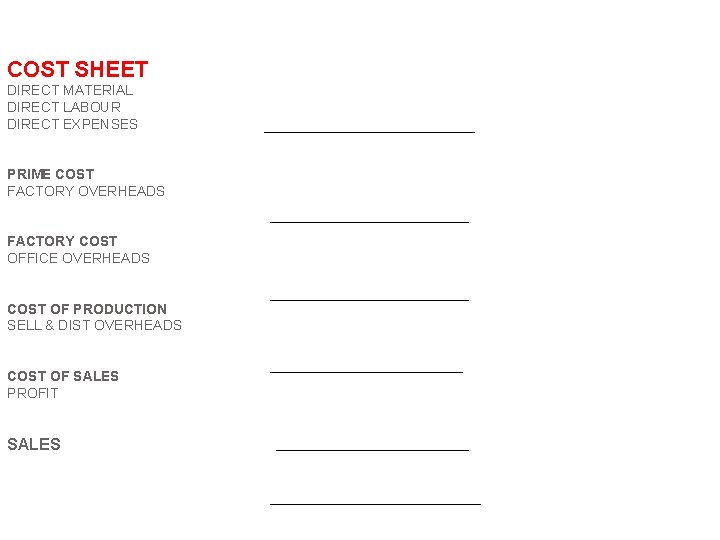

COST SHEET DIRECT MATERIAL DIRECT LABOUR DIRECT EXPENSES PRIME COST FACTORY OVERHEADS FACTORY COST OFFICE OVERHEADS COST OF PRODUCTION SELL & DIST OVERHEADS COST OF SALES PROFIT SALES

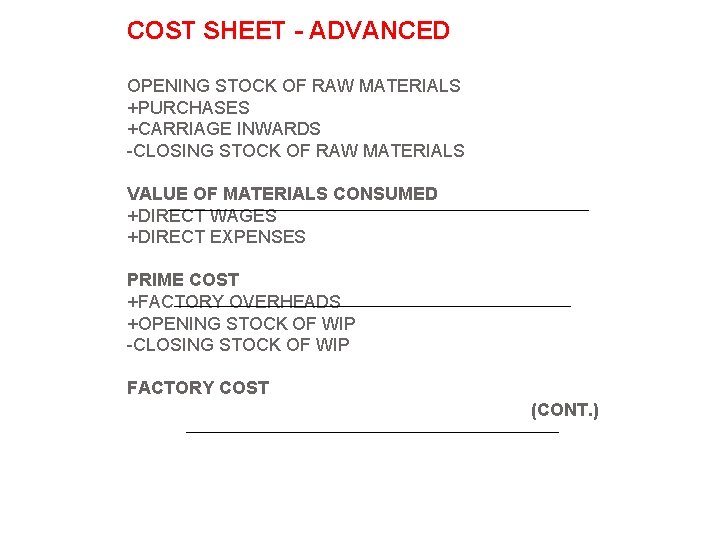

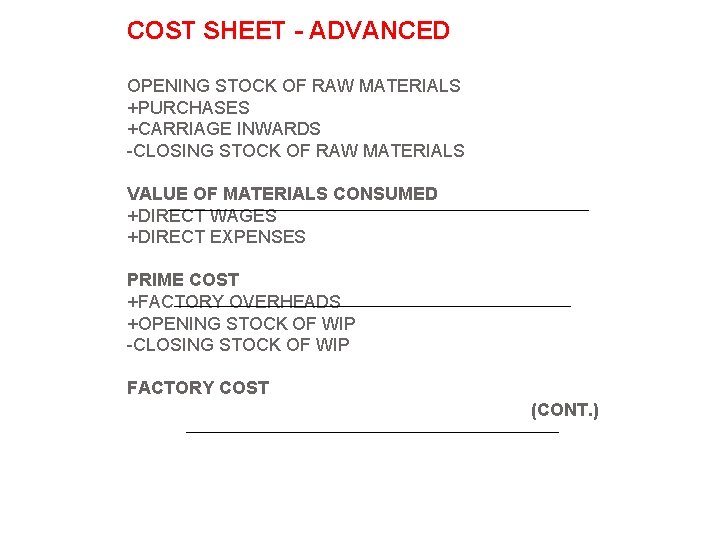

COST SHEET - ADVANCED OPENING STOCK OF RAW MATERIALS +PURCHASES +CARRIAGE INWARDS -CLOSING STOCK OF RAW MATERIALS VALUE OF MATERIALS CONSUMED +DIRECT WAGES +DIRECT EXPENSES PRIME COST +FACTORY OVERHEADS +OPENING STOCK OF WIP -CLOSING STOCK OF WIP FACTORY COST (CONT. )

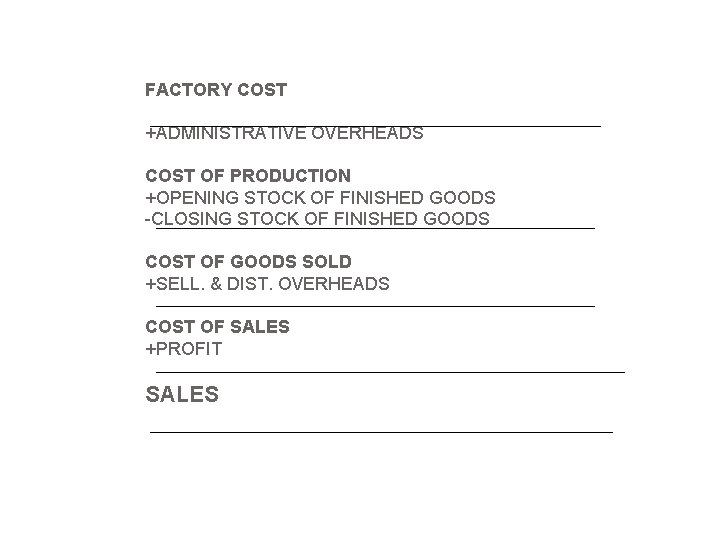

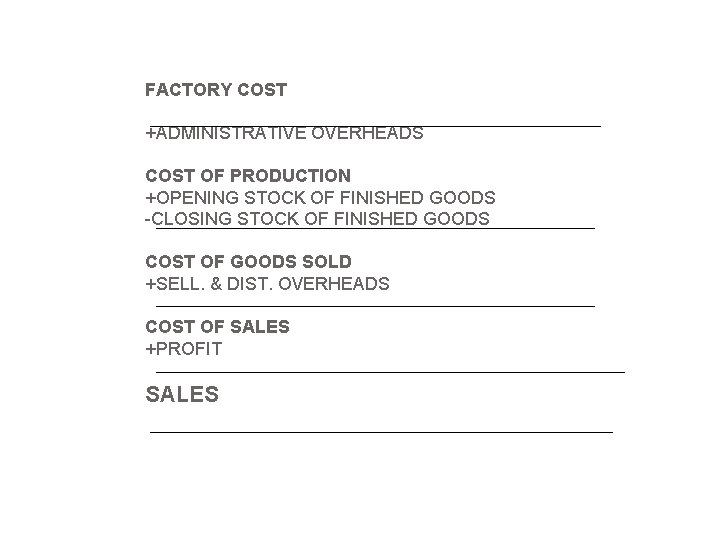

FACTORY COST +ADMINISTRATIVE OVERHEADS COST OF PRODUCTION +OPENING STOCK OF FINISHED GOODS -CLOSING STOCK OF FINISHED GOODS COST OF GOODS SOLD +SELL. & DIST. OVERHEADS COST OF SALES +PROFIT SALES

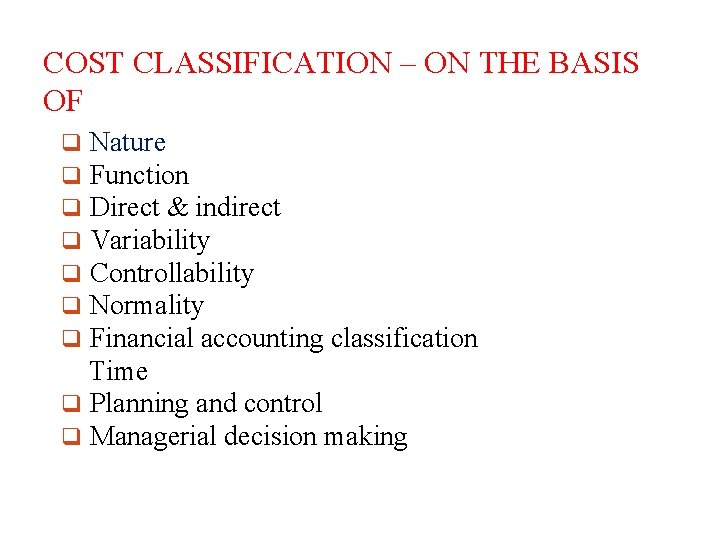

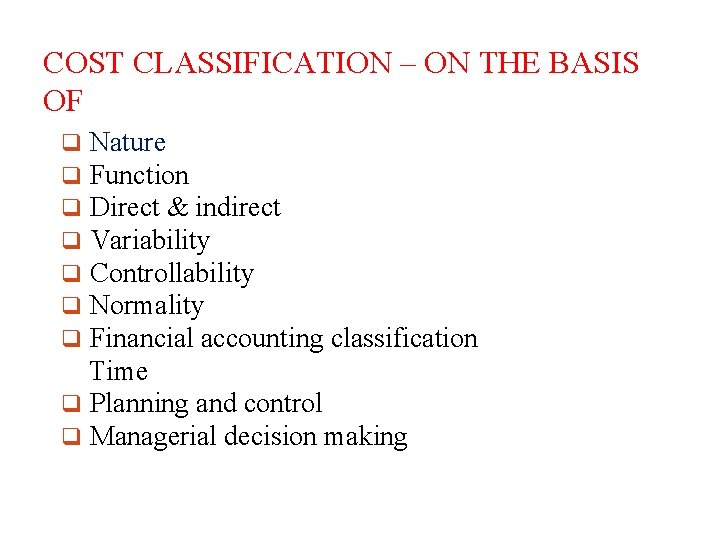

COST CLASSIFICATION – ON THE BASIS OF q Nature q Function q Direct & indirect q Variability q Controllability q Normality q Financial accounting classification Time q Planning and control q Managerial decision making

ON THE BASIS OF NATURE Ø Materials Ø Labour Ø Expenses

ON THE BASIS OF FUNCTION Ø Manufacturing costs Ø Commercial costs – ADM and S&D Costs ON THE BASIS OF DIRECT AND INDIRECT Ø Direct costs Ø Indirect costs

ON THE BASIS OF VARIABILITY Ø Fixed costs Ø Variable costs Ø Semi variable costs

ON THE BASIS OF CONTROLLABILITY Ø Controllable costs Ø Uncontrollable costs ON THE BASIS OF NORMALITY Ø Normal costs Ø Abnormal costs

ON THE BASIS OF FINANCIAL ACCOUNTS: Ø Capital costs Ø Revenue costs Ø Deferred revenue costs

ON THE BASIS OF TIME: Ø Historical costs Ø Pre determined costs ON THE BASIS OF PLANNING AND CONTROL: Ø Budgeted costs Ø Standard costs

ON THE BASIS OF MANAGERIAL DECISION MAKING Ø Marginal costs Ø Out of pocket costs Ø Sunk costs Ø Imputed costs Ø Opportunity costs Ø Replacement costs Ø Avoidable costs Ø Unavoidable costs Ø Relevant and irrelevant costs Ø Differential costs

TERMS IN COST ACCOUNTING Ø Cost unit Ø Cost centre Ø Cost estimation Ø Cost ascertainment Ø Cost allocation Ø Cost apportionment Ø Cost reduction Ø Cost control

METHODS OF COSTING Ø Job costing Ø Contract costing Ø Batch costing Ø Process costing Ø Unit costing Ø Operating costing Ø Operation costing Ø Multiple costing

TYPES OF COSTING Ø Uniform costing Ø Marginal costing Ø Standard costing Ø Historical costing Ø Direct costing Ø Absorption costing

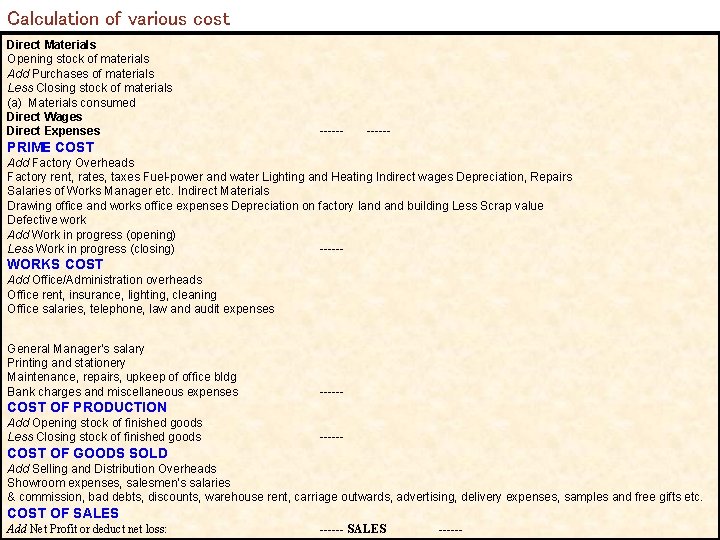

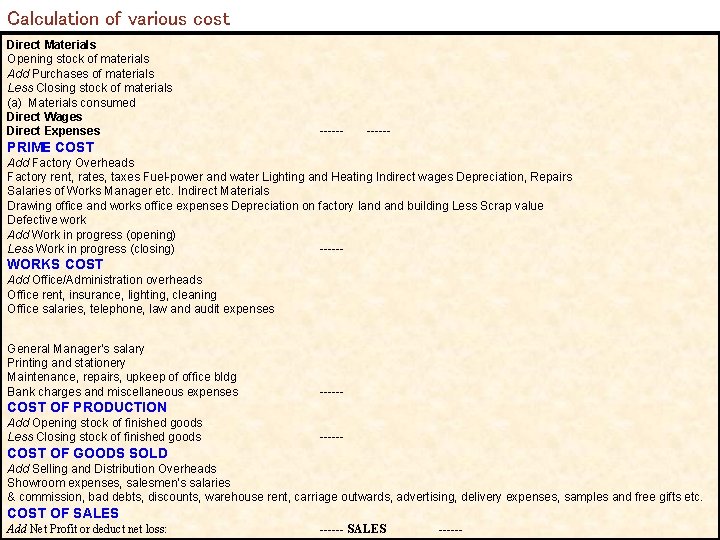

Calculation of various cost Direct Materials Opening stock of materials Add Purchases of materials Less Closing stock of materials (a) Materials consumed Direct Wages Direct Expenses ------ PRIME COST Add Factory Overheads Factory rent, rates, taxes Fuel-power and water Lighting and Heating Indirect wages Depreciation, Repairs Salaries of Works Manager etc. Indirect Materials Drawing office and works office expenses Depreciation on factory land building Less Scrap value Defective work Add Work in progress (opening) Less Work in progress (closing) ------ WORKS COST Add Office/Administration overheads Office rent, insurance, lighting, cleaning Office salaries, telephone, law and audit expenses General Manager’s salary Printing and stationery Maintenance, repairs, upkeep of office bldg Bank charges and miscellaneous expenses ------ COST OF PRODUCTION Add Opening stock of finished goods Less Closing stock of finished goods ------ COST OF GOODS SOLD Add Selling and Distribution Overheads Showroom expenses, salesmen’s salaries & commission, bad debts, discounts, warehouse rent, carriage outwards, advertising, delivery expenses, samples and free gifts etc. COST OF SALES Add Net Profit or deduct net loss: ------ SALES ------

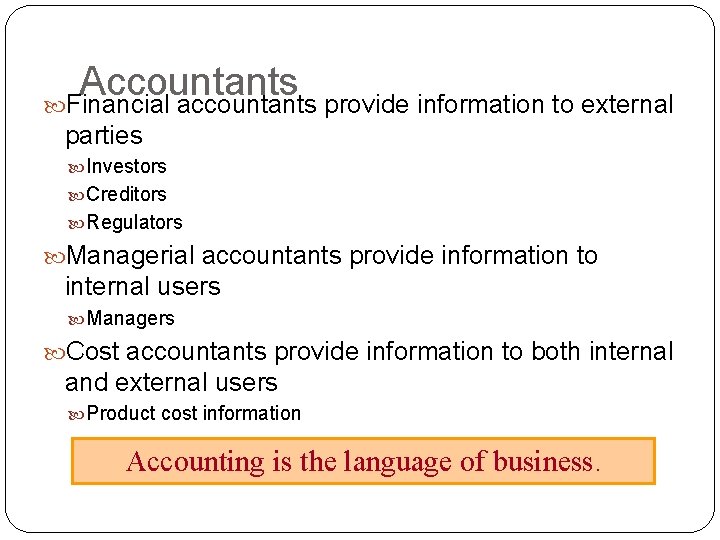

Accountants Financial accountants provide information to external parties Investors Creditors Regulators Managerial accountants provide information to internal users Managers Cost accountants provide information to both internal and external users Product cost information Accounting is the language of business.

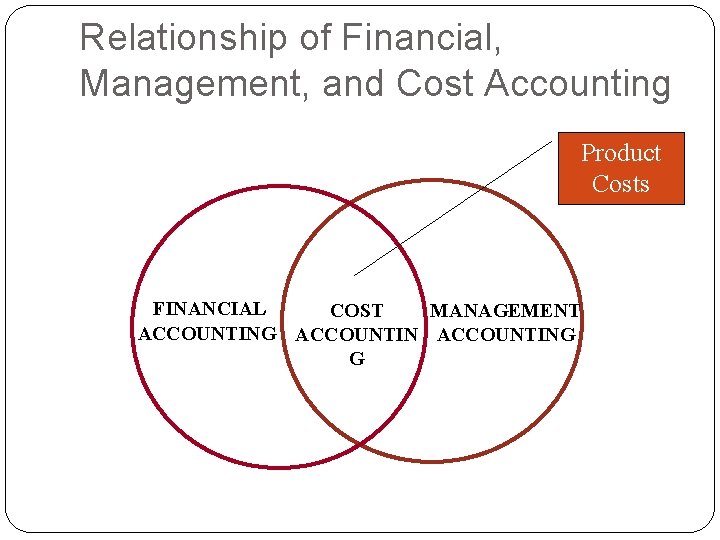

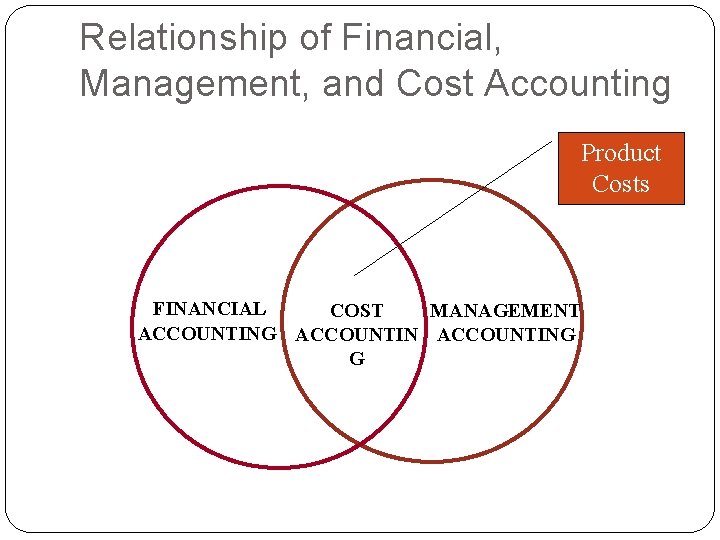

Relationship of Financial, Management, and Cost Accounting Product Costs FINANCIAL COST MANAGEMENT ACCOUNTING G

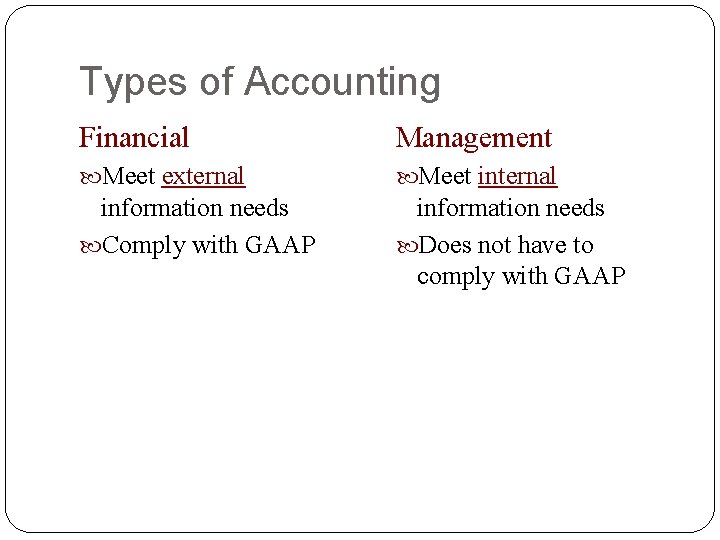

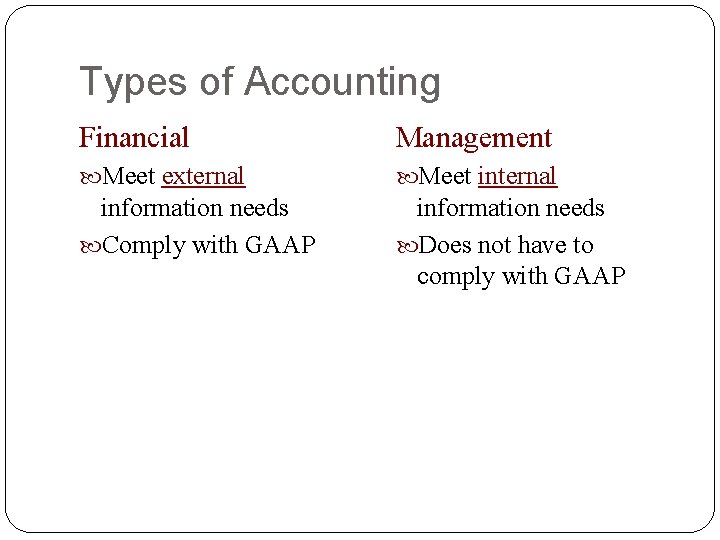

Types of Accounting Financial Management Meet external Meet internal information needs Comply with GAAP information needs Does not have to comply with GAAP

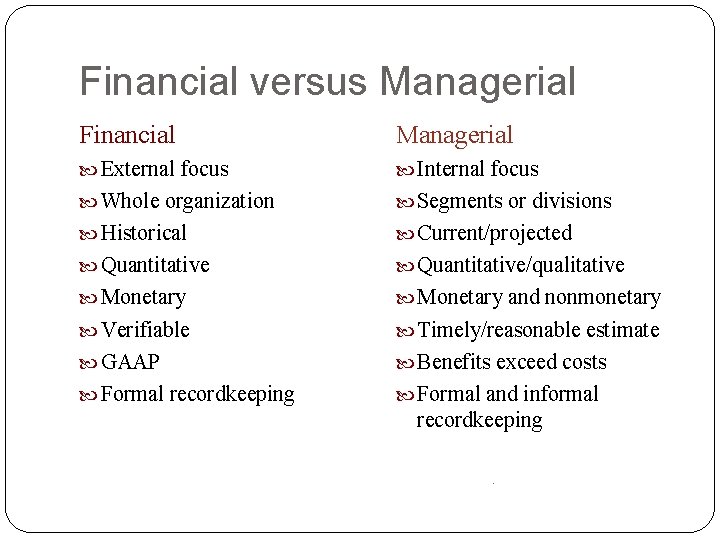

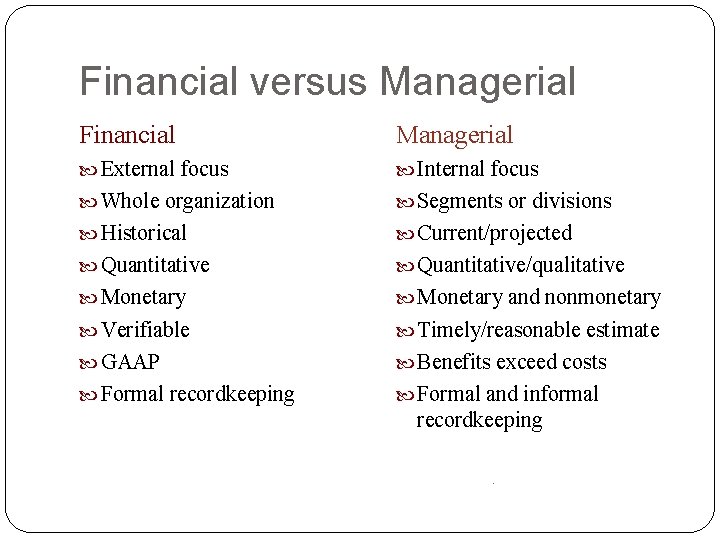

Financial versus Managerial Financial Managerial External focus Internal focus Whole organization Segments or divisions Historical Current/projected Quantitative/qualitative Monetary and nonmonetary Verifiable Timely/reasonable estimate GAAP Benefits exceed costs Formal recordkeeping Formal and informal recordkeeping.

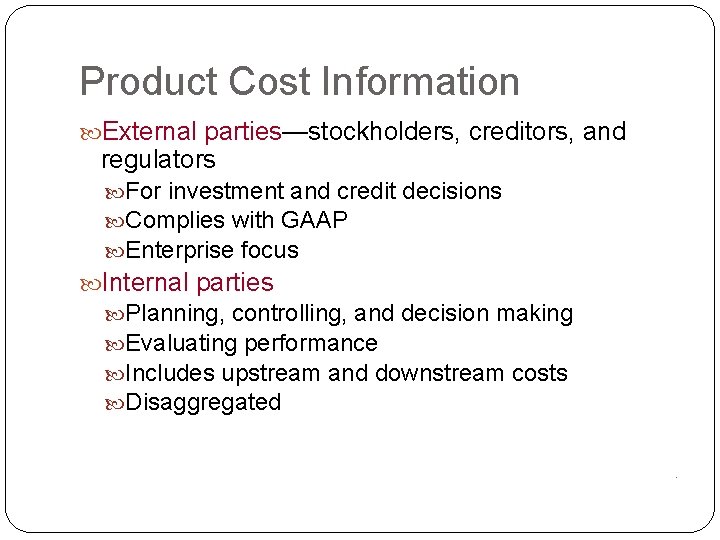

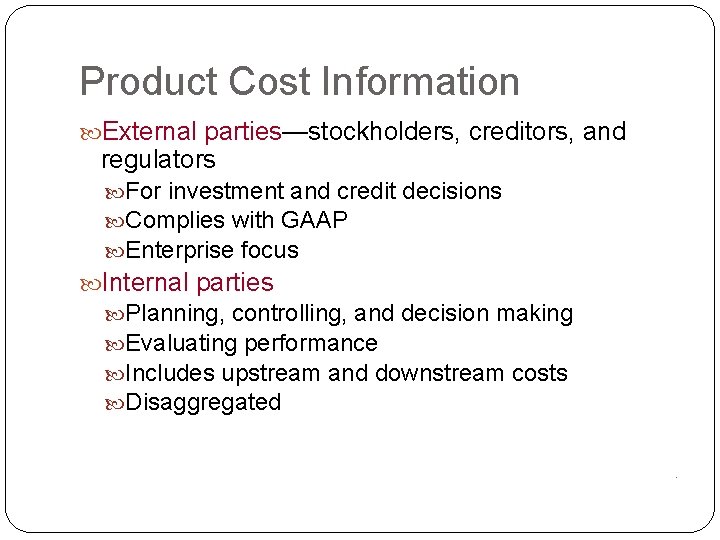

Product Cost Information External parties—stockholders, creditors, and regulators For investment and credit decisions Complies with GAAP Enterprise focus Internal parties Planning, controlling, and decision making Evaluating performance Includes upstream and downstream costs Disaggregated.

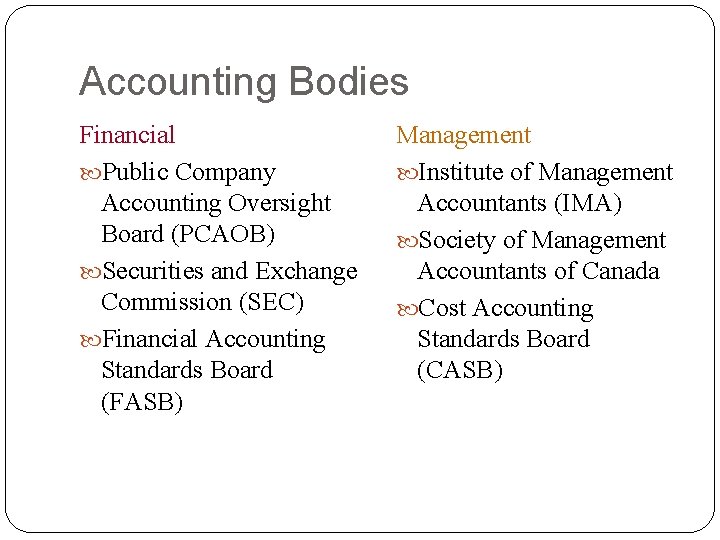

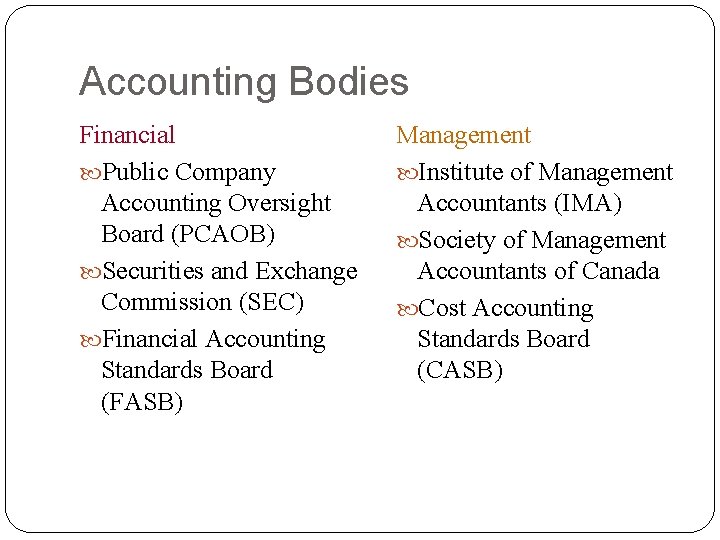

Accounting Bodies Financial Public Company Accounting Oversight Board (PCAOB) Securities and Exchange Commission (SEC) Financial Accounting Standards Board (FASB) Management Institute of Management Accountants (IMA) Society of Management Accountants of Canada Cost Accounting Standards Board (CASB)

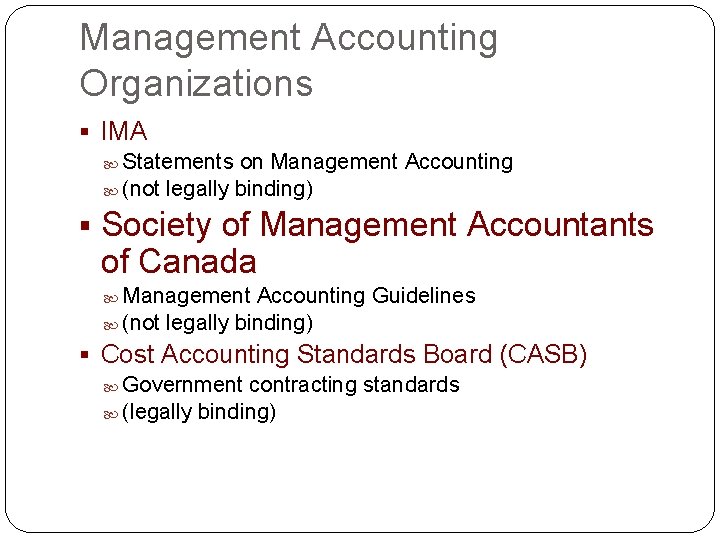

Management Accounting Organizations § IMA Statements on Management Accounting (not legally binding) § Society of Management Accountants of Canada Management Accounting Guidelines (not legally binding) § Cost Accounting Standards Board (CASB) Government contracting standards (legally binding)

Professional Ethics Earnings management—deliberate accounting adjustments to “hit” profit targets Often adjustments involve cost accounting Product costs Inventory valuations Stretching legitimate accounting techniques Outright fraud© 2011 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted in a license distributed with a certain product or service or otherwise

Ethics and Legislation Sarbanes-Oxley Act—CEOs and CFOs personally accountable for the accuracy of their organization’s financial reporting False Claims Act—whistle-blower protection and penalties for failure to blow the whistle (disclose known financial frauds)

Ethics and Management Accounting Standards of Ethical Conduct for Management Accountants Competence Confidentiality Integrity Credibility .

Organizational Strategy 1. 2. 3. 4. Develop mission statement Implement strategy Deploy resources to create value for customers and shareholders Recognize that each organization is unique— thus unique strategies must be developed

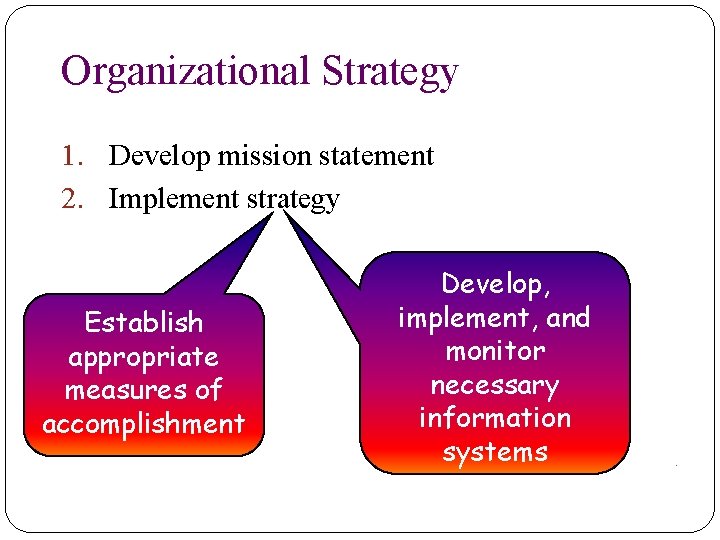

Organizational Strategy 1. Develop mission statement 2. Implement strategy Establish appropriate measures of accomplishment Develop, implement, and monitor necessary information systems .

Five Factors in Organizational Strategy Core competencies Organizational structure Management style and organizational culture Organizational constraints Environmental constraints

Organizational Strategies n n n Core competency—critical function or activity providing a competitive advantage Cost leadership strategy—undercut competitor prices Product differentiation strategy—superior quality products or unique services sold at a premium.

Strategy Questions What are your customers’ most important Who are your five most important competitors? Is your firm more or less profitable than these firms? Compare prices for equivalent products/services. Are they higher or lower? Explain the difference. Is it customers, costs, or profit requirements? Are your costs higher or lower than those of main competitors? Where are the differences most pronounced? What segment(s) of your business represents 80% profits? For each business segment above, how large are you relative to the largest competitors? Are you gaining or losing relative market share? purchase criteria? How do you and your competitors rate on these purchase criteria? What are your main strengths and competencies? Are they appreciated by the market? Which are your priority segments? Where is it most important that you gain market share? What is your competitive advantage? .

Organizational Structure Distribution of authority and responsibility in an organization Authority—right to use resources to accomplish a task or achieve an objective Responsibility—obligation to accomplish a task or achieve an objective Line manager works directly toward attaining organizational goals Staff employees give assistance and advice to line managers Treasurer and Controller © 2011 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted in a license distributed with a certain

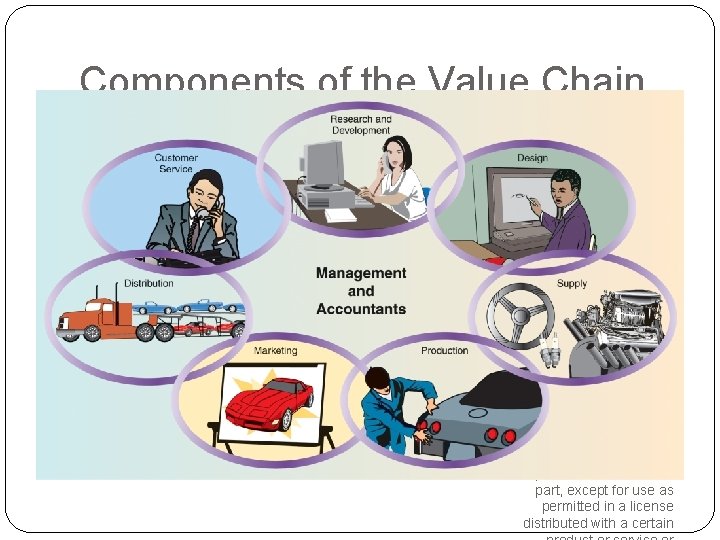

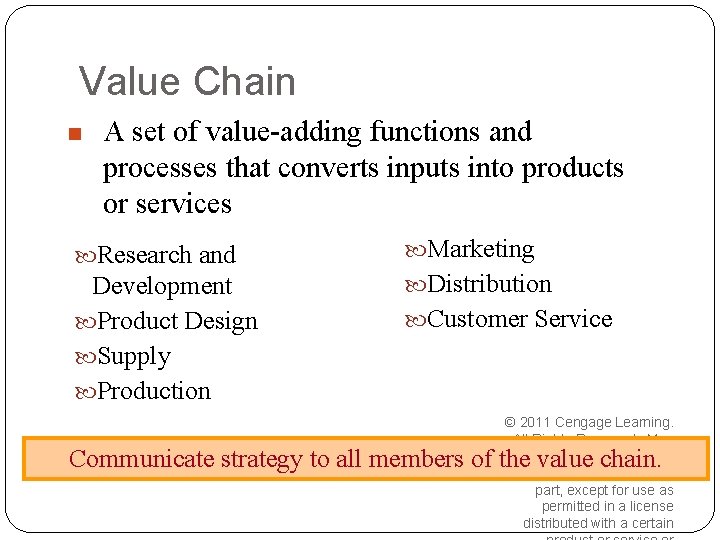

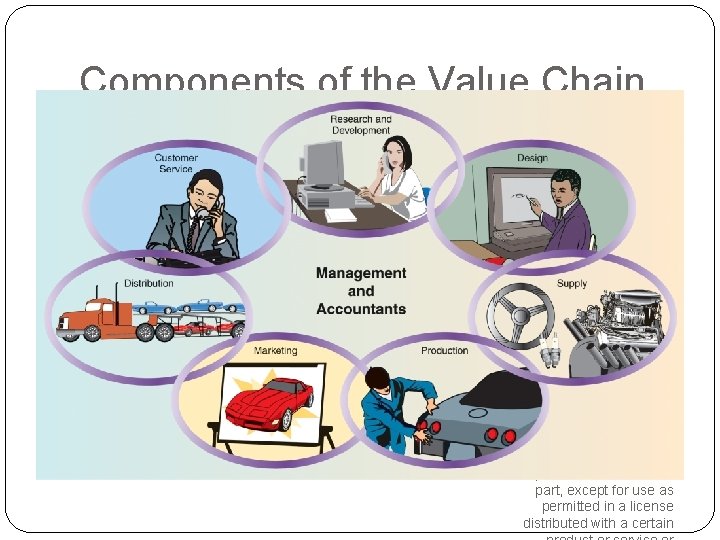

Value Chain n A set of value-adding functions and processes that converts inputs into products or services Research and Marketing Development Product Design Supply Production Distribution Customer Service © 2011 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted in a license distributed with a certain Communicate strategy to all members of the value chain.

Components of the Value Chain © 2011 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted in a license distributed with a certain

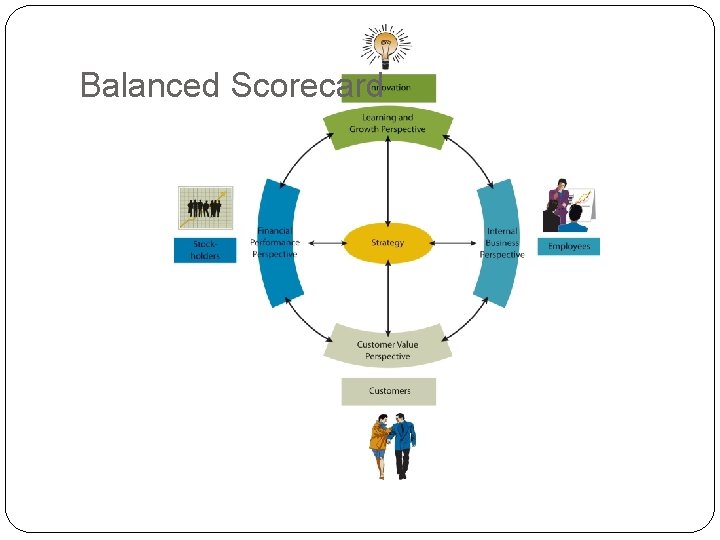

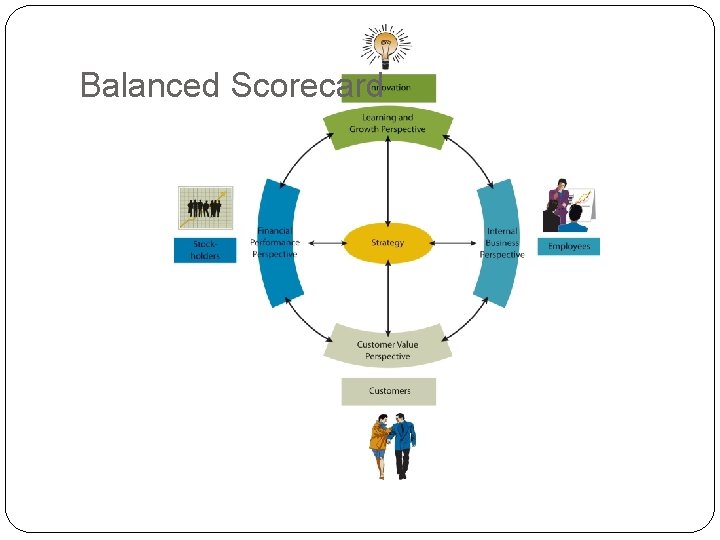

Balanced Scorecard

Balanced Scorecard Perspectives Learning and Growth Use the organization’s intellectual capital to adapt to changing customer needs or to influence new customers’ needs and expectations through product or service innovations Internal Business Things to do well to meet customer needs and expectations Customer Value How well the organization is doing relative to important customer criteria Financial Address stockholders/stakeholders concerns about profitability and organizational growth

Balanced Scorecard Measures Short-term and long-term Internal and external Financial and nonfinancial

Ethics in Multinationals Foreign Corrupt Practices Act—prohibits bribes to obtain/retain business Organization of Economic Cooperation and Development Convention—crime to offer, promise, give bribes to obtain/retain internal business deals .

Job costing definition

Job costing definition Standard cost system

Standard cost system Standard costing and variance analysis formulas

Standard costing and variance analysis formulas Standard cost accounting definition

Standard cost accounting definition What are accounting assumptions

What are accounting assumptions Cima defines management accounting as

Cima defines management accounting as Financial accounting chapter 1

Financial accounting chapter 1 Conclusion of computerised accounting system

Conclusion of computerised accounting system Basic accountin

Basic accountin Responsibility centers in management accounting

Responsibility centers in management accounting Jaggi and lau model,

Jaggi and lau model, Prime cost accounting

Prime cost accounting Ocas codes oklahoma

Ocas codes oklahoma Opportunity cost in accounting

Opportunity cost in accounting Scope of accounting

Scope of accounting Cost concept definition

Cost concept definition Cost management accounting and control

Cost management accounting and control Cost accounting standards

Cost accounting standards The foundation of a process costing system is the

The foundation of a process costing system is the Backflush inventory

Backflush inventory Example of semi variable cost

Example of semi variable cost Basic management accounting concepts

Basic management accounting concepts Cornerstones of cost accounting

Cornerstones of cost accounting Cost accounting chapter 9

Cost accounting chapter 9 Chapter 5 job order costing solutions

Chapter 5 job order costing solutions Introduction to cost accounting ppt

Introduction to cost accounting ppt Role of management accounting ppt

Role of management accounting ppt Nature of cost accounting

Nature of cost accounting Importance of cost accounting

Importance of cost accounting Managerial accounting cost concepts

Managerial accounting cost concepts Oracle advanced cost accounting

Oracle advanced cost accounting Escalation clause in cost accounting

Escalation clause in cost accounting Process costing steps

Process costing steps Reconciliation cost accounting

Reconciliation cost accounting What are accounting constraints

What are accounting constraints What is the basic concept of cost

What is the basic concept of cost Labour cost accounting

Labour cost accounting Managerial accounting and cost concepts

Managerial accounting and cost concepts Cost management accounting and control

Cost management accounting and control The two basic types of cost accounting systems are

The two basic types of cost accounting systems are Construction accounting basics

Construction accounting basics Cost accounting chapter 5

Cost accounting chapter 5 Chapter 1 managerial accounting and cost concepts

Chapter 1 managerial accounting and cost concepts Relevant cost in management accounting

Relevant cost in management accounting Hr inventory meaning

Hr inventory meaning Materiality constraint

Materiality constraint Cost accounting income statement

Cost accounting income statement Proration approach cost accounting

Proration approach cost accounting Job cost record

Job cost record Bookkeeping is mainly concerned with:

Bookkeeping is mainly concerned with: Drury management and cost accounting

Drury management and cost accounting Drury c management and cost accounting

Drury c management and cost accounting Fivestep

Fivestep