1 Chapter 13 Dividends Repurchases and Splits DIVIDENDS

- Slides: 39

1 Chapter 13– Dividends, Repurchases, and Splits DIVIDENDS, REPURCHASES, AND SPLITS Chapter 13 Professor James Kuhle

2 Chapter 13– Dividends, Repurchases, and Splits Learning Objectives v. Learn about Distributions v. Learn about Dividends v. Learn about Stock Repurchases v. Learn about Stock Splits Professor James Kuhle

3 Chapter 13– Dividends, Repurchases, and Splits LO 1: Distributions v. A distribution is a payment to shareholders v. There are two main types of distributions • Dividends • Share repurchases Professor James Kuhle

4 Chapter 13– Dividends, Repurchases, and Splits Distributions v. Cash dividends • Most common distribution • Typically paid quarterly v. Stock dividends • Not cash, but additional shares in the company Professor James Kuhle

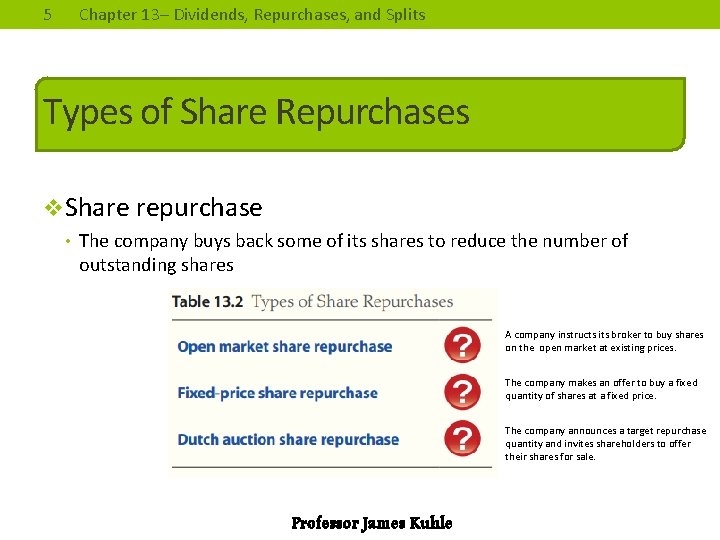

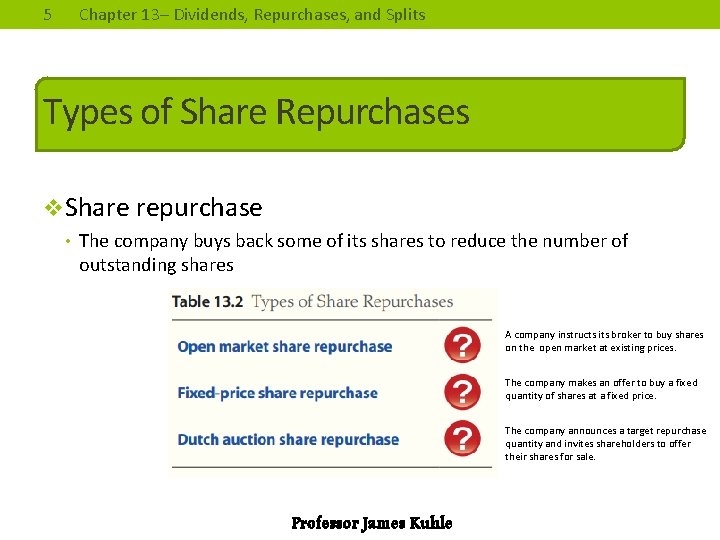

5 Chapter 13– Dividends, Repurchases, and Splits Types of Share Repurchases v. Share repurchase • The company buys back some of its shares to reduce the number of outstanding shares A company instructs its broker to buy shares on the open market at existing prices. The company makes an offer to buy a fixed quantity of shares at a fixed price. The company announces a target repurchase quantity and invites shareholders to offer their shares for sale. Professor James Kuhle

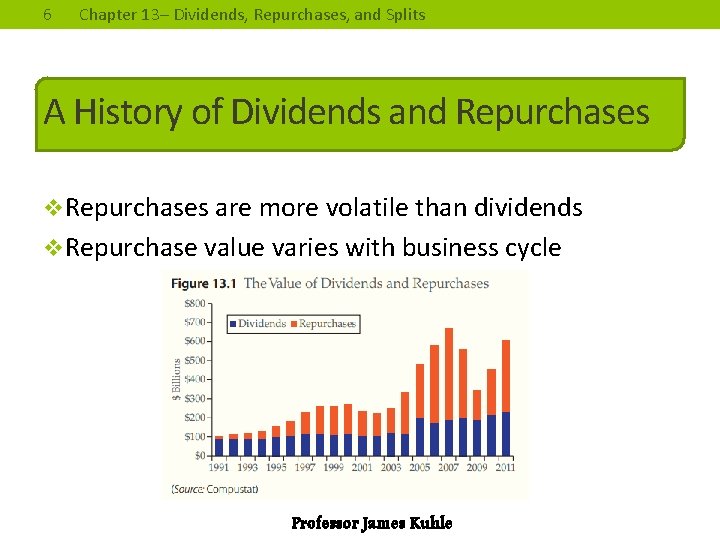

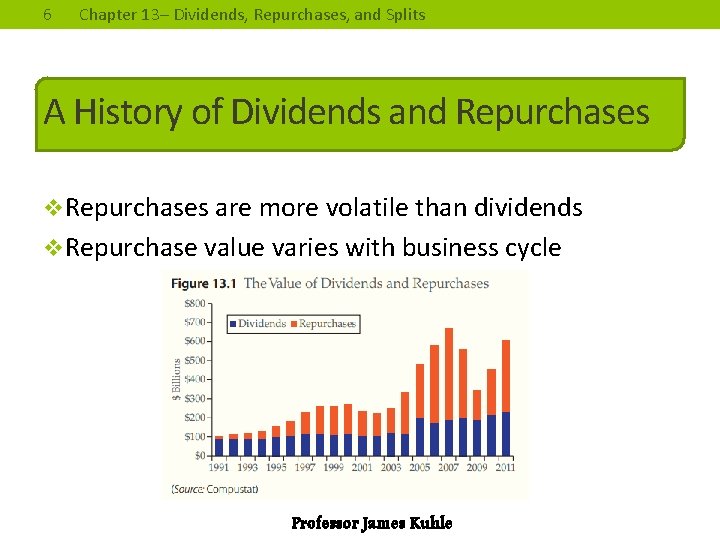

6 Chapter 13– Dividends, Repurchases, and Splits A History of Dividends and Repurchases v. Repurchases are more volatile than dividends v. Repurchase value varies with business cycle Professor James Kuhle

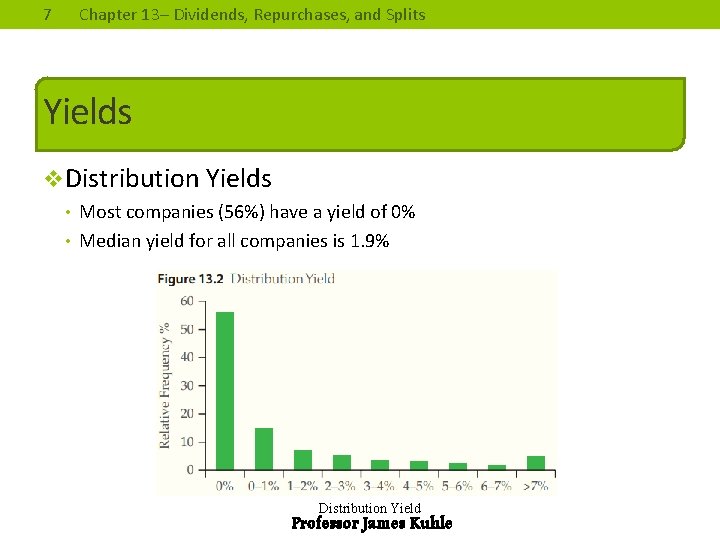

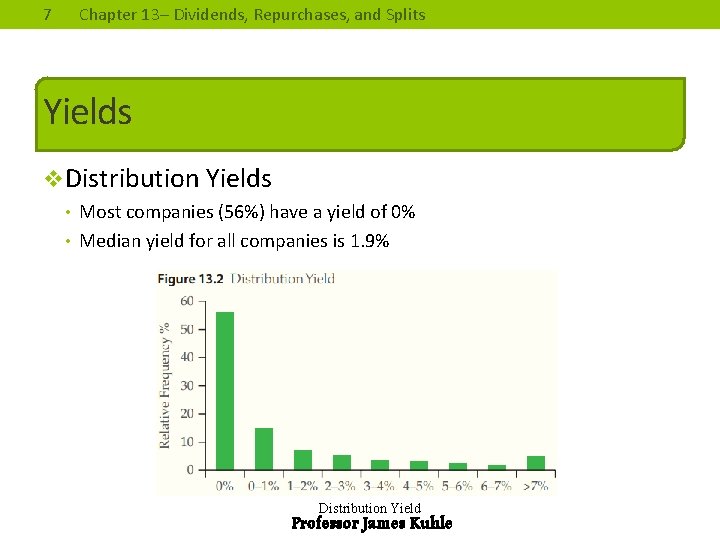

7 Chapter 13– Dividends, Repurchases, and Splits Yields v. Distribution Yields • Most companies (56%) have a yield of 0% • Median yield for all companies is 1. 9% Distribution Yield Professor James Kuhle

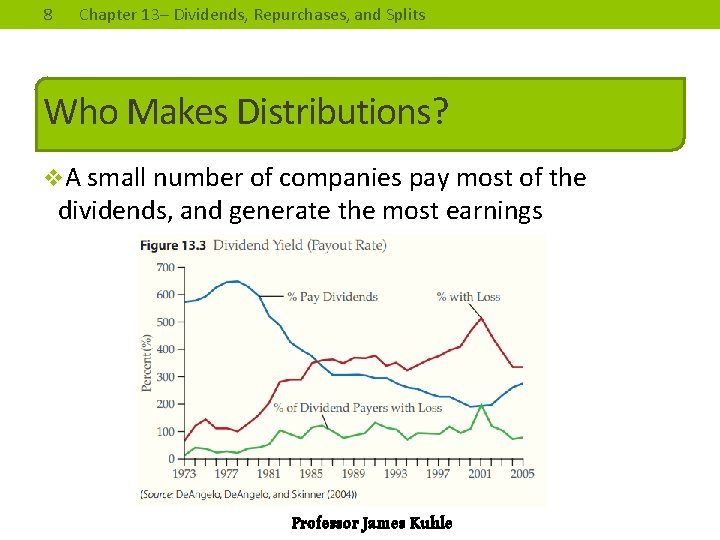

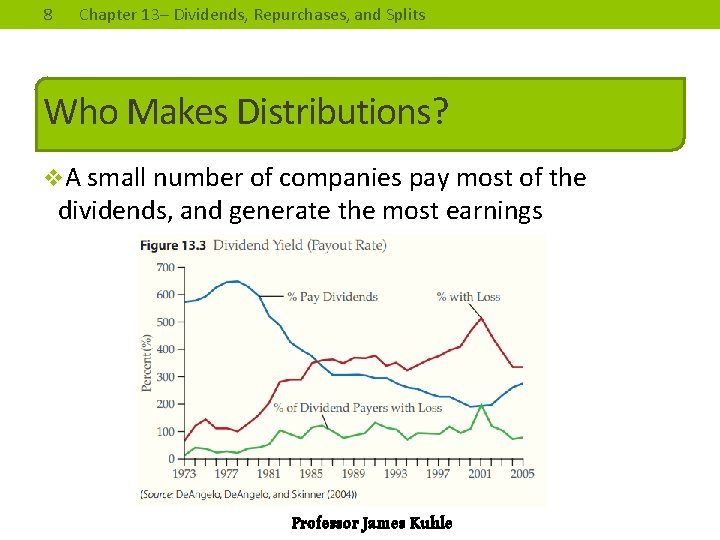

8 Chapter 13– Dividends, Repurchases, and Splits Who Makes Distributions? v. A small number of companies pay most of the dividends, and generate the most earnings Professor James Kuhle

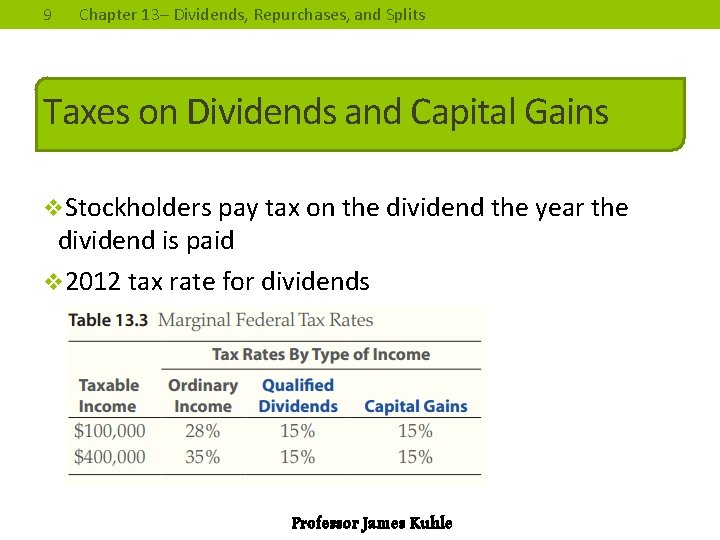

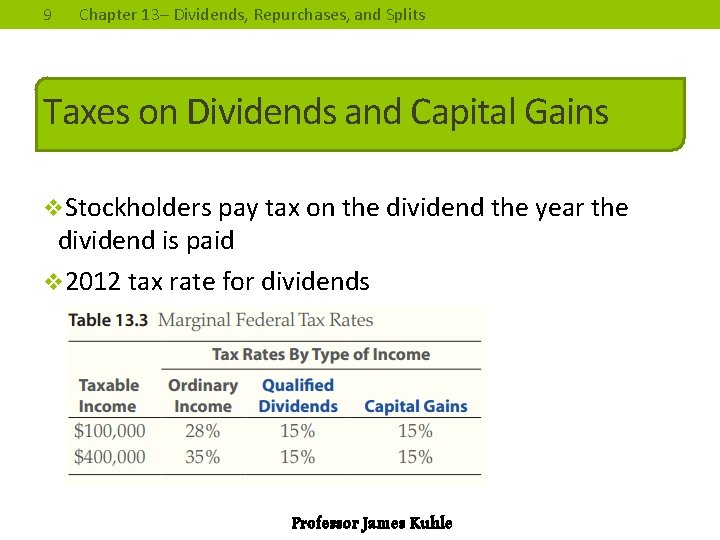

9 Chapter 13– Dividends, Repurchases, and Splits Taxes on Dividends and Capital Gains v. Stockholders pay tax on the dividend the year the dividend is paid v 2012 tax rate for dividends Professor James Kuhle

10 Chapter 13– Dividends, Repurchases, and Splits Clienteles v. Different groups of investors that have different distribution preferences v. Prefer types of distribution with the lowest tax rate Professor James Kuhle

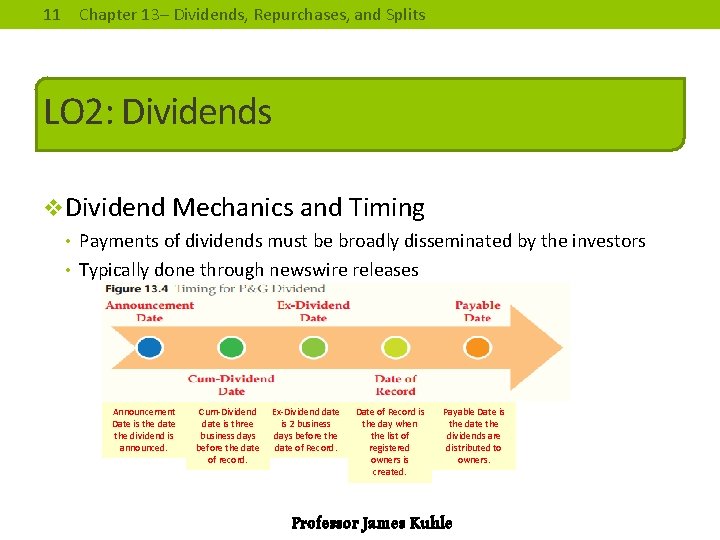

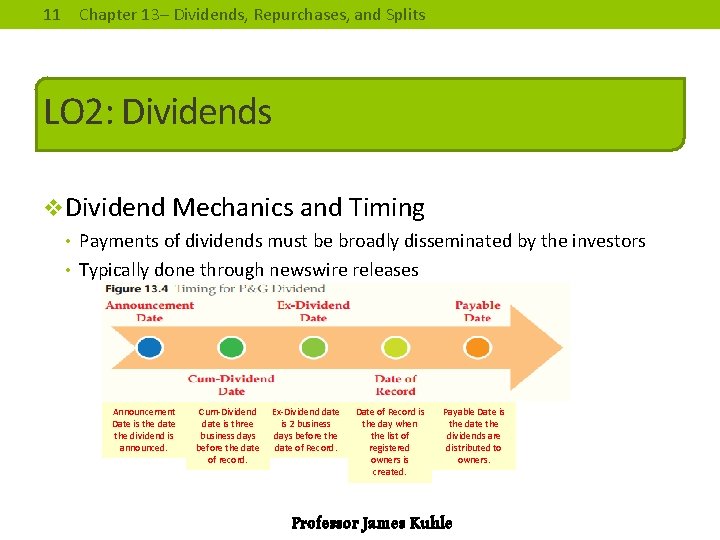

11 Chapter 13– Dividends, Repurchases, and Splits LO 2: Dividends v. Dividend Mechanics and Timing • Payments of dividends must be broadly disseminated by the investors • Typically done through newswire releases Announcement Date is the date the dividend is announced. Cum-Dividend date is three business days before the date of record. Ex-Dividend date is 2 business days before the date of Record. Date of Record is the day when the list of registered owners is created. Payable Date is the date the dividends are distributed to owners. Professor James Kuhle

12 Chapter 13– Dividends, Repurchases, and Splits The Impact of Dividends on the Stock Price v. Timeline of cash flows and value equation Professor James Kuhle

13 Chapter 13– Dividends, Repurchases, and Splits The Impact of Dividends on the Stock Price Professor James Kuhle

14 Chapter 13– Dividends, Repurchases, and Splits The Impact of Dividends on the Stock Price Professor James Kuhle

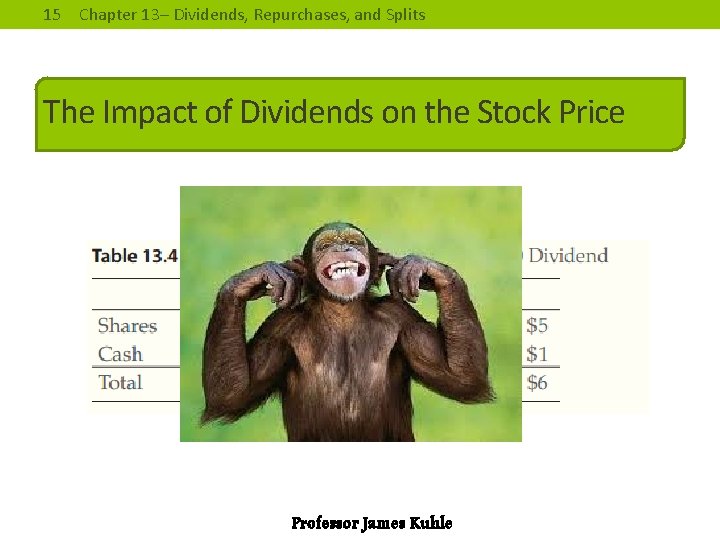

15 Chapter 13– Dividends, Repurchases, and Splits The Impact of Dividends on the Stock Price Professor James Kuhle

16 Chapter 13– Dividends, Repurchases, and Splits Other Factors Affecting Dividends v. Taxes • If dividend tax rates are higher than capital gain tax rates, then the price will fall by less than the amount of the dividend on the ex-dividend day v. Information Asymmetries & Signaling • Sustainable earnings • Good predictors of future earnings • Managers increase dividends when they expect higher future earnings v. Signaling hypothesis • Dividend increases should cause an increase in stock price Professor James Kuhle

17 Chapter 13– Dividends, Repurchases, and Splits Empirical Evidence About the Price Reaction of Dividends v. Dividend Decrease • One tenth the likelihood of a dividend increase • A negative market reaction is focused on dividend reductions by firms that have experienced recent decline in earnings (Note: Negative signals are stronger than positive signals because investors believe managers will exhaust all possibilities before cutting a dividend. ) v. Dividend Increase • Convey positive market information Professor James Kuhle

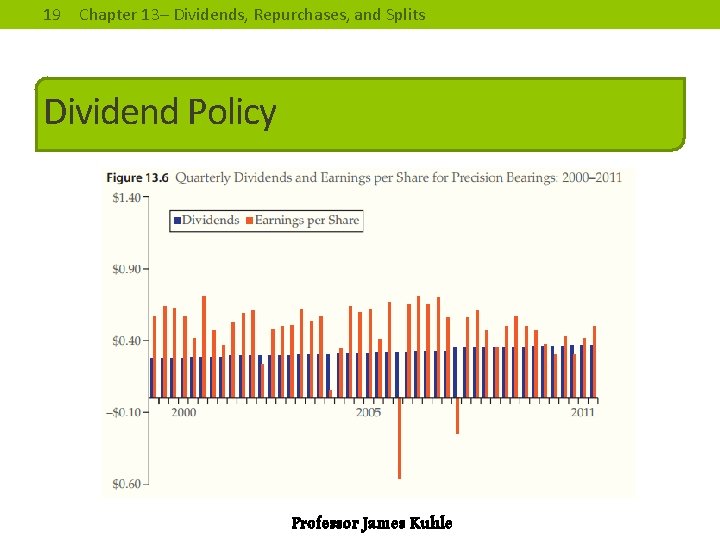

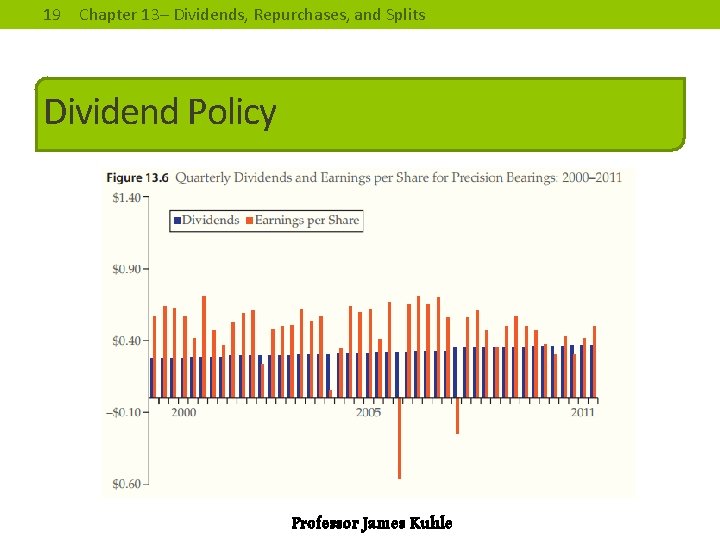

18 Chapter 13– Dividends, Repurchases, and Splits Dividend Policy v. Dividend decision is affected by: • The need for cash • Taxes • Asymmetric information (signaling) • Agency Problems v. Stable Dividends • Policy of keeping dividends steady • Dividends only increase IF earnings rise to a ‘sustainably’ higher level Professor James Kuhle

19 Chapter 13– Dividends, Repurchases, and Splits Dividend Policy Professor James Kuhle

20 Chapter 13– Dividends, Repurchases, and Splits Dividend Policy v. Target Payout Policy: Total Div. /Net Income (NI) • Target payout model Professor James Kuhle

21 Chapter 13– Dividends, Repurchases, and Splits Dividend Policy Professor James Kuhle

22 Chapter 13– Dividends, Repurchases, and Splits Dividend Policy v. Residual Dividend Policy • Recognizes that internal equity is a cheap source of project financing and sets dividends as a leftover • Residual dividend formula Professor James Kuhle

23 Chapter 13– Dividends, Repurchases, and Splits Dividend Policy Professor James Kuhle

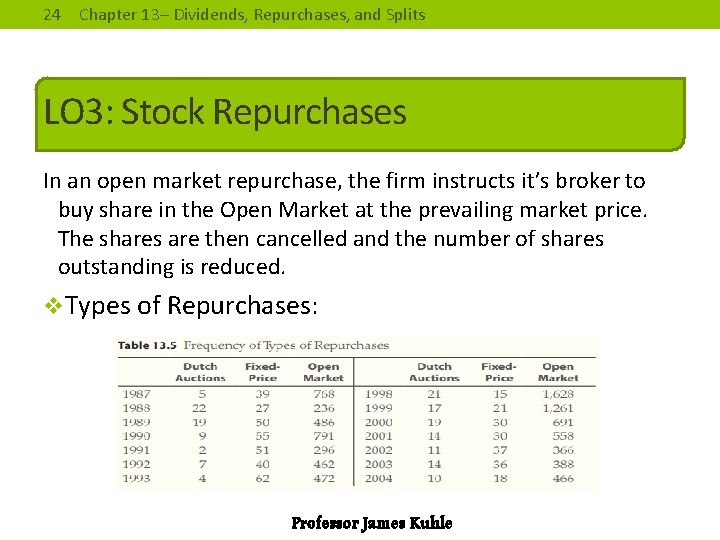

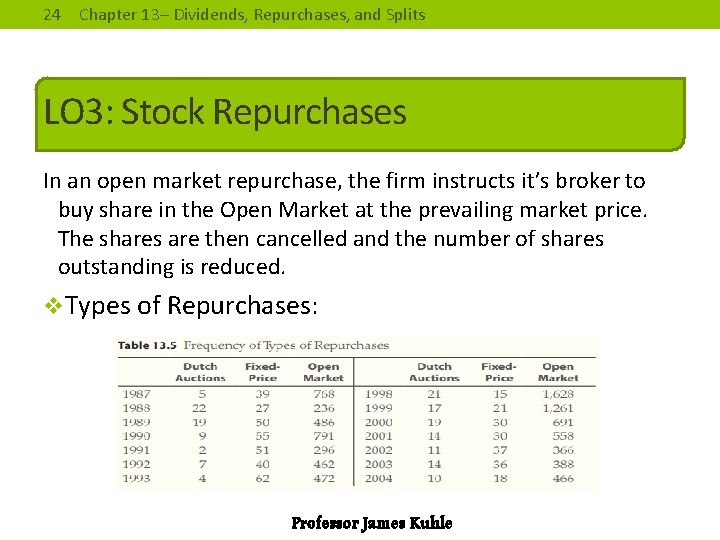

24 Chapter 13– Dividends, Repurchases, and Splits LO 3: Stock Repurchases In an open market repurchase, the firm instructs it’s broker to buy share in the Open Market at the prevailing market price. The shares are then cancelled and the number of shares outstanding is reduced. v. Types of Repurchases: Professor James Kuhle

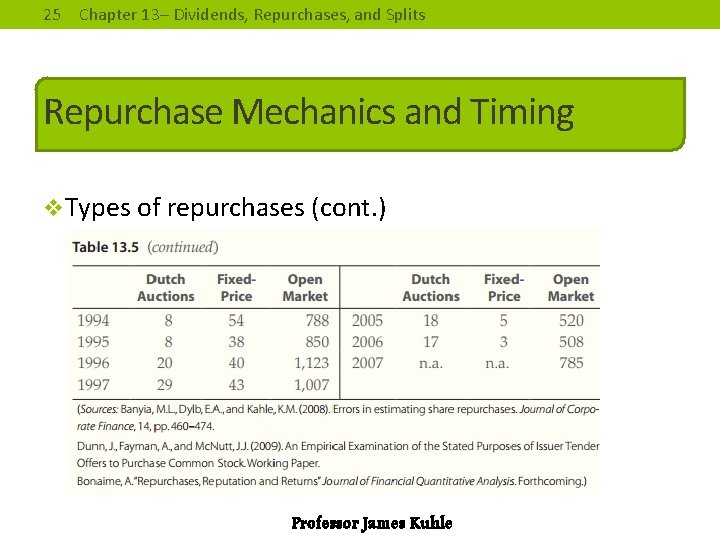

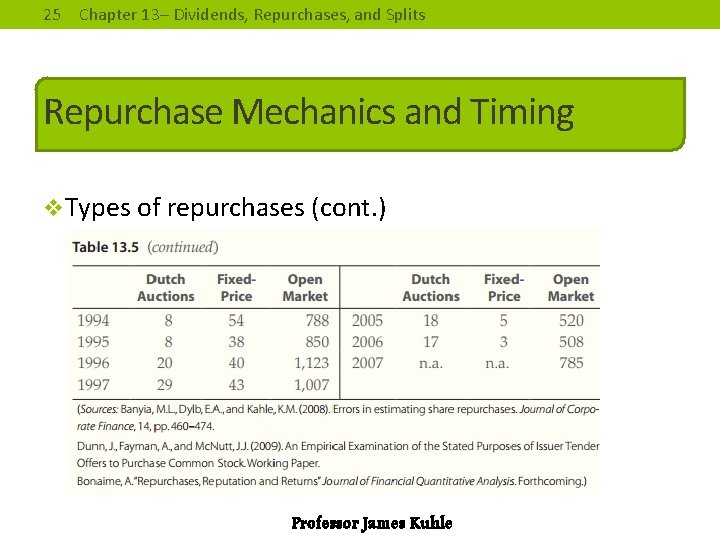

25 Chapter 13– Dividends, Repurchases, and Splits Repurchase Mechanics and Timing v. Types of repurchases (cont. ) Professor James Kuhle

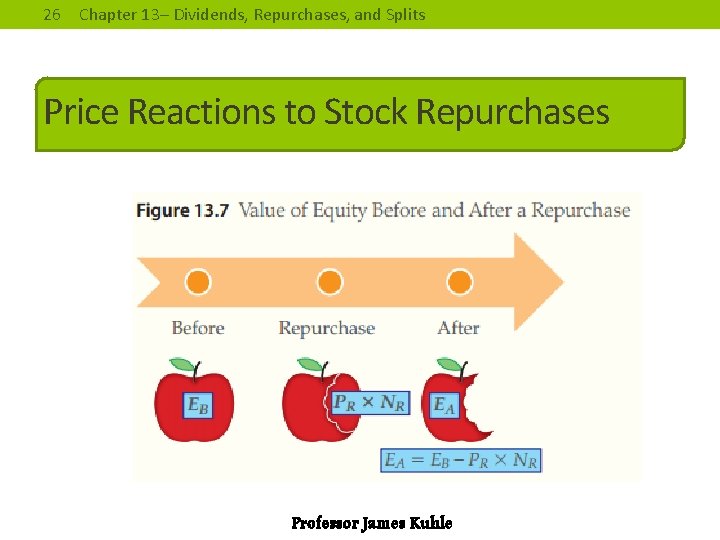

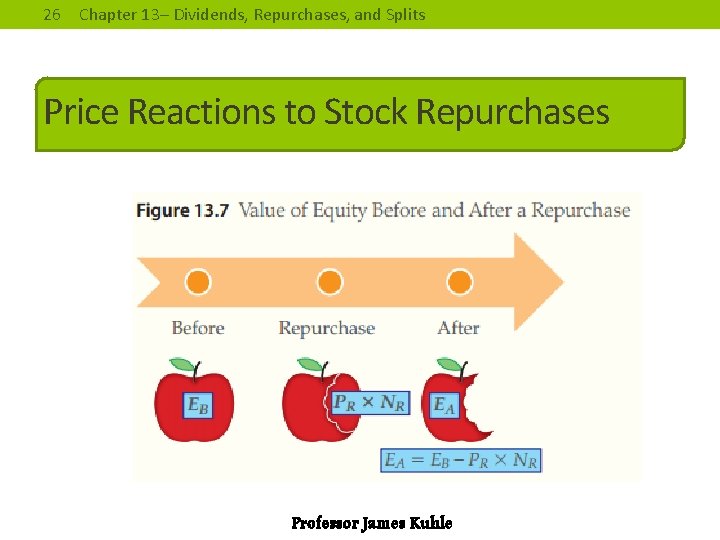

26 Chapter 13– Dividends, Repurchases, and Splits Price Reactions to Stock Repurchases Professor James Kuhle

27 Chapter 13– Dividends, Repurchases, and Splits Price Reactions to Stock Repurchases • After repurchase the value of a firms equity is equal to the value of the equity before repurchase minus the cost of the repurchase • Before repurchase equity is equal to stock price times shares outstanding • The value of the equity after the repurchase • Price after repurchase Professor James Kuhle

28 Chapter 13– Dividends, Repurchases, and Splits Price Reactions to Stock Repurchases Professor James Kuhle

29 Chapter 13– Dividends, Repurchases, and Splits Price Reactions to Stock Repurchases Professor James Kuhle

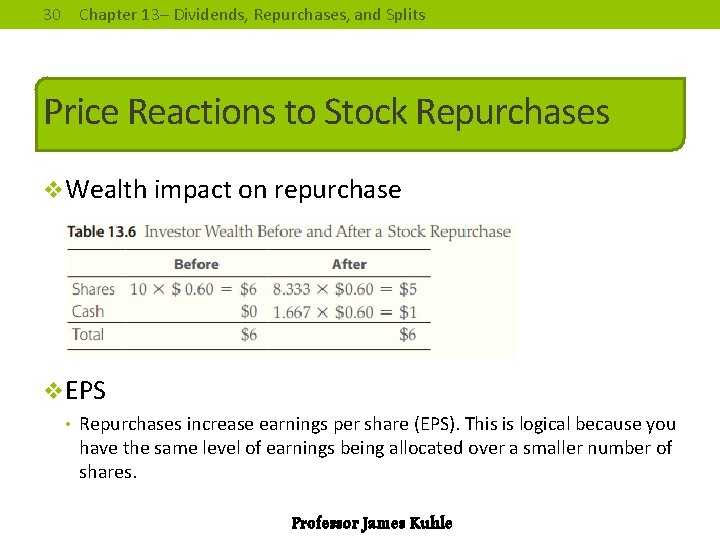

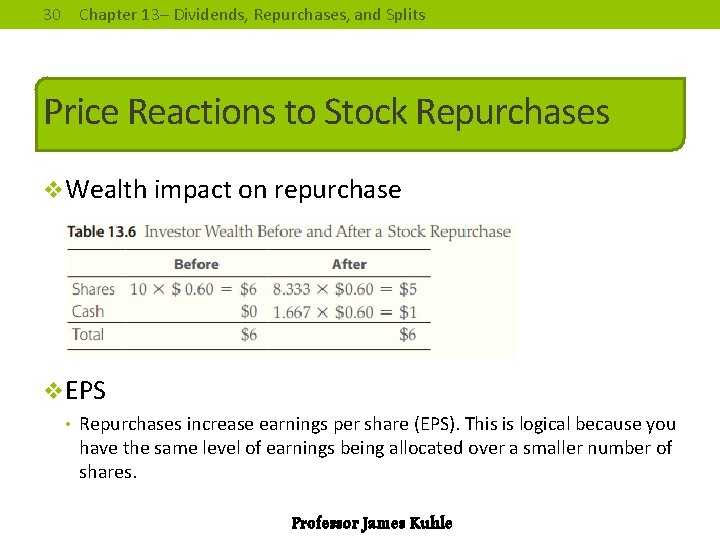

30 Chapter 13– Dividends, Repurchases, and Splits Price Reactions to Stock Repurchases v. Wealth impact on repurchase v. EPS • Repurchases increase earnings per share (EPS). This is logical because you have the same level of earnings being allocated over a smaller number of shares. Professor James Kuhle

31 Chapter 13– Dividends, Repurchases, and Splits Taxes, Asymmetric Information and Agency Problems v. A debt financed repurchase will substantially change leverage v. Repurchases have been proposed as signals of future earnings v. Repurchases remove free cash flow from wasteful managers Professor James Kuhle

32 Chapter 13– Dividends, Repurchases, and Splits Stock Repurchase Policy v. Flexibility hypothesis • Repurchases do not raise expectations and implicitly commit the firm to future payouts • This gives companies more flexibility to use repurchases selectively v. Stock Options • Repurchases leave the price of stocks unchanged (initially) so may be preferred to dividend distributions • There exists a positive relationship between repurchases and management stock options Professor James Kuhle

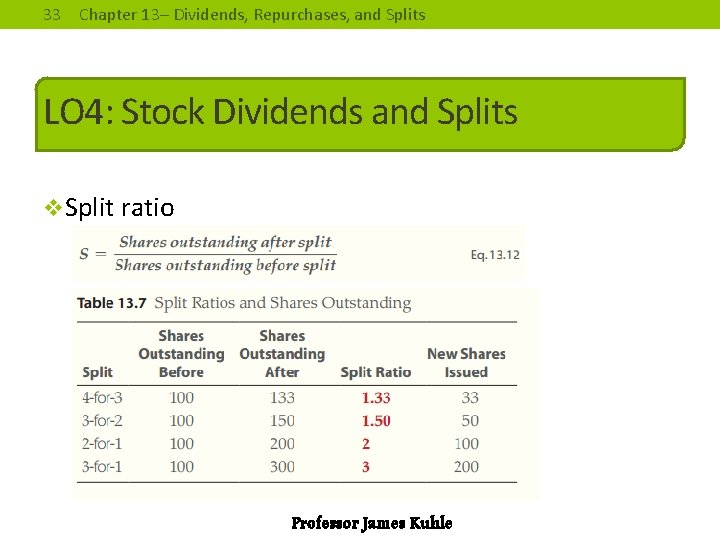

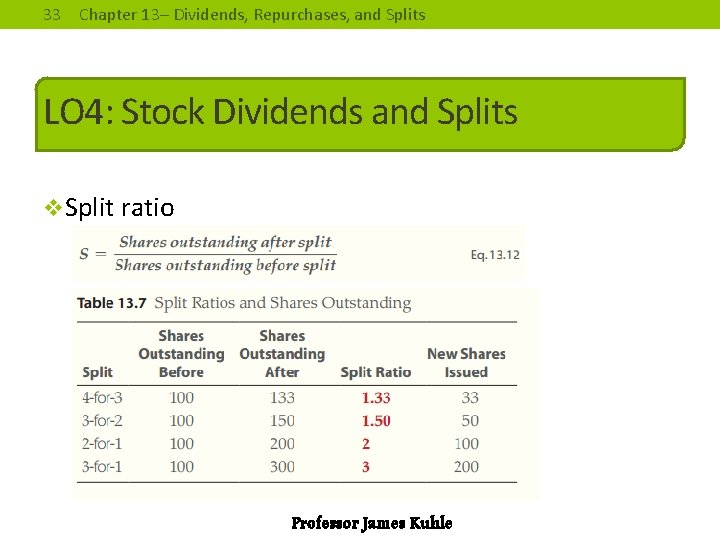

33 Chapter 13– Dividends, Repurchases, and Splits LO 4: Stock Dividends and Splits v. Split ratio Professor James Kuhle

34 Chapter 13– Dividends, Repurchases, and Splits The Price Impact of a Stock Split v. Price after a split • is equal to the price before split divided by the number of splits • Where • PA is Price after split • PB is Price before split • S is the number of splits Professor James Kuhle

35 Chapter 13– Dividends, Repurchases, and Splits The Price Impact of a Stock Split Professor James Kuhle

36 Chapter 13– Dividends, Repurchases, and Splits The Price Impact of a Stock Split v. Example continued Professor James Kuhle

37 Chapter 13– Dividends, Repurchases, and Splits Motive for Stock Splits v. Benefits • Stock prices move to a lower trading range • Particularly relevant since stocks typically trade in board lots v. Board lot • 100 shares • Less price volatility than odd-lots • Also called a round lot v. Odd-lot • Less than one board lot Professor James Kuhle

38 Chapter 13– Dividends, Repurchases, and Splits Reverse Split v. Occurs • When a company reduces the number of shares held by each shareholder by the same proportion • The price of stock will increase v. Reasons for higher stock prices • Some stock exchanges will de-list a stock if it trades below a price of $1 for too long • Some brokerages will not lend to investors (for margin purchases) if the stock trades below a threshold price (i. e. $3) Professor James Kuhle

39 Chapter 13– Dividends, Repurchases, and Splits End of 13 Professor James Kuhle