1 Agenda Technology overview Industry Overview Industry information

- Slides: 118

1

Agenda • Technology overview • Industry Overview – Industry information – Industry trends and outlook • Company Analysis – Intel (INTC) – Advanced Micro Devices (AMD) – Applied materials (AMAT) 2

3

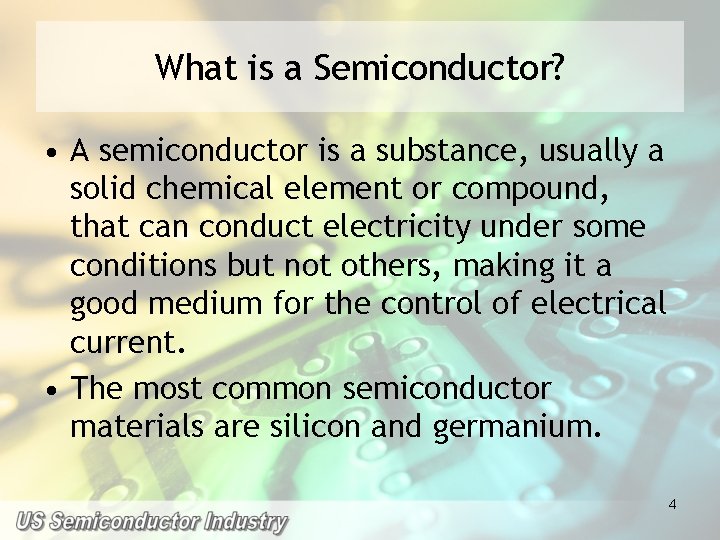

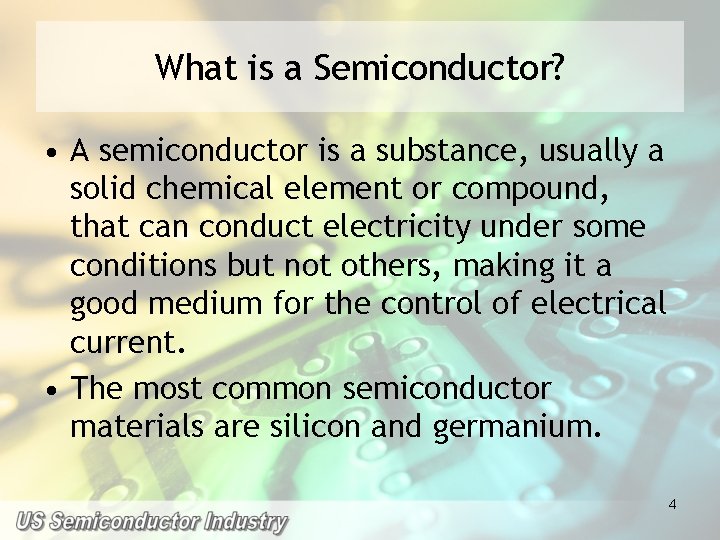

What is a Semiconductor? • A semiconductor is a substance, usually a solid chemical element or compound, that can conduct electricity under some conditions but not others, making it a good medium for the control of electrical current. • The most common semiconductor materials are silicon and germanium. 4

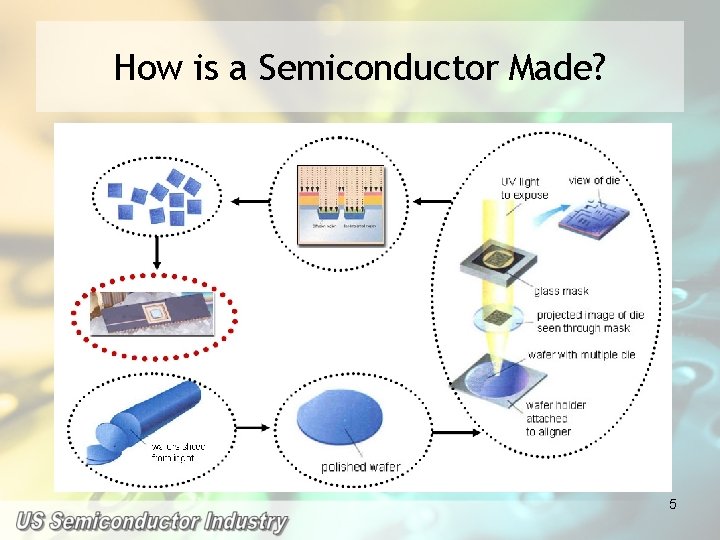

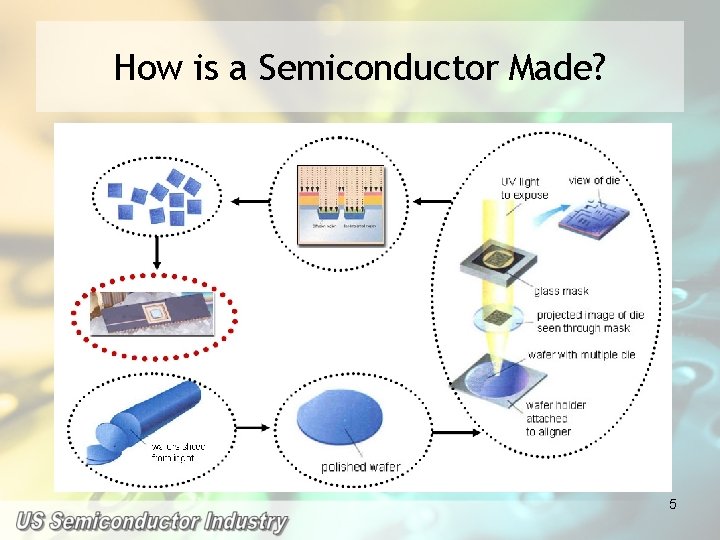

How is a Semiconductor Made? 5

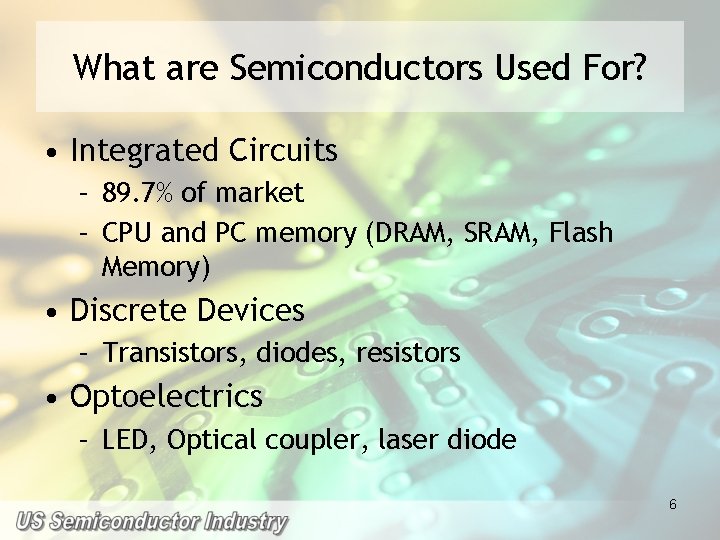

What are Semiconductors Used For? • Integrated Circuits – 89. 7% of market – CPU and PC memory (DRAM, SRAM, Flash Memory) • Discrete Devices – Transistors, diodes, resistors • Optoelectrics – LED, Optical coupler, laser diode 6

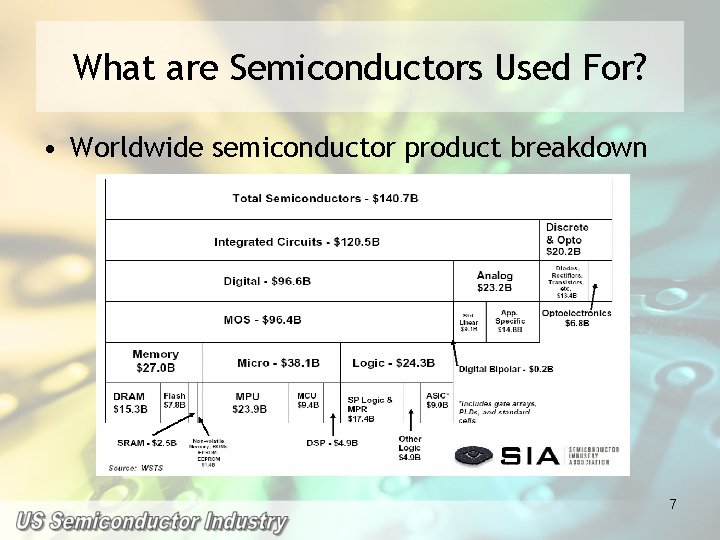

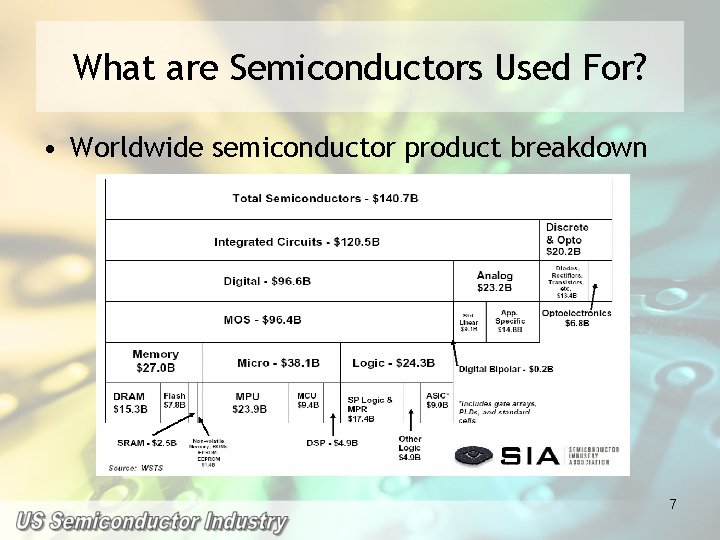

What are Semiconductors Used For? • Worldwide semiconductor product breakdown 7

8

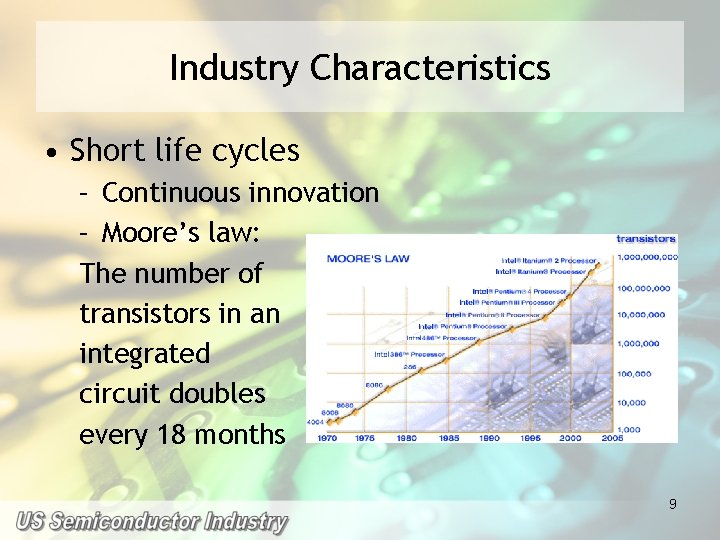

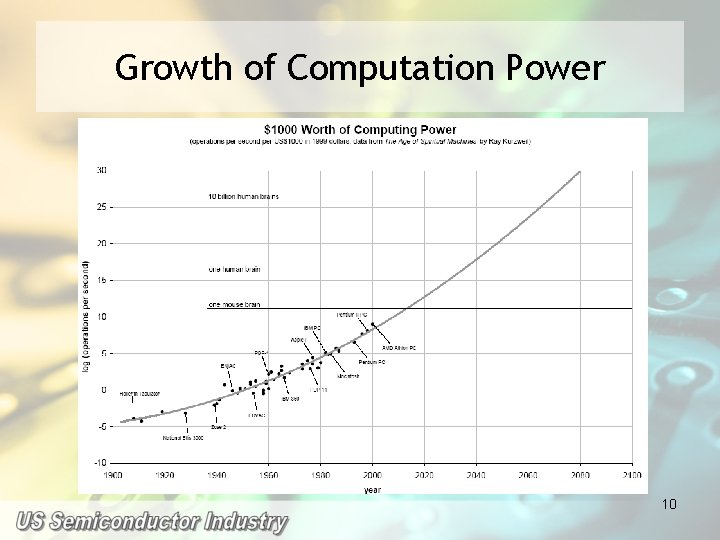

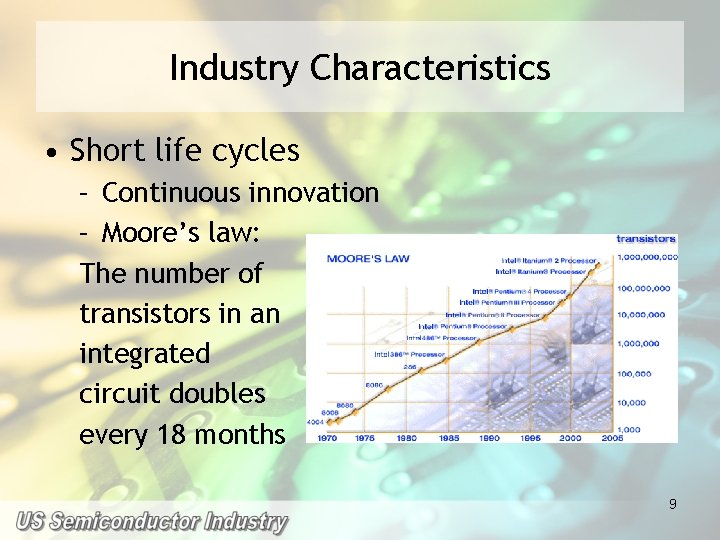

Industry Characteristics • Short life cycles – Continuous innovation – Moore’s law: The number of transistors in an integrated circuit doubles every 18 months 9

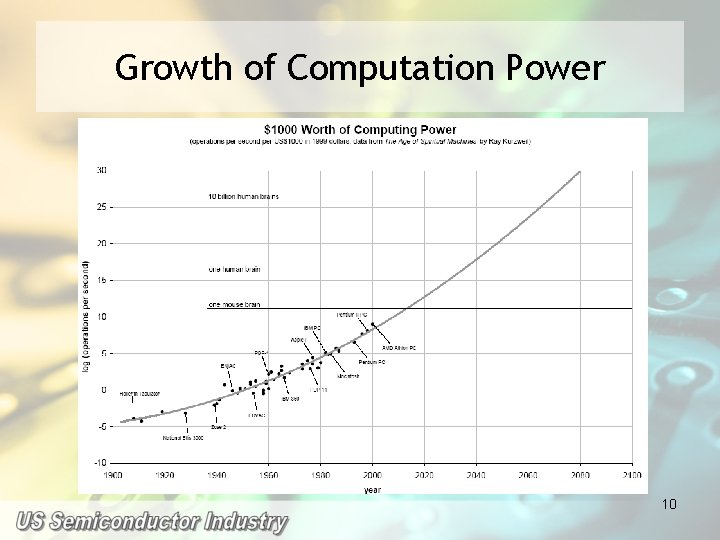

Growth of Computation Power 10

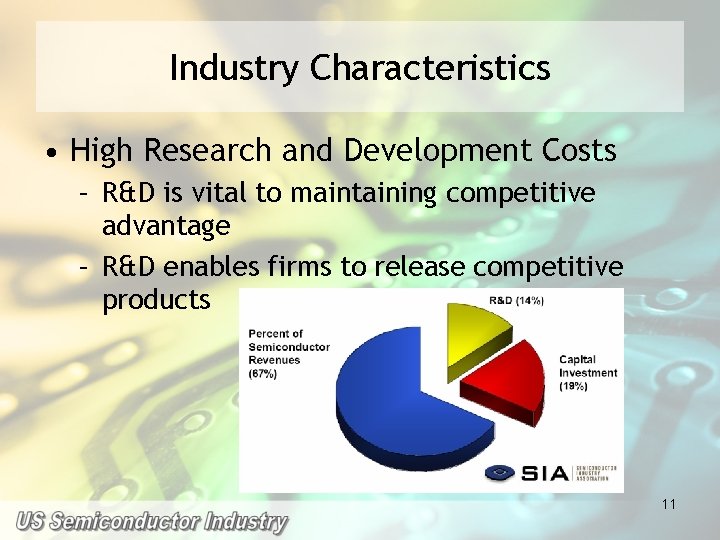

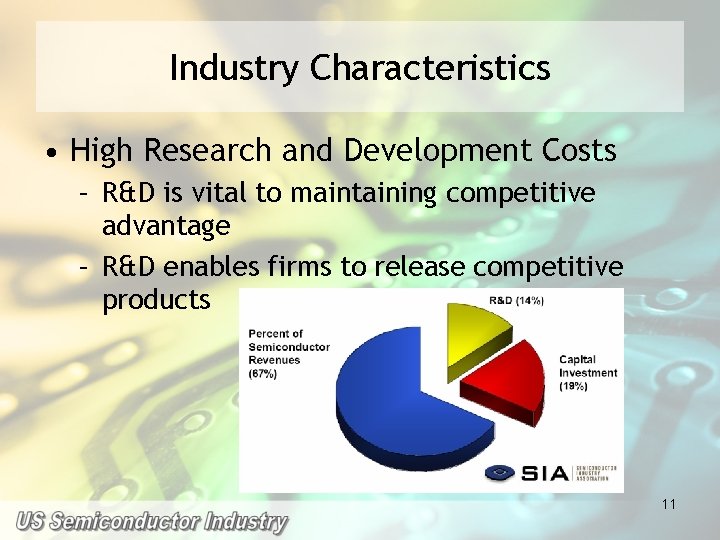

Industry Characteristics • High Research and Development Costs – R&D is vital to maintaining competitive advantage – R&D enables firms to release competitive products 11

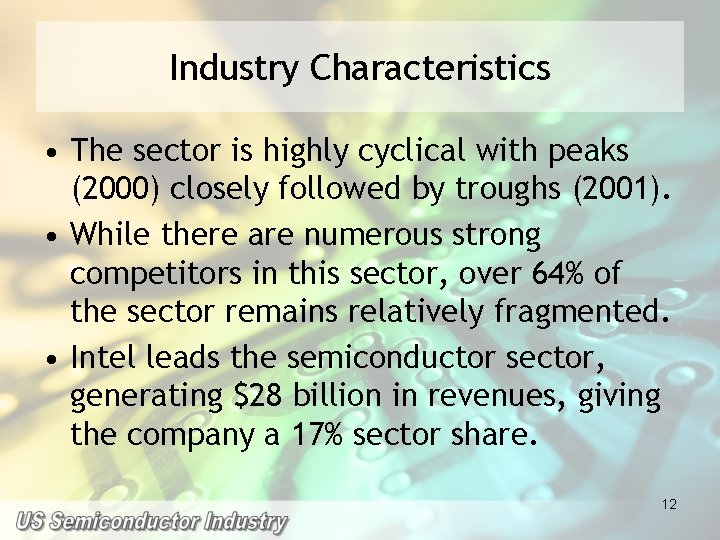

Industry Characteristics • The sector is highly cyclical with peaks (2000) closely followed by troughs (2001). • While there are numerous strong competitors in this sector, over 64% of the sector remains relatively fragmented. • Intel leads the semiconductor sector, generating $28 billion in revenues, giving the company a 17% sector share. 12

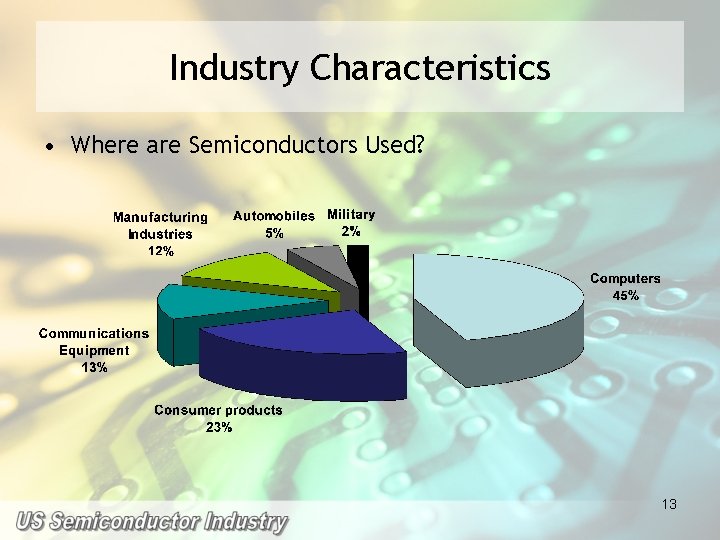

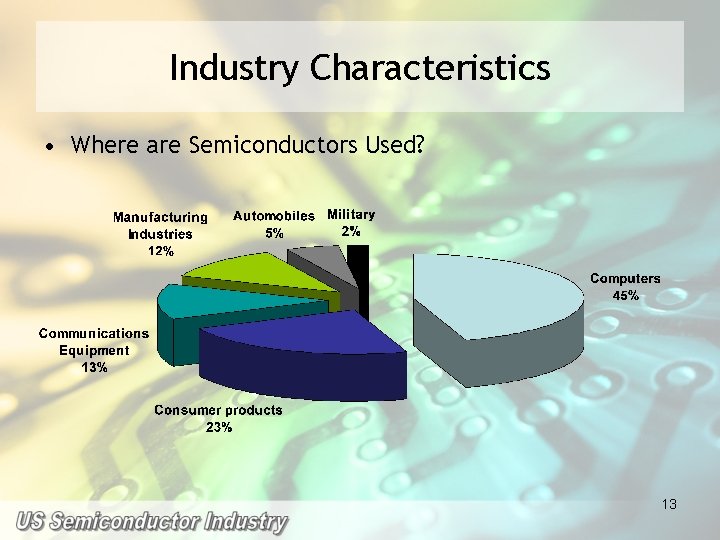

Industry Characteristics • Where are Semiconductors Used? 13

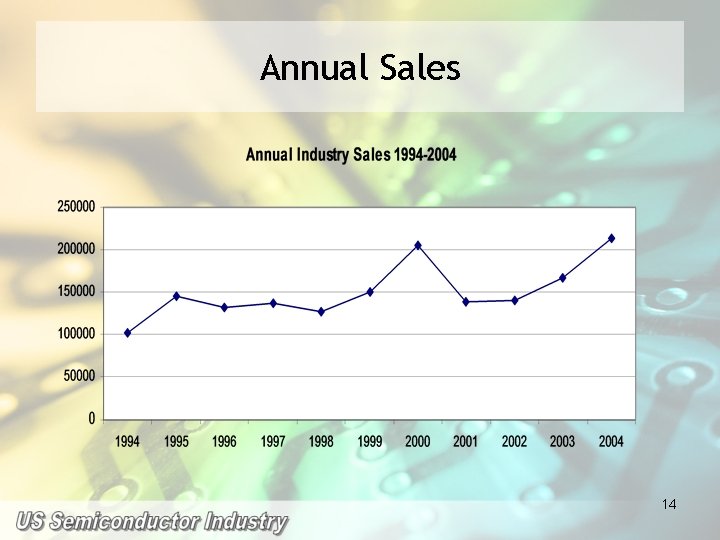

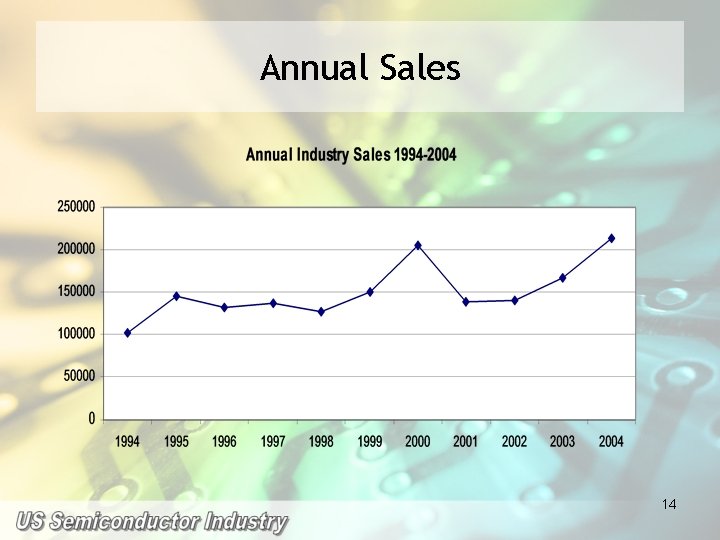

Annual Sales 14

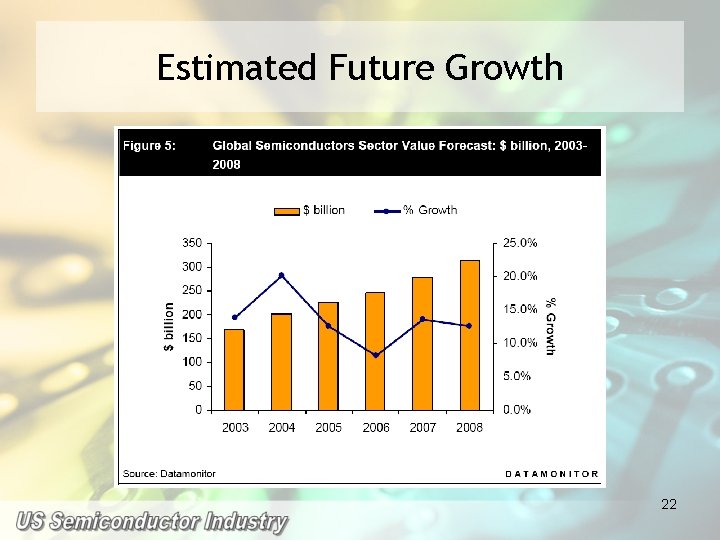

2004 Recap • Market Value – The global semiconductors industry sector grew by 28% in 2004 to reach a value of $213 billion. • Market Value Forecast – In 2008 the global semiconductors industry sector is forecast to have a value of $314 billion, an increase of 87. 1% since 2003. 15

2004 Recap • Market Segmentation I – By far the leading source of revenue for the semiconductors industry sector is the IC segment, which generates 89. 7% of the sector's value. • Market Segmentation II – The largest market globally for the semiconductors industry sector is the Asia-Pacific region, which generates 56. 8% of the sector's value. • Market Share – The leading company in the semiconductors industry sector is Intel, which generates 16. 7% of the sector's value. 16

Industry Leaders Ticker Name Mkt. Cap Weighted Average Market Capitalization TTM Sales $ Employees 48, 966. 738 13, 061. 236 33276 145, 774. 063 34, 209. 000 85000 INTC Intel Corporation TXN Texas Instruments Incorporated 44, 134. 445 12, 580. 000 35472 TSM Taiwan Semiconductor Mfg. Co. Ltd. (ADR) 39, 977. 859 NA 16529 AMAT Applied Materials, Inc. 26, 968. 701 8, 238. 181 12191 STMicroelectroni cs N. V. (ADR) 15, 438. 713 8, 760. 000 45700 AMD Advanced Micro Devices, Inc. 6, 349. 500 5, 001. 435 15900 17

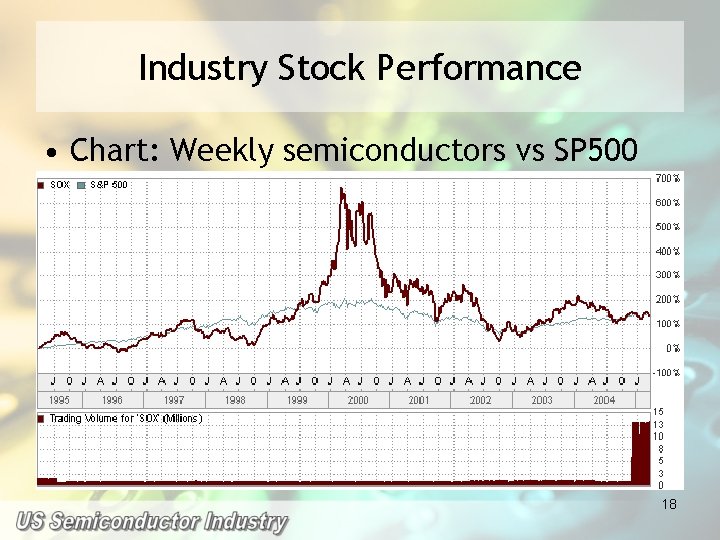

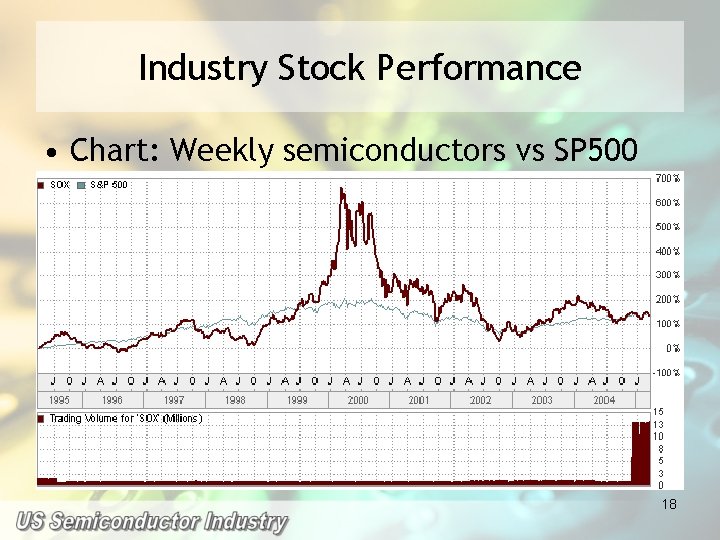

Industry Stock Performance • Chart: Weekly semiconductors vs SP 500 18

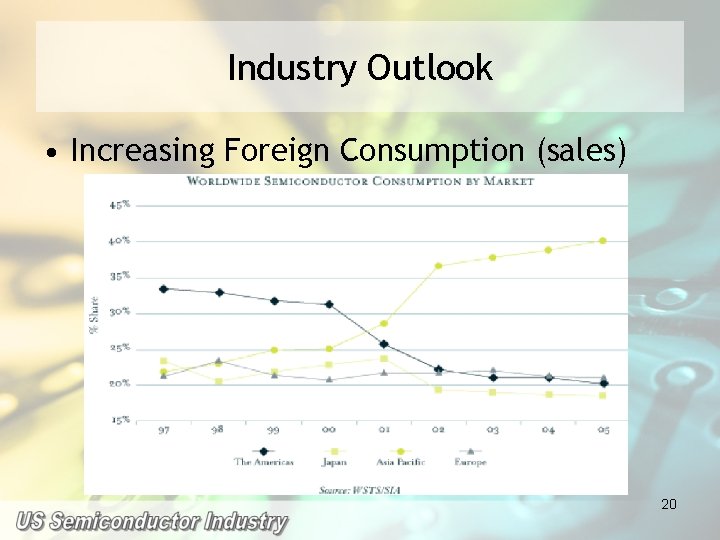

Industry Outlook • Opportunities – – Expansion into Asia Multi-core processors Network products (wired and wireless) Mobile products • Laptops • Personal Digital Assistants (PDAs) • Cellphones 19

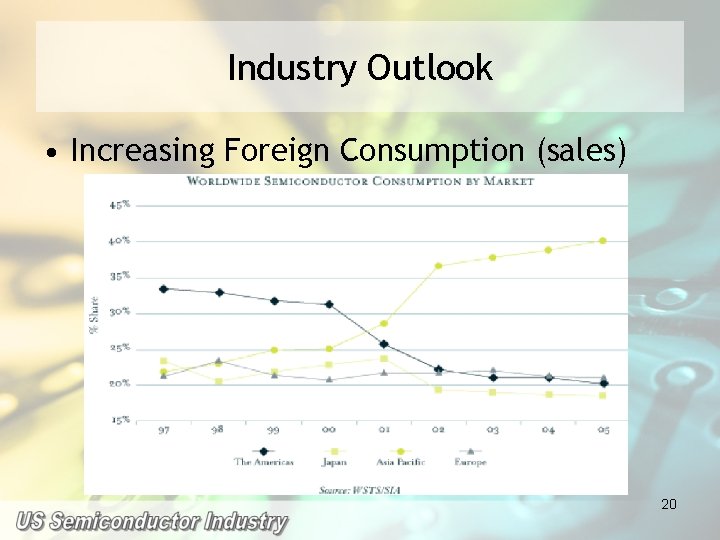

Industry Outlook • Increasing Foreign Consumption (sales) 20

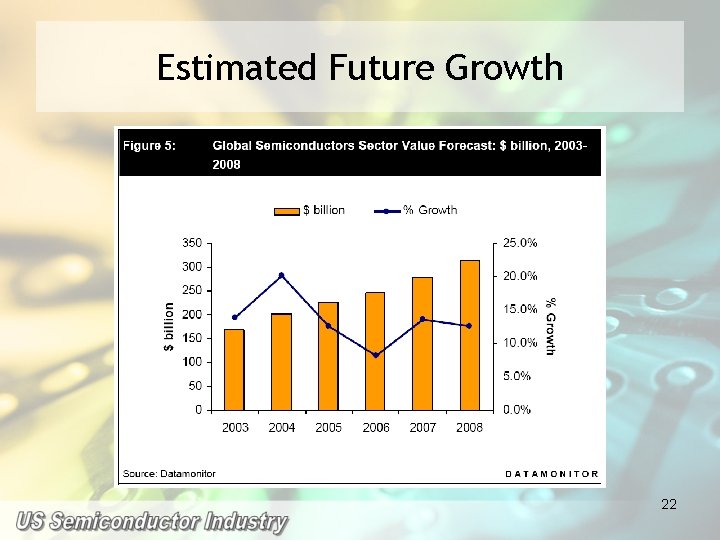

Estimated Future Growth • PC industry – Projected 14% growth – Technological advancement • Telecommunication – Projected 14 % growth – Increase use of wireless telecom products • Consumer products – Projected 30% growth – Increase use of digital technology 21

Estimated Future Growth 22

23

24

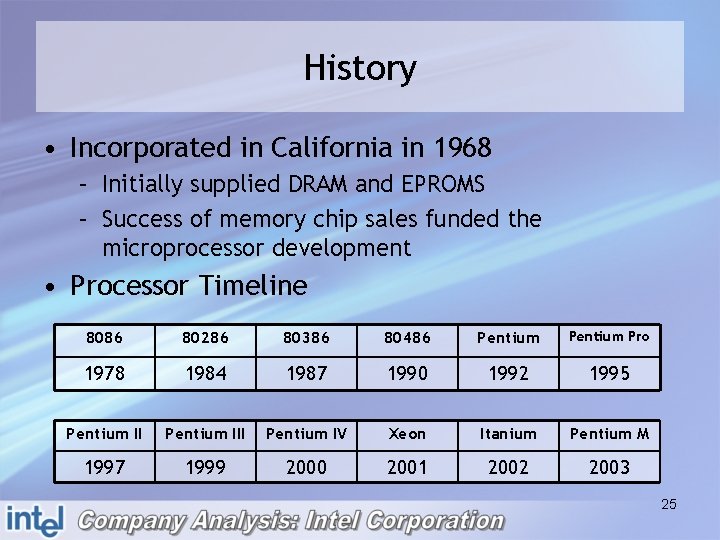

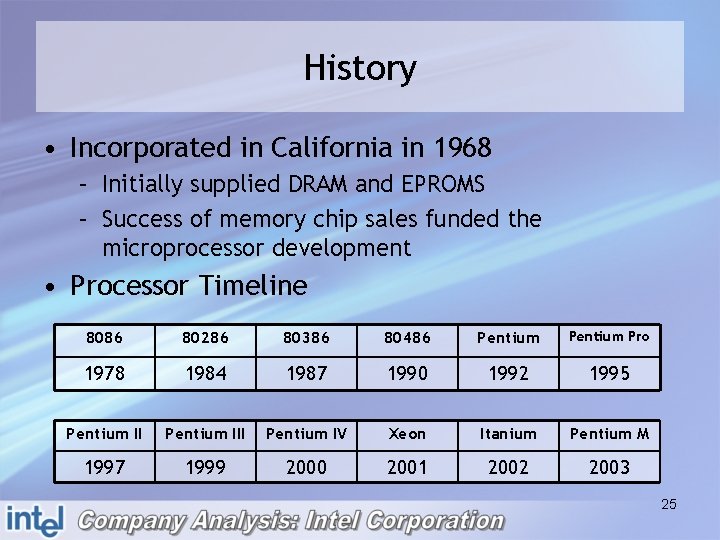

History • Incorporated in California in 1968 – Initially supplied DRAM and EPROMS – Success of memory chip sales funded the microprocessor development • Processor Timeline 8086 80286 80386 80486 Pentium Pro 1978 1984 1987 1990 1992 1995 Pentium III Pentium IV Xeon Itanium Pentium M 1997 1999 2000 2001 2002 2003 25

Company Overview • Mission statement: “ Do a great job for our customers, employees and stockholders by being the preeminent building block supplier to the worldwide digital economy. ” 26

Recent Developments • March 2005: Intel Corporation Raises Low End of Q 1 2005 Revenue Guidance Above Analysts' Estimates • February 2005: Intel Corporation Desktop Processors Get 64 -Bit Support 27

Recent Developments • January 2005: Intel Corporation Announces New Centrino Mobile Technology • January 2005: Intel Corporation Restructures Into Five Units 28

Recent Developments • November 2004: Intel Corporation Board Elects Paul Otellini Intel Chief Executive Officer; Craig Barrett to Become Intel Chairman • November 2004: Intel Corporation Doubles Cash Dividend and Authorizes Repurchase of 500 Million Shares of Intel Common Stock 29

Recent Developments • September 2004: Intel Corporation Invests in Five Companies Developing Technologies for the Digital Home • March 2004: Intel Corporation May Cut China Sales Due To Rule 30

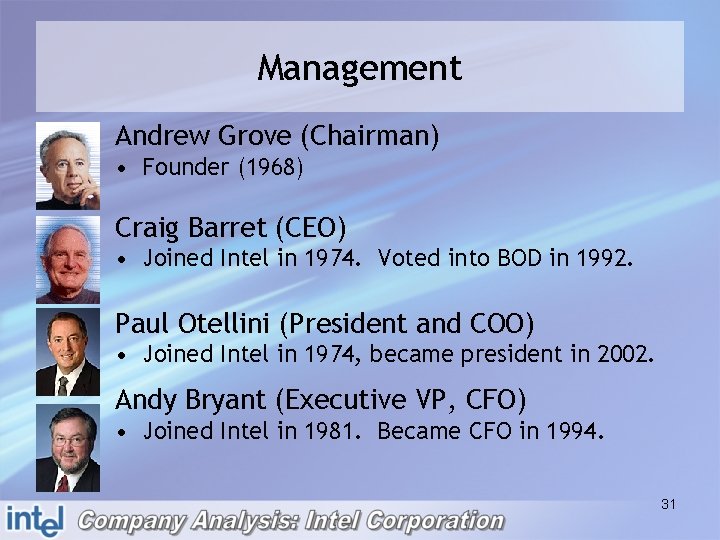

Management Andrew Grove (Chairman) • Founder (1968) Craig Barret (CEO) • Joined Intel in 1974. Voted into BOD in 1992. Paul Otellini (President and COO) • Joined Intel in 1974, became president in 2002. Andy Bryant (Executive VP, CFO) • Joined Intel in 1981. Became CFO in 1994. 31

Business Segments and Products • Primary lines of busines: – Intel Architecture Business – Intel Communications Group 32

Business Segments and Products • Intel Architecture Business – Microprocessors • Desktop Platform • Mobile Platform • Enterprise Platform Pentium 4 Pentium M Xeon – Chipsets • Intel chipsets are compatible with variety of industry-accepted specifications – Motherboard products 33

Business Segments and Products • Intel Communications Group – – Flash memory Wired and wireless connectivity products Processors for handheld computing devices Cellular baseband chipsets 34

Major Customers • Distributors • Original Equipment Manufacturers of computer systems • Retail 35

Competitors • Intel Architecture Business – Advanced Micro Devices (Desktop, mobile platform) – IBM (Desktop, mobile platform) – ATI, Broadcom, SIS, Via (Chipsets) – Nvidia, ATI (Chipsets/Motherboards) – Transmeta (Mobile platform) – Sun Microsystems (Enterprise platform) 36

Competitors • Intel Communications Group – Samsung, TI (Application processors) – Spanshion (falsh memory) – Qualacom (Cellular baseband chips) 37

Strategy • Strategy – – – Utilize core competencies to develop advanced products Exercise control over value chain Utilize “Intel inside” marketing campaign Expand into faster growing complementary businesses Invest in companies globally to further strategic objectives (Intel Capital program) • Objectives: – Extend silicon leadership and manufacturing capability – Deliver architectural innovation for all platforms – Pursue worldwide opportunities 38

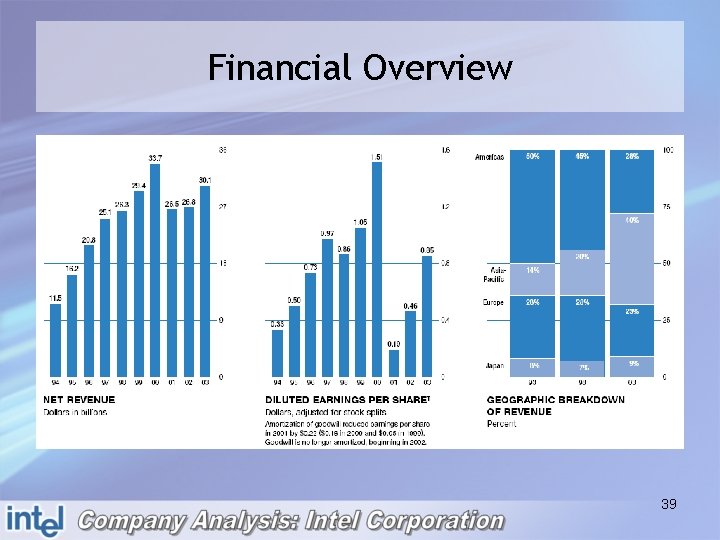

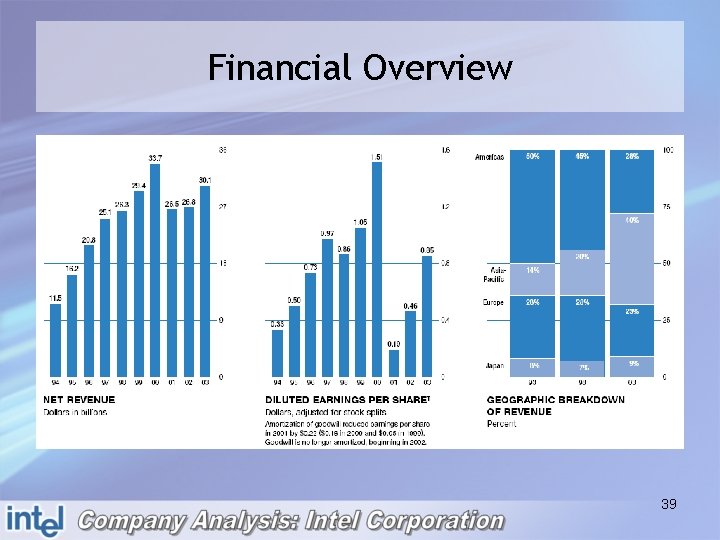

Financial Overview 39

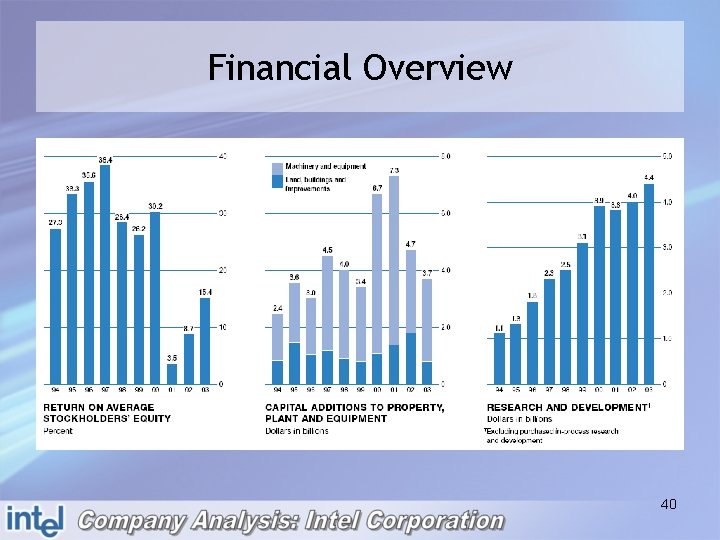

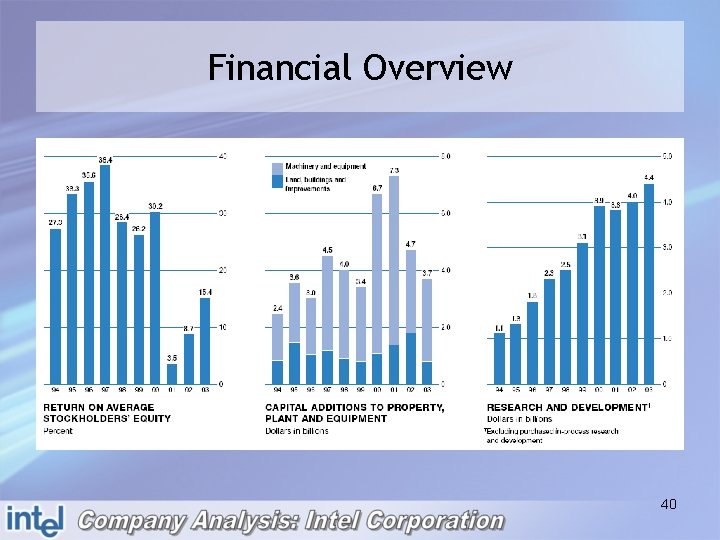

Financial Overview 40

Financial Statement Analysis 41

Segment Performance 43

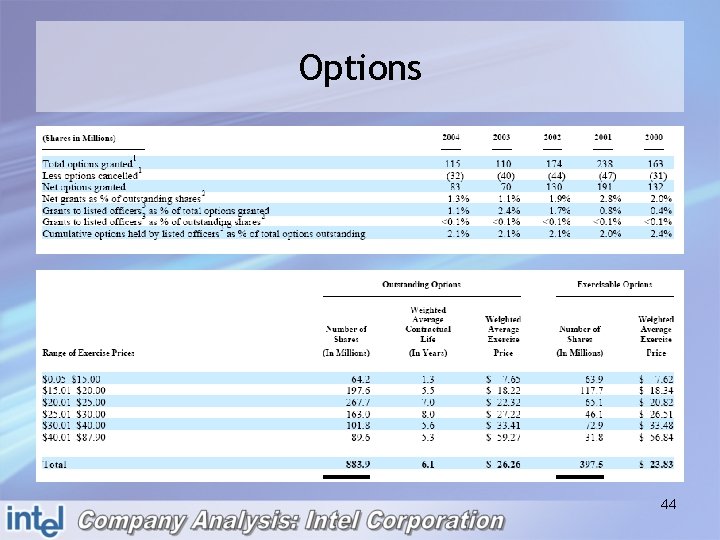

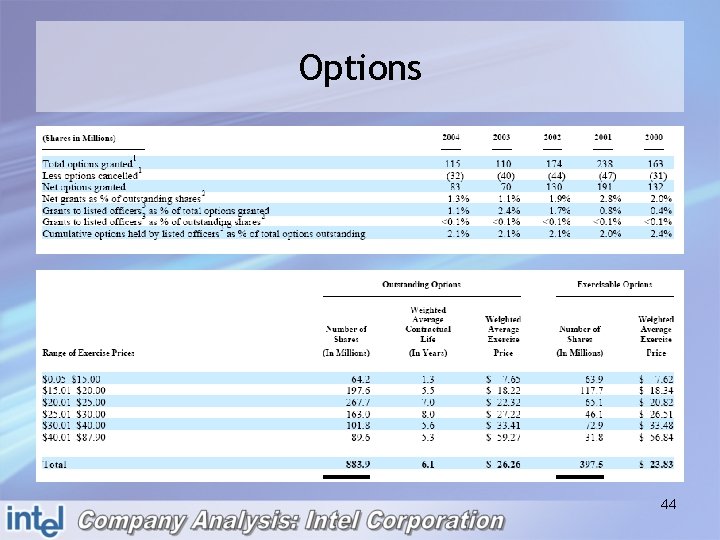

Options 44

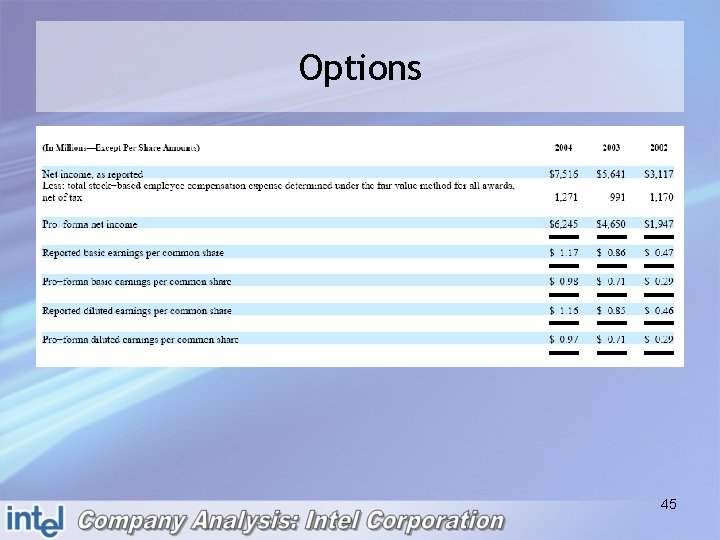

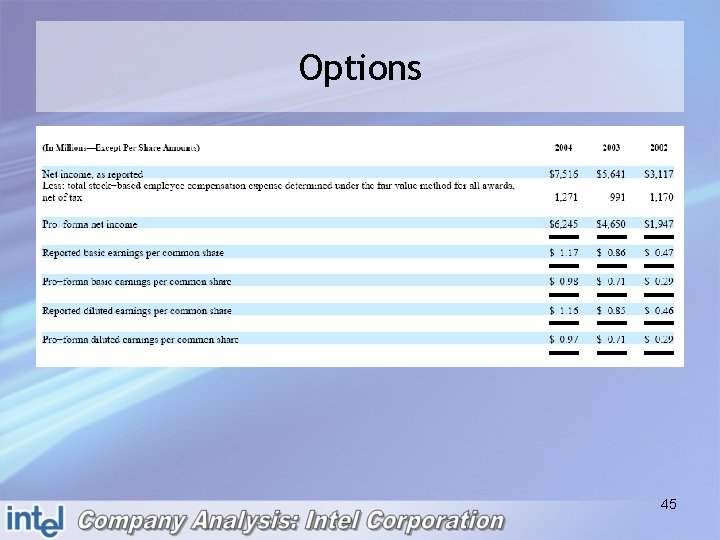

Options 45

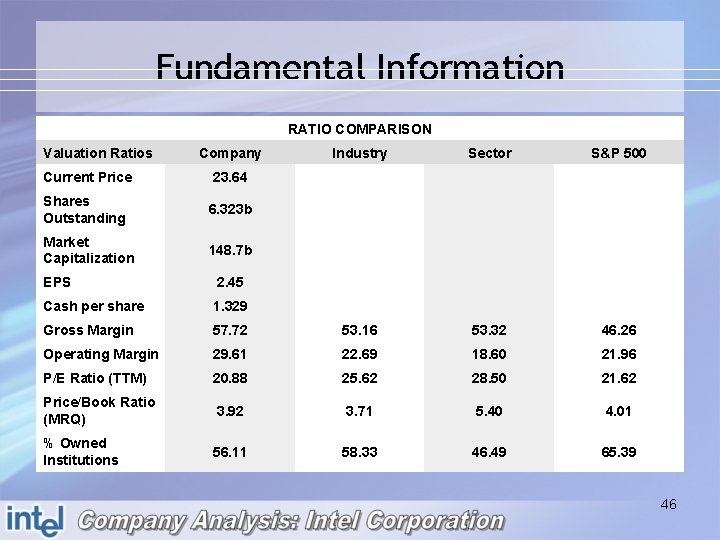

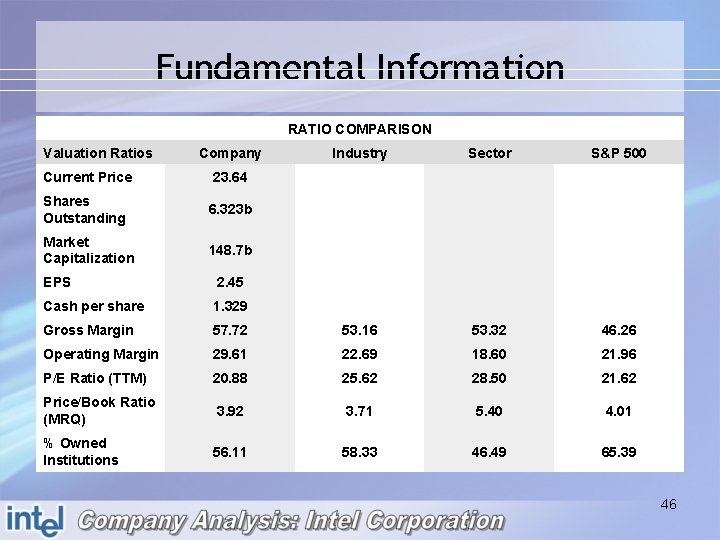

Fundamental Information RATIO COMPARISON Valuation Ratios Company Current Price 23. 64 Shares Outstanding 6. 323 b Market Capitalization 148. 7 b Industry Sector S&P 500 EPS 2. 45 Cash per share 1. 329 Gross Margin 57. 72 53. 16 53. 32 46. 26 Operating Margin 29. 61 22. 69 18. 60 21. 96 P/E Ratio (TTM) 20. 88 25. 62 28. 50 21. 62 Price/Book Ratio (MRQ) 3. 92 3. 71 5. 40 4. 01 % Owned Institutions 56. 11 58. 33 46. 49 65. 39 46

Management Effectiveness (%) Company Industry Sector S&P 500 Return On Assets (TTM) 15. 73 12. 19 10. 43 7. 59 Return On Assets 5 Yr. Avg. 12. 18 6. 80 6. 63 Return On Investment (TTM) 18. 59 14. 44 14. 23 11. 41 Return On Investment - 5 Yr. Avg. 14. 50 8. 06 9. 97 10. 50 Return On Equity (TTM) 19. 64 15. 57 17. 73 19. 89 Return On Equity 5 Yr. Avg. 15. 50 9. 02 13. 72 18. 69 47

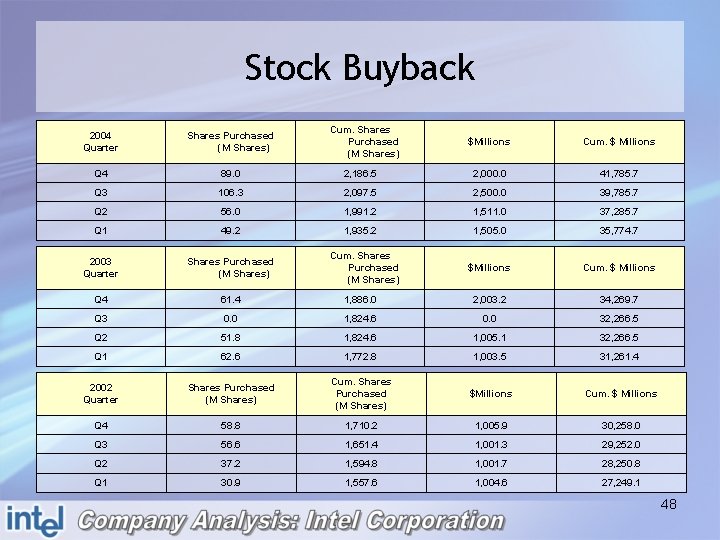

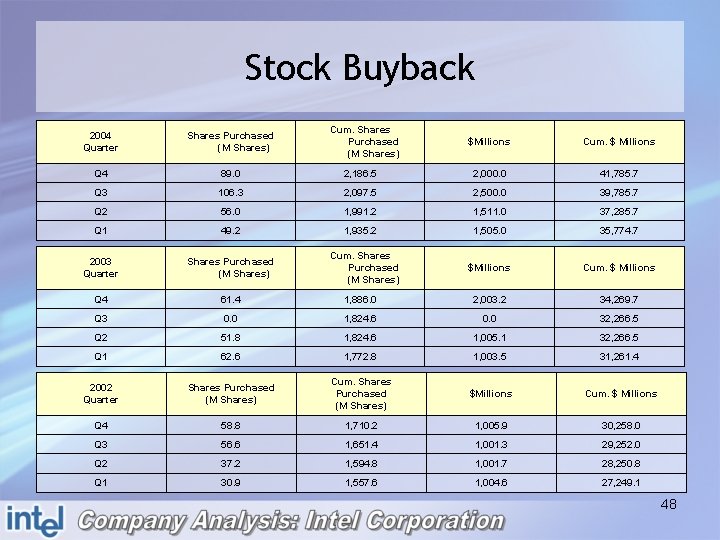

Stock Buyback 2004 Quarter Shares Purchased (M Shares) Q 4 89. 0 Q 3 Cum. Shares Purchased (M Shares) $Millions Cum. $ Millions 2, 186. 5 2, 000. 0 41, 785. 7 106. 3 2, 097. 5 2, 500. 0 39, 785. 7 Q 2 56. 0 1, 991. 2 1, 511. 0 37, 285. 7 Q 1 49. 2 1, 935. 2 1, 505. 0 35, 774. 7 2003 Quarter Shares Purchased (M Shares) $Millions Cum. $ Millions Q 4 61. 4 1, 886. 0 2, 003. 2 34, 269. 7 Q 3 0. 0 1, 824. 6 0. 0 32, 266. 5 Q 2 51. 8 1, 824. 6 1, 005. 1 32, 266. 5 Q 1 62. 6 1, 772. 8 1, 003. 5 31, 261. 4 2002 Quarter Shares Purchased (M Shares) Cum. Shares Purchased (M Shares) $Millions Cum. $ Millions Q 4 58. 8 1, 710. 2 1, 005. 9 30, 258. 0 Q 3 56. 6 1, 651. 4 1, 001. 3 29, 252. 0 Q 2 37. 2 1, 594. 8 1, 001. 7 28, 250. 8 Q 1 30. 9 1, 557. 6 1, 004. 6 27, 249. 1 Cum. Shares Purchased (M Shares) 48

Price History – 52 Weeks 49

Price History vs. SOX – 52 Weeks 50

Price History – 10 Years 51

Price History vs. SOX – 10 Years 52

Value Drivers • • Market leading research and development Financial strength High brand recognition Economies of scale 53

What Would Fisher Say? 1. “Superiority in production, marketing, research and financial skills” – Market leader in production – Strong “intel inside” marketing campaign – Solid financial base 2. “The people factor” – All top executives have been with the firm for over 20 years 54

What Would Fisher Say? 3. “Investment characteristics of some businesses” – High barriers to entry – Fragmented competition 4. “The price of the investment” – Moderate price – Low P/E ratio relative to industry 55

Recommendation Positive: • Competent and proven management • Strong financial performance • High profit margins • Future growth prospects Negative: • Size of company limits overall growth BUY!! 56

57

History • Founded in 1969 and based in Sunnyvale, California, AMD provides microprocessors, Flash memory devices, and silicon-based solutions for customers in the communications and computer industries worldwide. • Facilities in US, Europe, and Asia 58

Company Overview • Purpose: " We empower people everywhere to lead more productive lives. " • Mission: To achieve success, AMD combines innovative concepts with leadership in process technology and design and manufacturing excellence to offer products and services that reduce the cost, improve the performance and shorten the time to market for our target customers worldwide. 59

Company Overview • March 2005: AMD Supports Fair Trade Commission Of Japan’s (JFTC) Decision To Stop Illegal Business Practices By Intel • March 2005: AMD Opens New Test, Mark And Pack Manufacturing Facility In Suzhou, China 60

Company Overview • June 2004: AMD Strengthens Mobile Computing R&D with New Engineering Lab in Tokyo • August 2004: AMD Demonstrates World’s First X 86 Dual-Core Processor 61

Company Overview • October 2004: Spansion Expands System Engineering Capabilities at Design Centers Around the Globe • December 2004: AMD, IBM Announce Semiconductor Manufacturing Technology Breakthrough 62

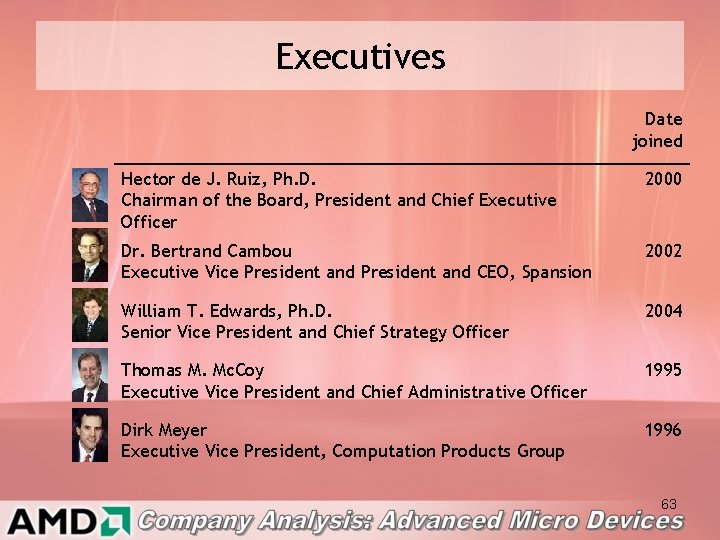

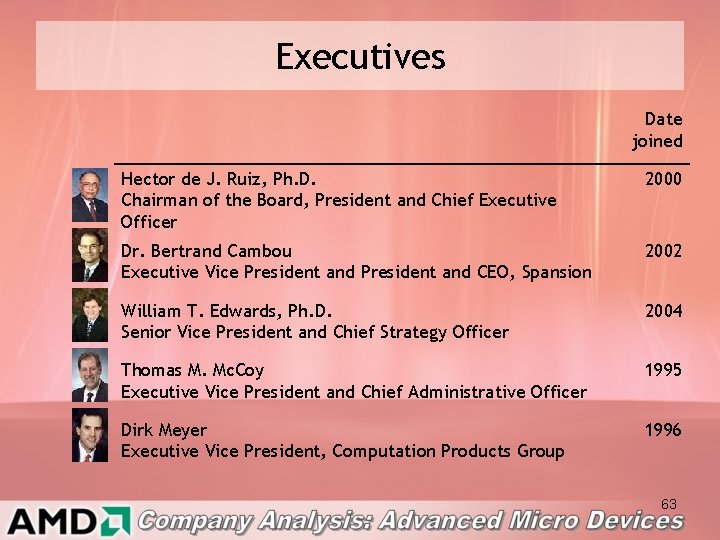

Executives Date joined Hector de J. Ruiz, Ph. D. Chairman of the Board, President and Chief Executive Officer 2000 Dr. Bertrand Cambou Executive Vice President and CEO, Spansion 2002 William T. Edwards, Ph. D. Senior Vice President and Chief Strategy Officer 2004 Thomas M. Mc. Coy Executive Vice President and Chief Administrative Officer 1995 Dirk Meyer Executive Vice President, Computation Products Group 1996 63

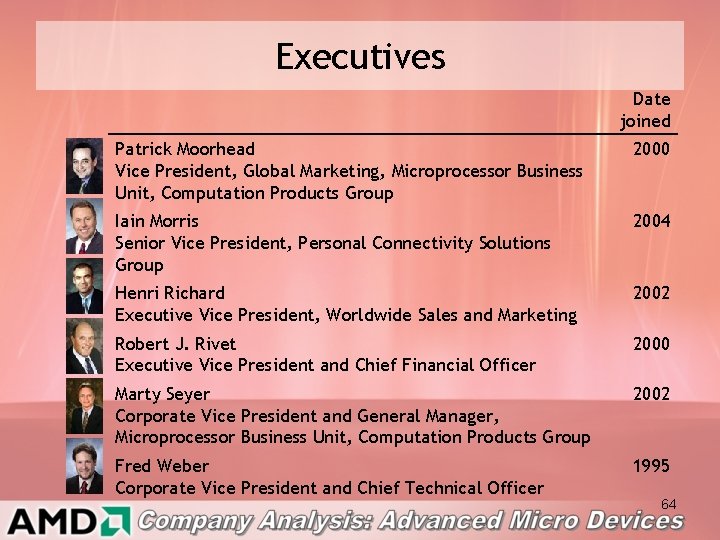

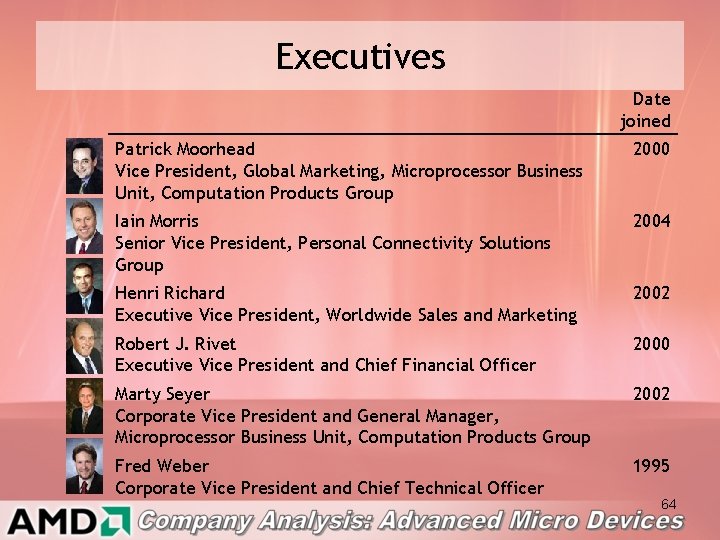

Executives Date joined Patrick Moorhead Vice President, Global Marketing, Microprocessor Business Unit, Computation Products Group 2000 Iain Morris Senior Vice President, Personal Connectivity Solutions Group 2004 Henri Richard Executive Vice President, Worldwide Sales and Marketing 2002 Robert J. Rivet Executive Vice President and Chief Financial Officer 2000 Marty Seyer Corporate Vice President and General Manager, Microprocessor Business Unit, Computation Products Group 2002 Fred Weber Corporate Vice President and Chief Technical Officer 1995 64

Business Segment and Products • Computation products • Memory products • Personal connectivity solution products 65

Computation products • Processors – – Desktop Server Mobile Workstation Sempron, Athlon 64 Opterron & Athlon Turion, Sempron Athlon Opteron & Athlon 66

Memory products • From Spansion – Flash Memory • Mirror. Bit • Floating gate 67

Personal connectivity solution products • E 86™ Embedded Processors – AMD Geode™ Solutions – AMD Alchemy™ Solutions • Wired Ethernet 68

Customers • Distributors • Original Equipment Manufacturers of computer systems • Resellers • Retail 69

Competitors • Computation Products – Intel • Memory Products – Intel, Samsung, Toshiba, Sharp, STMicroelectronics, Silicon Storage Technology and Macronix International • Personal connectivity solution products – Freescale (formerly Motorola Semiconductor), Hitachi, Intel, NEC Corporation, Toshiba and Via Technologies 70

Strategic Partners • Fujitsu – Spansion (manufacturing flash memory) • Microsoft – Developing and operating system that works with AMD 64 technology • IBM – Joint development agreement to develop new process technologies 71

Strategy • Expand position in the enterprise segment through AMD 64 based processors • Expand position in the Flash memory market – Increase adoption of Mirror. Bit technology • Developing new microprocessor and Flash memory products • Expanding to high growth global markets – China, Latin America, India and Europe 72

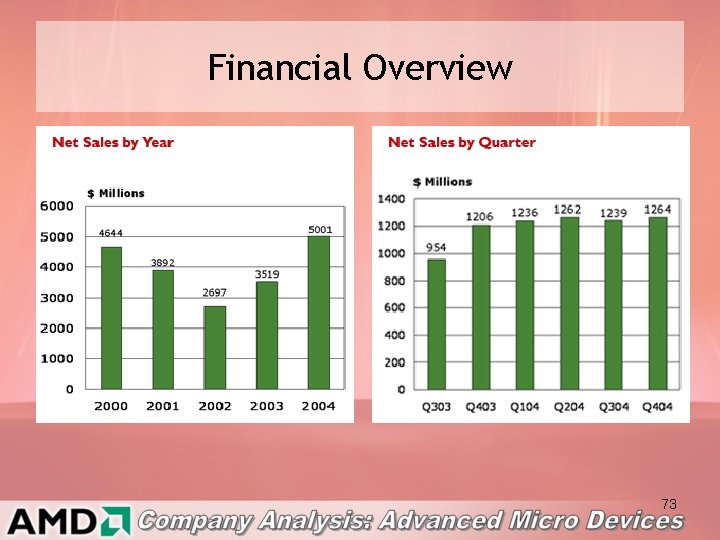

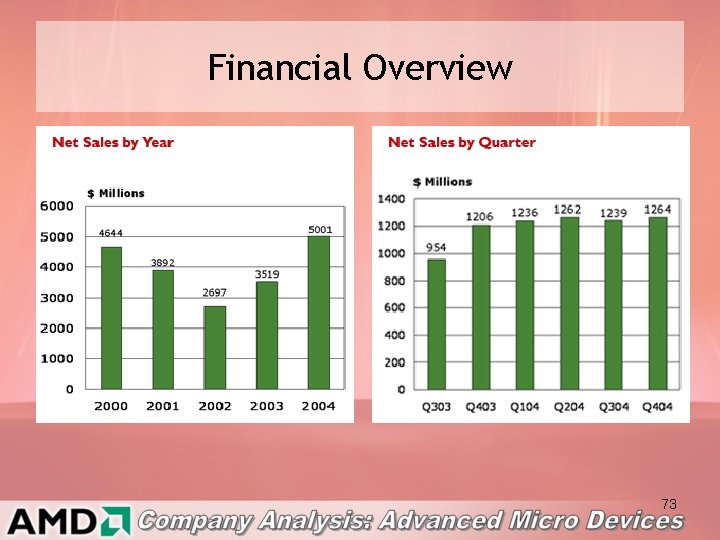

Financial Overview 73

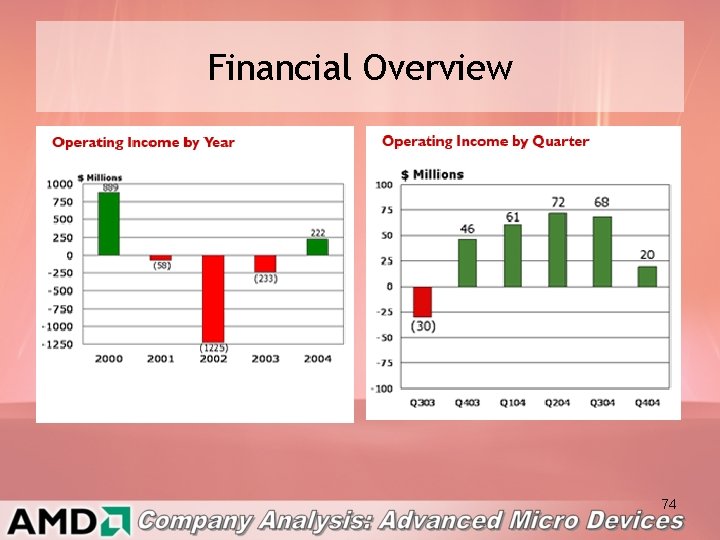

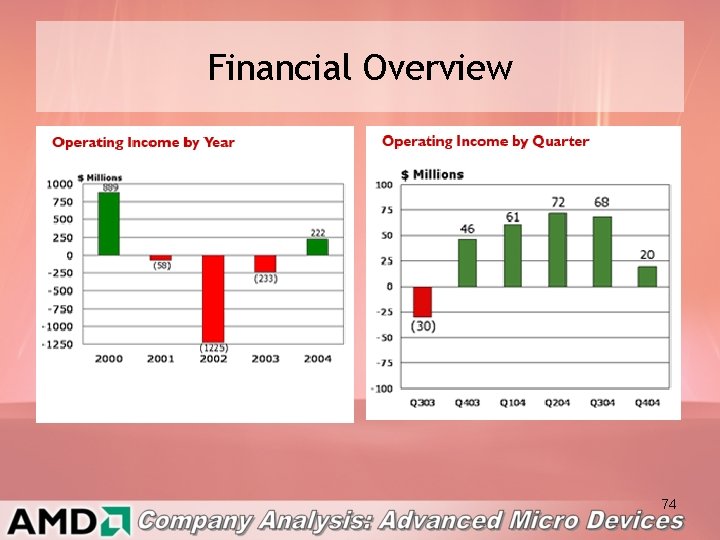

Financial Overview 74

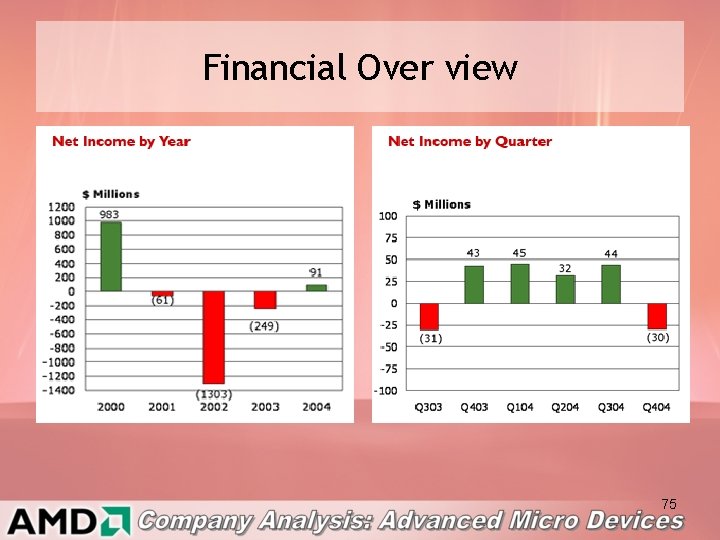

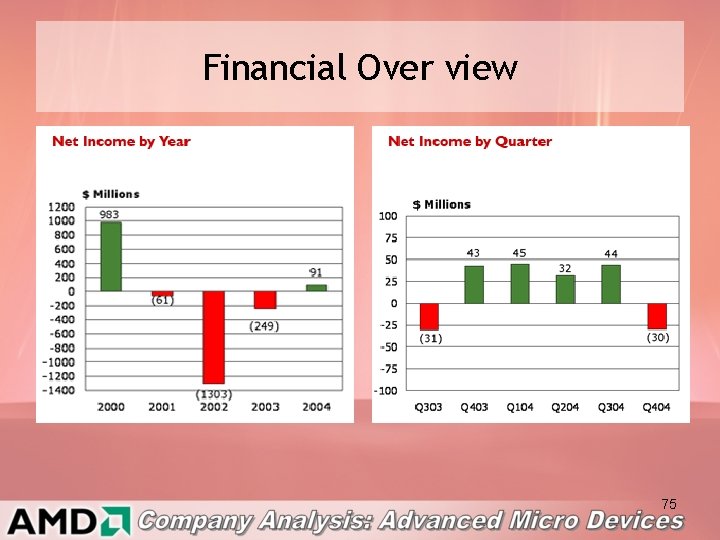

Financial Over view 75

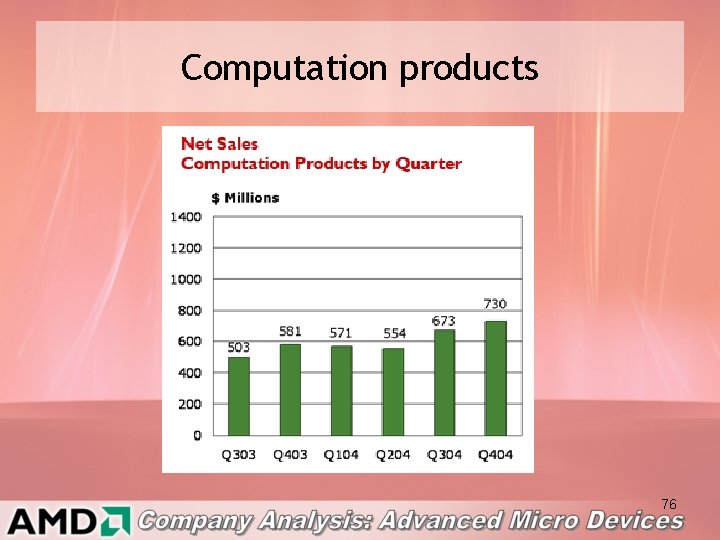

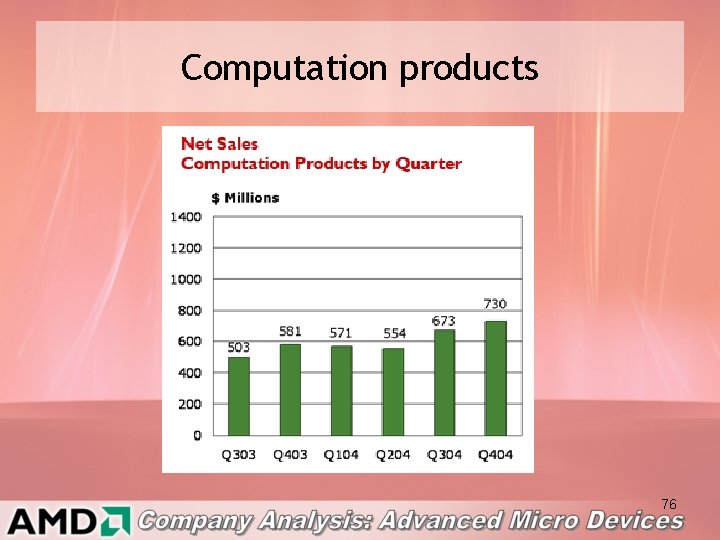

Computation products 76

Memory products 77

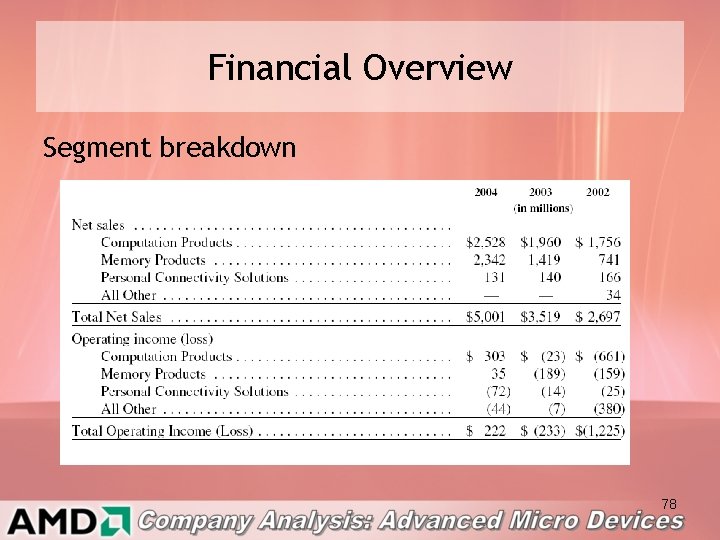

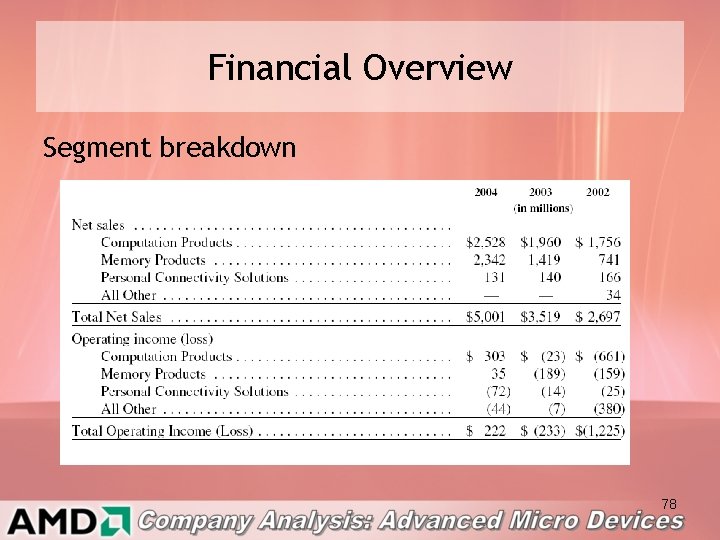

Financial Overview Segment breakdown 78

Financial Statement Analysis 79

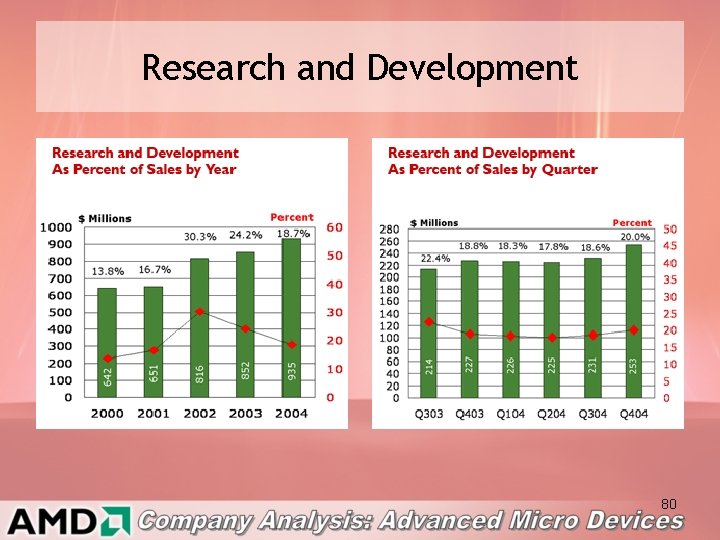

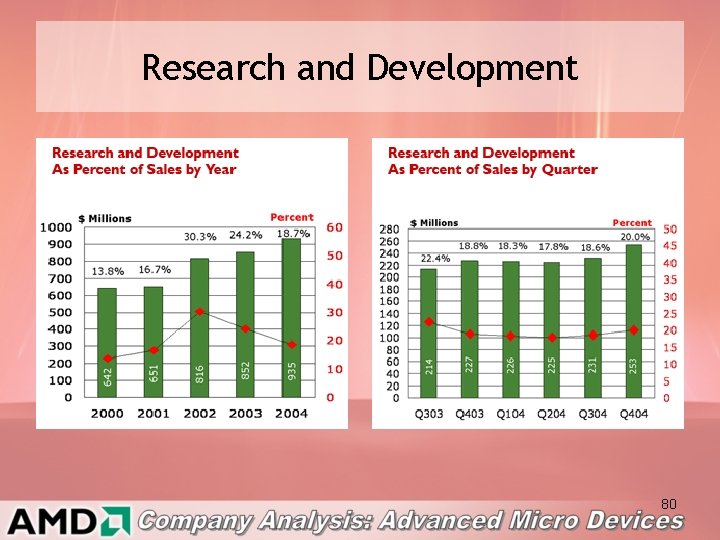

Research and Development 80

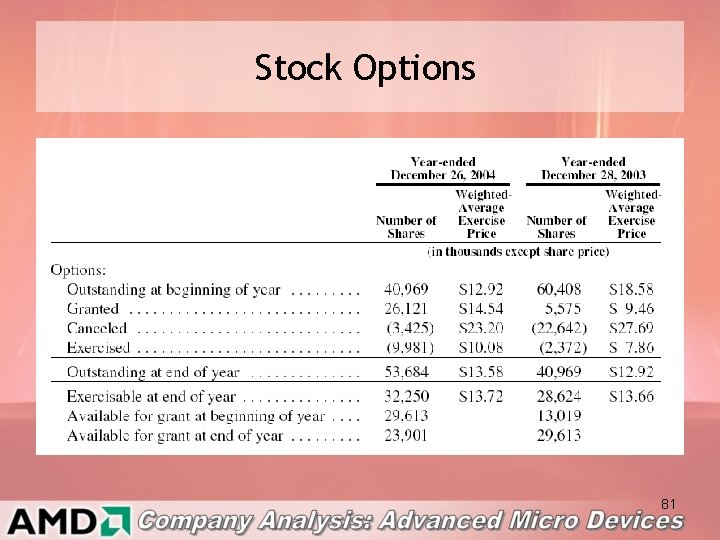

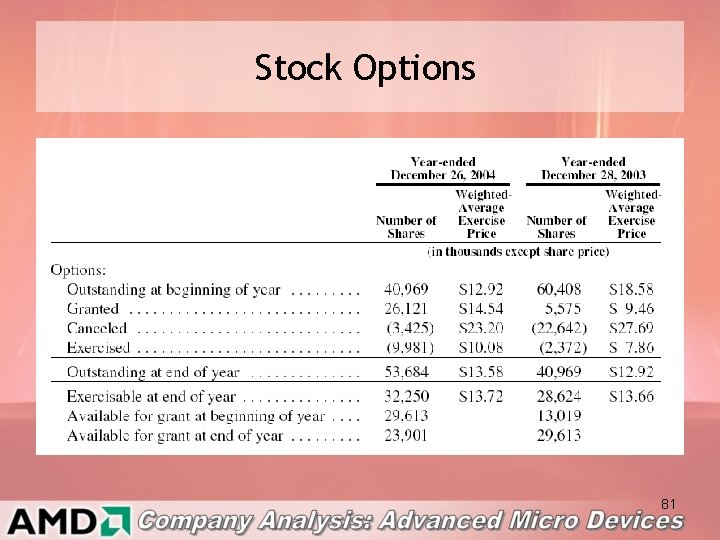

Stock Options 81

Stock Options 82

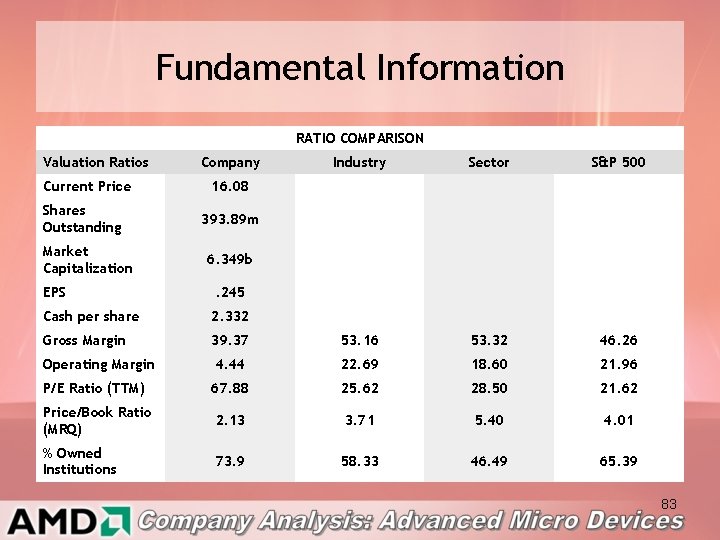

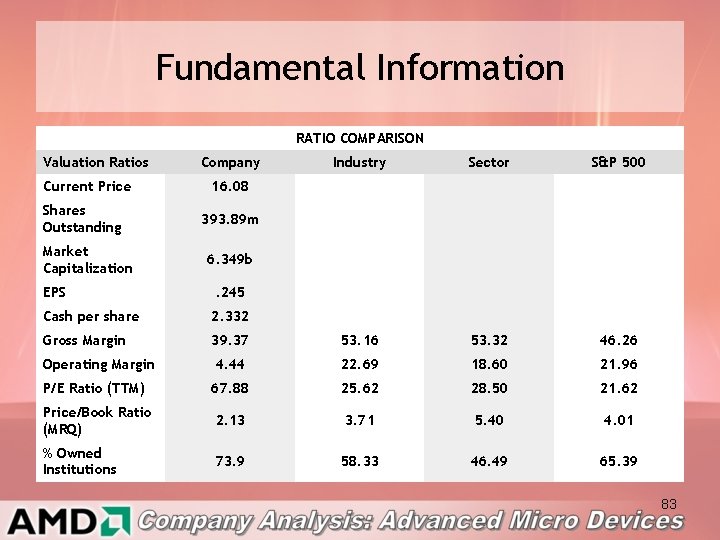

Fundamental Information RATIO COMPARISON Valuation Ratios Current Price Shares Outstanding Market Capitalization Company Industry Sector S&P 500 16. 08 393. 89 m 6. 349 b EPS . 245 Cash per share 2. 332 Gross Margin 39. 37 53. 16 53. 32 46. 26 Operating Margin 4. 44 22. 69 18. 60 21. 96 P/E Ratio (TTM) 67. 88 25. 62 28. 50 21. 62 Price/Book Ratio (MRQ) 2. 13 3. 71 5. 40 4. 01 % Owned Institutions 73. 9 58. 33 46. 49 65. 39 83

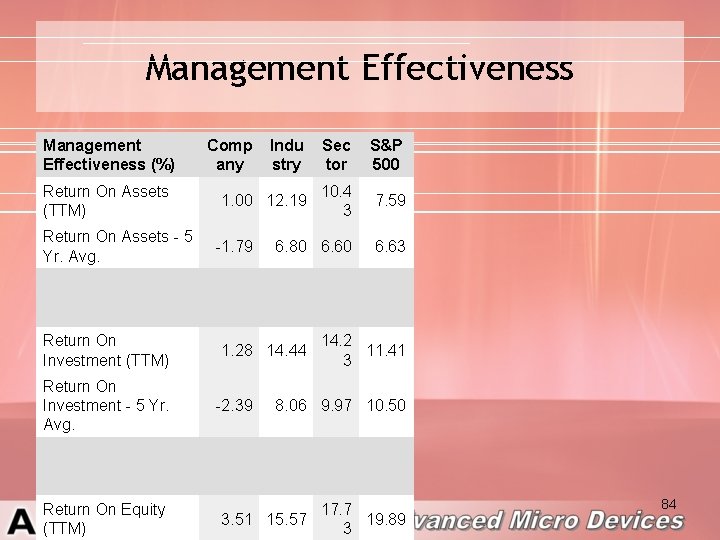

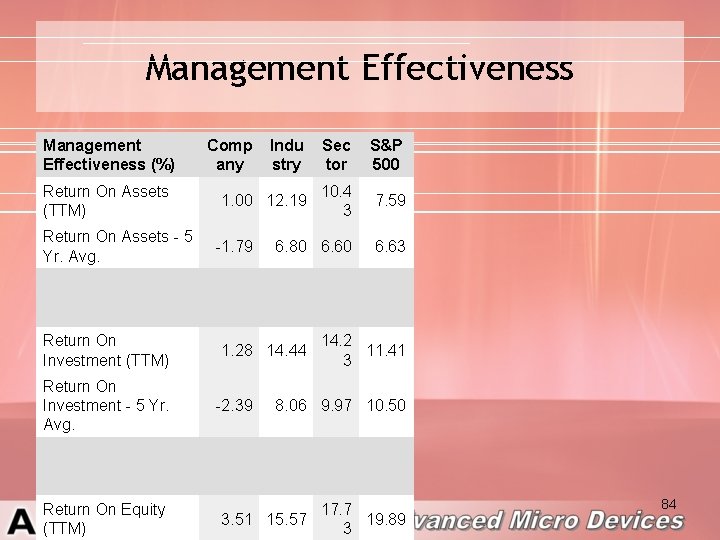

Management Effectiveness (%) Return On Assets (TTM) Return On Assets - 5 Yr. Avg. Return On Investment (TTM) Return On Investment - 5 Yr. Avg. Return On Equity (TTM) Comp any Indu stry Sec tor S&P 500 12. 19 10. 4 3 7. 59 6. 80 6. 63 -1. 79 1. 28 14. 44 -2. 39 14. 2 11. 41 3 8. 06 9. 97 10. 50 17. 7 3. 51 15. 57 19. 89 3 84

Price History – 52 weeks 85

Price History vs. SOX – 52 weeks 86

Price History – 10 year 87

Price History vs. Sox – 10 year 88

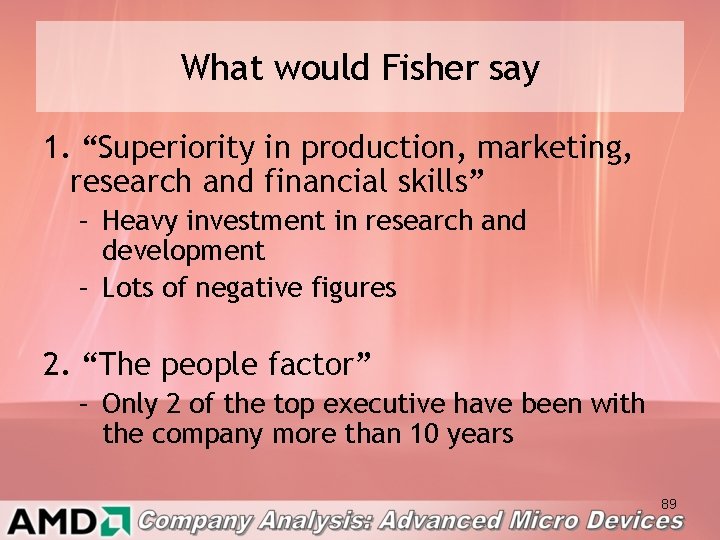

What would Fisher say 1. “Superiority in production, marketing, research and financial skills” – Heavy investment in research and development – Lots of negative figures 2. “The people factor” – Only 2 of the top executive have been with the company more than 10 years 89

What would Fisher say 3. “Investment characteristics of some businesses” – High barriers to entry – Fragmented competition 4. “The price of the investment” – Moderate price – High P/E ratio relative to industry 90

Recommendation Positive: Negative: • Relatively small and has room for growth • Good products (AMD 64) • Positive earning for 2004 • • Competes with Intel Inconsistent earnings No Dividends Lots of debt HOLD!! 91

92

Company Overview • History – 1967, Applied Material was founded by Michael A. Mc. Neilly and others – 1972, first public stock offering – 1992, became the world’s leading semiconductor equipment manufacture – From 1971, AMAT has opened office worldwide: Europe, China (Beijing, Shanghai), Korea, Taiwan, Singapore 93

Company Overview • Acquisition – 1997, Opal, Inc. and Orbot Instruments • Process diagnostic and control technology – 1998, Consilium, Inc. • Manufacturing Execution System Software – 2000, Etec Syetems, Inc. • Mask pattern generation – 2004, TORREX • Transistor Fabrication Technologies 94

Company Overview • Mission Statement – “to be the leading supplier of semiconductor fabrication solutions worldwide – through innovation and enhancement of customer productivity with systems and service solutions” 95

Company Overview • Current – Largest supplier of manufacturing systems and related service to the globe semicon industry – 2004 • First 65 -nm X Architecture Interconnect Test Chip Produced at Maydan Technology Center • ASIA, the source of more than 70% of revenue 96

Management Mike Splinter – President and CEO – Joined AMAT at 2003 – 30 yr veteran of the semiconductor industry • Intel • Rockwell James Morgan – Chairman of the Board – Joined AMAT at 1976 • CEO from 1977 -2003 • Chairman since 1987 97

Management • Dan Maydan (1980) – President Emeritus • Franz Janker (1982) – Executive V. P. , Sales and Marketing • David N. K. Wong (1980) – Executive V. P. , Applied Materials Asia • Nancy Handel (1985) – Senior V. P. , CFO • Manfred Kerschbaum (2004) – Senior V. P. , GM Applied Global Service • Farhad Moghadam (1999) – Senior V. P. , GM Thin Film Product Business Group and Foundation Engineering • Mark Pinto (2004) – CTO, Senior V. P. New Business and New Product Group • Ashon K. Sinha (1990) – Senior V. P, GM Etch Product Business Group 98

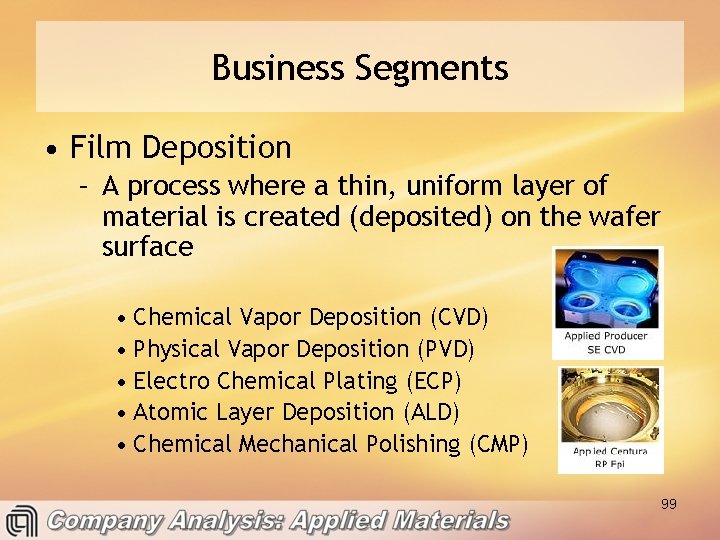

Business Segments • Film Deposition – A process where a thin, uniform layer of material is created (deposited) on the wafer surface • Chemical Vapor Deposition (CVD) • Physical Vapor Deposition (PVD) • Electro Chemical Plating (ECP) • Atomic Layer Deposition (ALD) • Chemical Mechanical Polishing (CMP) 99

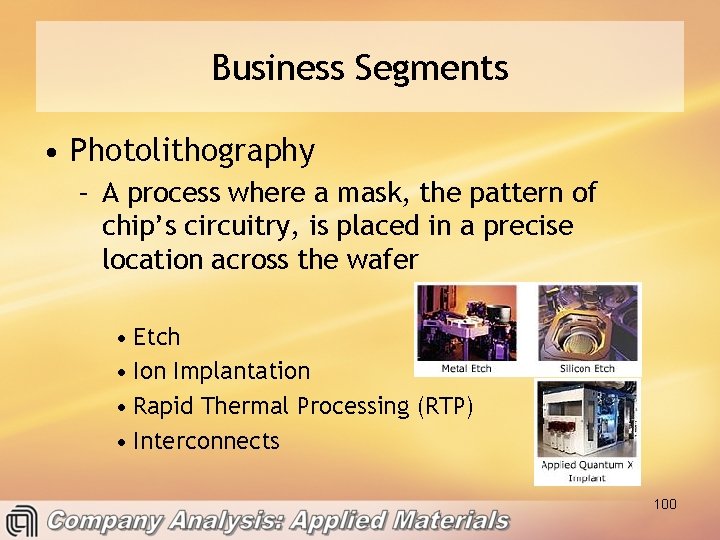

Business Segments • Photolithography – A process where a mask, the pattern of chip’s circuitry, is placed in a precise location across the wafer • Etch • Ion Implantation • Rapid Thermal Processing (RTP) • Interconnects 100

Business Segments • Metrology & Inspection – Defect Review Scanning Electron Microscopy (DR-SEM) – Critical Dimension Measurement Scanning Electron Microscopy (CDM-SEM) 101

Company Overview • Major Customers – – Intel Samsung Electronics AMD Freescale (Motorola) • Top Competitors – KLA-Tencor (8. 9 B) • Supplier of process control and yield management solutions – Lam Research (3. 8 B) • Designs, manufactures, markets, and services semicon process equip. – Tokyo Electronic • LCD Inspection equip 102

Strategy • Strategy – “Early leaders win. ” – “…Close to the Customer, Mutual Trust and Respect, World-Class Performance…” – “Attract, retain, and develop the best people…” • Objectives – “Our customers' business results come first! “ 103

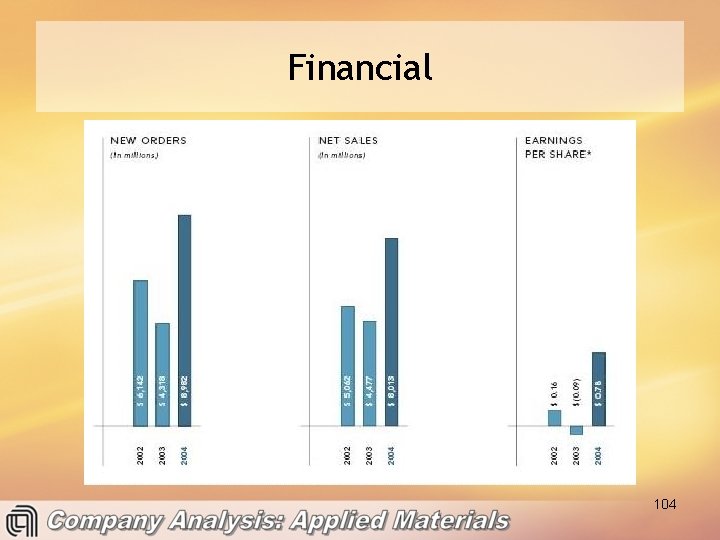

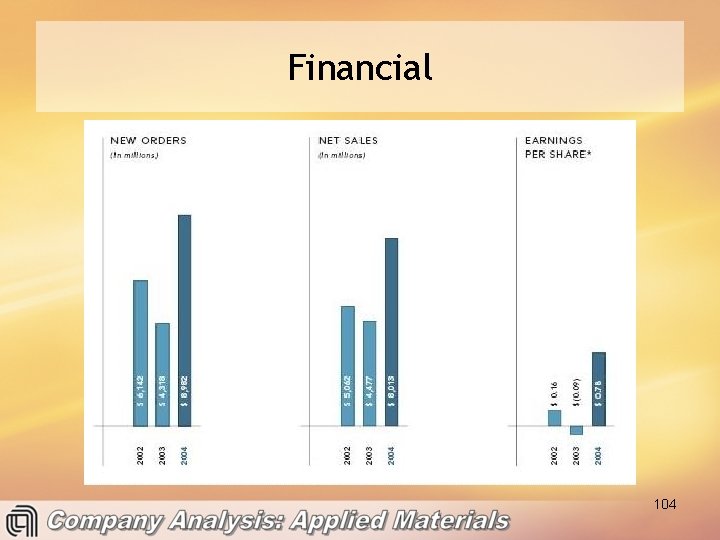

Financial 104

Financial Statement Analysis 105

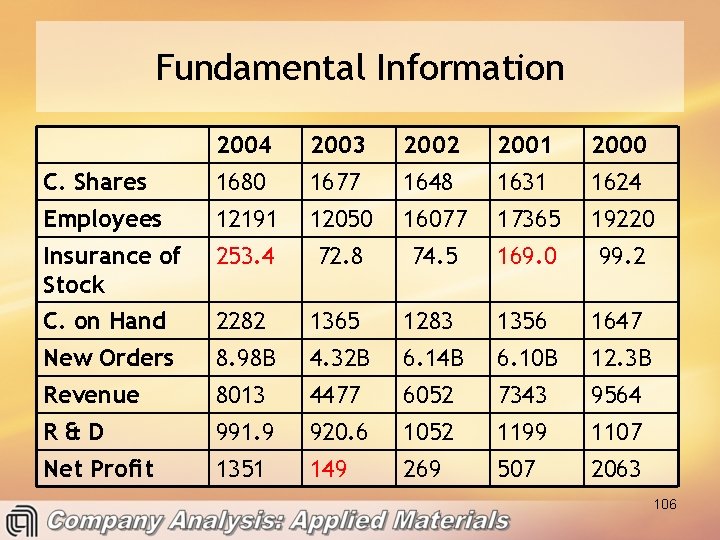

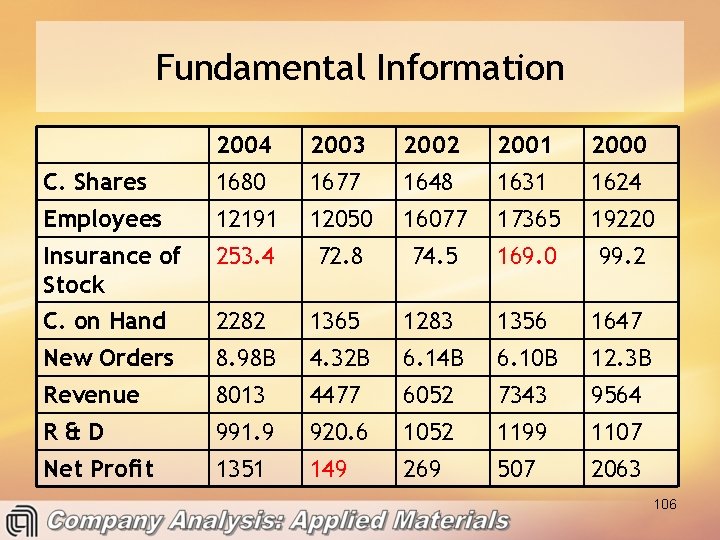

Fundamental Information 2004 2003 2002 2001 2000 C. Shares 1680 1677 1648 1631 1624 Employees 12191 12050 16077 17365 19220 Insurance of Stock 253. 4 72. 8 74. 5 169. 0 99. 2 C. on Hand 2282 1365 1283 1356 1647 New Orders 8. 98 B 4. 32 B 6. 14 B 6. 10 B 12. 3 B Revenue 8013 4477 6052 7343 9564 R&D 991. 9 920. 6 1052 1199 1107 Net Profit 1351 149 269 507 2063 106

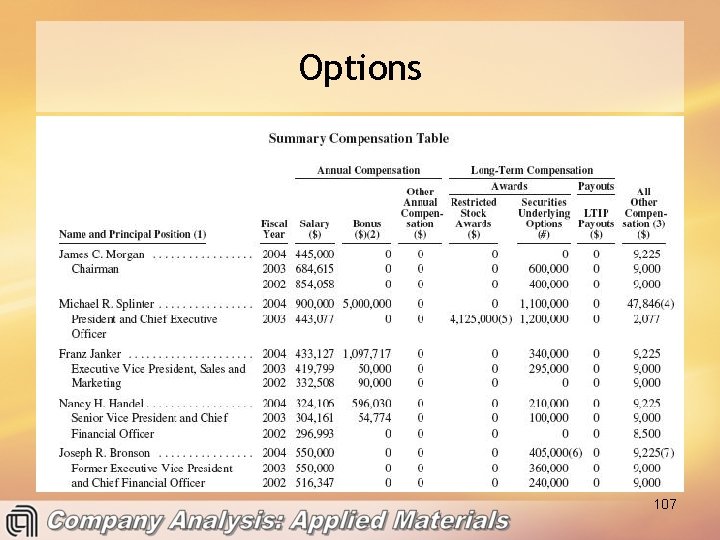

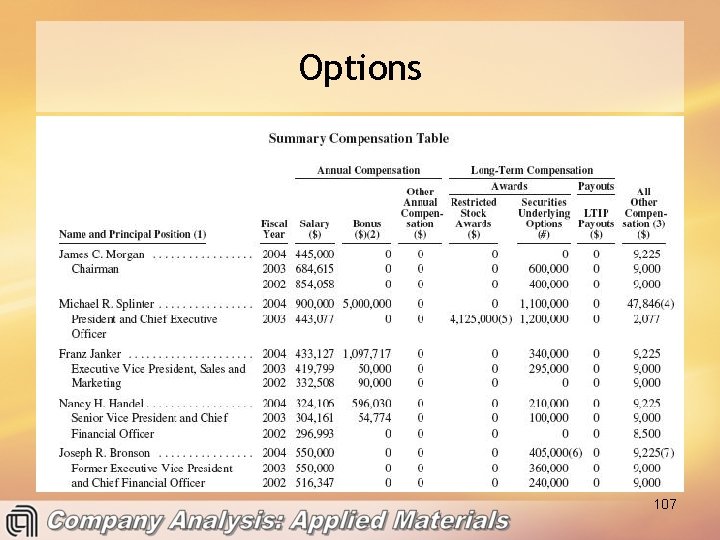

Options 107

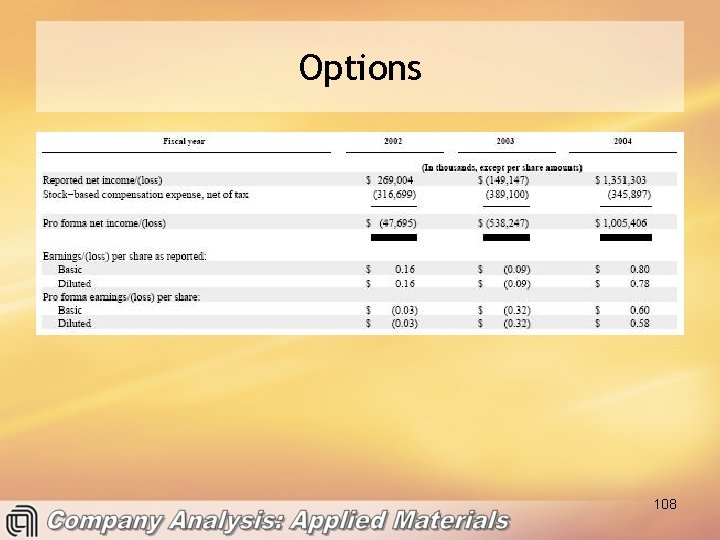

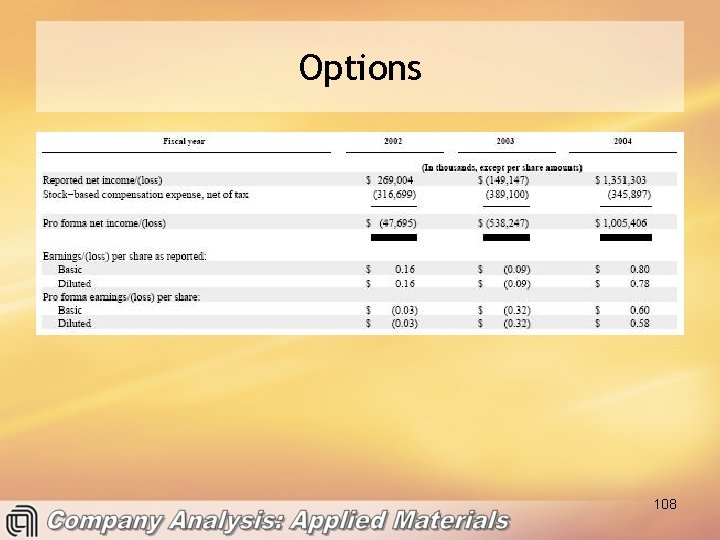

Options 108

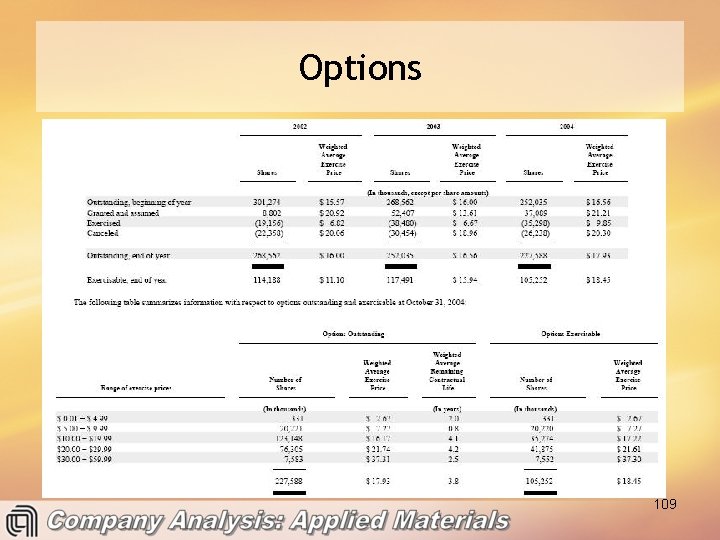

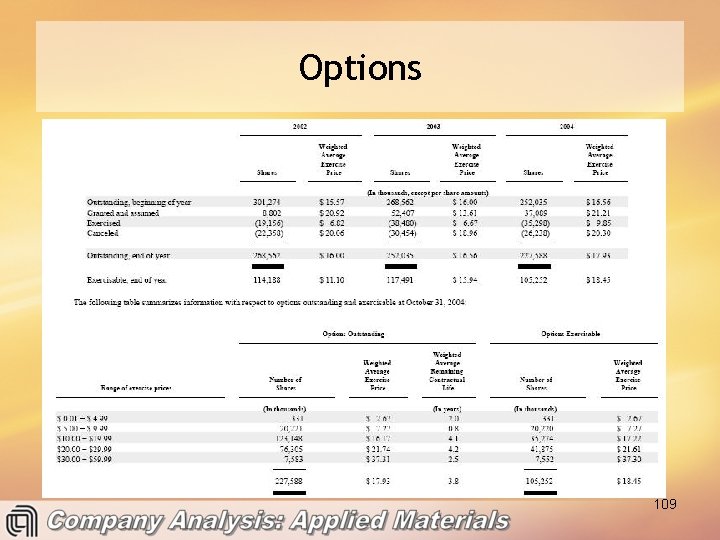

Options 109

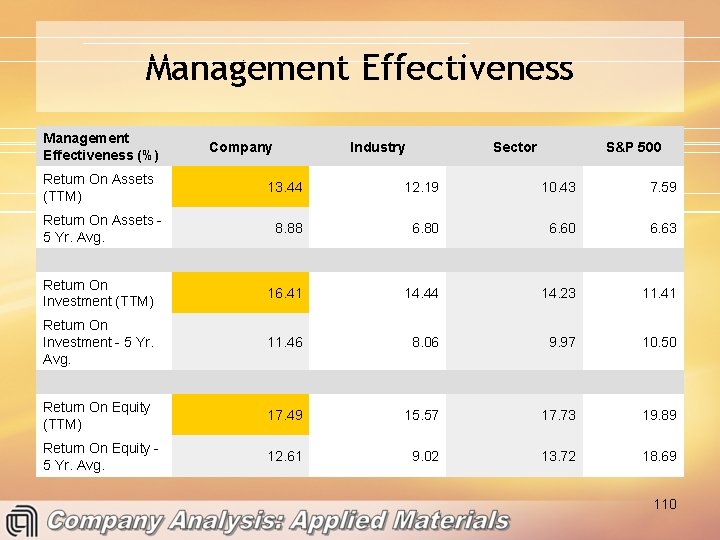

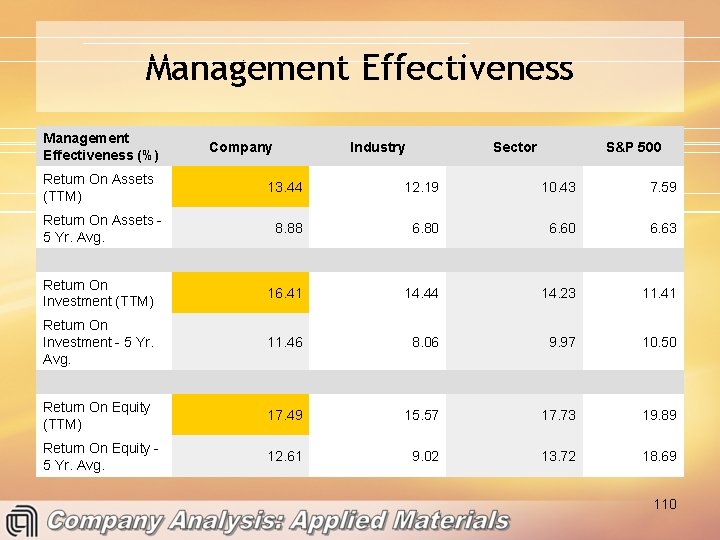

Management Effectiveness (%) Return On Assets (TTM) Company Industry Sector S&P 500 13. 44 12. 19 10. 43 7. 59 8. 88 6. 80 6. 63 Return On Investment (TTM) 16. 41 14. 44 14. 23 11. 41 Return On Investment - 5 Yr. Avg. 11. 46 8. 06 9. 97 10. 50 Return On Equity (TTM) 17. 49 15. 57 17. 73 19. 89 Return On Equity 5 Yr. Avg. 12. 61 9. 02 13. 72 18. 69 Return On Assets 5 Yr. Avg. 110

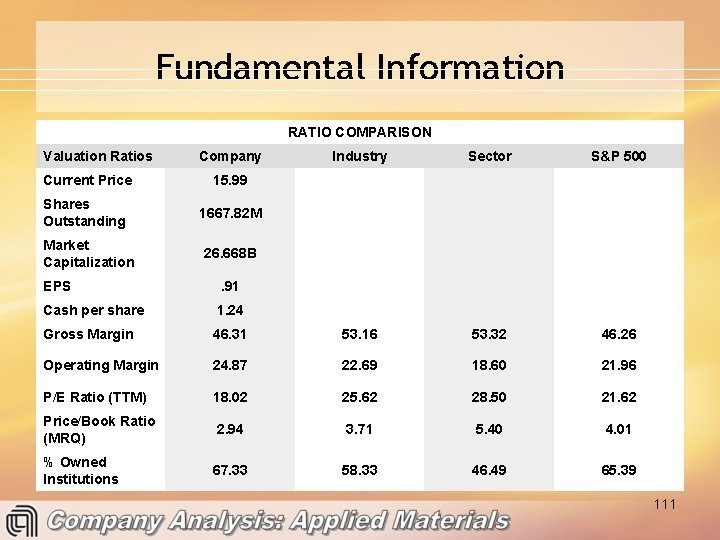

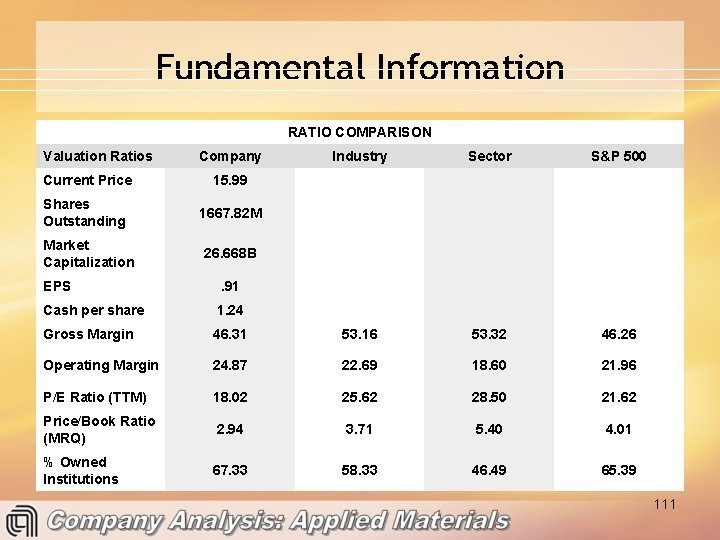

Fundamental Information RATIO COMPARISON Valuation Ratios Company Current Price 15. 99 Shares Outstanding 1667. 82 M Market Capitalization Industry Sector S&P 500 26. 668 B EPS . 91 Cash per share 1. 24 Gross Margin 46. 31 53. 16 53. 32 46. 26 Operating Margin 24. 87 22. 69 18. 60 21. 96 P/E Ratio (TTM) 18. 02 25. 62 28. 50 21. 62 Price/Book Ratio (MRQ) 2. 94 3. 71 5. 40 4. 01 % Owned Institutions 67. 33 58. 33 46. 49 65. 39 111

Price History – 52 weeks 112

Price History vs. SOX– 52 weeks 113

Price History – 10 years 114

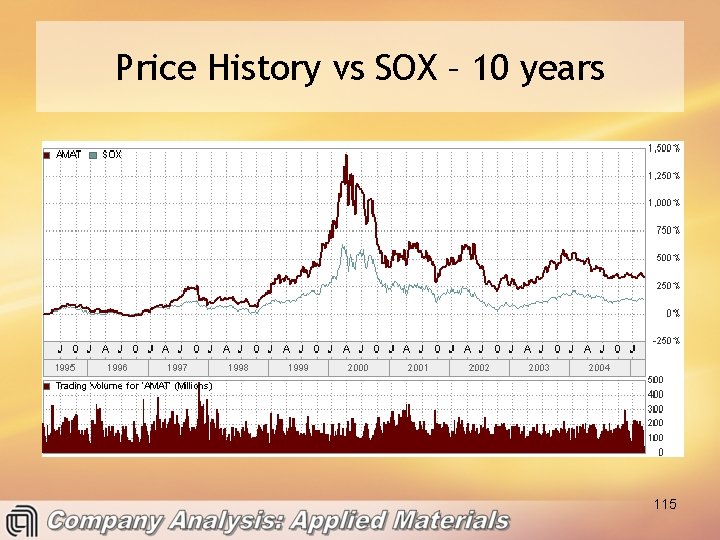

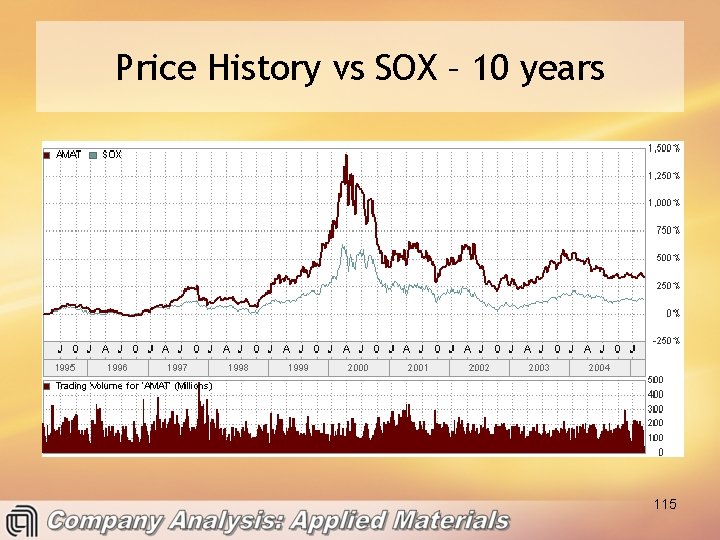

Price History vs SOX – 10 years 115

Value Drivers • Product Momentum – Increasing Market Share in Existing Product – Delivering Products for the Nanometer Era – Entering New Markets • Solution for a Changing Industry – Larger size wafers with nanotechnology • Inventing the Future w/ Breakthrough Technology – $992 millions in R&D 116

What Would Fisher Say? 1. “Superiority in production, marketing, research and financial skills” – Market leader – Solid financial base 2. “The people factor” – 6/10 executives joined AMAT prior 1990 117

What Would Fisher Say? 3. “Investment characteristic of some businesses” – Unique, hard to duplicate – Embedded growth factor 4. “The price of the investment” – At the low end of past 52 weeks 118

Recommendation Positive: • Positive Negative: – Under priced • Above industry PM and ROE – Another Adobe case – Limited growth due to its size – Industry leader and technology leader – Old faces in a longlasting company BUY!! 119

Agenda sistemica y agenda institucional

Agenda sistemica y agenda institucional Apple industry overview

Apple industry overview Why consulting

Why consulting Telecom industry overview

Telecom industry overview Rfid technology overview

Rfid technology overview Iptv technology overview

Iptv technology overview An overview of data warehousing and olap technology

An overview of data warehousing and olap technology An overview of data warehousing and olap technology

An overview of data warehousing and olap technology Overview of the current state of technology

Overview of the current state of technology The agenda communicates important information such as

The agenda communicates important information such as Gmail

Gmail Managing technology in the hospitality industry

Managing technology in the hospitality industry Pressing garment

Pressing garment Institute for information industry

Institute for information industry Dawning information industry

Dawning information industry Dawning information industry

Dawning information industry Dawning information industry

Dawning information industry Positive impacts of material technology

Positive impacts of material technology Positive effects of communication

Positive effects of communication Volvo information technology

Volvo information technology User acceptance of information technology

User acceptance of information technology Conclusion on ict

Conclusion on ict Media literacy and information literacy similarities

Media literacy and information literacy similarities Northwestern mailroom

Northwestern mailroom 5 disadvantages of information technology

5 disadvantages of information technology Discuss about information technology and e-business

Discuss about information technology and e-business Meaning of ict

Meaning of ict History information technology

History information technology Fluency with information technology

Fluency with information technology Social issues in information technology

Social issues in information technology Bridge in ict

Bridge in ict Erp information technology

Erp information technology Current and future trends of media and information.

Current and future trends of media and information. Control objectives for information and related technology

Control objectives for information and related technology Control objectives for information and related technology

Control objectives for information and related technology Information technology project management 9th edition

Information technology project management 9th edition Definitive estimate range

Definitive estimate range Information technology project management 9th edition ppt

Information technology project management 9th edition ppt Information technology chapter 3

Information technology chapter 3 Information technology auditing

Information technology auditing Enterprise and global management in mis

Enterprise and global management in mis Managing information technology resources

Managing information technology resources Cape information technology unit 1 notes

Cape information technology unit 1 notes Btec level 2 information and creative technology

Btec level 2 information and creative technology Accounting information technology and business solutions

Accounting information technology and business solutions Role of information technology in our daily life

Role of information technology in our daily life Flowchart in information technology

Flowchart in information technology Sri lanka institute of information technology

Sri lanka institute of information technology Rewrite the sentences using apposition

Rewrite the sentences using apposition Information technology unit 4

Information technology unit 4 Information technology mind map

Information technology mind map Media and information literacy ppt

Media and information literacy ppt Introduction to information and communication technology

Introduction to information and communication technology Information technology head

Information technology head It assessment

It assessment Technology big picture

Technology big picture Workshop security awareness

Workshop security awareness Data dictionary ipt

Data dictionary ipt History of information technology

History of information technology Applications of group technology

Applications of group technology Ethics in information technology fourth edition

Ethics in information technology fourth edition Department of information technology

Department of information technology Ministry of electronics and information technology

Ministry of electronics and information technology Electronics and information technology department odisha

Electronics and information technology department odisha Information technology in perspective

Information technology in perspective 7 building blocks of information technology

7 building blocks of information technology Competing with information technology

Competing with information technology Competing with information technology

Competing with information technology Chapter 1 information technology the internet and you

Chapter 1 information technology the internet and you Citp certification

Citp certification Apa itu ict

Apa itu ict Volvo information technology ab

Volvo information technology ab Information technology apprenticeship

Information technology apprenticeship Impact of information technology on auditing

Impact of information technology on auditing Information technology system

Information technology system Tashkent university of information technology

Tashkent university of information technology What are the social impacts of information technology

What are the social impacts of information technology College of information sciences and technology

College of information sciences and technology Unit 3 lesson 12 information technology

Unit 3 lesson 12 information technology Information technology unit 2

Information technology unit 2 Principles of information technology

Principles of information technology Library and information technology association

Library and information technology association Information technology mission statement

Information technology mission statement Information technology fundamentals

Information technology fundamentals Nature of information technology

Nature of information technology Introduction of computer ethics

Introduction of computer ethics Tfa information technology

Tfa information technology Information technology and customer relationship management

Information technology and customer relationship management Evolution of information technology

Evolution of information technology Colegiea

Colegiea Enterprise information technology knowledge

Enterprise information technology knowledge Australian curriculum ict

Australian curriculum ict Itgs strand 2

Itgs strand 2 History of health information technology

History of health information technology Ethics in information technology fourth edition

Ethics in information technology fourth edition Kanwal rekhi school of information technology

Kanwal rekhi school of information technology Information technology project management 8th edition

Information technology project management 8th edition Project management chapter 6

Project management chapter 6 Vertical information systems

Vertical information systems Logistics information technology

Logistics information technology Nature of information technology

Nature of information technology Chapter 1 information technology the internet and you

Chapter 1 information technology the internet and you Information technology fluency

Information technology fluency Tourism information technology

Tourism information technology Introduction to information and communication technology

Introduction to information and communication technology English for information technology 1 เฉลย

English for information technology 1 เฉลย Mutiyanganaya

Mutiyanganaya Prosofit

Prosofit Defining information technology

Defining information technology Creating business value through information technology

Creating business value through information technology Information technology auditing james hall

Information technology auditing james hall What is ict means

What is ict means Information technology

Information technology Chapter 2 computer

Chapter 2 computer Crooms academy of information technology

Crooms academy of information technology Frontiers of information technology

Frontiers of information technology Information technology applications

Information technology applications Definition information technology

Definition information technology Competing with information technology

Competing with information technology